EX-99.2

Published on July 29, 2021

April 29, 2021

FORWARD-LOOKING STATEMENTS This presentation contains certain statements related to future results, our intentions, beliefs and expectations or predictions for the future which are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from either historical or anticipated results depending on a variety of factors. These risks and uncertainties include, but are not limited to, the impact of the continuing financial and operational uncertainty due to the COVID-19 pandemic, including its impact on the overall economy, our sales, customers, operations, team members and suppliers. Further information concerning the Company and its business, including factors that potentially could materially affect the Company’s financial results, is contained in the Company’s filings with the Securities and Exchange Commission. This presentation includes market and industry data, forecasts and valuations that have been obtained from independent consultant reports, publicly available information, various industry publications and other published industry sources. Although we believe these sources are reliable, we have not independently verified the information and cannot make any representation as to the accuracy or completeness of such information. We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained in this presentation or to reflect any change in our expectations after the date of this presentation or any change in events, conditions or circumstances on which any statement is based. Use of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. These measures, the purposes for which management uses them, why management believes they are useful to investors, and a reconciliation to the most directly comparable GAAP financial measures can be found in the Appendix of this presentation. All references to profit measures and earnings per share on a comparable basis exclude items that affect comparability. 2Q2 2021 Earnings Presentation

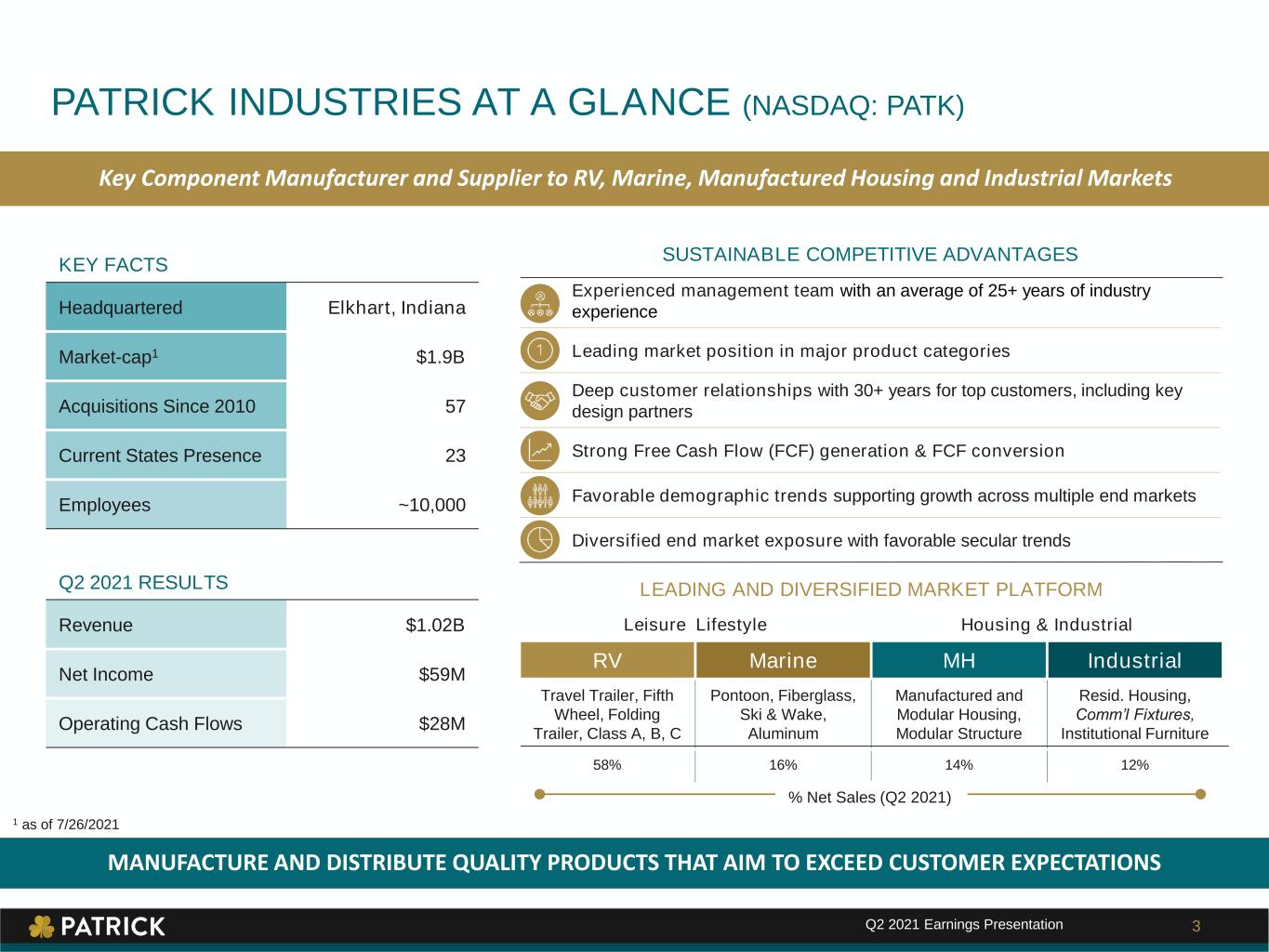

Experienced management team with an average of 25+ years of industry experience Leading market position in major product categories Deep customer relationships with 30+ years for top customers, including key design partners Strong Free Cash Flow (FCF) generation & FCF conversion Favorable demographic trends supporting growth across multiple end markets Diversified end market exposure with favorable secular trends PATRICK INDUSTRIES AT A GLANCE (NASDAQ: PATK) MANUFACTURE AND DISTRIBUTE QUALITY PRODUCTS THAT AIM TO EXCEED CUSTOMER EXPECTATIONS Key Component Manufacturer and Supplier to RV, Marine, Manufactured Housing and Industrial Markets KEY FACTS Headquartered Elkhart, Indiana Market-cap1 $1.9B Acquisitions Since 2010 57 Current States Presence 23 Employees ~10,000 Q2 2021 RESULTS Revenue $1.02B Net Income $59M Operating Cash Flows $28M SUSTAINABLE COMPETITIVE ADVANTAGES 1 as of 7/26/2021 Leisure Lifestyle Housing & Industrial RV Marine MH Industrial Travel Trailer, Fifth Wheel, Folding Trailer, Class A, B, C Pontoon, Fiberglass, Ski & Wake, Aluminum Manufactured and Modular Housing, Modular Structure Resid. Housing, Comm’l Fixtures, Institutional Furniture 58% 16% 14% 12% LEADING AND DIVERSIFIED MARKET PLATFORM 3Q2 2021 Earnings Presentation % Net Sales (Q2 2021)

Q2 2021 - QUARTERLY HIGHLIGHTS 1 Growth in Total Revenue of +141% Y/Y • RV / marine driven by outdoor recreation trends, strong execution of nimble platform against very lean dealer inventory and need for channel inventory replenishment • Industrial and MH driven by housing demand, low interest rates and shift from urban-to-suburban 2 Operating Margin Expansion of +640bps Y/Y • Efficient and flexible platform that leverages fixed costs • Commodity and labor pressures persist, automation and technology initiatives to help alleviate 3 Investments to Increase Scale, Breadth and Market Penetration • Acquisition of Alpha Systems and SeaDek, expanding Leisure Lifestyle footprint • Increases in capex to expand capacity, efficiency and automation 4 Continued Progress on ESG Initiatives • Ensuring well-being, health and safety of team members • Human Capital Management: Investments to attract, develop and retain top talent • Waste minimization and environmental initiatives 4Q2 2021 Earnings Presentation STRONG EXECUTION AS REVENUE TRENDS CONTINUE

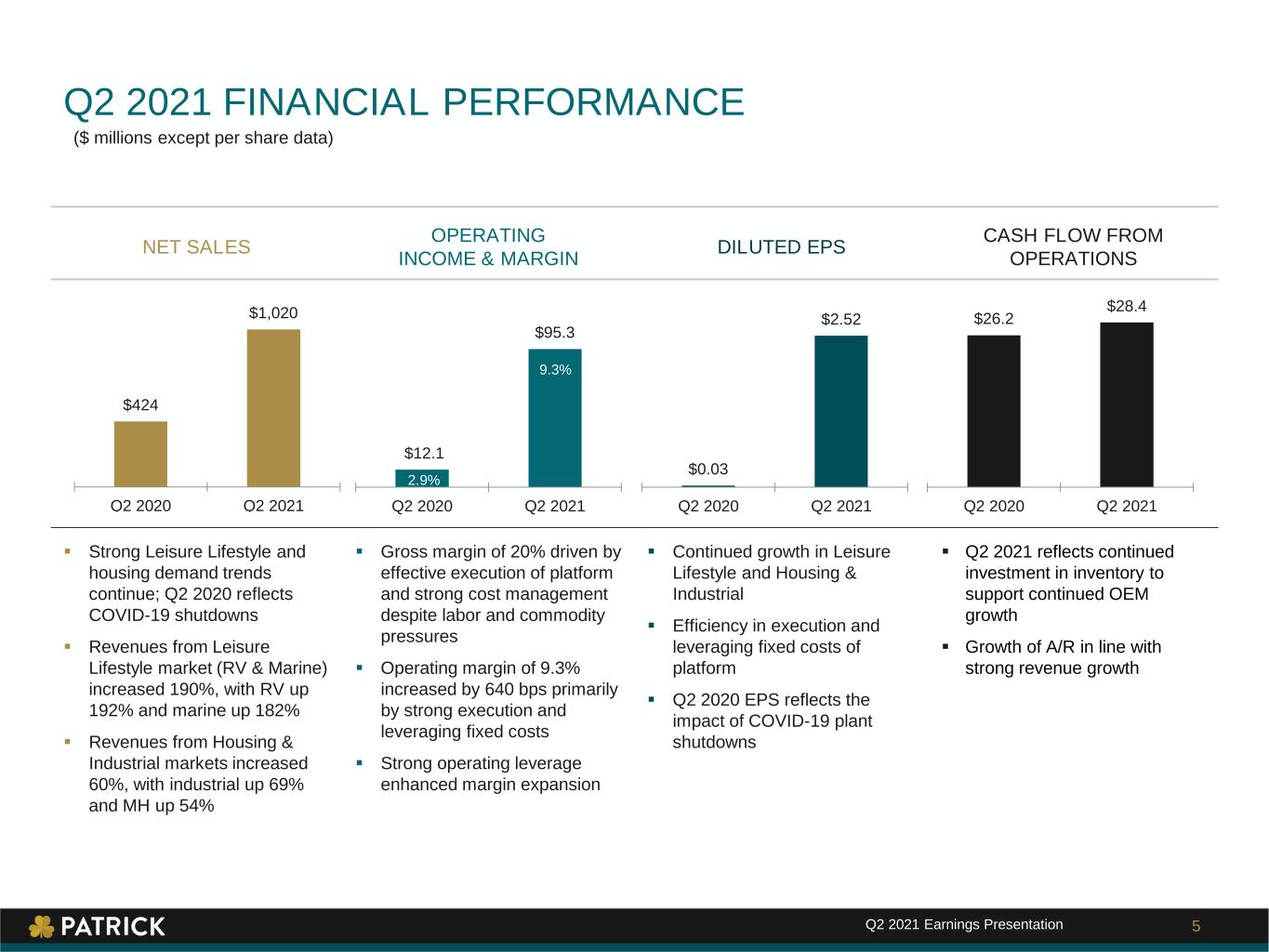

NET SALES OPERATING INCOME & MARGIN DILUTED EPS CASH FLOW FROM OPERATIONS Strong Leisure Lifestyle and housing demand trends continue; Q2 2020 reflects COVID-19 shutdowns Revenues from Leisure Lifestyle market (RV & Marine) increased 190%, with RV up 192% and marine up 182% Revenues from Housing & Industrial markets increased 60%, with industrial up 69% and MH up 54% Gross margin of 20% driven by effective execution of platform and strong cost management despite labor and commodity pressures Operating margin of 9.3% increased by 640 bps primarily by strong execution and leveraging fixed costs Strong operating leverage enhanced margin expansion Continued growth in Leisure Lifestyle and Housing & Industrial Efficiency in execution and leveraging fixed costs of platform Q2 2020 EPS reflects the impact of COVID-19 plant shutdowns Q2 2021 reflects continued investment in inventory to support continued OEM growth Growth of A/R in line with strong revenue growth Q2 2021 FINANCIAL PERFORMANCE $424 $1,020 Q2 2020 Q2 2021 $12.1 $95.3 $0 $20 $40 $60 $80 $100 $120 Q2 2020 Q2 2021 9.3% 2.9% $0.03 $2.52 Q2 2020 Q2 2021 $26.2 $28.4 Q2 2020 Q2 2021 ($ millions except per share data) 5Q2 2021 Earnings Presentation

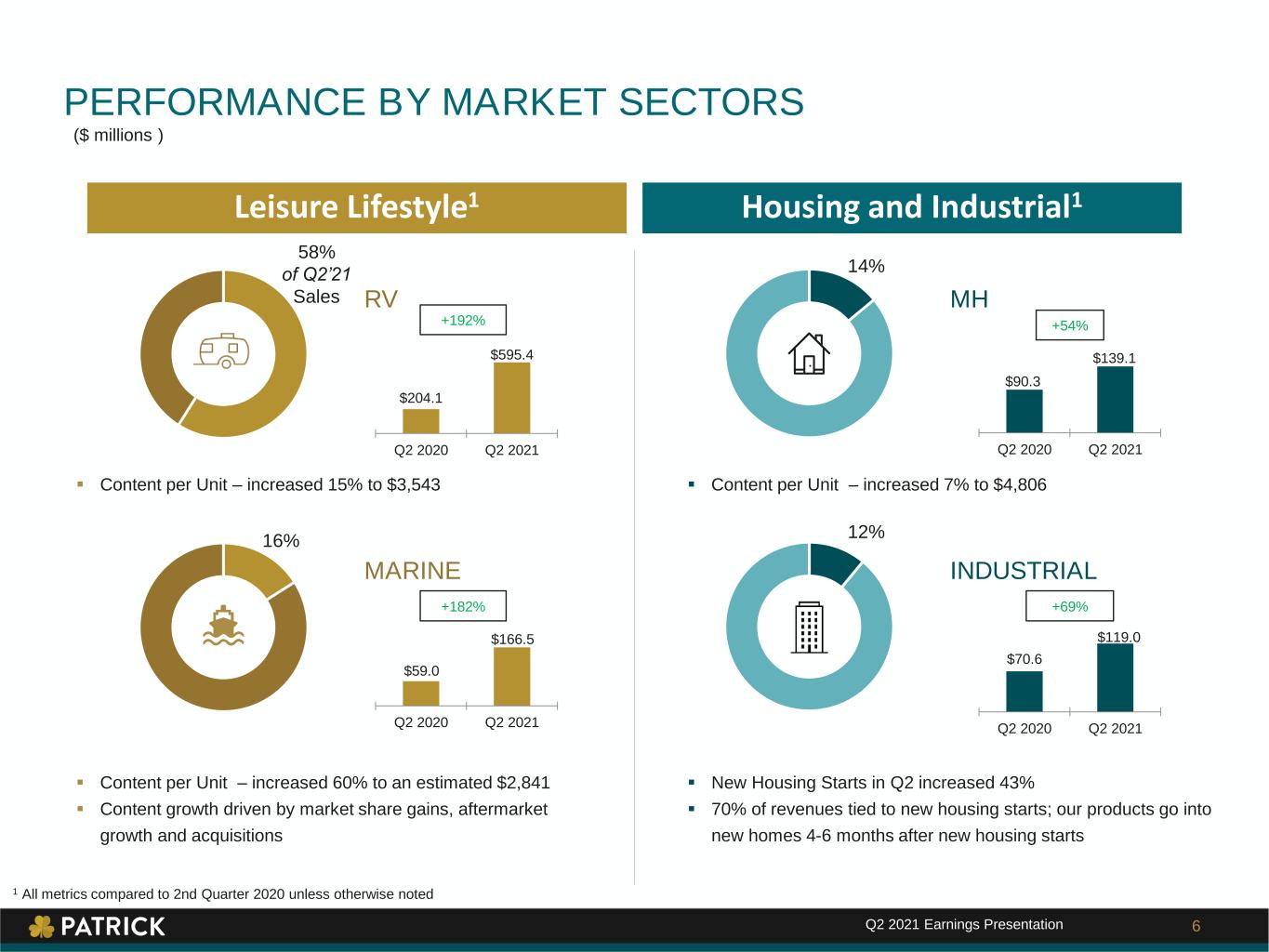

($ millions ) RV Content per Unit – increased 15% to $3,543 MARINE INDUSTRIAL PERFORMANCE BY MARKET SECTORS Leisure Lifestyle1 Housing and Industrial1 MH Content per Unit – increased 60% to an estimated $2,841 Content growth driven by market share gains, aftermarket growth and acquisitions Content per Unit – increased 7% to $4,806 New Housing Starts in Q2 increased 43% 70% of revenues tied to new housing starts; our products go into new homes 4-6 months after new housing starts $204.1 $595.4 Q2 2020 Q2 2021 $90.3 $139.1 Q2 2020 Q2 2021 $70.6 $119.0 Q2 2020 Q2 2021 +192% +54% +69%+182% 1 All metrics compared to 2nd Quarter 2020 unless otherwise noted $59.0 $166.5 Q2 2020 Q2 2021 6Q2 2021 Earnings Presentation 58% of Q2’21 Sales 16% 14% 12%

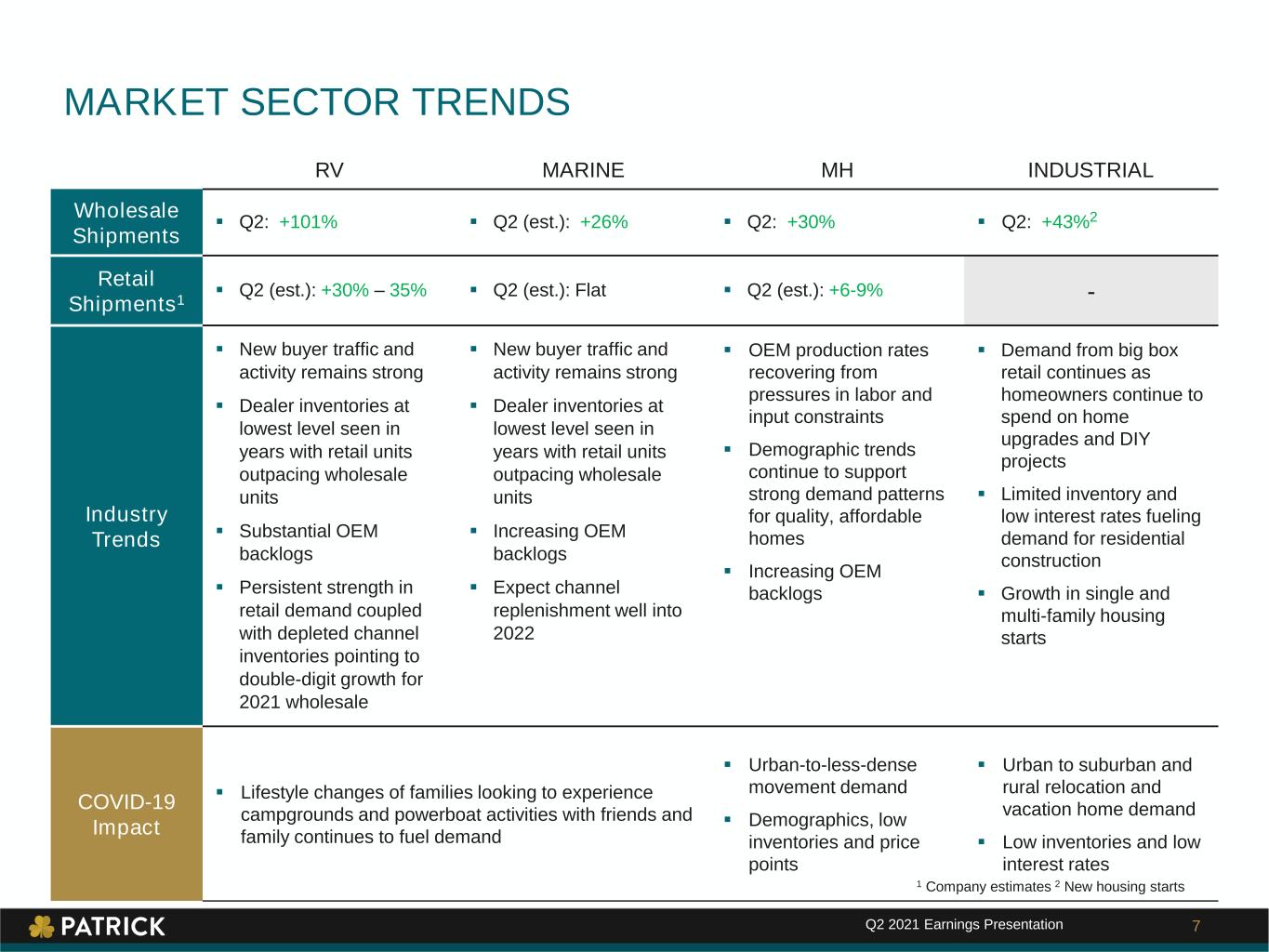

RV MARINE MH INDUSTRIAL Wholesale Shipments Q2: +101% Q2 (est.): +26% Q2: +30% Q2: +43%2 Retail Shipments1 Q2 (est.): +30% – 35% Q2 (est.): Flat Q2 (est.): +6-9% - Industry Trends New buyer traffic and activity remains strong Dealer inventories at lowest level seen in years with retail units outpacing wholesale units Substantial OEM backlogs Persistent strength in retail demand coupled with depleted channel inventories pointing to double-digit growth for 2021 wholesale New buyer traffic and activity remains strong Dealer inventories at lowest level seen in years with retail units outpacing wholesale units Increasing OEM backlogs Expect channel replenishment well into 2022 OEM production rates recovering from pressures in labor and input constraints Demographic trends continue to support strong demand patterns for quality, affordable homes Increasing OEM backlogs Demand from big box retail continues as homeowners continue to spend on home upgrades and DIY projects Limited inventory and low interest rates fueling demand for residential construction Growth in single and multi-family housing starts COVID-19 Impact Lifestyle changes of families looking to experience campgrounds and powerboat activities with friends and family continues to fuel demand Urban-to-less-dense movement demand Demographics, low inventories and price points Urban to suburban and rural relocation and vacation home demand Low inventories and low interest rates MARKET SECTOR TRENDS 7 1 Company estimates 2 New housing starts Q2 2021 Earnings Presentation

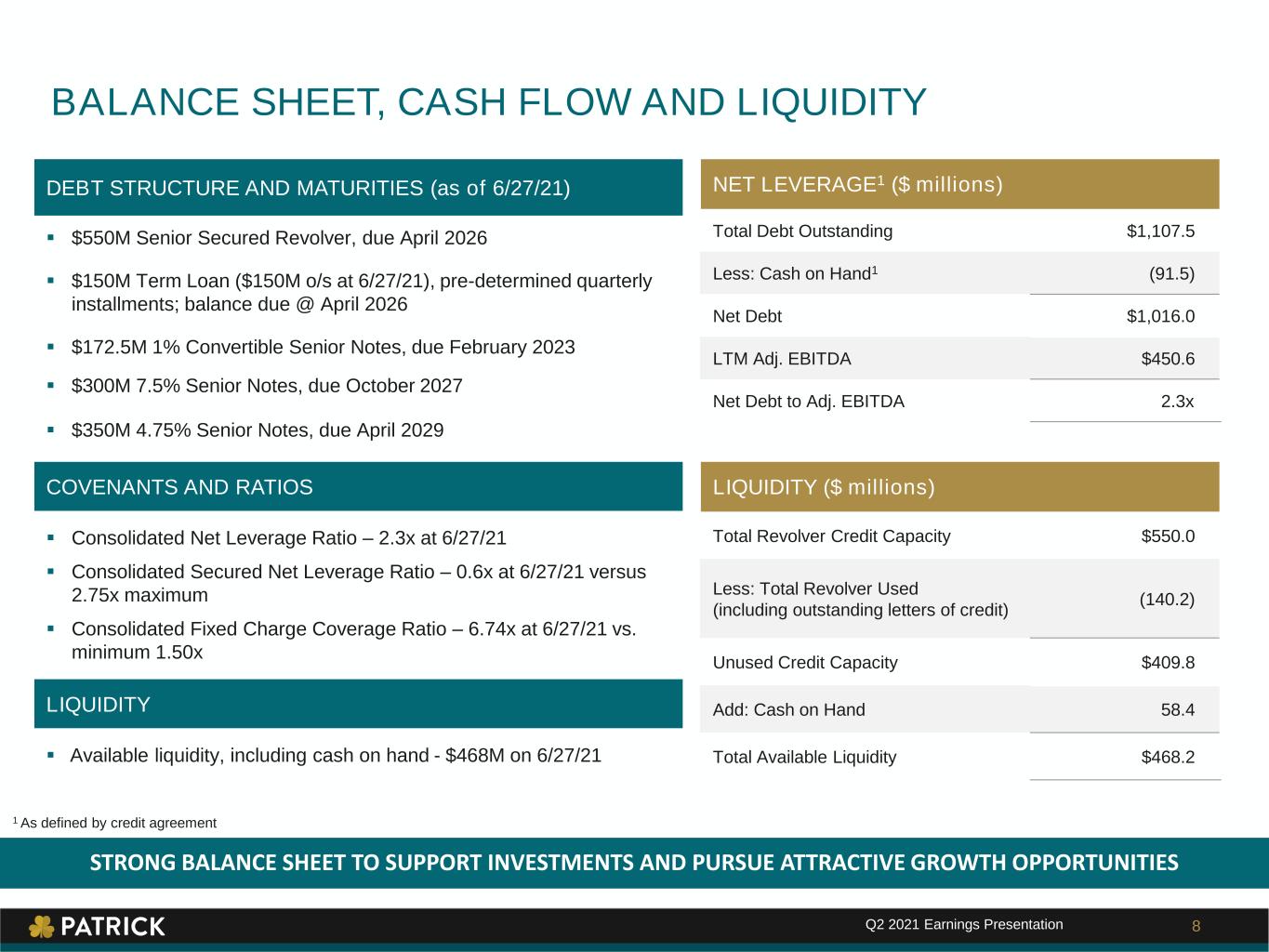

BALANCE SHEET, CASH FLOW AND LIQUIDITY 1 As defined by credit agreement NET LEVERAGE1 ($ millions) Total Debt Outstanding $1,107.5 Less: Cash on Hand1 (91.5) Net Debt $1,016.0 LTM Adj. EBITDA $450.6 Net Debt to Adj. EBITDA 2.3x LIQUIDITY ($ millions) Total Revolver Credit Capacity $550.0 Less: Total Revolver Used (including outstanding letters of credit) (140.2) Unused Credit Capacity $409.8 Add: Cash on Hand 58.4 Total Available Liquidity $468.2 DEBT STRUCTURE AND MATURITIES (as of 6/27/21) $550M Senior Secured Revolver, due April 2026 $150M Term Loan ($150M o/s at 6/27/21), pre-determined quarterly installments; balance due @ April 2026 $172.5M 1% Convertible Senior Notes, due February 2023 $300M 7.5% Senior Notes, due October 2027 $350M 4.75% Senior Notes, due April 2029 COVENANTS AND RATIOS Consolidated Net Leverage Ratio – 2.3x at 6/27/21 Consolidated Secured Net Leverage Ratio – 0.6x at 6/27/21 versus 2.75x maximum Consolidated Fixed Charge Coverage Ratio – 6.74x at 6/27/21 vs. minimum 1.50x LIQUIDITY Available liquidity, including cash on hand - $468M on 6/27/21 8Q2 2021 Earnings Presentation STRONG BALANCE SHEET TO SUPPORT INVESTMENTS AND PURSUE ATTRACTIVE GROWTH OPPORTUNITIES

LIQUIDITY Strong balance sheet with no near-term debt maturities, ample liquidity and an enhanced capital structure STRATEGIC Strong acquisition history and credibility with significant runway and pipeline opportunities LEADERSHIP Deep industry experience and proven track record of successfully navigating economic cycles BUSINESS MODEL Disciplined cost management; flexible, high variable cost business model to drive operational efficiency and navigate through all economic conditions MARKET POSITION Market leader in our primary product lines; uniquely positioned for near- and long- term shift toward outdoor activities COMPELLING INVESTMENT THESIS CREATING LONG-TERM SHAREHOLDER VALUE 9Q2 2021 Earnings Presentation

Appendix

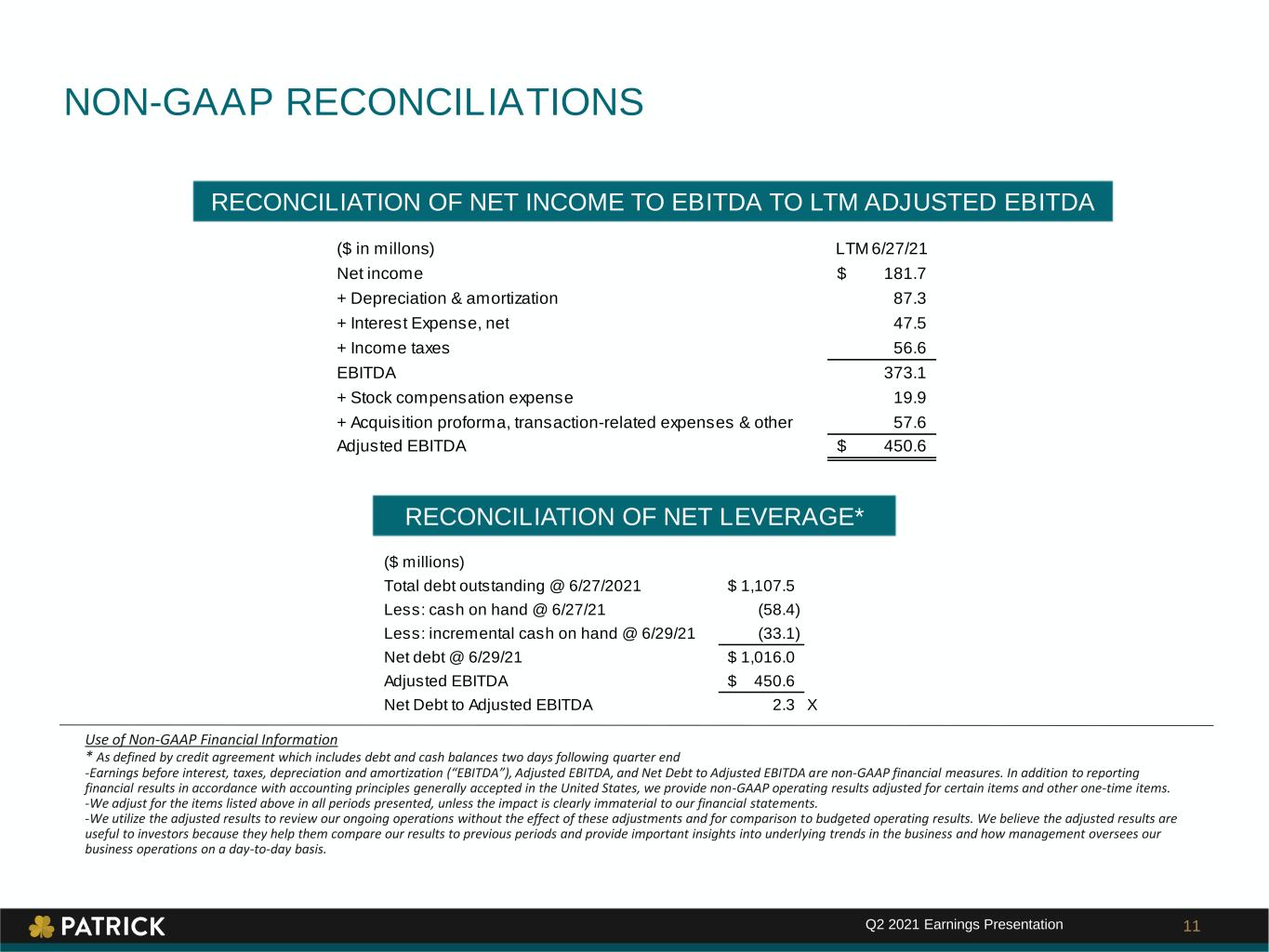

NON-GAAP RECONCILIATIONS Use of Non-GAAP Financial Information * As defined by credit agreement which includes debt and cash balances two days following quarter end -Earnings before interest, taxes, depreciation and amortization (“EBITDA”), Adjusted EBITDA, and Net Debt to Adjusted EBITDA are non-GAAP financial measures. In addition to reporting financial results in accordance with accounting principles generally accepted in the United States, we provide non-GAAP operating results adjusted for certain items and other one-time items. -We adjust for the items listed above in all periods presented, unless the impact is clearly immaterial to our financial statements. -We utilize the adjusted results to review our ongoing operations without the effect of these adjustments and for comparison to budgeted operating results. We believe the adjusted results are useful to investors because they help them compare our results to previous periods and provide important insights into underlying trends in the business and how management oversees our business operations on a day-to-day basis. RECONCILIATION OF NET INCOME TO EBITDA TO LTM ADJUSTED EBITDA RECONCILIATION OF NET LEVERAGE* ($ millions) Total debt outstanding @ 6/27/2021 1,107.5$ Less: cash on hand @ 6/27/21 (58.4) Less: incremental cash on hand @ 6/29/21 (33.1) Net debt @ 6/29/21 1,016.0$ Adjusted EBITDA 450.6$ Net Debt to Adjusted EBITDA 2.3 X ($ in millons) LTM 6/27/21 Net income 181.7$ + Depreciation & amortization 87.3 + Interest Expense, net 47.5 + Income taxes 56.6 EBITDA 373.1 + Stock compensation expense 19.9 + Acquisition proforma, transaction-related expenses & other 57.6 Adjusted EBITDA 450.6$ 11Q2 2021 Earnings Presentation