EX-99.2

Published on April 27, 2023

April 27, 2023 Q1 2023 EARNINGS PRESENTATION

This presentation contains certain statements related to future results, our intentions, beliefs and expectations or predictions for the future which are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from either historical or anticipated results depending on a variety of factors. These risks and uncertainties include, but are not limited to, the impact of the continuing financial and operational uncertainty due to the COVID-19 pandemic, including its impact on the overall economy, our sales, customers, operations, team members and suppliers. Further information concerning the Company and its business, including factors that potentially could materially affect the Company’s financial results, is contained in the Company’s filings with the Securities and Exchange Commission. This presentation includes market and industry data, forecasts and valuations that have been obtained from independent consultant reports, publicly available information, various industry publications and other published industry sources. Although we believe these sources are reliable, we have not independently verified the information and cannot make any representation as to the accuracy or completeness of such information. We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained in this presentation or to reflect any change in our expectations after the date of this presentation or any change in events, conditions or circumstances on which any statement is based. USE OF NON-GAAP FINANCIAL MEASURES This presentation contains non-GAAP financial measures. These measures, the purposes for which management uses them, why management believes they are useful to investors, and a reconciliation to the most directly comparable GAAP financial measures can be found in the Appendix of this presentation. All references to profit measures and earnings per share on a comparable basis exclude items that affect comparability. 2

• Marine revenue growth partially offset revenue declines in RV and Housing end markets • RV OEMs reduced production to better align dealer inventory with end user demand • Marine inventory continued to rebuild as estimated powerboat shipments increased year-over-year • Housing revenue declined due to industry headwinds, persistent inflation and higher rates • Long-term demand trends in Leisure Lifestyle and Housing remain positive despite near-term uncertainty REVENUE DOWN 33% Y/Y ON REDUCED RV OEM PRODUCTION Diversified Portfolio Improves Stability Despite Macroeconomic and Industry Headwinds • Growing portfolio of higher margin products in the marine market, partially offset lower RV volumes • Leveraging variable cost structure in line with lower unit volumes • Improved efficiency through automation and technology and growing offering of proprietary products promotes long-term margin expansion STABLE GROSS MARGIN AMID INDUSTRY VOLUME RECALIBRATION • Published our inaugural sustainability report in December 2022 • Our efforts support the main pillars of our ESG mission: Empowering People, Caring for Our Planet, and Living by Our Policies • We prioritize transparency and accuracy in our reporting as we continue to scale our sustainability data collection framework OUR ESG INITIATIVES • Monetization of inventory mitigated by the decrease in net income and seasonal receivables collection • Investing to increase automation, improve efficiency, and expand capabilities • Strong available liquidity, favorable debt structure and low leverage allow us to remain opportunistic and forward-leaning as we look for attractive acquisition opportunities • Returning cash to shareholders through $0.45/share dividend and opportunistic share repurchases IMPROVED CASH FLOW PERFORMANCE DESPITE ECONOMIC UNCERTAINTY 3

28% of Q1’23 Sales Revenue of $276M Revenue of $257M Industry Shipments1 Housing Starts (Y/Y) CPU3 of $5,349 CPU3 of $5,266 MH CPU3 of $6,353 Industry Shipments2 Manufactured Housing (“MH”) Industry Shipments2 4 (55%) +22% (54%) +25% +14% +27% 31% of Q1’23 Sales41% of Q1’23 Sales Revenue of $367M (14%) (28%) (18%) +16% 1 Data published by RV Industry Association (“RVIA”) I 2 Company estimates based on National Marine Manufacturers Association (“NMMA”), Manufactured Housing Institute (“MHI”) & SSI I 3CPU = Content per wholesale unit for the trailing twelve months

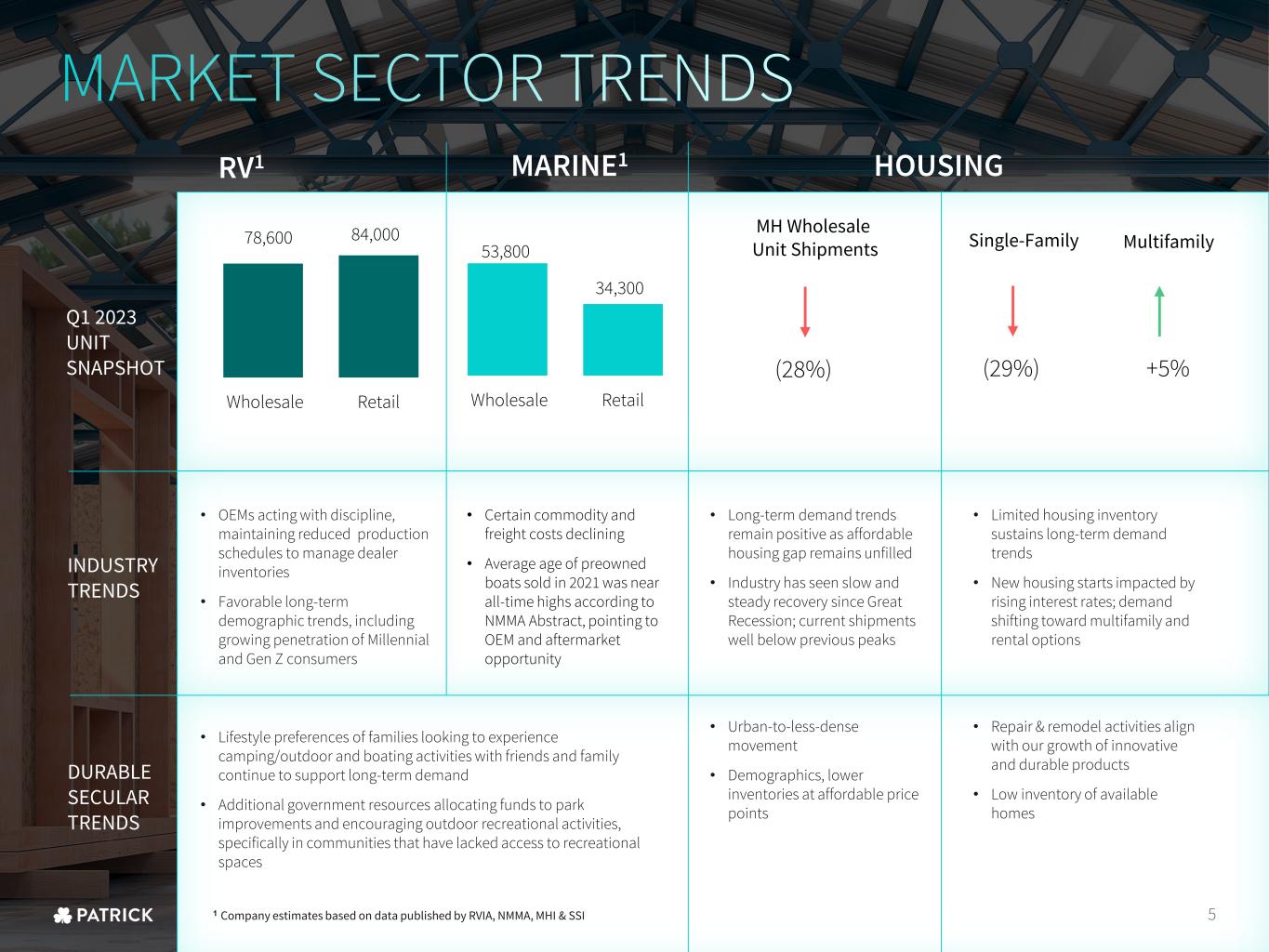

MH BASKET COMPANIES2: PATK: (29%) 5 78,600 84,000 Wholesale Retail 53,800 34,300 Wholesale Retail • OEMs acting with discipline, maintaining reduced production schedules to manage dealer inventories • Favorable long-term demographic trends, including growing penetration of Millennial and Gen Z consumers • Certain commodity and freight costs declining • Average age of preowned boats sold in 2021 was near all-time highs according to NMMA Abstract, pointing to OEM and aftermarket opportunity • Long-term demand trends remain positive as affordable housing gap remains unfilled • Industry has seen slow and steady recovery since Great Recession; current shipments well below previous peaks • Limited housing inventory sustains long-term demand trends • New housing starts impacted by rising interest rates; demand shifting toward multifamily and rental options • Lifestyle preferences of families looking to experience camping/outdoor and boating activities with friends and family continue to support long-term demand • Additional government resources allocating funds to park improvements and encouraging outdoor recreational activities, specifically in communities that have lacked access to recreational spaces • Urban-to-less-dense movement • Demographics, lower inventories at affordable price points • Repair & remodel activities align with our growth of innovative and durable products • Low inventory of available homes MultifamilySingle-Family RV1 MARINE1 HOUSING Q1 2023 UNIT SNAPSHOT INDUSTRY TRENDS DURABLE SECULAR TRENDS 1 Company estimates based on data published by RVIA, NMMA, MHI & SSI MH Wholesale Unit Shipments +5%(28%)

Q1 2022 Q1 2023 RV Marine Housing $4.54 $1.35 Q1 2022 Q1 2023 $162 $56 Q1 2022 Q1 2023 12.1% 6.2% • Net Sales declined 33% as Marine revenue growth partially mitigated a 55% reduction in RV revenue and 14% reduction in Housing revenue • Gross margin remained stable due to improved mix of Marine revenue despite sharp RV industry volume decline • Operating margin results driven by the impact to gross margin mentioned above, investments in human capital, continued execution of our IT transformation and an increase in amortization of intangible assets • Invested $20M in purchases of property, plant and equipment to support automation, production efficiency initiatives, and information technology 6 ($ millions except per share data) DILUTED EPSOPERATING INCOME & MARGINNET SALES & GROSS MARGIN 22.0% 21.6% $900 $1,342

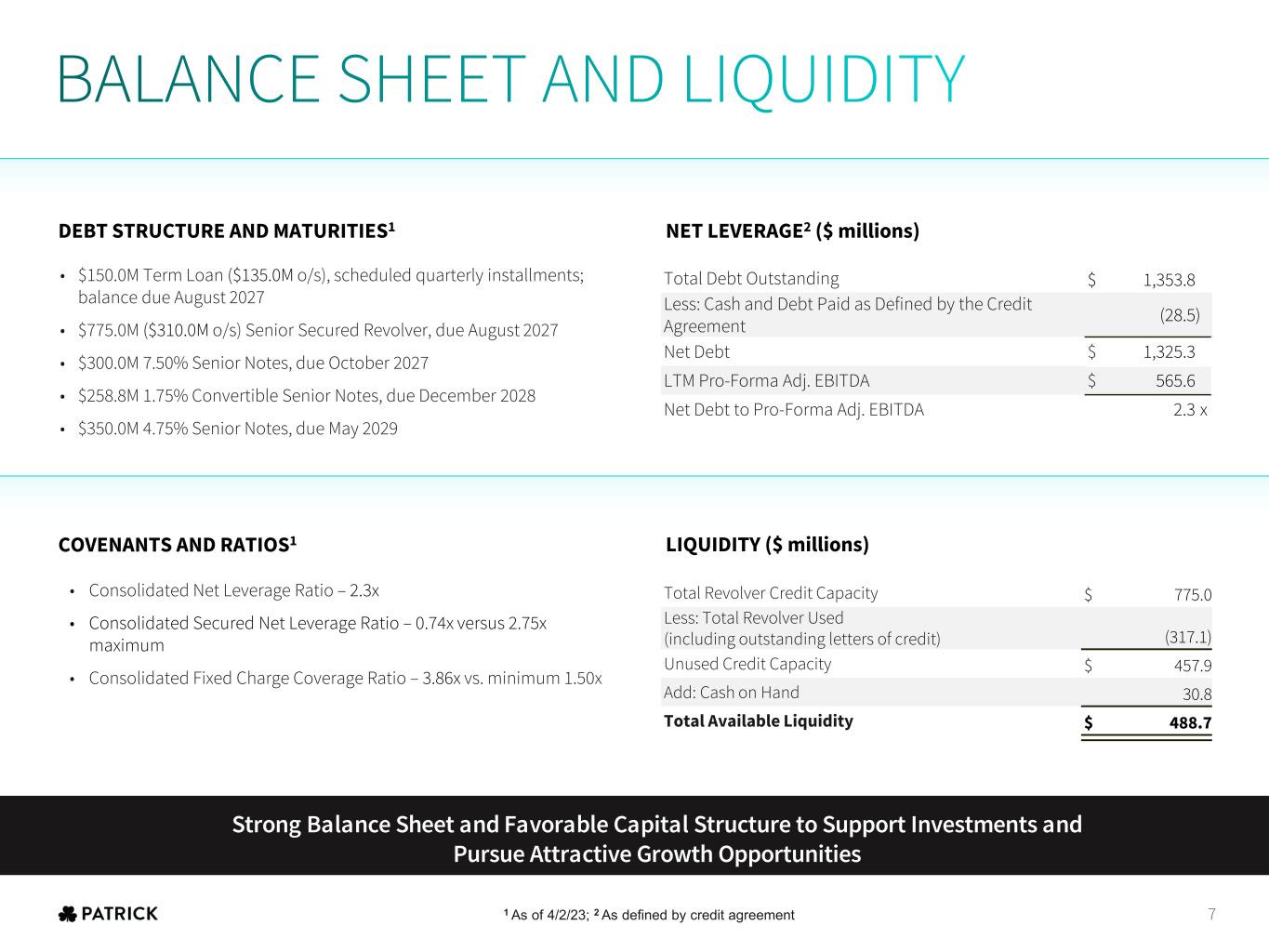

• $150.0M Term Loan ($135.0M o/s), scheduled quarterly installments; balance due August 2027 • $775.0M ($310.0M o/s) Senior Secured Revolver, due August 2027 • $300.0M 7.50% Senior Notes, due October 2027 • $258.8M 1.75% Convertible Senior Notes, due December 2028 • $350.0M 4.75% Senior Notes, due May 2029 Total Debt Outstanding $ 1,353.8 Less: Cash and Debt Paid as Defined by the Credit Agreement (28.5) Net Debt $ 1,325.3 LTM Pro-Forma Adj. EBITDA $ 565.6 Net Debt to Pro-Forma Adj. EBITDA 2.3 x Total Revolver Credit Capacity $ 775.0 Less: Total Revolver Used (including outstanding letters of credit) (317.1) Unused Credit Capacity $ 457.9 Add: Cash on Hand 30.8 Total Available Liquidity $ 488.7 • Consolidated Net Leverage Ratio – 2.3x • Consolidated Secured Net Leverage Ratio – 0.74x versus 2.75x maximum • Consolidated Fixed Charge Coverage Ratio – 3.86x vs. minimum 1.50x COVENANTS AND RATIOS1 DEBT STRUCTURE AND MATURITIES1 NET LEVERAGE2 ($ millions) LIQUIDITY ($ millions) 1 As of 4/2/23; 2 As defined by credit agreement 7 Strong Balance Sheet and Favorable Capital Structure to Support Investments and Pursue Attractive Growth Opportunities

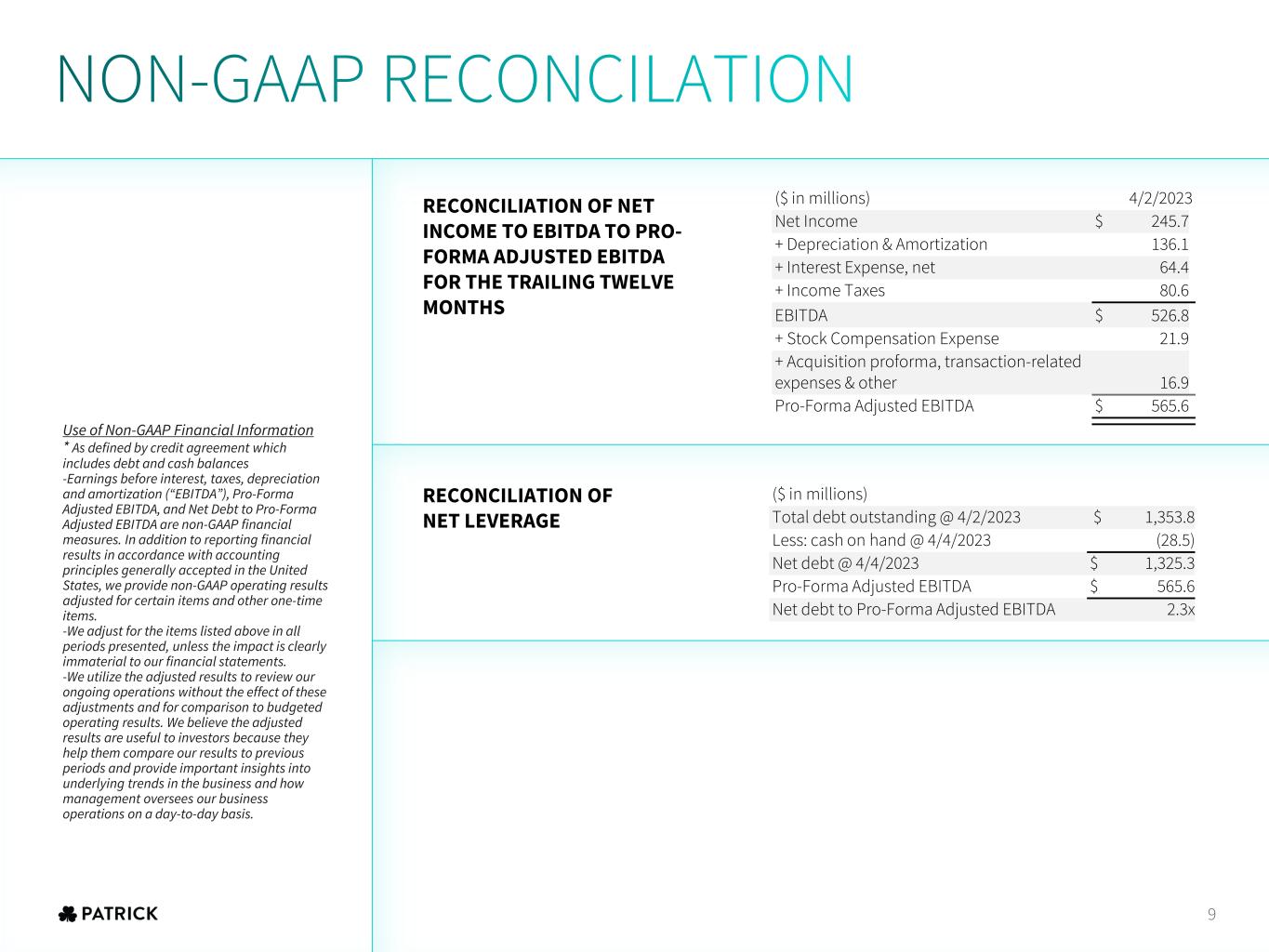

RECONCILIATION OF NET LEVERAGE Use of Non-GAAP Financial Information * As defined by credit agreement which includes debt and cash balances -Earnings before interest, taxes, depreciation and amortization (“EBITDA”), Pro-Forma Adjusted EBITDA, and Net Debt to Pro-Forma Adjusted EBITDA are non-GAAP financial measures. In addition to reporting financial results in accordance with accounting principles generally accepted in the United States, we provide non-GAAP operating results adjusted for certain items and other one-time items. -We adjust for the items listed above in all periods presented, unless the impact is clearly immaterial to our financial statements. -We utilize the adjusted results to review our ongoing operations without the effect of these adjustments and for comparison to budgeted operating results. We believe the adjusted results are useful to investors because they help them compare our results to previous periods and provide important insights into underlying trends in the business and how management oversees our business operations on a day-to-day basis. ($ in millions) 4/2/2023 Net Income $ 245.7 + Depreciation & Amortization 136.1 + Interest Expense, net 64.4 + Income Taxes 80.6 EBITDA $ 526.8 + Stock Compensation Expense 21.9 + Acquisition proforma, transaction-related expenses & other 16.9 Pro-Forma Adjusted EBITDA $ 565.6 ($ in millions) Total debt outstanding @ 4/2/2023 $ 1,353.8 Less: cash on hand @ 4/4/2023 (28.5) Net debt @ 4/4/2023 $ 1,325.3 Pro-Forma Adjusted EBITDA $ 565.6 Net debt to Pro-Forma Adjusted EBITDA 2.3x RECONCILIATION OF NET INCOME TO EBITDA TO PRO- FORMA ADJUSTED EBITDA FOR THE TRAILING TWELVE MONTHS 9