EXHIBIT 99.1

Published on September 13, 2018

Investor Presentation September 2018

Forward-Looking Statements This presentation contains certain statements related to future results or states our intentions, beliefs and expectations or predictions for the future which are forward- looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from either historical or anticipated results depending on a variety of factors. Further information concerning the Company and its business, including factors that potentially could materially affect the Company’s financial results, is contained in the Company’s filings with the Securities and Exchange Commission. This presentation includes market and industry data, forecasts and valuations that have been obtained from independent consultant reports, publicly available information, various industry publications and other published industry sources. Although we believe these sources are reliable, we have not independently verified the information and cannot make any representation as to the accuracy or completeness of such information. We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained in this presentation or to reflect any change in our expectations after the date of this presentation or any change in events, conditions or circumstances on which any statement is based. 2

Company Overview

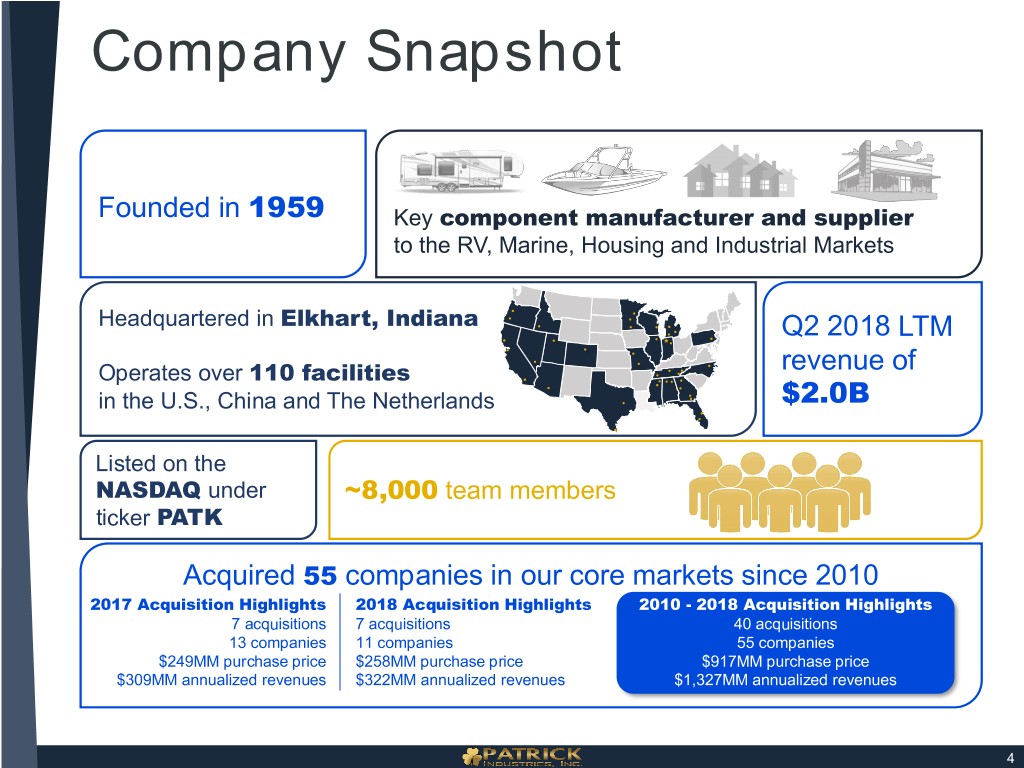

Company Snapshot Founded in 1959 Key component manufacturer and supplier to the RV, Marine, Housing and Industrial Markets Headquartered in Elkhart, Indiana Q2 2018 LTM Operates over 110 facilities revenue of in the U.S., China and The Netherlands $2.0B Listed on the NASDAQ under ~8,000 team members ticker PATK Acquired 55 companies in our core markets since 2010 2017 Acquisition Highlights 2018 Acquisition Highlights 2010 - 2018 Acquisition Highlights 7 acquisitions 7 acquisitions 40 acquisitions 13 companies 11 companies 55 companies $249MM purchase price $258MM purchase price $917MM purchase price $309MM annualized revenues $322MM annualized revenues $1,327MM annualized revenues 4

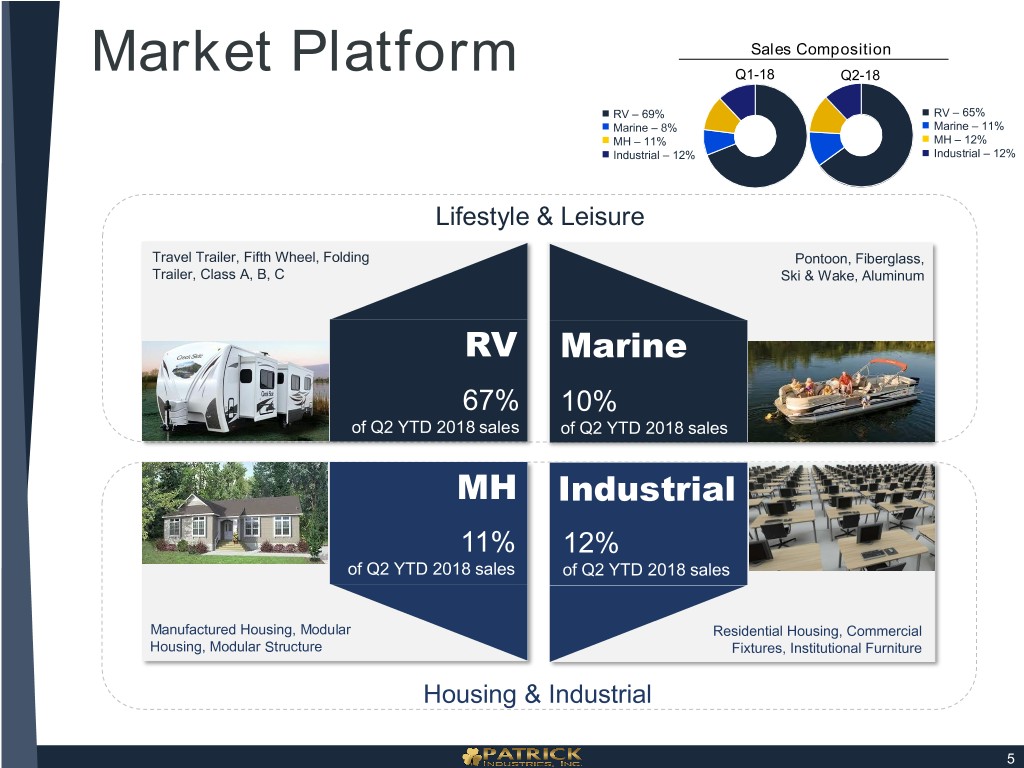

Sales Composition Market Platform Q1-18 Q2-18 RV – 69% RV – 65% Marine – 8% Marine – 11% MH – 11% MH – 12% Industrial – 12% Industrial – 12% Lifestyle & Leisure Travel Trailer, Fifth Wheel, Folding Pontoon, Fiberglass, Trailer, Class A, B, C Ski & Wake, Aluminum RV Marine 67% 10% of Q2 YTD 2018 sales of Q2 YTD 2018 sales MH Industrial 11% 12% of Q2 YTD 2018 sales of Q2 YTD 2018 sales Manufactured Housing, Modular Residential Housing, Commercial Housing, Modular Structure Fixtures, Institutional Furniture Housing & Industrial 5

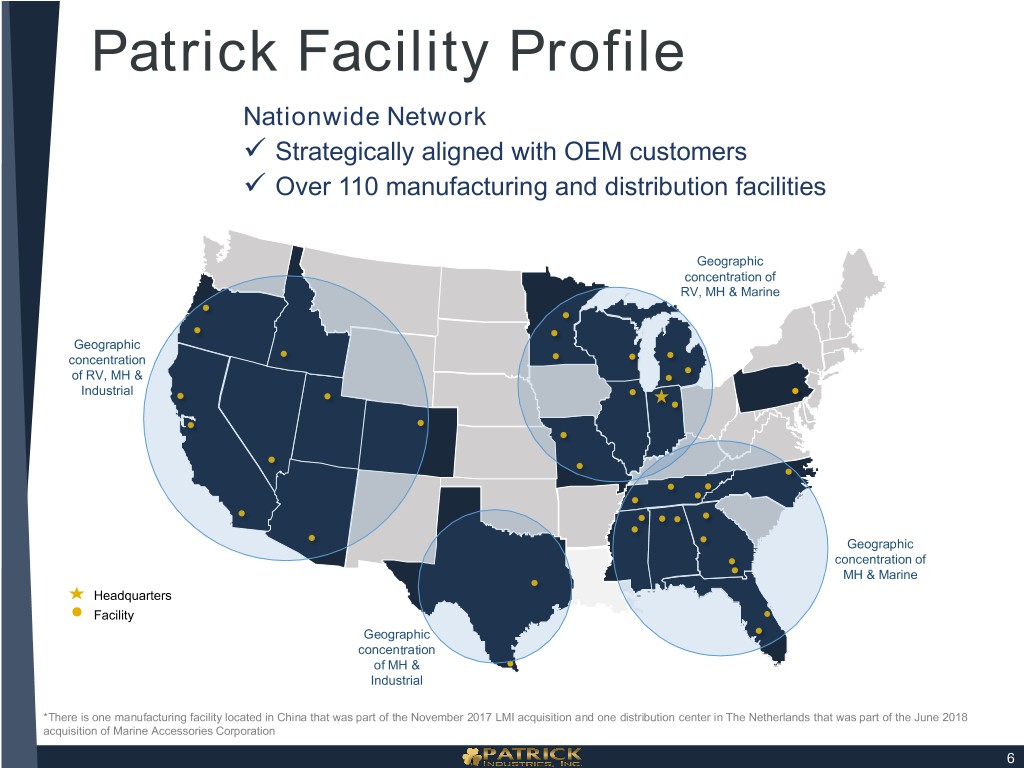

Patrick Facility Profile Nationwide Network Strategically aligned with OEM customers Over 110 manufacturing and distribution facilities Geographic concentration of RV, MH & Marine Geographic concentration of RV, MH & Industrial Geographic concentration of MH & Marine Headquarters Facility Geographic concentration of MH & Industrial *There is one manufacturing facility located in China that was part of the November 2017 LMI acquisition and one distribution center in The Netherlands that was part of the June 2018 acquisition of Marine Accessories Corporation 6

Industry Fundamentals

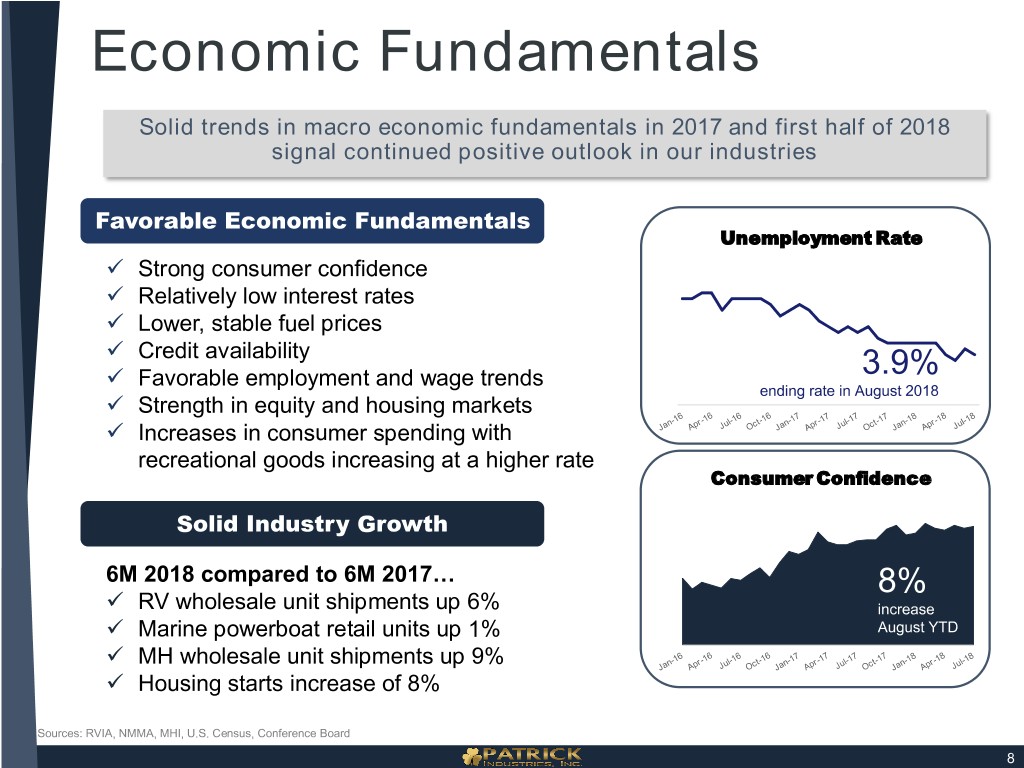

Economic Fundamentals Solid trends in macro economic fundamentals in 2017 and first half of 2018 signal continued positive outlook in our industries Favorable Economic Fundamentals Unemployment Rate Strong consumer confidence Relatively low interest rates Lower, stable fuel prices Credit availability Favorable employment and wage trends 3.9% ending rate in August 2018 Strength in equity and housing markets Increases in consumer spending with recreational goods increasing at a higher rate Consumer Confidence Solid Industry Growth 6M 2018 compared to 6M 2017… 8% RV wholesale unit shipments up 6% increase Marine powerboat retail units up 1% August YTD MH wholesale unit shipments up 9% Housing starts increase of 8% Sources: RVIA, NMMA, MHI, U.S. Census, Conference Board 8

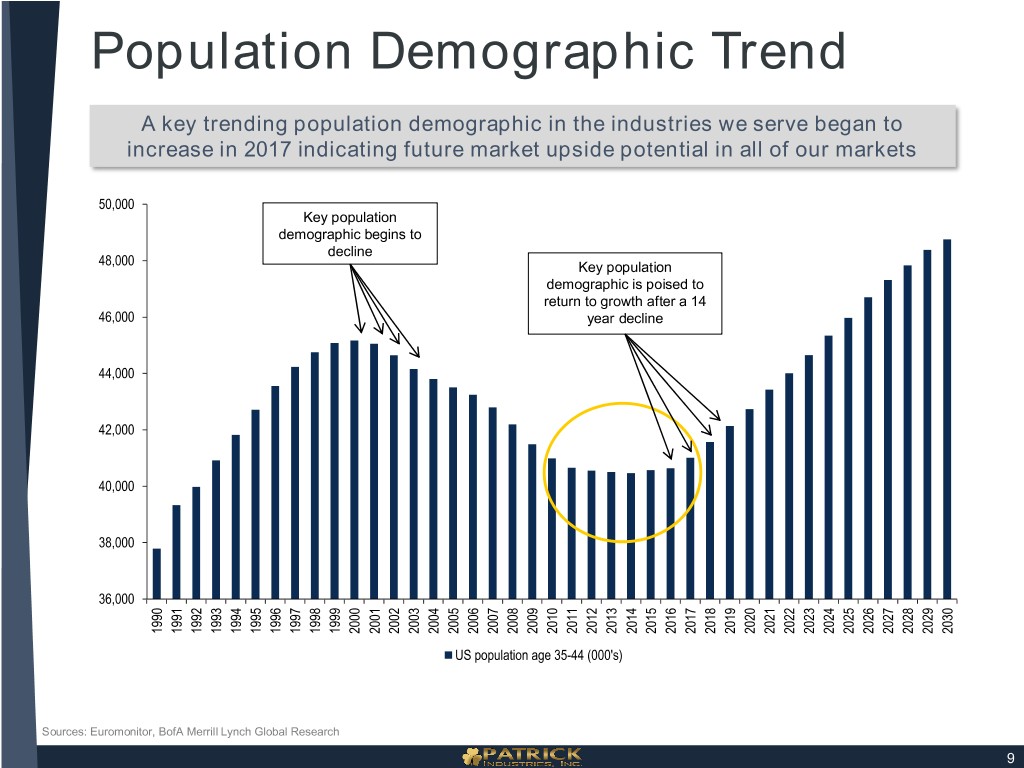

Population Demographic Trend A key trending population demographic in the industries we serve began to increase in 2017 indicating future market upside potential in all of our markets 50,000 Key population demographic begins to decline 48,000 Key population demographic is poised to return to growth after a 14 46,000 year decline 44,000 42,000 40,000 38,000 36,000 2000 2001 2027 2028 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2029 2030 US population age 35-44 (000's) Sources: Euromonitor, BofA Merrill Lynch Global Research 9

Industry and Market Review: Lifestyle & Leisure

Industry Trends RV Market Favorable Industry Trends Influx of younger, more diverse campers continue to build momentum for the North American outdoor, leisure lifestyle 77 million household campers in the U.S. 6 million new campers have started camping since 2014 83 million millennials in the U.S. 40% of all campers are millennials 23% (19 million) call themselves highly-likely RV buyers 64% growth in campers who camp three or more times per year (2014-2017) 74% of campers traveled within 150 miles of home (35% less than 50 miles from home) Source: 2018 KOA North American Camping Report; RVIA 11

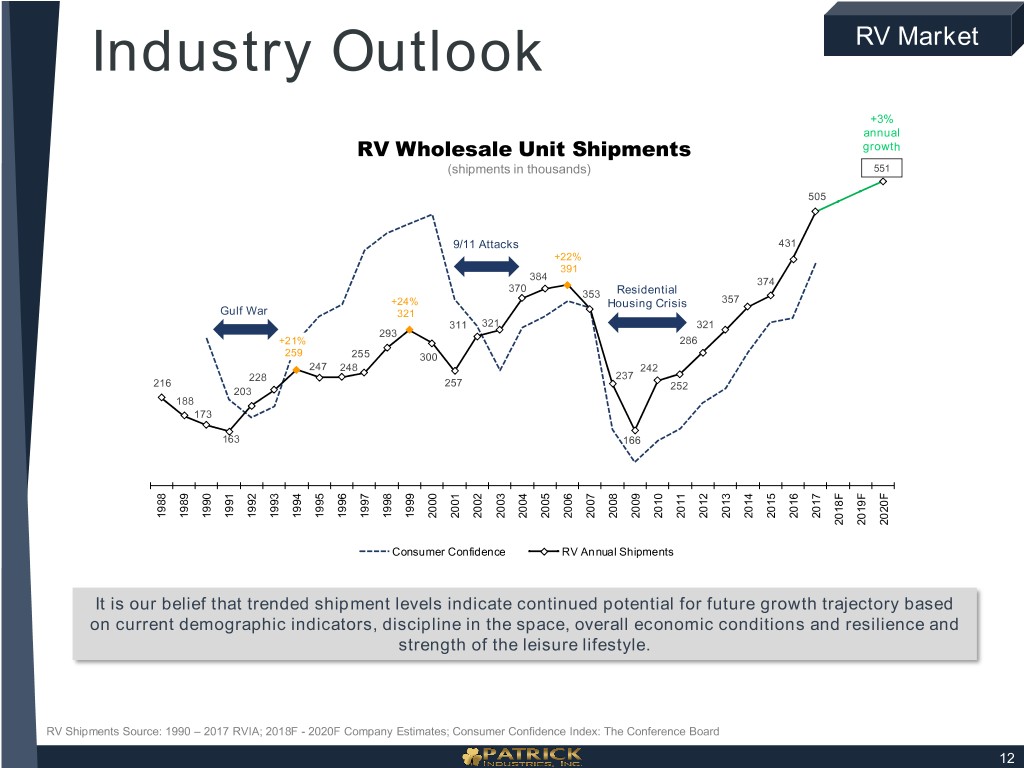

Industry Outlook RV Market +3% annual RV Wholesale Unit Shipments growth (shipments in thousands) 551 505 9/11 Attacks 431 +22% 391 384 374 370 353 Residential +24% Housing Crisis 357 Gulf War 321 311 321 321 293 +21% 286 259 255 300 247 248 242 228 237 216 257 252 203 188 173 163 166 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018F 2019F 2020F Consumer Confidence RV Annual Shipments It is our belief that trended shipment levels indicate continued potential for future growth trajectory based on current demographic indicators, discipline in the space, overall economic conditions and resilience and strength of the leisure lifestyle. RV Shipments Source: 1990 – 2017 RVIA; 2018F - 2020F Company Estimates; Consumer Confidence Index: The Conference Board 12

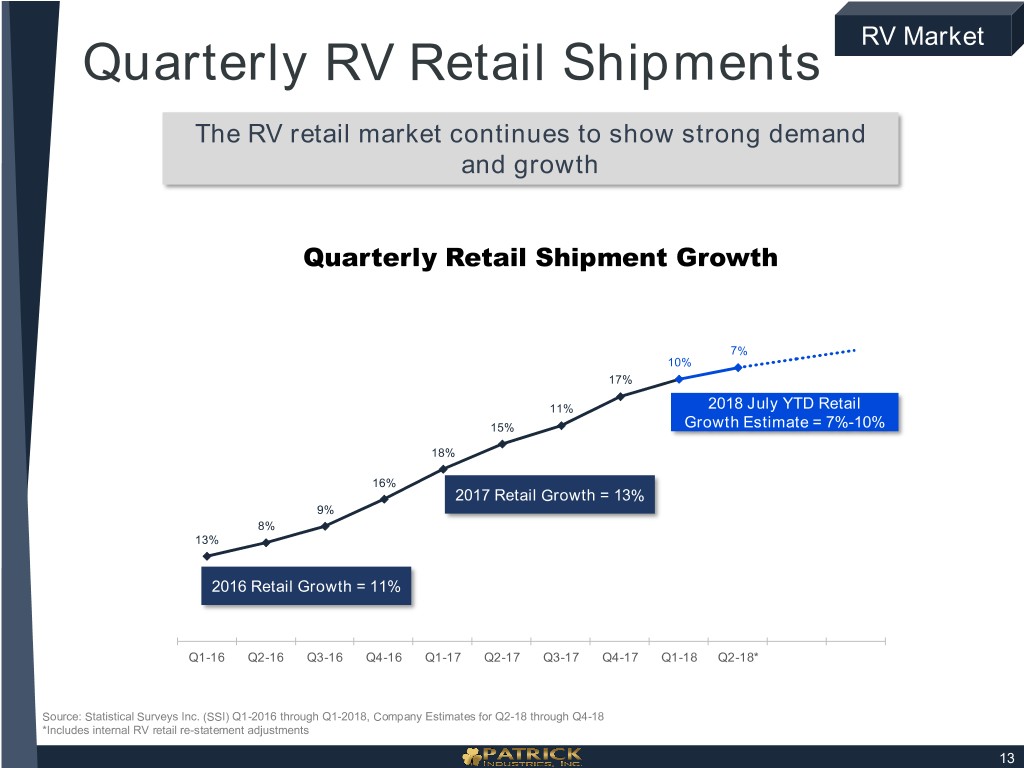

RV Market Quarterly RV Retail Shipments The RV retail market continues to show strong demand and growth Quarterly Retail Shipment Growth 7% 10% 17% 11% 2018 July YTD Retail 15% Growth Estimate = 7%-10% 18% 16% 2017 Retail Growth = 13% 9% 8% 13% 2016 Retail Growth = 11% Q1-16 Q2-16 Q3-16 Q4-16 Q1-17 Q2-17 Q3-17 Q4-17 Q1-18 Q2-18* Source: Statistical Surveys Inc. (SSI) Q1-2016 through Q1-2018, Company Estimates for Q2-18 through Q4-18 *Includes internal RV retail re-statement adjustments 13

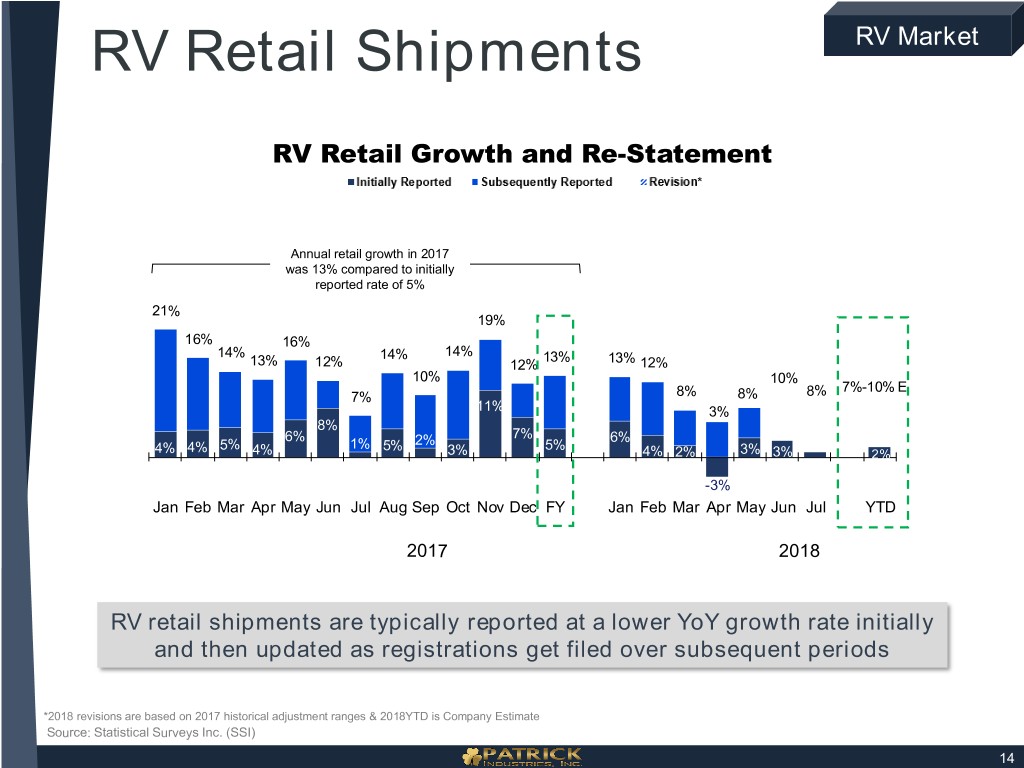

RV Retail Shipments RV Market RV Retail Growth and Re-Statement Annual retail growth in 2017 was 13% compared to initially reported rate of 5% 21% 19% 16% 16% 14% 14% 14% 13% 13% 12% 12% 13% 12% 10% 10% 7%-10% E 7% 8% 8% 8% 11% 3% 8% 6% 7% 6% 5% 1% 5% 2% 5% 4% 4% 4% 3% 4% 2% 3% 3% 2% 1% -3% Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec FY Jan Feb Mar Apr May Jun Jul YTD 2017 2018 RV retail shipments are typically reported at a lower YoY growth rate initially and then updated as registrations get filed over subsequent periods *2018 revisions are based on 2017 historical adjustment ranges & 2018YTD is Company Estimate Source: Statistical Surveys Inc. (SSI) 14

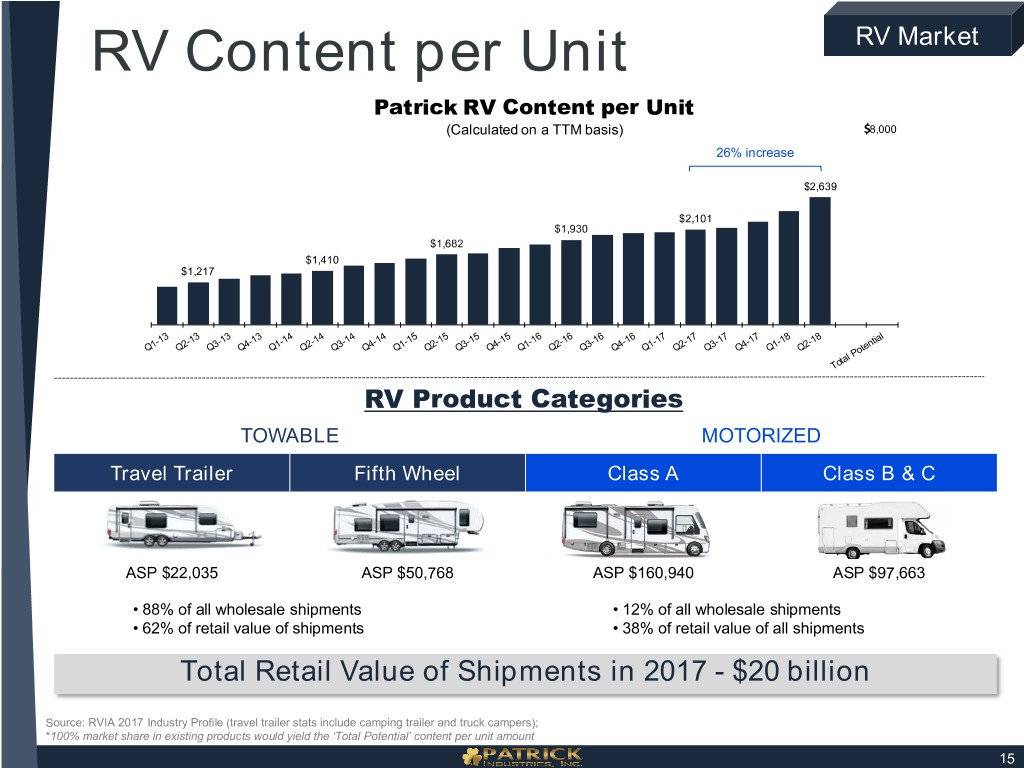

RV Content per Unit RV Market Patrick RV Content per Unit (Calculated on a TTM basis) $8,000 26% increase $2,639 $2,101 $1,930 $1,682 $1,410 $1,217 RV Product Categories TOWABLE MOTORIZED Travel Trailer Fifth Wheel Class A Class B & C ASP $22,035 ASP $50,768 ASP $160,940 ASP $97,663 • 88% of all wholesale shipments • 12% of all wholesale shipments • 62% of retail value of shipments • 38% of retail value of all shipments Total Retail Value of Shipments in 2017 - $20 billion Source: RVIA 2017 Industry Profile (travel trailer stats include camping trailer and truck campers); *100% market share in existing products would yield the ‘Total Potential’ content per unit amount 15

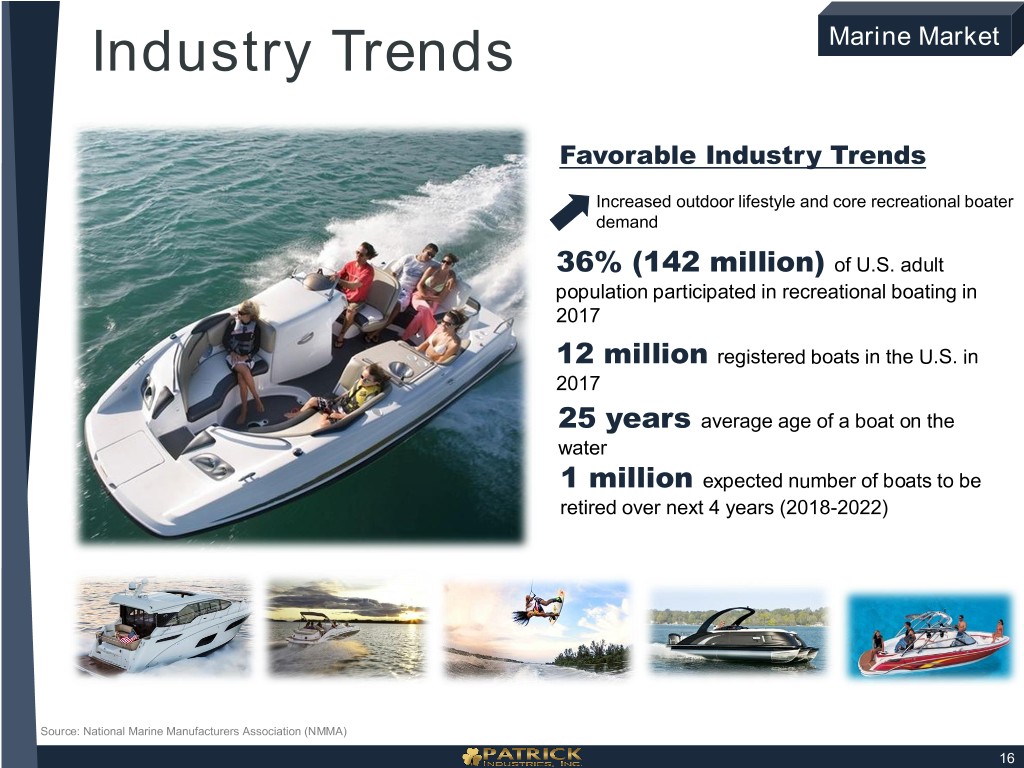

Industry Trends Marine Market Favorable Industry Trends Increased outdoor lifestyle and core recreational boater demand 36% (142 million) of U.S. adult population participated in recreational boating in 2017 12 million registered boats in the U.S. in 2017 25 years average age of a boat on the water 1 million expected number of boats to be retired over next 4 years (2018-2022) Source: National Marine Manufacturers Association (NMMA) 16

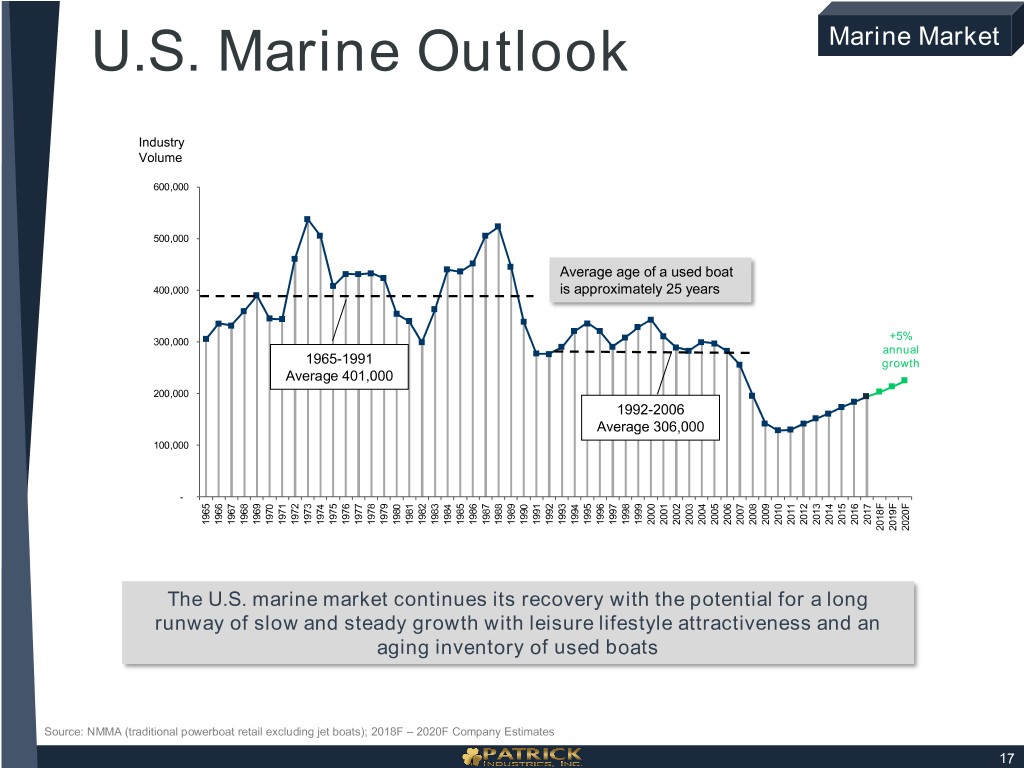

U.S. Marine Outlook Marine Market Industry Volume 600,000 500,000 Average age of a used boat 400,000 is approximately 25 years +5% 300,000 annual 1965-1991 growth Average 401,000 200,000 1992-2006 Average 306,000 100,000 - 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018F 2019F 2020F The U.S. marine market continues its recovery with the potential for a long runway of slow and steady growth with leisure lifestyle attractiveness and an aging inventory of used boats Source: NMMA (traditional powerboat retail excluding jet boats); 2018F – 2020F Company Estimates 17

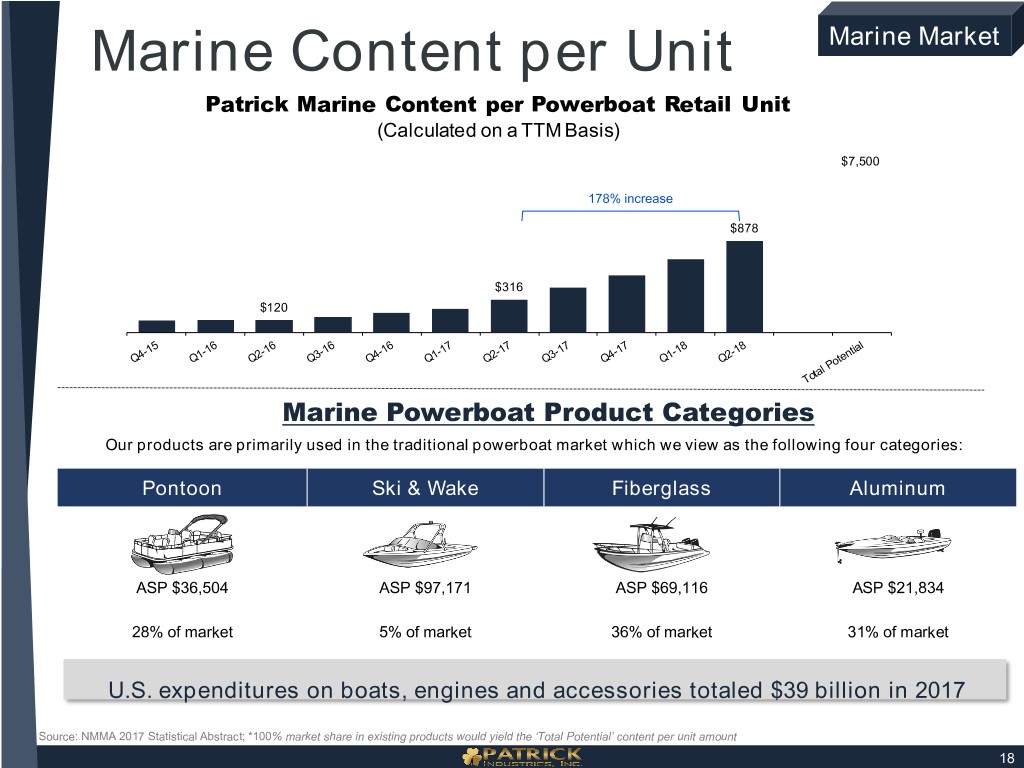

Marine Content per Unit Marine Market Patrick Marine Content per Powerboat Retail Unit (Calculated on a TTM Basis) $7,500 178% increase $878 $316 $120 Marine Powerboat Product Categories Our products are primarily used in the traditional powerboat market which we view as the following four categories: Pontoon Ski & Wake Fiberglass Aluminum ASP $36,504 ASP $97,171 ASP $69,116 ASP $21,834 28% of market 5% of market 36% of market 31% of market U.S. expenditures on boats, engines and accessories totaled $39 billion in 2017 Source: NMMA 2017 Statistical Abstract; *100% market share in existing products would yield the ‘Total Potential’ content per unit amount 18

Industry and Market Review: Housing & Industrial

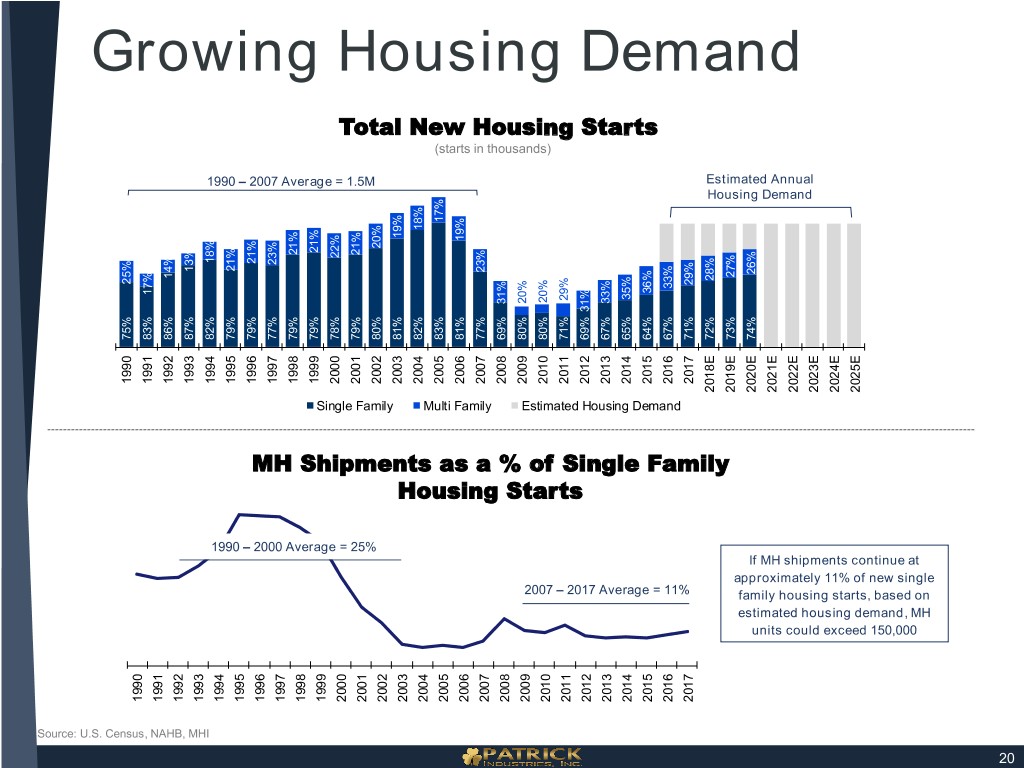

Source: U.S. NAHB, U.S. Census, Source: MHI GrowingHousing Demand 1990 75% 25% 1990 1991 83% 17% 1991 1992 86% 14% 1992 1993 87% 13% 1993 1990 1990 1994 82% 18% 1994 1995 79% 21% – 1995 – 2007 2007 1.5M Average= MH Shipments as a % of Single Family Single of % a as Shipments MH 2000 2000 Average= 25% 1996 79% 21% 1996 1997 77% 23% 1997 1998 79% 21% 1998 Single FamilySingle 1999 79% 21% 1999 2000 78% 22% TotalHousing Starts New 2000 79% 21% 2001 2001 2002 2002 80% 20% 2003 Starts Housing 2003 81% 19% 2004 FamilyMulti 2004 82% 18% (starts (starts 2005 2005 83% 17% 2006 2006 81% 19% in in thousands) 2007 2007 77% 23% 2008 2008 69% 31% EstimatedHousing Demand 2009 2007 2009 80% 20% 2010 2010 80% 20% – 2011 2017 11% Average= 2011 71% 29% 2012 2012 69% 31% 2013 2013 67% 33% 2014 2014 65% 35% 2015 2015 64% 36% 2016 2016 67% 33% 2017 2017 71% 29% Estimated Estimated Annual 2018E 72% 28% Housing Demand approximately 11% of new approximatelynew 11%of single 2019E 73% 27% estimated estimated housing demand, MH family starts, based housing on If MH shipments MH If shipments continue at units could exceed units could exceed 150,000 2020E 74% 26% 2021E 2022E 2023E 2024E 2025E 20

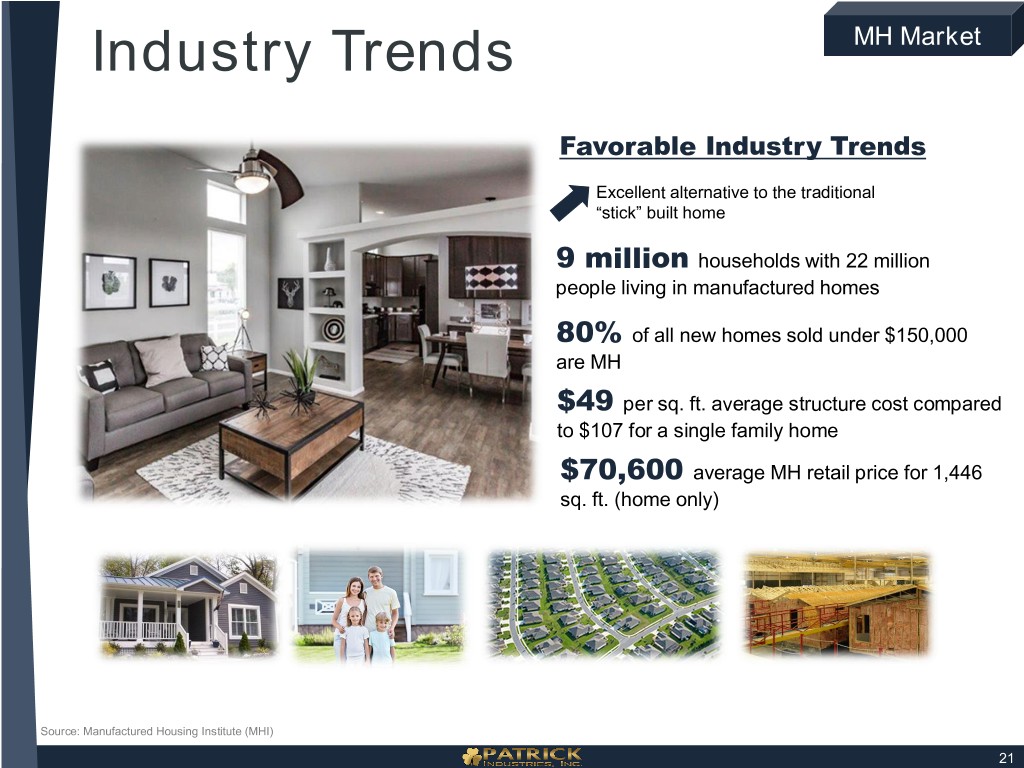

Industry Trends MH Market Favorable Industry Trends Excellent alternative to the traditional “stick” built home 9 million households with 22 million people living in manufactured homes 80% of all new homes sold under $150,000 are MH $49 per sq. ft. average structure cost compared to $107 for a single family home $70,600 average MH retail price for 1,446 sq. ft. (home only) Source: Manufactured Housing Institute (MHI) 21

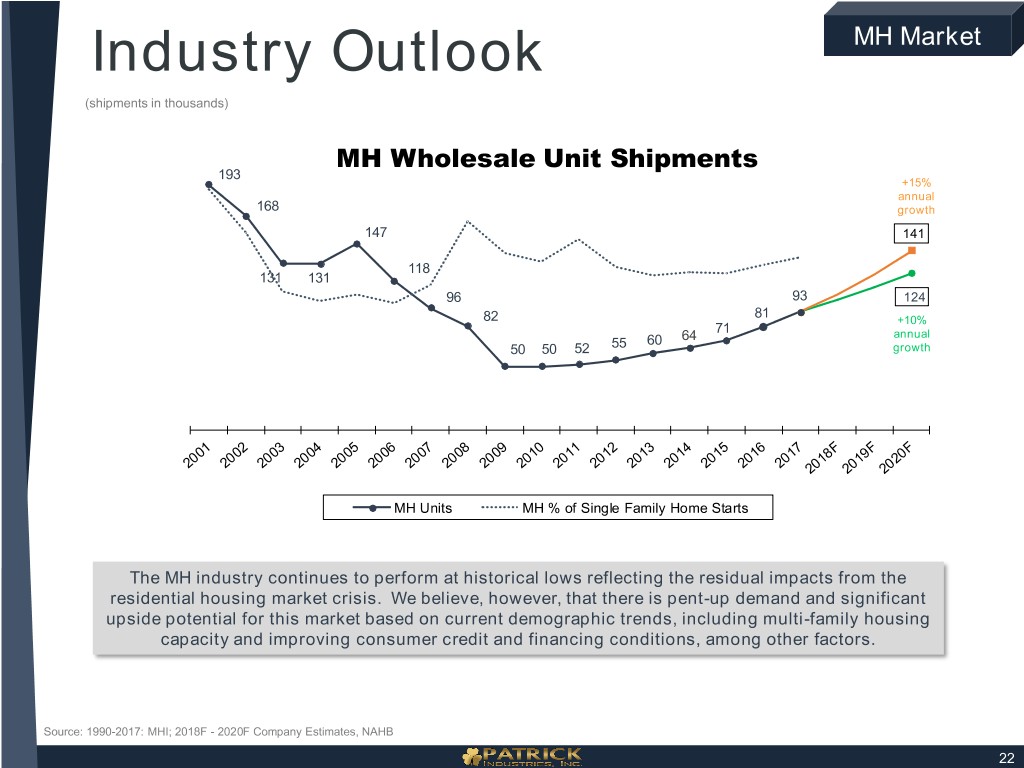

Industry Outlook MH Market (shipments in thousands) MH Wholesale Unit Shipments 193 +15% annual 168 growth 147 141 118 131 131 96 93 124 81 82 +10% 71 60 64 annual 50 50 52 55 growth MH Units MH % of Single Family Home Starts The MH industry continues to perform at historical lows reflecting the residual impacts from the residential housing market crisis. We believe, however, that there is pent-up demand and significant upside potential for this market based on current demographic trends, including multi-family housing capacity and improving consumer credit and financing conditions, among other factors. Source: 1990-2017: MHI; 2018F - 2020F Company Estimates, NAHB 22

MH Content per Unit MH Market Our focus on strategic acquisitions and organic growth has resulted in significant increases in our content per unit and sales outpacing our respective markets MH Content per Unit (Calculated on a TTM Basis) 21% increase $8,500 $2,520 $2,084 $1,790 $1,827 $1,585 $1,592 *100% market share in existing products would yield the ‘Total Potential’ content per unit amount 23

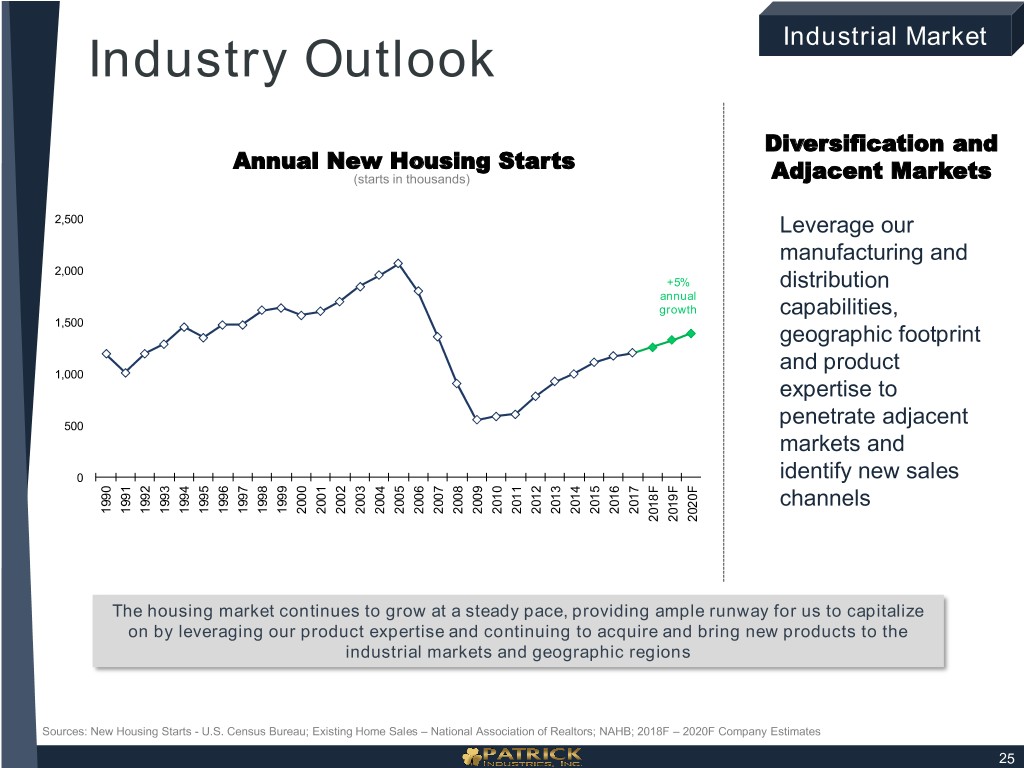

Industry Trends Industrial Market Favorable Industry Trends Housing starts are well below the prior peak and there continues to be pent-up demand, providing continued runway in the new housing market 60% of Patrick’s Industrial sales are linked to the residential housing market 9% increase in single-family housing starts vs. prior year 40% of Patrick’s Industrial sales are linked to the non-residential housing market which includes: big box retail, retail & commercial fixtures and high rise, office, hospitality, schools & universities Source: U.S. Census, NAHB 24

Industry Outlook Industrial Market Diversification and Annual New Housing Starts (starts in thousands) Adjacent Markets 2,500 Leverage our manufacturing and 2,000 +5% distribution annual growth capabilities, 1,500 geographic footprint and product 1,000 expertise to 500 penetrate adjacent markets and 0 identify new sales channels 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018F 2019F 2020F The housing market continues to grow at a steady pace, providing ample runway for us to capitalize on by leveraging our product expertise and continuing to acquire and bring new products to the industrial markets and geographic regions Sources: New Housing Starts - U.S. Census Bureau; Existing Home Sales – National Association of Realtors; NAHB; 2018F – 2020F Company Estimates 25

Strategy

Capital Allocation Strategy Our capital allocation strategy is centered around the utilization of a balanced leverage position, strong cash flows and capital resources to grow and reinvest in the business model Capital Stock Debt Acquisitions Expansion Expenditures Repurchases Reduction . . Execute disciplined . Invest in internal Focus on geographic . Return capital to . Use strong cash flow strategic acquisition growth and cost expansion shareholders through to reduce debt and program in core saving opportunities opportunities to share repurchases reload growth markets including product leverage our existing capacity extensions, relationships and infrastructure and expertise expansions $326 million of capital deployed in first half of 2018 with leverage ratio of 2.2x Acquisitions 79% Stock Repurchases 17% Capital Expenditures 3% Expansion 1% 27

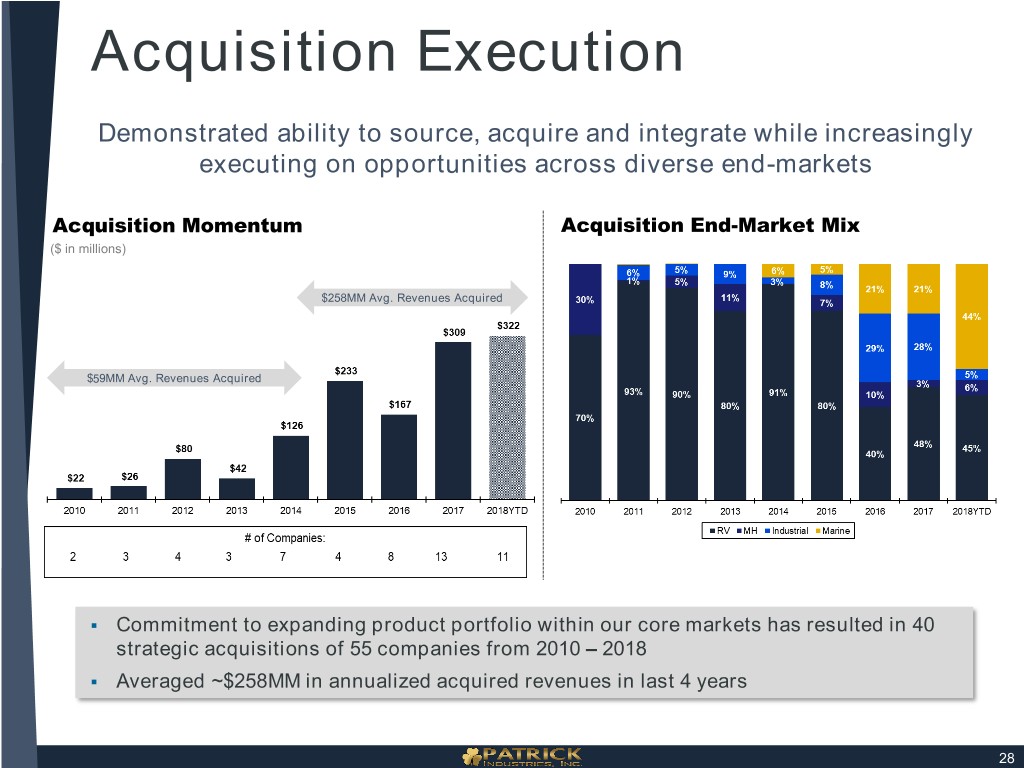

Acquisition Execution Demonstrated ability to source, acquire and integrate while increasingly executing on opportunities across diverse end-markets Acquisition Momentum Acquisition End-Market Mix ($ in millions) $258MM Avg. Revenues Acquired $59MM Avg. Revenues Acquired . Commitment to expanding product portfolio within our core markets has resulted in 40 strategic acquisitions of 55 companies from 2010 – 2018 . Averaged ~$258MM in annualized acquired revenues in last 4 years 28

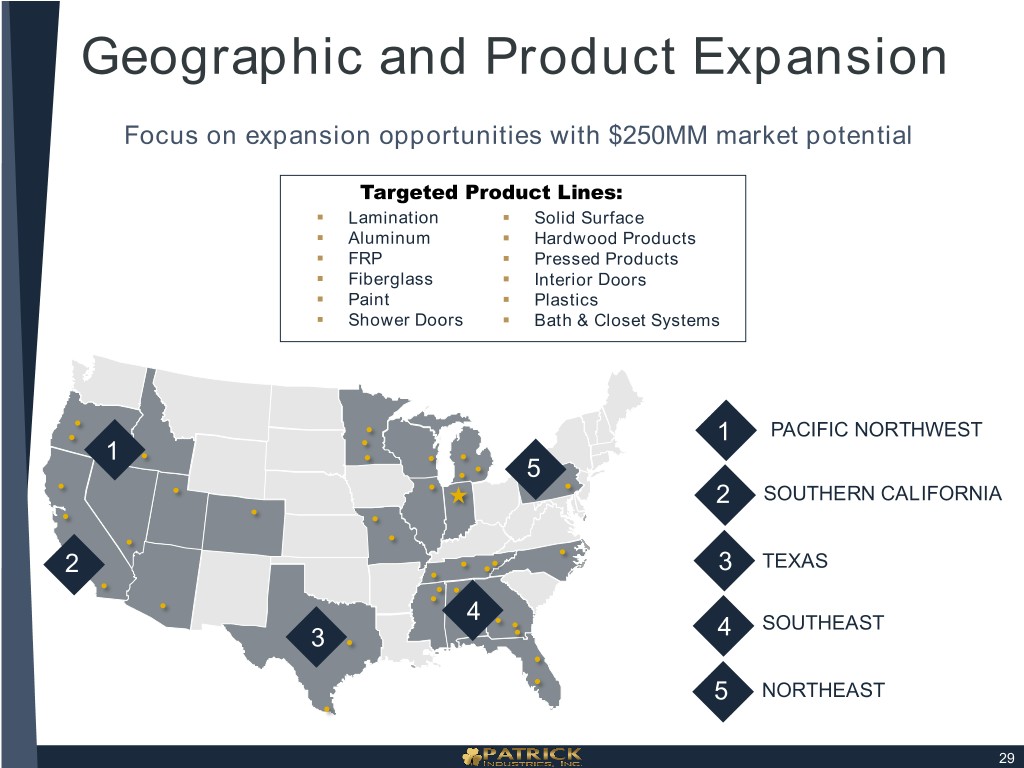

Geographic and Product Expansion Focus on expansion opportunities with $250MM market potential Targeted Product Lines: . Lamination . Solid Surface . Aluminum . Hardwood Products . FRP . Pressed Products . Fiberglass . Interior Doors . Paint . Plastics . Shower Doors . Bath & Closet Systems 1 PACIFIC NORTHWEST 1 5 2 SOUTHERN CALIFORNIA 2 3 TEXAS 4 SOUTHEAST 3 4 5 NORTHEAST 29

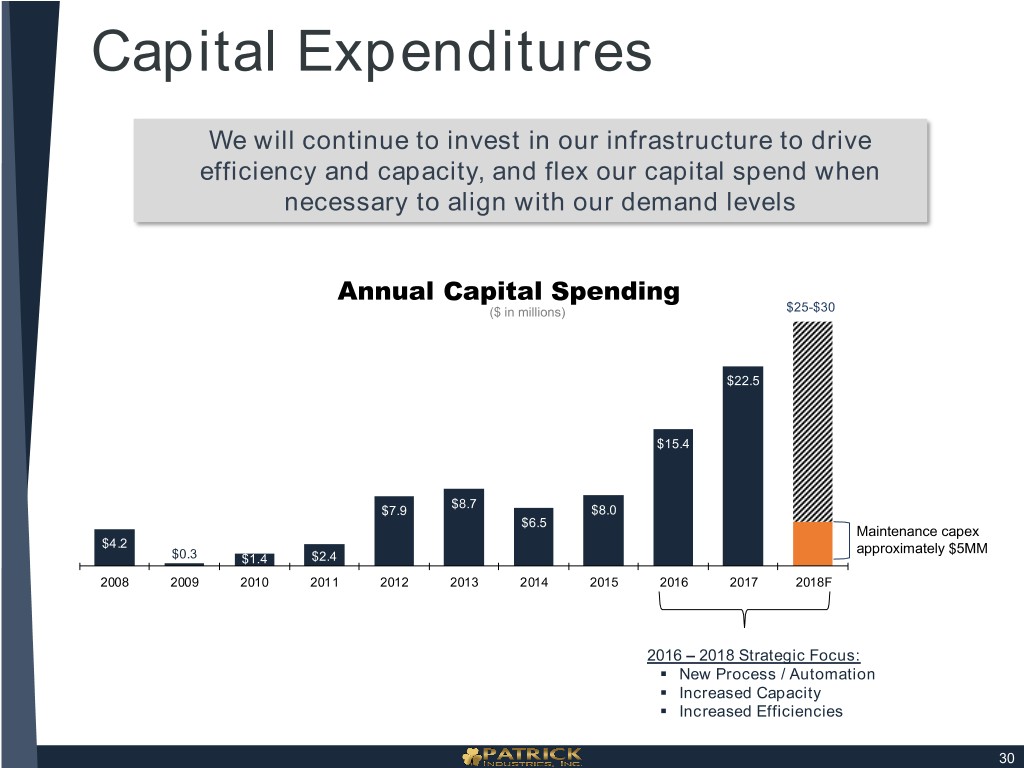

Capital Expenditures We will continue to invest in our infrastructure to drive efficiency and capacity, and flex our capital spend when necessary to align with our demand levels Annual Capital Spending ($ in millions) $25-$30 $22.5 $15.4 $8.7 $7.9 $8.0 $6.5 Maintenance capex $4.2 approximately $5MM $0.3 $1.4 $2.4 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018F 2016 – 2018 Strategic Focus: . New Process / Automation . Increased Capacity . Increased Efficiencies 30

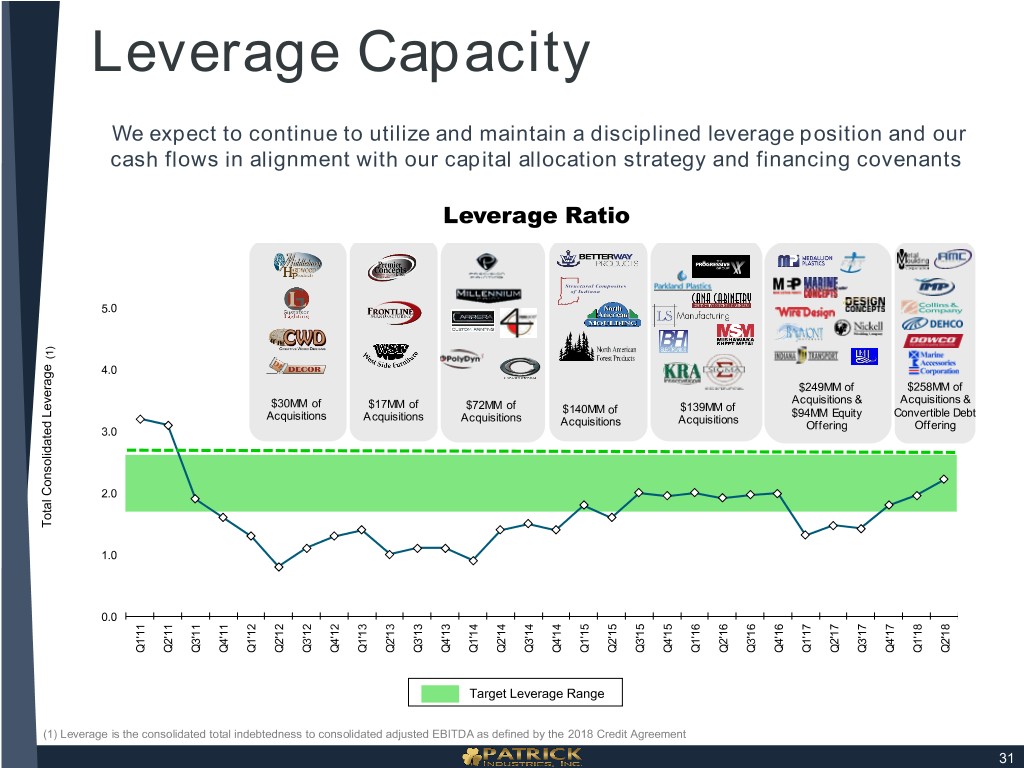

Leverage Capacity We expect to continue to utilize and maintain a disciplined leverage position and our cash flows in alignment with our capital allocation strategy and financing covenants Leverage Ratio 5.0 (1) 4.0 $249MM of $258MM of Acquisitions & Acquisitions & $30MM of $17MM of $72MM of $139MM of $140MM of $94MM Equity Convertible Debt Acquisitions Acquisitions Acquisitions Acquisitions Acquisitions Offering Offering 3.0 2.0 Total Consolidated LeverageConsolidatedTotal 1.0 0.0 Q1'11 Q2'11 Q3'11 Q4'11 Q1'12 Q2'12 Q3'12 Q4'12 Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14 Q4'14 Q1'15 Q2'15 Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17 Q3'17 Q4'17 Q1'18 Q2'18 Target Leverage Range (1) Leverage is the consolidated total indebtedness to consolidated adjusted EBITDA as defined by the 2018 Credit Agreement 31

Performance

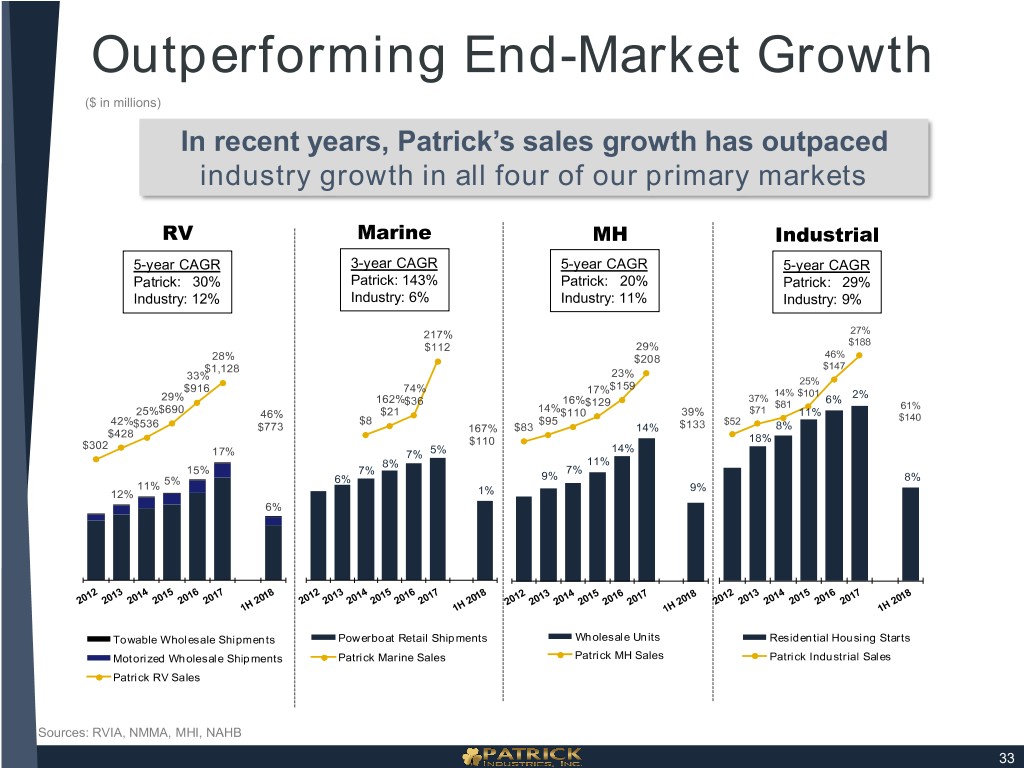

Outperforming End-Market Growth ($ in millions) In recent years, Patrick’s sales growth has outpaced industry growth in all four of our primary markets RV Marine MH Industrial 5-year CAGR 3-year CAGR 5-year CAGR 5-year CAGR Patrick: 30% Patrick: 143% Patrick: 20% Patrick: 29% Industry: 12% Industry: 6% Industry: 11% Industry: 9% 217% 27% $112 29% $188 28% $208 46% $147 $1,128 23% 33% 25% $916 74% 17%$159 29% 14% $101 2% 162%$36 16%$129 37% 6% 14% $81 61% 25%$690 46% $21 $110 39% $71 11% 42% $8 $95 $52 $140 $536 $773 $83 14% $133 8% $428 167% $110 18% $302 14% 17% 7% 5% 8% 11% 15% 7% 7% 5% 6% 9% 8% 11% 9% 12% 1% 6% Towable Wholesale Shipments Powerboat Retail Shipments Wholesale Units Residential Housing Starts Motorized Wholesale Shipments Patrick Marine Sales Patrick MH Sales Patrick Industrial Sales Patrick RV Sales Sources: RVIA, NMMA, MHI, NAHB 33

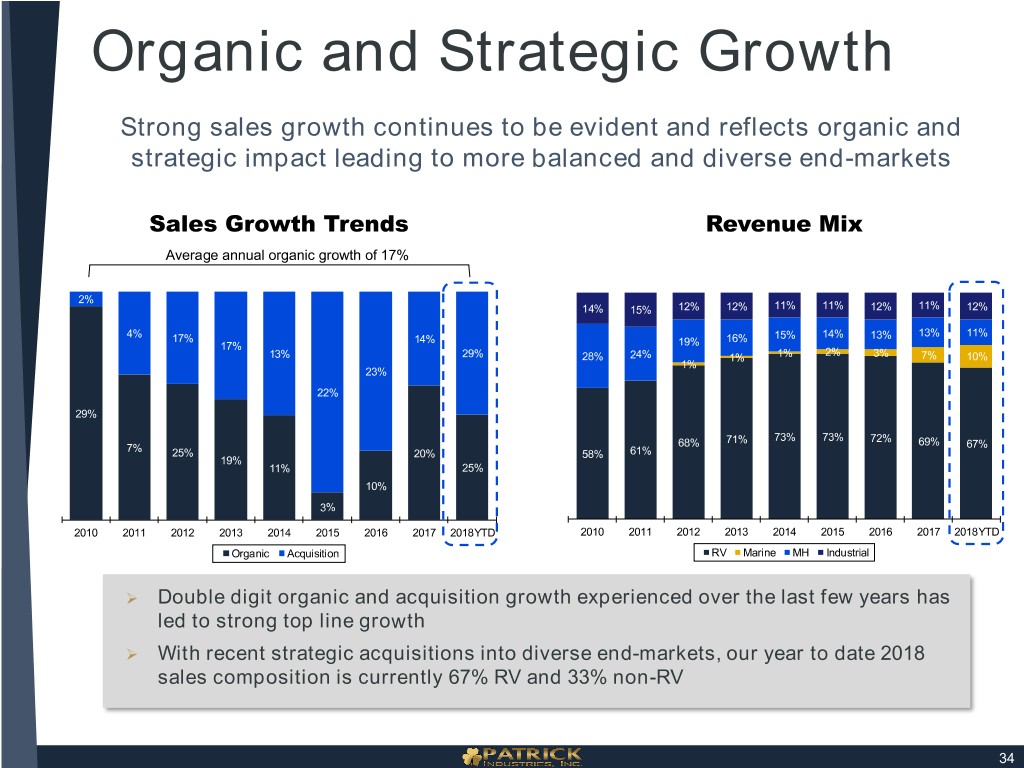

Organic and Strategic Growth Strong sales growth continues to be evident and reflects organic and strategic impact leading to more balanced and diverse end-markets Sales Growth Trends Revenue Mix Average annual organic growth of 17% 2% 14% 15% 12% 12% 11% 11% 12% 11% 12% 4% 13% 11% 17% 14% 16% 15% 14% 13% 17% 19% 2% 13% 29% 28% 24% 1% 1% 3% 7% 10% 1% 23% 22% 29% 71% 73% 73% 72% 69% 7% 68% 67% 25% 20% 58% 61% 19% 11% 25% 10% 3% 2010 2011 2012 2013 2014 2015 2016 2017 2018YTD 2010 2011 2012 2013 2014 2015 2016 2017 2018YTD Organic Acquisition RV Marine MH Industrial Double digit organic and acquisition growth experienced over the last few years has led to strong top line growth With recent strategic acquisitions into diverse end-markets, our year to date 2018 sales composition is currently 67% RV and 33% non-RV 34

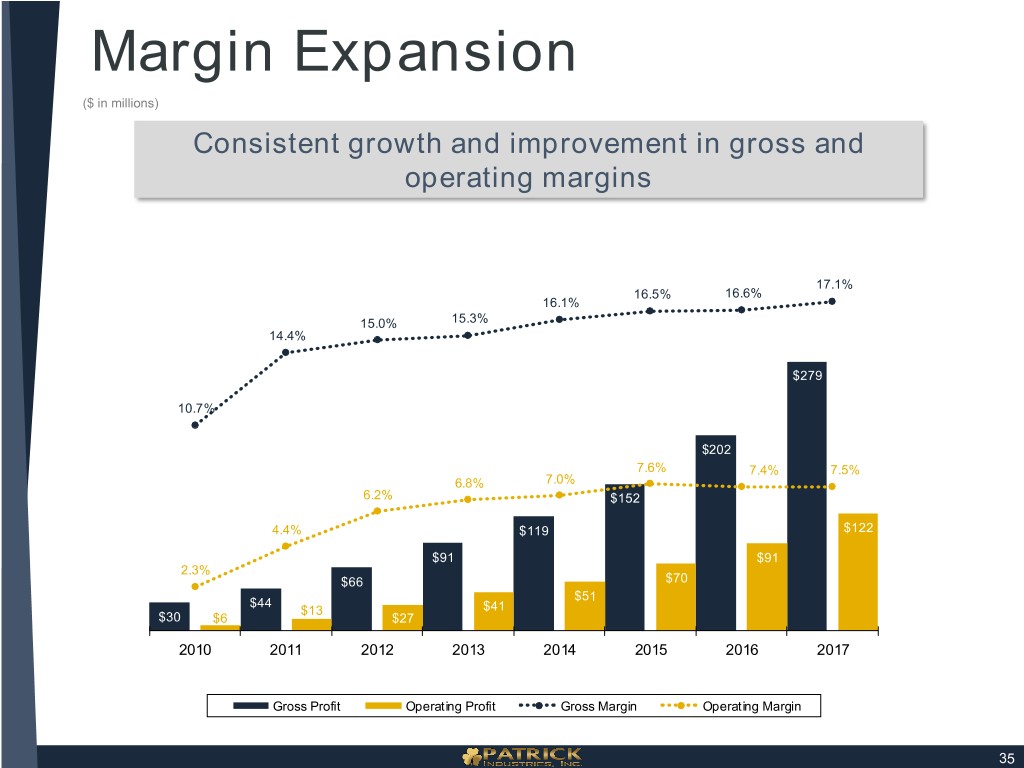

Margin Expansion ($ in millions) Consistent growth and improvement in gross and operating margins 17.1% 16.5% 16.6% 16.1% 15.0% 15.3% 14.4% $279 10.7% $202 7.6% 7.4% 7.5% 6.8% 7.0% 6.2% $152 4.4% $119 $122 $91 $91 2.3% $66 $70 $51 $44 $13 $41 $30 $6 $27 2010 2011 2012 2013 2014 2015 2016 2017 Gross Profit Operating Profit Gross Margin Operating Margin 35

Sales & Earnings Growth ($ in millions except per share data) Sales Growth Earnings Growth 2013 – 2017 2013 – 2017 CAGR = 29% CAGR = 37% $4.50 +43% $2,040 $3.48 +34% +34% $112 $2.43 $1,636 +42% 54% +29% $1.81 +33% +11% $86 $1.27 $1,222 $0.99 +25% 32% +24% $920 +38% $56 +36% $736 +28% $42 +13% $595 $31 $24 2013 2014 2015 2016 2017 2018 LTM 2013 2014 2015 2016 2017 2018 LTM Sales Net Income Diluted EPS Sales continue to grow and outpace their respective markets, driven by acquisitions, new products and line extensions, and market share gains Net Income and EPS continue steady growth driven by the following: . Leveraging of fixed costs . Tight management of controllable expenses . Realized cost synergies from acquisitions 36