DEF 14A: Definitive proxy statements

Published on April 1, 2024

Table of Contents

Table of Contents

Proxy

Statement

& Notice of 2024 Annual Meeting of Shareholders

Table of Contents

Dear

Shareholder

|

1 | |

Table of Contents

Table of Contents

Notice of Annual Meeting

| Date |

Location | Record Date | ||||||

| Thursday, May 16, 2024; |

Online at: meetnow.global/ | March 22, 2024 | ||||||

| 10:00 A.M. ET |

MAFG6HS | |||||||

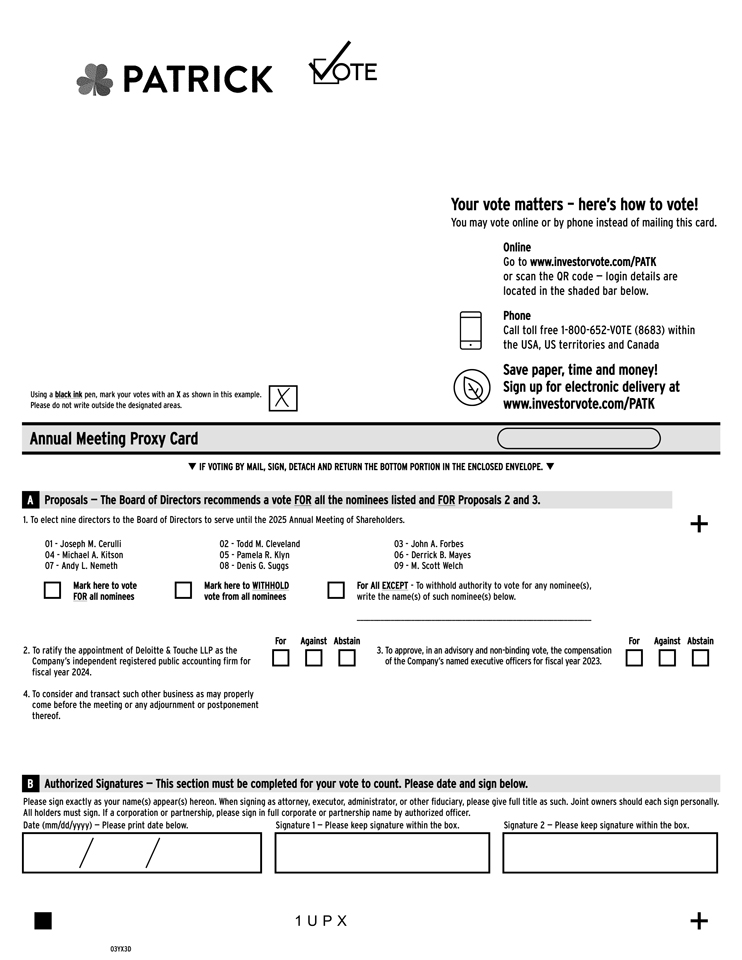

| PROPOSAL 1 | PROPOSAL 2 | PROPOSAL 3 | ||||||

|

To elect nine directors to the Board of Directors to serve until the 2025 Annual Meeting of Shareholders |

To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 2024 |

To approve, in an advisory and non- binding vote, the compensation of the Company’s named executive officers for fiscal year 2023 as disclosed in the Proxy Statement (a “Say-on- Pay” vote)

|

||||||

| Board Vote |

Board Vote | Board Vote | ||||||

| Recommendation: |

Recommendation: | Recommendation: | ||||||

| For Each Nominee

|

For

|

For

|

In addition

To consider and transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

Voting

Please vote your shares using the Internet, by telephone or by mail by signing, dating and returning the enclosed Proxy Card in the enclosed envelope. If you hold shares through a broker, custodian, fiduciary, or nominee (a “beneficial holder”), please check the voting instructions used by that broker, custodian, fiduciary, or nominee. Holders with a control number from Computershare, our transfer agent, can vote at the virtual Annual Meeting.

Please return your Proxy Card so your vote can be counted. See “Voting Q&A”.

By Order of the Board of Directors,

Joel D. Duthie

Executive Vice President, Chief Legal Officer

and Secretary

April 1, 2024

Virtual Meeting Format

You will be able to attend and participate in the Annual Meeting online, vote your shares electronically and submit your questions prior to and during the meeting by visiting: meetnow.global/ MAFG6HS on the meeting date and time described in the accompanying Proxy Statement.

If you plan to attend the meeting virtually on the Internet, you must register by following the instructions contained in the “Voting Q & A” section.

Notice of Internet Availability of Proxy Materials for the Annual Meeting of Shareholders

Our 2024 Proxy Statement and Annual Report to Shareholders for fiscal 2023 are available on Patrick Industries, Inc.’s website at www.patrickind.com under “For Investors - Company Info.” You may also request hard copies of these documents free of charge by writing to us at the following address: 107 W. Franklin Street, Elkhart, Indiana 46516. Attention: Office of the Secretary.

| Notice of 2024 Annual Meeting of Shareholders & Proxy Statement |

Table of Contents

Proxy Statement

Annual Meeting of Shareholders

This Proxy Statement and the accompanying Proxy Card are being mailed to shareholders of Patrick Industries, Inc. (the “Company” or “Patrick”) on or about April 3, 2024, and are furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) for the Annual Meeting of Shareholders to be held online (virtual meeting) on May 16, 2024 (the “Annual Meeting”) for the purpose of considering and acting upon the matters specified in the Notice of Annual Meeting of Shareholders accompanying this Proxy Statement.

If the form of proxy which accompanies this Proxy Statement is executed and returned, or is voted by Internet or by telephone, it may be revoked by the person giving it at any time prior to the voting thereof by:

| • | changing your vote using the online voting method, in which case only your latest Internet proxy submitted prior to the Annual Meeting will be counted; |

| • | filing with the Secretary of the Company, during or before the Annual Meeting, a written notice of revocation bearing a date later than the date of the proxy; |

| • | duly executing and dating a subsequent proxy relating to the common stock and delivering it to the Secretary of the Company during or before the Annual Meeting; or |

| • | voting your shares electronically during the Annual Meeting. |

If the form of proxy is signed, dated and returned without specifying choices on one or more matters presented to the shareholders, the shares will be voted on the matter or matters listed on the Proxy Card as recommended by the Company’s Board.

Additional solicitations in person, by telephone, or otherwise, may be made by certain directors, officers and employees of the Company regarding the proposals without additional compensation. Expenses incurred in the solicitation of proxies, including postage, printing and handling, and actual expenses incurred by brokerage houses, custodians, nominees and fiduciaries in forwarding documents to beneficial owners, will be paid by the Company.

Patrick’s Annual Report to Shareholders, which contains Patrick’s Annual Report on Form 10-K for the year ended December 31, 2023, accompanies this Proxy Statement. Requests for additional copies of the Annual Report on Form 10-K should be submitted to the Office of the Secretary, Patrick Industries, Inc., 107 W. Franklin Street, Elkhart, Indiana 46516. Annual Meeting materials may also be viewed online through our website, www.patrickind.com under “For Investors - Company Info.”

|

||

Table of Contents

Table of Contents

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 6 | ||||

| 8 | ||||

| 13 | ||||

| 14 | ||||

| Ratification of the Appointment of Independent Registered Public Accounting Firm |

16 | |||

| 18 | ||||

| 19 | ||||

| Advisory Vote to Approve the Compensation of Our Named Executive Officers |

20 | |||

| 22 | ||||

| 24 | ||||

| 29 | ||||

| 35 | ||||

| 36 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| Stock Options and Stock Appreciation Rights Exercises and Stock Vested in Fiscal 2023 |

41 | |||

| 42 | ||||

| Potential Payments upon Termination or Upon a Change of Control |

43 | |||

| 46 | ||||

| 47 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

51 | |||

| 52 | ||||

| 52 | ||||

| 53 | ||||

| 53 | ||||

| 54 | ||||

| Notice of 2024 Annual Meeting of Shareholders & Proxy Statement |

Table of Contents

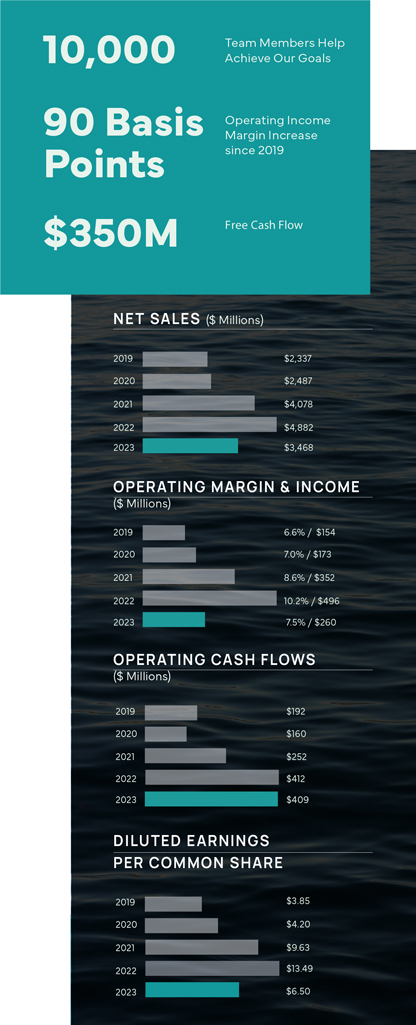

Business Financial Highlights

Fiscal 2023 clearly demonstrated the benefits of the strategic diversification investments we have made over the last five years, evidenced by the resilience of our business model as end market demand remained challenged. Our performance and operational excellence were driven by our phenomenal team members whose passion is clear in the solutions they provide, the customer relationships they foster, and the innovative products they design. Despite the impact of higher inflation and interest rates on our end markets, our team’s thoughtful execution of our playbook resulted in record free cash flow and gross margin in 2023. We strengthened our balance sheet and continued to return cash to shareholders, punctuated by our Board’s November 2023 decision to increase our quarterly dividend by 22%.

Our performance would not have been possible without our team’s diligent optimization of our processes, coupled with stringent inventory and cost management. We paid down $260 million of debt, reduced our inventory by $158 million, and saw year-over-year declines in our expenses through prudent management of our operations. We continued to reinvest in our business and our people, focusing on automation, product innovations and our BETTER Together training. We remain forward-looking and continue to evaluate future organic and strategic growth opportunities.

As a result of our team’s efforts, we have a strong financial foundation and see a promising long-term growth trajectory for each of our end markets, as we seek to leverage the work we have done to optimize our business and the strategic diversification investments we have made. As part of these efforts, we completed the acquisition of Sportech, our largest acquisition to date, in January 2024. Sportech is another step in the evolution of our business, providing a solid platform within the Powersports market for future organic and strategic growth. Our team’s experience managing through market cycles and their drive to be the supplier of choice to the Outdoor Enthusiast and Housing markets we serve leave us confident in the future of Patrick.

2023 results were anchored by our team members’ passion for the outdoors and our customer-focused values they exhibit when building Patrick’s portfolio of products, creating value for our shareholders and the communities we serve.

Table of Contents

Sustainability & Responsibility Highlights

In pursuit of a sustainable future, Patrick champions initiatives across three foundational pillars: Empowering People, Caring for Our Planet, and Living by Our Policies. This strategic approach has enhanced our operational efficiency, preserved our ethical standards and fostered a culture that prioritizes safety, wellness and professional growth.

Key achievements in 2023 include a 36% reduction in the Total Recordable Incident Rate, a 60% total waste recycling rate, and the engagement of over 3,000 team members in leadership training experiences, underscoring our commitment to our people, our planet, and our principles.

OUR AMBITION

“We are stewards, dedicated to our pursuit of responsible and sustainable practices - anchored in our BETTER Together culture - to positively impact our communities.”

| Notice of 2024 Annual Meeting of Shareholders & Proxy Statement | 2 | |

Table of Contents

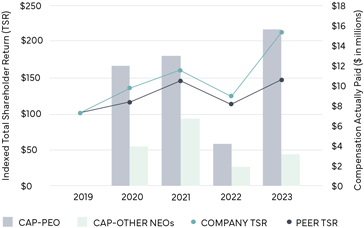

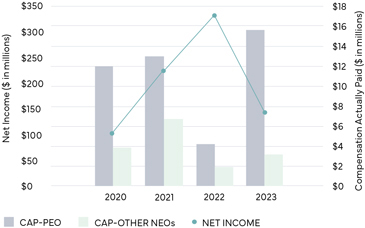

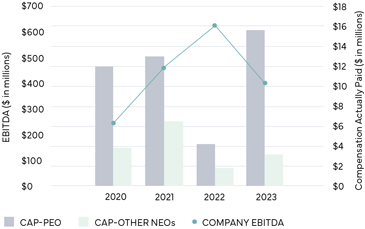

Executive Compensation Highlights

Aligning Pay to Differentiated Performance

Our leaders understand and are motivated to meet key metrics that drive growth, profitability and ultimately shareholder value in both the short and long term. Our Compensation Committee recommends compensation decisions to the Board which support this philosophy. The plan design is brought to life through understanding each compensation element and the impact of the individual’s and the team’s performance as outlined below.

Each compensation component, relative to peer group and general industry data, supports our philosophy of rewarding differentiated performance by emphasizing each executive’s variable pay elements.

| • | Base Salary, though lower than peer base compensation, is designed in alignment with the philosophy of focusing on performance-dependent variable pay. |

| • | The annual Short-Term Cash Compensation Plan provides for enhanced payouts for performance above plan up to a maximum of 200% of target compensation at 115% of plan and incorporates a threshold payout of 50% of target compensation at 75% of plan. |

| • | The annual Long-Term Incentive Compensation Plan is designed to drive the executive’s focus on long-term profitability through both organic and inorganic growth over the three-year award performance period. This equity plan is also designed to motivate leadership to perform above plan with a maximum payout of 200% of target compensation at 120% of plan and a threshold payout of 50% of target compensation at 80% of plan. |

| Compensation Element | Percentile Positioning vs. Peer Proxy and General Industry Data |

Our focus on variable pay to motivate performance, a key component of our compensation plan over the past decade, has proven successful in aligning our team’s compensation to shareholder returns. |

||||

|

Base Salary |

25th - 50th |

|||||

|

Short-Term Incentive |

50th - 75th |

|||||

|

Total Target Cash |

50th - 75th |

|||||

|

Long-Term Incentive |

25th - 50th |

|||||

|

Total Target Compensation |

50th - 75th |

|||||

Key Compensation Actions Taken In Fiscal 2023

| • | Base compensation for our Named Executive Officers (“NEOs”) was unchanged from 2022 to align with end-market conditions and expected financial performance in 2023 and size-scoping of our peer group and general industry data. |

| • | Continued to utilize external consultant, Willis Towers Watson, for data and consultation as requested by the Compensation Committee. |

For the compensation of our NEOs, please refer to the Compensation Discussion and Analysis.

|

3 | |

Table of Contents

Corporate Governance Highlights

In addition to executive compensation practices that strongly link pay and performance, the Board believes that fundamental corporate governance is critical to ensuring the Company is managed for the long-term benefit of our shareholders. Patrick’s Code of Ethics for Directors, Officers and Employees and its Corporate Governance Guidelines help to ensure that we “do business right.” For more information about our governance programs and Board of Directors, see Proposal 1.

Board Risk Oversight

The Board has delegated its risk oversight responsibilities to the Audit Committee, as described under the heading “Audit Committee”. In accordance with the Audit Committee’s Charter, each of our senior financial and accounting officers reports directly to the Audit Committee regarding material risks to our business, among other matters, and the Audit Committee meets in executive sessions with the senior financial and accounting officers, and with representatives of our independent registered public accounting firm. The Audit Committee Chairman reports to the full Board regarding material risks as deemed appropriate. In addition, the Compensation Committee annually considers the extent to which the risks arising from the compensation policies and practices of the Company are reasonably likely to have a material adverse effect on the Company as a whole.

Director Independence

Seven of the nine members of the Board (as of the date of this Proxy) have been designated by the Board as independent directors. The Board determines whether a director is independent by following the guidelines of the NASDAQ Stock Market and the SEC rules and regulations. The Board has determined that the independent directors in 2023 were Joseph M. Cerulli, John A. Forbes, Michael A. Kitson, Pamela R. Klyn, Derrick B. Mayes, Denis G. Suggs and M. Scott Welch.

Consideration of Director Candidates

| • | The Corporate Governance and Nominations Committee will consider Board nominees recommended by shareholders, which can be sent to the address provided below. |

| • | To nominate a candidate for director, under our Bylaws, a shareholder must provide to the Secretary of the Company: |

| • | Timely notice of the nomination (not less than 20 days or more than 50 days prior to the next Annual Meeting of Shareholders) |

| • | Written notice of nominee |

| • | Nominee’s name, age, business address, residential address, principal occupation, and number of shares of the Company owned |

| • | Nominee’s consent to be elected and serve |

| • | Documents required under federal securities laws |

| • | Candidate’s other board memberships (if any) |

Communication With Our Shareholders And Ensuring Document Accessibility

You can find our committee charters, Board Diversity Policy, Code of Ethics and Business Conduct, Corporate Governance Guidelines, and other documents on our website at www. patrickind.com, under “For Investors-Governance” or by writing to:

Patrick Industries, Inc.

Attn: Joel D. Duthie

EVP - Chief Legal Officer and Secretary

107 W. Franklin Street

Elkhart, Indiana 46516

Shareholders can reach out directly to our full Board or a Board member by writing to the above address. Communications intended for independent directors should be directed to the Chairman of the Corporate Governance and Nominations Committee.

| Notice of 2024 Annual Meeting of Shareholders & Proxy Statement | 4 | |

Table of Contents

Board Leadership and Accountability

As of the date of this Proxy Statement, our Board has nine members. Todd Cleveland serves as Chairman of the Board and M. Scott Welch serves as Lead Independent Director. Except for Andy Nemeth, our Chief Executive Officer, no director is an employee.

| • | Directors are elected for a one-year term |

| • | Board had 16 meetings in 2023 |

| • | Each director attended at least 75% of Board meetings and meetings of Board Committees on which they serve in 2023 |

| • | All directors attended the most recent Annual Meeting of Shareholders which was held on May 25, 2023 |

| • | We expect all Board Members to attend the annual meetings, but from time to time, other commitments may prevent all directors from attending each meeting |

Director Qualifications and Diversity

The Corporate Governance and Nominations Committee follows a diversity policy that requires the committee to consider diversity criteria - including race, ethnicity and gender - when identifying candidates for membership. The Committee will consider a candidate’s qualifications and background, including responsibility for operating a public company or a division of a public company, international business experience, a candidate’s technical and financial background or professional qualification, diversity of background and personal experience, and any other public company boards on which the candidate is a director. The Committee will also consider whether the candidate would be “independent” for purposes of the NASDAQ Stock Market and the SEC rules and regulations. The Committee may, from time to time, engage the services of a professional search firm to identify and evaluate potential nominees.

Board Composition Matrix (9 Total Directors)*

| Experience Expertise |

J. Cerulli | T. Cleveland | J. Forbes | M. Kitson | P. Klyn | D. Mayes | A. Nemeth | D. Suggs | M. Welch | |||||||||

|

Strategic Planning

|

● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||

|

Sales/Marketing

|

● | ● | ● | ● | ● | ● | ● | ● | ||||||||||

|

Manufacturing/ New Product Development

|

● | ● | ● | ● | ● | ● | ● | |||||||||||

|

Acquisitions

|

● | ● | ● | ● | ● | ● | ● | |||||||||||

|

Banking/Finance Relations

|

● | ● | ● | ● | ● | ● | ● | |||||||||||

|

Operations/Risk Management

|

● | ● | ● | ● | ● | ● | ● | |||||||||||

|

Industry Experience

|

● | ● | ● | ● | ● | |||||||||||||

|

Other Public Company Boards Currently Serving

|

● | ● | ● | ● | ||||||||||||||

|

Diversity

|

||||||||||||||||||

|

Gender Identity

|

Male | Male | Male | Male | Female | Male | Male | Male | Male | |||||||||

|

Race/Ethnicity

|

White | White | White | White | White | African American |

White | African American |

White | |||||||||

* As of March 22, 2024

|

5 | |

Table of Contents

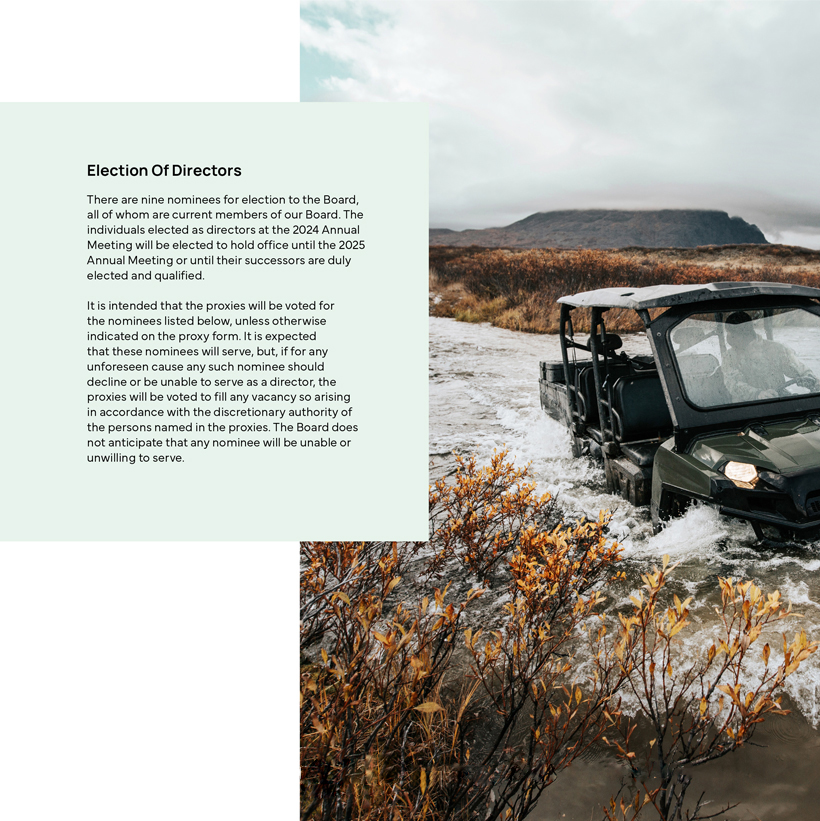

Proposal 1

| Notice of 2024 Annual Meeting of Shareholders & Proxy Statement | 6 | |

Table of Contents

| 2023 Board Composition and Governance Highlights |

||||||

| Size of Board | 9 | Annual Election of All Directors | ✓ | |||

| Average Age (in years) of Directors | 59 | Diverse Board Committee Chairs | ✓ | |||

| Number of Independent Directors | 7/9 |

Independent Directors Meet Without Non-Independent Directors Present |

✓ | |||

| Directors that are Gender or Racially/ Ethnically Diverse |

33% |

Board Orientation and Continuing Education | ✓ | |||

| Audit Committee Expertise | 67% | Board-level Oversight of Environmental, Social & Governance (ESG) Matters |

✓ | |||

| Average Tenure (in years) on Board | 10.9 | Annual Review of Committee Charters, Code of Ethics & Governance Guidelines |

✓ | |||

| Separate Chairman and CEO positions | ✓ | Succession Planning | ✓ | |||

| Lead Independent Director | ✓ | Sustainability Reporting Framework: SASB | ✓ | |||

Andy Nemeth, CEO

|

7 | |

Table of Contents

|

Nominees for Election |

|

|

Biography

Joseph M. Cerulli, age 64, has been employed by Tontine Associates, LLC, an investment management firm (together with its affiliates, “Tontine”), since January 2007.

Qualifications

Mr. Cerulli possesses extensive knowledge with respect to business operations, strategic planning, financial and investment matters, including investment banking, capital markets, and mergers and acquisitions strategy. |

|||

|

Joseph M. Cerulli

Age 64

Director since 2008 Committees Corporate Governance and Nominations (Chair) |

||||

|

Biography

Todd M. Cleveland, age 56, has been our Chairman of the Board since January 1, 2023 and Executive Chairman of the Board from January 2020 to December 31, 2022. Prior to that, Mr. Cleveland was Chairman of the Board from May 2018 to December 2019 and our Chief Executive Officer from February 2009 to December 2019. Mr. Cleveland was President of the Company from May 2008 to December 2015 and Chief Operating Officer of the Company from May 2008 to March 2013. Mr. Cleveland has served as a Director of IES Holdings, Inc. (“IES”) from 2017 to the present, and he has been the chairman of IES’s Human Resources and Compensation Committee since February 2019 and a member of IES’s Audit Committee since February 2021.

|

|||

|

Todd M. Cleveland

Age 56 Director since 2008 Committees None

Other Public Board Directorships IES Holdings, Inc. |

Qualifications

Mr. Cleveland has over 33 years of RV, marine, manufactured housing, and industrial experience in various operating capacities. He also has extensive knowledge of our Company and the industries to which we sell our products. Mr. Cleveland’s experience includes management development and leadership, acquisitions, strategic planning, finance and capital allocation, and the manufacturing and sales of our products. |

|||

| Notice of 2024 Annual Meeting of Shareholders & Proxy Statement | 8 | |

Table of Contents

|

Biography

John A. Forbes, age 64, has been a partner with Outcomes LLC and Full Sails LLC, two firms engaged in new product development and strategic business consulting, since June 2017. In addition, Mr. Forbes served as the interim Chief Financial Officer (“CFO”) of the Company from June 2020 to November 2020. Previously, Mr. Forbes was the President of Utilimaster, a business unit of Shyft Group (formerly known as Spartan Motors USA, Inc.), from July 2010 to June 2017. Prior to that time, he was the CFO of Utilimaster from May 2009 to July 2010, the CFO of Nautic Global Group, LLC from 2007 to 2009 and the CFO of Adorn, LLC from 2003 to 2007. Mr. Forbes has served as a director of Chase Packaging Corporation since March 2019. |

|||

|

John A. Forbes

Age 64 Director since 2011 Committees Audit • Compensation • Corporate Governance and Nominations

Other Public Board Directorships Chase Packaging Corporation |

Qualifications

Mr. Forbes has over 37 years of experience in serving various manufacturing industries, having held senior financial leadership roles. Mr. Forbes also has extensive experience with operations and talent management, acquisitions, strategic planning, risk management and banking relations. He has been determined by our Board to be an “audit committee financial expert” under the rules and regulations of the Securities and Exchange Commission (the “SEC”). |

|||

|

Biography

Michael A. Kitson, age 65, served as a fractional Chief Financial Officer (“CFO”) at Ascent CFO Solutions, a provider of outsourced financial and accounting services, from May 2022 to March 2023. Prior to that time, Mr. Kitson served as the CFO of oVertone Haircare, Inc. from July 2018 through January 2022. Previously, Mr. Kitson was a principal with AVL Growth Partners, a firm that provides Chief Financial Officer and other financial advisory services, from March 2017 to July 2018. Prior to that, Mr. Kitson was the CFO of MikaTek, Ltd. from January 2016 to July 2016, the Chief Executive Officer (“CEO”) of SharpShooter Imaging from March 2015 to January 2016, the CEO of Nautic Global Group (“Nautic”) from March 2011 to October 2013, and the CFO of Nautic from August 2010 to March 2011. |

|||

|

Michael A. Kitson

Age 65 Director since 2013 Committees Audit (Chair) • Compensation

|

Qualifications

Mr. Kitson has over 37 years of experience in serving various manufacturing industries in senior financial leadership roles. Mr. Kitson also has extensive experience with corporate and operations management, finance and capital allocation, strategic planning and risk management. He has been determined by our Board to be an “audit committee financial expert” under the SEC’s rules and regulations. |

|||

|

9 | |

Table of Contents

|

Biography

Pamela R. Klyn, age 53, has been the Executive Vice President of Corporate Relations and Sustainability at Whirlpool Corporation, a leading global major appliance company, since August 2023 and the Senior Vice President of Corporate Relations and Sustainability at Whirlpool from January 2022 to July 2023. Prior to that time, Ms. Klyn was a Senior Vice President in the Global Product Organization at Whirlpool Corporation from 2018 to 2021, and has held various leadership positions in marketing and engineering with Whirlpool Corporation since 1993. |

|||

|

Pamela R. Klyn

Age 53 Director since 2019 Committees Audit • Compensation • Corporate Governance and Nominations

|

Qualifications

Ms. Klyn has over 30 years of experience in the home appliance industry and has extensive experience in marketing, engineering, strategic planning, new product development, and sustainability practices. |

|||

|

Biography

Derrick B. Mayes, age 50, has been a Managing Partner of Bonaventure Equity, LLC since 2022. Prior to that time, Mr. Mayes was a Managing Partner of Play Like a Champion Capital, LLC from 2020 to 2022, and Vice President of WME/IMG, a strategic advisory firm to the sports and entertainment industry, from 2015 to 2021. Previously, he was the Chief Executive Officer of Executive Action Sports & Entertainment, serving as a strategic adviser to high profile individuals, groups and organizations in the sports and entertainment industry, from 2007 to 2015. |

|||

|

Derrick B. Mayes

Age 50 Director since 2019 Committees Audit • Compensation • Corporate Governance and Nominations

|

Qualifications

Mr. Mayes has over 23 years of experience in strategic planning, mergers and acquisitions, and executive leadership, with extensive experience in the digital communications space, and has been a leadership and diversity speaker to numerous public companies and private organizations, particularly in the sports and entertainment markets. |

|||

| Notice of 2024 Annual Meeting of Shareholders & Proxy Statement | 10 | |

Table of Contents

|

Biography

Andy L. Nemeth, age 55, has been the Company’s Chief Executive Officer since January 2020. Prior to that time, Mr. Nemeth was the President from January 2016 to July 2021, Executive Vice President of Finance and Chief Financial Officer from May 2004 to December 2015, and Secretary-Treasurer from 2002 to 2015. He was also the Vice President of Finance and Chief Financial Officer from 2003 to 2004. |

|||

|

Andy L. Nemeth

Age 55 Director since 2006 Committees None

|

Qualifications

Mr. Nemeth has over 32 years of RV, marine, manufactured housing, and industrial experience in various financial and management capacities. Mr. Nemeth also has particular knowledge of our Company and the industries to which we sell our products and has extensive experience with corporate management, development and leadership, acquisitions, strategic planning, risk management, capital allocation, and banking and finance relations. |

|||

|

Biography

Denis G. Suggs, age 58, has been the Chief Executive Officer of LCP Transportation, LLC, a non-emergency medical transportation company, since February 2020. Prior to that time, Mr. Suggs was the President and Chief Executive Officer of Strategic Materials Corp. from March 2014 to January 2020 and also served as Chairman from 2017 to 2020. Prior to that time, Mr. Suggs was the Global Executive Vice President of Belden, Inc. from 2009 to 2013 and the President of the Americas Division / Vice President of Belden, Inc. from 2007 to 2009. Mr. Suggs has served as a director of Smith & Wesson Brands, Inc. from May 2021 to present. |

|||

|

Denis G. Suggs

Age 58 Director since 2019 Committees Compensation (Chair) • Audit • Corporate Governance and Nominations

Other Public Board Directorships Smith & Wesson Brands, Inc. |

Qualifications

Mr. Suggs has over 25 years of experience in leading complex global businesses, having also held senior financial executive leadership roles with Danaher Corporation and Public Storage Corporation. Mr. Suggs also has extensive experience with corporate and operations management, strategic planning, mergers and acquisitions and risk management. Mr. Suggs served as a director of the Education Corporation of America from 2015 to 2018 and of Strategic Materials, Inc. and the Glass Packaging Institute from 2014 to 2020. He has been determined by our Board to be an “audit committee financial expert” under the SEC’s rules and regulations. |

|||

|

11 | |

Table of Contents

|

Biography

M. Scott Welch, age 64, has been the President and Chief Executive Officer of Welch Packaging Group, a large independently owned corrugated packaging company, since 1985. Prior to establishing Welch Packaging Group, he worked at Northern Box, Performance Packaging and Elkhart Container. Mr. Welch has served as a director of Lakeland Financial Corporation (“Lakeland”) from 1998 to present and a member of the compensation committee since 2012, and he was Lakeland’s lead independent director from 2012 to 2019. He has also served as a trustee of DePauw University since 2005. |

|||

|

M. Scott Welch

Age 64 Director since 2015 Lead Independent Director since 2018 Committees Audit • Compensation • Corporate Governance and Nominations

Other Public Board Directorships Lakeland Financial Corporation |

Qualifications

Mr. Welch has over 42 years of experience in the packaging industry and has extensive experience in sales, marketing, acquisitions, organizational development, strategic planning, finance and capital allocation. He has been determined by our Board to be an “audit committee financial expert” under the SEC’s rules and regulations. |

|||

|

| Notice of 2024 Annual Meeting of Shareholders & Proxy Statement | 12 | |

Table of Contents

2023 Non-Employee Director Compensation

|

01/01/2023-12/31/2023 |

(1) Non-employee directors receive an annual restricted stock grant in May of each year, which vests upon such director’s continued service as a Board member for one year from the grant date or earlier upon certain events. In addition, non-employee directors receive cash dividends on their restricted common stock holdings. The Company does not have stock ownership guidelines for its directors. |

|||||

|

Chairman of the Board Annual Retainer |

$400,000 | |||||

|

Annual Retainer (Non-Chairman Members) |

90,000 | |||||

|

Committee Chairpersons Annual Retainer: |

||||||

|

● Audit |

20,000 | |||||

|

● Compensation |

15,000 | |||||

|

● Corporate Governance and Nominations |

10,000 | |||||

|

Lead Independent Director Additional Annual Retainer |

25,000 | |||||

|

Annual Restricted Stock Grant (1) |

125,000 | |||||

In addition to the compensation described above, the Company reimburses the non-employee directors’ expenses, including travel, accommodations and meals, for attending Board and Board Committee meetings, our Annual Meeting of Shareholders and any other activities related to our business. Employee directors receive no compensation as such.

The compensation paid by the Company to the directors for 2023, other than Mr. Nemeth, is set forth in the table below. Information on compensation for Mr. Nemeth is set forth in the “Executive Compensation” section.

| Name

|

Fees Earned Or Paid In Cash (2)

|

Stock Awards (3)

|

Other

|

Total

|

||||||||||||

|

Joseph M. Cerulli |

|

$100,000 |

|

|

$125,020 |

|

|

$3,477 |

|

|

$228,497 |

|

||||

| Todd M. Cleveland (1) |

400,000 | 173,719 | 2,974 | 576,693 | ||||||||||||

| John A. Forbes |

90,000 | 125,020 | 3,477 | 218,497 | ||||||||||||

| Michael A. Kitson |

110,000 | 125,020 | 3,477 | 238,497 | ||||||||||||

| Pamela R. Klyn |

90,000 | 125,020 | 3,477 | 218,497 | ||||||||||||

| Derrick B. Mayes |

90,000 | 125,020 | 3,477 | 218,497 | ||||||||||||

| Denis G. Suggs |

105,000 | 125,020 | 3,477 | 233,497 | ||||||||||||

| M. Scott Welch |

115,000 | 125,020 | 3,477 | 243,497 | ||||||||||||

(1) Effective January 1, 2023, Mr. Cleveland was appointed Chairman of the Board (a non-executive position). Prior to that time, Mr. Cleveland was Executive Chairman of the Board of the Company (a named executive officer position) from January 2020 through December 31, 2022.

(2) Fees consist of an annual cash retainer for the Board, lead independent director, and committee chairperson’s service.

(3) Amounts shown do not represent compensation actually received. Such amounts reflect the aggregate grant date fair value of 1,803 shares of restricted stock granted to each non-employee director, at a closing stock price of $69.34 on May 25, 2023. In addition, upon Mr. Cleveland’s appointment as Chairman of the Board, he was granted an additional 799 shares of restricted stock at a closing stock price of $60.95 on January 3, 2023, which represents a pro-rated portion of the restricted stock granted to the other non-employee directors on May 12, 2022. These shares were 100% vested on May 12, 2023.

(4) Amounts shown represent cash dividends paid by the Company in 2023 on unvested shares held by the non-employee directors.

|

13 | |

Table of Contents

Board

Committees

Audit Committee

The Board has an Audit Committee for which Michael A. Kitson serves as the Chairman. The Audit Committee met 13 times in 2023.

The Audit Committee has a charter, which sets forth the responsibilities of the Audit Committee, which include:

| • | Oversight responsibilities related to potential material risks to the business, including, but not limited to, credit, liquidity, IT security, and operational risks; |

| • | Recommending to the Board the independent auditors to be engaged by the Company for the purpose of conducting the annual audit of our financial statements; |

| • | Discussing with the independent auditors the scope of their examination; |

| • | Reviewing our financial statements and the independent auditors’ report thereon with our personnel and the independent auditors; |

| • | Inviting the recommendations of the independent auditors regarding internal controls and other matters; and |

| • | Approving all non-audit services provided by the independent auditors and reviewing these engagements on a per occurrence basis. |

The Board has determined that each of the current members of the Audit Committee is independent, as defined in the NASDAQ listing standards and relevant SEC rules. In addition, as of the date of this proxy, the Board has determined that four of these members also meet both the qualifications required to be an audit committee financial expert and the financial sophistication requirements contained in the NASDAQ listing standards (Messrs. Forbes, Kitson, Suggs and Welch).

| For a more detailed list of the roles and responsibilities of the Audit Committee, please see the Audit Committee Charter located in the “For Investors – Governance – Governance Documents” section of our website at www.patrickind.com |

Compensation Committee

The Board has a Compensation Committee for which Denis G. Suggs serves as Chairman. The Compensation Committee met six times in 2023.

The Compensation Committee has a charter, which sets forth the responsibilities of the Compensation Committee, which include:

| • | Reviewing and recommending to the independent members of the Board the overall compensation programs for the officers of the Company; |

| • | Oversight authority to attract, develop, promote and retain qualified senior executive management; and |

| • | Oversight authority for the stock-based compensation programs. |

In its oversight of executive officer compensation, the Compensation Committee seeks assistance from our management and our independent compensation consultant, Willis Towers Watson, as further described below under the heading “Compensation Discussion and Analysis.” Willis Towers Watson’s fees are approved by the Compensation Committee. Willis Towers Watson provides the Compensation Committee with data about the compensation paid by our peer group and industry benchmark groups, updates the Compensation Committee on new developments in areas that fall within the Compensation Committee’s scope and is available to advise the Compensation Committee regarding all of its responsibilities, including best practices, market trends in executive compensation, and pay versus performance disclosures. Our Compensation Committee has assessed the independence of Willis Towers Watson pursuant to SEC and NASDAQ listing rules and determined that their work did not give rise to any conflicts of interest.

The Board has determined each of the current members of the Compensation Committee, as of the date of this proxy, is independent as defined in the NASDAQ listing standards and our Corporate Governance Guidelines.

| Notice of 2024 Annual Meeting of Shareholders & Proxy Statement | 14 | |

Table of Contents

Compensation Committee Interlocks and Director Participation

During 2023, no executive officer served on the board or compensation committee of any other corporation with respect to which any member of the Compensation Committee was engaged as an executive officer. No member of the Compensation Committee was an officer or employee of the Company during 2023.

| For a more detailed list of the roles and responsibilities of the Compensation Committee, please see the Compensation Committee Charter located in the “For Investors – Governance – Governance Documents” section of our website at www.patrickind.com |

Corporate Governance and Nominations Committee

The Board has a Corporate Governance and Nominations Committee for which Joseph M. Cerulli serves as the Chairman. The Corporate Governance and Nominations Committee met five times in 2023.

The Corporate Governance and Nominations Committee has a charter, which sets forth the responsibilities of the Corporate Governance and Nominations Committee, which include:

| • | Assisting the Board in identifying, screening and recommending qualified candidates to serve as directors; |

| • | Recommending nominees to the Board to fill new positions or vacancies as they occur; |

| • | Reviewing and recommending to the Board the compensation of directors; |

| • | Recommending to the Board nominees for election by shareholders at the Annual Meeting; |

| • | Reviewing and monitoring corporate governance compliance as well as recommending appropriate changes; |

| • | Reviewing the succession planning for our senior executive officers; |

| • | Providing overall oversight of our ESG policies and initiatives and working with management to identify and define relevant ESG topics and programs; and |

| • | Conducting an annual assessment of the Board’s performance. |

The Board has determined that each of the current members of the Corporate Governance and Nominations Committee, as of the date of this proxy, is independent as defined in the listing standards of the NASDAQ Stock Market and our Corporate Governance Guidelines.

Delinquent Section 16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934 requires that certain of our officers, directors and 10% shareholders file with the SEC an initial statement of beneficial ownership and certain statements of changes in beneficial ownership of our common stock. Based solely on our review of such forms and written representation from the directors and officers that no other reports were required, we are unaware of any instances of noncompliance or late compliance with such filings during the fiscal year ended December 31, 2023, except with respect to the late filings of: two Form 4 filings on June 8, 2023 and on September 11, 2023 for Andy L. Nemeth, Chief Executive Officer, with respect to the gifting of stock transactions that occurred on June 5, 2023 and July 28, 2023, respectively; one Form 4 filing on September 22, 2023 for Derrick B. Mayes, Director, with respect to a transaction that occurred on September 13, 2023; and one Form 4 filing on October 4, 2023 for Joel D. Duthie, Executive Vice President, Chief Legal Officer and Secretary, with respect to a transaction that occurred on September 29, 2023.

| For a more detailed list of the roles and responsibilities of the Corporate Governance and Nominations Committee, please see the Corporate Governance and Nominations Committee Charter located in the “For Investors – Governance – Governance Documents” section of our website at www.patrickind.com |

|

15 | |

Table of Contents

| Notice of 2024 Annual Meeting of Shareholders & Proxy Statement | 16 | |

Table of Contents

|

17 | |

Table of Contents

Independent Public Accountants

Audit Fees

The following table presents fees and out-of-pocket expenses for professional audit services rendered by Deloitte during the fiscal years ended December 31, 2023 and 2022:

As noted above in Proposal 2, the Audit Committee has appointed Deloitte as our independent registered public accounting firm for the fiscal year ending December 31, 2024.

| 2023 | 2022 | |||||||

| Audit Fees (1) |

$2,918,600 | $2,674,300 | ||||||

| Audit Related Fees (2) |

- | 298,300 | ||||||

| Tax Fees (3) |

507,600 | 362,800 | ||||||

| Other Fees (4) |

1,900 | 1,900 | ||||||

| Total Fees |

$3,428,100 | $3,337,300 | ||||||

(1) Audit fees consist of fees for professional services rendered for the annual audit of the Company’s financial statements, the reviews of the financial statements included in the Company’s quarterly reports, and other services normally provided by the independent auditor in connection with statutory and regulatory filings or engagements.

(2) Audit related fees in 2022 consist of fees related to due diligence services.

(3) Tax fees include fees related to tax compliance and consulting services.

(4) Other fees consist of an annual subscription for an online accounting research tool licensed from Deloitte.

The Audit Committee has advised us that it has determined that the non-audit services rendered by our independent auditors during our most recent fiscal year are compatible with maintaining the independence of such auditors.

The Audit Committee has adopted a Preapproval Policy for Audit and Non-Audit Services pursuant to which it preapproves all audit and non-audit services provided by the independent auditors prior to each particular engagement.

The Audit Committee has delegated authority to its Chairman to approve certain proposed services other than the annual audit, tax and quarterly review services, and the Chairman must report any approvals to the balance of the Committee at the next scheduled meeting.

| Notice of 2024 Annual Meeting of Shareholders & Proxy Statement | 18 | |

Table of Contents

Audit Committee Report

The following report of the Audit Committee does not constitute soliciting material and shall not be deemed incorporated by reference by any general statement incorporating by reference the proxy statement into any filing by us under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under such acts.

The responsibilities of the Audit Committee, which are set forth in the Audit Committee Charter adopted by the Board, include providing oversight of our financial reporting process through periodic meetings with our independent auditors, principal accounting officer and management to review accounting, auditing, internal controls and financial reporting matters.

The Audit Committee has met and held discussions with management and Deloitte with respect to the 2023 audited financial statements. The Audit Committee reviewed and discussed with Deloitte the consolidated financial statements, and Deloitte’s evaluation of the Company’s internal controls over financial reporting.

The Audit Committee also discussed with Deloitte the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC, and other professional standards and regulatory requirements currently in effect.

We have received from Deloitte a letter providing the disclosures required by the applicable requirements of the Public Company Accounting Oversight Board regarding Deloitte’s communications with the Audit Committee concerning independence with respect to any relationships between us and Deloitte that in their professional judgment may reasonably be thought to bear on independence. Deloitte has discussed its independence with us, and has confirmed in such letter that, in its professional judgment, it is independent from us within the meaning of the federal securities laws. The Audit Committee concluded that non-audit services provided by Deloitte during the year ended December 31, 2023 were compatible with Deloitte’s independence.

Based on the review and discussions described above, with respect to our audited financial statements included in our 2023 Annual Report to Shareholders, we have recommended to the Board of Directors that such financial statements be included in our Annual Report on Form 10-K for filing with the SEC.

As specified in the Audit Committee Charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that our financial statements are complete and accurate and in accordance with generally accepted accounting principles. That is the responsibility of management and our independent auditors. In giving our recommendation to the Board of Directors, we have relied on (i) management’s representation that such financial statements have been prepared with integrity and objectivity and in conformity with generally accepted accounting principles and (ii) the report of our independent auditors with respect to such financial statements. This report was adopted by the Audit Committee on February 27, 2024.

| The Audit Committee

Michael A. Kitson (Chairman)

John A. Forbes

Pamela R. Klyn

Derrick B. Mayes

Denis G. Suggs

M. Scott Welch |

||

|

19 | |

Table of Contents

| Notice of 2024 Annual Meeting of Shareholders & Proxy Statement | 20 | |

Table of Contents

|

21 | |

Table of Contents

Executive Compensation

The following Compensation Discussion and Analysis (“CD&A”) should be read in conjunction with the executive compensation tables and corresponding footnotes that follow. The discussion focuses on the compensation program approved by the Board for the 2023 fiscal year for the Named Executive Officers (“NEOs”).

Named Executive Officers

Andy L. Nemeth, Jeffrey M. Rodino, Kip B. Ellis, Matthew S. Filer and Joel D. Duthie, who are the NEOs for fiscal 2023, are shown below along with a brief biography. Mr. Filer, who joined the Company in November 2022 as Senior Vice President of Finance, assumed the position of Interim Chief Financial Officer (“CFO”) effective May 15, 2023 upon the resignation of Jacob R. Petkovich. Mr. Petkovich, who served as CFO from November 2020 until his departure from the Company effective May 14, 2023, was an NEO for a portion of 2023 and is included in the CD&A and accompanying tables as applicable.

|

Andy L. Nemeth was appointed Chief Executive Officer of the Company in January 2020. Prior to that time, Mr. Nemeth served as President of the Company from January 2016 to July 2021. Mr. Nemeth was the Executive Vice President of Finance and Chief Financial Officer from May 2004 to December 2015, and Secretary-Treasurer from 2002 to 2015. Mr. Nemeth has over 32 years of RV, marine, manufactured housing, and industrial experience in various financial and managerial capacities.

|

|||||

|

Andy L. Nemeth

Chief Executive Officer |

||||||

|

Jeffrey M. Rodino was appointed President of the Company in July 2021. Prior to that time, Mr. Rodino was Chief Sales Officer from September 2016 to July 2021 and Executive Vice President of Sales from December 2011 to July 2021. Mr. Rodino was Chief Operating Officer of the Company from March 2013 to September 2016, and Vice President of Sales for the Midwest from August 2009 to December 2011. Mr. Rodino has over 30 years of experience in serving the RV, marine, manufactured housing, and industrial markets. Effective January 24, 2024, Mr. Rodino was named President – Recreational Vehicles (“RV”) with responsibility for the oversight, leadership, strategic planning, and accounting for our RV end market businesses.

|

|||||

|

Jeffrey M. Rodino

President |

||||||

| Notice of 2024 Annual Meeting of Shareholders & Proxy Statement | 22 | |

Table of Contents

|

Kip B. Ellis was appointed Executive Vice President of Operations and Chief Operating Officer of the Company in September 2016. He was elected an officer in September 2016. Mr. Ellis joined the Company as Vice President of Market Development in April 2016. Prior to his role at Patrick, Mr. Ellis served as Vice President of Aftermarket Sales for the Dometic Group from 2015 to 2016. Prior to his tenure at Dometic, Mr. Ellis served as Vice President of Global Sales and Marketing from 2007 to 2015 at Atwood Mobile Products. Mr. Ellis has over 27 years of experience serving the RV, marine, manufactured housing, and industrial and automotive markets. Effective January 24, 2024, Mr. Ellis was named President - Powersports, Technology and Housing, with responsibility for the oversight, leadership, strategic planning and accounting in those end markets.

|

|||||

|

Kip B. Ellis

Executive Vice President of Operations and Chief Operating Officer |

||||||

|

Matthew S. Filer was appointed Interim Executive Vice President - Finance, Chief Financial Officer, and Treasurer of the Company in May 2023, a position which he held until March 4, 2024 at which time he returned to his previous role as Senior Vice President of Finance. Mr. Filer joined the Company in November 2022 as Senior Vice President of Finance. Prior to his role at Patrick, Mr. Filer was with Caterpillar Inc. from 2007 to 2021, serving in a series of progressive global leadership roles which culminated in his appointment as Chief Financial Officer for divisions within Caterpillar’s Resource Industries segment. With over 27 years of experience with prior organizations that include Honeywell and Raytheon, Mr. Filer has extensive industry knowledge across multiple disciplines such as rail, mining, industrial and defense.

|

|||||

|

Matthew S. Filer

Interim Executive Vice President of Finance, Chief Financial Officer, and Treasurer |

||||||

|

Joel D. Duthie joined the Company as General Legal Counsel in November 2020 and was appointed Executive Vice President, Chief Legal Officer and Secretary in May 2021. Prior to joining Patrick, Mr. Duthie was a partner with Barnes & Thornburg LLP, and practiced law at the firm from 2000 to 2002 and 2007 to 2020. As a corporate lawyer, Mr. Duthie focused on mergers and acquisitions, supply chain management and commercial contract counseling. Mr. Duthie served as an assistant general counsel for a privately held manufacturer of flow control products from 2002 to 2006.

|

|||||

|

Joel D. Duthie

Executive Vice President, Chief Legal Officer and Secretary |

||||||

|

23 | |

Table of Contents

Compensation Discussion

and Analysis

We believe our compensation plan, as it relates to the NEOs and other executives, should be aligned with the Company’s short-term and long-term organizational strategic agendas and its operating performance and cash flows and ensure appropriate management ownership in the Company. Messrs. Nemeth, Rodino, Ellis, Filer, Petkovich and Duthie comprise our NEOs for fiscal 2023, as such term is used under SEC rules. Our philosophy and objectives are to provide a comprehensive market competitive compensation program designed to attract, retain and motivate the best qualified talent from inside and outside the industry and to align the interests of our senior management team with the interests of our shareholders, in both the short-term and long-term.

The Company utilizes a “pay-for-differentiated performance” compensation philosophy that establishes base salaries that are generally low relative to its peer group companies while offering the opportunity for greater upside potential by establishing performance-based short-term and long-term incentives that are generally high relative to its peer group companies. Our performance management system links compensation to achieving or exceeding certain objectives based on our short-term and long-term goals. In order to meet these objectives, the Compensation Committee has met numerous times over the past year and has conducted independent benchmark studies and analyses, in conjunction with the utilization of a third-party compensation consultant, to develop a comprehensive performance and rewards compensation strategy as it relates to our NEOs and other executives. See “Plan Components” discussion below.

2023 Executive Compensation Plan: Pay-at-Risk

The 2023 Executive Compensation Plan for the NEOs was designed to compensate and reward the plan participants with “pay-for-differentiated performance.” The executive compensation is designed for each component to incrementally reward the NEO as performance against established key financial metrics is achieved. This plan design places a high degree of emphasis and reward based on variable compensation or “pay-at-risk.” Each element of compensation is outlined below to demonstrate the philosophy and architecture of the plan design.

Base Pay (Salary)

To implement our variable pay-at-risk philosophy in 2023, we intentionally set the NEOs’ base salaries lower than market-based salaries. The base pay in 2023 was unchanged from the 2022 base pay for each of the NEOs, including that of Messrs. Filer and Duthie, who were not NEOs in 2022. Base compensation in 2023 was set to align with end-market conditions and expected financial performance in 2023 and was in alignment with the Company’s and NEO’s scope and to assure a competitive position with the market for total target direct compensation.

The CEO and each of the other NEOs’ base compensation for 2023 was aligned to the 25th to 50th percentile range of their respective established peer group and general industry data.

| Executive |

2023 Base Pay

|

Fixed Or Variable Pay | ||||||

| CEO |

$850,000 | Fixed Pay | ||||||

| All Other NEOs Combined (1) |

1,925,000 | Fixed Pay | ||||||

(1) All other NEOs comprised of Messrs. Rodino, Ellis, Filer and Duthie. Mr. Petkovich is excluded.

| Notice of 2024 Annual Meeting of Shareholders & Proxy Statement | 24 | |

Table of Contents

Non-Equity Incentive Plan Compensation (Short-Term Incentive Plan)

The 2023 Short-Term Incentive Plan (“STIP”) was designed to reward the CEO and each of the other NEOs for differentiated incremental performance against the net income of the plan year (net of 2023 acquisitions) and individual performance goals of each NEO. The STIP is designed to be 100% variable, performance dependent, pay-at-risk. Assuming target performance, the net income metric performance accounts for 70% of the performance payout and each NEO’s personal strategic objectives account for 30% of the performance payout, allowing for differentiation of each individual NEO’s contributions to the performance of the Company. STIP compensation may range from 0% to 200% of target.

If an individual’s performance rating is below the threshold performance rating, such individual is not eligible for a STIP award regardless of Company performance. If the Company’s net income (net of acquisitions) performance is below the threshold Company performance, no individual is eligible for that performance plan year’s annual STIP award regardless of individual performance.

The STIP threshold, target, stretch and maximum performance levels for both net income (net of 2023 acquisitions) and personal performance and related payouts, are noted below for reference.

Company Performance (70% Of Target Performance Payout)

| Net Income Performance |

Performance To Plan (%)

|

Payout (%) | ||||||

| Less Than Threshold |

<75 | - | ||||||

| Threshold |

75 | 50 | ||||||

| Target (Plan) |

100 | 100 | ||||||

| Stretch |

110 | 175 | ||||||

| Maximum |

115 | 200 | ||||||

NEO Individual Performance (30% Of Target Performance Payout)

| Personal Performance |

Performance Rating (0-5 Scale)

|

Payout (%) | ||||||

| Less Than Threshold |

<2.5 | - | ||||||

| Threshold |

2.5 | 50 | ||||||

| Target (Plan) |

3.5 | 100 | ||||||

| Stretch |

4.4 | 175 | ||||||

| Maximum |

5.0 | 200 | ||||||

The STIP target amount for the CEO and each of the other NEOs is designed to align to the 50th to 75th percentile range of established peer group and general industry pay percentiles.

| Executive |

2023 Target STIP

|

Fixed Or Variable Pay | ||||||

| CEO |

$1,800,000 | Variable Pay | ||||||

| All Other NEOs Combined (1) |

2,650,000 | Variable Pay | ||||||

(1) All other NEOs comprised of Messrs. Rodino, Ellis, Filer and Duthie. Mr. Petkovich is excluded.

|

25 | |

Table of Contents

Long-Term Incentive Plan Compensation (Long-Term Incentive Plan)

The 2023 Long-Term Incentive Plan (“LTIP”) was designed to reward the NEOs for sustained, long-term performance while ensuring incremental reward for differentiated performance against the Company’s three-year cumulative earnings before interest, taxes, depreciation and amortization (“EBITDA”) plan. The design of the LTIP creates 80% of the target value of the award in the form of performance-dependent variable pay and 20% in the form of retentive, time-based fixed compensation with three-year cliff vesting.

The LTIP threshold, target, stretch and maximum performance levels for three-year cumulative EBITDA and related payouts are noted below for reference.

|

3-Year Cumulative EBITDA

|

Performance To Plan (%)

|

Payout (%)

|

||||||

| Less Than Threshold |

<80 | - | ||||||

| Threshold |

80 | 50 | ||||||

| Target (Plan) |

100 | 100 | ||||||

| Stretch |

110 | 150 | ||||||

| Maximum |

120 | 200 | ||||||

The LTIP target amount for the CEO and each of the other NEOs is designed to align to the 25th to 50th percentile range of peer and general industry pay percentiles. The target value of the LTIP is awarded in Restricted Stock Units (“RSUs”). The table below outlines the target LTIP amount for the CEO and all the other NEOs combined.

|

Executive

|

2023 Target LTIP

|

Variable Pay (80%)

|

Fixed Pay (20%)

|

|||||||||

| CEO |

$3,000,000 | $2,400,000 | $600,000 | |||||||||

| All Other NEOs Combined (1) |

3,113,000 | 2,490,400 | 622,600 | |||||||||

(1) All other NEOs comprised of Messrs. Rodino, Ellis, Filer and Duthie. Mr. Petkovich is excluded.

Total Target Compensation Fixed vs. Variable Pay Summary

Upon combining all pay elements of the 2023 Executive Compensation Plan, the percentages of Total Fixed versus Variable Pay at target are depicted in the table below.

| Executive | Total Target Compensation |

Total Target Fixed Pay |

Total Target Variable Pay |

|||||||||||||||||

|

$

|

%

|

$

|

%

|

|||||||||||||||||

| CEO |

$5,650,000 | $1,450,000 | 25.7 | % | $4,200,000 | 74.3 | % | |||||||||||||

| All Other NEOs Combined (1) |

7,688,000 | 2,547,600 | 33.1 | % | 5,140,400 | 66.9 | % | |||||||||||||

(1) All other NEOs comprised of Messrs. Rodino, Ellis, Filer and Duthie. Mr. Petkovich is excluded.

Clawback Policy

In 2023, the Board implemented an Incentive Compensation Recovery Policy (otherwise commonly referred to as a “Clawback Policy”). The Incentive Compensation Recovery Policy was implemented in alignment with federal securities regulations and NASDAQ listing requirements.

| Notice of 2024 Annual Meeting of Shareholders & Proxy Statement | 26 | |

Table of Contents

Participants and Roles

|

Participants

|

Responsibilities

|

|

| Compensation Committee |

• Reviews and approves, with input from our management team and external advisors, the Company’s executive compensation and benefits programs, including the NEOs.

• Provides annual and ongoing review, discussion, analysis and recommendations regarding the evaluation of the execution of the performance plan for the NEOs against defined business objectives.

|

|

| Independent Committee Consultant |

• Provides published survey data, peer group proxy data and analysis and consultation to the Compensation Committee on executive and non-employee director compensation.

• Establishes and maintains an independent perspective to avoid any conflicts of interests while working directly for the Compensation Committee unless the Committee has preapproved any work to be conducted with management for review by the Committee and approval by the Board.

|

|

| Chief Executive Officer and Chief Human Resources Officer |

• When requested by the Compensation Committee, provide executive compensation and benefit plan input related to the performance management structure and provides support on compensation and benefit program design and implementation, as well as compliance and disclosure requirements.

• The CEO evaluates the performance plans of the President, COO and CFO and other executives in accordance with the Board approved plan.

|

|

Plan Factors

There are several key factors the Compensation Committee considers when recommending plan-year executive compensation decisions:

| • | NEOs’ roles, position scope, experience, skill set and performance history; |

| • | External market for comparable roles; |

| • | Current and expected business climate; and |

| • | Company’s financial position and operating results. |

Plan Components

The Compensation Committee utilizes its own judgment in approving the components of compensation, benefits, and plan targets for the NEOs. The Compensation Committee further reviews and approves compensation including base compensation, targets, thresholds, and maximums of short-term and long-term incentive compensation. In addition, the Compensation Committee utilizes a third-party compensation consulting firm, Willis Towers Watson, to provide relevant compensation benchmarks for the NEOs and other key leadership roles as well as plan design review and input. The CEO evaluates the performance plans of the President, COO, CFO and other executive officers with the Compensation Committee. The CEO develops his own individual objectives for the plan year and evaluates his own performance against those objectives. Final determinations regarding our CEO’s performance and compensation are made during an executive session of the Compensation Committee and are reported to and reviewed by the Board in an independent directors’ session. Holders of approximately 95% of the shares voted in the most recent shareholder advisory vote at our Annual Meeting of Shareholders held on May 25, 2023 voted to approve the compensation of the NEOs for fiscal year 2022. The Compensation Committee takes the shareholder advisory voting results, along with any other shareholder input on executive compensation, into consideration as one of several decision points in its executive compensation decision making process for each plan year.

|

27 | |

Table of Contents

Benchmark Sources and Fiscal Year 2023 Peer Group

In an effort to provide a better aligned peer group for purposes of market comparison of our executive compensation packages based on our general guidelines and as described under “Plan Components,” an important factor in establishing the 2023 Executive Compensation Plan is the external market for comparable roles. In addition, based on the data utilized from an index of General Industry companies provided by the Central Data Base Survey of Willis Towers Watson, our independent compensation committee consultant, there were no changes made by the Compensation Committee to the benchmark peer group for the period ended December 31, 2023 (as compared to the 2022 peer group). We believe the following companies listed represent an effective comparator group of similar size and with similar scope of revenue and market capitalization.

| • | American Woodmark Corporation |

| • | Apogee Enterprises, Inc. |

| • | Brunswick Corporation |

| • | Cavco Industries, Inc. |

| • | EnPro Industries, Inc. |

| • | Hyster-Yale Materials Handling, Inc. |

| • | LCI Industries, Inc. |

| • | Masonite International Corporation |

| • | Modine Manufacturing Company |

| • | Mueller Industries, Inc. |

| • | Polaris, Inc. |

| • | Thor Industries, Inc. |

| • | UFP Industries, Inc. |

| • | Wabash National Corporation |

| • | Winnebago Industries, Inc. |

| Notice of 2024 Annual Meeting of Shareholders & Proxy Statement | 28 | |

Table of Contents

Fiscal Year 2023 Executive Compensation

| Compensation And Benefits Components |

Description And Purpose | |

| Base Salary | Cash payments reflecting a market competitive position for performance of functional role. | |

| Short-Term Incentives | Lump sum cash payments reflective of approved pay-for-performance plan and the relative achievements of the business and individual performance objectives. In addition, the Board reserves the right at any time to award discretionary bonuses to senior management based on outstanding performance or other factors. | |

| Long-Term Incentives | Stock vehicle grants reflecting approved pay-for-performance plan and the relative long-term achievement of the business performance plans as well as the Company’s desire to retain high-performing talent and align the interests of senior management with shareholder interests. | |

| Executive Health and Welfare Benefits | Health and welfare benefits mirror scope of standard plans for all employees. | |

| Voluntary Deferred Compensation Plan | Highly compensated individuals can elect to voluntarily defer all or a portion of their wages in any given year subject to applicable laws and restrictions. Designed to supplement market competitive position and further drive retention of key executives. | |

| Other Compensation | Other compensation includes: Automobile allowance, Company contributions pursuant to the Patrick Industries, Inc. 401(k) Plan and to individual Health Savings Accounts, and health club reimbursement pursuant to the Company’s general health and welfare program. | |

| Severance Benefits | Reasonable and customary transition support aligned to market benchmark data. | |

Base Salary

The Compensation Committee reviews and approves the base salaries of the NEOs each year, as well as at the time of promotion, change in job responsibilities or any other change deemed to be a material event. Base salaries are set during the first quarter of each year. The Compensation Committee sets the salary for the CEO and approves the base salaries for the other NEOs and other executive officers based on recommendations by the CEO.

When determining base salary adjustments for its NEOs, the Compensation Committee considers a combination of (i) peer group data, (ii) market data, including industry norms and benchmarking data from companies of similar size and scope and (iii) outstanding Company and individual performance. In general, the Compensation Committee targets the 25th to 50th percentile of the Company’s peer group in determining base salaries.

|

29 | |

Table of Contents

| Name | 2022 Base Salary | 2023 Base Salary | % Increase/Decrease | |||||||||

| Andy L. Nemeth |

$850,000 | $850,000 | - | |||||||||

| Jeffrey M. Rodino |

575,000 | 575,000 | - | |||||||||

| Kip B. Ellis |

525,000 | 525,000 | - | |||||||||

| Matthew S. Filer (1) |

350,000 | 350,000 | - | |||||||||

| Jacob R. Petkovich (2) |

475,000 | 475,000 | - | |||||||||

| Joel D. Duthie |

475,000 | 475,000 | - | |||||||||

(1) Mr. Filer assumed the position of Interim CFO upon the resignation of Mr. Petkovich for the period of May 15, 2023 through December 31, 2023. The amount shown for 2023 represents his full annual salary. Mr. Filer joined the Company in November 2022 and his 2022 base salary represents his full annual salary for his position as Senior Vice President of Finance.

(2) Mr. Petkovich resigned from the Company effective May 14, 2023. The amount shown represents his full annual salary. The amount actually paid in 2023 was pro-rated based on his period of service.

Non-Equity Incentive Plan Awards

The short-term incentive portion of the 2023 Executive Compensation Plan consists of annual non-equity incentive plan awards, which are reviewed and approved each year and are based on the Company’s financial results and the individual’s performance against defined objectives. Several key components were considered in the development of the 2023 STIP to align the 2023 STIP with shareholder interest by measuring the Company’s financial performance and the individual’s performance in support of the Company’s short- and long-term strategies. The components are noted on pages 25.

The STIP metric components for 2023 are as follows:

| 2023 STIP Award Component ($ in millions) | Threshold Performance |

Target Performance |

Maximum Performance |

|||||||||

| Company Performance (Net Income) (1) |

$124.5 | $166.0 | $190.9 | |||||||||

| Individual Rating |

2.5 | 3.5 | 5.0 | |||||||||

| Payout as a Percentage of Target Award |

50% | 100% | 200% | |||||||||

(1) All net income targets are net of the contributions of 2023 acquisitions and certain one-time and non-recurring charges and credits.

The Company achieved adjusted fiscal 2023 net income of $147.0 million (net of 2023 acquisitions and non-recurring charges and credits) which equated to 89% of the target Company performance. When combined with the individual performance rating for each NEO, the actual STIP award payouts for 2023 were as follows:

| Name / Benefit | 2023 Base Salary (1) |

Target Award As % Of Base Salary (2) |

Target STIP Award

|

Actual Award Amount As % Of Target Award |

Actual 2023 STIP Award Payout |

|||||||||||||||

| Andy L. Nemeth |

$850,000 | 212% | $1,800,000 | 91% | $1,632,600 | |||||||||||||||

| Jeffrey M. Rodino |

575,000 | 174% | 1,000,000 | 93% | 931,900 | |||||||||||||||

| Kip B. Ellis |

525,000 | 171% | 900,000 | 88% | 793,890 | |||||||||||||||

| Matthew S. Filer (3) |

350,000 | 71% | 250,000 | 104% | 260,800 | |||||||||||||||

| Jacob R. Petkovich (4) |

475,000 | 153% | 725,000 | N/A | - | |||||||||||||||

| Joel D. Duthie |

475,000 | 105% | 500,000 | 93% | 465,950 | |||||||||||||||

(1) The 2023 Base Salary for each of the NEOs reflects the Base Salary in effect of as of January 2023.

(2) The target award as a percentage of base salary for the NEOs, with the exception of Mr. Filer, was determined by the Compensation Committee and applied to the base salary in effect as of January 2023. The target award as a percentage of base salary was established for each NEO in 2023 in alignment with the Company’s “pay-for-differentiated-performance” philosophy, market competitive positions for earned payout, and further enhancement of the pay-at-risk for each NEO.

(3) Mr. Filer’s actual 2023 STIP award payout excluded an additional $300,000 discretionary bonus payment related to his service as Interim CFO from May 2023 through December 2023.

(4) Mr. Petkovich’s target STIP award represents his full year target award. He did not receive an STIP award payout for the 2023 fiscal year.

| Notice of 2024 Annual Meeting of Shareholders & Proxy Statement | 30 | |

Table of Contents

While these targets were used in fiscal year 2023, the Compensation Committee reserves the right to modify, cancel, change or reallocate any components of this calculation or criteria at any time.

Each NEO’s individual performance rating takes into account four strategic performance objectives in assessing the personal performance of the NEOs named in the Summary Compensation Table for 2023. The four strategic objectives are specific for each NEO and are linked to the Company’s strategic plan and that year’s organizational strategic agenda and include, among others:

| 1. | Improving the revenue and profitability of business units under the leadership and control of the NEO; |

| 2. | The introduction of new product lines and product line extensions to achieve target revenue growth levels and market share; |

| 3. | The ongoing evaluation of strategic opportunities related to our capital allocation strategy and the execution of those opportunities, as appropriate; and |

| 4. | Objectives linked to developing and managing talent consistent with the Company’s values and enhancing and developing the leadership capabilities of the Company’s future leaders. |

The NEOs, other than Mr. Nemeth, initially developed their own individual objectives for the plan year which were then reviewed and approved by the CEO. For the 2023 STIP award, Mr. Filer initially developed his own objectives for the plan year, based on his then role of Senior Vice President of Finance. His objectives were reviewed and approved by Mr. Petkovich. Mr. Nemeth developed his own objectives for the plan year which were reviewed and approved by the Board.

In assessing the NEOs’ individual performance, the Compensation Committee is provided with detailed quantitative and qualitative documentation substantiating individual performance against each individual objective.

The Compensation Committee looks to the CEO’s performance assessments of the other NEOs and his recommendations regarding a performance rating for each, as well as input from the non-management Board members. These recommendations may be adjusted by the Compensation Committee prior to finalization. The personal performance assessment of our CEO is determined by the Compensation Committee with input from members of the Board.

While the achievement of corporate objectives is quantified with an individual rating, each NEO’s relative contribution to those objectives is only one

qualitative component against which the individual’s performance is assessed by the Compensation Committee. Based upon their individual achievements, as evaluated by the Compensation Committee, and by the CEO for Messrs. Rodino, Ellis, Filer and Duthie, the individual performance rating achieved by each of these four NEOs exceeded the target performance rating of 3.5 set by the Compensation Committee.

Discretionary Bonus

In recognition of Mr. Filer’s contributions to the Company in the role of Interim CFO during 2023, Mr. Filer was awarded a year-end 2023 discretionary cash bonus in the amount of $300,000.

Long-Term Equity Incentive Plan

We believe long-term incentive compensation represents an important and appropriate motivational tool to achieve certain long-term Company goals and closely align the interests of our management team with those of our shareholders. Our executive officers participate in our long-term incentive plan as a result of their ability to make a significant contribution to the Company’s financial performance, their level of responsibility, their ability to meet performance objectives and their leadership potential and execution.