EX-99.2

Published on February 10, 2022

p 4th Quarter 2021 Earnings Presentation

FORWARD-LOOKING STATEMENTS This presentation contains certain statements related to future results, our intentions, beliefs and expectations or predictions for the future which are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from either historical or anticipated results depending on a variety of factors. These risks and uncertainties include, but are not limited to, the impact of the continuing financial and operational uncertainty due to the COVID-19 pandemic, including its impact on the overall economy, our sales, customers, operations, team members and suppliers. Further information concerning the Company and its business, including factors that potentially could materially affect the Company’s financial results, is contained in the Company’s filings with the Securities and Exchange Commission. This presentation includes market and industry data, forecasts and valuations that have been obtained from independent consultant reports, publicly available information, various industry publications and other published industry sources. Although we believe these sources are reliable, we have not independently verified the information and cannot make any representation as to the accuracy or completeness of such information. We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained in this presentation or to reflect any change in our expectations after the date of this presentation or any change in events, conditions or circumstances on which any statement is based. Use of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. These measures, the purposes for which management uses them, why management believes they are useful to investors, and a reconciliation to the most directly comparable GAAP financial measures can be found in the Appendix of this presentation. All references to profit measures and earnings per share on a comparable basis exclude items that affect comparability. 2Q4 2021 Earnings Presentation

VALUE PROPOSITION Experienced management team with an average of 27+ years of industry experience Leading market position in major product categories Deep customer relationships with 30+ years for top customers, including key design partners Strong Free Cash Flow (FCF) generation & FCF conversion Favorable demographic trends supporting growth across multiple end markets Diversified end market exposure with favorable secular trends PATRICK INDUSTRIES AT A GLANCE (NASDAQ: PATK) MANUFACTURE AND DISTRIBUTE QUALITY PRODUCTS THAT AIM TO EXCEED CUSTOMER EXPECTATIONS Key Component Manufacturer and Supplier to RV, Marine, Manufactured Housing and Industrial Markets KEY FACTS Headquartered Elkhart, Indiana Market-cap1 $1.6B Acquisitions Since 2010 63 Current States Presence 23 Employees ~11,000 Q4 2021 RESULTS Revenue $1.1B Net Income $61M Diluted EPS $2.62 Operating Cash Flows $105M 1 As of 02/04/2022 Leisure Lifestyle Housing & Industrial RV Marine MH Industrial Travel Trailer, Fifth Wheel, Folding Trailer, Class A, B, C Pontoon, Fiberglass, Ski & Wake, Aluminum Manufactured and Modular Housing, Modular Structure Resid. Housing, Comm’l Fixtures, Institutional Furniture 59% 16% 13% 12% LEADING AND DIVERSIFIED MARKET PLATFORM 3 % Net Sales (Q4 2021) Q4 2021 Earnings Presentation

1 Growth in Total Revenue of +49% Y/Y • RV / Marine driven by outdoor recreation trends, strong execution of nimble platform against continued lean dealer inventory and need for channel inventory replenishment • Industrial and MH driven by housing demand, low interest rates and shift from urban to suburban 2 Operating Margin Expansion of +30bps Y/Y • Efficient and flexible platform that leverages fixed costs • Automation and technology initiatives to help alleviate persisting commodity and labor pressures • Strong execution and partnership with customers 3 Continued Strategic Diversification of Marine and Aftermarket Presence + Increased Capex • Acquisitions of Wet Sounds, driving consumer connectivity in marine, powersports and home audio; and Williamsburg, enhancing marine and RV solutions • Increases in Capex to expand capacity, efficiency and automation 4 Continued Progress on ESG Initiatives • Ensuring well-being, health and safety of team members • Human Capital Management: Investments to attract, develop and retain top talent • Waste minimization and environmental initiatives Q4 2021 - QUARTERLY HIGHLIGHTS 4 STRONG EXECUTION AS REVENUE TRENDS CONTINUE Q4 2021 Earnings Presentation

$62 $95 Q4 2020 Q4 2021 $773 $1,147 Q4 2020 Q4 2021 NET SALES OPERATING INCOME & MARGIN DILUTED EPS CASH FLOW FROM OPERATIONS Q4 2021 FINANCIAL PERFORMANCE ($ millions except per share data) 5 8.0% 8.3% • 49% increase in Net Sales driven by increased demand in each of our four end markets • Gross margin improved through leveraging fixed costs through our team's operations and efficiencies in production • Operational performance supported by proactive securement of inventory for OEMs • Invested $21 million in capital expenditures to support automation, information technology and production and capacity initiatives $1.64 $2.62 Q4 2020 Q4 2021 $47 $105 Q4 2020 Q4 2021 Q4 2021 Earnings Presentation

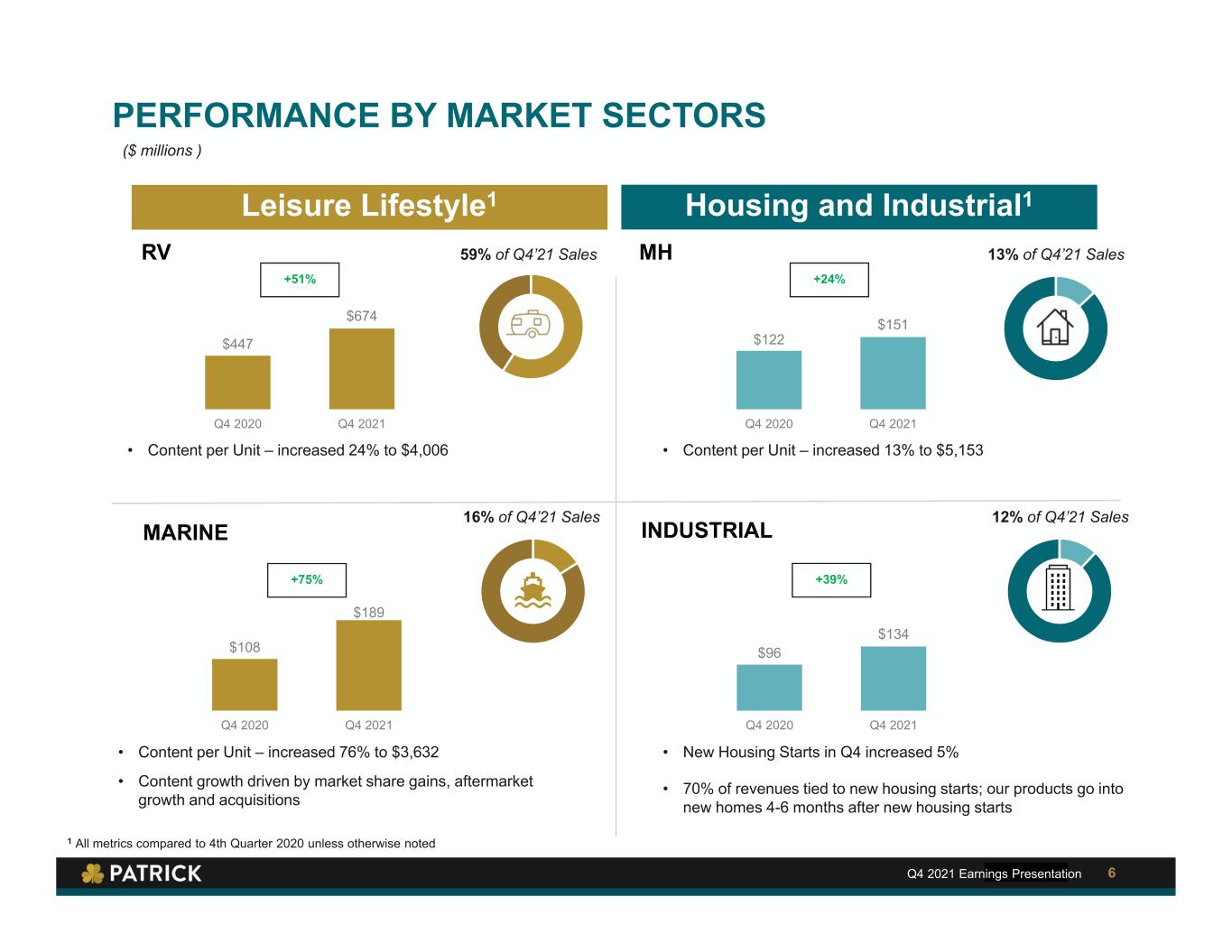

• Content per Unit – increased 24% to $4,006 ($ millions ) MARINE INDUSTRIAL PERFORMANCE BY MARKET SECTORS Leisure Lifestyle1 Housing and Industrial1 MH • Content per Unit – increased 76% to $3,632 • Content growth driven by market share gains, aftermarket growth and acquisitions • Content per Unit – increased 13% to $5,153 • New Housing Starts in Q4 increased 5% • 70% of revenues tied to new housing starts; our products go into new homes 4-6 months after new housing starts 1 All metrics compared to 4th Quarter 2020 unless otherwise noted 59% of Q4’21 Sales 6 RV +51% $447 $674 Q4 2020 Q4 2021 +75% $108 $189 Q4 2020 Q4 2021 +24% $122 $151 Q4 2020 Q4 2021 +39% $96 $134 Q4 2020 Q4 2021 16% of Q4’21 Sales 13% of Q4’21 Sales 12% of Q4’21 Sales Q4 2021 Earnings Presentation

Industry Trends • Long term demographic shift of RV owners • Dealer inventories at a healthier state compared to year end 2020 against record OEM backlogs • Traditional seasonal winter retail demand trends • Dealers preparing for primary selling months in 2022 • New buyer traffic and activity remain strong • Dealer inventories at low levels with retail units outpacing wholesale units • Durable OEM production level against record backlogs • Production expected to accelerate into end of 2023 • Demographic trends continue to support strong demand patterns for quality, affordable homes • Record OEM backlogs • Demand from big box retail continues as homeowners continue to spend on home upgrades and DIY projects • Limited inventory and low interest rates fueling demand for residential construction • Growth in multi-family housing starts Durable Secular Trends • Lifestyle changes of families looking to experience campgrounds and boating activities with friends and family continues to fuel demand • Urban-to-less-dense movement demand • Demographics, lower inventories and price points • Urban to suburban and rural relocation and vacation home demand • Low inventories and low interest rates MARKET SECTOR TRENDS 7 Retail Trends 2021 TTM 1 Company estimates supported by RVIA & NMMA RV1 MARINE1 MH INDUSTRIAL RV: Slight restocking to move to healthier dealer inventories MARINE: Retail channel depletion continues 600,200 564,400 Wholesale Retail 138,400 214,200 Wholesale Retail Q4 2021 Earnings Presentation 83 2

BALANCE SHEET, CASH FLOW AND LIQUIDITY 1 As of 12/31/21; 2 As defined by credit agreement DEBT STRUCTURE AND MATURITIES1 • $150M Term Loan ($144M o/s), pre-determined quarterly installments; balance due April 2026 • $550M ($135M o/s) Senior Secured Revolver, due April 2026 • $172.5M 1.00% Convertible Senior Notes, due February 2023 • $300M 7.50% Senior Notes, due October 2027 • $259M 1.75% Convertible Senior Notes, due December 2028 • $350M 4.75% Senior Notes, due April 2029 LIQUIDITY1 • Available liquidity, including cash on hand - $532.4M STRONG BALANCE SHEET TO SUPPORT INVESTMENTS AND PURSUE ATTRACTIVE GROWTH OPPORTUNITIES 8Q4 2021 Earnings Presentation NET LEVERAGE2 ($ millions) Total Debt Outstanding $ 1,360.6 Less: Cash on Hand1 (122.8) Net Debt $ 1,237.8 LTM Adj. EBITDA $ 530.8 Net Debt to Adj. EBITDA 2.3x LIQUIDITY ($ millions) Total Revolver Credit Capacity $ 550.0 Less: Total Revolver Used (including outstanding letters of credit) (140.4) Unused Credit Capacity $ 409.6 Add: Cash on Hand 122.8 Total Available Liquidity $ 532.4 COVENANTS AND RATIOS1 • Consolidated Net Leverage Ratio – 2.3x • Consolidated Secured Net Leverage Ratio – 0.29x versus 2.75x maximum • Consolidated Fixed Charge Coverage Ratio – 5.83x vs. minimum 1.50x

STRATEGIC ACQUISITIONS Execute on strategic acquisitions in primary markets INNOVATION New product development and product line extensions INDUSTRY GROWTH BUSINESS MODEL Flexible, high variable cost business model to drive operational efficiency and navigate through all economic conditions MARKET POSITION COMPELLING INVESTMENT THESIS CREATING LONG‐TERM SHAREHOLDER VALUE 9 Market leader in our primary product lines; Market presence propels us to cross-pollinate sales across customers and end markets Long-term secular growth across all end markets & favorable demographics Q4 2021 Earnings Presentation

Appendix

($ in millions) LTM 12/31/2021 Net Income $ 224.9 +Depreciation & Amortization 104.8 + Interest Expense, net 57.9 + Income Taxes 68.9 EBITDA $ 456.5 + Stock Compensation Expense 22.9 + Acquisition proforma, transaction-related expenses & other 51.4 Adjusted EBITDA $ 530.8 NON-GAAP RECONCILIATIONS Use of Non-GAAP Financial Information * As defined by credit agreement which includes debt and cash balances -Earnings before interest, taxes, depreciation and amortization (“EBITDA”), Adjusted EBITDA, and Net Debt to Adjusted EBITDA are non-GAAP financial measures. In addition to reporting financial results in accordance with accounting principles generally accepted in the United States, we provide non-GAAP operating results adjusted for certain items and other one-time items. -We adjust for the items listed above in all periods presented, unless the impact is clearly immaterial to our financial statements. -We utilize the adjusted results to review our ongoing operations without the effect of these adjustments and for comparison to budgeted operating results. We believe the adjusted results are useful to investors because they help them compare our results to previous periods and provide important insights into underlying trends in the business and how management oversees our business operations on a day-to-day basis. RECONCILIATION OF NET INCOME TO EBITDA TO LTM ADJUSTED EBITDA RECONCILIATION OF NET LEVERAGE* 11 ($ in millions) Total debt outstanding @ 12/31/2021 $ 1,360.6 Less: cash on hand @ 12/31/2021 (122.8) Net debt @ 12/31/2021 $ 1,237.8 Adjusted EBITDA $ 530.8 Net debt to Adjusted EBITDA 2.3x Q4 2021 Earnings Presentation