EXHIBIT 99.1

Published on May 17, 2017

Annual Shareholders Meeting

May 17, 2017

Welcome

Julie Ann Kotowski

Director of Investor Relations

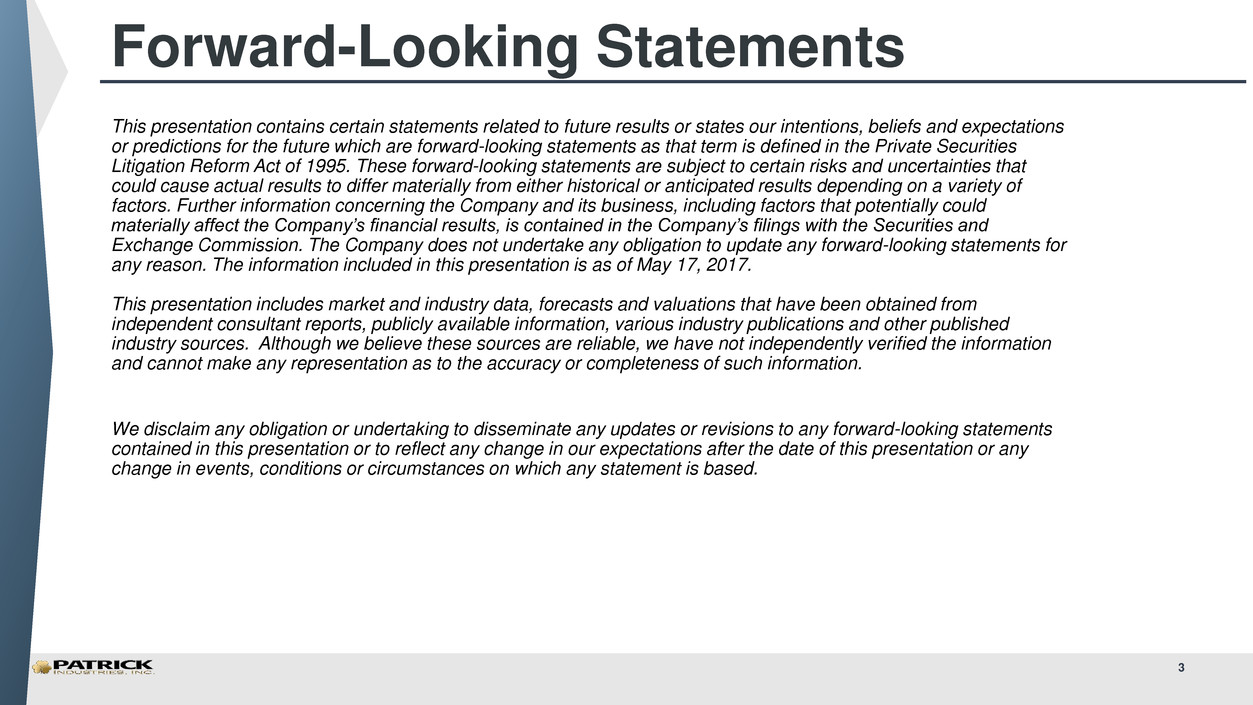

Forward-Looking Statements

This presentation contains certain statements related to future results or states our intentions, beliefs and expectations

or predictions for the future which are forward-looking statements as that term is defined in the Private Securities

Litigation Reform Act of 1995. These forward-looking statements are subject to certain risks and uncertainties that

could cause actual results to differ materially from either historical or anticipated results depending on a variety of

factors. Further information concerning the Company and its business, including factors that potentially could

materially affect the Company’s financial results, is contained in the Company’s filings with the Securities and

Exchange Commission. The Company does not undertake any obligation to update any forward-looking statements for

any reason. The information included in this presentation is as of May 17, 2017.

This presentation includes market and industry data, forecasts and valuations that have been obtained from

independent consultant reports, publicly available information, various industry publications and other published

industry sources. Although we believe these sources are reliable, we have not independently verified the information

and cannot make any representation as to the accuracy or completeness of such information.

We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements

contained in this presentation or to reflect any change in our expectations after the date of this presentation or any

change in events, conditions or circumstances on which any statement is based.

3

Paul Hassler

Chairman of the Board

Andy Nemeth

President

Strong Brands

5

2016 Review

Todd Cleveland

Chief Executive Officer

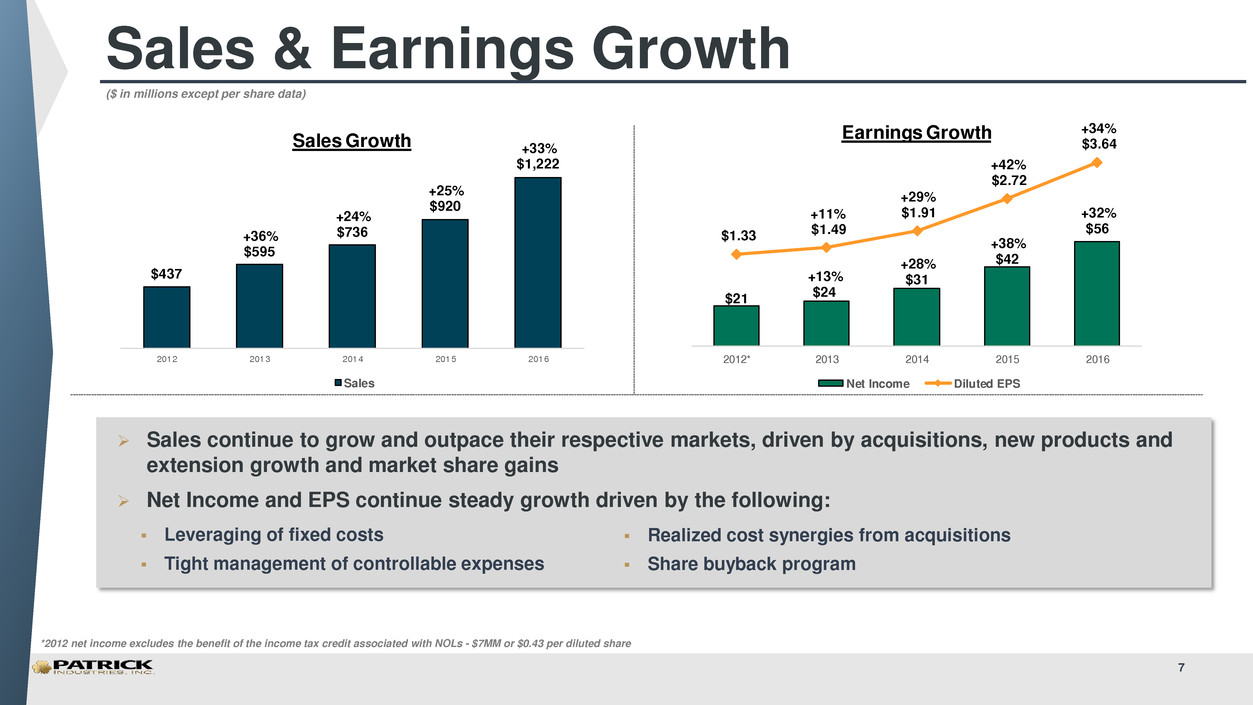

Sales & Earnings Growth

7

Sales continue to grow and outpace their respective markets, driven by acquisitions, new products and

extension growth and market share gains

Net Income and EPS continue steady growth driven by the following:

Leveraging of fixed costs

Tight management of controllable expenses

*2012 net income excludes the benefit of the income tax credit associated with NOLs - $7MM or $0.43 per diluted share

($ in millions except per share data)

$21

+13%

$24

+28%

$31

+38%

$42

+32%

$56

$1.33

+11%

$1.49

+29%

$1.91

+42%

$2.72

+34%

$3.64

2012* 2013 2014 2015 2016

Earnings Growth

Net Income Diluted EPS

Realized cost synergies from acquisitions

Share buyback program

7

$437

+36%

$595

+24%

$736

+25

$920

+33%

$1,222

2012 2013 2014 2015 2016

Sales Growth

Sales

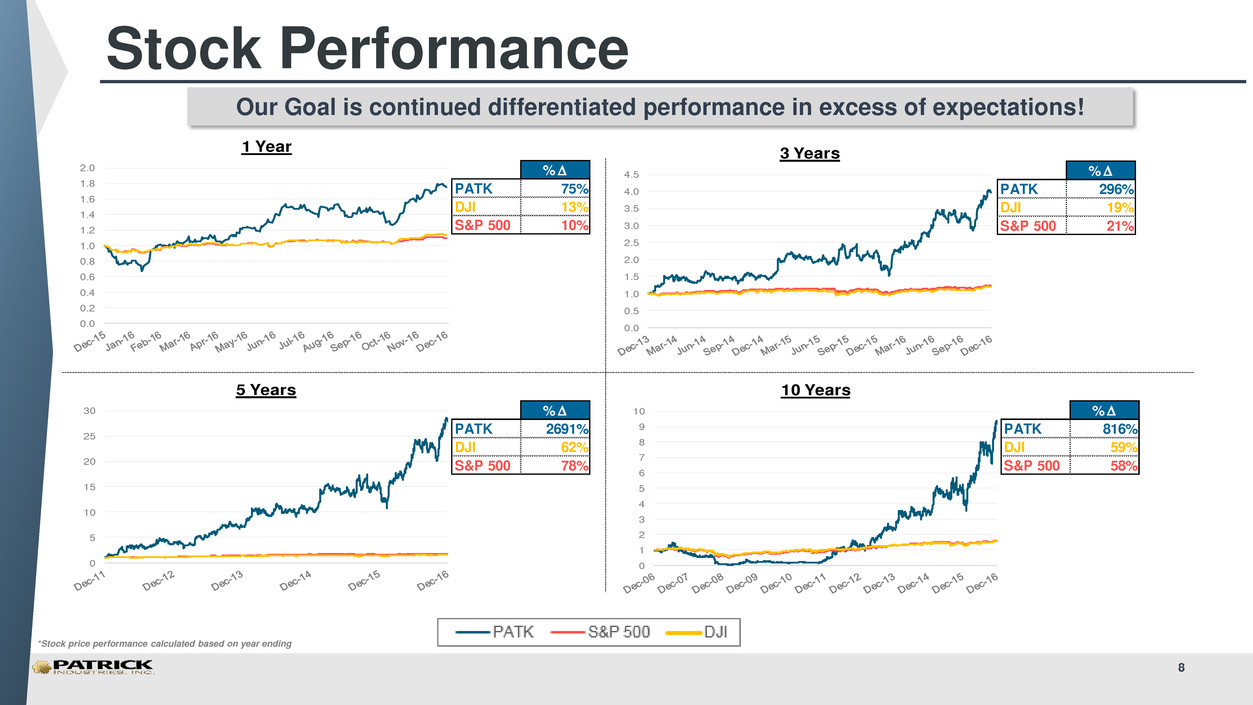

Stock Performance

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

1.8

2.0

1 Year

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

3 Years

0

5

10

15

20

25

30

5 Years

0

1

2

3

4

5

6

7

8

9

10

10 Years

*Stock price performance calculated based on year ending

% D

PATK 296%

DJI 19%

S&P 500 21%

% D

PATK 2691%

DJI 62%

S&P 500 78%

% D

PATK 816%

DJI 59%

S&P 500 58%

Our Goal is continued differentiated performance in excess of expectations!

8

% D

PATK 75%

DJI 13%

S&P 500 10%

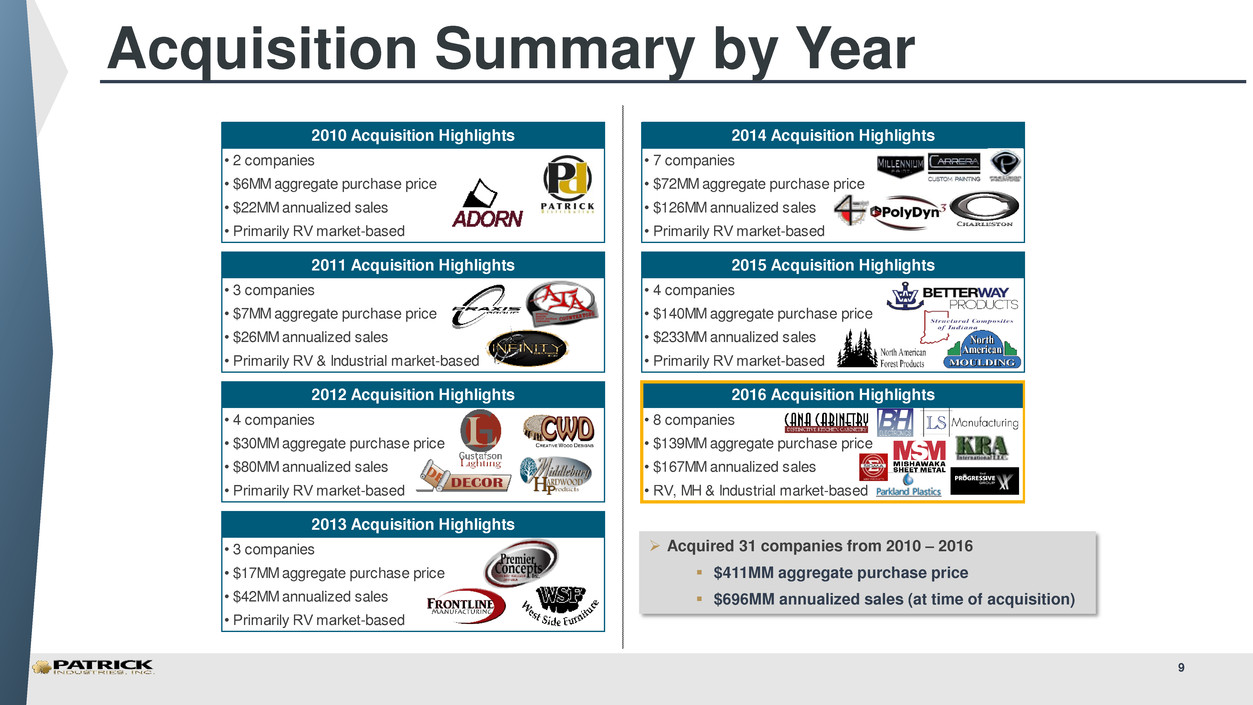

2010 Acquisition Highlights 2014 Acquisition Highlights

• 2 companies • 7 companies

• $6MM aggregate purchase price • $72MM aggregate purchase price

• $22MM annualized sales • $126MM annualized sales

• Primarily RV market-based • Primarily RV market-based

2011 Acquisition Highlights 2015 Acquisition Highlights

• 3 companies • 4 companies

• $7MM aggregate purchase price • $140MM aggregate purchase price

• $26MM annualized sales • $233MM annualized sales

• Primarily RV & Industrial market-based • Primarily RV market-based

2012 Acquisition Highlights 2016 Acquisition Highlights

• 4 companies • 8 companies

• $30MM aggregate purchase price • $139MM aggregate purchase price

• $80MM annualized sales • $167MM annualized sales

• Primarily RV market-based • RV, MH & Industrial market-based

2013 Acquisition Highlights

• 3 companies

• $17MM aggregate purchase price

• $42MM annualized sales

• Primarily RV market-based

Acquired 31 companies from 2010 – 2016

$411MM aggregate purchase price

$696MM annualized sales (at time of acquisition)

Acquisition Summary by Year

9

*Annualized sales represents projected full year sales volumes as of the acquisition date

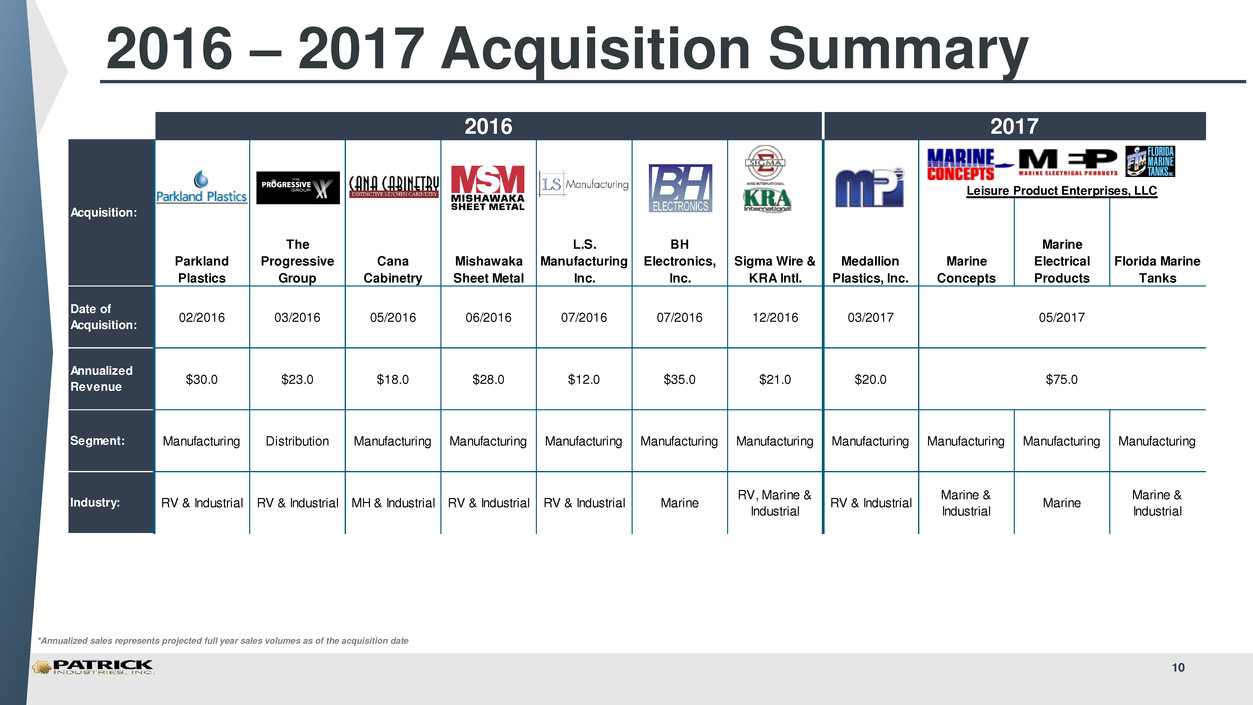

2016 – 2017 Acquisition Summary

10

2016 2017

Parkland

Plastics

The

Progressive

Group

Cana

Cabinetry

Mishawaka

Sheet Metal

L.S.

Manufacturing

Inc.

BH

Electronics,

Inc.

Sigma Wire &

KRA Intl.

Medallion

Plastics, Inc.

Marine

Concepts

Marine

Electrical

Products

Florida Marine

Tanks

Date of

Acquisition:

02/2016 03/2016 05/2016 06/2016 07/2016 07/2016 12/2016 03/2017

Annualized

Revenue

$30.0 $23.0 $18.0 $28.0 $12.0 $35.0 $21.0 $20.0

Segment: Manufacturing Distribution Manufacturing Manufacturing Manufacturing Manufacturing Manufacturing Manufacturing Manufacturing Manufacturing Manufacturing

Industry: RV & Industrial RV & Industrial MH & Industrial RV & Industrial RV & Industrial Marine

RV, Marine &

Industrial

RV & Industrial

Marine &

Industrial

Marine

Marine &

Industrial

$75.0

Acquisition:

Leisure Product Enterprises, LLC

05/2017

Industry Trends

Andy Nemeth

President

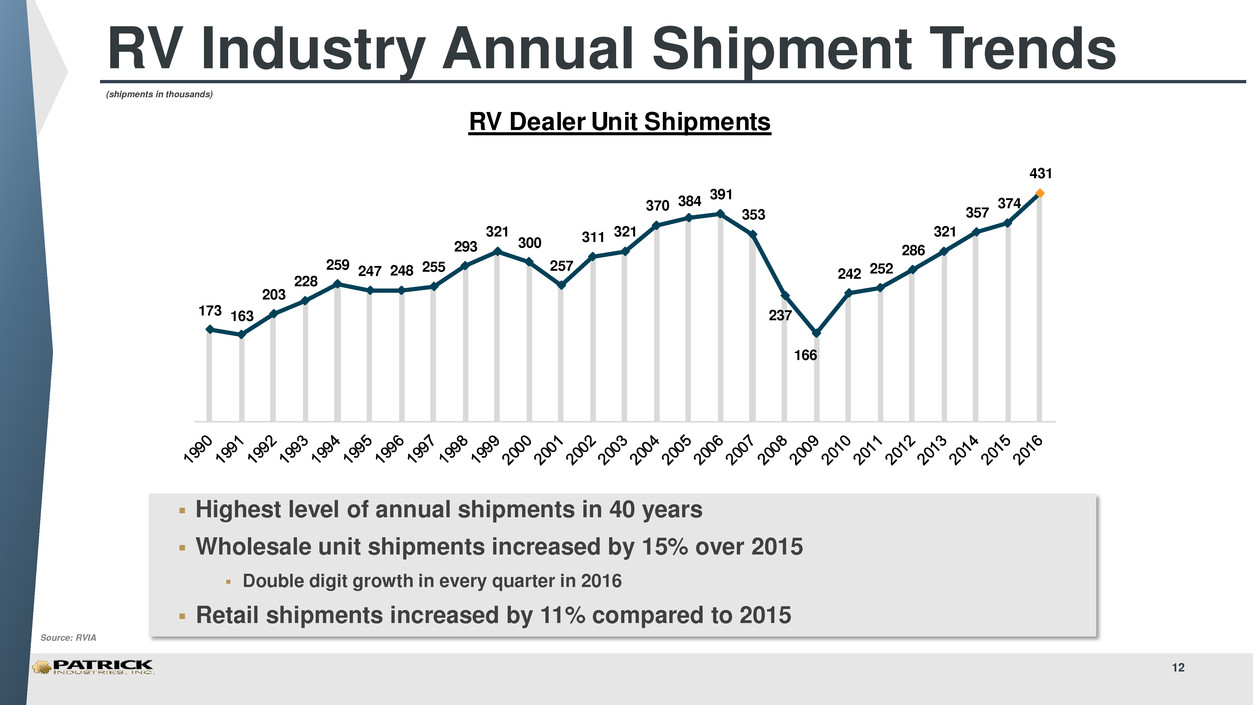

(shipments in thousands)

Source: RVIA

Highest level of annual shipments in 40 years

Wholesale unit shipments increased by 15% over 2015

Double digit growth in every quarter in 2016

Retail shipments increased by 11% compared to 2015

RV Industry Annual Shipment Trends

12

173 163

203

228

259 247 248 255

293

321

300

257

311 321

370 384

391

353

237

166

242 252

286

321

357

374

431

RV Dealer Unit Shipments

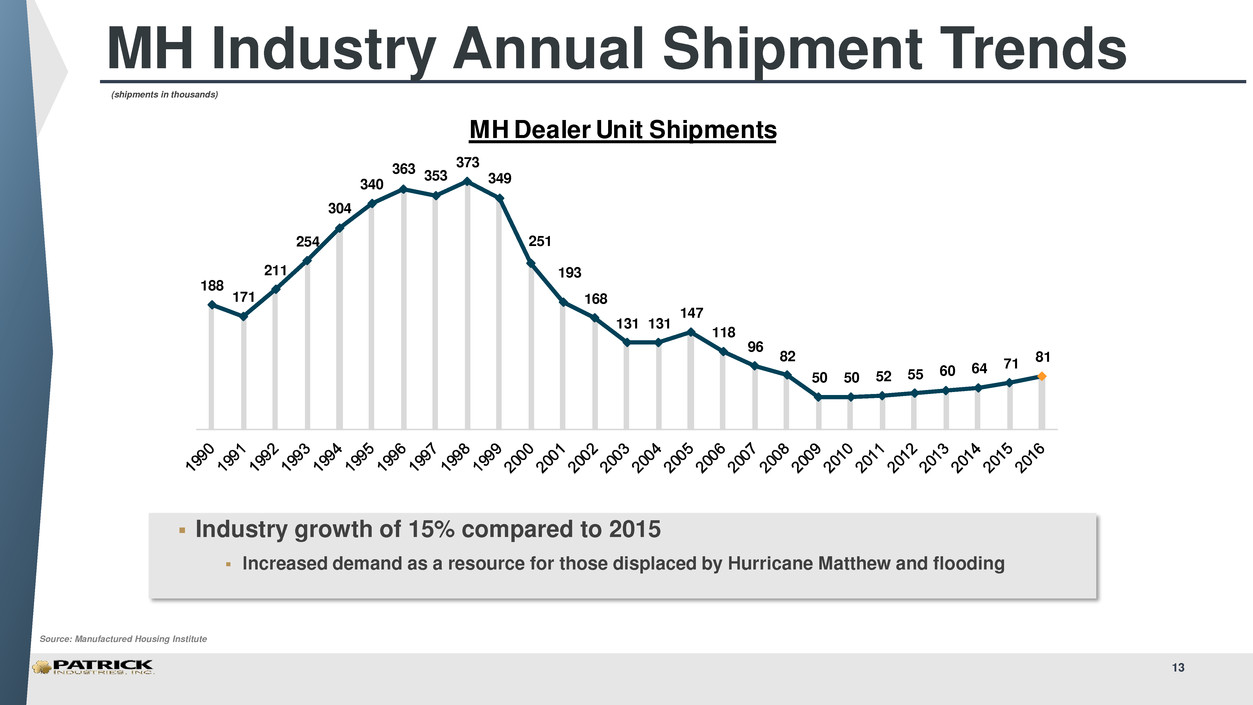

(shipments in thousands)

Source: Manufactured Housing Institute

MH Industry Annual Shipment Trends

Industry growth of 15% compared to 2015

Increased demand as a resource for those displaced by Hurricane Matthew and flooding

13

188

171

211

254

304

340

363 353

373

349

251

193

168

131 131

147

118

96

82

50 50 52 55 60

64 71

81

MH Dealer Unit Shipments

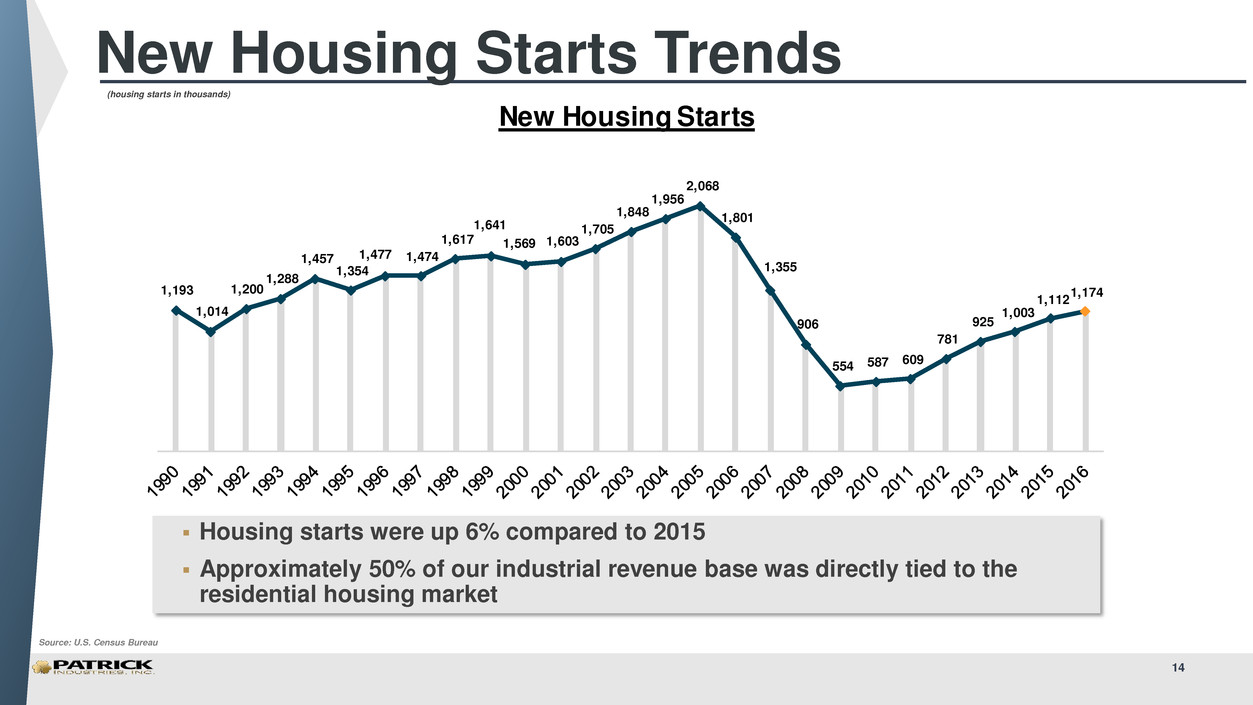

(housing starts in thousands)

Source: U.S. Census Bureau

New Housing Starts Trends

1,193

1,014

1,200

1,288

1,457

1,354

1,477 1,474

1,617

1,641

1,569 1,603

1,705

1,848

1,956

2,068

1,801

1,355

906

554 587

609

781

925

1,003

1,112

1,174

New Housing Starts

Housing starts were up 6% compared to 2015

Approximately 50% of our industrial revenue base was directly tied to the

residential housing market

14

1st Quarter

2017 Review

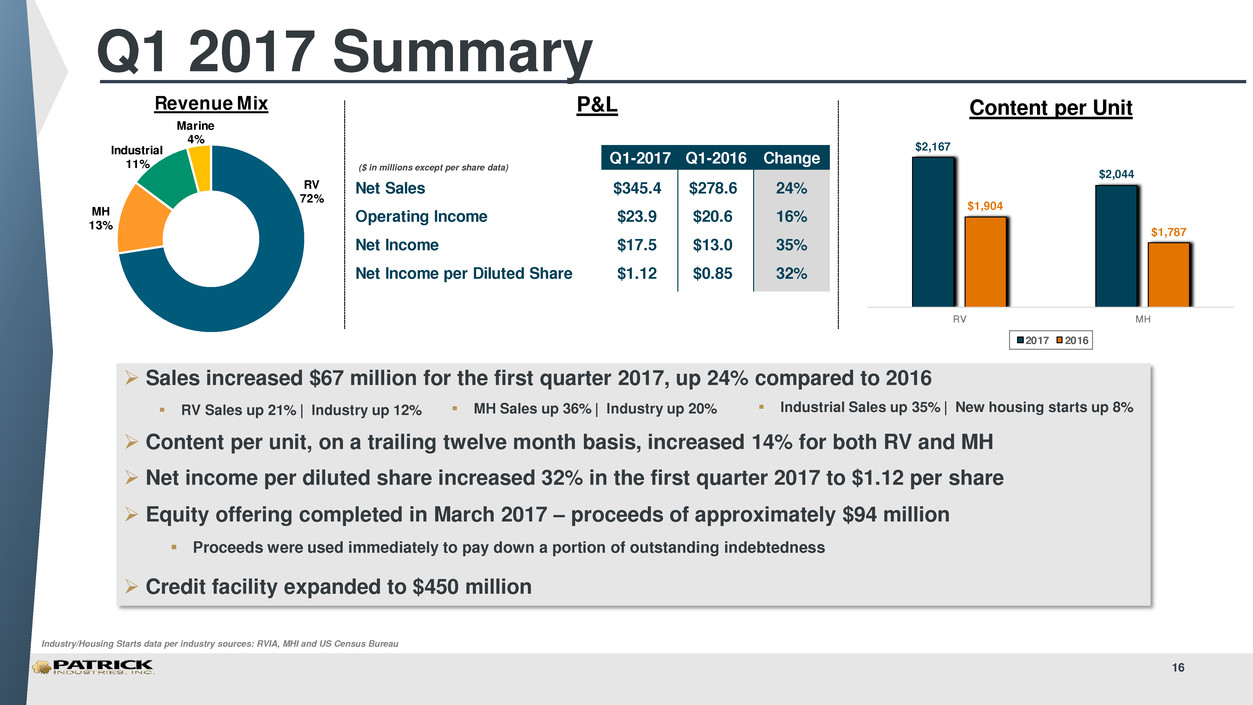

Q1-2017 Q1-2016 Change

Net Sales $345.4 $278.6 24%

Operating Income $23.9 $20.6 16%

Net Income $17.5 $13.0 35%

Net Income per Diluted Share $1.12 $0.85 32%

$2,167

$2,044

$1,904

$1,787

RV MH

2017 2016

RV

72%

MH

13%

Industrial

11%

Marine

4%

Revenue Mix

Sales increased $67 million for the first quarter 2017, up 24% compared to 2016

RV Sales up 21% Industry up 12%

Content per unit, on a trailing twelve month basis, increased 14% for both RV and MH

Net income per diluted share increased 32% in the first quarter 2017 to $1.12 per share

Equity offering completed in March 2017 – proceeds of approximately $94 million

Proceeds were used immediately to pay down a portion of outstanding indebtedness

Credit facility expanded to $450 million

($ in millions except per share data)

Industry/Housing Starts data per industry sources: RVIA, MHI and US Census Bureau

Q1 2017 Summary

P&L Content per Unit

16

MH Sales up 36% Industry up 20% Industrial Sales up 35% New housing starts up 8%

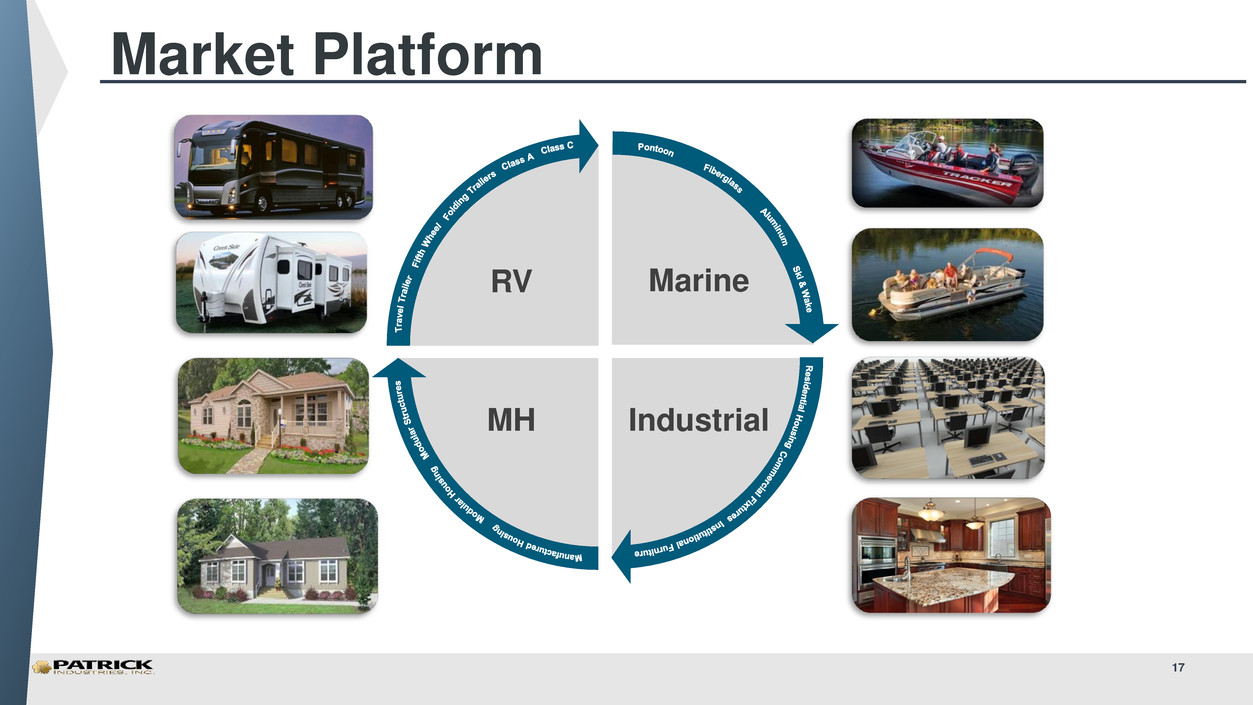

Market Platform

Marine

Industrial MH

RV

17

18

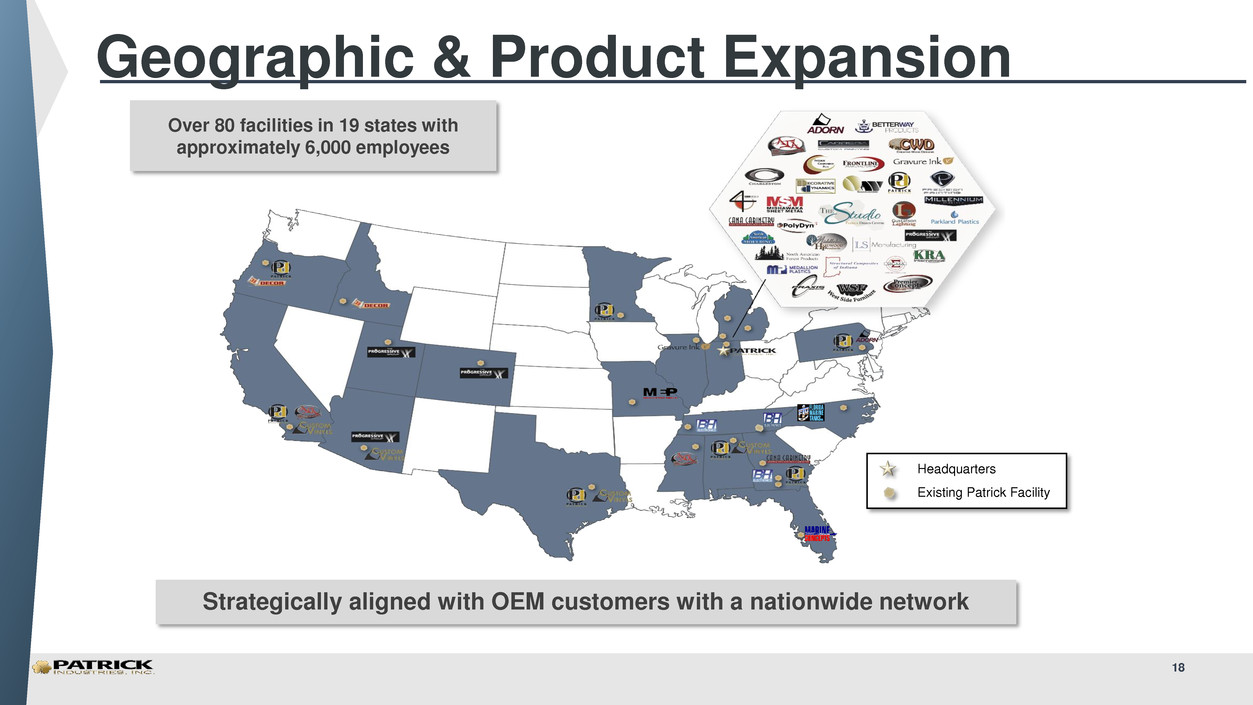

Strategically aligned with OEM customers with a nationwide network

Over 80 facilities in 19 states with

approximately 6,000 employees

Headquarters

Existing Patrick Facility

Geographic & Product Expansion

18

Annual Shareholders Meeting

May 17, 2017