DEF 14A: Definitive proxy statements

Published on April 19, 2011

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

|

o

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

x

|

Definitive Proxy Statement

|

|

o

|

Definitive Additional Materials

|

|

o

|

Soliciting Material Pursuant to Sections 240.14a-11(c) or Section 240.14a-12

|

PATRICK INDUSTRIES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

x

|

No fee required

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

5)

|

Total fee paid:

|

|

o

|

Fee paid previously with preliminary materials

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

1)

|

Amount Previously Paid:

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

|

3)

|

Filing Party:

|

|

4)

|

Date Filed:

|

|

PATRICK INDUSTRIES, INC.

|

|

107 West Franklin Street

|

|

P.O. Box 638

|

|

Elkhart, Indiana 46515-0638

|

|

(574) 294-7511

|

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

|

|

To Be Held May 26, 2011

|

TO OUR SHAREHOLDERS:

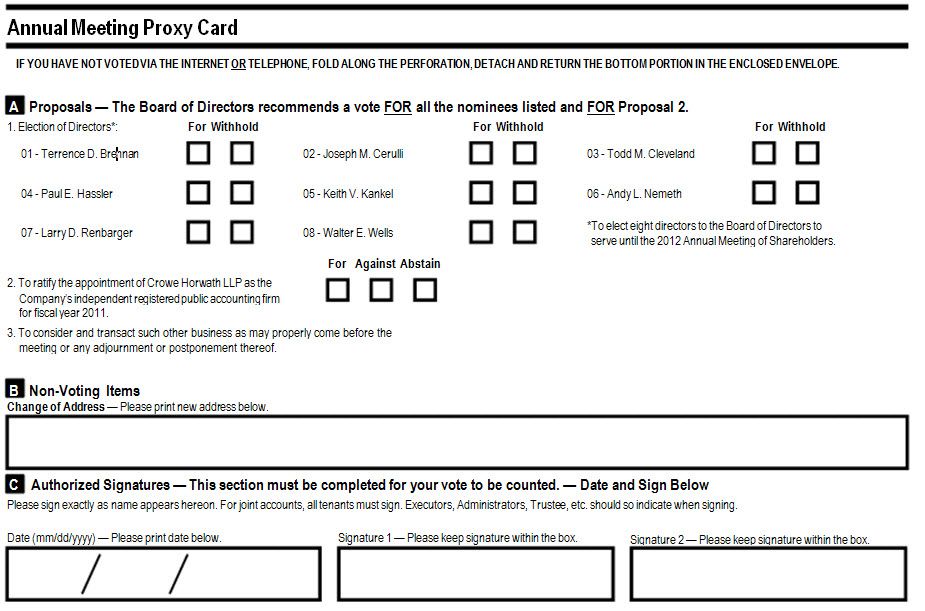

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of Patrick Industries, Inc., an Indiana corporation, will be held at the Company’s corporate office, 107 West Franklin Street, Elkhart, Indiana, on Thursday, May 26, 2011 at 10:00 A.M., Eastern time, for the following purposes:

|

1.

|

To elect eight directors to the Board of Directors to serve until the 2012 Annual Meeting of Shareholders;

|

|

2.

|

To ratify the appointment of Crowe Horwath LLP as our independent registered public accounting firm for fiscal year 2011; and

|

|

3.

|

To consider and transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

|

The Board has fixed the close of business on March 30, 2011 as the record date for the determination of the holders of shares of our outstanding common stock entitled to notice of and to vote at the Annual Meeting of Shareholders. Each shareholder is entitled to one vote per share on all matters to be voted on at the meeting.

Your vote is important. Whether or not you expect to attend the meeting, please vote your shares using the Internet, by telephone, or by mail by signing, dating, and returning the enclosed proxy in the enclosed envelope. Your shares will then be represented at the meeting if you are unable to attend. You may, of course, revoke your Proxy and vote in person at the meeting if you desire. If you hold shares through a broker or other custodian, please check the voting instructions used by that broker or custodian. Please note that brokers may no longer vote your shares on the election of directors in the absence of your specific instructions as to how to vote. Please return your proxy card so your vote can be counted.

| By Order of the Board of Directors, | |

| /s/ Andy L. Nemeth | |

| Andy L. Nemeth | |

| Secretary | |

| April 26, 2011 |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to Be Held On May 26, 2011.

Our Proxy Statement and Annual Report to Shareholders for fiscal 2010 are available on Patrick Industries, Inc.'s website at www.patrickind.com under “Investors.” You may also request hard copies of these documents free of charge by writing to us at the address above, Attention: Office of the Secretary.

|

1

|

|

|

2

|

|

|

3

|

|

| Registered Public Accounting Firm | 4 |

|

5

|

|

|

6

|

|

|

7

|

|

|

8

|

|

|

12

|

|

|

26

|

|

|

27

|

|

|

27

|

|

|

29

|

|

|

29

|

|

PATRICK INDUSTRIES, INC.

|

|

107 West Franklin Street

|

|

P.O. Box 638

|

|

Elkhart, Indiana 46515-0638

|

|

(574) 294-7511

|

|

____________

|

|

PROXY STATEMENT

|

|

Annual Meeting of Shareholders

|

|

To Be Held May 26, 2011

|

|

______________

|

This Proxy Statement and the accompanying Proxy Card are being mailed to shareholders of Patrick Industries, Inc. (the “Company” or “Patrick”) on or about April 26, 2011, and are furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) for the Annual Meeting of Shareholders to be held on May 26, 2011 (the “Annual Meeting”) for the purpose of considering and acting upon the matters specified in the Notice of Annual Meeting of Shareholders accompanying this Proxy Statement. If the form of proxy which accompanies this Proxy Statement is executed and returned, or is voted by Internet or by telephone, it may be revoked by the person giving it at any time prior to the voting thereof by written notice to the Secretary, by delivery of a later dated proxy, or by requesting to vote in person at the meeting.

If the form of proxy is signed, dated and returned without specifying choices on one or more matters presented to the shareholders, the shares will be voted on the matter or matters listed on the proxy card as recommended by the Company’s Board.

Additional solicitations, in person or by telephone or otherwise, may be made by certain directors, officers and employees of the Company without additional compensation. Expenses incurred in the solicitation of proxies, including postage, printing and handling, and actual expenses incurred by brokerage houses, custodians, nominees and fiduciaries in forwarding documents to beneficial owners, will be paid by the Company.

Patrick’s Annual Report to Shareholders, which contains Patrick’s Annual Report on Form 10-K for the year ended December 31, 2010, accompanies this Proxy Statement. Requests for additional copies of the Annual Report on Form 10-K should be submitted to the Office of the Secretary, Patrick Industries, Inc., 107 West Franklin Street, P.O. Box 638, Elkhart, Indiana 46515-0638. Annual meeting materials may also be viewed online through our website, www.patrickind.com.

Each shareholder is entitled to one vote for each share of our common stock held as of the record date. For purposes of the meeting, a quorum means a majority of the outstanding shares. Abstentions and withheld votes are counted as shares represented at the meeting for purposes of determining a quorum. As of the close of business on March 30, 2011, the record date for shareholders entitled to vote at the Annual Meeting, there were outstanding 9,460,189 shares of common stock entitled to one vote each. In determining whether a quorum exists at the meeting, all shares represented in person or by proxy will be counted. Proxies properly executed and received by us prior to the meeting and not revoked will be voted as directed therein on all matters presented at the meeting.

A shareholder may, with respect to the election of directors, (i) vote for the election of all named director nominees, (ii) withhold authority to vote for all named director nominees, or (iii) vote for the election of all named director nominees other than any nominee with respect to whom the shareholder withholds authority to vote by so

indicating in the appropriate space on the proxy. With respect to any other proposal, a shareholder may vote for, against or abstain.

Please note that brokers may no longer vote your shares on the election of directors in the absence of your specific instructions as to how to vote. Please return your proxy card so your vote can be counted.

If a shareholder’s shares are held by a broker on the shareholder’s behalf (that is, in “street name”) and the shareholder does not instruct the broker as to how to vote the shareholder’s shares on the election of directors, the broker may not exercise discretion to vote for or against this proposal. This is a “broker non-vote.” A broker non-vote occurs when a broker holding shares registered in street name is permitted to vote, in the broker’s discretion, on routine matters without receiving instructions from the client, but is not permitted to vote without instructions on non-routine matters, and the broker returns a proxy card with no vote on the non-routine matter. Broker non-votes and abstentions will be included in the determination of the number of shares of common stock present at our Annual Meeting for quorum purposes, but will not be counted as votes cast on any matter presented at our Annual Meeting that is a non-routine matter. If, however, the shareholder does not instruct the broker as to how to vote the shares on the ratification of accountants, the broker may exercise its discretion to vote for or against that proposal.

A broker or other nominee may vote your shares on routine matters, and therefore no broker non-votes are expected to exist in connection with Proposal 2. Under Proposal 1, the directors are elected by a plurality of the votes cast by shares present in person or by proxy at the Annual Meeting and entitled to vote. Therefore, broker non-votes and abstentions will have no effect on Proposal 1, except to the extent that they will count as votes not cast. Proposal 2 in this Proxy Statement requires the affirmative vote of a majority of the votes cast, provided a quorum (50% of the outstanding shares of common stock) is present. Broker non-votes and abstentions will have no effect on Proposal 2.

The Board knows of no other matter which may come up for action at the Annual Meeting. However, if any other matter properly comes before the Annual Meeting, the persons named in the proxy form enclosed will vote in accordance with their judgment upon such matter.

Proposals Included in the Proxy Statement

Shareholder proposals for inclusion in proxy materials for the next Annual Meeting should be addressed to the Office of the Secretary, 107 West Franklin Street, P.O. Box 638, Elkhart, Indiana 46515-0638, and must be received no later than December 28, 2011.

Proposals Not Included in the Proxy Statement

Our By-laws require notice of any other business to be brought before a meeting by a shareholder (but not included in the proxy statement) to be delivered, in writing, to the Company’s Secretary, together with certain prescribed information, on or after April 5, 2012 and no later than May 5, 2012. Likewise, the Articles of Incorporation and By-laws require that shareholder nominations to the Board be delivered to the Secretary, together with certain prescribed information in accordance with the procedures for bringing business before an annual meeting at which directors are to be elected.

ELECTION OF DIRECTORS

There are eight nominees for election to the Board, all of which are current members of our Board. The individuals elected as directors at the 2011 Annual Meeting will be elected to hold office until the 2012 Annual Meeting or until their successors are duly elected and qualified.

It is intended that the proxies will be voted for the nominees listed below, unless otherwise indicated on the proxy form. It is expected that these nominees will serve, but, if for any unforeseen cause any such nominee should decline or be unable to serve, the proxies will be voted to fill any vacancy so arising in accordance with the discretionary authority of the persons named in the proxies. The Board does not anticipate that any nominee will be unable or unwilling to serve.

The information provided below has been furnished by the director nominees, and sets forth (as of March 31, 2011) the names, ages, principal occupations, recent professional experience, certain specific qualifications identified as part of the Board’s determination that each such individual should serve on the Board, and other directorships at other public companies for at least the past five years, if any. Each of the following nominees was elected to his present term of office at the Annual Meeting of Shareholders held on May 20, 2010.

Paul E. Hassler, age 63, has been our Chairman of the Board since May 2008. Mr. Hassler was Chief Executive Officer of the Company from April 2004 to January 2009 (retired) and President from April 2004 to May 2008. Mr. Hassler held the position of Vice President Operations and Distribution - West of the Company from December 2003 through the first quarter of 2004; Executive Director of West Coast Operations from 1994 to 2003; and General Manager of California Operations from 1986 to 1994. Mr. Hassler has over 37 years of recreational vehicle, manufactured housing and industrial experience in various capacities and has demonstrated leadership as Non-Executive Chairman of the Board. He has served as a director of the Company since 2005.

Terrence D. Brennan, age 72, was the President and Chief Executive Officer of NBD Bank, Elkhart, Indiana from 1973-1997 (retired). Mr. Brennan has extensive knowledge of the banking industry and its operations, experience in corporate management and leadership, and strategic planning. He possesses accounting and financial acumen, and has been determined to be an “audit committee financial expert” under the Securities and Exchange Commission (“SEC”) rules and regulations by our Board. Mr. Brennan currently serves as the Chairman of the Company’s Corporate Governance and Nominations Committee, and as a member of the Company’s Compensation Committee and Audit Committee. He has served as a director of the Company since 1999.

Joseph M. Cerulli, age 51, has been employed by Tontine Associates, LLC, an affiliate of Tontine Capital Partners, LP, Tontine Capital Overseas Master Fund, LP, and Tontine Capital Overseas Master Fund II, LP (collectively, “Tontine”) since January 2007. Prior to that, Mr. Cerulli was an independent financial consultant from 2002 to 2006. Mr. Cerulli was a director of Neenah Enterprises, Inc., one of the largest independent foundry companies in the U.S., from February 2009 to July 2010. As an employee of Tontine, the majority shareholder of the Company’s common stock, Mr. Cerulli possesses particular knowledge of our Company and the industries in which we operate and possesses accounting and financial acumen and extensive knowledge with respect to financial and investment matters. Mr. Cerulli currently serves as a member of the Company’s Corporate Governance and Nominations Committee and the Compensation Committee. He has served as a director of the Company since 2008.

Todd M. Cleveland, age 43, has been serving as President and Chief Executive Officer of the Company since February 2009. Mr. Cleveland assumed the position of President and Chief Operating Officer of the Company in May 2008. Prior to that, he served as Executive Vice President of Operations and Sales and Chief Operating Officer of the Company from August 2007 to May 2008. Mr. Cleveland also spent 17 years with Adorn Holdings, Inc. (“Adorn”) serving as President and Chief Executive Officer from 2004 to 2007; President and Chief Operating Officer from 1998 to 2004; and Vice President of Operations and Chief Operating Officer from 1994 to 1998. Mr. Cleveland has over 20 years of recreational vehicle, manufactured housing and industrial experience in various operating capacities. He also has extensive knowledge of our Company and the industries to which we sell our products, and experience with management development and leadership, acquisitions, strategic planning, manufacturing, and sales of our products. He has served as a director of the Company since 2008.

Keith V. Kankel, age 68, was the Interim President and Chief Executive Officer of the Company from 2003 to 2004 (retired). In addition, he was Vice President of Finance of the Company from 1987 through July 2002, and retired Secretary-Treasurer of the Company from 1974 through July 2002. Mr. Kankel has accounting and financial acumen, with particular knowledge of financial reporting, and has been determined to be an “audit committee financial expert” under the SEC’s rules and regulations by our Board. His long-time service on the Board has provided critical knowledge of our operations and corporate history. Mr. Kankel currently serves as the Chairman of the Company’s Audit Committee and as a member of the Company’s Corporate Governance and Nominations Committee and the Compensation Committee. He has served as a director of the Company since 1977.

Andy L. Nemeth, age 42, has been the Company’s Executive Vice President of Finance, Secretary-Treasurer, and Chief Financial Officer since May 2004. Mr. Nemeth was Vice President-Finance, Chief Financial Officer, and Secretary-Treasurer from 2003 to 2004, and Secretary-Treasurer from 2002 to 2003. Mr. Nemeth was a Division Controller from 1996 to 2002 and prior to that, he spent five years in public accounting. Mr. Nemeth has over 19 years of recreational vehicle, manufactured housing, and industrial experience in various financial capacities. Mr. Nemeth also has particular knowledge of our Company and the industries to which we sell our products, extensive experience with corporate management, acquisitions, strategic planning and banking relations, and has financial and accounting acumen. He has served as a director of the Company since 2006.

Larry D. Renbarger, age 72, was the Chief Executive Officer of Shelter Components, a manufacturer and supplier of products to the manufactured housing and recreational vehicle industries, from 1984 to 1998 (retired). Mr. Renbarger is a director of Thermolite, Inc., a window manufacturer, and of Universal Precision Instruments, Inc., an orthopedic supplier. He has particular knowledge of our Company and the industries in which we sell our products, experience in corporate management and leadership, and strategic planning. He also has a public accounting background and has been determined to be an “audit committee financial expert” under the SEC’s rules and regulations by our Board. Mr. Renbarger currently serves as a member of the Company’s Corporate Governance and Nominations Committee and Audit Committee. He has served as a director of the Company since 2002.

Walter E. Wells, age 72, was the President and Chief Executive Officer of Schult Homes Corporation, a leading builder of manufactured and modular housing, from 1970 to 1998 (retired). Mr. Wells has particular knowledge of our Company and the industries in which we sell our products, experience in corporate management and leadership, and strategic planning. He possesses financial acumen and has been determined to be an “audit committee financial expert” under the SEC’s rules and regulations by our Board. Mr. Wells currently serves as the Chairman of the Company’s Compensation Committee and as a member of the Company’s Corporate Governance and Nominations Committee and the Audit Committee. He has served as a director of the Company since 2001.

| The Board of Directors unanimously recommends a vote FOR the nominated directors. |

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed Crowe Horwath LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2011. Crowe Horwath LLP has been the Company’s independent registered public accounting firm since June 2009. The Board and the Audit Committee recommend that shareholders ratify the appointment of Crowe Horwath LLP as our independent registered public accounting firm for our fiscal year 2011. Although we are not required to do so, we believe that it is appropriate to request that shareholders ratify this appointment. If shareholders do not ratify the appointment, the Audit Committee will investigate the reasons for the shareholders’ rejection and reconsider the appointment. Representatives of Crowe Horwath LLP will be at the Annual Meeting, will be given the opportunity to make a statement, and will be available to respond to questions.

Unless otherwise instructed, the proxy holders will vote the proxies received by them “FOR” approval of the ratification of the appointment of Crowe Horwath LLP. The ratification of the appointment will be approved by our shareholders if, at the Annual Meeting, a quorum is present and a majority of the shares present in person or represented by proxy and entitled to vote on the proposal are voted in favor of the proposal.

| The Board of Directors unanimously recommends a vote FOR approval of the ratification of the appointment of Crowe Horwath LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2011. |

On June 22, 2009, the Audit Committee appointed Crowe Horwath LLP as our independent registered public accounting firm. As noted above in Proposal 2, the Audit Committee has appointed Crowe Horwath LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2011.

Audit Fees

The following table presents fees for professional audit and tax services rendered by Crowe Horwath LLP for the years ended December 31, 2010 and 2009:

|

2010

|

2009

|

|||||||

|

Audit Fees (1)

|

$ | 199,500 | $ | 214,900 | ||||

|

Audit-Related Fees

|

- | - | ||||||

|

Tax Fees (2)

|

48,000 | 24,000 | ||||||

|

All Other Fees

|

- | - | ||||||

|

Total Fees

|

$ | 247,500 | $ | 238,900 | ||||

|

(1)

|

Audit fees consist of fees for professional services rendered for the audit of our financial statements and review of financial statements included in our quarterly reports and services normally provided by the independent auditor in connection with statutory and regulatory filings or engagements. In addition, audit fees include the reviews of various SEC filings.

|

|

(2)

|

Tax fees consist of the preparation and/or review of Federal and State tax returns, assistance with preparation of tax inquiries, primarily from state and local tax authorities, enterprise zone property tax filings, and preparation and review of employee benefit plan filings. Tax fees in 2010 and 2009 were related to the review by Crowe Horwath LLP of the 2009 and 2008 tax returns, respectively.

|

In addition to the fees listed in the table above pertaining to audit and tax services rendered by the Company’s current independent registered public accounting firm, Crowe Horwath LLP, there were additional audit and tax fees incurred in 2010 and 2009 for professional services rendered by our former independent registered public accounting firms for the fiscal years ended December 31, 2010 and 2009. Total audit fees for professional services rendered were $11,000 and $58,700 in 2010 and 2009, respectively. Total tax fees were $18,500 for 2009. There were no additional tax fees, other than those listed in the table above, pertaining to 2010.

The Audit Committee has advised us that it has determined that the non-audit services rendered by our independent auditors during our most recent fiscal year are compatible with maintaining the independence of such auditors.

The Audit Committee has adopted a Pre-Approval Policy for Audit and Non-Audit Services pursuant to which it pre-approves all audit and non-audit services provided by the independent auditors prior to each particular engagement. The Committee has delegated authority to its Chairman to approve proposed services other than the annual audit, tax and quarterly review services, and the Chairman must report any approvals to the balance of the Committee at the next scheduled meeting.

The responsibilities of the Audit Committee, which are set forth in the Audit Committee Charter adopted by the Board of Directors, include providing oversight of our financial reporting process through periodic meetings with our independent auditors, principal accounting officer and management to review accounting, auditing, internal controls and financial reporting matters. Our management is responsible for the preparation and integrity of the financial reporting information and related systems of internal controls. The Audit Committee, in carrying out its role, relies on senior management, including senior financial management, and the independent auditors.

We have reviewed and discussed with senior management our audited financial statements included in the 2010 Annual Report to Shareholders. Management has confirmed to us that such financial statements (i) have been prepared with integrity and objectivity and are the responsibility of management and (ii) have been prepared in conformity with accounting principles generally accepted in the United States of America.

We have discussed with Crowe Horwath LLP, our independent auditors, the matters required to be discussed by the statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1, AU section 380), as adopted by the Public Company Accounting Oversight Board (the “PCAOB”). In addition, the Audit Committee has received from the independent auditors the written disclosures and the letter required by the applicable requirements of the PCAOB regarding the independent accountant’s communications with the Audit Committee concerning independence rules.

We have received from Crowe Horwath LLP a letter providing the disclosures required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) with respect to any relationships between us and Crowe Horwath LLP that in their professional judgment may reasonably be thought to bear on independence. Crowe Horwath LLP has discussed its independence with us, and has confirmed in such letter that, in its professional judgment, it is independent from us within the meaning of the federal securities laws.

Based on the review and discussions described above, with respect to our audited financial statements included in our 2010 Annual Report to Shareholders, we have recommended to the Board of Directors that such financial statements be included in our Annual Report on Form 10-K for filing with the SEC.

As specified in the Audit Committee Charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that our financial statements are complete and accurate and in accordance with generally accepted accounting principles. That is the responsibility of management and our independent auditors. In giving our recommendation to the Board of Directors, we have relied on (i) management’s representation that such financial statements have been prepared with integrity and objectivity and in conformity with generally accepted accounting principles and (ii) the report of our independent auditors with respect to such financial statements.

The Audit Committee:

Keith V. Kankel (Chairman)

Terrence D. Brennan

Larry D. Renbarger

Walter E. Wells

The foregoing report of the Audit Committee does not constitute soliciting material and shall not be deemed incorporated by reference by any general statement incorporating by reference the proxy statement into any filing by us under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under such acts.

The following table sets forth, as of March 30, 2011 (the record date), information concerning the only parties known to us as having beneficial ownership of more than five percent of our outstanding common stock and information with respect to the stock ownership of all of our directors, named executive officers, and all of our directors and executive officers as a group. The address of each director and named executive officer listed below is 107 West Franklin Street, P.O. Box 638, Elkhart, Indiana, 46515-0638.

|

Name and Address of Beneficial Owner

|

Aggregate Number of Shares of Common Stock Beneficially Owned

|

Percent of Class

|

||||||

|

Five Percent Shareholders:

|

||||||||

|

Jeffrey L. Gendell

c/o Tontine Capital Management, L.L.C.

55 Railroad Avenue, 1st Floor

Greenwich, CT 06830

|

5,174,963 | (1)(2) | 54.7 | % | ||||

|

Wells Fargo and Company

|

||||||||

|

420 Montgomery Street

San Francisco, CA 94104

|

573,524 | (3) | 6.1 | % | ||||

|

Directors:

|

||||||||

|

Paul E. Hassler

|

47,505 | * | ||||||

|

Keith V. Kankel

|

39,686 | * | ||||||

|

Larry D. Renbarger

|

39,500 | * | ||||||

|

Terrence D. Brennan

|

32,000 | * | ||||||

|

Walter E. Wells

|

32,000 | * | ||||||

|

Joseph M. Cerulli (4)

|

7,000 | * | ||||||

|

Named Executive Officers:

|

||||||||

|

Todd M. Cleveland (5)

|

422,391 | 4.4 | % | |||||

|

Andy L. Nemeth (6)

|

170,838 | 1.8 | % | |||||

|

Jeffrey M. Rodino

|

47,300 | * | ||||||

|

Doyle K. Stump (7)

|

92,610 | * | ||||||

|

Darin R. Schaeffer (8)

|

20,610 | * | ||||||

|

All Directors and Executive Officers as a group (13 persons)

|

1,069,283 | 11.0 | % | |||||

* Less than 1%.

|

(1)

|

Information based on the Schedule 13D/A filed jointly by Tontine Capital Management, L.L.C. (“TCM”), Tontine Capital Partners, L.P. (“TCP”), Tontine Capital Overseas Master Fund, L.P. (“TMF”), Tontine Capital Overseas Master Fund II, L.P. (“TCP 2”), Tontine Capital Overseas GP, L.L.C. (“TCO”), Tontine Asset Associates, L.L.C. (“TAA”) and Jeffrey L. Gendell on March 4, 2011. Includes 4,221,155 shares owned directly by TCP, 729,399 shares owned directly by TMF, and 224,409 shares owned directly by TCP 2. Mr. Gendell is the managing member of TCM, TCO and TAA, the general partners of TCP, TMF and TCP 2, respectively, and has shared voting and dispositive power over these shares. All of these shares may be deemed to be beneficially owned by Mr. Gendell. He disclaims beneficial ownership of the shares owned by Tontine, except to the extent of his pecuniary interest therein.

|

|

(2)

|

Based on information contained in a Schedule 13D/A filed by Tontine on April 6, 2011 (subsequent to the record date), the aggregate number of shares of the Company’s common stock beneficially owned by Tontine increased to 5,299,963 or 55.3% of our common stock outstanding, reflecting 125,000 shares issuable upon exercise of a warrant acquired by TCP2 on March 31, 2011.

|

|

(3)

|

Information based on the Schedule 13G/A filed by Wells Fargo and Company on January 20, 2011.

|

|

(4)

|

Mr. Cerulli is employed by an affiliate of Tontine. He disclaims beneficial ownership of the shares beneficially owned by Tontine, except to the extent of his pecuniary interest therein.

|

|

(5)

|

Includes 105,000 options which are exercisable within 60 days of the record date.

|

|

(6)

|

Includes 75,750 options which are exercisable within 60 days of the record date.

|

|

(7)

|

Includes 45,500 options which are exercisable within 60 days of the record date.

|

|

(8)

|

Mr. Schaeffer’s total share ownership is calculated based on the latest Form 4 filed on March 25, 2010 and includes an additional 7,000 shares related to stock options that were subsequently exercised by Mr. Schaeffer in March 2011 based on the terms of his employment contract.

|

The Board believes that fundamental corporate governance is important to ensure that we are managed for the long-term benefit of our shareholders. The Board annually reviews its corporate governance practices and policies as set forth in its Corporate Governance Guidelines, Code of Ethics, and various Committee Charters, all of which were updated in accordance with the listing standards of the NASDAQ Stock Market and the SEC rules.

Board Membership

As of the date of this Proxy Statement, the Board has eight members. Except for Mr. Cleveland, our President and Chief Executive Officer, and Mr. Nemeth, our Chief Financial Officer, no director is an employee.

Mr. Cerulli has been employed by Tontine Associates, LLC, an affiliate of Tontine Capital Partners, L.P., Tontine Capital Overseas Master Fund, L.P., and Tontine Capital Overseas Master Fund II, L.P. (collectively, “Tontine”) since January 2007. As such, Mr. Cerulli has an indirect interest in the Company’s transactions with Tontine. Including the related party transactions described herein that occurred on March 31, 2011, Tontine beneficially owned approximately 55.3% of the Company’s common stock outstanding as described in a Schedule 13D/A filed by Tontine on April 6, 2011. Mr. Cerulli began receiving compensation for his service as a member of the Board beginning in January 2009.

In connection with the financing of its acquisition of Adorn in May 2007, the Company entered into a Securities Purchase Agreement with Tontine, dated April 10, 2007 (the “2007 Securities Purchase Agreement”), which provided that, among other things, so long as Tontine (i) holds between 7.5% and 14.9% of the Company’s common stock then outstanding, Tontine has the right to appoint one nominee to the Board; or (ii) holds at least 15% of the Company’s common stock then outstanding, Tontine has the right to appoint two nominees to the Board. The Company also agreed to limit the number of directors serving on its Board to no more than nine directors for so long as Tontine has the right to appoint a director to the Board. Tontine’s right to appoint directors and the Company’s obligation to limit the size of its Board were affirmed in a subsequent Securities Purchase Agreement with Tontine, dated March 10, 2008 (the “2008 Securities Purchase Agreement”), in connection with a private placement in March 2008. Mr. Cerulli’s appointment to the Board in July 2008 was made pursuant to Tontine’s right to appoint directors as described above. As of the date hereof, Tontine has not exercised its right to appoint a second nominee to the Board.

Election of Directors and Length of Board Term

Directors are currently elected for a one-year term at the Annual Meeting of Shareholders.

Board Committees

The Board has three standing committees: the Audit Committee, the Compensation Committee, and the Corporate Governance and Nominations Committee. Each Committee has a committee chairman and a written charter.

Shareholder Communications

Shareholders may send communications to members of the Board by sending a communication to the Board and/or a particular member care of Andy L. Nemeth-Secretary, Patrick Industries, Inc., 107 West Franklin

Street, P.O. Box 638, Elkhart, Indiana 46515-0638. Communications intended for independent directors should be directed to the Chairman of the Corporate Governance and Nominations Committee.

Code of Ethics

We have a code of ethics that applies to all of our employees, officers and directors.

Access to Corporate Governance Documents

The charters of our Audit, Compensation, and Corporate Governance and Nominations Committees, our Corporate Governance Guidelines, and our Code of Ethics are all available on our website at www.patrickind.com, or by writing to:

| Patrick Industries, Inc. | |

| Attn: Andy L. Nemeth, Secretary | |

| 107 West Franklin Street | |

| P.O. Box 638 | |

| Elkhart, Indiana 46515-0638 |

Board Meetings and Attendance

The Board and Board Committees hold regular meetings on a set schedule and may hold special meetings and act by written consent from time to time as necessary or appropriate. The Board had four regular meetings and four special meetings in 2010. Additionally, the Board participated in regularly scheduled monthly update calls with the Chief Executive Officer and Chief Financial Officer during 2010. In 2010, each director attended at least 75% of the meetings of the Board and the Board Committees on which he served. We expect all Board members to attend the Annual Meeting of Shareholders, but from time to time, other commitments may prevent all directors from attending each meeting. All directors attended the most recent Annual Meeting of Shareholders which was held on May 20, 2010.

Executive Sessions of Non-Employee Directors

The Board and committees regularly meet in executive session without the presence of any management directors or representatives. There was no lead independent director designated to preside over the executive sessions of the Board in 2010. Any non-employee director can request additional executive sessions.

Board Leadership Structure and Risk Oversight

The Company maintains separate positions for the Chairman of the Board (“Chairman”) and for the Chief Executive Officer. The Board believes this leadership structure has enhanced the Board’s oversight of and independence from our management, the ability of the Board to carry out its roles and responsibilities on behalf of our shareholders, and our overall corporate governance compared to our prior combined Chairman and Chief Executive Officer leadership structure. Mr. Hassler serves as Chairman and Mr. Cleveland is the Chief Executive Officer.

The Board has delegated its risk oversight responsibilities to the Audit Committee, as described below under the heading “Audit Committee.” In accordance with the Audit Committee’s Charter, each of our senior financial and accounting, and internal audit professionals reports directly to the Audit Committee regarding material risks to our business, among other matters, and the Audit Committee meets in executive sessions with each professional and with representatives of our independent registered public accounting firm. The Audit Committee Chairman reports to the full Board regarding material risks as deemed appropriate.

Independent Directors

The Board has designated five of its members as independent directors. In general, the Board determines whether a director is independent by following the guidelines of the NASDAQ Stock Market and the SEC rules and regulations, in addition to those other factors it may deem relevant. The Board of Directors has determined that the independent directors are Terrence D. Brennan, Joseph M. Cerulli (except for purposes of the audit committee), Keith V. Kankel, Larry D. Renbarger and Walter E. Wells. The independent directors met four times in 2010.

Director Qualifications and Director Diversity

The Board seeks a diverse group of candidates who possess the background, skills and expertise and the highest level of personal and professional ethics, integrity, judgment and values to represent the long-term interests of our Company and its shareholders. To be considered for membership on the Board, a candidate should possess the following major attributes:

|

|

·

|

Breadth of knowledge about issues affecting the Company and the industries/markets in which it operates;

|

|

|

·

|

Significant experience in leadership positions or at senior policy-making levels and an established reputation in the business community;

|

|

|

·

|

Expertise in key areas of corporate management and in strategic planning;

|

|

|

·

|

Financial literacy and financial and accounting expertise; and

|

|

|

·

|

Independence and a willingness to devote sufficient time to carry out his or her duties and responsibilities effectively and assume broad fiduciary responsibility.

|

The Corporate Governance and Nominations Committee does not have a formal policy specifying how diversity of background and personal experience should be applied in identifying or evaluating director candidates. However, as part of its annual self-evaluation under our Corporate Governance Principles, the Board considers whether the level of diversity of its members is appropriate, and the Corporate Governance and Nominations Committee takes the outcome into account when identifying and evaluating director candidates.

Consideration of Director Candidates - Corporate Governance and Nominations Committee Processes

The Corporate Governance and Nominations Committee will consider board nominees recommended by shareholders. Those recommendations should be sent to the Chairman of the Corporate Governance and Nominations Committee, c/o of the Secretary of Patrick Industries, Inc., 107 West Franklin Street, P.O. Box 638, Elkhart, Indiana 46515-0638. In order for a shareholder to nominate a candidate for director, under our By-laws, timely notice of the nomination must be given in writing to the Secretary of the Company. To be timely, such notice must be received at our principal executive office not less than 20 days or more than 50 days prior to the next Annual Meeting of Shareholders. Notice of nomination must include the name, address and number of shares owned by the person submitting the nomination; the name, age, business address, residence address and principal occupation of the nominee; and the number of shares beneficially owned by the nominee. It must also include the information that would be required to be disclosed in the solicitation of proxies for election of directors under the federal securities laws, as well as whether the individual can understand basic financial statements and the candidate’s other board memberships (if any). The nominee’s consent to be elected and serve must be submitted. The Corporate Governance and Nominations Committee may require any nominee to furnish any other information, within reason, that may be needed to determine the eligibility of the nominee.

As provided in its Charter, the Corporate Governance and Nominations Committee will follow procedures which the committee deems reasonable and appropriate in the identification of candidates for election to the board and evaluating the background and qualification of those candidates. Those processes include consideration of nominees suggested by an outside search firm, by incumbent board members, and by shareholders. The Committee will seek candidates having experience and abilities relevant to serving as a director of the Company, and who represent the best interests of shareholders as a whole and not any specific group or constituency.

The Committee will consider a candidate’s qualifications and background, including responsibility for operating a public company or a division of a public company, international business experience, a candidate’s

technical and financial background or professional qualification, diversity of background and personal experience, and any other public company boards on which the candidate is a director. The Committee will also consider whether the candidate would be “independent” for purposes of the NASDAQ Stock Market and the SEC rules and regulations by our Board. The Committee may, from time to time, engage the services of a professional search firm to identify and evaluate potential nominees.

Board Committee Responsibilities and Related Matters

The Board has delegated certain responsibilities and authority to each Board Committee as described below. At each regularly scheduled Board meeting, each Board Committee Chairman (or other designated Board Committee member) reports to the full Board on his Board Committee’s activities.

Audit Committee

The Board has an Audit Committee, which is comprised of Keith V. Kankel (Chairman), Terrence D. Brennan, Larry D. Renbarger, and Walter E. Wells. The Audit Committee’s responsibilities include oversight responsibilities related to potential material risks to our business including, but not limited to, credit, liquidity and operational risks. In addition, its responsibilities include recommending to the Board the independent accountants to be employed for the purpose of conducting the annual examination of our financial statements, discussing with the independent accountants the scope of their examination, reviewing our financial statements and the independent accountants’ report thereon with our personnel and the independent accountants, and inviting the recommendations of the independent accountants regarding internal controls and other matters. Additionally, the Audit Committee is responsible for approving all non-audit services provided by the independent accountants and reviews these engagements on a per occurrence basis. The Audit Committee’s report is provided on page 6 of this Proxy Statement.

The Board has determined that each of the members of the Audit Committee is independent as defined in the NASDAQ listing standards and relevant SEC rules, and that Messrs. Kankel, Brennan, Renbarger and Wells all meet the qualifications required to be an audit committee financial expert and meet the financial sophistication requirements of the NASDAQ listing standards. The Audit Committee met twelve times in 2010. These meetings included conference calls with management to review quarterly earnings releases and SEC filings prior to their issuance.

For a more detailed list of the roles and responsibilities of the Audit Committee, please see the Audit Committee Charter located in the “Corporate Governance” section of our website at www.patrickind.com.

Compensation Committee

The Board has a Compensation Committee, which from January 1, 2010 to May 20, 2010, was comprised of Walter E. Wells (Chairman), Terrence D. Brennan, Joseph M. Cerulli, Keith V. Kankel, and Larry D. Renbarger. Mr. Renbarger resigned as a member of the Compensation Committee effective with the 2010 Annual Meeting. Effective May 20, 2010, the Compensation Committee was comprised of Walter E. Wells (Chairman), Terrence D. Brennan, Joseph M. Cerulli, and Keith V. Kankel. The Compensation Committee met six times in 2010. The primary responsibilities of this committee include:

|

|

·

|

Reviewing and recommending to the independent members of the Board the overall compensation programs for the officers of the Company;

|

|

|

·

|

Oversight authority to attract, develop, promote and retain qualified senior executive management; and

|

|

|

·

|

Oversight authority for the stock-based compensation programs.

|

In its oversight of executive officer compensation, the Compensation Committee seeks assistance from our management and our independent compensation consultant, Towers Watson, as further described below under the heading “Compensation Discussion and Analysis - Compensation of Executive Officers and Directors.” The Compensation Committee’s report is provided on page 27 of this Proxy Statement.

The Board has determined that each of the current members of the Compensation Committee is independent as defined in the NASDAQ listing standards and our Corporate Governance Principles. For a more detailed list of the roles and responsibilities of the Compensation Committee, please see the Compensation Committee Charter located in the “Corporate Governance” section of our website at www.patrickind.com.

Compensation Committee Interlocks and Director Participation

During 2010, no executive officer served on the Board or compensation committee of any other corporation with respect to which any member of the Compensation Committee was engaged as an executive officer. No member of the Compensation Committee was an officer or employee of the Company during 2010. Keith V. Kankel was formerly an officer of the Company from 1974-2004 and became a member of the Compensation Committee in 2008.

Corporate Governance and Nominations Committee

The Board has a Corporate Governance and Nominations Committee, which is comprised of Terrence D. Brennan (Chairman), Joseph M. Cerulli, Keith V. Kankel, Larry D. Renbarger and Walter E. Wells. This Committee met five times in 2010. The primary responsibilities of this committee include:

|

|

·

|

To assist the Board in identifying, screening, and recommending qualified candidates to serve as directors;

|

|

|

·

|

To recommend nominees to the Board to fill new positions or vacancies as they occur;

|

|

|

·

|

To review and recommend to the Board the compensation of directors;

|

|

|

·

|

To recommend to the Board candidates for election by shareholders at the annual meeting; and

|

|

|

·

|

To review and monitor corporate governance compliance as well as recommend appropriate changes.

|

The Board has determined that each of the current members of the Corporate Governance and Nominations Committee is independent as defined in the listing standards of the NASDAQ stock exchange and our Corporate Governance Principles. For a more detailed list of the roles and responsibilities of the Corporate Governance and Nominations Committee, please see the Corporate Governance and Nominations Committee Charter located in the “Corporate Governance” section of our website at www.patrickind.com.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires that certain of our officers, directors and 10% shareholders file with the SEC an initial statement of beneficial ownership and certain statements of changes in beneficial ownership of our common stock. Based solely on our review of such forms and written representation from the directors and officers that no other reports were required, we are unaware of any instances of noncompliance or late compliance with such filings during the fiscal year ended December 31, 2010, except with respect to the late filing of one Form 4 on December 6, 2010 for Mr. Cleveland.

The following Compensation Discussion and Analysis should be read in conjunction with the executive compensation tables and corresponding footnotes that follow. The discussion focuses on the compensation program in effect for the 2010 fiscal year and compensation decisions made with respect to the compensation program.

Compensation Discussion and Analysis

Compensation of Executive Officers and Directors

Summary

We believe that the compensation plan as it relates to our Named Executive Officers - Mr. Cleveland (“Chief Executive Officer” or “CEO”) and Mr. Nemeth (“Chief Financial Officer” or “CFO”), collectively the

(“NEOs”) and other members of senior management, including our named officers - Messrs. Rodino, Stump, and Schaeffer (the “other named officers”), should be aligned with the Company’s short-term and long-term organizational strategic agenda and its operating performance and cash flows, and assure appropriate management ownership in the Company. Messrs. Cleveland, Nemeth, Rodino, Stump and Schaeffer comprise our “named executive officers” as such term is used under SEC rules. Our objective is to provide a comprehensive market competitive program designed to attract, retain, motivate and align the best qualified top talents from inside and outside the industry and align the interest of our Board with our senior management team. In totality, we have implemented a performance management system which ultimately drives decisions by senior management to facilitate a “Customer First-Performance Based” environment through the execution of approved objectives linked to the short-term and long-term goals of the Company. In order to meet these objectives, the Compensation Committee has met numerous times over the past year and has conducted independent benchmark studies and analyses to ensure we are providing a complete and competitive performance and rewards strategy as it relates to our NEOs and other named officers.

Executive Compensation Decisions –

Participants and Roles, Plan Factors, Plan Components and Benchmark Sources

Participants and Roles

|

COMPENSATION

COMMITTEE

|

|

● Recommends to the Board, with the support of our management team and external advisors, the Company’s executive compensation and benefits programs to include the NEOs, other named officers, and select other members of senior management.

● Provides annual and ongoing review, discussion, analysis and recommendations regarding the evaluation of the execution of the performance plan for the NEOs, other named officers, and other members of senior management against business deliverables.

|

|

INDEPENDENT

COMMITTEE

CONSULTANT

|

● Provides published survey data, peer group proxy data and analysis and consultation to the Compensation Committee on executive and non-employee director compensation.

● Establishes and maintains an independent perspective to avoid any conflicts of interests while working directly for the Compensation Committee unless the committee has pre-approved any work to be conducted with management for review by the committee and approval by the Board.

|

|

|

CHIEF EXECUTIVE

OFFICER and VICE

PRESIDENT OF HUMAN

RESOURCES

|

|

● When requested by the Compensation Committee, provide executive compensation and benefit plan input related to the performance management structure and provide support on compensation and benefit program design and implementation, and compliance and disclosure requirements.

● Evaluate the performance plans of the CFO, named officers, and other senior management members in accordance with the Board approved plan.

|

Plan Factors

There are several key factors the Compensation Committee considers when recommending plan-year executive compensation:

|

·

|

NEOs, other named officers, and senior management members’ roles, position scope, organizational structure, experience, skill set, and performance history;

|

|

·

|

The external market for comparable roles;

|

|

·

|

The current and expected business climate; and

|

|

·

|

The Company’s financial position and its reflection of operating results.

|

Plan Components

The Compensation Committee enacts its own judgment in approving the components of compensation, benefits, and plan targets for the NEOs and other named officers. The committee further reviews and approves all pay and benefits parameters to include targets, thresholds, and maximums of short-term and long-term incentives. The committee takes into account these aforementioned factors and total compensation that may be earned through performance and paid through short-term and long-term incentives.

The Compensation Committee and the Company believe that the components of compensation and benefits should be directly linked to a pay-for-differentiated performance strategy and plan design. As a result, the approved executive compensation plan is heavily weighted and focused on the variable pay component of short-term and long-term incentives. The goal of the Committee is to ensure that the incentive plans are aligned with both the short-term and long-term interests of the shareholders through execution of the performance-based plan.

Benchmark Sources

Towers Watson, the Company’s independent compensation consultant for 2010 (the “Consultant”), provides the Compensation Committee with independent benchmark data for consideration when making compensation decisions. The Compensation Committee considers this information along with other relevant published compensation data in conjunction with the plan factors mentioned above when making compensation recommendations to the Board.

The Compensation Committee uses data from both general industry and the durable goods industry as part of its decision making process for the comparison of the NEOs and the other named officers. In 2010, the Compensation Committee established a peer group for the CEO (Mr. Cleveland) and CFO (Mr. Nemeth) roles and utilized peer group data in conjunction with the general industry and durable goods industry published survey data to evaluate and support compensation decisions for these roles.

Peer Group Selection Criteria

|

1.

|

Commensurate revenue generation scope to the Company’s revenue profile

|

|

2.

|

Industry/business type – industrial manufacturing and distribution firms with national footprints

|

|

3.

|

Geographically headquartered in the Mid-West markets

|

|

4.

|

The criteria above were the main drivers of peer group selection, along with each peer group candidate being evaluated for other similar business attributes which include profit margins, business mix, culture, and values fit.

|

Fiscal Year 2010 Peer Group

American Woodmark Corp., Cavco Industries Inc., Continental Materials Corp., Drew Industries Inc., Lawson Products Inc., MFRI Inc., Palm Harbor Homes Inc., PGT Inc., Skyline Corp., Spartan Motors Inc., Strattec Security Corp., and US Home Systems Inc.

Fiscal Year 2010 Compensation Context

The 2010 performance plan year was influenced by the initial onset of the market emerging from the effects of the recent worldwide macroeconomic downturn. Though certain segments of our business saw significant growth from 2009 to 2010, other segments remained challenged from the effects of the soft housing market and restrictive financing environment and continued to influence our compensation and benefits not only for the executive team, but for all team members. As our business continued to stabilize in 2010, we were able to reconfigure our Company-wide market and performance-based rewards platform to reflect the new state of our business and current market conditions.

Fiscal Year 2010 Executive Compensation

|

Compensation and Benefits Components

|

Description and Purpose

|

|

Base Salary

|

Cash payments reflective of market competitive position for performance of functional role.

|

|

Short-Term Incentives

|

Lump sum cash payments reflective of approved pay-for-performance plan and the relative achievements of the business and individual performance plans. The Board reserves the right at any time to award discretionary bonuses to senior management based on outstanding performance or other factors.

|

|

Long-Term Incentives

|

Restricted stock grants reflective of the Company’s desire to retain high performing talent and align the interests of senior management with shareholder interests.

|

|

Executive Health and Welfare Benefits

|

We do not have health and welfare benefits outside the scope of our standard plans for all employees.

|

|

Voluntary Deferred Compensation Plan

|

Voluntary deferred compensation plan whereby highly compensated individuals could elect to voluntarily defer all or a portion of their wages in any given years subject to applicable laws and restrictions. Designed to supplement market competitive position and further drive retention of key executives.

|

|

Perquisites

|

Perquisites were not included in the 2010 compensation and benefit plan design.

|

|

Other Compensation

|

Other compensation includes automobile allowance, Company contributions pursuant to the Patrick Industries, Inc. 401(k) Plan, and Company contributions to individual Health Savings Accounts and health club reimbursement pursuant to the Company’s general health and wellness program.

|

|

Executive Retirement Plan

|

Supplemental executive retirement program based on a formula of base wages, service and other criteria designed to retain key senior talent.

|

|

Severance Benefits

|

We continue to support our executive team and want to provide reasonable and customary transition support aligned to our market benchmark data.

|

Compensation Components – Mix and Levels

Base Salary

The Compensation Committee reviews and approves the base salaries of the NEOs and other named officers each year, as well as at the time of promotion, change in job responsibilities, or any other change deemed to be a material event. Base salaries are set during the first quarter of each year. The Compensation Committee sets

the salary for the President and CEO, and approves the base salaries for the CFO and the other named officers based on recommendations by the President and CEO.

In May 2008 in conjunction with Mr. Cleveland being appointed President and Chief Operating Officer, the Compensation Committee and the Board approved, based on a recommendation by the then CEO, Mr. Hassler, that Mr. Cleveland’s base salary be increased to $300,000 from $265,000. Mr. Cleveland, recognizing the deteriorating economic conditions, voluntarily elected not to accept the increase in base salary as recommended by the Compensation Committee and the Board until these conditions improved. Additionally, effective July 1, 2008, based upon unprecedented economic conditions in the recreational vehicle and manufactured housing industries, Mr. Nemeth voluntarily elected to take a 10% reduction in base salary. Effective March 30, 2009, the NEOs and the other named officers voluntarily elected to take significant further reductions in their base wages to levels that were well below market. The Board approved a partial restoration of base compensation for the NEOs and other named officers effective January 4, 2010 due to the stabilization of the Company’s performance in the second half of 2009.

The following table summarizes the 2009 and 2010 base salaries as approved by the Board for the NEOs and other named officers:

|

Name

|

2009 Base

Salary –

3/30/09 (1)

|

2010 Base

Salary –

1/4/10

|

%

Increase

1/04/10

|

|||||||||

|

Todd M. Cleveland

|

$ | 75,000 | $ | 275,000 | (2) | 266.7 | % | |||||

|

Andy L. Nemeth

|

120,000 | 215,000 | (2) | 79.2 | % | |||||||

|

Jeffrey M. Rodino (3)

|

110,000 | 150,000 | (4) | 36.4 | % | |||||||

|

Doyle K. Stump

|

110,000 | 145,000 | (4) | 31.8 | % | |||||||

|

Darin R. Schaeffer (5)

|

100,000 | 130,000 | (4) | 30.0 | % | |||||||

|

|

(1)

|

The 2009 base salaries represent the base salaries effective as of March 30, 2009 following voluntary reductions in base wages taken by the NEOs and other named officers.

|

|

|

(2)

|

The 2010 base salaries for Messrs. Cleveland and Nemeth were partially restored to levels previously approved by the Compensation Committee and the Board in 2008 which were $300,000 for Mr. Cleveland and $230,000 for Mr. Nemeth.

|

|

|

(3)

|

Mr. Rodino joined the Company in May 2007 with the acquisition of Adorn by the Company and held a variety of top level sales and marketing roles until his departure in January 2008. Mr. Rodino returned to the Company in August 2009 and was appointed Vice President of Sales for the Midwest. He was elected as a corporate officer in May 2010.

|

|

|

(4)

|

The 2010 base salaries for the other named officers were increased to reflect market referenced and performance based levels as of January 4, 2010.

|

|

|

(5)

|

Mr. Schaeffer resigned from all positions held with the Company effective September 3, 2010. Mr. Schaeffer’s base salary for 2010 represents his base salary through his date of resignation.

|

Non-Equity Incentive Plan Awards

The Annual Non-Equity Incentive Plan Awards (“Short-Term Incentives” or “STIs”) are reviewed and approved each year and are based on the achievement of a combination of the Company’s financial results and the individual’s performance against defined objectives. There are several key components considered in the development of the 2010 STI plan. These components are intended to align the STIs with shareholder interest by measuring the Company’s financial performance and the individual’s performance that we believe support the Company’s short and long-term strategies. These components include:

· Company performance, which is measured by the Company’s Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”) (50% weighting);

· Individual performance objectives (50% weighting) which is measured by:

|

|

1.

|

Financial objectives – Revenue and EBITDA targets (40% weighting within the individual performance objectives);

|

|

|

2.

|

Strategic objectives – Actions and initiatives linked to the Company’s organizational strategic agenda for the plan year (30% weighting within the individual performance objectives);

|

|

|

3.

|

Leadership and talent objectives – Actions and initiatives linked to the development of our talent, leadership, capabilities and our values (30% weighting within the individual performance objectives).

|

The portion of the STI award that is based on individual performance is determined the Compensation Committee’s assessment of an individual’s performance against defined objectives (50% weighting). It includes an individual performance target that is a percentage of base salary. Each NEO and the other named officers received an individual performance rating ranging from 0.0 to 5.0, with (a) a threshold performance rating of 2.5 (below which an individual is not eligible for an STI award regardless of Company performance), (b) a target performance rating of 3.0, and (c) a maximum performance rating of 5.0.

The actual STI award is also based upon the Company’s EBITDA performance (50% weighting), with (a) a threshold performance rating of 2.0 (below which an individual is not eligible for an STI award regardless of Company performance) ($8.0 million EBITDA in 2010), (b) a target performance rating of 3.0 ($10.1 million EBITDA in 2010), and (c) a maximum performance rating of 5.0 ($13.5 million EBITDA in 2010).

The actual STI award as a percentage of the target STI award is as follows: threshold individual and Company ratings - 42%; target individual and Company ratings - 100%; and maximum individual and Company ratings - 250%.

The Company achieved 2010 EBITDA of $9.5 million which equates to a 2.7 Company performance rating. When combined with the individual performance rating for each NEO and the other named officers, the resulting STI awards for 2010 were as follows:

2010 Short-Term Incentive Pay Out

|

Name

|

2010 Base

Salary

|

Target Award as a %

of Base Salary (1)

|

Target STI

Award

|

Actual Award

Amount as a %

of Target Award

|

2010 STI Award

|

|||||||||||||||

|

Todd M. Cleveland

|

$ | 275,000 | 85 | % | $ | 233,750 | 113.3 | % | $ | 264,917 | ||||||||||

|

Andy L. Nemeth

|

215,000 | 60 | % | 129,000 | 110.5 | % | 142,545 | |||||||||||||

|

Jeffrey M. Rodino

|

150,000 | 65 | % | 97,500 | 107.7 | % | 104,975 | |||||||||||||

|

Doyle K. Stump

|

145,000 | 55 | % | 79,750 | 90.7 | % | 72,307 | |||||||||||||

|

Darin R. Schaeffer

|

130,000 | N/A | N/A | N/A | N/A | |||||||||||||||

|

|

(1)

|

The target award as a percentage of base salary for the NEOs and other named officers was determined by the Compensation Committee and applied to the base salary in effect as of January 4, 2010.

|

While these targets were used in 2010, the Compensation Committee reserves the right to modify, cancel, change or reallocate any components of this calculation or criteria at any time.

Long-Term Incentives - Stock Awards

We believe that long-term incentive compensation provides appropriate motivational tools to achieve certain long-term Company goals and align the interests of our management team closely with those of our shareholders. Executive officers participate in our long-term compensation programs based on their ability to make

a significant contribution to the Company’s financial performance, their level of responsibility, their ability to meet performance objectives, and their leadership potential.

Performance Contingent Share Awards:

We believe that increasing senior management’s ownership in the Company is critical to our long-term strategic plan and keeping management goals aligned with increasing shareholder value. Due to the depressed economic conditions in 2010 and the Company’s financial position, there were no performance contingent shares granted to the NEOs and other named officers in 2010.

Discretionary Stock Awards:

We believe that management should be rewarded for outstanding performance and incentivized to remain with the Company irrespective of financial targets and metrics and therefore reserve the right to issue restricted stock grants to the NEOs, other named officers, and other individuals at our discretion. The Compensation Committee approved the granting of 110,000 shares of discretionary restricted stock to certain NEOs, other named officers and other members of senior management for the year ended December 31, 2010. The restricted stock grants distributed to the NEOs and the other named officers in 2010 are as follows:

Restricted Stock Grants – 2010 Distribution

|

Name

|

# of Shares (1)

|

|

Todd M. Cleveland

|

32,000

|

|

Andy L. Nemeth

|

22,000

|

|

Jeffrey M. Rodino

|

18,000

|

|

Doyle K. Stump

|

15,000

|

|

Darin R. Schaeffer

|

-

|

|

(1)

|

The closing stock price was $2.75 on the May 20, 2010 grant date. These shares cliff vest on the third anniversary of the grant date or May 20, 2013.

|

Non-Qualified Stock Options

There were no non-qualified stock options granted in 2010. A description of all stock awards held by the NEOs and other named officers as of the end of fiscal 2010 is contained in the “Outstanding Equity Awards at December 31, 2010” table on page 23. We reserve the right at any time to grant options under our Patrick Industries, Inc. 2009 Omnibus Incentive Plan.

Executive Retirement Plan and Non-Qualified Excess Plan

Executive Retirement Plan

The Company maintains a non-qualified executive retirement plan (the “Plan”) for Mr. Nemeth. According to the provisions of the Plan, Mr. Nemeth, upon vesting, is entitled to receive annually 40% of his respective highest annual base wages earned in the last three years prior to retirement or termination from the Company paid over ten years in 260 consecutive bi-weekly payments. Mr. Nemeth became fully vested in the plan on May 18, 2007 pursuant to a change of control event, which occurred on May 18, 2007, as a result of the Adorn acquisition and the Company’s private placement of shares to Tontine. No new employees have been invited to participate in the plan since January 1, 2007.

Non-Qualified Excess Plan

The Company maintains a voluntary non-qualified deferred compensation plan (the “NQDC Plan”) for its key executives whereby individuals can elect at the beginning of any fiscal year to defer all or a portion of their base

wages for that particular year, subject to applicable laws and restrictions. Participants are immediately vested in the plan. There were no material contributions made to the NQDC Plan in 2010.

Perquisites

We believe in a performance-based compensation and benefits package and therefore provide very few perquisites to our NEOs and other named officers. We do not provide the personal use of a company airplane, nor does the Company provide security at a personal residence, commuting expenses, personal travel using vehicles owned or leased by the Company except for the use of a company automobile by Mr. Cleveland, housing and other living expenses, clerical or secretarial services for personal matters, club memberships not exclusively used for business purposes, personal financial or tax advice or investment management services, or tax planning, financial planning, or tax preparation costs. We provide a car allowance to our NEOs, other named officers, corporate managers, and general managers, all of which are included as taxable income.

Benefit Plans

We do not maintain separate benefit plans for our NEOs and the other named officers. They participate in the same health and welfare plans as all of our other general employees with the same deductibles and co-pays. The NEOs and named officers also participate in the same 401(k) retirement program as all of the other general employees.

Equity Trading Restrictions

The Company has a policy whereby the mandatory blackout period begins on the last day of the fiscal month ending in a reporting period (March, June, September and December) and ends forty-eight hours after the public release of the financial information for that reporting period. During this period, Section 16 insiders and other management employees who have access to “inside” information are precluded from trading in the public market, any types of company owned equity securities. Additionally, the Company precludes any Section 16 insider, as defined by the SEC, Director, Officer or Employee from trading in the public market, or any other market, based on information that is not made available to the general public.

Summary Compensation Table

The following Summary Compensation Table sets forth information about the compensation paid to our CEO, our CFO and other named officers for the year ended December 31, 2010:

|

Name and Principal Position

|

Year

|

Salary

($)(1)

|

Bonus

($)(2)

|

Stock Awards

($)(3)

|

Option Awards

($)(4)

|

Non-Equity Incentive

Plan Compensation

($)(5)

|

All

Other Compensation

($)(6)

|

Total ($)

|

||||||||||||||||||||||

|

Todd M. Cleveland,

|

2010

|

$ | 266,250 | $ | - | $ | 88,000 | $ | 13,875 | $ | 264,917 | $ | 7,820 | $ | 640,862 | |||||||||||||||

| President and Chief |

2009

|

87,750 | - | 24,150 | 11,063 | - | 93 | 123,056 | ||||||||||||||||||||||

| Executive Officer |

2008

|

260,730 | - | 38,335 | - | - | 10,819 | 309,884 | ||||||||||||||||||||||

|

Andy L. Nemeth,

|

2010

|

211,347 | - | 60,500 | 8,094 | 142,545 | 23,832 | 446,318 | ||||||||||||||||||||||

|

Executive Vice President of Finance,

|

2009

|

159,411 | - | 17,250 | 6,453 | - | 12,559 | 195,673 | ||||||||||||||||||||||

|

Secretary-Treasurer, and Chief Financial Officer

|

2008

|

212,659 | - | 38,335 | 12,905 | - | 29,965 | 293,864 | ||||||||||||||||||||||

|

Jeffrey M. Rodino, Vice President Sales, Midwest (7)

|

2010

|

144,462 | - | 49,500 | - | 104,975 | 11,907 | 310,844 | ||||||||||||||||||||||

|

Doyle K. Stump,

|

2010

|

142,404 | - | 41,250 | 6,013 | 72,307 | 11,839 | 273,813 | ||||||||||||||||||||||

|

Vice President, Operations (8)

|

2009

|

112,298 | - | 13,800 | 4,794 | - | 10,500 | 141,392 | ||||||||||||||||||||||

|

Darin R. Schaeffer,

|

2010

|

90,897 | - | - | 625 | - | 46,727 | 138,249 | ||||||||||||||||||||||

| Vice President, |

2009

|

106,460 | - | - | 1,475 | - | (2,458 | ) | 105,477 | |||||||||||||||||||||

| Corporate Controller, and Principal Accounting Officer (9) |

2008

|

147,712 | - | 14,224 | - | - | 3,266 | 165,202 | ||||||||||||||||||||||

|

(1)

|

For information on base salaries, voluntary reductions in base wages taken in 2008 and 2009, and the restoration of base salaries to market referenced and performance based levels, see “Base Salary” on pages 15 and 16.

|

|

(2)

|

The NEOs and other named officers were not entitled to receive any payments that would be characterized as “Bonus” payments for the fiscal years ended December 31, 2010, 2009 or 2008.