EX-99.2

Published on October 26, 2023

October 26, 2023 Q3 2023 EARNINGS PRESENTATION

This presentation contains certain statements related to future results, our intentions, beliefs and expectations or predictions for the future which are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from either historical or anticipated results depending on a variety of factors. These risks and uncertainties include, but are not limited to, the impact of the continuing financial and operational uncertainty due to public health emergencies or pandemics, such as the COVID-19 pandemic, including its impact on the overall economy, our sales, customers, operations, team members and suppliers. Further information concerning the Company and its business, including factors that potentially could materially affect the Company’s financial results, is contained in the Company’s filings with the Securities and Exchange Commission. This presentation includes market and industry data, forecasts and valuations that have been obtained from independent consultant reports, publicly available information, various industry publications and other published industry sources. Although we believe these sources are reliable, we have not independently verified the information and cannot make any representation as to the accuracy or completeness of such information. We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained in this presentation or to reflect any change in our expectations after the date of this presentation or any change in events, conditions or circumstances on which any statement is based. USE OF NON-GAAP FINANCIAL MEASURES This presentation contains non-GAAP financial measures. These measures, the purposes for which management uses them, why management believes they are useful to investors, and a reconciliation to the most directly comparable GAAP financial measures can be found in the Appendix of this presentation. All references to profit measures and earnings per share on a comparable basis exclude items that affect comparability. 2

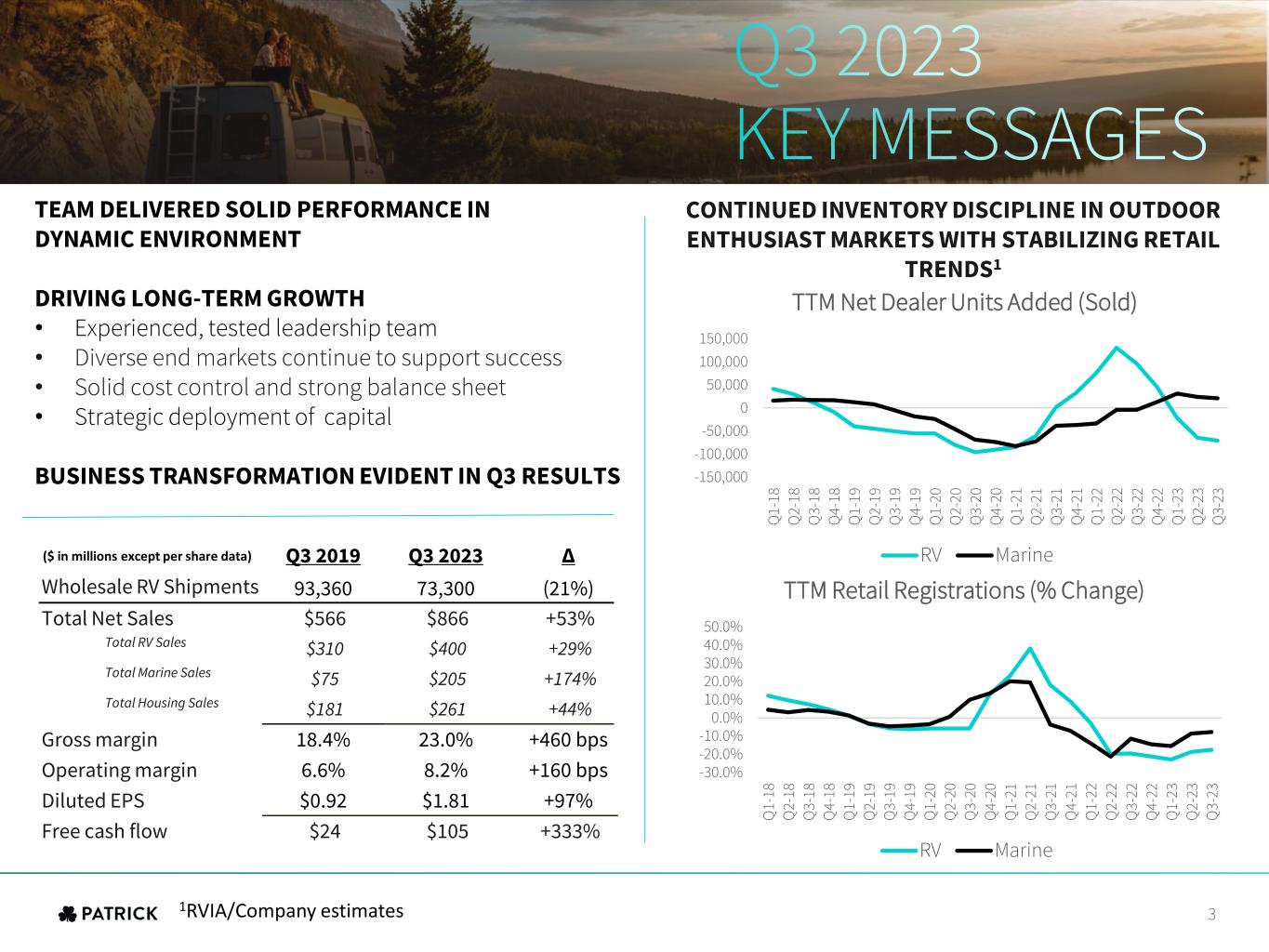

TEAM DELIVERED SOLID PERFORMANCE IN DYNAMIC ENVIRONMENT DRIVING LONG-TERM GROWTH • Experienced, tested leadership team • Diverse end markets continue to support success • Solid cost control and strong balance sheet • Strategic deployment of capital BUSINESS TRANSFORMATION EVIDENT IN Q3 RESULTS 3 Q3 2019 Q3 2023 Δ Wholesale RV Shipments 93,360 73,300 (21%) Total Net Sales $566 $866 +53% Total RV Sales $310 $400 +29% Total Marine Sales $75 $205 +174% Total Housing Sales $181 $261 +44% Gross margin 18.4% 23.0% +460 bps Operating margin 6.6% 8.2% +160 bps Diluted EPS $0.92 $1.81 +97% Free cash flow $24 $105 +333% CONTINUED INVENTORY DISCIPLINE IN OUTDOOR ENTHUSIAST MARKETS WITH STABILIZING RETAIL TRENDS1 ($ in millions except per share data) 1RVIA/Company estimates -150,000 -100,000 -50,000 0 50,000 100,000 150,000 Q 1- 18 Q 2- 18 Q 3- 18 Q 4- 18 Q 1- 19 Q 2- 19 Q 3- 19 Q 4- 19 Q 1- 20 Q 2- 20 Q 3- 20 Q 4- 20 Q 1- 21 Q 2- 21 Q 3- 21 Q 4- 21 Q 1- 22 Q 2- 22 Q 3- 22 Q 4- 22 Q 1- 23 Q 2- 23 Q 3- 23 TTM Net Dealer Units Added (Sold) RV Marine -30.0% -20.0% -10.0% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% Q 1- 18 Q 2- 18 Q 3- 18 Q 4- 18 Q 1- 19 Q 2- 19 Q 3- 19 Q 4- 19 Q 1- 20 Q 2- 20 Q 3- 20 Q 4- 20 Q 1- 21 Q 2- 21 Q 3- 21 Q 4- 21 Q 1- 22 Q 2- 22 Q 3- 22 Q 4- 22 Q 1- 23 Q 2- 23 Q 3- 23 TTM Retail Registrations (% Change) RV Marine

• RV retail registrations continue to outpace declining wholesale shipments, implying continued dealer inventory reductions • Marine OEMs remained disciplined as inventories reached equilibrium at the end of Q2’23 • Housing revenue declined as consumers continue to adjust to inflationary pressures and higher interest rates REVENUE DOWN 22% Y/Y AS SHIPMENTS DECREASED ACROSS END MARKETS RESILIENT MARGIN PERFORMANCE WITH CONTINUED STRONG CASH FLOW GENERATION • Repaid $112 million of long-term debt in the third quarter, including $110 million on revolving credit facility • Our acquisition pipeline remains full of companies with strong management teams and solid growth characteristics • Investing in automation and innovation to improve operational efficiency WE REMAIN POISED TO DILIGENTLY DEPLOY CAPITAL AND SEIZE OPPPORTUNITIES • Executing $100 million of annualized cost reductions at the organization level • Operating margin declined 10 bps despite a 22% reduction in quarterly sales • Working capital monetization helping drive significant operating and free cash flow despite lower net income • With improved cost structure, solid balance sheet, and committed team, we are focused on our ongoing continuous improvement initiatives, along with capitalizing on long-term growth opportunities DIVERSE PORTFOLIO AND STRINGENT COST MANAGEMENT DROVE RESILIENT OPERATING MARGIN 4

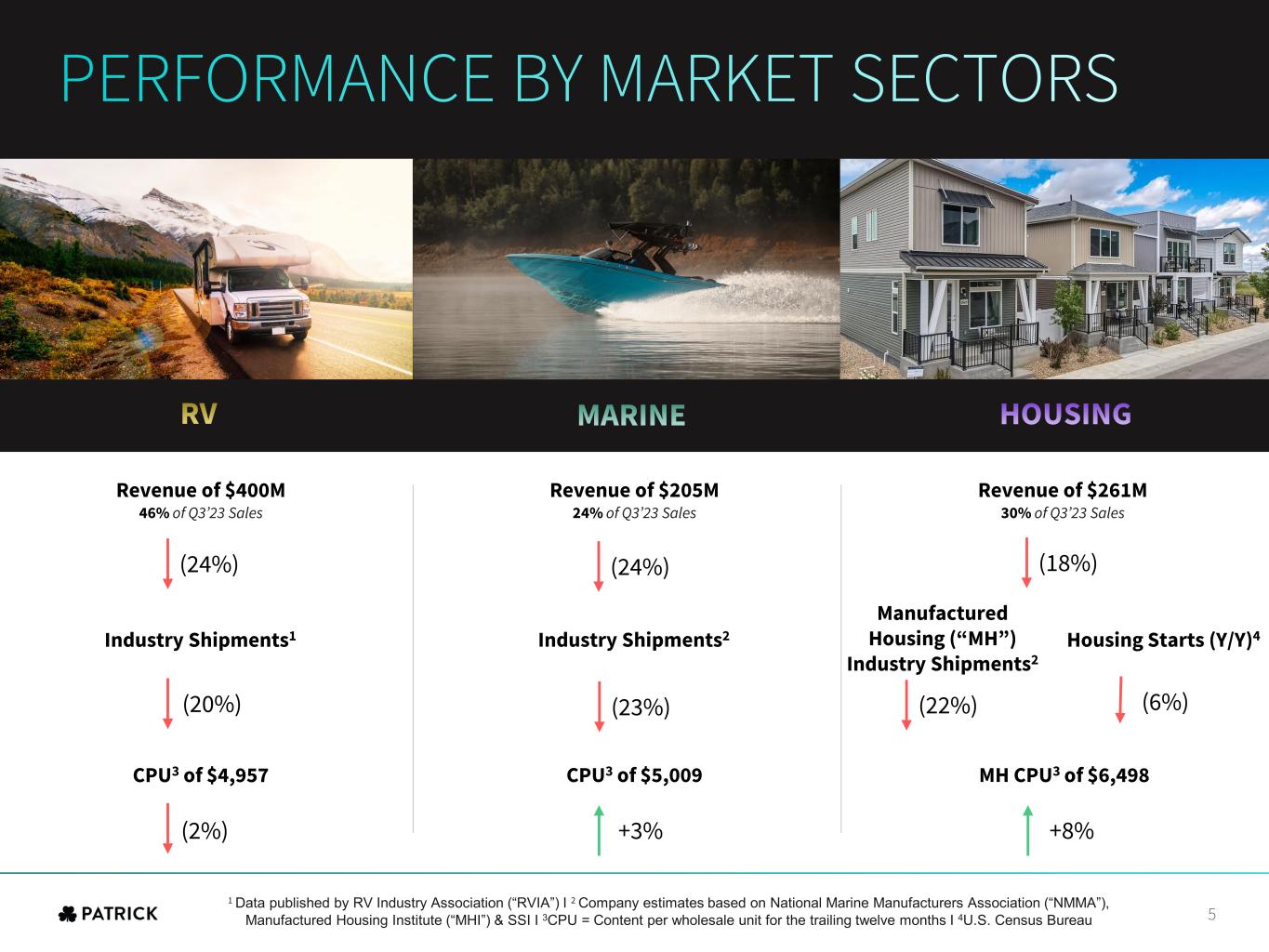

(6%)(20%) 30% of Q3’23 Sales Revenue of $205M Revenue of $261M Industry Shipments1 Housing Starts (Y/Y)4 CPU3 of $4,957 CPU3 of $5,009 MH CPU3 of $6,498 Industry Shipments2 Manufactured Housing (“MH”) Industry Shipments2 5 (24%) (2%) +3% 24% of Q3’23 Sales46% of Q3’23 Sales Revenue of $400M (22%) +8% 1 Data published by RV Industry Association (“RVIA”) I 2 Company estimates based on National Marine Manufacturers Association (“NMMA”), Manufactured Housing Institute (“MHI”) & SSI I 3CPU = Content per wholesale unit for the trailing twelve months I 4U.S. Census Bureau (24%) (18%) (23%)

MH BASKET COMPANIES2: PATK: +7% 6 • OEMs maintaining production discipline to manage dealer inventory levels • We estimate dealer inventory remains low relative to historical weeks-on-hand metrics • Dealers and OEMs are collaborating on how best to manage model year change-over • Marine inventory at normalized levels for most categories • OEMs maintaining disciplined production schedules to reflect consumers and dealers impacted by higher interest rates • MH dealer-level inventory back to historical seasonal trends • OEM backlogs returning to normalized levels • Consumers continue to adjust to higher interest rate environment • Long-term demand for construction continues to be supported by low inventory of affordable housing • New construction importance remains elevated given lack of inventory with homeowners locked into low rates and unwilling to re-finance at current rates • Lifestyle preferences of families looking to experience camping/outdoor and boating activities with friends and family continue to support long- term demand • An increase in Millennial and Gen-Z outdoor enthusiasts support favorable, long-term market trends • Additional government resources allocating funds to park improvements and encouraging outdoor recreational activities, specifically in communities that have lacked access to recreational spaces • Limited inventory of cost- effective, affordable homes • MH continues to retain significant price point advantage vs. site-built homes • Annual OEM shipments remain well below long- term historical average • Low inventory of homes on secondary market • High mortgage rates and persistent inflation contribute to demand for affordable housing • Innovative and durable products continue to support demand in the repair and remodel space Multifamily 2Single-Family 2 RV1 MARINE1 HOUSING1 Q3 2023 UNIT SNAPSHOT INDUSTRY TRENDS DURABLE SECULAR TRENDS 1 Company estimates based on data published by RVIA, NMMA, MHI & SSI I 2U.S. Census Bureau MH Wholesale Unit Shipments 1 (28%)(22%) 73,300 105,800 Wholesale Retail 37,700 48,600 Wholesale Retail

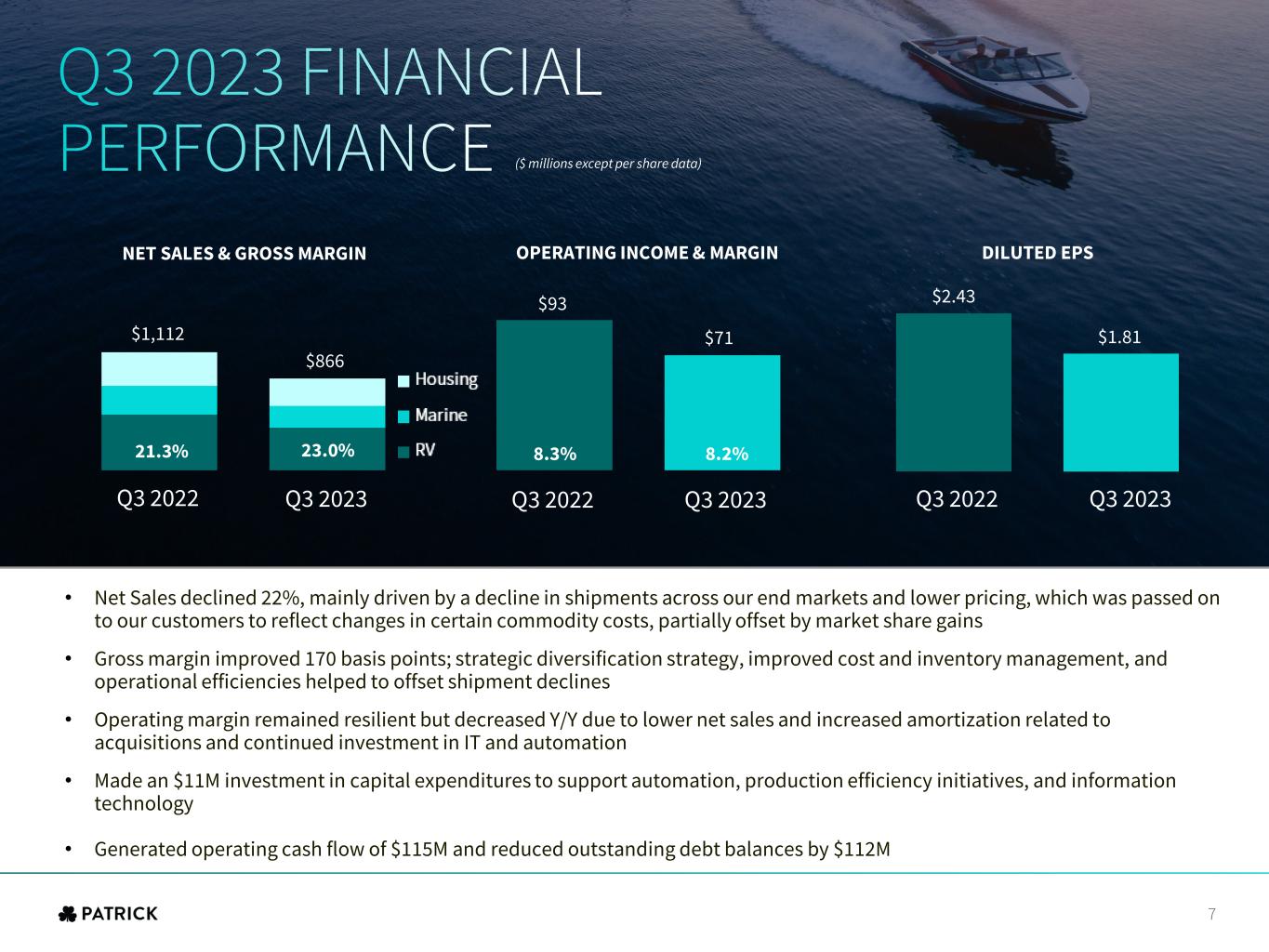

$2.43 $1.81 $93 $71 8.3% 8.2% • Net Sales declined 22%, mainly driven by a decline in shipments across our end markets and lower pricing, which was passed on to our customers to reflect changes in certain commodity costs, partially offset by market share gains • Gross margin improved 170 basis points; strategic diversification strategy, improved cost and inventory management, and operational efficiencies helped to offset shipment declines • Operating margin remained resilient but decreased Y/Y due to lower net sales and increased amortization related to acquisitions and continued investment in IT and automation • Made an $11M investment in capital expenditures to support automation, production efficiency initiatives, and information technology • Generated operating cash flow of $115M and reduced outstanding debt balances by $112M 7 ($ millions except per share data) DILUTED EPSOPERATING INCOME & MARGINNET SALES & GROSS MARGIN Q3 2022 Q3 2022 Q3 2023 Q3 2022 Q3 2023Q3 2023 21.3% 23.0% $866 $1,112

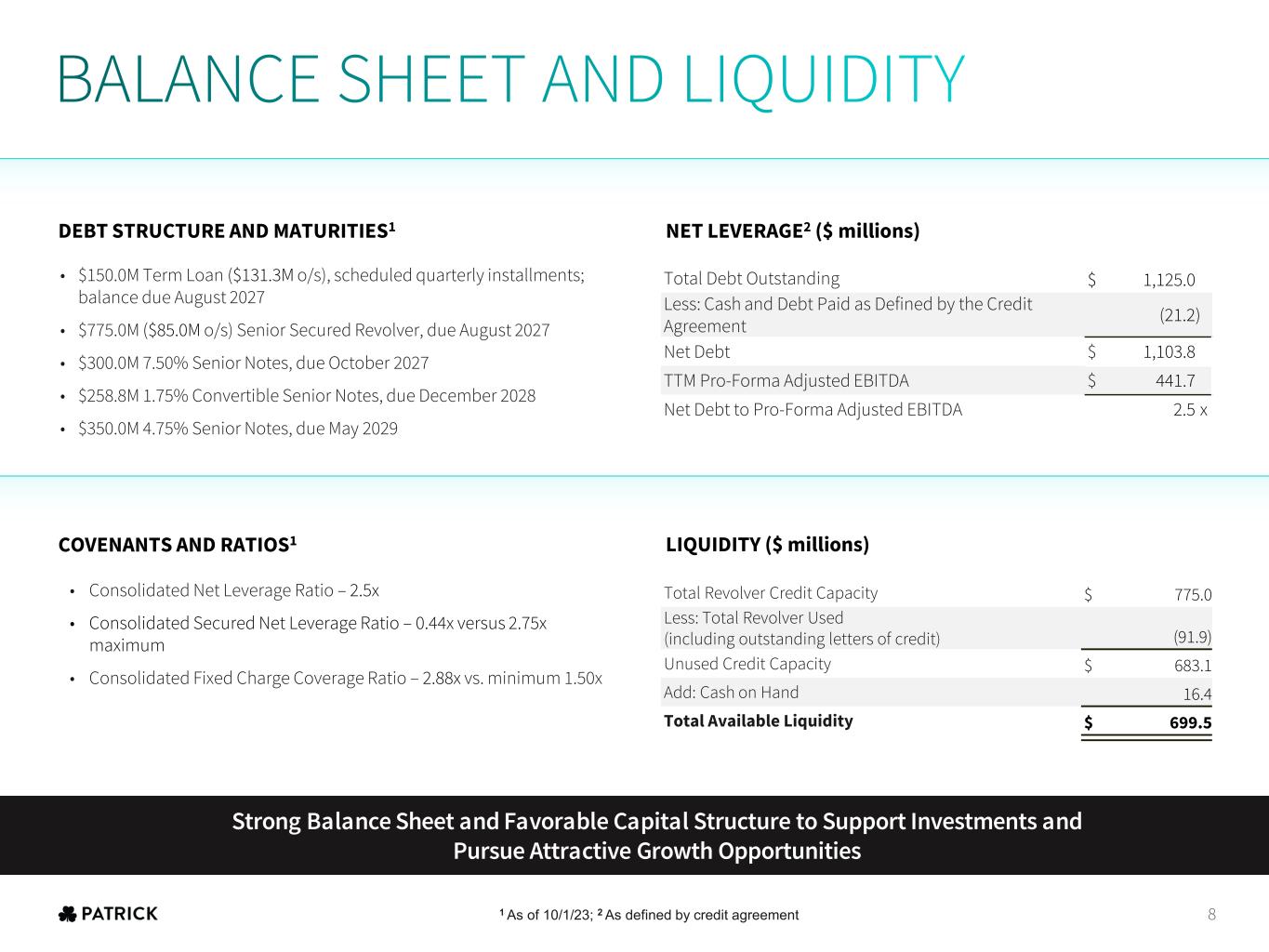

• $150.0M Term Loan ($131.3M o/s), scheduled quarterly installments; balance due August 2027 • $775.0M ($85.0M o/s) Senior Secured Revolver, due August 2027 • $300.0M 7.50% Senior Notes, due October 2027 • $258.8M 1.75% Convertible Senior Notes, due December 2028 • $350.0M 4.75% Senior Notes, due May 2029 Total Debt Outstanding $ 1,125.0 Less: Cash and Debt Paid as Defined by the Credit Agreement (21.2) Net Debt $ 1,103.8 TTM Pro-Forma Adjusted EBITDA $ 441.7 Net Debt to Pro-Forma Adjusted EBITDA 2.5 x Total Revolver Credit Capacity $ 775.0 Less: Total Revolver Used (including outstanding letters of credit) (91.9) Unused Credit Capacity $ 683.1 Add: Cash on Hand 16.4 Total Available Liquidity $ 699.5 • Consolidated Net Leverage Ratio – 2.5x • Consolidated Secured Net Leverage Ratio – 0.44x versus 2.75x maximum • Consolidated Fixed Charge Coverage Ratio – 2.88x vs. minimum 1.50x COVENANTS AND RATIOS1 DEBT STRUCTURE AND MATURITIES1 NET LEVERAGE2 ($ millions) LIQUIDITY ($ millions) 1 As of 10/1/23; 2 As defined by credit agreement 8 Strong Balance Sheet and Favorable Capital Structure to Support Investments and Pursue Attractive Growth Opportunities

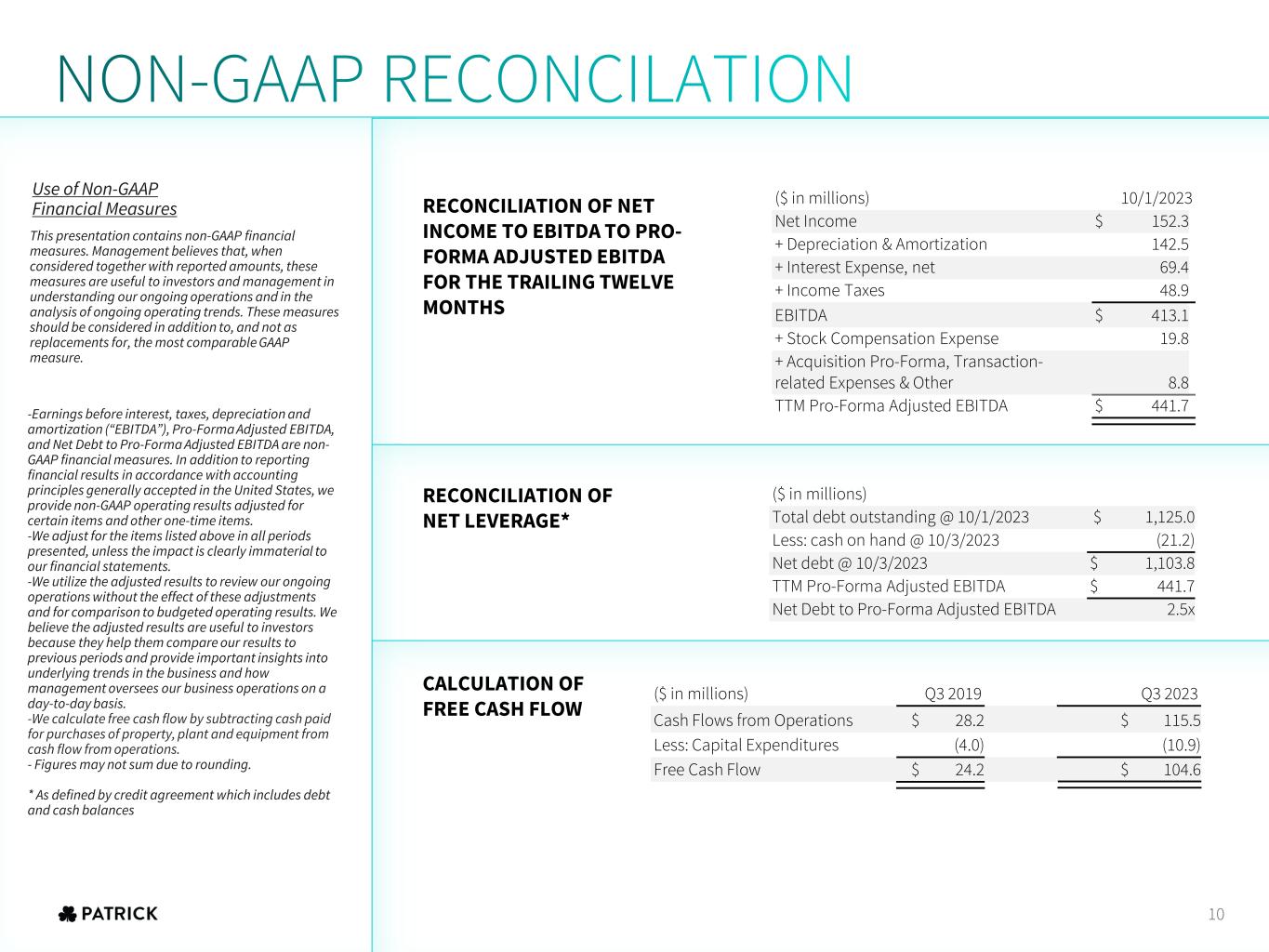

RECONCILIATION OF NET LEVERAGE* ($ in millions) 10/1/2023 Net Income $ 152.3 + Depreciation & Amortization 142.5 + Interest Expense, net 69.4 + Income Taxes 48.9 EBITDA $ 413.1 + Stock Compensation Expense 19.8 + Acquisition Pro-Forma, Transaction- related Expenses & Other 8.8 TTM Pro-Forma Adjusted EBITDA $ 441.7 ($ in millions) Total debt outstanding @ 10/1/2023 $ 1,125.0 Less: cash on hand @ 10/3/2023 (21.2) Net debt @ 10/3/2023 $ 1,103.8 TTM Pro-Forma Adjusted EBITDA $ 441.7 Net Debt to Pro-Forma Adjusted EBITDA 2.5x RECONCILIATION OF NET INCOME TO EBITDA TO PRO- FORMA ADJUSTED EBITDA FOR THE TRAILING TWELVE MONTHS 10 -Earnings before interest, taxes, depreciation and amortization (“EBITDA”), Pro-Forma Adjusted EBITDA, and Net Debt to Pro-Forma Adjusted EBITDA are non- GAAP financial measures. In addition to reporting financial results in accordance with accounting principles generally accepted in the United States, we provide non-GAAP operating results adjusted for certain items and other one-time items. -We adjust for the items listed above in all periods presented, unless the impact is clearly immaterial to our financial statements. -We utilize the adjusted results to review our ongoing operations without the effect of these adjustments and for comparison to budgeted operating results. We believe the adjusted results are useful to investors because they help them compare our results to previous periods and provide important insights into underlying trends in the business and how management oversees our business operations on a day-to-day basis. -We calculate free cash flow by subtracting cash paid for purchases of property, plant and equipment from cash flow from operations. - Figures may not sum due to rounding. * As defined by credit agreement which includes debt and cash balances Use of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. Management believes that, when considered together with reported amounts, these measures are useful to investors and management in understanding our ongoing operations and in the analysis of ongoing operating trends. These measures should be considered in addition to, and not as replacements for, the most comparable GAAP measure. CALCULATION OF FREE CASH FLOW ($ in millions) Q3 2019 Q3 2023 Cash Flows from Operations $ 28.2 $ 115.5 Less: Capital Expenditures (4.0) (10.9) Free Cash Flow $ 24.2 $ 104.6