DEF 14A: Definitive proxy statements

Published on April 26, 2013

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

|

o

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

x

|

Definitive Proxy Statement

|

|

o

|

Definitive Additional Materials

|

|

o

|

Soliciting Material Pursuant to Sections 240.14a-11(c) or Section 240.14a-12

|

PATRICK INDUSTRIES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

x

|

No fee required

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

5)

|

Total fee paid:

|

|

o

|

Fee paid previously with preliminary materials

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

1)

|

Amount Previously Paid:

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

|

3)

|

Filing Party:

|

|

4)

|

Date Filed:

|

|

PATRICK INDUSTRIES, INC.

|

|

107 West Franklin Street

|

|

P.O. Box 638

|

|

Elkhart, Indiana 46515-0638

|

|

(574) 294-7511

|

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

|

|

To Be Held May 23, 2013

|

TO OUR SHAREHOLDERS:

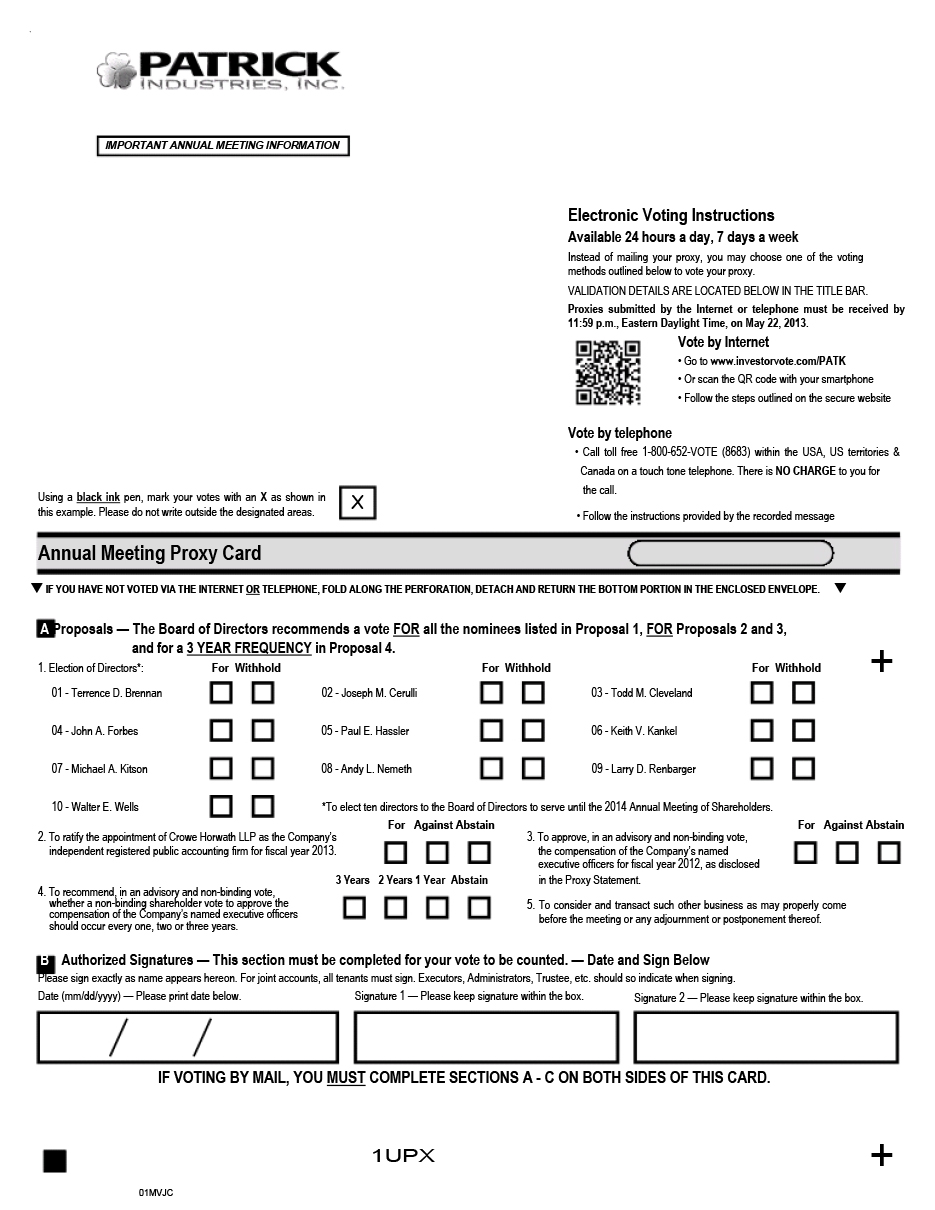

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of Patrick Industries, Inc., an Indiana corporation, will be held at the Company’s corporate office, 107 West Franklin Street, Elkhart, Indiana, on Thursday, May 23, 2013 at 10:00 A.M., Eastern time, for the following purposes:

|

1.

|

To elect ten directors to the Board of Directors to serve until the 2014 Annual Meeting of Shareholders;

|

|

2.

|

To ratify the appointment of Crowe Horwath LLP as our independent registered public accounting firm for fiscal year 2013;

|

|

3.

|

To approve, in an advisory and non-binding vote, the compensation of the Company’s named executive officers for fiscal year 2012 as disclosed in the Proxy Statement (a “Say-on-Pay” vote);

|

|

4.

|

To recommend, in an advisory and non-binding vote, whether a non-binding shareholder vote to approve the compensation of the Company’s named executive officers should occur every one, two or three years (a “Say-on-Frequency” vote); and

|

|

5.

|

To consider and transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

|

The Board has fixed the close of business on March 28, 2013 as the record date for the determination of the holders of shares of our outstanding common stock entitled to notice of and to vote at the Annual Meeting of Shareholders. Each shareholder is entitled to one vote per share on all matters to be voted on at the meeting.

Your vote is important. Whether or not you expect to attend the meeting, please vote your shares using the Internet, by telephone, or by mail by signing, dating, and returning the enclosed proxy in the enclosed envelope. Your shares will then be represented at the meeting, if you are unable to attend. You may, of course, revoke your proxy and vote in person at the meeting, if you desire. If you hold shares through a broker or other custodian, please check the voting instructions used by that broker or custodian. Please note that brokers may not vote your shares on the election of directors, on compensation matters or on other shareholder proposals to be considered at the Annual Meeting (except on the ratification of the independent accountants) in the absence of your specific instructions as to how to vote. Please return your proxy card so your vote can be counted.

|

By Order of the Board of Directors,

|

|

|

/s/ Andy L. Nemeth

|

|

|

Andy L. Nemeth

|

|

| Secretary |

April 29, 2013

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to Be Held On May 23, 2013.

Our Proxy Statement and Annual Report to Shareholders for fiscal 2012 are available on Patrick Industries, Inc.'s website at www.patrickind.com under “Investor Relations”. You may also request hard copies of these documents free of charge by writing to us at the address above, Attention: Office of the Secretary.

Table of Contents

|

Voting Information

|

1 | |||

|

Proposals of Shareholders

|

2 | |||

|

Proposal 1 – Election of Directors

|

3 | |||

|

Proposal 2 – Ratification of the Appointment of Independent Registered Public Accounting Firm

|

5 | |||

|

Independent Public Accountants

|

6 | |||

|

Audit Committee Report

|

6 | |||

|

Proposal 3 – Advisory Vote on Executive Compensation

|

7 | |||

|

Proposal 4 – Advisory Vote on Frequency of Vote on Executive Compensation

|

8 | |||

|

Security Ownership of Certain Beneficial Owners and Management

|

9 | |||

|

Corporate Governance

|

10 | |||

|

Executive Compensation

|

15 | |||

|

2012 Non-Employee Director Compensation

|

28 | |||

|

Compensation Committee Report

|

29 | |||

|

Related Party Transactions

|

30 | |||

|

Householding of Annual Meeting Materials

|

32 | |||

|

Other Matters

|

32 |

|

PATRICK INDUSTRIES, INC.

|

|

107 West Franklin Street

|

|

P.O. Box 638

|

|

Elkhart, Indiana 46515-0638

|

|

(574) 294-7511

|

|

____________

|

|

PROXY STATEMENT

|

|

Annual Meeting of Shareholders

|

|

To Be Held May 23, 2013

|

|

______________

|

This Proxy Statement and the accompanying Proxy Card are being mailed to shareholders of Patrick Industries, Inc. (the “Company” or “Patrick”) on or about April 29, 2013, and are furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) for the Annual Meeting of Shareholders to be held on May 23, 2013 (the “Annual Meeting”) for the purpose of considering and acting upon the matters specified in the Notice of Annual Meeting of Shareholders accompanying this Proxy Statement. If the form of proxy which accompanies this Proxy Statement is executed and returned, or is voted by Internet or by telephone, it may be revoked by the person giving it at any time prior to the voting thereof by written notice to the Secretary, by delivery of a later dated proxy, or by requesting to vote in person at the Annual Meeting.

If the form of proxy is signed, dated and returned without specifying choices on one or more matters presented to the shareholders, the shares will be voted on the matter or matters listed on the proxy card as recommended by the Company’s Board.

Additional solicitations, in person or by telephone or otherwise, may be made by certain directors, officers and employees of the Company without additional compensation. Expenses incurred in the solicitation of proxies, including postage, printing and handling, and actual expenses incurred by brokerage houses, custodians, nominees and fiduciaries in forwarding documents to beneficial owners, will be paid by the Company.

Patrick’s Annual Report to Shareholders, which contains Patrick’s Annual Report on Form 10-K for the year ended December 31, 2012, accompanies this Proxy Statement. Requests for additional copies of the Annual Report on Form 10-K should be submitted to the Office of the Secretary, Patrick Industries, Inc., 107 West Franklin Street, P.O. Box 638, Elkhart, Indiana 46515-0638. Annual Meeting materials may also be viewed online through our website, www.patrickind.com.

VOTING INFORMATION

Each shareholder is entitled to one vote for each share of our common stock held as of the record date. For purposes of the meeting, a quorum means a majority of the outstanding shares. Abstentions and withheld votes are counted as shares represented at the meeting for purposes of determining a quorum. As of the close of business on March 28, 2013, the record date for shareholders entitled to vote at the Annual Meeting, there were outstanding 10,696,923 shares of common stock entitled to one vote each. In determining whether a quorum exists at the meeting, all shares represented in person or by proxy will be counted. Proxies properly executed and received by us prior to the meeting and not revoked will be voted as directed therein on all matters presented at the meeting.

A shareholder may, with respect to the election of directors, (i) vote for the election of each named director nominee, or (ii) withhold authority to vote for each named director nominee. With respect to Proposals 2 and 3, a shareholder may vote for, against or abstain. For Proposal 4, a shareholder may vote for a frequency of one, two or three years or abstain by so indicating in the appropriate space on the proxy.

Please note that brokers may not vote your shares on the election of directors, on compensation matters or on other shareholder proposals to be considered at the Annual Meeting (except on the ratification of the independent accountants) in the absence of your specific instructions as to how to vote. Please return your proxy card so your vote can be counted.

If a shareholder’s shares are held by a broker or other financial institution (the “broker”) on the shareholder’s behalf (that is, in “street name”) and the shareholder does not instruct the broker as to how to vote the shareholder’s shares, the broker may vote the shares in its discretion on matters designated as routine under the rules of NASDAQ. However, a broker cannot vote shares held in street name on matters designated as non-routine by NASDAQ, unless the broker receives voting instructions from the beneficial owner. If a shareholder’s shares are held in street name and the shareholder does not provide voting instructions to the broker, the broker will have discretion to vote those shares only on Proposal 2 because the ratification of the Company’s independent registered public accounting firm appointment is considered a routine matter. Each of the other items to be submitted for a vote of shareholders at the Annual Meeting is considered non-routine under applicable NASDAQ rules. “Broker non-votes” occur when brokerage firms return proxies for which no voting instructions have been received from beneficial owners and the broker does not have discretionary authority to vote on the proposal. Broker non-votes and abstentions will be included in the determination of the number of shares of common stock present at our Annual Meeting for quorum purposes, but will not be counted as votes cast on any matter presented at our Annual Meeting that is a non-routine matter.

Under Proposal 1, the directors are elected by a plurality of the votes cast by shares present in person or by proxy at the Annual Meeting and entitled to vote. Therefore, broker non-votes and abstentions will have no effect on Proposal 1, except to the extent that they will count as votes not cast. Proposal 2 and Proposal 3 in this Proxy Statement require the affirmative vote of a majority of the votes cast. Broker non-votes and abstentions will have no effect on these proposals.

With respect to Proposal 4, the option of “1 Year”, “2 Years”, and “3 Years” that receives the highest number of votes cast will be the frequency of the advisory vote recommended by shareholders on executive compensation. Broker non-votes and abstentions will have no effect on Proposal 4. Although the vote is non-binding, the Compensation Committee and the Board value the opinions of shareholders and will consider the outcome of the vote on Proposal 4 when determining the frequency of when it will submit to shareholders a vote on executive compensation. However, because this vote is advisory and non-binding on the Board in any way, the Board may decide that it is in the best interest of our shareholders and the Company to hold an advisory vote on executive compensation more or less frequently than the frequency recommended by shareholders.

If you hold your shares through a broker, for your vote to be counted, you will need to communicate your voting decisions to your broker before the date of the Annual Meeting. A street name shareholder who wishes to vote at the Annual Meeting will need to obtain a legal proxy from his or her broker or other nominee and present that proxy and proof of identification at the Annual Meeting to hand in with his or her ballot.

The Board knows of no other matter which may come up for action at the Annual Meeting. However, if any other matter properly comes before the Annual Meeting, the persons named in the proxy form enclosed will vote in accordance with their judgment upon such matter.

PROPOSALS OF SHAREHOLDERS

Proposals Included in the Proxy Statement

Shareholder proposals for inclusion in proxy materials for the next Annual Meeting should be addressed to the Office of the Secretary, 107 West Franklin Street, P.O. Box 638, Elkhart, Indiana 46515-0638, and must be received no later than December 28, 2013.

2

Proposals Not Included in the Proxy Statement

Our By-laws require notice of any other business to be brought by a shareholder before the 2014 annual meeting of shareholders (but not included in the proxy statement) to be delivered, in writing, to the Company’s Secretary, together with certain prescribed information, on or after April 2, 2014 and no later than May 2, 2014. Likewise, the Articles of Incorporation and By-laws require that shareholder nominations to the Board for the election of directors to occur at the 2014 annual meeting of shareholders be delivered to the Secretary, together with certain prescribed information, in accordance with the procedures for bringing business before an annual meeting at which directors are to be elected.

PROPOSAL 1

ELECTION OF DIRECTORS

There are ten nominees for election to the Board, all of which are current members of our Board. The individuals elected as directors at the 2013 Annual Meeting will be elected to hold office until the 2014 Annual Meeting or until their successors are duly elected and qualified.

It is intended that the proxies will be voted for the nominees listed below, unless otherwise indicated on the proxy form. It is expected that these nominees will serve, but, if for any unforeseen cause any such nominee should decline or be unable to serve, the proxies will be voted to fill any vacancy so arising in accordance with the discretionary authority of the persons named in the proxies. The Board does not anticipate that any nominee will be unable or unwilling to serve.

The information provided below has been furnished by the director nominees, and sets forth (as of March 31, 2013) the names, ages, principal occupations, recent professional experience, certain specific qualifications identified as part of the Board’s determination that each such individual should serve on the Board, and other directorships at other public companies for at least the past five years, if any. Each of the following nominees was elected to his present term of office at the Annual Meeting of Shareholders held on May 24, 2012 with the exception of Michael A. Kitson, who was appointed to the Board on March 19, 2013 to fill a newly created director position.

Paul E. Hassler, age 65, has been our Chairman of the Board since May 2008. Mr. Hassler was Chief Executive Officer of the Company from April 2004 to January 2009 (retired) and President from April 2004 to May 2008. Mr. Hassler held the position of Vice President Operations and Distribution - West of the Company from December 2003 through the first quarter of 2004; Executive Director of West Coast Operations from 1994 to 2003; and General Manager of California Operations from 1986 to 1994. Mr. Hassler has over 39 years of recreational vehicle, manufactured housing and industrial experience in various capacities and has demonstrated leadership as Non-Executive Chairman of the Board. He has been determined to be an “audit committee financial expert” under the Securities and Exchange Commission (“SEC’) rules and regulations by our Board. Mr. Hassler currently serves as a member of the Company’s Audit Committee, Corporate Governance and Nominations Committee and the Compensation Committee. He has served as a director of the Company since 2005.

Terrence D. Brennan, age 74, was the President and Chief Executive Officer of NBD Bank, Elkhart, Indiana from 1973 to 1997 (retired). Mr. Brennan has extensive knowledge of the banking industry and its operations, experience in corporate management and leadership, and strategic planning. He has been determined to be an “audit committee financial expert” under the SEC’s rules and regulations by our Board. Mr. Brennan currently serves as the Chairman of the Company’s Corporate Governance and Nominations Committee, and as a member of the Company’s Compensation Committee and Audit Committee. He has served as a director of the Company since 1999.

Joseph M. Cerulli, age 53, has been employed by Tontine Associates, LLC, an affiliate of Tontine Capital Partners, LP, Tontine Capital Overseas Master Fund, LP, and Tontine Capital Overseas Master Fund II, LP (collectively, “Tontine”), since January 2007. Prior to that, Mr. Cerulli was an independent financial consultant from 2002 to 2006. Mr. Cerulli was a director of Neenah Enterprises, Inc., one of the largest independent foundry companies in the U.S., from February 2009 to July 2010. As an employee of Tontine, a major shareholder of the

3

Company’s common stock as of the March 28, 2013 record date, Mr. Cerulli has particular knowledge of our Company and the industries in which we operate and possesses extensive knowledge with respect to financial and investment matters. Mr. Cerulli currently serves as a member of the Company’s Corporate Governance and Nominations Committee and the Compensation Committee. He has served as a director of the Company since 2008.

Todd M. Cleveland, age 45, has been serving as President and Chief Executive Officer of the Company since February 2009. Mr. Cleveland assumed the position of President and Chief Operating Officer of the Company in May 2008. Prior to that, he served as Executive Vice President of Operations and Sales and Chief Operating Officer of the Company from August 2007 to May 2008. Mr. Cleveland also spent 17 years with Adorn Holdings, Inc. (“Adorn”) serving as President and Chief Executive Officer from 2004 to 2007; President and Chief Operating Officer from 1998 to 2004; and Vice President of Operations and Chief Operating Officer from 1994 to 1998. Mr. Cleveland has over 22 years of recreational vehicle, manufactured housing and industrial experience in various operating capacities. He also has extensive knowledge of our Company and the industries to which we sell our products, and experience with management development and leadership, acquisitions, strategic planning, manufacturing, and sales of our products. He has served as a director of the Company since 2008.

John A. Forbes, age 53, has been serving as the President of Utilimaster Corporation, a subsidiary of Spartan Motors, Inc., since July 2010. Prior to that, he was the CFO of Utilimaster from May 2009 to July 2010, the CFO of Nautic Global Group LLC from 2007 to 2009, and the CFO of Adorn LLC from 2003 to 2007. Mr. Forbes has over 26 years of experience in serving various manufacturing industries having held senior financial leadership roles including Trimas Corporation/Masco Tech, Inc., both with Fulton Performance Products and Reese Products. Mr. Forbes also has extensive experience with operations management, acquisitions, strategic planning, risk management, and banking relations. He has been determined to be an “audit committee financial expert” under the SEC’s rules and regulations by our Board. Mr. Forbes currently serves as a member of the Company’s Audit Committee, Corporate Governance and Nominations Committee and the Compensation Committee. He has served as a director of the Company since 2011.

Keith V. Kankel, age 70, was the Interim President and Chief Executive Officer of the Company from 2003 to 2004 (retired). In addition, he was Vice President of Finance of the Company from 1987 through July 2002, and Secretary-Treasurer of the Company from 1974 through July 2002. Mr. Kankel possesses particular knowledge of financial reporting and has been determined to be an “audit committee financial expert” under the SEC’s rules and regulations by our Board. His long-time service on the Board has provided critical knowledge of our operations and corporate history. Mr. Kankel currently serves as the Chairman of the Company’s Audit Committee and as a member of the Company’s Corporate Governance and Nominations Committee and the Compensation Committee. He has served as a director of the Company since 1977.

Michael A. Kitson, age 54, has been serving as the Chief Executive Officer of Nautic Global Group, a major manufacturer of recreational boats, since March 2011. Prior to that, he was the CFO of Nautic from August 2010 to March 2011, the President and CEO of Utilimaster Corporation, a subsidiary of Spartan Motors, Inc., from 2007 to 2010, and the CFO of Utilimaster from 1999 to 2007. Mr. Kitson has over 25 years of experience in serving various manufacturing industries having also held senior financial leadership roles with Lilly Industries, Inc. Mr. Kitson also has extensive experience with corporate and operations management, strategic planning, and risk management. He has been determined to be an “audit committee financial expert” under the SEC’s rules and regulations by our Board. Mr. Kitson currently serves as a member of the Company’s Audit Committee, Corporate Governance and Nominations Committee and the Compensation Committee since his appointment to the Board on March 19, 2013.

Andy L. Nemeth, age 44, has been the Company’s Executive Vice President of Finance, Secretary-Treasurer, and Chief Financial Officer since May 2004. Mr. Nemeth was Vice President-Finance, Chief Financial Officer, and Secretary-Treasurer from 2003 to 2004, and Secretary-Treasurer from 2002 to 2003. Mr. Nemeth was a Division Controller from 1996 to 2002 and prior to that, he spent five years in public accounting. Mr. Nemeth has over 21 years of recreational vehicle, manufactured housing, and industrial experience in various financial capacities. Mr. Nemeth also has particular knowledge of our Company and the industries to which we sell our products, and has extensive experience with corporate management, acquisitions, strategic planning and banking relations. He has served as a director of the Company since 2006.

4

Larry D. Renbarger, age 74, was the Chief Executive Officer of Shelter Components, a manufacturer and supplier of products to the manufactured housing and recreational vehicle industries, from 1984 to 1998 (retired). Mr. Renbarger is a director of Thermolite, Inc., a window manufacturer, and of Universal Precision Instruments, Inc., an orthopedic supplier. He has particular knowledge of our Company and the industries to which we sell our products, experience in corporate management and leadership, and strategic planning. He has been determined to be an “audit committee financial expert” under the SEC’s rules and regulations by our Board. Mr. Renbarger currently serves as a member of the Company’s Corporate Governance and Nominations Committee and Audit Committee. He has served as a director of the Company since 2002.

Walter E. Wells, age 74, was the President and Chief Executive Officer of Schult Homes Corporation, a leading builder of manufactured and modular housing, from 1970 to 1998 (retired). Mr. Wells is a director and a member of the compensation committee of Woodland Foundation, which specializes in various types of rehabilitation counseling. Mr. Wells has particular knowledge of our Company and the industries to which we sell our products, experience in corporate management and leadership, and strategic planning. He has been determined to be an “audit committee financial expert” under the SEC’s rules and regulations by our Board. Mr. Wells currently serves as the Chairman of the Company’s Compensation Committee and as a member of the Company’s Corporate Governance and Nominations Committee and the Audit Committee. He has served as a director of the Company since 2001.

| The Board of Directors unanimously recommends a vote FOR the nominated directors. |

PROPOSAL 2

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed Crowe Horwath LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013. Crowe Horwath LLP has been the Company’s independent registered public accounting firm since June 2009. The Board and the Audit Committee recommend that shareholders ratify the appointment of Crowe Horwath LLP as our independent registered public accounting firm for our fiscal year 2013. Although we are not required to do so, we believe that it is appropriate to request that shareholders ratify this appointment. If shareholders do not ratify the appointment, the Audit Committee will investigate the reasons for the shareholders’ rejection and reconsider the appointment. Representatives of Crowe Horwath LLP will be at the Annual Meeting, will be given the opportunity to make a statement, and will be available to respond to questions.

Unless otherwise instructed, the proxy holders will vote the proxies received by them “FOR” approval of the ratification of the appointment of Crowe Horwath LLP. The ratification of the appointment will be approved by our shareholders if, at the Annual Meeting, a quorum is present and the vote of a majority of the votes cast are voted in favor of the proposal.

| The Board of Directors unanimously recommends a vote FOR approval of the ratification of the appointment of Crowe Horwath LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013. |

5

INDEPENDENT PUBLIC ACCOUNTANTS

As noted above in Proposal 2, the Audit Committee has appointed Crowe Horwath LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013.

Audit Fees

The following table presents fees for professional audit and tax services rendered by Crowe Horwath LLP for the years ended December 31, 2012 and 2011:

|

2012

|

2011

|

|||||||

|

Audit Fees (1)

|

$ | 212,500 | $ | 199,500 | ||||

|

Audit-Related Fees (2)

|

30,000 | 20,200 | ||||||

|

Tax Fees (3)

|

46,500 | 34,700 | ||||||

|

All Other Fees

|

- | - | ||||||

| Total Fees | $ | 289,000 | $ | 254,400 | ||||

|

(1)

|

Audit fees consist of fees for professional services rendered for the annual audit of the Company’s financial statements and for the review of the interim financial statements included in the Company’s quarterly reports.

|

|

(2)

|

Audit-related fees consist primarily of fees for services normally provided by the independent auditor in connection with statutory and regulatory filings or engagements and other audit-related services and filings. In addition, audit-related fees include the reviews of various SEC filings.

|

|

(3)

|

Tax fees consist of the preparation and/or review of Federal and State tax returns, assistance with preparation of tax inquiries, primarily from state and local tax authorities, enterprise zone property tax filings, and preparation and review of employee benefit plan filings. Tax fees in 2012 and 2011 were related to the review by Crowe Horwath LLP of the 2011 and 2010 tax returns, respectively.

|

In addition to the fees listed in the table above pertaining to audit and tax services rendered by the Company’s current independent registered public accounting firm, Crowe Horwath LLP, there were additional audit and tax fees incurred in 2012 and 2011 for professional services rendered by our former independent registered public accounting firms for the fiscal years ended December 31, 2012 and 2011. Total audit fees for professional services rendered were $24,300 and $12,700 in 2012 and 2011, respectively. There were no additional tax fees, other than those listed in the table above, pertaining to 2012 and 2011.

The Audit Committee has advised us that it has determined that the non-audit services rendered by our independent auditors during our most recent fiscal year are compatible with maintaining the independence of such auditors.

The Audit Committee has adopted a Pre-Approval Policy for Audit and Non-Audit Services pursuant to which it pre-approves all audit and non-audit services provided by the independent auditors prior to each particular engagement. The Committee has delegated authority to its Chairman to approve proposed services other than the annual audit, tax and quarterly review services, and the Chairman must report any approvals to the balance of the Committee at the next scheduled meeting.

AUDIT COMMITTEE REPORT

The responsibilities of the Audit Committee, which are set forth in the Audit Committee Charter adopted by the Board, include providing oversight of our financial reporting process through periodic meetings with our independent auditors, principal accounting officer and management to review accounting, auditing, internal controls and financial reporting matters. Our management is responsible for the preparation and integrity of the financial reporting information and related systems of internal controls. The Audit Committee, in carrying out its role, relies on senior management, including senior financial management, and the independent auditors.

6

We have reviewed and discussed with senior management our audited financial statements included in the 2012 Annual Report to Shareholders. Management has confirmed to us that such financial statements (i) have been prepared with integrity and objectivity and are the responsibility of management and (ii) have been prepared in conformity with accounting principles generally accepted in the United States of America.

We have discussed with Crowe Horwath LLP, our independent auditors, the matters required to be discussed by the statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1, AU section 380), as adopted by the Public Company Accounting Oversight Board (the “PCAOB”). In addition, the Audit Committee has received from the independent auditors the written disclosures and the letter required by the applicable requirements of the PCAOB regarding the independent accountant’s communications with the Audit Committee concerning independence rules.

We have received from Crowe Horwath LLP a letter providing the disclosures required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) with respect to any relationships between us and Crowe Horwath LLP that in their professional judgment may reasonably be thought to bear on independence. Crowe Horwath LLP has discussed its independence with us, and has confirmed in such letter that, in its professional judgment, it is independent from us within the meaning of the federal securities laws.

Based on the review and discussions described above, with respect to our audited financial statements included in our 2012 Annual Report to Shareholders, we have recommended to the Board of Directors that such financial statements be included in our Annual Report on Form 10-K for filing with the SEC.

As specified in the Audit Committee Charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that our financial statements are complete and accurate and in accordance with generally accepted accounting principles. That is the responsibility of management and our independent auditors. In giving our recommendation to the Board of Directors, we have relied on (i) management’s representation that such financial statements have been prepared with integrity and objectivity and in conformity with generally accepted accounting principles and (ii) the report of our independent auditors with respect to such financial statements. This report was adopted by the Audit Committee on March 18, 2013.

The Audit Committee:

Keith V. Kankel (Chairman)

Terrence D. Brennan

John A. Forbes

Paul E. Hassler

Larry D. Renbarger

Walter E. Wells

The foregoing report of the Audit Committee does not constitute soliciting material and shall not be deemed incorporated by reference by any general statement incorporating by reference the proxy statement into any filing by us under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under such acts.

PROPOSAL 3

ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Act requires that the Company seek a non-binding advisory vote from its shareholders to approve the compensation of its named executive officers as disclosed under “Executive Compensation” on pages 15 to 28 in this Proxy Statement in accordance with SEC rules. Because it is a smaller reporting company, this is the first year that the Company is required to seek this advisory vote.

Our executive compensation policy is designed to enable the Company to attract, motivate and retain highly-qualified senior executives by providing a competitive compensation opportunity based on performance. Our intent is to provide fair and equitable compensation in a way that rewards executives for achieving specified

7

financial and non-financial performance goals. Our performance-related awards are structured to link a substantial portion of our executives’ total potential compensation to the Company’s performance on both a long-term and short-term basis, to recognize individual contribution, as well as overall business results, and to align executive and shareholder interest. Accordingly, we reward performance in excess of pre-established targets of earnings before interest, taxes, depreciation, and amortization (“EBITDA”) and we avoid establishing goals that could divert our executives’ attention from the fundamentals of effective and efficient operations.

We are requesting shareholder approval of the compensation of our named executive officers as disclosed in this Proxy Statement, including the disclosures under “Executive Compensation- Compensation Discussion and Analysis,” the compensation tables, and the related information and discussion. The vote is intended to address the overall compensation of our named executive officers and the policies and practices described in this Proxy Statement.

The vote is advisory and therefore not binding on the Company or the Compensation Committee or the Board. However, we value the opinions of our shareholders, and we will carefully consider the outcome of the advisory vote on executive compensation when making future compensation decisions.

|

For the reasons stated, the Board of Directors recommends a vote FOR the following non-binding resolution:

“RESOLVED, that the compensation paid to the Company’s named executive officers for fiscal year 2012, as disclosed in this Proxy Statement pursuant to the compensation disclosure rules of the SEC, including the Compensation Discussion and Analysis, compensation tables, and related information and discussion, is hereby APPROVED.”

|

The affirmative vote of a majority of the votes cast is required for advisory approval of the foregoing non-binding resolution. See “Voting Information” on pages 1 and 2.

PROPOSAL 4

ADVISORY VOTE ON FREQUENCY OF VOTE ON EXECUTIVE COMPENSATION

As required by the Dodd-Frank Act, at least once every six years the Company is required to request its shareholders to recommend, in a non-binding advisory resolution, whether the advisory shareholder vote on executive compensation should occur every one, two or three years.

In formulating its recommendation, our Board believes that a frequency of every three years for the advisory vote on executive compensation is the optimal interval for conducting and responding to a “Say-on-Pay” vote. One of the core principles of our executive compensation program is to ensure management’s interests are aligned with our shareholders’ interests to support long-term value creation. We encourage our officers to focus on long-term performance, and recommend a triennial vote which would allow our executive compensation programs to be evaluated by shareholders over a similar time-frame and in relation to our long-term performance.

Shareholders who have concerns about executive compensation during the interval between “Say-on-Pay” votes are welcome to bring their specific concerns to the attention of the Board. Please refer to “Corporate Governance—Shareholder Communications” in this Proxy Statement for information about communicating with the Board.

Accordingly, the following resolution is submitted for shareholder vote at the Annual Meeting of Shareholders:

“RESOLVED, that the highest number of votes cast by the shareholders of Patrick Industries, Inc. for the option set forth below shall be the preferred frequency selected by shareholders with which the Company is to hold an advisory vote on the approval of the compensation of its named executive officers included in the proxy statement: yearly or every two years or every three years.”

8

The option of one year, two years or three years that receives the highest number of votes cast by shareholders will be the preferred frequency for the advisory vote on executive compensation that has been selected by shareholders. However, as this is an advisory vote, the result will not be binding on our Board or the Company. Our Compensation Committee will consider the outcome of the vote when determining how often the Company should submit to shareholders an advisory vote to approve the compensation of its named executive officers included in the Company’s Proxy Statement. Proxies submitted without direction pursuant to this solicitation will be voted for the option of “EVERY THREE YEARS”.

Recommendation of the Board:

| The Board of Directors recommends that shareholders vote for the option of “Every Three Years” as the frequency with which shareholders are provided an advisory vote on the compensation of the Company’s named executive officers included in the Proxy Statement. |

The Board will carefully consider the outcome of the vote when making future decisions regarding the frequency of advisory votes on executive compensation. However, because this vote is advisory and non-binding, the Board may decide that it is in the best interest of the Company and its shareholders to hold an advisory vote more or less frequently than the alternative that has been selected by shareholders.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of March 28, 2013 (the record date), information concerning shareholders known to us as having beneficial ownership of more than five percent of our outstanding common stock and information with respect to the stock ownership of all of our directors, named executive officers, and all of our directors and executive officers as a group. The address of each director and named executive officer listed below is 107 West Franklin Street, P.O. Box 638, Elkhart, Indiana, 46515-0638, except as otherwise provided.

|

Name and Address of Beneficial Owner

|

Aggregate Number

of Shares of

Common Stock

Beneficially Owned

|

Percent of

Class

|

||||||

|

Five Percent Shareholder:

|

||||||||

|

Jeffrey L. Gendell

C/o Tontine Capital Management, L.L.C.

One Sound Shore Drive Suite 304

Greenwich, CT 06830

|

3,977,636 (1)(2) | 37.2 | % | |||||

|

Directors:

|

||||||||

|

Walter E. Wells

|

39,000 | * | ||||||

|

Paul E. Hassler

|

34,505 | * | ||||||

|

Keith V. Kankel

|

32,686 | * | ||||||

|

Larry D. Renbarger

|

25,000 | * | ||||||

|

Terrence D. Brennan

|

24,000 | * | ||||||

|

Joseph M. Cerulli (3)

|

14,000 | * | ||||||

|

John A. Forbes

|

7,316 | * | ||||||

|

Michael A. Kitson

|

3,000 | * | ||||||

|

Named Executive Officers:

|

||||||||

|

Todd M. Cleveland

|

519,884 | 4.9 | % | |||||

|

Andy L. Nemeth

|

125,889 | 1.2 | % | |||||

|

Jeffrey M. Rodino

|

75,551 | * | ||||||

|

All Directors, Named Executive Officers and other executive officers as a group (13 persons)

|

984,987 | 9.2 | % | |||||

* Less than 1%.

9

|

(1)

|

Information based on the Schedule 13D/A filed jointly by Tontine Capital Management, L.L.C. (“TCM”), Tontine Capital Partners, L.P. (“TCP”), Tontine Capital Overseas Master Fund, L.P. (“TMF”), Tontine Capital Overseas Master Fund II, L.P. (“TCP 2”), Tontine Capital Overseas GP, L.L.C. (“TCO”), Tontine Asset Associates, L.L.C. (“TAA”) and Jeffrey L. Gendell on January 4, 2013, as subsequently corrected in the Form 4 filed by Tontine on April 3, 2013 described in footnote (2) below. Includes 3,348,031 shares owned directly by TCP, 370,842 shares owned directly by TMF, and 258,763 shares owned directly by TCP 2.

|

|

Mr. Gendell is the managing member of TCM, TCO and TAA, the general partners of TCP, TMF and TCP 2, respectively, and has shared voting and dispositive power over these shares. All of these shares may be deemed to be beneficially owned by Mr. Gendell. He disclaims beneficial ownership of the shares owned by Tontine, except to the extent of his pecuniary interest therein.

|

|

|

(2)

|

Based on information contained in a Form 4 filed by Tontine on April 3, 2013 (subsequent to the record date), the aggregate number of shares of the Company’s common stock beneficially owned by Tontine decreased to 3,895,320 or 36.4% of the Company’s common stock outstanding as of April 1, 2013, reflecting the distribution on April 1, 2013 of 82,316 shares to investors that are not directly or indirectly controlled by Mr. Gendell in connection with the redemption of ownership interests in TCP 2 held by those investors. On April 1, 2013, TCP distributed 82,316 shares of common stock to TCP 2 (the “transferred shares”). The Transferred Shares were distributed to TCP 2 in connection with the redemption by TCP 2 of ownership interests in TCP.

|

|

(3)

|

Mr. Cerulli is employed by an affiliate of Tontine. He disclaims beneficial ownership of the shares beneficially owned by Tontine, except to the extent of his pecuniary interest therein.

|

CORPORATE GOVERNANCE

The Board believes that fundamental corporate governance is important to ensure that we are managed for the long-term benefit of our shareholders. The Board expects to review its corporate governance practices and policies as set forth in its Corporate Governance Guidelines, Code of Ethics, and various Committee Charters, all of which were updated in accordance with the listing standards of the NASDAQ Stock Market and the SEC rules, at least every two years or as it deems appropriate.

Board Membership

As of the date of this Proxy Statement, the Board has ten members. Except for Mr. Cleveland, our President and Chief Executive Officer, and Mr. Nemeth, our Executive Vice President-Finance and Chief Financial Officer, no director is an employee.

Mr. Cerulli has been employed by Tontine since January 2007. As such, Mr. Cerulli has an indirect interest in the Company’s transactions with Tontine. Mr. Cerulli began receiving compensation for his service as a member of the Board beginning in January 2009. As of April 1, 2013, Tontine beneficially owned approximately 36.4% of the Company’s outstanding common stock.

In connection with the financing of its acquisition of Adorn in May 2007, the Company entered into a Securities Purchase Agreement with Tontine, dated April 10, 2007 (the “2007 Securities Purchase Agreement”), which provided that, among other things, so long as Tontine (i) holds between 7.5% and 14.9% of the Company’s common stock then outstanding, Tontine has the right to appoint one nominee to the Board; or (ii) holds at least 15% of the Company’s common stock then outstanding, Tontine has the right to appoint two nominees to the Board. The Company also agreed to limit the number of directors serving on its Board to no more than nine directors for so long as Tontine has the right to appoint a director to the Board. Subsequently, Tontine agreed to waive the Company’s obligation to limit the size of its Board in connection with the increase of the Board to 10 persons in order to allow the appointment of Michael A. Kitson as a director on March 19, 2013. Mr. Cerulli’s appointment to the Board in July 2008 was made pursuant to Tontine’s right to appoint directors as described above. As of the date hereof, Tontine has not exercised its right to appoint a second nominee to the Board.

10

Election of Directors and Length of Board Term

Directors are currently elected for a one-year term at the Annual Meeting of Shareholders.

Board Committees

The Board has three standing committees: the Audit Committee, the Compensation Committee, and the Corporate Governance and Nominations Committee. Each Committee has a committee chairman and a written charter.

Shareholder Communications

Shareholders may send communications to members of the Board by sending a communication to the Board and/or a particular member c/o Andy L. Nemeth-Secretary, Patrick Industries, Inc., 107 West Franklin Street, P.O. Box 638, Elkhart, Indiana 46515-0638. Communications intended for independent directors should be directed to the Chairman of the Corporate Governance and Nominations Committee.

Code of Ethics

We have a code of ethics that applies to all of our employees, officers and directors.

Access to Corporate Governance Documents

The charters of our Audit, Compensation, and Corporate Governance and Nominations Committees, our Corporate Governance Guidelines, and our Code of Ethics are all available on our website at www.patrickind.com, or by writing to:

Patrick Industries, Inc.

Attn: Andy L. Nemeth, Secretary

107 West Franklin Street

P.O. Box 638

Elkhart, Indiana 46515-0638

Board Meetings and Attendance

The Board and Board Committees hold regular meetings on a set schedule and may hold special meetings and act by written consent from time to time as necessary or appropriate. The Board had four regular meetings in 2012. Additionally, the Board participated in seven special meetings in 2012 which included periodic update calls with the Chief Executive Officer and Chief Financial Officer. In 2012, each director attended at least 75% of the meetings of the Board and the Board Committees on which he served. All directors attended the most recent Annual Meeting of Shareholders which was held on May 24, 2012. We expect all Board members to attend the 2013 Annual Meeting, but from time to time, other commitments may prevent all directors from attending each meeting.

Executive Sessions of Independent Directors

The Board and Board committees regularly meet in executive session without the presence of any management directors or representatives. There was no lead independent director designated to preside over the executive sessions of the Board in 2012. Any independent director can request additional executive sessions. The independent directors met four times in executive session in 2012.

Board Leadership Structure and Risk Oversight

The Company maintains separate positions for the Chairman of the Board (“Chairman”) and for the Chief Executive Officer. The Board believes this leadership structure has enhanced the Board’s oversight of and independence from our management, the ability of the Board to carry out its roles and responsibilities on behalf of our shareholders, and our overall corporate governance. Mr. Hassler serves as Chairman and Mr. Cleveland is the Chief Executive Officer.

The Board has delegated its risk oversight responsibilities to the Audit Committee, as described below under the heading “Audit Committee”. In accordance with the Audit Committee’s Charter, each of our senior

11

financial and accounting professionals reports directly to the Audit Committee regarding material risks to our business, among other matters, and the Audit Committee meets in executive sessions with each professional and with representatives of our independent registered public accounting firm. The Audit Committee Chairman reports to the full Board regarding material risks as deemed appropriate.

Independent Directors

A majority of the members of the Board (eight of the ten members) have been designated by the Board as independent directors. In general, the Board determines whether a director is independent by following the guidelines of the NASDAQ Stock Market and the SEC rules and regulations. The Board has determined that the independent directors are Terrence D. Brennan, Joseph M. Cerulli (except for purposes of the Audit Committee), John A. Forbes, Paul E. Hassler, Keith V. Kankel, Michael A. Kitson (upon his appointment to the Board on March 19, 2013), Larry D. Renbarger and Walter E. Wells. The independent directors met four times in 2012.

Director Qualifications and Director Diversity

The Board seeks a diverse group of candidates who possess the background, skills and expertise and the highest level of personal and professional ethics, integrity, judgment and values to represent the long-term interests of our Company and its shareholders. To be considered for membership on the Board, a candidate should possess some or all of the following major attributes:

|

|

·

|

Breadth of knowledge about issues affecting the Company and the industries/markets in which it operates;

|

|

|

·

|

Significant experience in leadership positions or at senior policy-making levels and an established reputation in the business community;

|

|

|

·

|

Expertise in key areas of corporate management and in strategic planning;

|

|

|

·

|

Financial literacy and financial and accounting expertise; and

|

|

|

·

|

Independence and a willingness to devote sufficient time to carry out his or her duties and responsibilities effectively and assume broad fiduciary responsibility.

|

The Corporate Governance and Nominations Committee does not have a formal policy specifying how diversity of background and personal experience should be applied in identifying or evaluating director candidates. However, as part of its annual self-evaluation under our Corporate Governance Guidelines, the Board considers whether the level of diversity of its members is appropriate, and the Corporate Governance and Nominations Committee takes the outcome into account when identifying and evaluating director candidates.

Consideration of Director Candidates - Corporate Governance and Nominations Committee Processes

The Corporate Governance and Nominations Committee will consider board nominees recommended by shareholders. Those recommendations should be sent to the Chairman of the Corporate Governance and Nominations Committee, c/o of the Secretary of Patrick Industries, Inc., 107 West Franklin Street, P.O. Box 638, Elkhart, Indiana 46515-0638. In order for a shareholder to nominate a candidate for director, under our By-laws, timely notice of the nomination must be given in writing to the Secretary of the Company. To be timely, such notice must be received at our principal executive office not less than 20 days or more than 50 days prior to the next Annual Meeting of Shareholders. Notice of nomination must include the name, address and number of shares owned by the person submitting the nomination; the name, age, business address, residence address and principal occupation of the nominee; and the number of shares beneficially owned by the nominee. It must also include the information that would be required to be disclosed in the solicitation of proxies for election of directors under the federal securities laws, as well as whether the individual can understand basic financial statements and the candidate’s other board memberships (if any). The nominee’s consent to be elected and serve must be submitted. The Corporate Governance and Nominations Committee may require any nominee to furnish any other information, within reason, that may be needed to determine the eligibility of the nominee.

As provided in its Charter, the Corporate Governance and Nominations Committee will follow procedures which the committee deems reasonable and appropriate in the identification of candidates for election to the Board and evaluating the background and qualification of those candidates. Those processes include consideration of

12

nominees suggested by an outside search firm, by incumbent board members, and by shareholders. The Committee will seek candidates having experience and abilities relevant to serving as a director of the Company, and who represent the best interests of shareholders as a whole and not any specific group or constituency.

The Committee will consider a candidate’s qualifications and background, including responsibility for operating a public company or a division of a public company, international business experience, a candidate’s technical and financial background or professional qualification, diversity of background and personal experience, and any other public company boards on which the candidate is a director. The Committee will also consider whether the candidate would be “independent” for purposes of the NASDAQ Stock Market and the SEC rules and regulations by our Board. The Committee may, from time to time, engage the services of a professional search firm to identify and evaluate potential nominees.

Board Committee Responsibilities and Related Matters

The Board has delegated certain responsibilities and authority to each Board Committee as described below. At each regularly scheduled Board meeting, each Board Committee Chairman (or other designated Board Committee member) reports to the full Board on his Board Committee’s activities.

Audit Committee

The Board has an Audit Committee, which from January 1, 2012 to May 23, 2012, was comprised of Keith V. Kankel (Chairman), Terrence D. Brennan, John A. Forbes, Larry D. Renbarger, and Walter E. Wells. Effective May 24, 2012, the Audit Committee was comprised of Keith V. Kankel (Chairman), Terrence D. Brennan, John A. Forbes, Paul E. Hassler, Larry D. Renbarger, and Walter E. Wells. Effective March 19, 2013 with the appointment of Michael A. Kitson to the Board, the Audit Committee was comprised of Keith V. Kankel (Chairman), Terrence D. Brennan, John A. Forbes, Paul E. Hassler, Michael A. Kitson, Larry D. Renbarger, and Walter E. Wells. The Audit Committee’s responsibilities include oversight responsibilities related to potential material risks to our business including, but not limited to, credit, liquidity and operational risks. In addition, its responsibilities include recommending to the Board the independent accountants to be employed for the purpose of conducting the annual audit of our financial statements, discussing with the independent accountants the scope of their examination, reviewing our financial statements and the independent accountants’ report thereon with our personnel and the independent accountants, and inviting the recommendations of the independent accountants regarding internal controls and other matters. Additionally, the Audit Committee is responsible for approving all non-audit services provided by the independent accountants and reviews these engagements on a per occurrence basis. The Audit Committee’s report is provided on pages 6 and 7 of this Proxy Statement.

The Board has determined that each of the members of the Audit Committee is independent as defined in the NASDAQ listing standards and relevant SEC rules, and that Messrs. Kankel, Brennan, Forbes, Hassler, Kitson, Renbarger, and Wells all meet the qualifications required to be an audit committee financial expert and meet the financial sophistication requirements of the NASDAQ listing standards. The Audit Committee met 14 times in 2012. These meetings included conference calls with management to review quarterly earnings releases and SEC filings prior to their issuance.

For a more detailed list of the roles and responsibilities of the Audit Committee, please see the Audit Committee Charter located in the “Corporate Governance” section of our website at www.patrickind.com.

Compensation Committee

The Board has a Compensation Committee, which from January 1, 2012 to May 23, 2012, was comprised of Walter E. Wells (Chairman), Terrence D. Brennan, Joseph M. Cerulli, John A. Forbes, and Keith V. Kankel. Effective May 24, 2012, the Compensation Committee was comprised of Walter E. Wells (Chairman), Terrence D. Brennan, Joseph M. Cerulli, John A. Forbes, Paul E. Hassler, and Keith V. Kankel. Effective March 19, 2013 with the appointment of Michael A. Kitson to the Board, the Compensation Committee was comprised of Walter E. Wells (Chairman), Terrence D. Brennan, Joseph M. Cerulli, John A. Forbes, Paul E. Hassler, Keith V. Kankel, and

13

Michael A. Kitson. The Compensation Committee met four times in 2012. The primary responsibilities of this committee include:

|

|

·

|

Reviewing and recommending to the independent members of the Board the overall compensation programs for the officers of the Company;

|

|

|

·

|

Oversight authority to attract, develop, promote and retain qualified senior executive management; and

|

|

|

·

|

Oversight authority for the stock-based compensation programs.

|

In its oversight of executive officer compensation, the Compensation Committee seeks assistance from our management and our independent compensation consultant, Towers Watson, as further described below under the heading “Compensation Discussion and Analysis - Compensation of Executive Officers and Directors”. The Compensation Committee’s report is provided on page 29 of this Proxy Statement.

The Board has determined that each of the current members of the Compensation Committee is independent as defined in the NASDAQ listing standards and our Corporate Governance Guidelines. For a more detailed list of the roles and responsibilities of the Compensation Committee, please see the Compensation Committee Charter located in the “Corporate Governance” section of our website at www.patrickind.com.

Compensation Committee Interlocks and Director Participation

During 2012, no executive officer served on the Board or compensation committee of any other corporation with respect to which any member of the Compensation Committee was engaged as an executive officer. No member of the Compensation Committee was an officer or employee of the Company during 2012. Paul E. Hassler was formerly an officer of the Company from 2004-2009 and became a member of the Compensation Committee in 2012. Keith V. Kankel was formerly an officer of the Company from 1974-2004 and became a member of the Compensation Committee in 2008.

Corporate Governance and Nominations Committee

The Board has a Corporate Governance and Nominations Committee, which from January 1, 2012 to May 23, 2012, was comprised of Terrence D. Brennan (Chairman), Joseph M. Cerulli, John A. Forbes, Keith V. Kankel, Larry D. Renbarger, and Walter E. Wells. Effective May 24, 2012, the Compensation Committee was comprised of Terrence D. Brennan (Chairman), Joseph M. Cerulli, John A. Forbes, Paul E. Hassler, Keith V. Kankel, Larry D. Renbarger, and Walter E. Wells. Effective March 19, 2013 with the appointment of Michael A. Kitson to the Board, the Compensation Committee was comprised of Terrence D. Brennan (Chairman), Joseph M. Cerulli, John A. Forbes, Paul E. Hassler, Keith V. Kankel, Michael A. Kitson, Larry D. Renbarger, and Walter E. Wells. This Committee met four times in 2012. The primary responsibilities of this committee include:

|

|

·

|

Assist the Board in identifying, screening, and recommending qualified candidates to serve as directors;

|

|

|

·

|

Recommend nominees to the Board to fill new positions or vacancies as they occur;

|

|

|

·

|

Review and recommend to the Board the compensation of directors;

|

|

|

·

|

Recommend to the Board nominees for election by shareholders at the annual meeting; and

|

|

|

·

|

Review and monitor corporate governance compliance as well as recommend appropriate changes.

|

The Board has determined that each of the current members of the Corporate Governance and Nominations Committee is independent as defined in the listing standards of the NASDAQ stock exchange and our Corporate Governance Guidelines. For a more detailed list of the roles and responsibilities of the Corporate Governance and Nominations Committee, please see the Corporate Governance and Nominations Committee Charter located in the “Corporate Governance” section of our website at www.patrickind.com.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires that certain of our officers, directors and 10% shareholders file with the SEC an initial statement of beneficial ownership and certain statements of changes in

14

beneficial ownership of our common stock. Based solely on our review of such forms and written representation from the directors and officers that no other reports were required, we are unaware of any instances of noncompliance or late compliance with such filings during the fiscal year ended December 31, 2012.

EXECUTIVE COMPENSATION

The following Compensation Discussion and Analysis should be read in conjunction with the executive compensation tables and corresponding footnotes that follow. The discussion focuses on the compensation program in effect for the 2012 fiscal year and compensation decisions made with respect to the compensation program.

Compensation Discussion and Analysis

Compensation of Executive Officers and Directors

Summary

We believe that the compensation plan as it relates to our Named Executive Officers - Todd M. Cleveland (“Chief Executive Officer” or “CEO”), Andy L. Nemeth (“Chief Financial Officer” or “CFO”) and Jeffrey M. Rodino (“Chief Operating Officer” or “COO”) - and other executives, should be aligned with the Company’s short-term and long-term organizational strategic agenda and its operating performance and cash flows, and assure appropriate management ownership in the Company. Messrs. Cleveland, Nemeth and Rodino comprise our “Named Executive Officers” or “NEOs”, as such term is used under SEC rules. Our objective is to provide a comprehensive market competitive compensation program designed to attract, retain and motivate the best qualified talents from inside and outside the industry and to align the interests of our senior management team with the interests of our shareholders. We apply a performance management system which is used to drive decisions by senior management to facilitate a “Customer 1st-Performance Based” culture. Our performance management system links compensation to satisfying certain objectives based on our short-term and long-term goals. In order to meet these objectives, the Compensation Committee has met numerous times over the past year and has conducted independent benchmark studies and analyses to develop a comprehensive performance and rewards compensation strategy as it relates to our NEOs and other executives.

Executive Compensation Decisions –

Participants and Roles, Plan Factors, Plan Components and Benchmark Sources

Participants and Roles

|

COMPENSATION

COMMITTEE

|

|

|

INDEPENDENT

COMMITTEE

CONSULTANT

|

|

15

|

CHIEF EXECUTIVE

OFFICER and VICE

PRESIDENT OF HUMAN

RESOURCES

|

|

Plan Factors

There are several key factors the Compensation Committee considers when recommending plan-year executive compensation:

| ● | NEOs’ roles, position scope, experience, skill set, and performance history; |

| ● |

The external market for comparable roles;

|

| ● |

The current and expected business climate; and

|

| ● |

The Company’s financial position and its reflection of operating results.

|

Plan Components

The Compensation Committee utilizes its own judgment in approving the components of compensation, benefits, and plan targets for the NEOs. The committee further reviews and approves compensation including targets, thresholds, and maximums of short-term and long-term incentive compensation.

The Compensation Committee and the Company believe that the components of compensation should be directly linked to a pay-for-differentiated performance strategy and plan design. As a result, the approved executive compensation plan is heavily weighted and focused on the variable pay component of short-term and long-term incentives. The goal of the Committee is to ensure that the incentive plans are aligned with both the short-term and long-term interests of the shareholders through execution of a performance-based plan.

Benchmark Sources

Towers Watson, the Company’s independent compensation consultant for 2012 (the “Consultant”), provides the Compensation Committee with independent benchmark data for consideration when making compensation decisions. The Compensation Committee considers this information along with other relevant published compensation data in conjunction with the plan factors mentioned above when making compensation recommendations to the Board. The Compensation Committee has reviewed the independence of the Consultant in light of new SEC rules and Nasdaq listing standards regarding compensation consultants and has concluded that the Consultant’s work for the Compensation Committee does not raise any conflict of interest. All work performed by the Consultant is subject to review and approval of the Compensation Committee.

The Compensation Committee uses data from both general industry and the durable goods industry as part of its decision making process for the comparison of the NEOs. In 2012, the Compensation Committee continued to utilize both peer group data and a combination of general industry and durable goods industry data to evaluate and support compensation decisions for the CEO (Mr. Cleveland) and CFO (Mr. Nemeth) roles. The Committee used general industry and durable goods industry data for the COO (Mr. Rodino) role.

Peer Group Selection Criteria

1. Commensurate revenue generation scope to the Company’s revenue profile

2. Market capitalization generally consistent with the Company’s market capitalization

3. Industry/business type – industrial manufacturing and distribution firms with national footprints

16

4. Geographically headquartered in the Mid-West markets

5. Similarity of other business attributes, including profit margins and business mix.

Fiscal Year 2012 Peer Group

American Woodmark Corp., Cavco Industries Inc., Continental Materials Corp., Drew Industries Inc., Lawson Products Inc., MFRI Inc., PGT Inc., Skyline Corp., Spartan Motors Inc., Strattec Security Corp., and US Home Systems Inc.

Fiscal Year 2012 Compensation Context

The 2012 performance plan year was influenced by the continued recovery of the economy, measured growth of our business markets (Recreational Vehicles, Manufactured Housing and Industrial) as well as the effects of the Company’s strategic initiatives executed over the past three years. Certain segments of our business saw significant revenue and profit growth from 2011 to 2012, while other segments realized growth at a more measured pace. As our business continued to grow in 2012, the Company was able to execute a Company-wide market and performance-based rewards platform to reflect our exceptional operating results, including record net income, not only for the executive team, but for all team members.

Fiscal Year 2012 Executive Compensation

|

Compensation and

Benefits Components

|

Description and Purpose

|

|

Base Salary

|

Cash payments reflecting a market competitive position for performance of functional role.

|

|

Short-Term Incentives

|

Lump sum cash payments reflective of approved pay-for-performance plan and the relative achievements of the business and individual performance plans. The Board reserves the right at any time to award discretionary bonuses to senior management based on outstanding performance or other factors.

|

|

Long-Term Incentives

|

Restricted stock grants reflecting approved pay-for-performance plan and the relative long-term achievement of the business performance plans as well as the Company’s desire to retain high performing talent and align the interests of senior management with shareholder interests.

|

|

Executive Health and

Welfare Benefits

|

We do not have health and welfare benefits outside the scope of our standard plans for all employees.

|

|

Voluntary Deferred

Compensation Plan

|

Voluntary deferred compensation plan whereby highly compensated individuals can elect to voluntarily defer all or a portion of their wages in any given years subject to applicable laws and restrictions. Designed to supplement market competitive position and further drive retention of key executives.

|

|

Other Compensation

|

Other compensation includes automobile allowance, Company contributions pursuant to the Patrick Industries, Inc. 401(k) Plan, and Company contributions to individual Health Savings Accounts and health club reimbursement pursuant to the Company’s general health and wellness program.

|

|

Executive Retirement Plan

|

Supplemental executive retirement program based on a formula of base wages, service and other criteria designed to retain key senior talent.

|

|

Severance Benefits

|

We provide reasonable and customary transition support aligned to our market benchmark data.

|

17

Compensation Components – Mix and Levels

Base Salary

The Compensation Committee reviews and approves the base salaries of the NEOs each year, as well as at the time of promotion, change in job responsibilities, or any other change deemed to be a material event. Base salaries are set during the first quarter of each year. The Compensation Committee sets the salary for the President and CEO, and approves the base salaries for the other NEOs based on recommendations by the President and CEO.

When determining base salary adjustments for its NEOs, the Compensation Committee considers a combination of (1) peer group data, (2) market data, including industry norms and benchmarking data from companies of similar size, and (3) outstanding Company and individual performance in the performance plan year. In general, the Compensation Committee targets the 25th percentile of the Company’s peer group in determining base salaries and the 75th percentile of the Company’s peer group for determining short-term incentive compensation.

The Board approved a base compensation increase for the NEOs on February 13, 2012 in alignment with market data and the Company plan factors.

The following table summarizes the 2011 and 2012 base salaries as approved by the Board for the NEOs:

|

Name

|

2011 Base

Salary –

2/28/11

|

2012 Base

Salary –

2/13/12

|

%

Increase

2/13/12

|

|

Todd M. Cleveland

|

$300,000

|

$350,000

|

16.7%

|

|

Andy L. Nemeth

|

225,000

|

235,000

|

4.4%

|

|

Jeffrey M. Rodino

|

170,000

|

200,000

|

17.6%

|

Non-Equity Incentive Plan Awards

The Annual Non-Equity Incentive Plan Awards (“Short-Term Incentives” or “STIs”) are reviewed and approved each year and are based on the achievement of a combination of the Company’s financial results and the individual’s performance against defined objectives. Several key components were considered in the development of the 2012 STI plan to align the STIs with shareholder interest by measuring the Company’s financial performance and the individual’s performance in support of the Company’s short and long-term strategies. These components include:

|

|

·

|

Company performance (50% weighting), which is measured by the Company’s EBITDA;

|

|

|

·

|

Individual performance (50% weighting), which is measured by: |

|

|

1.

|

Financial objectives – Revenue and EBITDA targets (40% weighting within the individual performance objectives);

|

|

|

2.

|

Strategic objectives – Actions and initiatives linked to the Company’s organizational strategic agenda for the plan year (30% weighting within the individual performance objectives);

|

|

|

3.

|

Leadership and talent objectives – Actions and initiatives linked to the development of our talent, leadership, capabilities and our values (30% weighting within the individual performance objectives).

|

For each of the NEOs, a target STI award is established as a percentage of base salary. The portion of the STI award that is tied to individual performance is based on the Compensation Committee’s assessment of an individual’s performance against defined objectives (50% weighting), with the NEOs each receiving an individual performance rating ranging from 0.0 to 5.0. The Company performance component of the STI award is based upon the Company’s EBITDA performance versus target EBITDA (50% weighting), with the actual results placed on a scale ranging from 0.0 to 5.0. The threshold Company EBITDA performance is 80% of target EBITDA (a 2.0

18

rating) and the maximum Company EBITDA performance is 120% of target EBITDA (a 5.0 rating). The threshold, target and maximum performance metrics for the 2012 STI plan are outlined below:

|

2012 STI Award Component

|

Threshold Performance

|

Target Performance

|

Maximum Performance

|

|

Company Rating (EBITDA)

|

2.0 ($18.5MM)

|

3.0 ($23.0MM)

|

5.0 ($27.7MM)

|

|

Individual Rating

|

2.5

|

3.0

|

5.0

|

If an individual’s performance rating is below the threshold rating of 2.5, such individual is not eligible for an STI award regardless of Company performance. If the Company’s EBITDA performance is below the threshold Company rating of 2.0, no individual is eligible for an STI award regardless of individual performance.

The individual rating is translated into a payout factor ranging from 83% (threshold) to 167% (maximum), and the Company rating is translated into a payout factor ranging from 50% (threshold) to 150% (maximum). The individual and Company payout factors are multiplied to establish an aggregate payout factor, which is then multiplied by the target STI award to determine the actual dollar award. The range of potential 2012 aggregate payout factors as a percentage of the target STI award was as follows:

|

|

·

|

Threshold individual and Company performance - 41.7%

|

|

|

·

|

Target individual and Company performance - 100%

|

|

|

·

|

Maximum individual and Company performance - 250%.

|