EXHIBIT 99.1

Published on July 30, 2018

Investor Presentation Second Quarter 2018

Forward-Looking Statements This presentation contains certain statements related to future results or states our intentions, beliefs and expectations or predictions for the future which are forward- looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from either historical or anticipated results depending on a variety of factors. Further information concerning the Company and its business, including factors that potentially could materially affect the Company’s financial results, is contained in the Company’s filings with the Securities and Exchange Commission. This presentation includes market and industry data, forecasts and valuations that have been obtained from independent consultant reports, publicly available information, various industry publications and other published industry sources. Although we believe these sources are reliable, we have not independently verified the information and cannot make any representation as to the accuracy or completeness of such information. We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained in this presentation or to reflect any change in our expectations after the date of this presentation or any change in events, conditions or circumstances on which any statement is based. 2

Company Overview

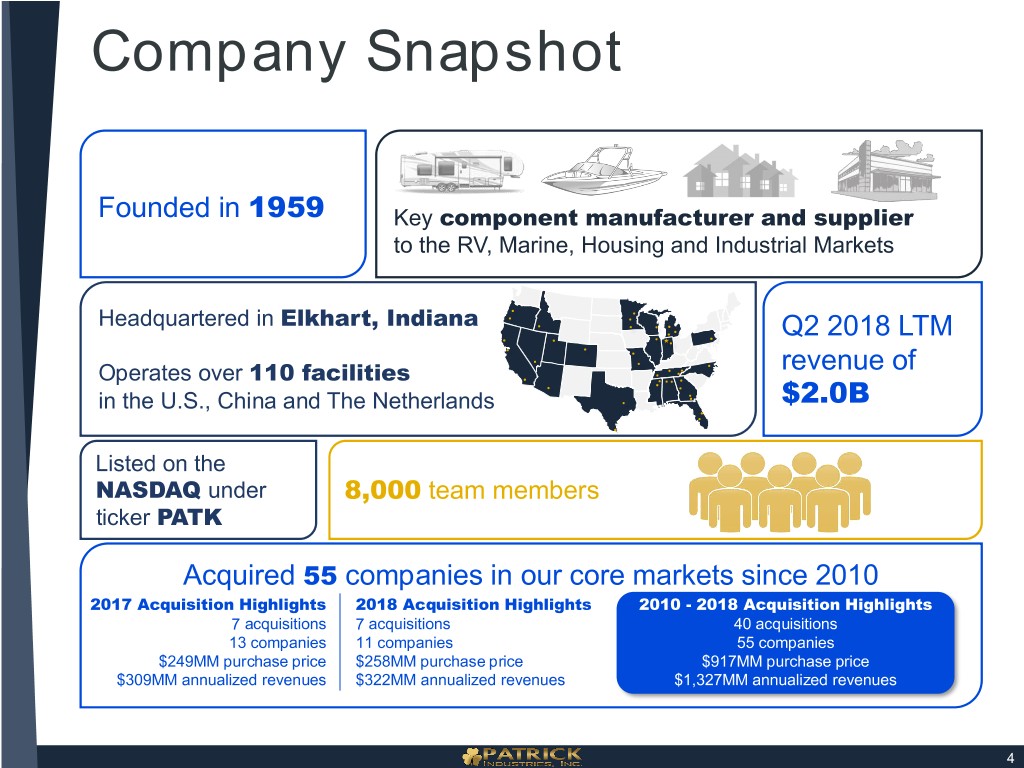

Company Snapshot Founded in 1959 Key component manufacturer and supplier to the RV, Marine, Housing and Industrial Markets Headquartered in Elkhart, Indiana Q2 2018 LTM Operates over 110 facilities revenue of in the U.S., China and The Netherlands $2.0B Listed on the NASDAQ under 8,000 team members ticker PATK Acquired 55 companies in our core markets since 2010 2017 Acquisition Highlights 2018 Acquisition Highlights 2010 - 2018 Acquisition Highlights 7 acquisitions 7 acquisitions 40 acquisitions 13 companies 11 companies 55 companies $249MM purchase price $258MM purchase price $917MM purchase price $309MM annualized revenues $322MM annualized revenues $1,327MM annualized revenues 4

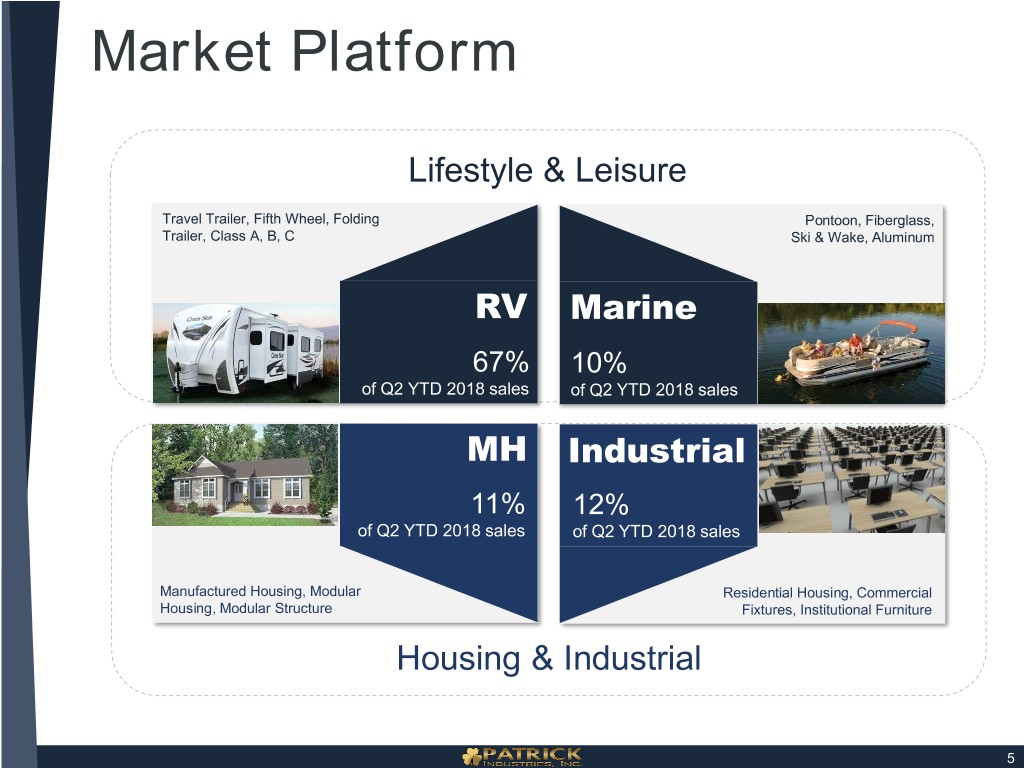

Market Platform Lifestyle & Leisure Travel Trailer, Fifth Wheel, Folding Pontoon, Fiberglass, Trailer, Class A, B, C Ski & Wake, Aluminum RV Marine 67% 10% of Q2 YTD 2018 sales of Q2 YTD 2018 sales MH Industrial 11% 12% of Q2 YTD 2018 sales of Q2 YTD 2018 sales Manufactured Housing, Modular Residential Housing, Commercial Housing, Modular Structure Fixtures, Institutional Furniture Housing & Industrial 5

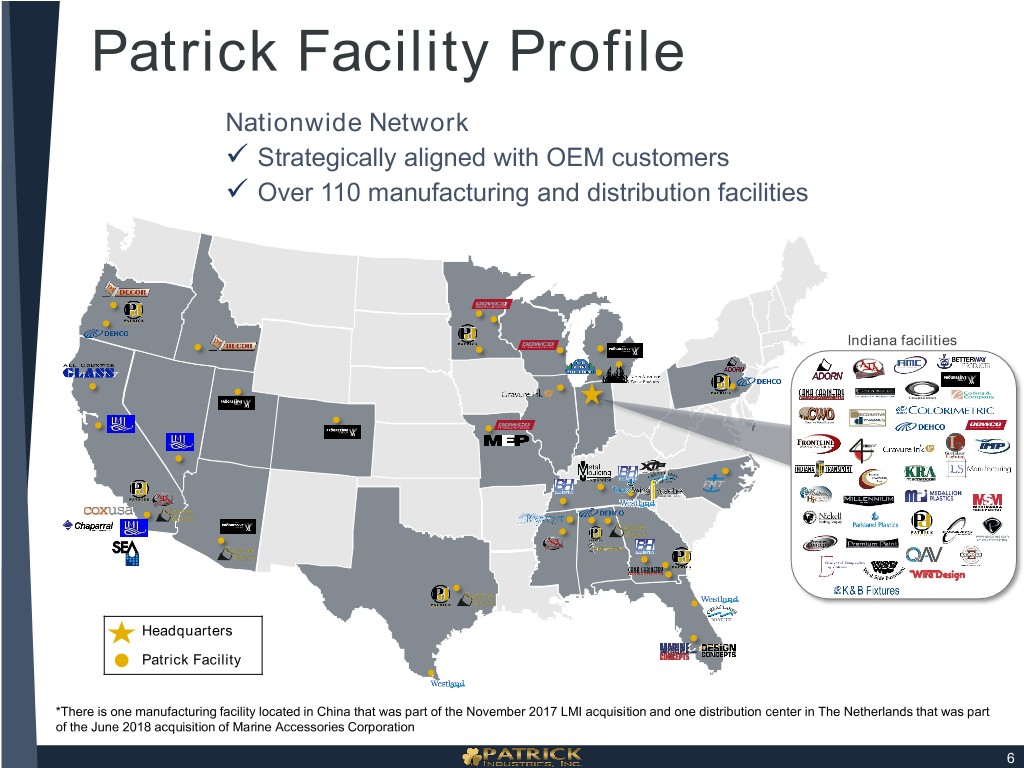

Patrick Facility Profile Nationwide Network Strategically aligned with OEM customers Over 110 manufacturing and distribution facilities Indiana facilities Headquarters Patrick Facility *There is one manufacturing facility located in China that was part of the November 2017 LMI acquisition and one distribution center in The Netherlands that was part of the June 2018 acquisition of Marine Accessories Corporation 6

Industry Fundamentals

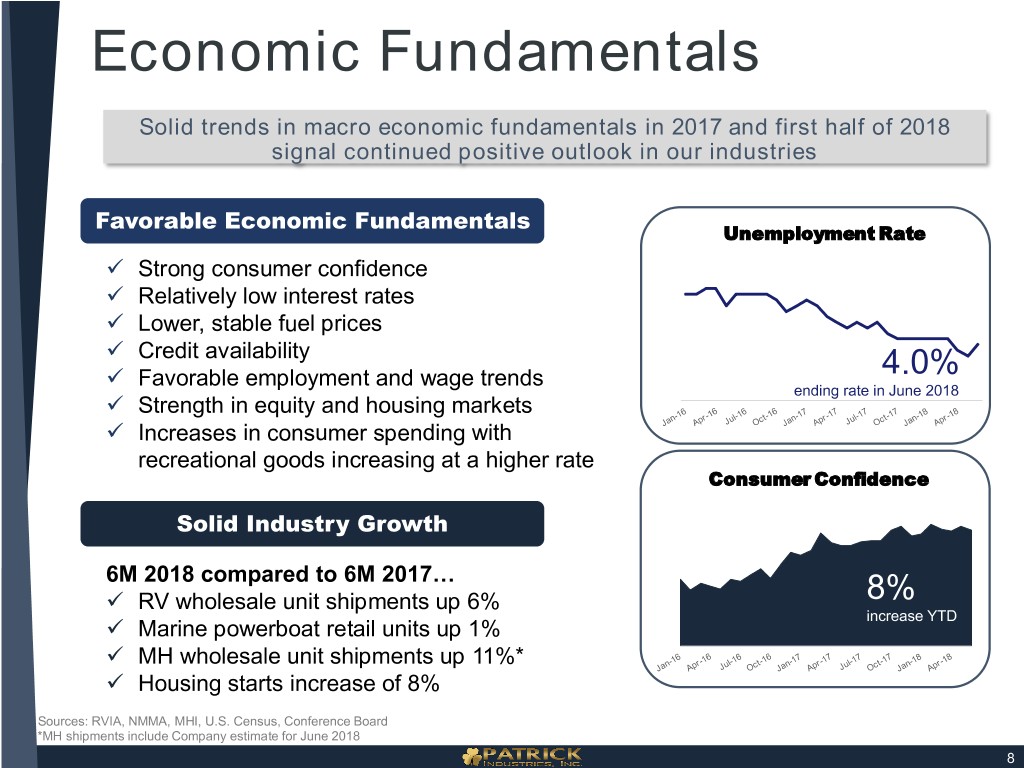

Economic Fundamentals Solid trends in macro economic fundamentals in 2017 and first half of 2018 signal continued positive outlook in our industries Favorable Economic Fundamentals Unemployment Rate Strong consumer confidence Relatively low interest rates Lower, stable fuel prices Credit availability Favorable employment and wage trends 4.0% ending rate in June 2018 Strength in equity and housing markets Increases in consumer spending with recreational goods increasing at a higher rate Consumer Confidence Solid Industry Growth 6M 2018 compared to 6M 2017… RV wholesale unit shipments up 6% 8% increase YTD Marine powerboat retail units up 1% MH wholesale unit shipments up 11%* Housing starts increase of 8% Sources: RVIA, NMMA, MHI, U.S. Census, Conference Board *MH shipments include Company estimate for June 2018 8

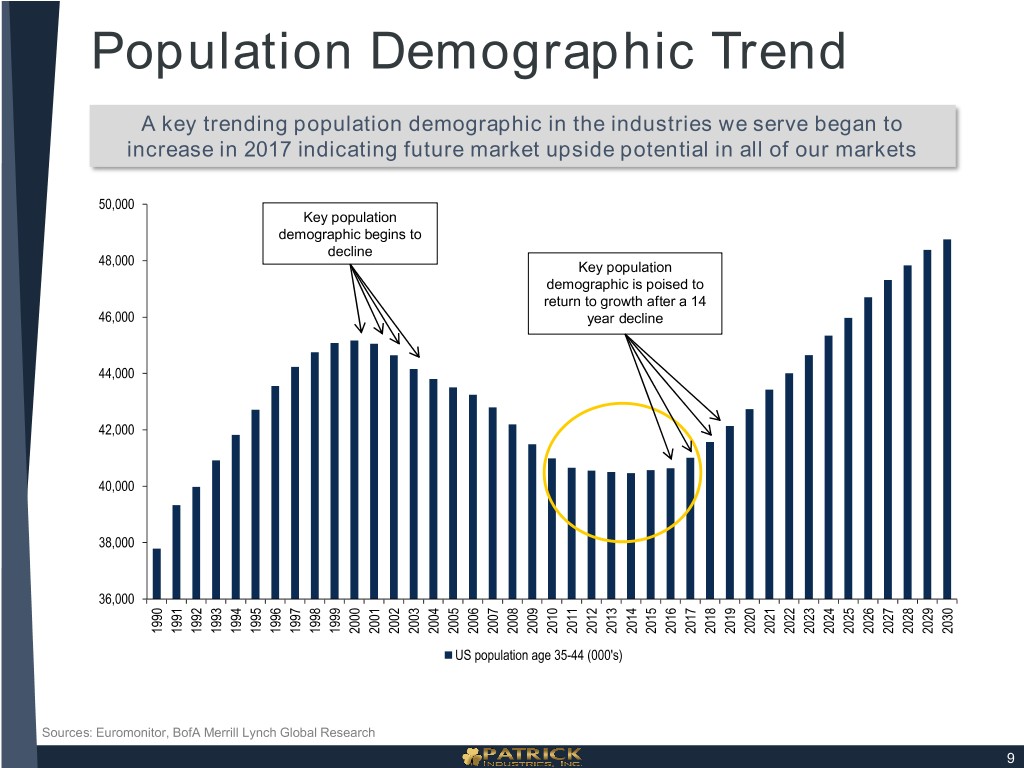

Population Demographic Trend A key trending population demographic in the industries we serve began to increase in 2017 indicating future market upside potential in all of our markets 50,000 Key population demographic begins to decline 48,000 Key population demographic is poised to return to growth after a 14 46,000 year decline 44,000 42,000 40,000 38,000 36,000 1997 1998 2020 1990 1991 1992 1993 1994 1995 1996 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 US population age 35-44 (000's) Sources: Euromonitor, BofA Merrill Lynch Global Research 9

Industry and Market Review: Lifestyle & Leisure

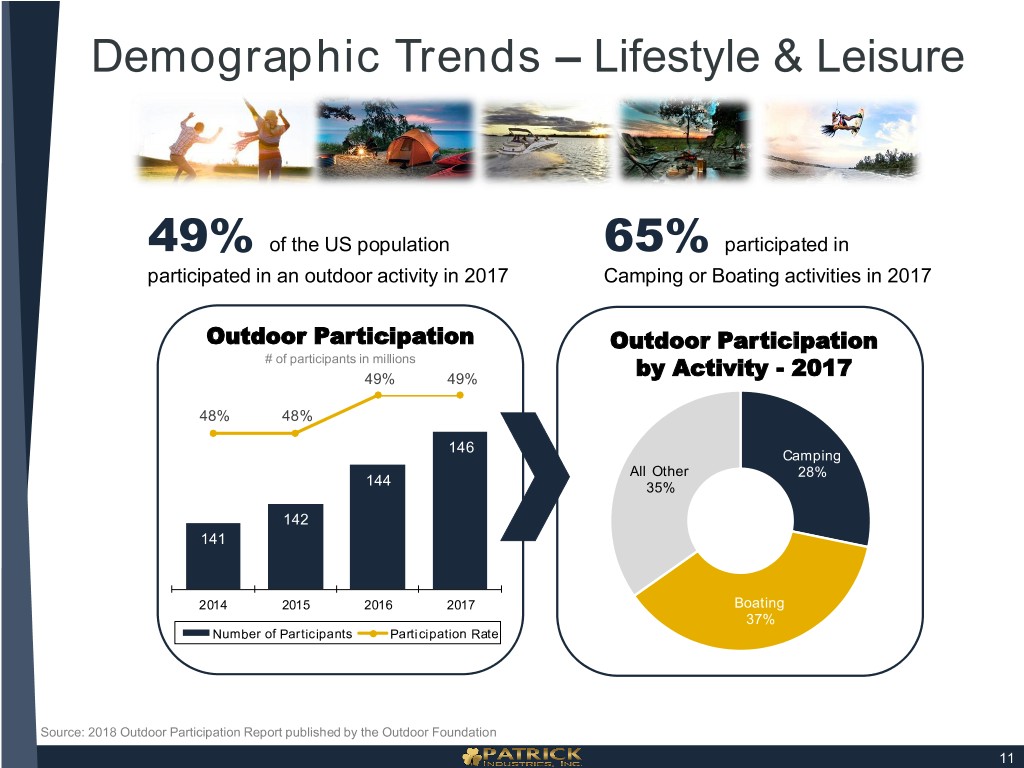

Demographic Trends – Lifestyle & Leisure 49% of the US population 65% participated in participated in an outdoor activity in 2017 Camping or Boating activities in 2017 Outdoor Participation Outdoor Participation # of participants in millions 49% 49% by Activity - 2017 48% 48% 146 Camping All Other 28% 144 35% 142 141 2014 2015 2016 2017 Boating 37% Number of Participants Participation Rate Source: 2018 Outdoor Participation Report published by the Outdoor Foundation 11

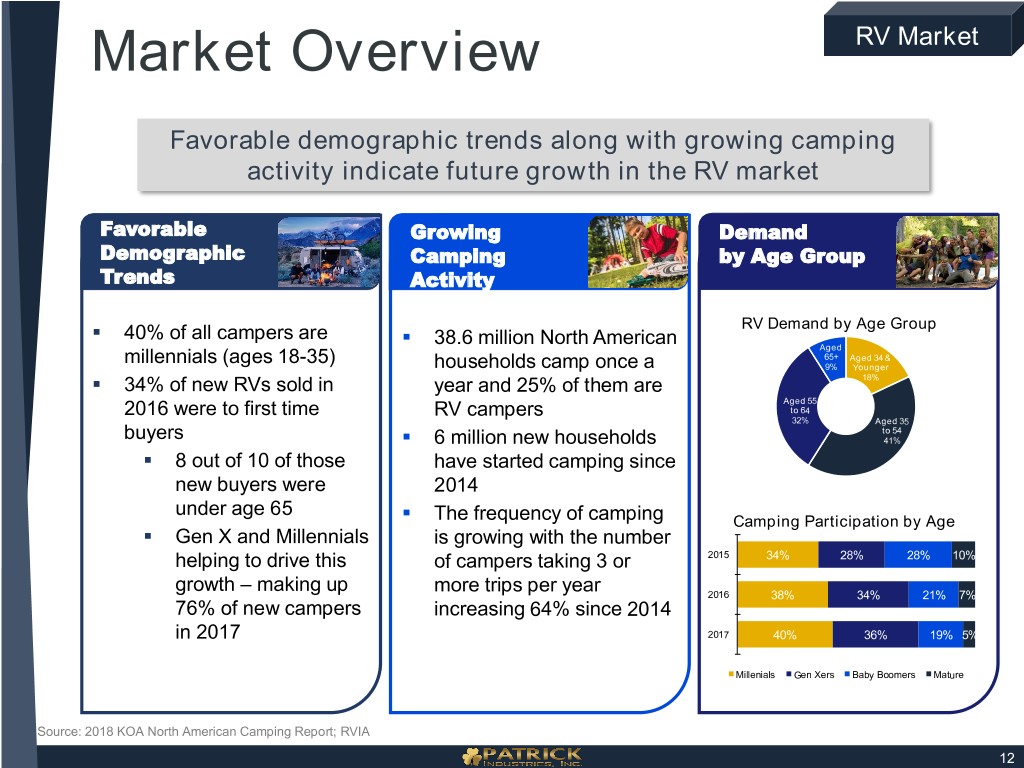

Market Overview RV Market Favorable demographic trends along with growing camping activity indicate future growth in the RV market Favorable Growing Demand Demographic Camping by Age Group Trends Activity . 40% of all campers are . RV Demand by Age Group 38.6 million North American Aged millennials (ages 18-35) 65+ Aged 34 & households camp once a 9% Younger . 34% of new RVs sold in year and 25% of them are 18% Aged 55 2016 were to first time RV campers to 64 32% Aged 35 . to 54 buyers 6 million new households 41% . 8 out of 10 of those have started camping since new buyers were 2014 under age 65 . The frequency of camping Camping Participation by Age . Gen X and Millennials is growing with the number helping to drive this of campers taking 3 or 2015 34% 28% 28% 10% growth – making up more trips per year 2016 38% 34% 21% 7% 76% of new campers increasing 64% since 2014 in 2017 2017 40% 36% 19% 5% Millenials Gen Xers Baby Boomers Mature Source: 2018 KOA North American Camping Report; RVIA 12

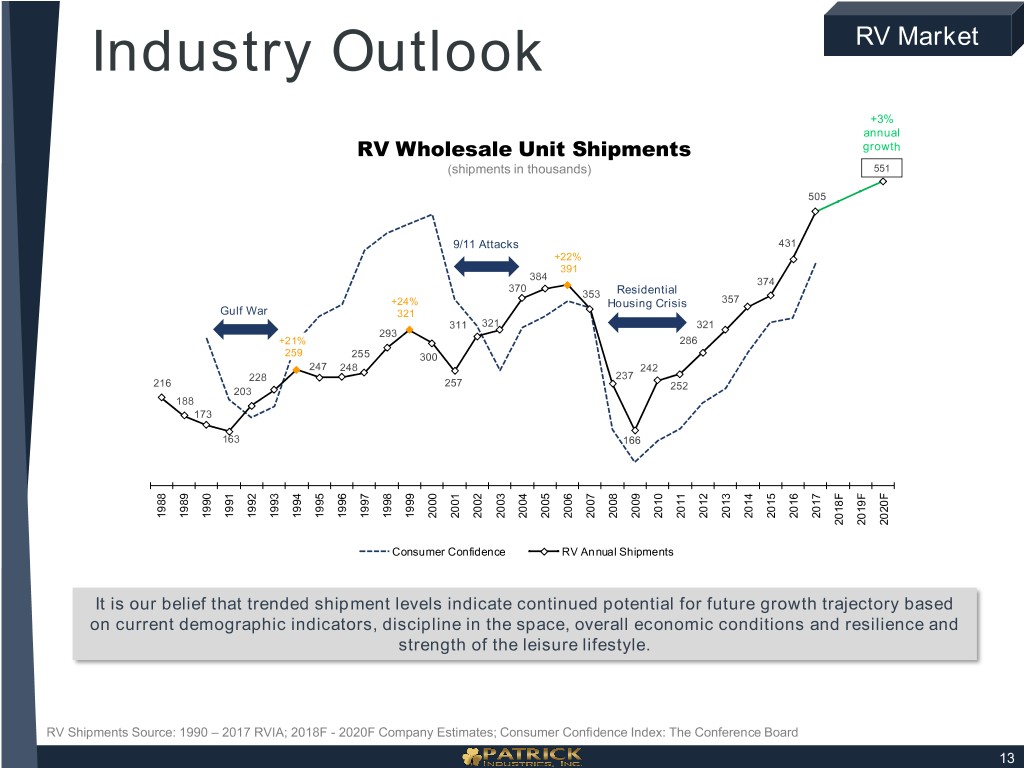

Industry Outlook RV Market +3% annual RV Wholesale Unit Shipments growth (shipments in thousands) 551 505 9/11 Attacks 431 +22% 391 384 374 370 353 Residential +24% Housing Crisis 357 Gulf War 321 311 321 321 293 +21% 286 259 255 300 247 248 242 228 237 216 257 252 203 188 173 163 166 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018F 2019F 2020F Consumer Confidence RV Annual Shipments It is our belief that trended shipment levels indicate continued potential for future growth trajectory based on current demographic indicators, discipline in the space, overall economic conditions and resilience and strength of the leisure lifestyle. RV Shipments Source: 1990 – 2017 RVIA; 2018F - 2020F Company Estimates; Consumer Confidence Index: The Conference Board 13

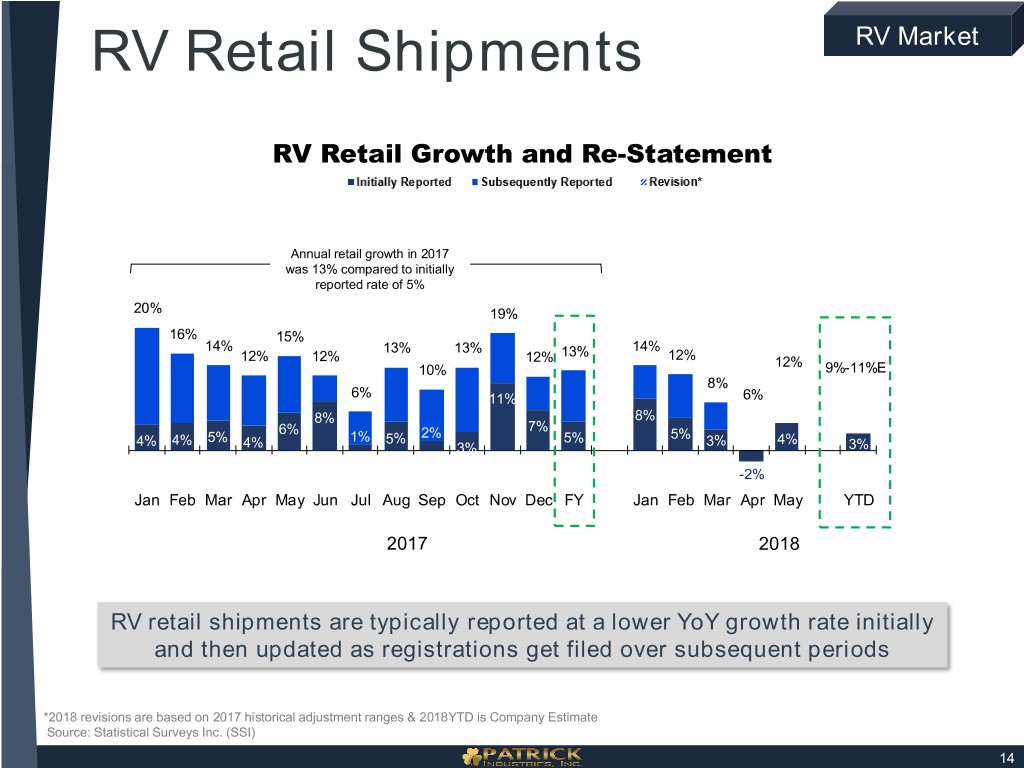

RV Retail Shipments RV Market RV Retail Growth and Re-Statement Annual retail growth in 2017 was 13% compared to initially reported rate of 5% 20% 19% 16% 15% 14% 13% 13% 13% 14% 12% 12% 12% 12% 12% 10% 9%-11%E 8% 6% 11% 6% 8% 8% 6% 2% 7% 4% 5% 1% 5% 5% 5% 3% 4% 4% 4% 3% 3% -2% Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec FY Jan Feb Mar Apr May YTD 2017 2018 RV retail shipments are typically reported at a lower YoY growth rate initially and then updated as registrations get filed over subsequent periods *2018 revisions are based on 2017 historical adjustment ranges & 2018YTD is Company Estimate Source: Statistical Surveys Inc. (SSI) 14

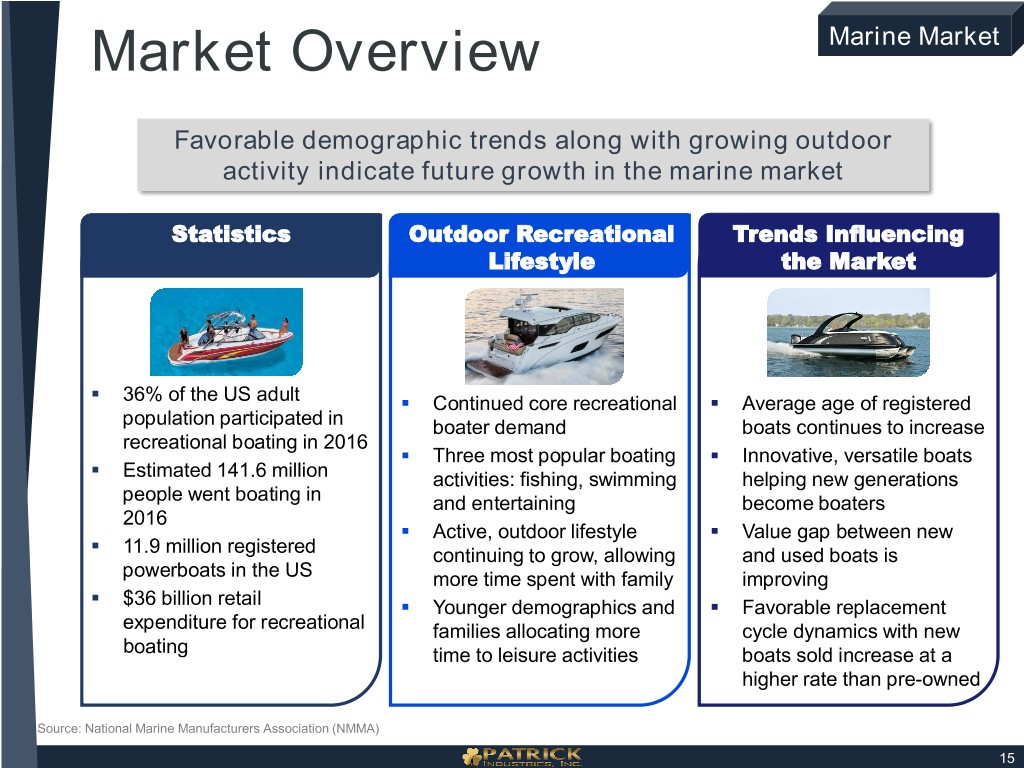

Market Overview Marine Market Favorable demographic trends along with growing outdoor activity indicate future growth in the marine market Statistics Outdoor Recreational Trends Influencing Lifestyle the Market . 36% of the US adult . Continued core recreational . Average age of registered population participated in boater demand boats continues to increase recreational boating in 2016 . . . Three most popular boating Innovative, versatile boats Estimated 141.6 million activities: fishing, swimming helping new generations people went boating in and entertaining become boaters 2016 . . . Active, outdoor lifestyle Value gap between new 11.9 million registered continuing to grow, allowing and used boats is powerboats in the US more time spent with family improving . $36 billion retail . Younger demographics and . Favorable replacement expenditure for recreational families allocating more cycle dynamics with new boating time to leisure activities boats sold increase at a higher rate than pre-owned Source: National Marine Manufacturers Association (NMMA) 15

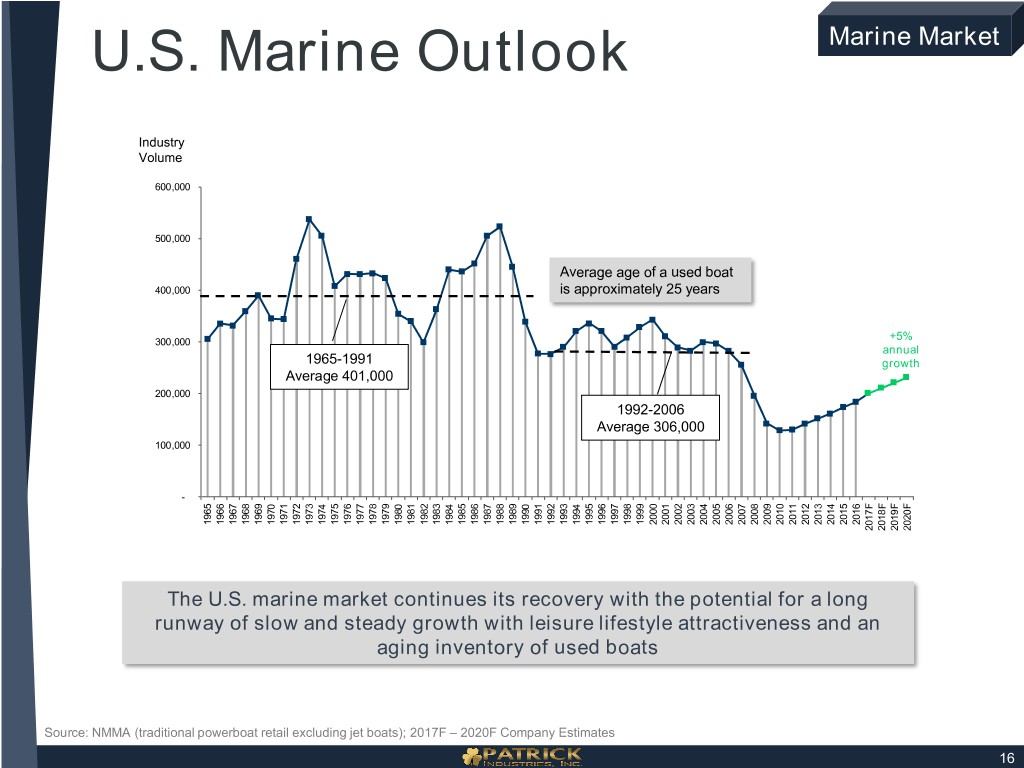

U.S. Marine Outlook Marine Market Industry Volume 600,000 500,000 Average age of a used boat 400,000 is approximately 25 years +5% 300,000 annual 1965-1991 growth Average 401,000 200,000 1992-2006 Average 306,000 100,000 - 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017F 2018F 2019F 2020F The U.S. marine market continues its recovery with the potential for a long runway of slow and steady growth with leisure lifestyle attractiveness and an aging inventory of used boats Source: NMMA (traditional powerboat retail excluding jet boats); 2017F – 2020F Company Estimates 16

Industry and Market Review: Housing & Industrial

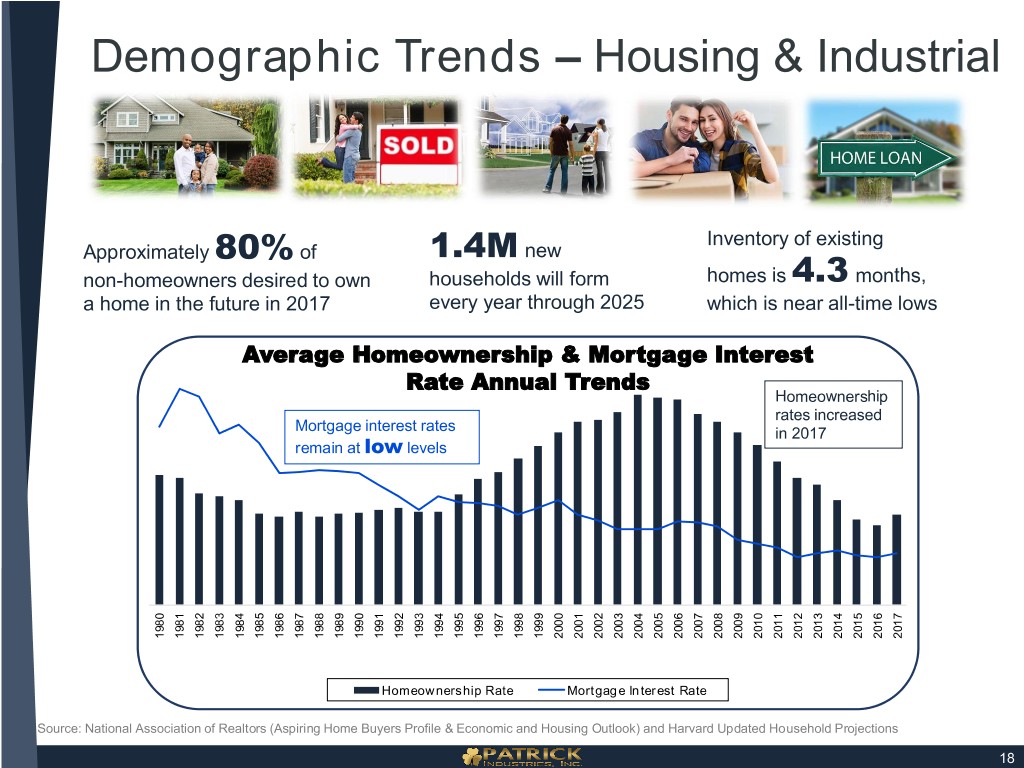

Source: Source: National Association Realtors (Aspiring of Home Buyers & Profile Economic and Housing Outlook) Updated and Harvard Ho a home in the future in 2017 non Approximately Demographic Trends - homeowners desired to own 1980 1981 1982 1983 80% 1984 Interest Mortgage & Average Homeownership 1985 1986 Mortgage Mortgage interest rates remain at 1987 of 1988 1989 1990 low Homeownership Rate Homeownership 1991 1992 RateTrends Annual levels 1993 everyyear through 2025 households willform 1.4M 1994 1995 1996 1997 1998 new 1999 2000 – Mortgage Interest Rate Interest Mortgage 2001 2002 Housing & Industrial 2003 2004 2005 2006 2007 which is near all homes Inventory of existing 2008 2009 2010 is is 2011 in 2017 rates increased Homeownership use 4.3 2012 hold hold Projections 2013 2014 - time lows 2015 months, 2016 2017 18

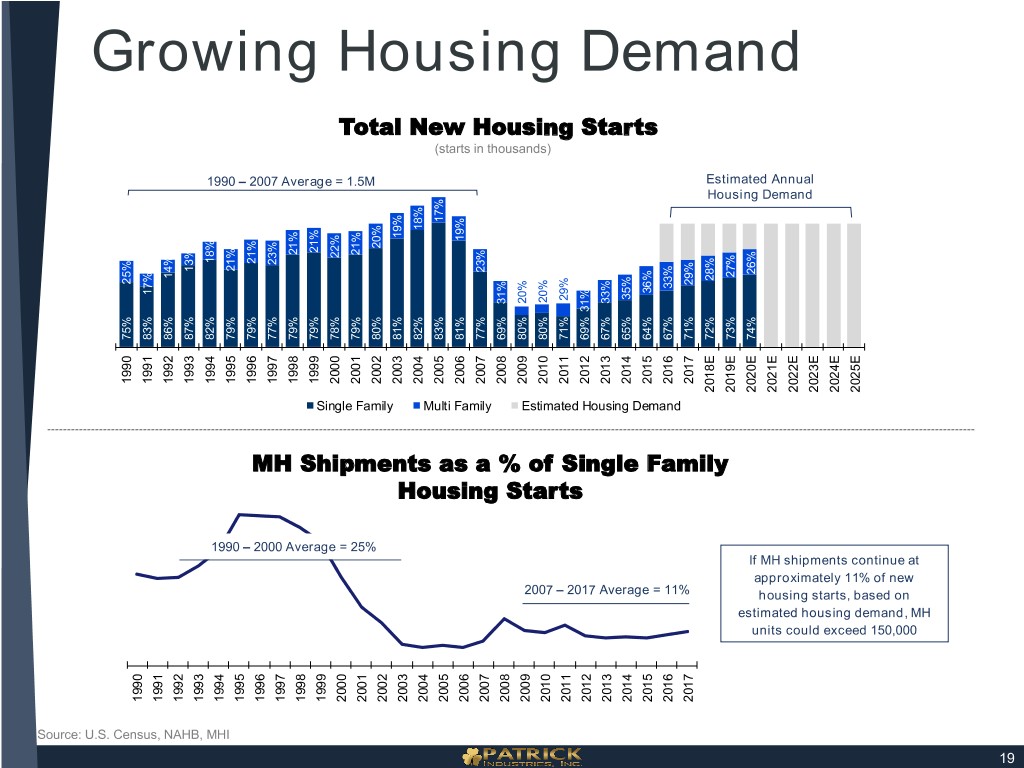

Source: Source: Census, U.S. NAHB,MHI GrowingHousing Demand 1990 75% 25% 1990 1991 83% 17% 1991 1992 86% 14% 1992 1993 87% 13% 1993 1990 1990 1994 82% 18% 1994 1995 79% 21% – 1995 – 2007 2007 1.5M Average= MH Shipments as a % of Single Family Single of % as a Shipments MH 2000 2000 25% Average= 1996 79% 21% 1996 1997 77% 23% 1997 1998 79% 21% 1998 Single FamilySingle 1999 79% 21% 1999 2000 78% 22% TotalHousing Starts New 2000 79% 21% 2001 2001 2002 2002 80% 20% 2003 Starts Housing 2003 81% 19% 2004 FamilyMulti 2004 82% 18% (starts (starts 2005 2005 83% 17% 2006 2006 81% 19% in in thousands) 2007 2007 77% 23% 2008 2008 69% 31% EstimatedHousing Demand 2009 2007 2009 80% 20% 2010 2010 80% 20% – 2011 2017 11% Average= 2011 71% 29% 2012 2012 69% 31% 2013 2013 67% 33% 2014 2014 65% 35% 2015 2015 64% 36% 2016 2016 67% 33% 2017 2017 71% 29% Estimated Estimated Annual 2018E 72% 28% Demand Housing 2019E 73% 27% estimated estimated housing demand, MH If MH shipments MH If shipments continue at units could exceed units could exceed 150,000 approximately 11%of new 2020E 74% 26% housing housing starts, on based 2021E 2022E 2023E 2024E 2025E 19

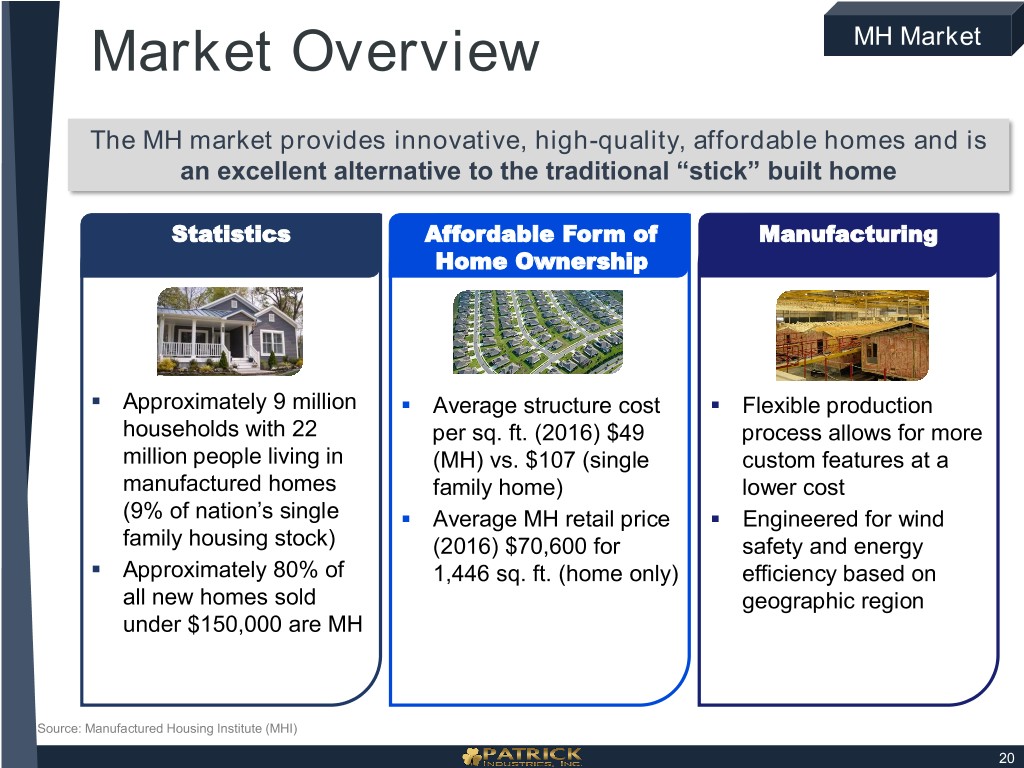

Market Overview MH Market The MH market provides innovative, high-quality, affordable homes and is an excellent alternative to the traditional “stick” built home Statistics Affordable Form of Manufacturing Home Ownership . Approximately 9 million . Average structure cost . Flexible production households with 22 per sq. ft. (2016) $49 process allows for more million people living in (MH) vs. $107 (single custom features at a manufactured homes family home) lower cost (9% of nation’s single . Average MH retail price . Engineered for wind family housing stock) (2016) $70,600 for safety and energy . Approximately 80% of 1,446 sq. ft. (home only) efficiency based on all new homes sold geographic region under $150,000 are MH Source: Manufactured Housing Institute (MHI) 20

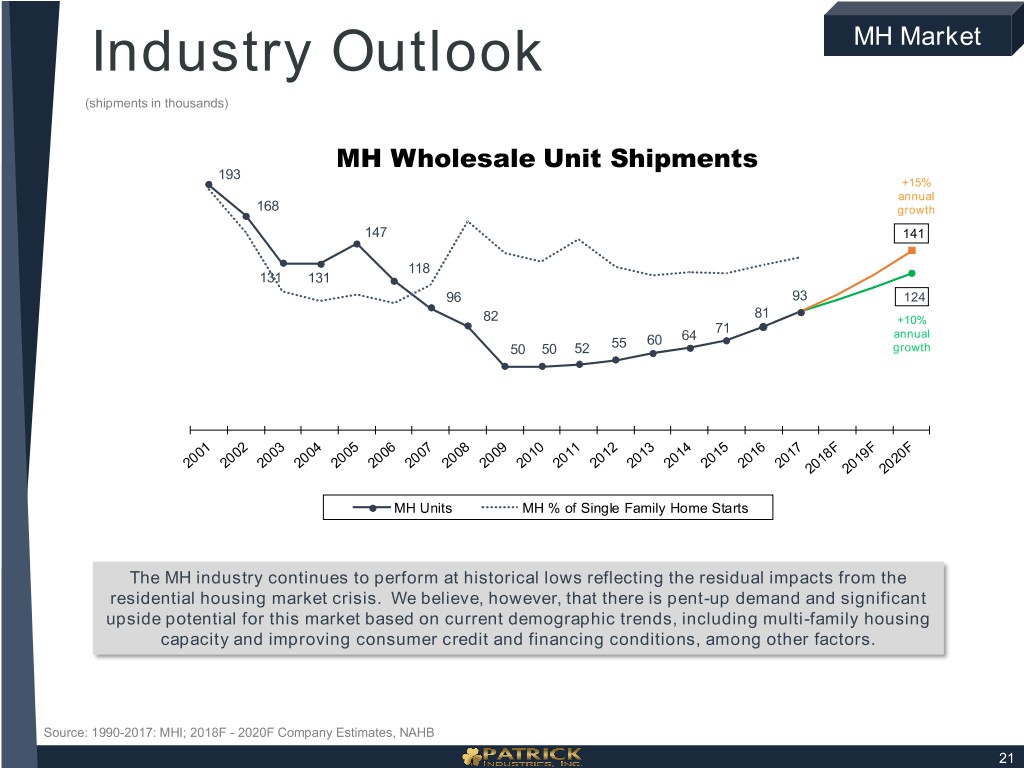

Industry Outlook MH Market (shipments in thousands) MH Wholesale Unit Shipments 193 +15% annual 168 growth 147 141 118 131 131 96 93 124 81 82 +10% 71 60 64 annual 50 50 52 55 growth MH Units MH % of Single Family Home Starts The MH industry continues to perform at historical lows reflecting the residual impacts from the residential housing market crisis. We believe, however, that there is pent-up demand and significant upside potential for this market based on current demographic trends, including multi-family housing capacity and improving consumer credit and financing conditions, among other factors. Source: 1990-2017: MHI; 2018F - 2020F Company Estimates, NAHB 21

Market Overview Industrial Market The industrial market provides an excellent growth segment, allowing us to bring our high-quality, innovative product lines to both the residential and non- residential industrial markets Patrick Sales Commercial & Residential Housing Composition Institutional Fixtures Residential Commercial & . . Housing Institutional Housing starts increased Includes the 3 following 60% Fixtures 2% compared to 2016 40% classifications: . Single-family housing starts . Big Box Retail up 9% vs. 2016 . Retail & Commercial . New housing starts are well Fixtures below the prior peak and . High Rise, Office, there continues to be pent- Hospitality, Schools & up demand, providing Universities continued runway in the new housing market Sources: U.S. Census, NAHB 22

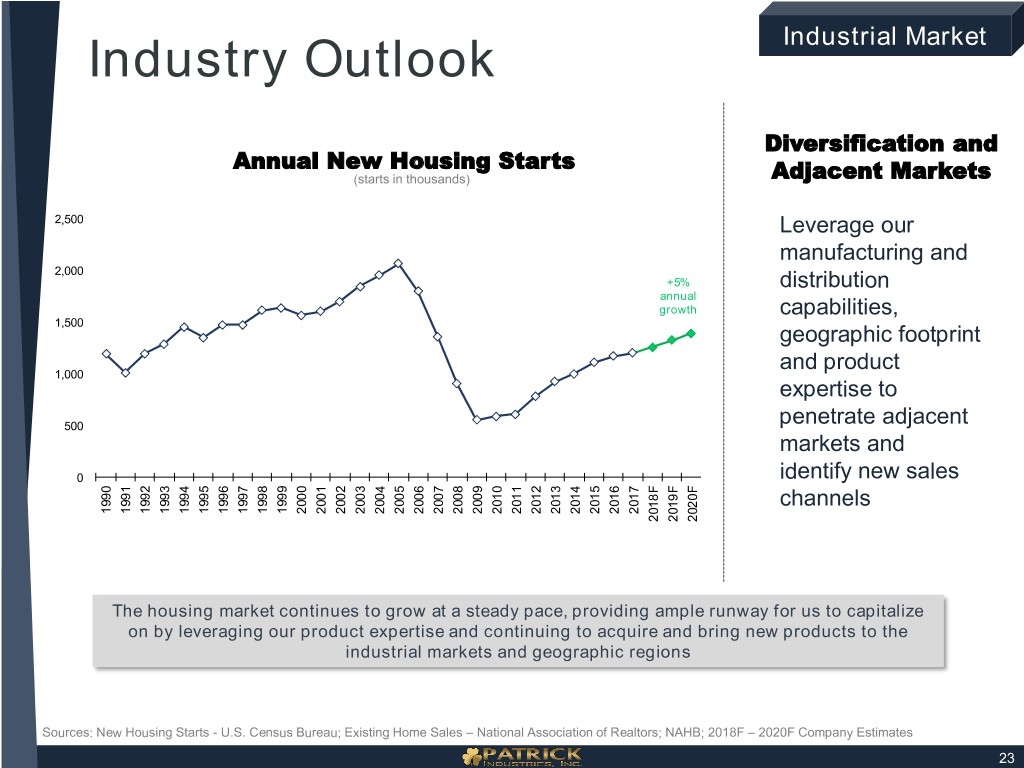

Industry Outlook Industrial Market Diversification and Annual New Housing Starts (starts in thousands) Adjacent Markets 2,500 Leverage our manufacturing and 2,000 +5% distribution annual growth capabilities, 1,500 geographic footprint and product 1,000 expertise to 500 penetrate adjacent markets and 0 identify new sales channels 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018F 2019F 2020F The housing market continues to grow at a steady pace, providing ample runway for us to capitalize on by leveraging our product expertise and continuing to acquire and bring new products to the industrial markets and geographic regions Sources: New Housing Starts - U.S. Census Bureau; Existing Home Sales – National Association of Realtors; NAHB; 2018F – 2020F Company Estimates 23

Strategy

Capital Allocation Strategy Our capital allocation strategy is centered around the utilization of a balanced leverage position, strong cash flows and capital resources to grow and reinvest in the business model Capital Stock Debt Acquisitions Expansion Expenditures Repurchases Reduction . . Execute disciplined . Invest in internal Focus on geographic . Return capital to . Use strong cash flow strategic acquisition growth and cost expansion shareholders through to reduce debt and program in core saving opportunities opportunities to share repurchases reload growth markets including product leverage our existing capacity extensions, relationships and infrastructure and expertise expansions $326 million of capital deployed in first half of 2018 with leverage ratio of 2.2x Acquisitions 79% Stock Repurchases 17% Capital Expenditures 3% Expansion 1% 25

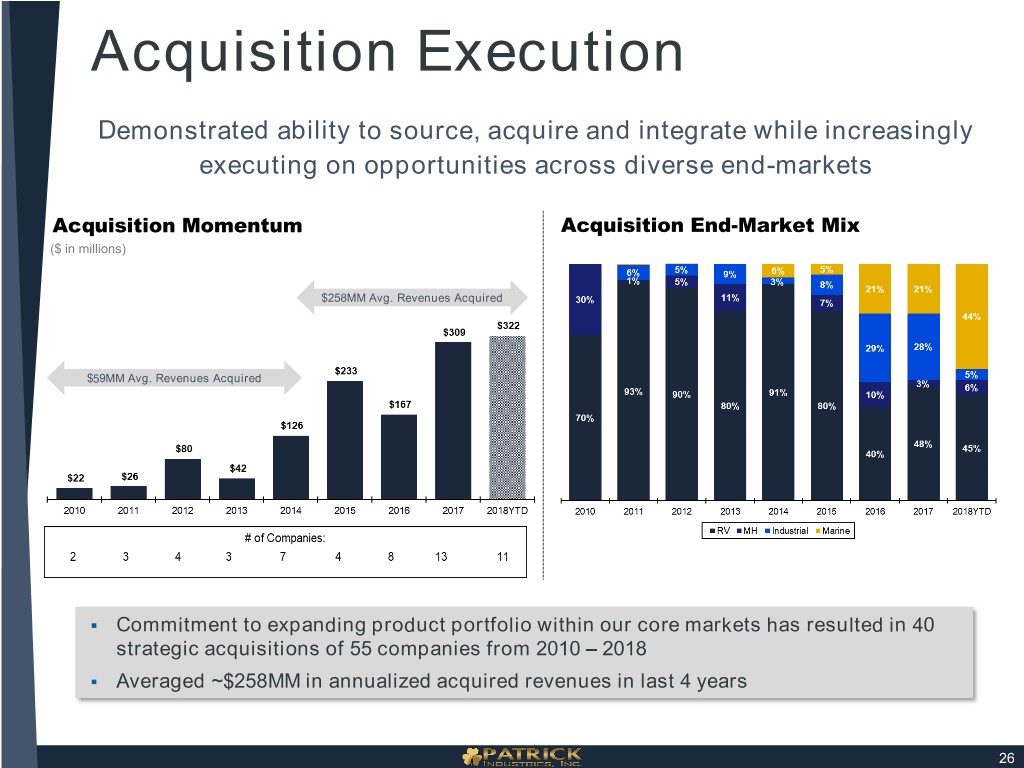

Acquisition Execution Demonstrated ability to source, acquire and integrate while increasingly executing on opportunities across diverse end-markets Acquisition Momentum Acquisition End-Market Mix ($ in millions) $258MM Avg. Revenues Acquired $59MM Avg. Revenues Acquired . Commitment to expanding product portfolio within our core markets has resulted in 40 strategic acquisitions of 55 companies from 2010 – 2018 . Averaged ~$258MM in annualized acquired revenues in last 4 years 26

Geographic and Product Expansion Focus on expansion opportunities with $250MM market potential Targeted Product Lines: . Lamination . Solid Surface . Aluminum . Hardwood Products . FRP . Pressed Products . Fiberglass . Interior Doors . Paint . Plastics . Shower Doors . Bath & Closet Systems 1 PACIFIC NORTHWEST 1 5 2 SOUTHERN CALIFORNIA 2 3 TEXAS 4 SOUTHEAST 3 4 5 NORTHEAST 27

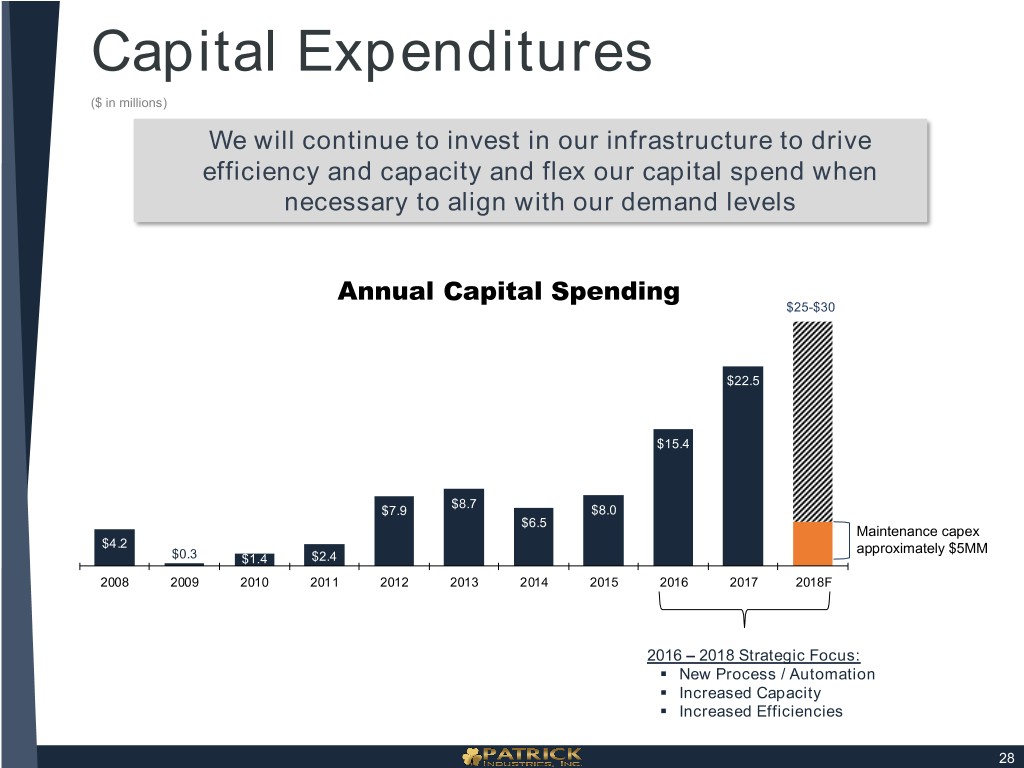

Capital Expenditures ($ in millions) We will continue to invest in our infrastructure to drive efficiency and capacity and flex our capital spend when necessary to align with our demand levels Annual Capital Spending $25-$30 $22.5 $15.4 $8.7 $7.9 $8.0 $6.5 Maintenance capex $4.2 approximately $5MM $0.3 $1.4 $2.4 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018F 2016 – 2018 Strategic Focus: . New Process / Automation . Increased Capacity . Increased Efficiencies 28

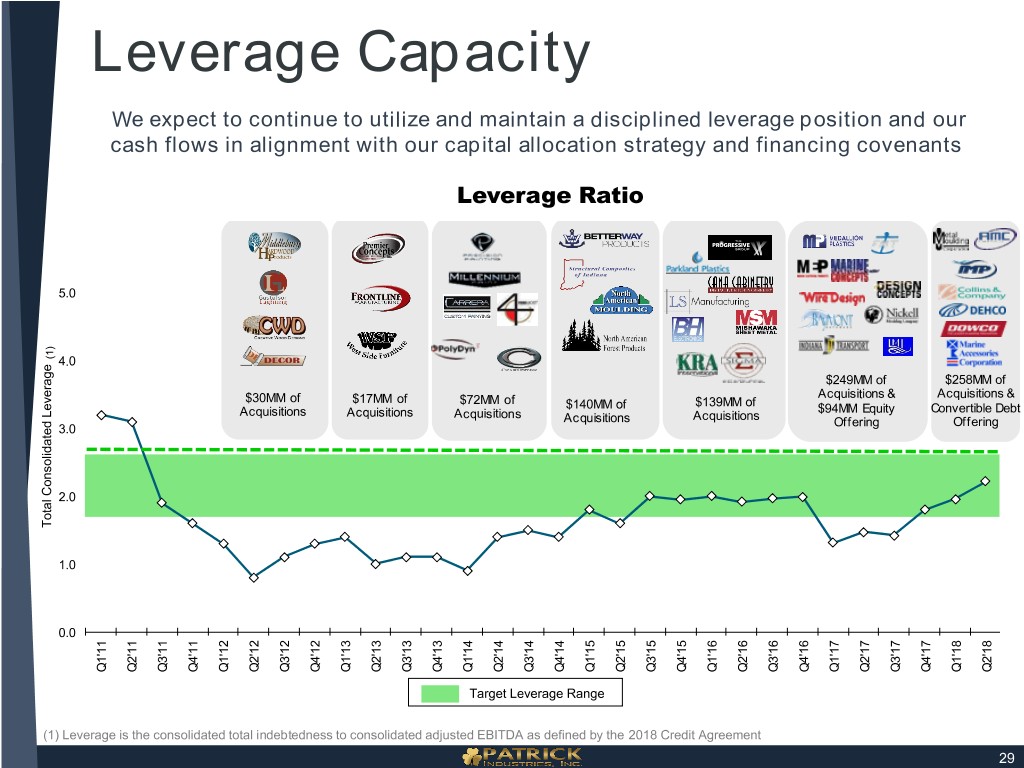

Leverage Capacity We expect to continue to utilize and maintain a disciplined leverage position and our cash flows in alignment with our capital allocation strategy and financing covenants Leverage Ratio 5.0 (1) 4.0 $249MM of $258MM of Acquisitions & Acquisitions & $30MM of $17MM of $72MM of $139MM of $140MM of $94MM Equity Convertible Debt Acquisitions Acquisitions Acquisitions Acquisitions Acquisitions Offering Offering 3.0 2.0 Total Consolidated LeverageConsolidatedTotal 1.0 0.0 Q3'11 Q2'12 Q1'13 Q2'13 Q1'14 Q4'14 Q3'15 Q4'15 Q3'16 Q2'17 Q2'18 Q1'11 Q2'11 Q4'11 Q1'12 Q3'12 Q4'12 Q3'13 Q4'13 Q2'14 Q3'14 Q1'15 Q2'15 Q1'16 Q2'16 Q4'16 Q1'17 Q3'17 Q4'17 Q1'18 Target Leverage Range (1) Leverage is the consolidated total indebtedness to consolidated adjusted EBITDA as defined by the 2018 Credit Agreement 29

Performance

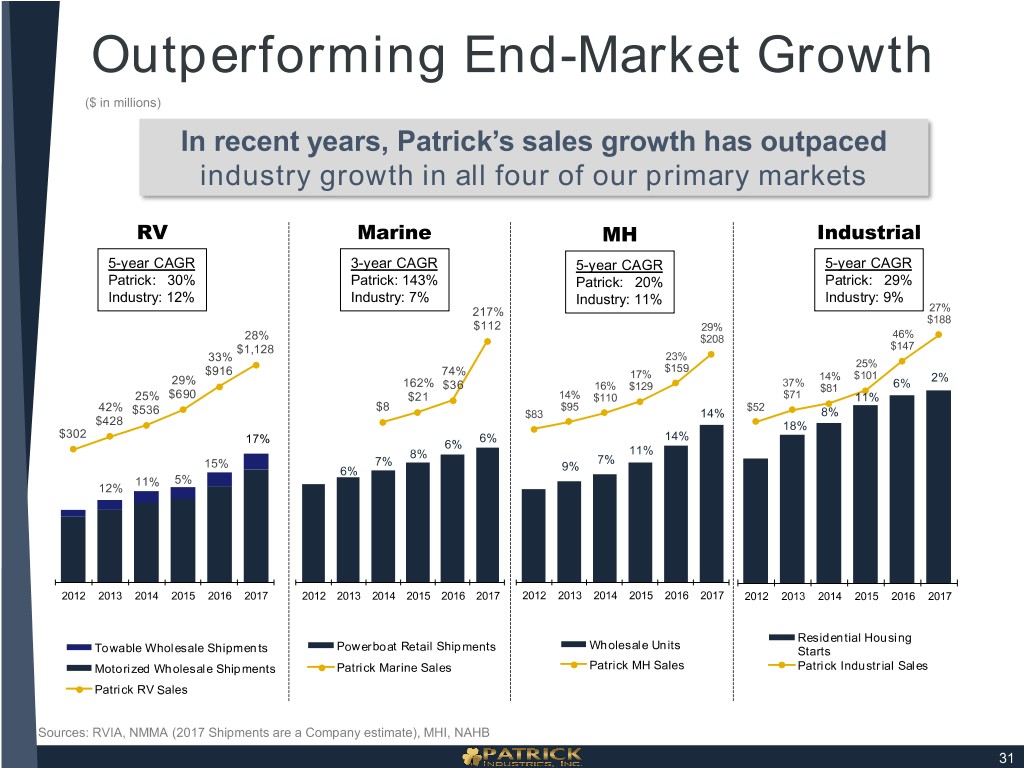

Outperforming End-Market Growth ($ in millions) In recent years, Patrick’s sales growth has outpaced industry growth in all four of our primary markets RV Marine MH Industrial 5-year CAGR 3-year CAGR 5-year CAGR 5-year CAGR Patrick: 30% Patrick: 143% Patrick: 20% Patrick: 29% Industry: 12% Industry: 7% Industry: 11% Industry: 9% 217% 27% $188 $112 29% 28% $208 46% $1,128 $147 33% 23% $159 25% $916 74% 17% 14% $101 29% 37% 2% 162% $36 16% $129 $81 6% 25% $690 $21 14% $110 $71 11% 42% $8 $95 $52 $536 $83 14% 8% $428 18% $302 6% 14% 17% 6% 8% 11% 15% 7% 7% 6% 9% 11% 5% 12% 2012 2013 2014 2015 2016 2017 2012 2013 2014 2015 2016 2017 2012 2013 2014 2015 2016 2017 2012 2013 2014 2015 2016 2017 Residential Housing Wholesale Units Towable Wholesale Shipments Powerboat Retail Shipments Starts Motorized Wholesale Shipments Patrick Marine Sales Patrick MH Sales Patrick Industrial Sales Patrick RV Sales Sources: RVIA, NMMA (2017 Shipments are a Company estimate), MHI, NAHB 31

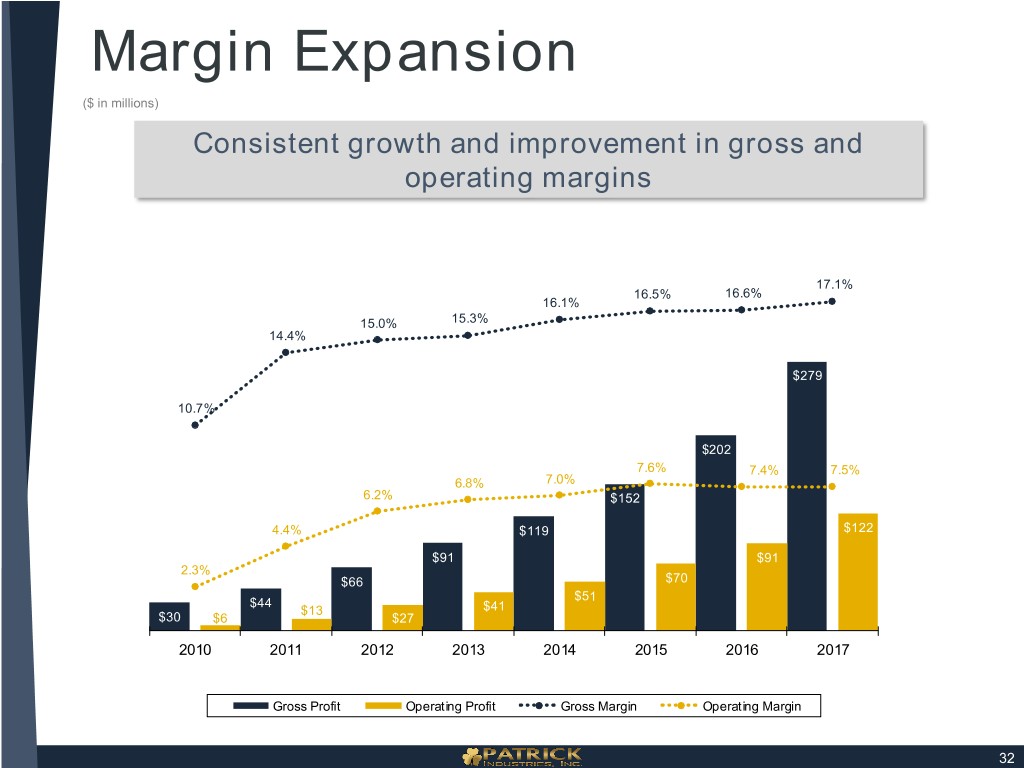

Margin Expansion ($ in millions) Consistent growth and improvement in gross and operating margins 17.1% 16.5% 16.6% 16.1% 15.0% 15.3% 14.4% $279 10.7% $202 7.6% 7.4% 7.5% 6.8% 7.0% 6.2% $152 4.4% $119 $122 $91 $91 2.3% $66 $70 $51 $44 $13 $41 $30 $6 $27 2010 2011 2012 2013 2014 2015 2016 2017 Gross Profit Operating Profit Gross Margin Operating Margin 32

Sales & Earnings Growth ($ in millions except per share data) Sales Growth Earnings Growth 2013 – 2017 2013 – 2017 CAGR = 29% CAGR = 37% $4.50 +43% $2,040 $3.48 +34% +34% $112 $2.43 $1,636 +42% 54% +29% $1.81 +33% +11% $86 $1.27 $1,222 $0.99 +25% 32% +24% $920 +38% $56 +36% $736 +28% $42 +13% $595 $31 $24 2013 2014 2015 2016 2017 2018 LTM 2013 2014 2015 2016 2017 2018 LTM Sales Net Income Diluted EPS Sales continue to grow and outpace their respective markets, driven by acquisitions, new products and extension growth and market share gains Net Income and EPS continue steady growth driven by the following: . Leveraging of fixed costs . Tight management of controllable expenses . Realized cost synergies from acquisitions 33

Steady Increase In Content Per Unit $8,500 $8,000 Our focus on strategic acquisitions and organic growth have resulted in significant increases in our content per unit and sales outpacing our respective markets . RV and MH content per unit increase of 26% and 20%, respectively, in Q2 2018 compared to Q2 2017 Strategic Growth Initiatives . Acquiring new product lines and strong management teams . Developing new innovative product lines . Geographic expansion . Entering adjacent markets *100% market share in existing products would yield the ‘total potential’ content per unit amount; RV content per unit re-stated excluding marine sales 34