CORRESP: A correspondence can be sent as a document with another submission type or can be sent as a separate submission.

Published on January 5, 2015

Corporate Office ● 107 W. Franklin Street ● P.O. Box 638 ● Elkhart, Indiana 46515-0638

Phone: (574) 294-7511 ● Fax: (574) 522-5213

January 5, 2015

VIA EDGAR

United States Securities and Exchange Commission

Division of Corporation Finance

Mail Stop 4631

Washington, D.C. 20549-4631

Attention: John Cash, Accounting Branch Chief

|

Re: |

Patrick Industries, Inc. |

|

|

Form 10-K for the Year Ended December 31, 2013 Definitive Proxy Statement on Schedule 14A (filed April 28, 2014) Form 8-K (filed November 18, 2014) Response Dated December 8, 2014 |

Dear Mr. Cash:

The following contains the responses of Patrick Industries, Inc. (the “Company”) to the written comments from the staff (“Staff”) of the Securities and Exchange Commission (“SEC”), dated December 17, 2014, concerning the above-referenced documents. For your convenience, the Company’s responses follow the bolded text of the applicable SEC comment.

FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2013

Business, page 3

Marketing and Distribution, page 12

|

1. |

We note your response to comment one from our letter dated November 5, 2014; however, please be advised if you elect to identify your major customers in the notes to your financial statements your disclosures are also required to comply with ASC 280-10-50-42. Please revise your proposed disclosures to indicate the percentages of revenues from each major customer. |

RESPONSE: We have revised our previously submitted proposed disclosures to be included in our future annual filings to not disclose the specific identity of our major customers but to indicate the percentages of revenues from each major customer to comply with ASC 280-10-50-42.

For example, the Major Customers section on page F-39 of our 2013 Form 10-K would be revised as follows:

“The Company had one RV customer that accounted for approximately 28% and 30% of the trade receivables balance at December 31, 2013 and 2012, respectively. There were no other customers that accounted for more than 10% of the trade receivables balance at December 31, 2013 and 2012.

The Company had two customers in the RV market that each accounted for over 10% of consolidated net sales. One RV customer accounted for approximately 34%, 34% and 32% of consolidated net sales for the years ended December 31, 2013, 2012 and 2011, respectively. In addition, sales to a different RV customer accounted for approximately 23%, 20% and 17% of consolidated net sales for the years ended December 31, 2013, 2012 and 2011, respectively.”

Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 26

Consolidated Operating Results, page 32

|

2. |

We note your response to comment two from our letter dated November 5, 2014. You disclose on page 40 that the West Side furniture business acquired in 2013 made a positive contribution to operating income during 2013. We believe that quantifying the effect on operating income of some of your larger acquisitions would help provide greater transparency and context to investors regarding the impact acquisitions had on your business. Please refer to Item 303(a)(3)(i) of Regulation S-K and revise your future filings accordingly. |

RESPONSE: In future filings, we will quantify within each operating segment, in the aggregate and where applicable, the effect on operating income of some of our larger acquisitions for the period in which those businesses were acquired, to the extent such calculations are material.

Consolidated Financial Statements

4. Acquisitions, page F-12

|

3. |

We note your responses to comments four and five from our letter dated November 5, 2014. Regardless of whether the acquired businesses were considered material enough to qualify as a significant subsidiary, the amount of earnings attributable to acquirees after the acquisition date should be disclosed if the impact was material. Furthermore, please note that ASC 805-10-50-3 requires the disclosures in ASC 805-10-50-2(e) through 2(h) to be provided for individually immaterial business combinations that are material collectively. Please revise your future filings accordingly. |

RESPONSE: In future filings, we will disclose the amount of earnings attributable to any future acquirees after the acquisition date, for the period in which the business is acquired and to the extent deemed material, and will provide the disclosures in ASC 805-10-50-2(e) through 2(h) for individually immaterial business combinations, in the aggregate, that are material collectively.

20. Segment Information, page F-37

|

4. |

We note your response to comment six from our letter dated November 5, 2014. Your response states that disclosure of the amount of revenues from external customers by product type within each of your reportable operating segments is impracticable because it is not consistent with your method of internal reporting to the chief operating decision maker. The standard does not require disclosure of revenues by product type separately for each reportable operating segment. Rather, our comment asked how you considered providing revenues from external customers for each group of similar products or services on a consolidated basis. If you have revenues from external customers for each group of similar products or services, please provide the disclosures required by ASC 280-10-50-40, if providing that information is impracticable, please disclose that fact. |

RESPONSE: In future annual filings, we will disclose, in tabular format, the amount of revenues from external customers for each group of similar products or services on a consolidated basis within our “Segment Information” footnote to the Notes to the Consolidated Financial Statements for the applicable reporting periods.

Beginning with our Annual Report on Form 10-K for the fiscal year ended December 31, 2014, we currently intend to report revenues from external customers for each group of similar products or services on a consolidated basis as follows: (1) Decorative interior products and components; (2) Non-decorative interior products and components; and (3) Exterior products and other. In addition, we intend to provide similar product sales figures in the “Principal Products” section within the “Part I - Item 1. Business” section of the Form 10-K.

DEFINITIVE PROXY STATEMENT ON SCHEDULE 14A FILED APRIL 28, 2014

Executive Compensation, page 19

Non-Equity Incentive Plan Awards, page 22

|

5. |

In response to comment nine in our letter dated November 5, 2014, you discuss the overall objectives and factors that the compensation committee took into consideration in determining whether objectives were achieved and you indicate that the compensation committee is provided with “detailed quantitative documentation substantiating individual performance against each individual objective.” However, in your sample disclosure, you do not identify or quantify actual performance ratings, nor indicate that you will disclose individual performance ratings for each NEO in future filings. Please advise or otherwise please comply with our prior comment nine in full. |

RESPONSE: In response to the Staff’s comment noted above, we will not disclose the individual performance rating for each NEO, however, we will provide disclosure in future filings to quantify the target individual performance rating set by the Compensation Committee for each of the individual NEOs and identify whether the actual individual performance rating achieved by each of the NEOs met or exceeded the specific target rating as determined by the Compensation Committee. In addition, as previously noted, our proposed disclosure will include a summary of the overall strategic, leadership and talent objectives and the factors that the Compensation Committee considered in determining whether these objectives were achieved.

We intend to provide additional similar disclosure as that stated below in the “Non-Equity Incentive Plan Awards” section within the “Compensation Discussion and Analysis” section of our Definitive Proxy Statement on Schedule 14A to be filed in April 2015. The discussion below reflects the consideration by the Company’s Compensation Committee of the individual performance of each of our NEOs for the 2013 plan year.

“Each NEO’s individual performance rating takes into account three categories of performance objectives in assessing the personal performance of the NEOs named in the Summary Compensation Table for 2013 against individual objectives: (i) financial performance including revenue targets, EBITDA targets and an optional financial goal approved by the Company’s Compensation Committee and by the Chief Executive Officer (“CEO”); (ii) two or three strategic objectives linked to the Company’s strategic plan which include, among others: (a) improving the revenue and profitability of business units under the leadership and control of the NEO; (b) the introduction of new product lines and product line extensions to achieve target revenue growth levels and market share; and (c) the ongoing evaluation of strategic opportunities related to our capital allocation strategy and the execution of those opportunities, as appropriate; and (iii) objectives linked to developing and managing talent consistent with the Company’s values, and enhancing and developing the leadership capabilities of the Company’s future leaders. The financial objectives are the same for each NEO and linked directly to the plan year goals. The strategic objectives are specific for each NEO, but are linked to the strategic plan and that year’s organizational strategic agenda. Finally, the talent, values and leadership objectives are also tailored for each NEO according to the specific areas of focus for the individual NEO and their respective areas of responsibility.

The individual objectives for the NEOs are initially developed by each NEO to guide their planned respective contribution toward the Company’s strategic and financial goals for the plan year, and reviewed and approved by either the CEO or by the Board of Directors, in the CEO’s case.

In assessing the NEOs’ individual performance, the Compensation Committee is provided with detailed quantitative documentation substantiating individual performance against each individual objective. The Compensation Committee looks to the CEO’s performance assessments of the other NEOs and his recommendations regarding a performance rating for each, as well as input from the non-management Board members. These recommendations may be adjusted by the Compensation Committee prior to finalization. The personal performance assessment of our CEO is determined by the Compensation Committee with input from members of the Board.

While the achievement of corporate objectives is quantified with an individual rating, each NEO’s relative contribution to those objectives is only one qualitative component against which the individual’s performance is assessed by the Compensation Committee. Based upon their individual achievements and the Company’s overall financial performance, as evaluated by the Compensation Committee, and by the CEO for Mr. Rodino and Mr. Nemeth, the individual performance rating achieved by each of the three NEOs exceeded the target performance rating of 3.0 set by the Compensation Committee.”

FORM 8-K FILED NOVEMBER 18, 2014

|

6. |

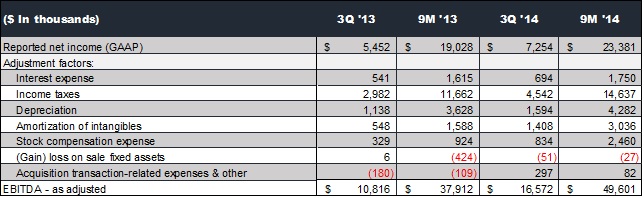

We note your response to comment 12 from our letter dated November 5, 2014. Your reconciliation of net income to EBITDA on page 32 of Exhibit 99 includes reconciling items related to gains and losses on fixed asset sales, acquisition transaction-related expenses, and stock compensation expense. Please be advised that Question 103.01 of our “Compliance and Disclosure Interpretations: Non-GAAP Financial Measures” indicates that EBITDA is defined as “earnings before interest, taxes, depreciation and amortization.” Please revise the non-GAAP measure you present as EBITDA to only include adjustments for items contemplated by its acronym or revise the title of the non-GAAP measure you present to convey the additional adjustments. |

RESPONSE: In response to the Staff’s comment noted above, we have revised the following disclosure in tabular format to change the title of the non-GAAP measure from “EBITDA” to “EBITDA – as adjusted”. We believe the inclusion of additional noteworthy adjustments that are included in addition to the adjustments contemplated by the EBITDA acronym are important to make meaningful period-to-period comparisons and that this supplemental information is helpful to investors. In future filings, the non-GAAP measure of “EBITDA – as adjusted” will be reconciled to the GAAP measure, net income.

For example, the disclosure included in the Company’s Report on Form 8-K as furnished to the SEC on November 18, 2014, for the third quarter and nine months periods ended September 28, 2014 and September 29, 2013, would be revised as follows:

****

In connection with our response to your comments, we acknowledge that: (1) We are responsible for the adequacy and accuracy of the disclosures in our filings; (2) Staff comments or changes to disclosures in response to Staff comments do not foreclose the Commission from taking any action with respect to the filings; and (3) the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

We hope that the foregoing has been responsive to the Staff’s comments. Please do not hesitate to contact me at (574) 294-7511 with any questions or comments.

Sincerely yours,

/s/ Andy L. Nemeth

Andy L. Nemeth

Executive Vice President-Finance and Chief Financial Officer

6