EX-99.2

Published on March 11, 2024

INVESTOR PRESENTATION March 2024

This presentation includes contains statements that are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are generally identified by words such as “estimates,” “guidance,” “expects,” ”anticipates,” “intends,” “plans,” “believes,” “seeks” and similar expressions. Forward- looking statements include information with respect to financial condition, results of operations, business strategies, operating efficiencies or synergies, competitive position, industry projections, growth opportunities, acquisitions, plans and objectives of management, markets for the common stock and other matters. These forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from either historical or anticipated results depending on a variety of factors. These risks and uncertainties include, in addition to other matters described in this presentation, the impacts of future pandemics, geopolitical tensions or natural disaster, on the overall economy, our sales, customers, operations, team members and suppliers. Further information concerning the Company and its business, including risk factors that potentially could materially affect the Company’s financial results are discussed under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the Securities and Exchange Commission on February 29, 2024 We caution readers not to place undue reliance on forward-looking statements. Forward- looking statements speak only as of the date they are made, and we disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained in this presentation or to reflect any change in our expectations after the date of this presentation or any change in events, conditions or circumstances on which any statement is based. USE OF NON-GAAP FINANCIAL MEASURES This presentation contains non-GAAP financial measures. These measures, the purposes for which management uses them, why management believes they are useful to investors, and a reconciliation to the most directly comparable GAAP financial measures can be found in the Appendix of this presentation. All references to profit measures and earnings per share on a comparable basis exclude items that affect comparability. FORWARD- LOOKING STATEMENTS 2

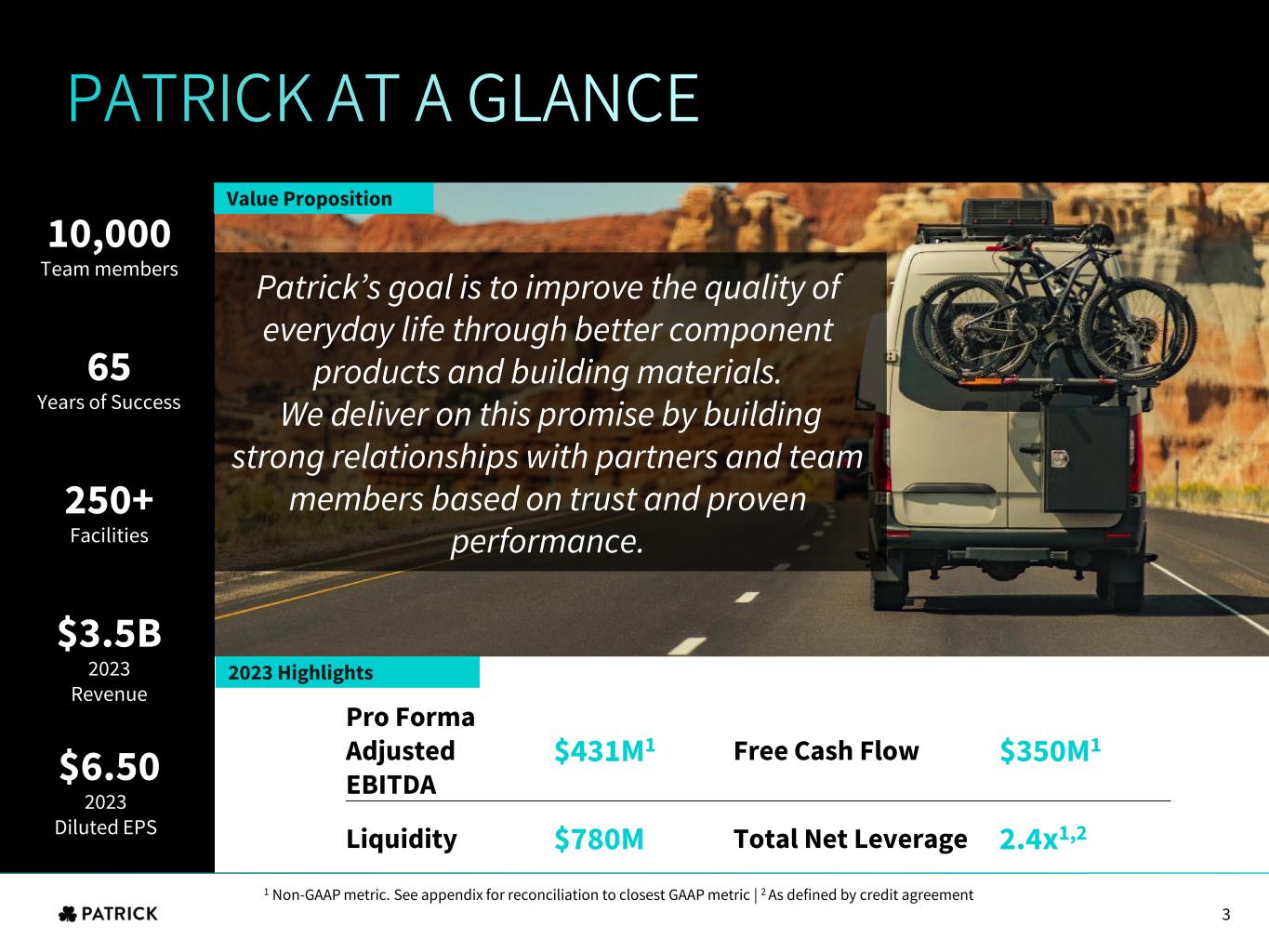

3 Team members 10,000 Years of Success 65 Facilities 250+ 2023 Revenue $3.5B 2023 Diluted EPS $6.50 Pro Forma Adjusted EBITDA $431M1 Free Cash Flow $350M1 Liquidity $780M Total Net Leverage 2.4x1,2 1 Non-GAAP metric. See appendix for reconciliation to closest GAAP metric | 2 As defined by credit agreement 2023 Highlights Value Proposition PATRICK AT A GLANCE TRICK AT A GLANCE Patrick’s goal is to improve the quality of everyday life through better component products and building materials. We deliver on this promise by building strong relationships with partners and team members based on trust and proven performance. 3

LEADERSHIP IN THE MARKETS WE SERVE RV MARINE HOUSING PATRICK Sales by End Market 43% 27% 30% FY 2023 RV HOUSING MARINE 69% 7% 24% FY 2017 Extensive Supplier to OEMs with Growing Aftermarket Presence Strong OEM Relationships Built Through Customer Service and Scalability $3.5B $1.6B Leading Component Solutions Provider to OEMs 43% 2023 net sales 27% 2023 net sales 30% 2023 net sales 4

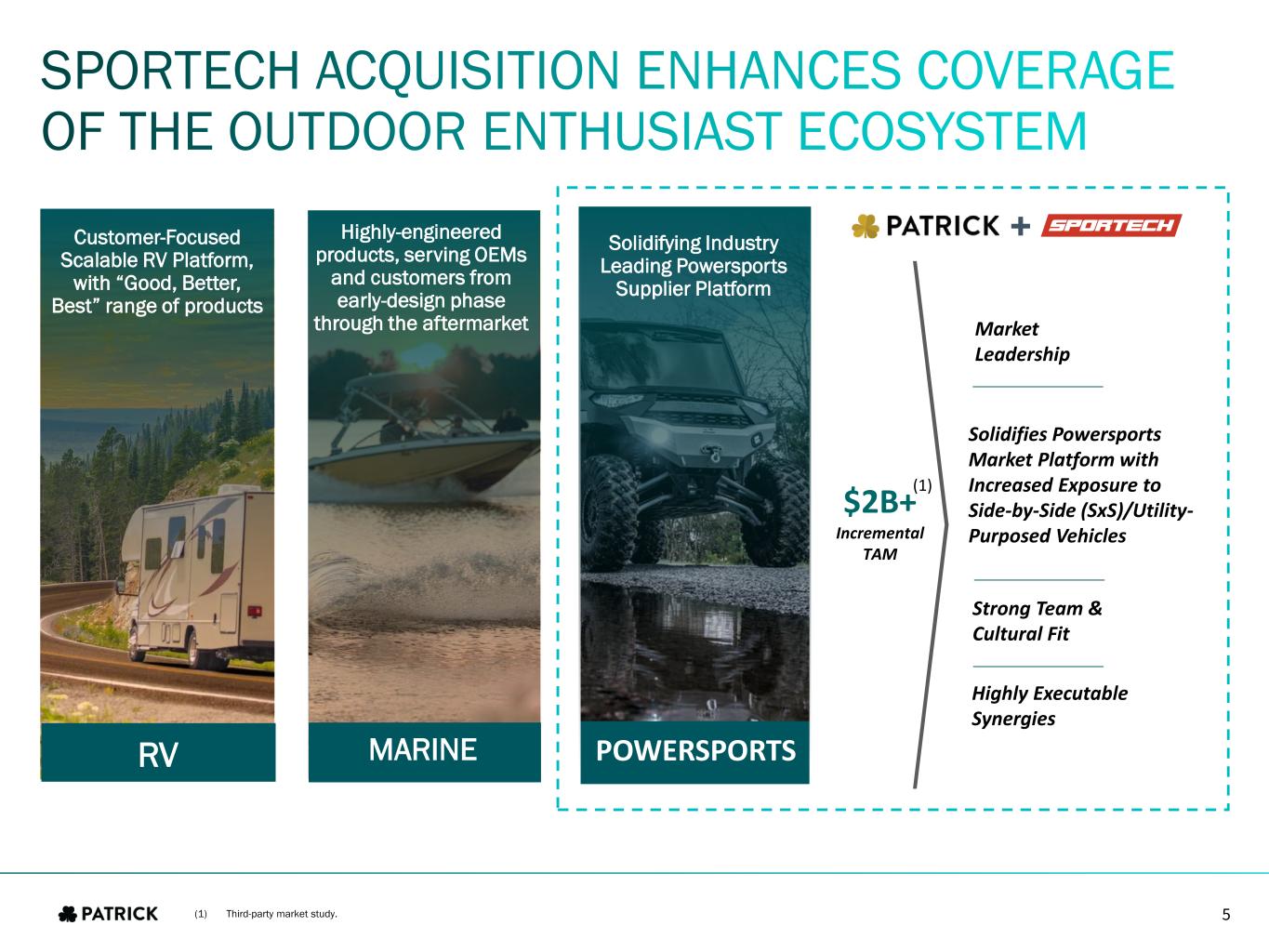

SPORTECH ACQUISITION ENHANCES COVERAGE OF THE OUTDOOR ENTHUSIAST ECOSYSTEM $2B+ Incremental TAM Strong Team & Cultural Fit Customer-Focused Scalable RV Platform, with “Good, Better, Best” range of products Highly-engineered products, serving OEMs and customers from early-design phase through the aftermarket Market Leadership Solidifies Powersports Market Platform with Increased Exposure to Side-by-Side (SxS)/Utility- Purposed Vehicles Highly Executable Synergies Solidifying Industry Leading Powersports Supplier Platform RV MARINE POWERSPORTS (1) Third-party market study. (1) 5

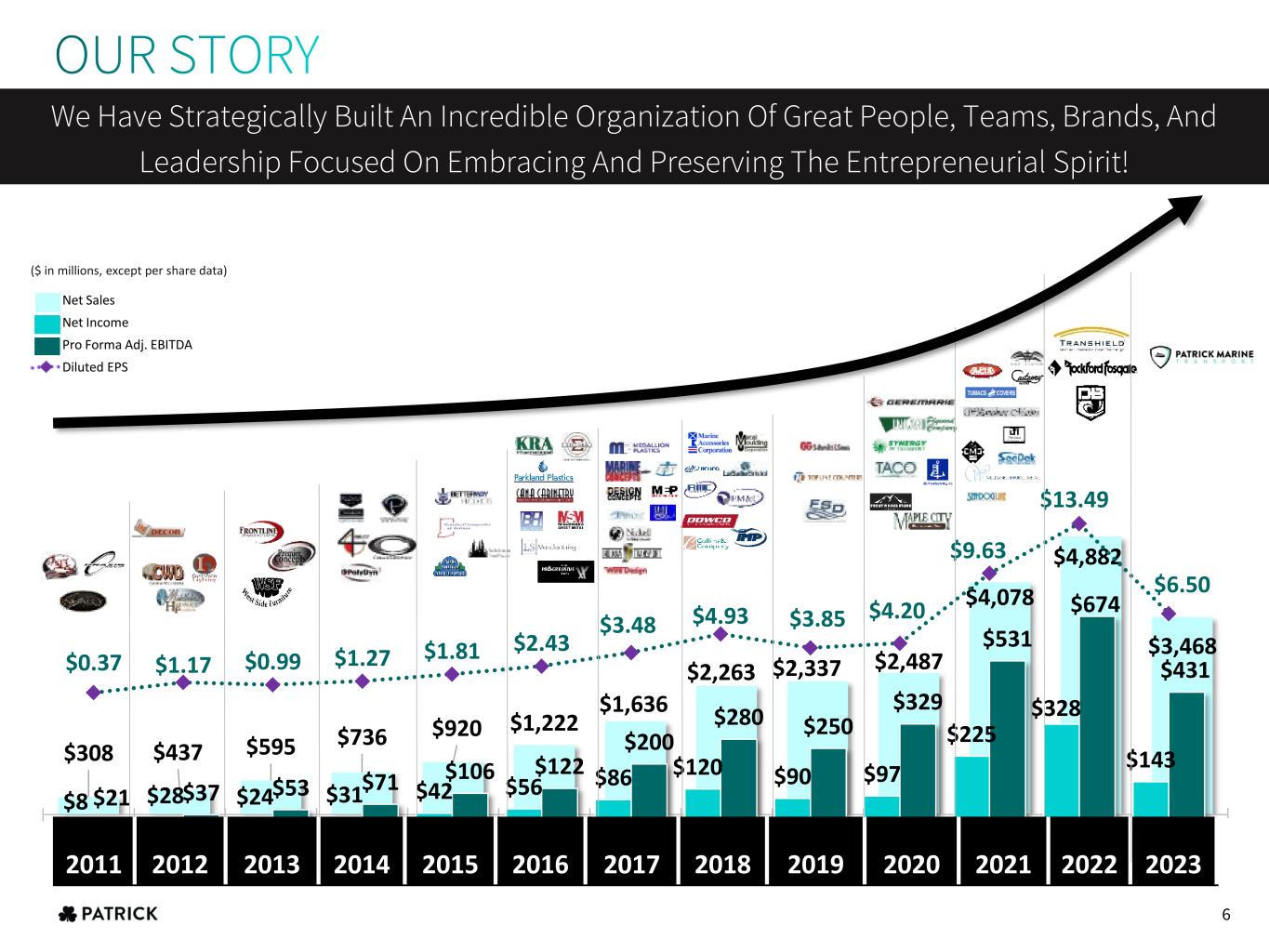

$308 $437 $595 $736 $920 $1,222 $1,636 $2,263 $2,337 $2,487 $4,078 $4,882 $3,468 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Q1 23 TTm $8 $28 $24 $31 $42 $56 $86 $120 $90 $97 $225 $328 $143 $21 $37 $53 $71 $106 $122 $200 $280 $250 $329 $531 $674 $431 $0.37 $1.17 $0.99 $1.27 $1.81 $2.43 $3.48 $4.93 $3.85 $4.20 $9.63 $13.49 $6.50 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Q1 2023 TTM Net Sales Net Income Pro Forma Adj. EBITDA Diluted EPS We Have Strategically Built An Incredible Organization Of Great People, Teams, Brands, And Leadership Focused On Embracing And Preserving The Entrepreneurial Spirit! ($ in millions, except per share data) OUR STORY 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 6

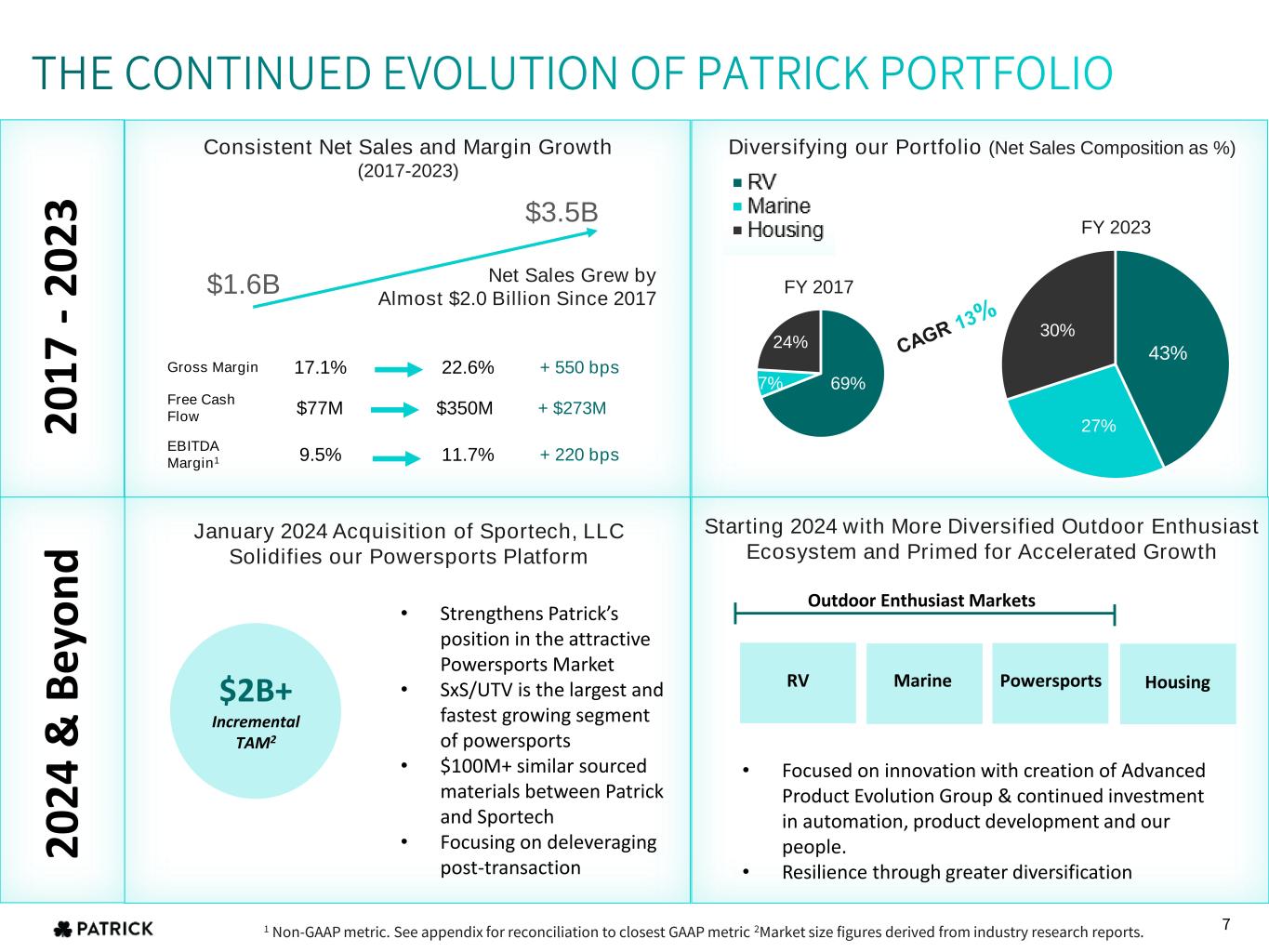

43% 27% 30% $3.5B Net Sales Grew by Almost $2.0 Billion Since 2017 $1.6B Diversifying our Portfolio (Net Sales Composition as %) FY 2023 Consistent Net Sales and Margin Growth (2017-2023) Gross Margin 17.1% 22.6% + 550 bps Free Cash Flow $77M $350M + $273MM EBITDA Margin1 9.5% 11.7% + 220 bps FY 2017 69%7% 24% THE CONTINUED EVOLUTION OF PATRICK PORTFOLIO 1 Non-GAAP metric. See appendix for reconciliation to closest GAAP metric 2Market size figures derived from industry research reports. 7 2 0 1 7 - 2 0 2 3 2 0 2 4 & B ey o n d January 2024 Acquisition of Sportech, LLC Solidifies our Powersports Platform $2B+ Incremental TAM2 • Strengthens Patrick’s position in the attractive Powersports Market • SxS/UTV is the largest and fastest growing segment of powersports • $100M+ similar sourced materials between Patrick and Sportech • Focusing on deleveraging post-transaction RV Outdoor Enthusiast Markets Starting 2024 with More Diversified Outdoor Enthusiast Ecosystem and Primed for Accelerated Growth • Focused on innovation with creation of Advanced Product Evolution Group & continued investment in automation, product development and our people. • Resilience through greater diversification Marine Powersports Housing

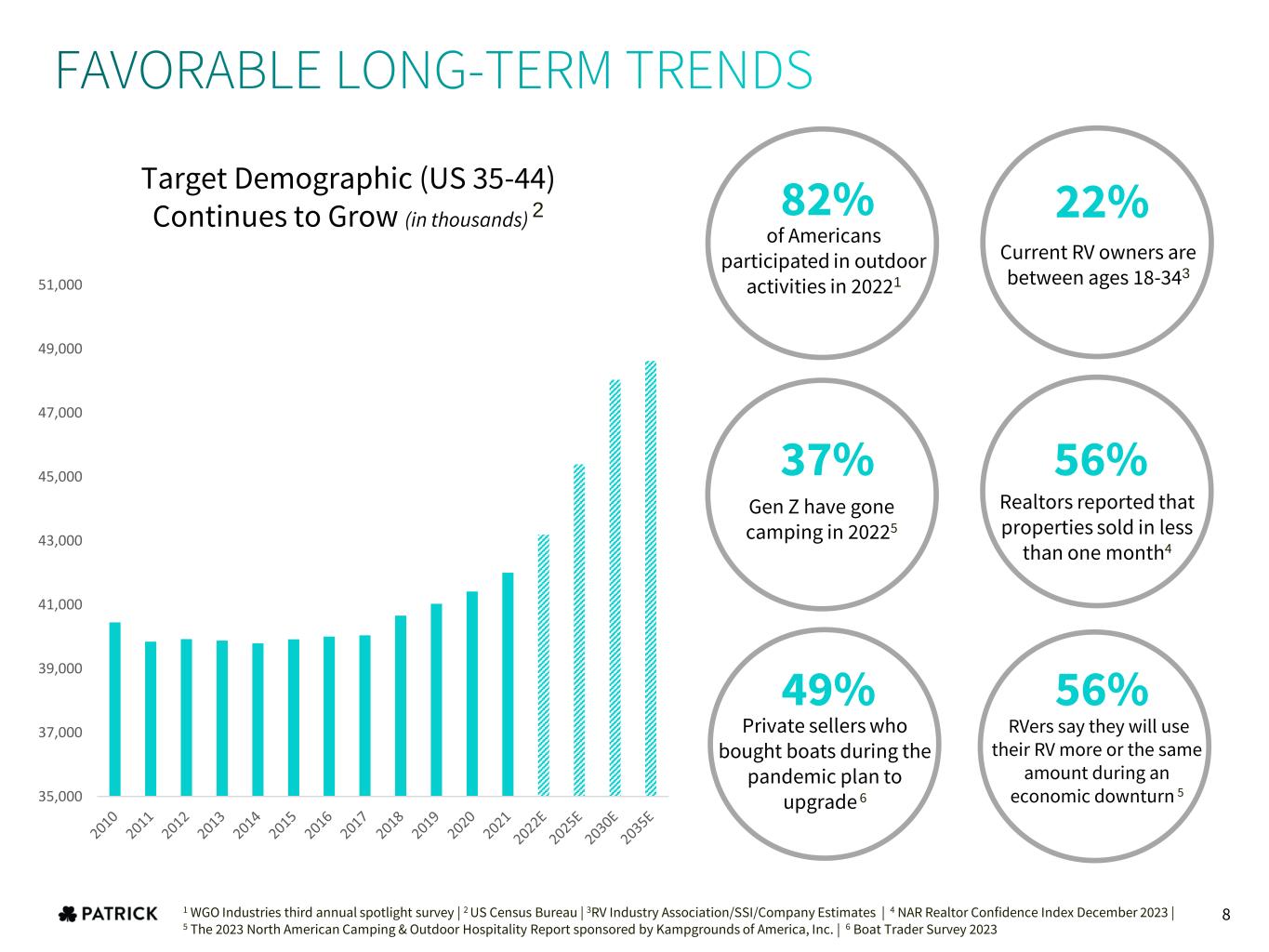

FAVORABLE LONG-TERM TRENDS 1 WGO Industries third annual spotlight survey | 2 US Census Bureau | 3RV Industry Association/SSI/Company Estimates | 4 NAR Realtor Confidence Index December 2023 | 5 The 2023 North American Camping & Outdoor Hospitality Report sponsored by Kampgrounds of America, Inc. | 6 Boat Trader Survey 2023 Target Demographic (US 35-44) Continues to Grow (in thousands) 2 of Americans participated in outdoor activities in 20221 82% Current RV owners are between ages 18-343 22% Gen Z have gone camping in 20225 37% Realtors reported that properties sold in less than one month4 56% Private sellers who bought boats during the pandemic plan to upgrade 6 49% RVers say they will use their RV more or the same amount during an economic downturn 5 56% 35,000 37,000 39,000 41,000 43,000 45,000 47,000 49,000 51,000 8

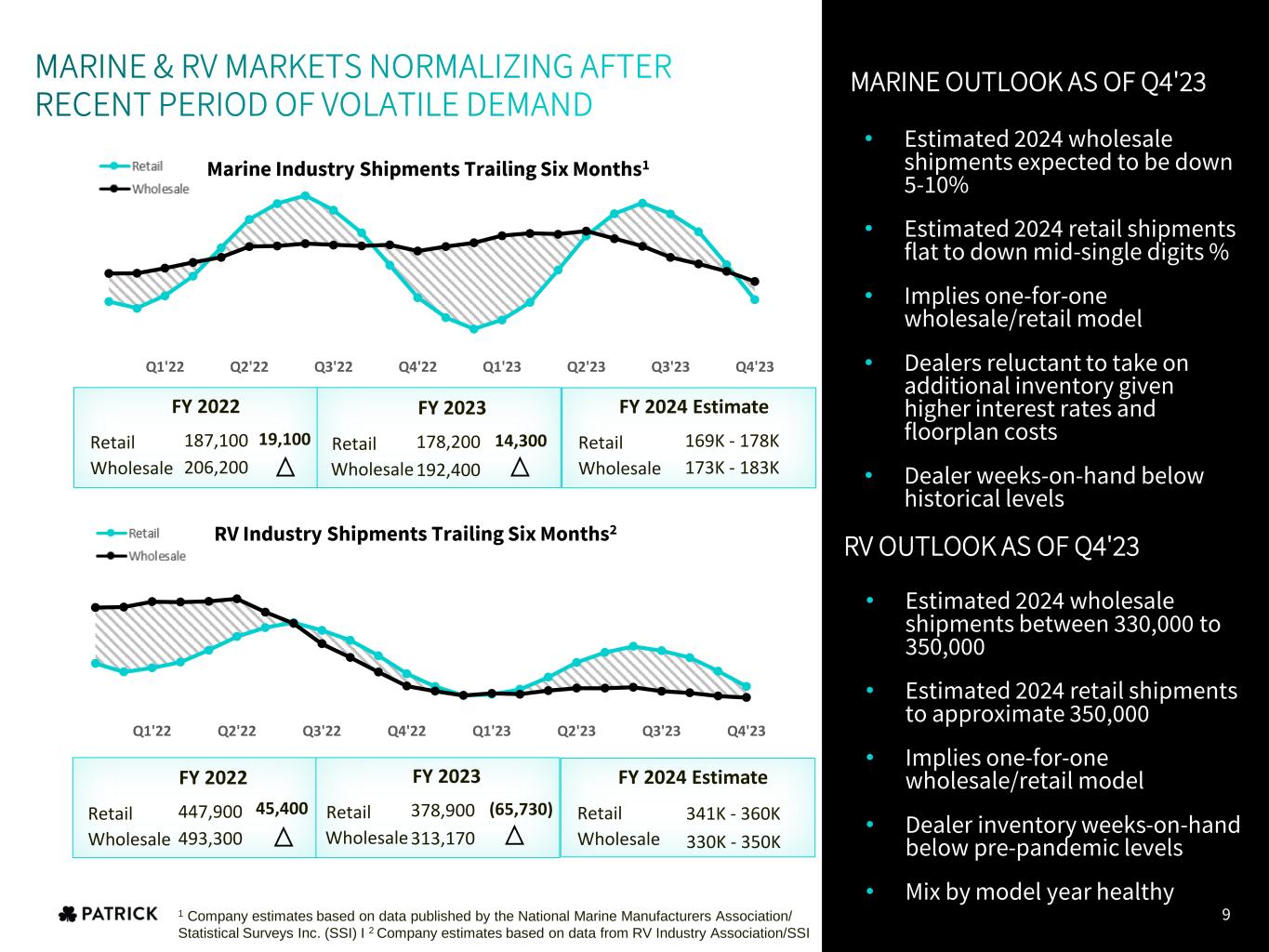

FY 2022 Wholesale 493,300 1 Company estimates based on data published by the National Marine Manufacturers Association/ Statistical Surveys Inc. (SSI) I 2 Company estimates based on data from RV Industry Association/SSI Retail Wholesale 187,100 206,200 FY 2022 Retail 447,900 19,100 45,400 MARINE & RV MARKETS NORMALIZING AFTER RECENT PERIOD OF VOLATILE DEMAND • Estimated 2024 wholesale shipments expected to be down 5-10% • Estimated 2024 retail shipments flat to down mid-single digits % • Implies one-for-one wholesale/retail model • Dealers reluctant to take on additional inventory given higher interest rates and floorplan costs • Dealer weeks-on-hand below historical levels • Estimated 2024 wholesale shipments between 330,000 to 350,000 • Estimated 2024 retail shipments to approximate 350,000 • Implies one-for-one wholesale/retail model • Dealer inventory weeks-on-hand below pre-pandemic levels • Mix by model year healthy RV OUTLOOK AS OF Q4'23 9 Wholesale FY 2023 Retail 378,900 313,170 (65,730) Wholesale FY 2023 Retail 178,200 192,400 14,300 FY 2024 Estimate Retail Wholesale 169K - 178K 173K - 183K FY 2024 Estimate Retail Wholesale 341K - 360K 330K - 350K Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Marine Industry Shipments Trailing Six Months1 RV Industry Shipments Trailing Six Months2 MARINE OUTLOOK AS OF Q4'23

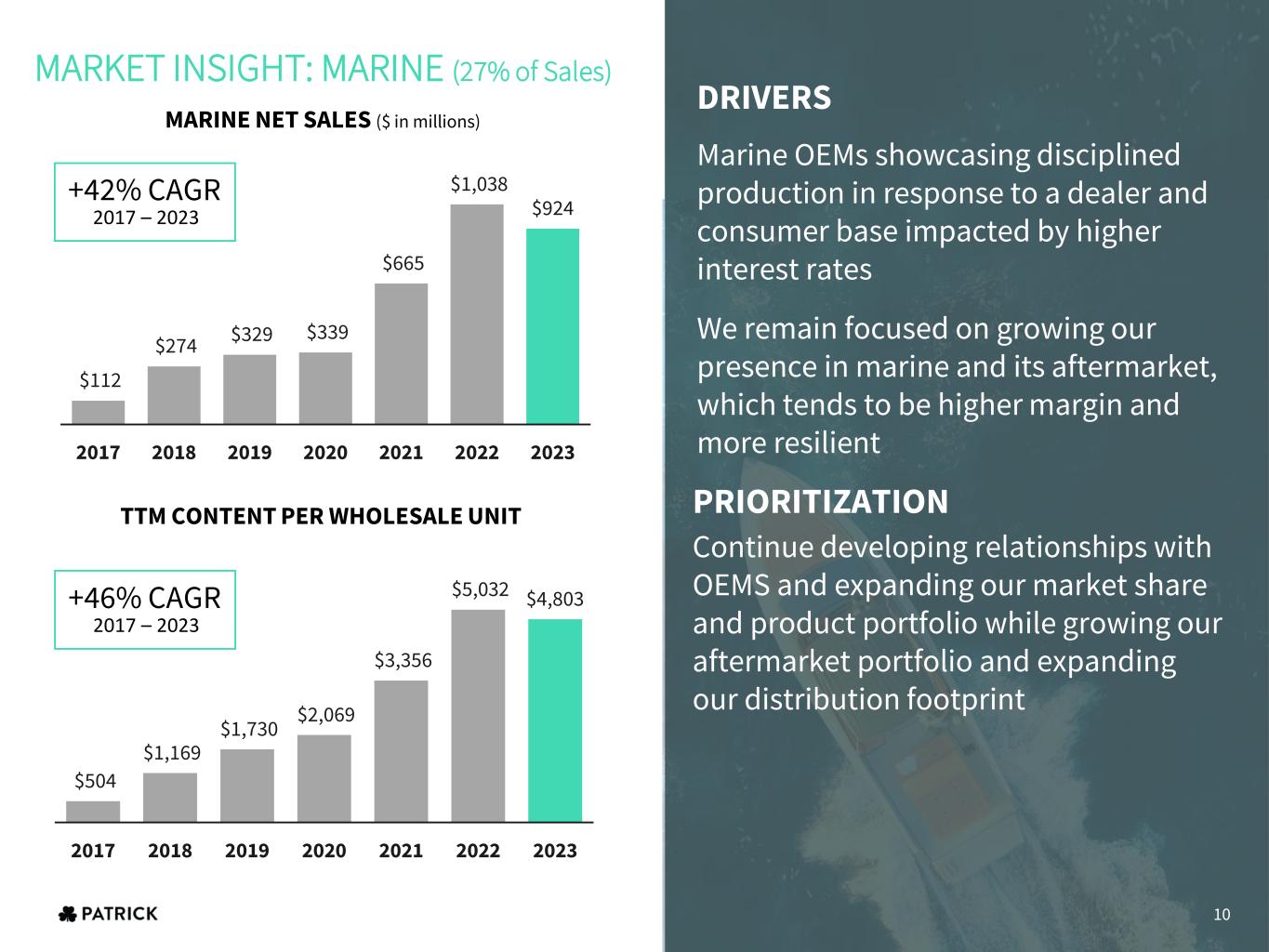

Marine OEMs showcasing disciplined production in response to a dealer and consumer base impacted by higher interest rates We remain focused on growing our presence in marine and its aftermarket, which tends to be higher margin and more resilient MARINE NET SALES ($ in millions) TTM CONTENT PER WHOLESALE UNIT $112 $274 $329 $339 $665 $1,038 $924 2017 2018 2019 2020 2021 2022 2023 $504 $1,169 $1,730 $2,069 $3,356 $5,032 $4,803 2017 2018 2019 2020 2021 2022 2023 PRIORITIZATION Continue developing relationships with OEMS and expanding our market share and product portfolio while growing our aftermarket portfolio and expanding our distribution footprint MARKET INSIGHT: MARINE (27% of Sales) DRIVERS +42% CAGR 2017 – 2023 +46% CAGR 2017 – 2023 10

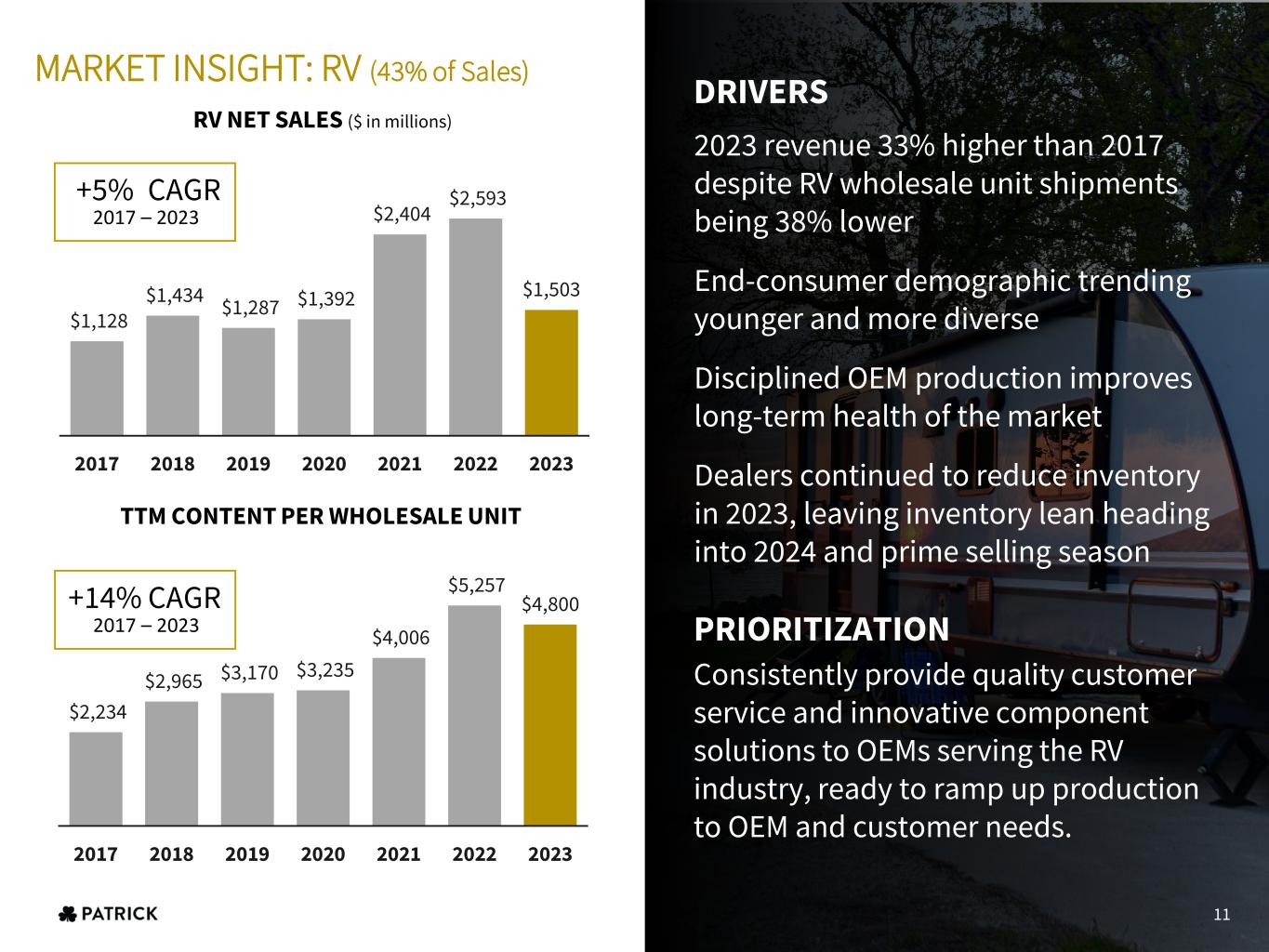

2023 revenue 33% higher than 2017 despite RV wholesale unit shipments being 38% lower End-consumer demographic trending younger and more diverse Disciplined OEM production improves long-term health of the market Dealers continued to reduce inventory in 2023, leaving inventory lean heading into 2024 and prime selling season $1,128 $1,434 $1,287 $1,392 $2,404 $2,593 $1,503 2017 2018 2019 2020 2021 2022 2023 $2,234 $2,965 $3,170 $3,235 $4,006 $5,257 $4,800 2017 2018 2019 2020 2021 2022 2023 PRIORITIZATION Consistently provide quality customer service and innovative component solutions to OEMs serving the RV industry, ready to ramp up production to OEM and customer needs. MARKET INSIGHT: RV (43% of Sales) DRIVERS RV NET SALES ($ in millions) TTM CONTENT PER WHOLESALE UNIT +5% CAGR 2017 – 2023 +14% CAGR 2017 – 2023 11

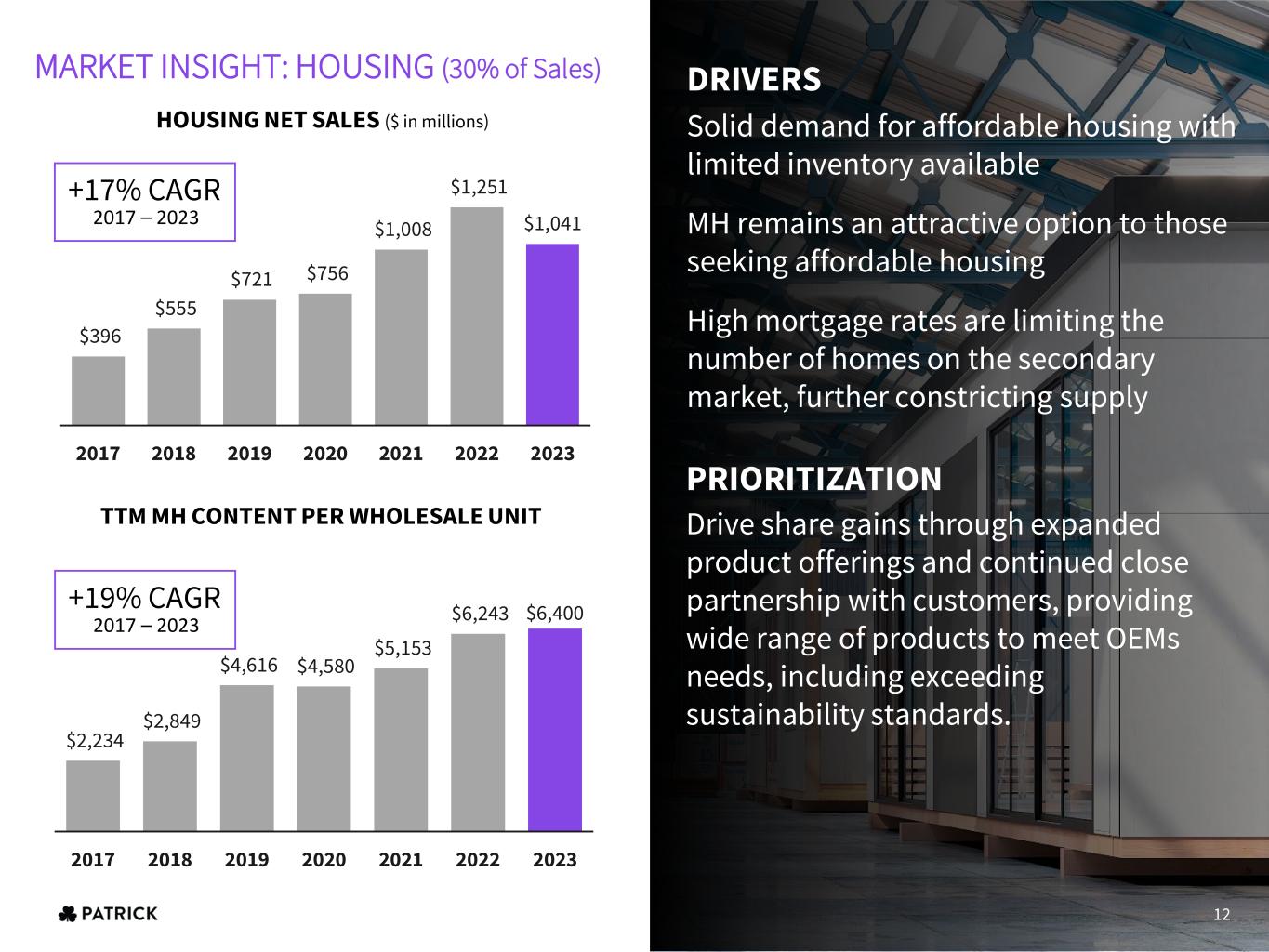

Solid demand for affordable housing with limited inventory available MH remains an attractive option to those seeking affordable housing High mortgage rates are limiting the number of homes on the secondary market, further constricting supply $396 $555 $721 $756 $1,008 $1,251 $1,041 2017 2018 2019 2020 2021 2022 2023 $2,234 $2,849 $4,616 $4,580 $5,153 $6,243 $6,400 2017 2018 2019 2020 2021 2022 2023 PRIORITIZATION Drive share gains through expanded product offerings and continued close partnership with customers, providing wide range of products to meet OEMs needs, including exceeding sustainability standards. MARKET INSIGHT: HOUSING (30% of Sales) DRIVERS HOUSING NET SALES ($ in millions) TTM MH CONTENT PER WHOLESALE UNIT +17% CAGR 2017 – 2023 +19% CAGR 2017 – 2023 12

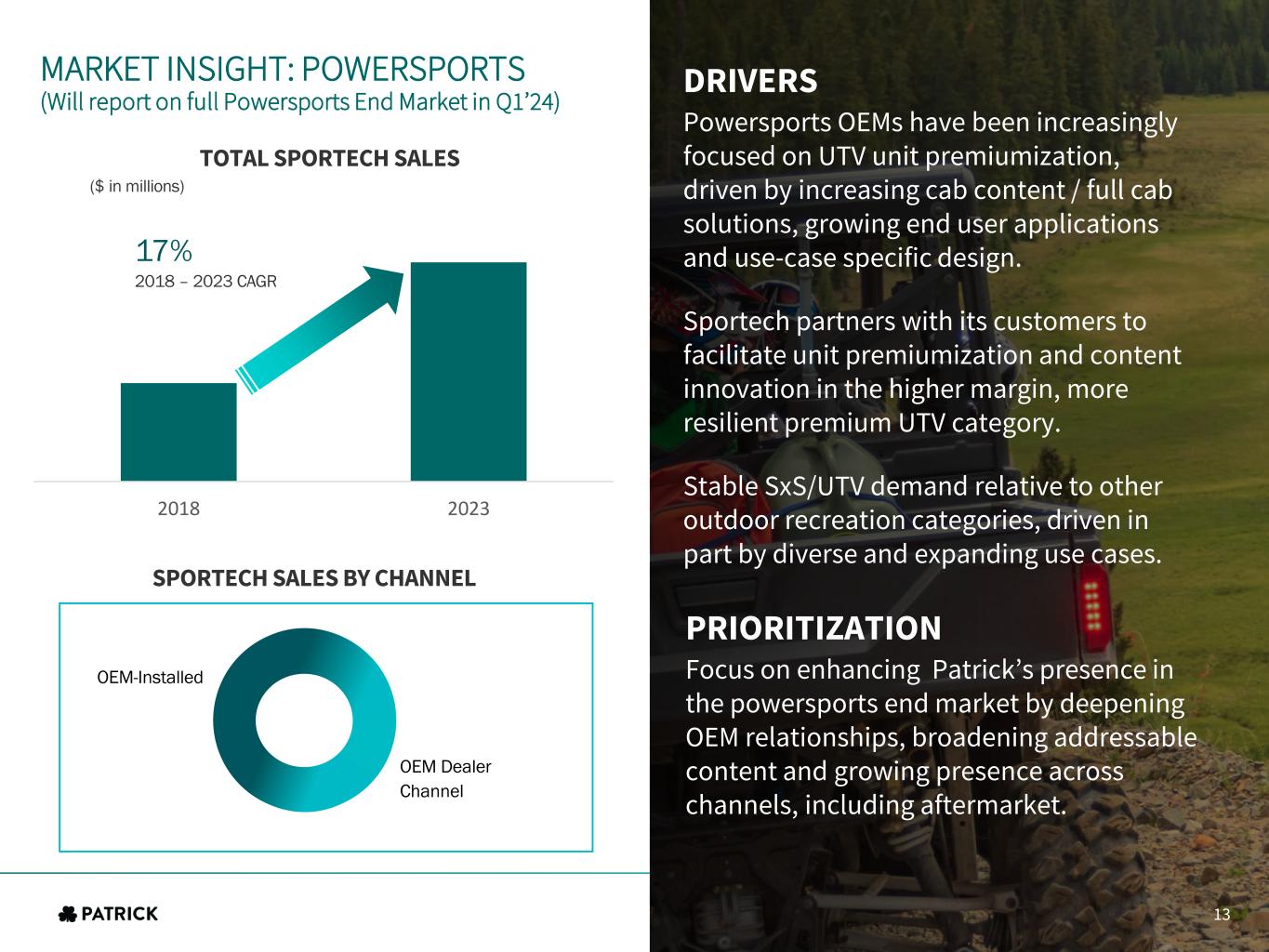

2018 2023 DRIVERS Powersports OEMs have been increasingly focused on UTV unit premiumization, driven by increasing cab content / full cab solutions, growing end user applications and use-case specific design. Sportech partners with its customers to facilitate unit premiumization and content innovation in the higher margin, more resilient premium UTV category. Stable SxS/UTV demand relative to other outdoor recreation categories, driven in part by diverse and expanding use cases. PRIORITIZATION Focus on enhancing Patrick’s presence in the powersports end market by deepening OEM relationships, broadening addressable content and growing presence across channels, including aftermarket. TOTAL SPORTECH SALES ($ in millions) 17% 2018 – 2023 CAGR SPORTECH SALES BY CHANNEL OEM Dealer Channel OEM-Installed MARKET INSIGHT: POWERSPORTS (Will report on full Powersports End Market in Q1’24) 13

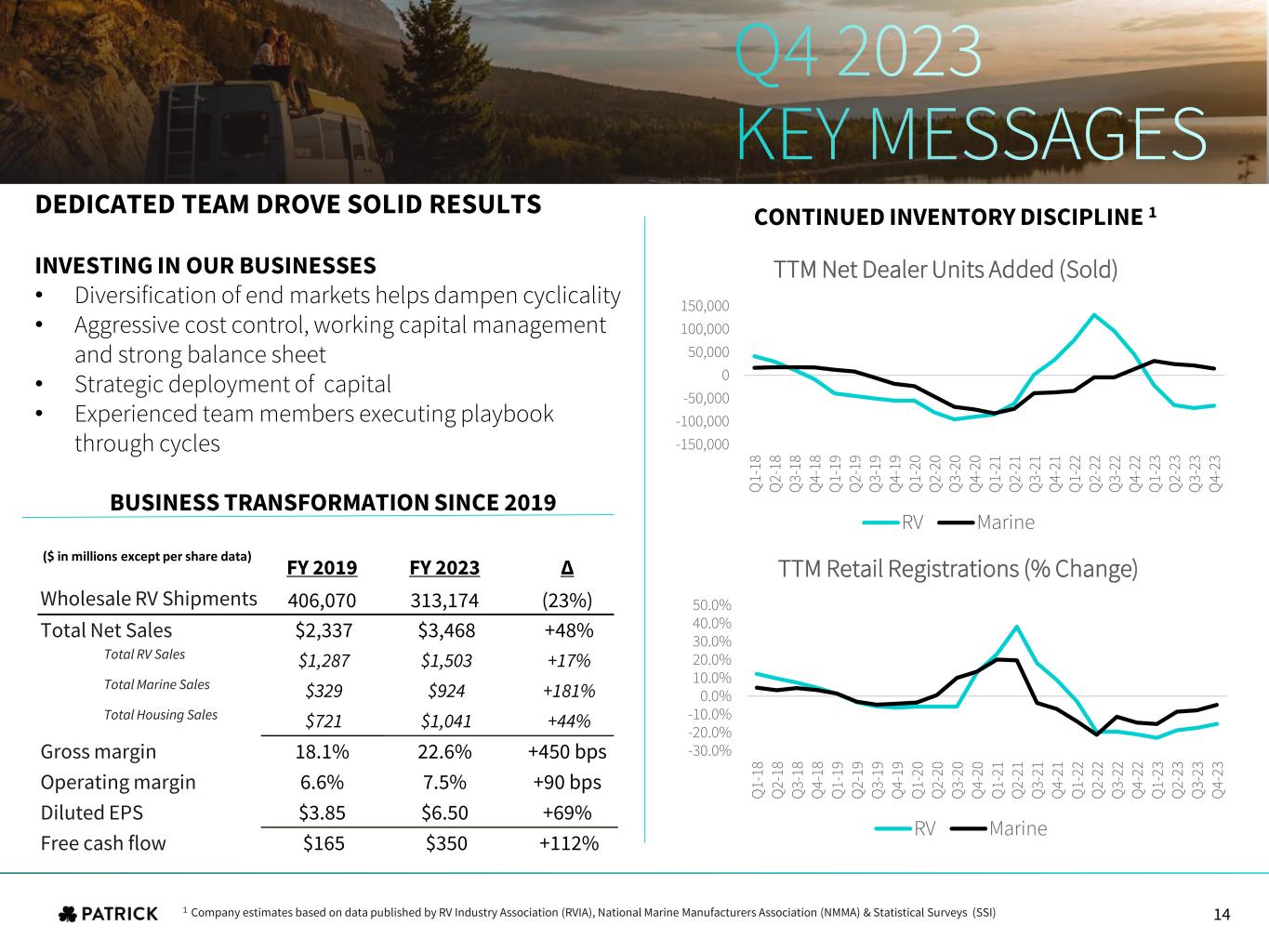

DEDICATED TEAM DROVE SOLID RESULTS INVESTING IN OUR BUSINESSES • Diversification of end markets helps dampen cyclicality • Aggressive cost control, working capital management and strong balance sheet • Strategic deployment of capital • Experienced team members executing playbook through cycles BUSINESS TRANSFORMATION SINCE 2019 Q4 2023 KEY MESSAGES FY 2019 FY 2023 Δ Wholesale RV Shipments 406,070 313,174 (23%) Total Net Sales $2,337 $3,468 +48% Total RV Sales $1,287 $1,503 +17% Total Marine Sales $329 $924 +181% Total Housing Sales $721 $1,041 +44% Gross margin 18.1% 22.6% +450 bps Operating margin 6.6% 7.5% +90 bps Diluted EPS $3.85 $6.50 +69% Free cash flow $165 $350 +112% CONTINUED INVENTORY DISCIPLINE 1 ($ in millions except per share data) -150,000 -100,000 -50,000 0 50,000 100,000 150,000 Q 1- 18 Q 2- 18 Q 3- 18 Q 4- 18 Q 1- 19 Q 2- 19 Q 3- 19 Q 4- 19 Q 1- 20 Q 2- 20 Q 3- 20 Q 4- 20 Q 1- 21 Q 2- 21 Q 3- 21 Q 4- 21 Q 1- 22 Q 2- 22 Q 3- 22 Q 4- 22 Q 1- 23 Q 2- 23 Q 3- 23 Q 4- 23 TTM Net Dealer Units Added (Sold) RV Marine -30.0% -20.0% -10.0% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% Q 1- 18 Q 2- 18 Q 3- 18 Q 4- 18 Q 1- 19 Q 2- 19 Q 3- 19 Q 4- 19 Q 1- 20 Q 2- 20 Q 3- 20 Q 4- 20 Q 1- 21 Q 2- 21 Q 3- 21 Q 4- 21 Q 1- 22 Q 2- 22 Q 3- 22 Q 4- 22 Q 1- 23 Q 2- 23 Q 3- 23 Q 4- 23 TTM Retail Registrations (% Change) RV Marine 1 Company estimates based on data published by RV Industry Association (RVIA), National Marine Manufacturers Association (NMMA) & Statistical Surveys (SSI) 14

Q4 2023 QUARTERLY HIGHLIGHTS • RV revenue declined due to lower pricing passed on to customers, mix of entry-level units and continued decline in wholesale unit shipments • Marine OEMs maintained conservative stance given dealers sensitivity to higher floorplan costs and limited visibility into consumer demand • Housing revenue declined as consumers continued to be impacted by inflationary pressures and higher interest rates REVENUE DOWN 18% Y/Y DUE TO LOWER SHIPMENTS ACROSS END MARKETS IMPRESSIVE MARGIN PERFORMANCE WITH PRUDENT COST MANAGEMENT AND CONTINUED STRONG CASH FLOW GENERATION • Repaid $87 million of long-term debt in the fourth quarter, including $85 million on revolving credit facility • Completed Sportech, LLC acquisition, which closed in January 2024, continue to have ample liquidity • Investing in automation and innovation to improve operational efficiency WE REMAIN POISED TO DEPLOY CAPITAL AND SEIZE OPPPORTUNITIES • Gross margin improved 180 bps due to strategic diversification initiatives and investments despite a reduction in shipments across our end markets • Operating margin improved 20 bps, reflecting our continued cost control, labor management and automation initiatives • Solid profitability and working capital monetization helped drive significant operating and free cash flow GROSS MARGIN AND OPERATING MARGIN IMPROVEMENT DRIVEN BY COST MANAGEMENT, STRATEGIC DIVERSIFICATION, AND AUTOMATION INITIATIVES 15

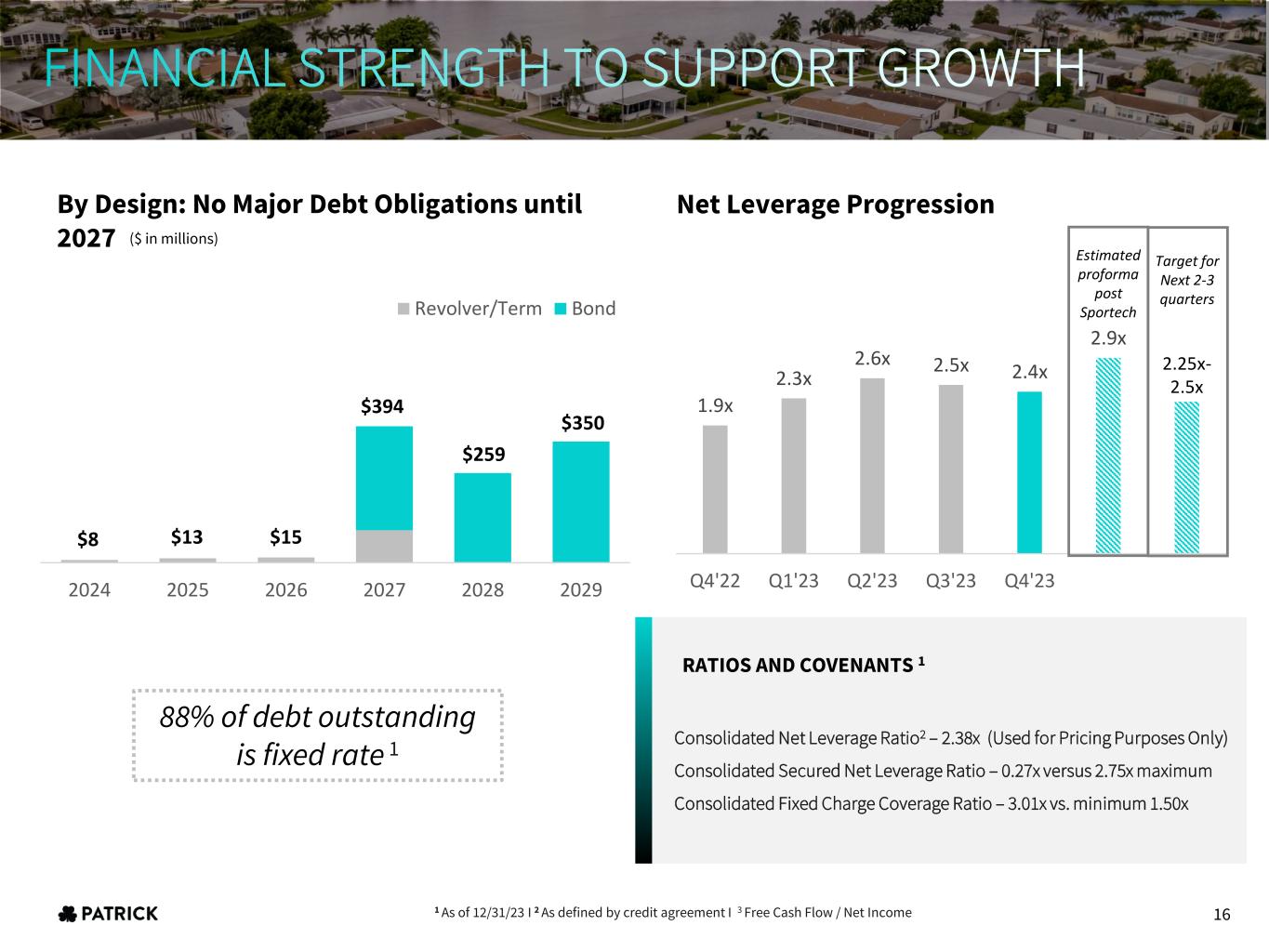

2024 2025 2026 2027 2028 2029 Revolver/Term Bond 1 As of 12/31/23 I 2 As defined by credit agreement I 3 Free Cash Flow / Net Income FINANCIAL STRENGTH TO SUPPORT GROWTH By Design: No Major Debt Obligations until 2027 Consolidated Net Leverage Ratio2 – 2.38x (Used for Pricing Purposes Only) Consolidated Secured Net Leverage Ratio – 0.27x versus 2.75x maximum Consolidated Fixed Charge Coverage Ratio – 3.01x vs. minimum 1.50x RATIOS AND COVENANTS 1 88% of debt outstanding is fixed rate 1 ($ in millions) $394 $259 $350 $15$13$8 1.9x 2.3x 2.6x 2.5x 2.4x 2.9x 2.5x Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Net Leverage Progression Estimated proforma post Sportech 16 Target for Next 2-3 quarters 2.25x- 2.5x

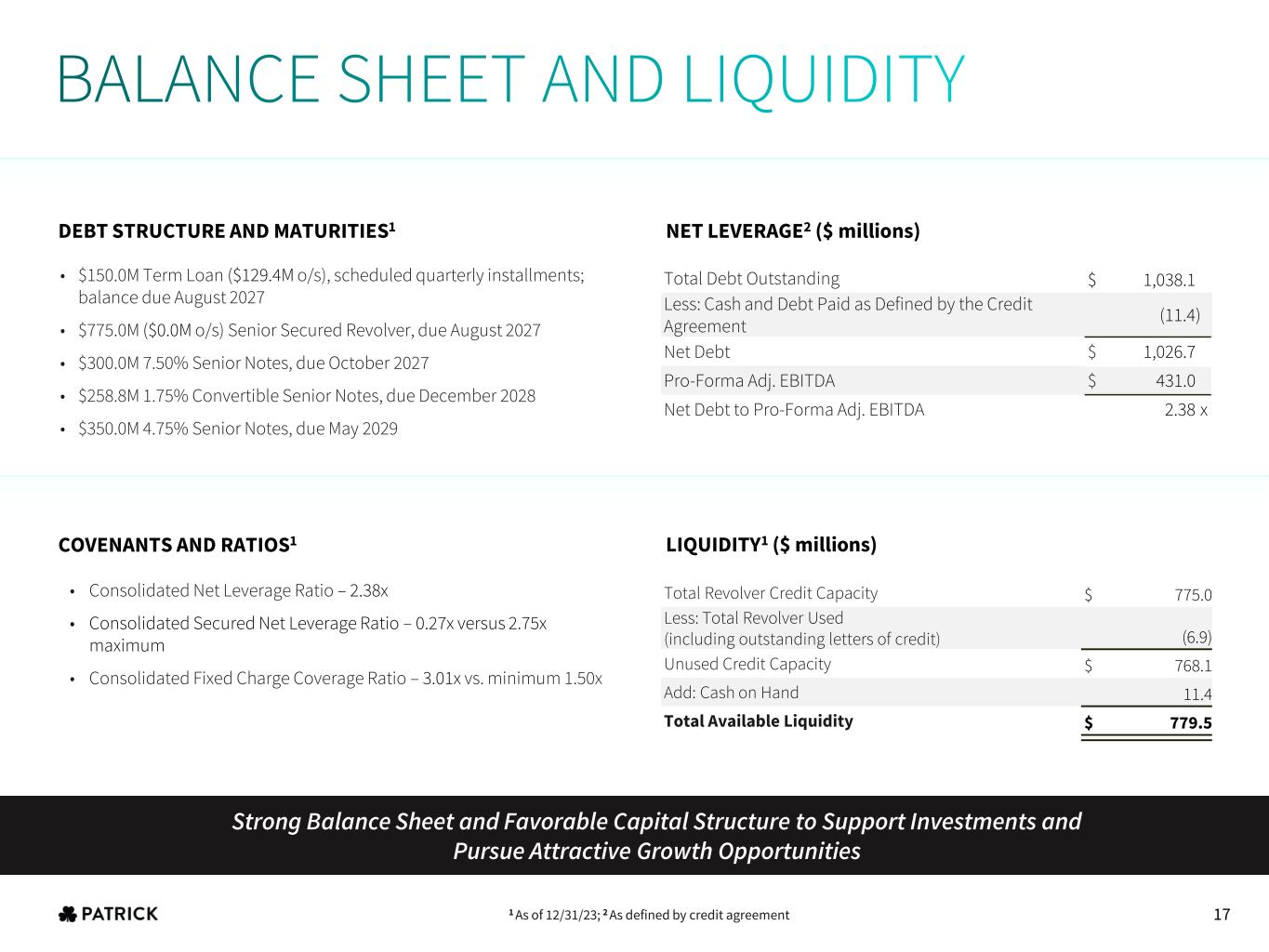

COVENANTS AND RATIOS1 DEBT STRUCTURE AND MATURITIES1 NET LEVERAGE2 ($ millions) LIQUIDITY1 ($ millions) 1 As of 12/31/23; 2 As defined by credit agreement Strong Balance Sheet and Favorable Capital Structure to Support Investments and Pursue Attractive Growth Opportunities • $150.0M Term Loan ($129.4M o/s), scheduled quarterly installments; balance due August 2027 • $775.0M ($0.0M o/s) Senior Secured Revolver, due August 2027 • $300.0M 7.50% Senior Notes, due October 2027 • $258.8M 1.75% Convertible Senior Notes, due December 2028 • $350.0M 4.75% Senior Notes, due May 2029 Total Debt Outstanding $ 1,038.1 Less: Cash and Debt Paid as Defined by the Credit Agreement (11.4) Net Debt $ 1,026.7 Pro-Forma Adj. EBITDA $ 431.0 Net Debt to Pro-Forma Adj. EBITDA 2.38 x Total Revolver Credit Capacity $ 775.0 Less: Total Revolver Used (including outstanding letters of credit) (6.9) Unused Credit Capacity $ 768.1 Add: Cash on Hand 11.4 Total Available Liquidity $ 779.5 • Consolidated Net Leverage Ratio – 2.38x • Consolidated Secured Net Leverage Ratio – 0.27x versus 2.75x maximum • Consolidated Fixed Charge Coverage Ratio – 3.01x vs. minimum 1.50x 17 BALANCE SHEET AND LIQUIDITY

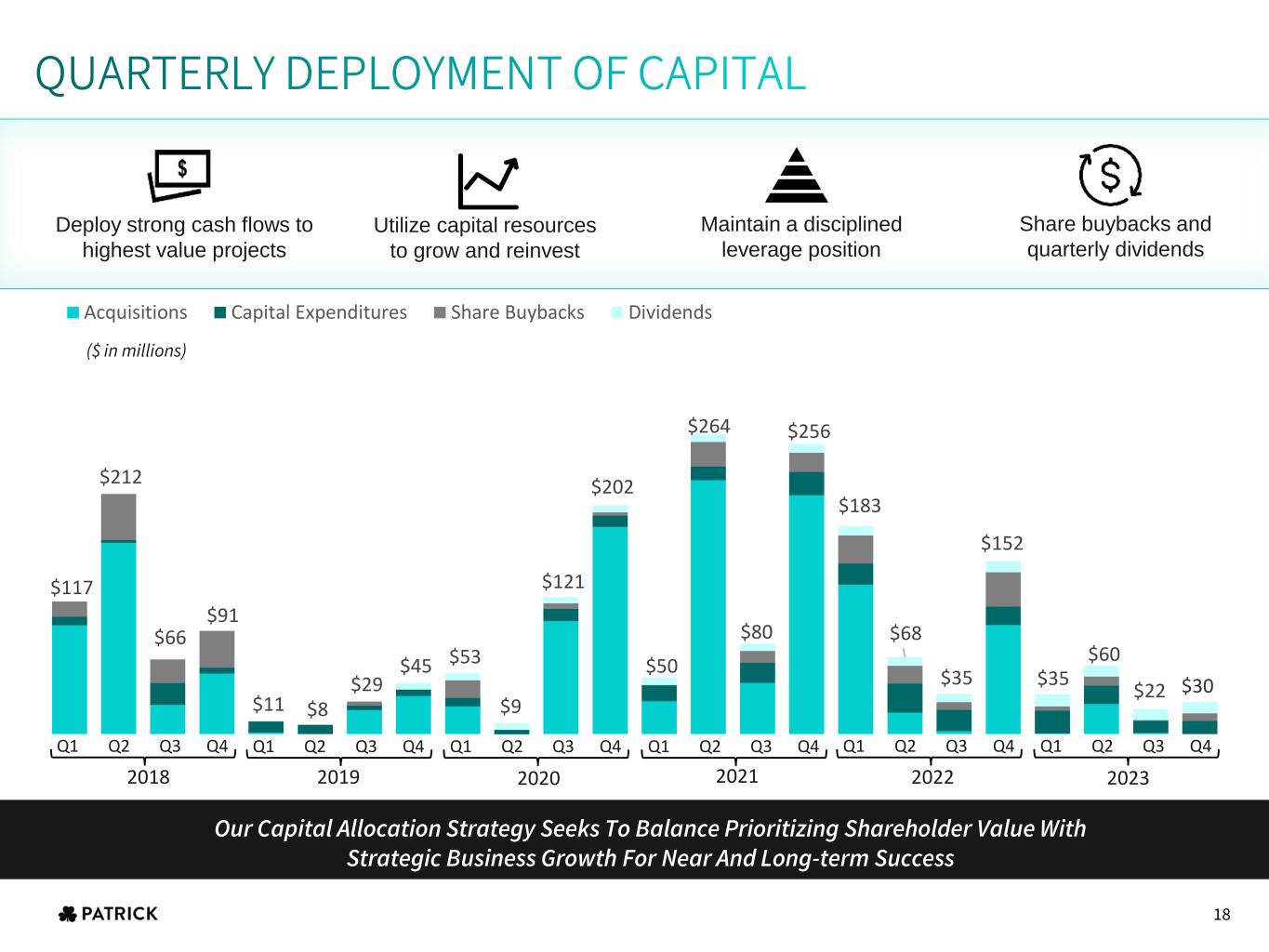

$117 $212 $66 $91 $11 $8 $29 $45 $53 $9 $121 $202 $50 $264 $80 $256 $183 $68 $35 $152 $35 $60 $22 Acquisitions Capital Expenditures Share Buybacks Dividends Q1 Q2 Q3 Q4 ($ in millions) Our Capital Allocation Strategy Seeks To Balance Prioritizing Shareholder Value With Strategic Business Growth For Near And Long-term Success Deploy strong cash flows to highest value projects Maintain a disciplined leverage position Utilize capital resources to grow and reinvest Share buybacks and quarterly dividends 2022 QUARTERLY DEPLOYMENT OF CAPITAL 2021 2023202020192018 $30 18 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

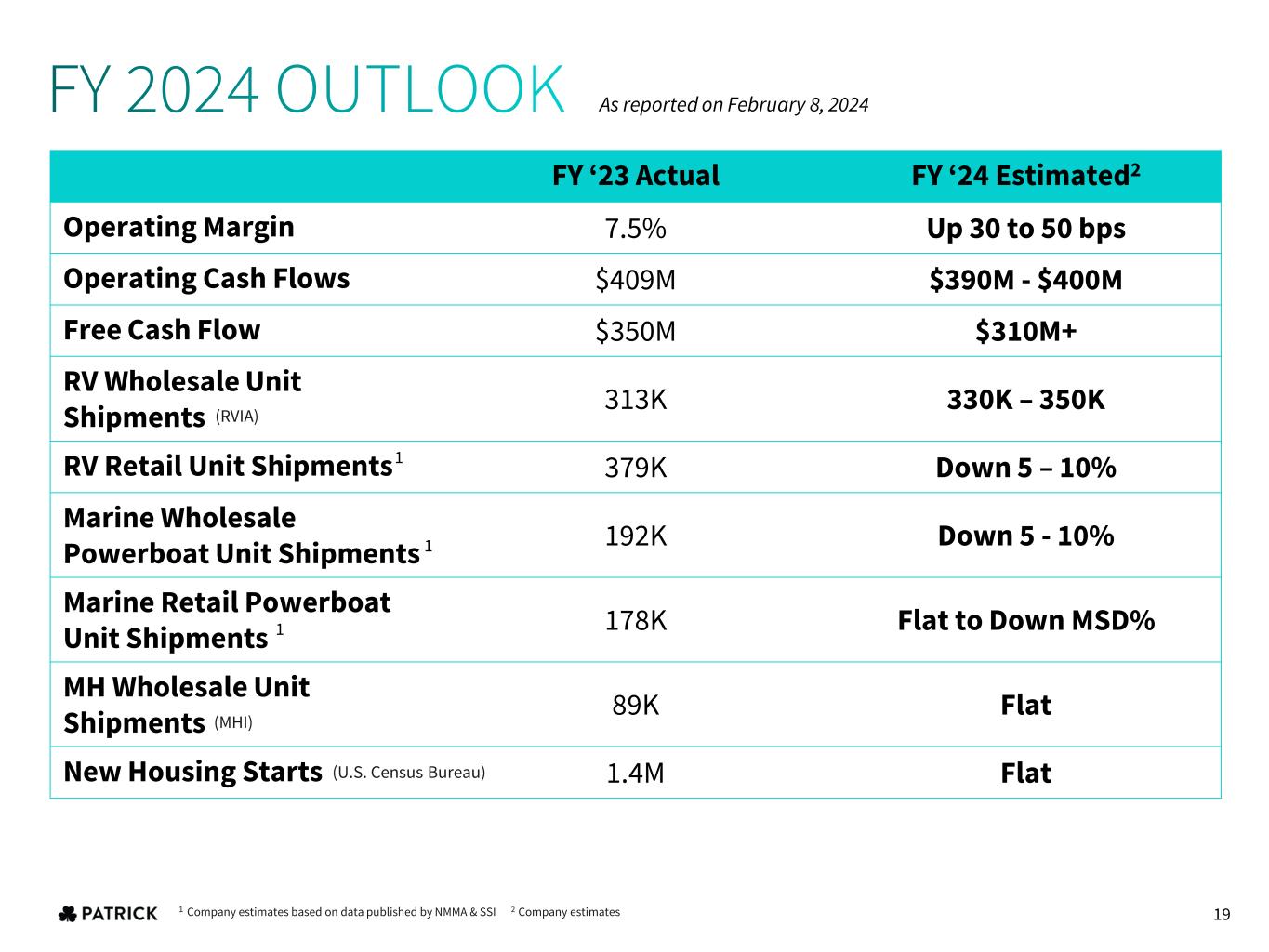

FY ‘23 Actual FY ‘24 Estimated2 Operating Margin 7.5% Up 30 to 50 bps Operating Cash Flows $409M $390M - $400M Free Cash Flow $350M $310M+ RV Wholesale Unit Shipments 313K 330K – 350K RV Retail Unit Shipments 379K Down 5 – 10% Marine Wholesale Powerboat Unit Shipments 192K Down 5 - 10% Marine Retail Powerboat Unit Shipments 178K Flat to Down MSD% MH Wholesale Unit Shipments 89K Flat New Housing Starts 1.4M Flat FY 2024 OUTLOOK 1 Company estimates based on data published by NMMA & SSI 2 Company estimates (U.S. Census Bureau) (MHI) (RVIA) 1 1 1 19 As reported on February 8, 2024

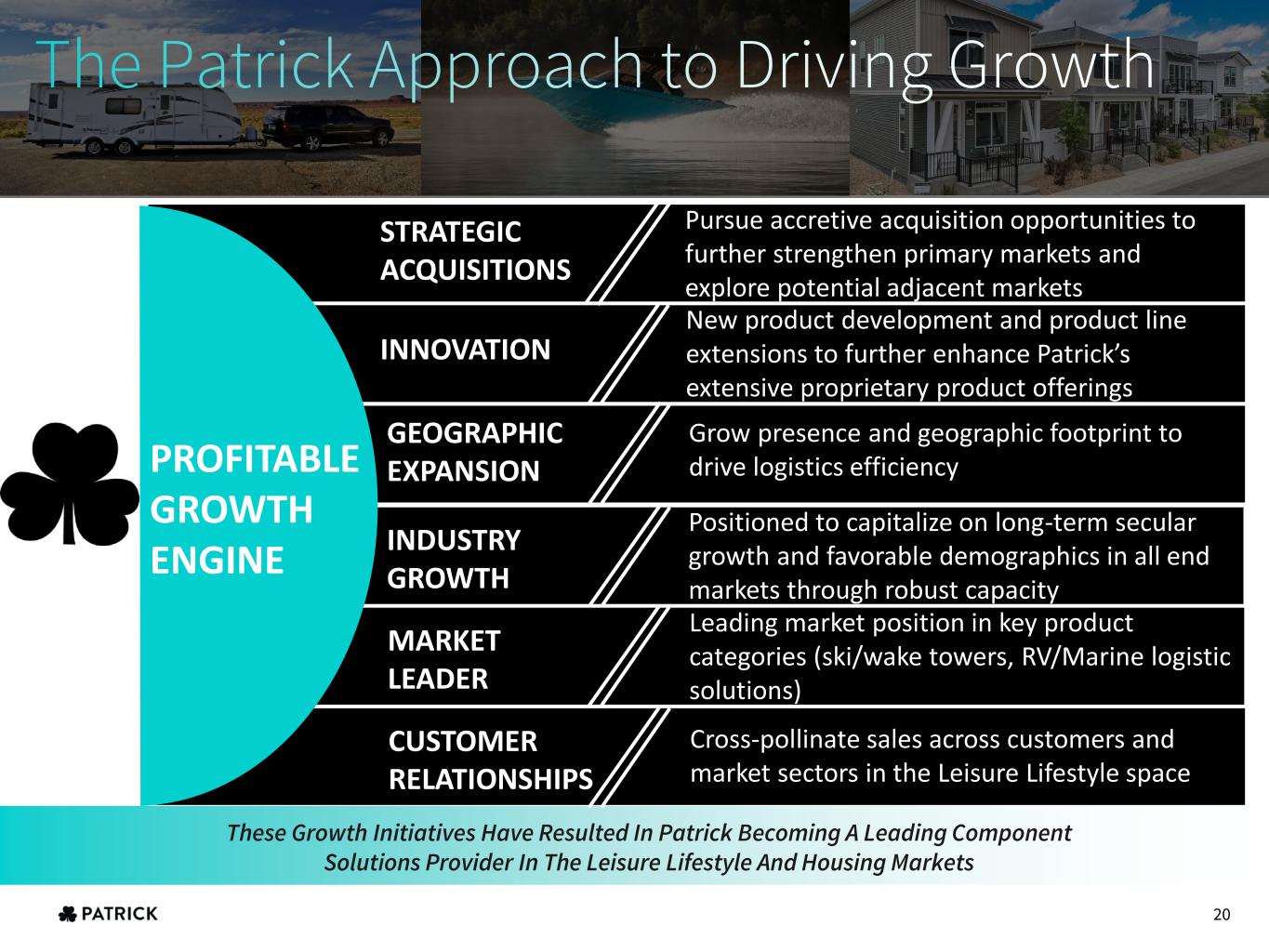

These Growth Initiatives Have Resulted In Patrick Becoming A Leading Component Solutions Provider In The Leisure Lifestyle And Housing Markets PROFITABLE GROWTH ENGINE STRATEGIC ACQUISITIONS Pursue accretive acquisition opportunities to further strengthen primary markets and explore potential adjacent markets INNOVATION New product development and product line extensions to further enhance Patrick’s extensive proprietary product offerings GEOGRAPHIC EXPANSION Grow presence and geographic footprint to drive logistics efficiency INDUSTRY GROWTH Positioned to capitalize on long-term secular growth and favorable demographics in all end markets through robust capacity MARKET LEADER Leading market position in key product categories (ski/wake towers, RV/Marine logistic solutions) CUSTOMER RELATIONSHIPS Cross-pollinate sales across customers and market sectors in the Leisure Lifestyle space The Patrick Approach to Driving Growth 20

M&A CRITERIA AND FILTERS FOR SUCCESSFUL STRATEGIC INVESTMENTS Strategic Criteria Strong Leadership Team and Cultural Fit Executable Revenue Synergies Geographic / Market Expansion Market Leadership Strong Track Record of Operational Success Key Market Category EPS Accretion in First Full Year ROIC > Internal hurdle rate Accretive to Profit Margins 21

BALANCE We work to build a healthy work environment that encourages excellence, happiness, and peace in both our work and our home life. EXCELLENCE We strive to meet the highest possible standards of achievement in our work and relationships. TRUST We do what we say we will do every time — and communicate with all stakeholders if a commitment evolves. TEAMWORK We challenge, encourage, equip, empower, and inspire the individuals we work with. EMPOWERMENT We give our team members the information, tools and trust they need to grow as leaders and achieve results. RESPECT We treat our teammates and partners with the utmost honor and dignity. OUR VALUES 22

APPENDIX

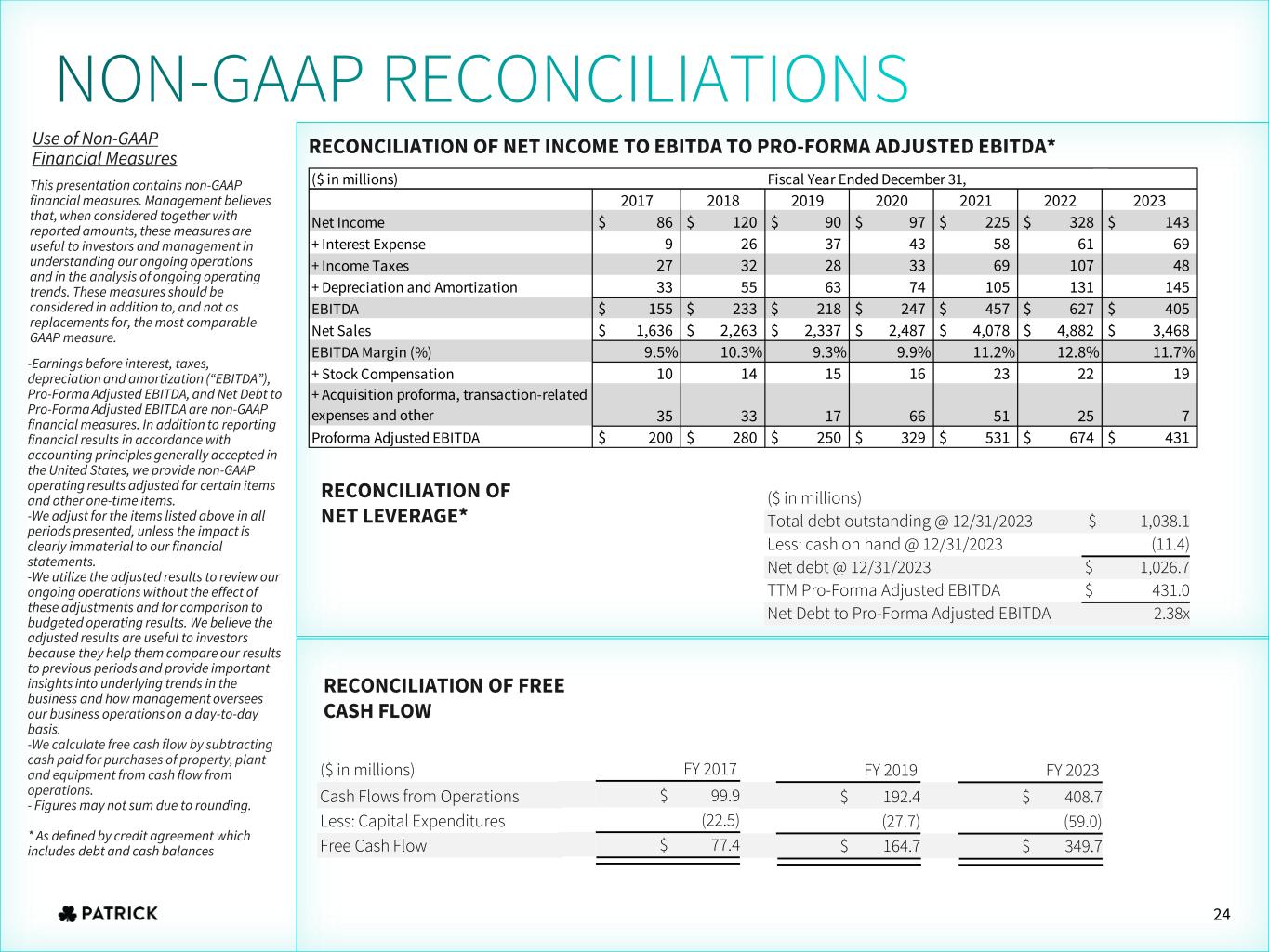

RECONCILIATION OF NET LEVERAGE* -Earnings before interest, taxes, depreciation and amortization (“EBITDA”), Pro-Forma Adjusted EBITDA, and Net Debt to Pro-Forma Adjusted EBITDA are non-GAAP financial measures. In addition to reporting financial results in accordance with accounting principles generally accepted in the United States, we provide non-GAAP operating results adjusted for certain items and other one-time items. -We adjust for the items listed above in all periods presented, unless the impact is clearly immaterial to our financial statements. -We utilize the adjusted results to review our ongoing operations without the effect of these adjustments and for comparison to budgeted operating results. We believe the adjusted results are useful to investors because they help them compare our results to previous periods and provide important insights into underlying trends in the business and how management oversees our business operations on a day-to-day basis. -We calculate free cash flow by subtracting cash paid for purchases of property, plant and equipment from cash flow from operations. - Figures may not sum due to rounding. * As defined by credit agreement which includes debt and cash balances RECONCILIATION OF NET INCOME TO EBITDA TO PRO-FORMA ADJUSTED EBITDA* RECONCILIATION OF FREE CASH FLOW NON-GAAP RECONCILIATIONS Use of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. Management believes that, when considered together with reported amounts, these measures are useful to investors and management in understanding our ongoing operations and in the analysis of ongoing operating trends. These measures should be considered in addition to, and not as replacements for, the most comparable GAAP measure. ($ in millions) Total debt outstanding @ 12/31/2023 $ 1,038.1 Less: cash on hand @ 12/31/2023 (11.4) Net debt @ 12/31/2023 $ 1,026.7 TTM Pro-Forma Adjusted EBITDA $ 431.0 Net Debt to Pro-Forma Adjusted EBITDA 2.38x ($ in millions) Cash Flows from Operations Less: Capital Expenditures Free Cash Flow 24 FY 2019 $ 192.4 (27.7) $ 164.7 FY 2017 $ 99.9 (22.5) $ 77.4 ($ in millions) Fiscal Year Ended December 31, Net Income $ 86 $ 120 $ 90 $ 97 $ 225 $ 328 $ 143 + Interest Expense 9 26 37 43 58 61 69 + Income Taxes 27 32 28 33 69 107 48 + Depreciation and Amortization 33 55 63 74 105 131 145 EBITDA $ 155 $ 233 $ 218 $ 247 $ 457 $ 627 $ 405 Net Sales $ 1,636 $ 2,263 $ 2,337 $ 2,487 $ 4,078 $ 4,882 $ 3,468 EBITDA Margin (%) 9.5% 10.3% 9.3% 9.9% 11.2% 12.8% 11.7% + Stock Compensation 10 14 15 16 23 22 19 + Acquisition proforma, transaction-related expenses and other 35 33 17 66 51 25 7 Proforma Adjusted EBITDA $ 200 $ 280 $ 250 $ 329 $ 531 $ 674 $ 431 20232017 2018 2019 2020 2021 2022 FY 2023 $ 408.7 (59.0) $ 349.7

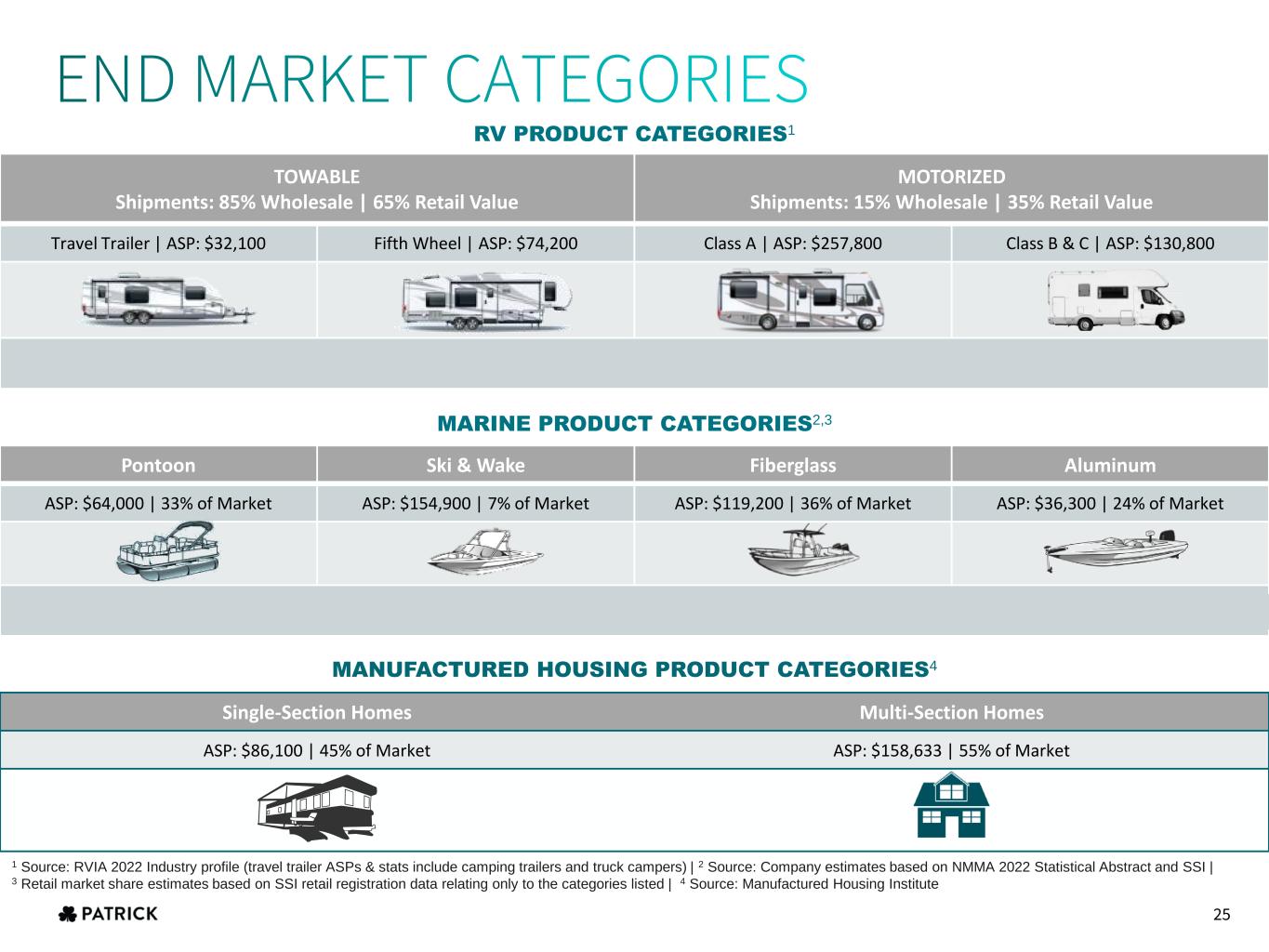

Single-Section Homes Multi-Section Homes ASP: $86,100 | 45% of Market ASP: $158,633 | 55% of Market TOWABLE Shipments: 85% Wholesale | 65% Retail Value MOTORIZED Shipments: 15% Wholesale | 35% Retail Value Travel Trailer | ASP: $32,100 Fifth Wheel | ASP: $74,200 Class A | ASP: $257,800 Class B & C | ASP: $130,800 RV PRODUCT CATEGORIES1 Pontoon Ski & Wake Fiberglass Aluminum ASP: $64,000 | 33% of Market ASP: $154,900 | 7% of Market ASP: $119,200 | 36% of Market ASP: $36,300 | 24% of Market U.S Expenditures on Boats, Engines, and Accessories Totaled $xxB in 2019 MARINE PRODUCT CATEGORIES2,3 MANUFACTURED HOUSING PRODUCT CATEGORIES4 1 Source: RVIA 2022 Industry profile (travel trailer ASPs & stats include camping trailers and truck campers) | 2 Source: Company estimates based on NMMA 2022 Statistical Abstract and SSI | 3 Retail market share estimates based on SSI retail registration data relating only to the categories listed | 4 Source: Manufactured Housing Institute END MARKET CATEGORIES 25

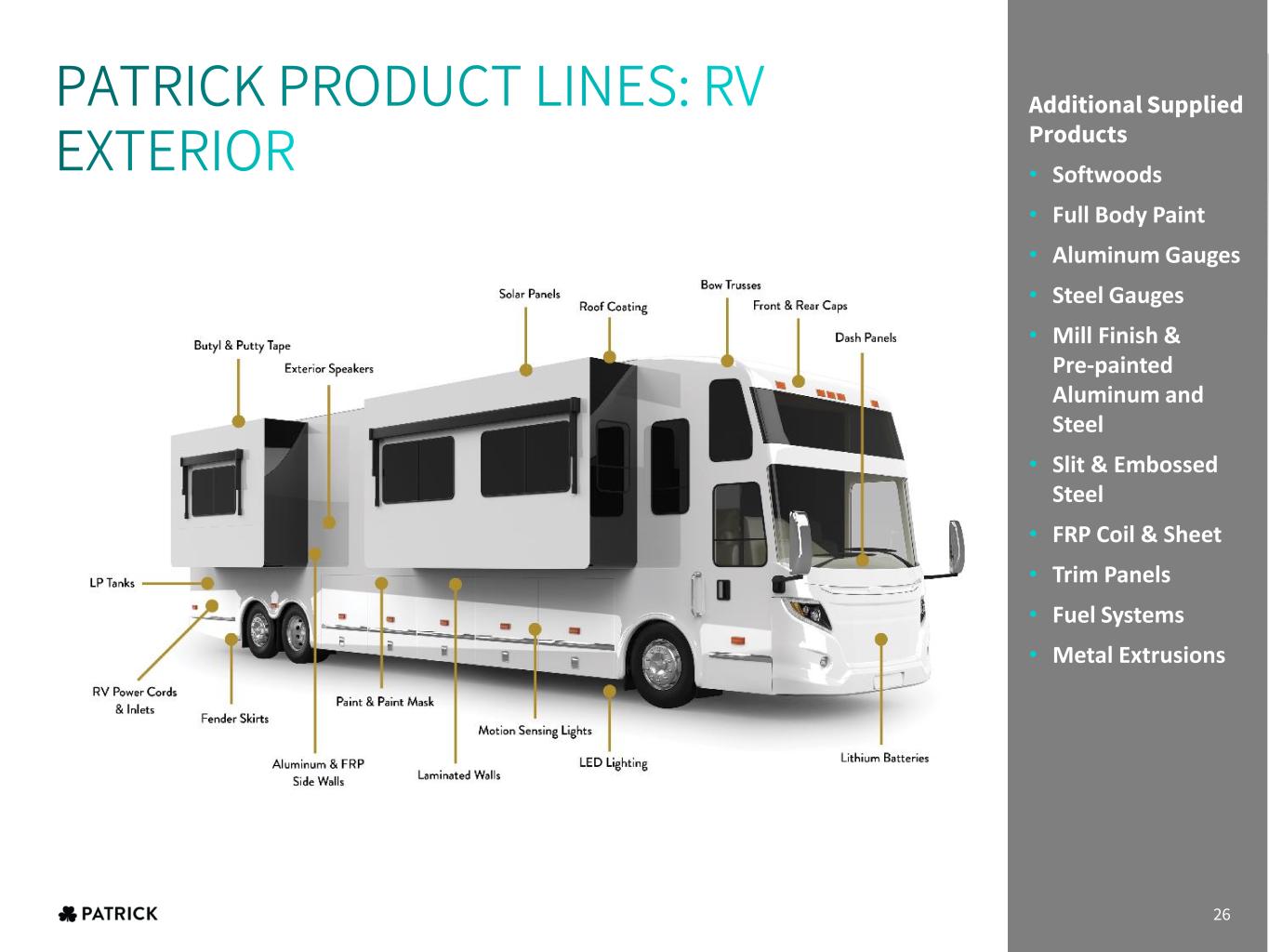

PATRICK PRODUCT LINES: RV EXTERIOR Additional Supplied Products • Softwoods • Full Body Paint • Aluminum Gauges • Steel Gauges • Mill Finish & Pre-painted Aluminum and Steel • Slit & Embossed Steel • FRP Coil & Sheet • Trim Panels • Fuel Systems • Metal Extrusions 26

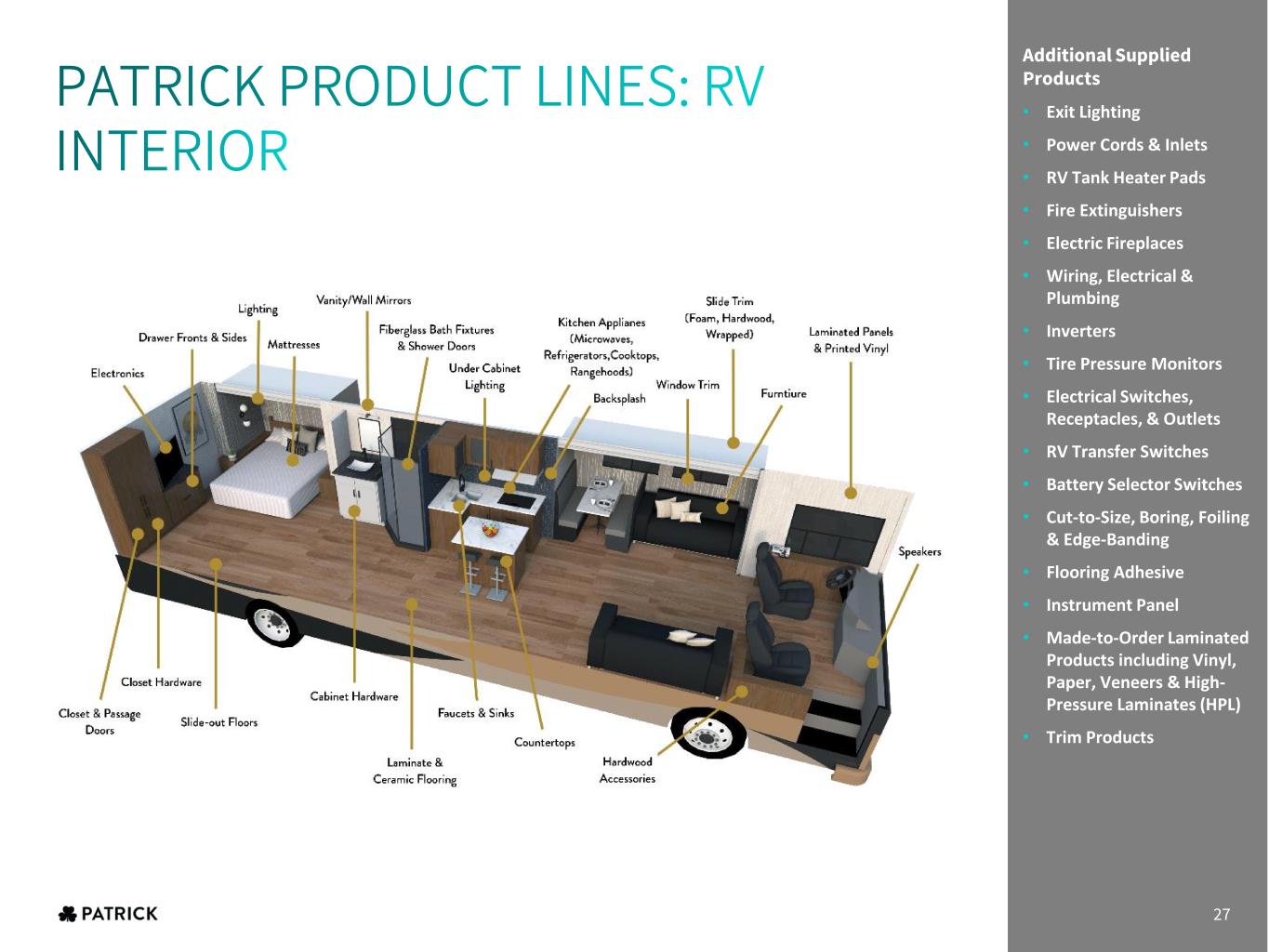

PATRICK PRODUCT LINES: RV INTERIOR Additional Supplied Products • Exit Lighting • Power Cords & Inlets • RV Tank Heater Pads • Fire Extinguishers • Electric Fireplaces • Wiring, Electrical & Plumbing • Inverters • Tire Pressure Monitors • Electrical Switches, Receptacles, & Outlets • RV Transfer Switches • Battery Selector Switches • Cut-to-Size, Boring, Foiling & Edge-Banding • Flooring Adhesive • Instrument Panel • Made-to-Order Laminated Products including Vinyl, Paper, Veneers & High- Pressure Laminates (HPL) • Trim Products 27

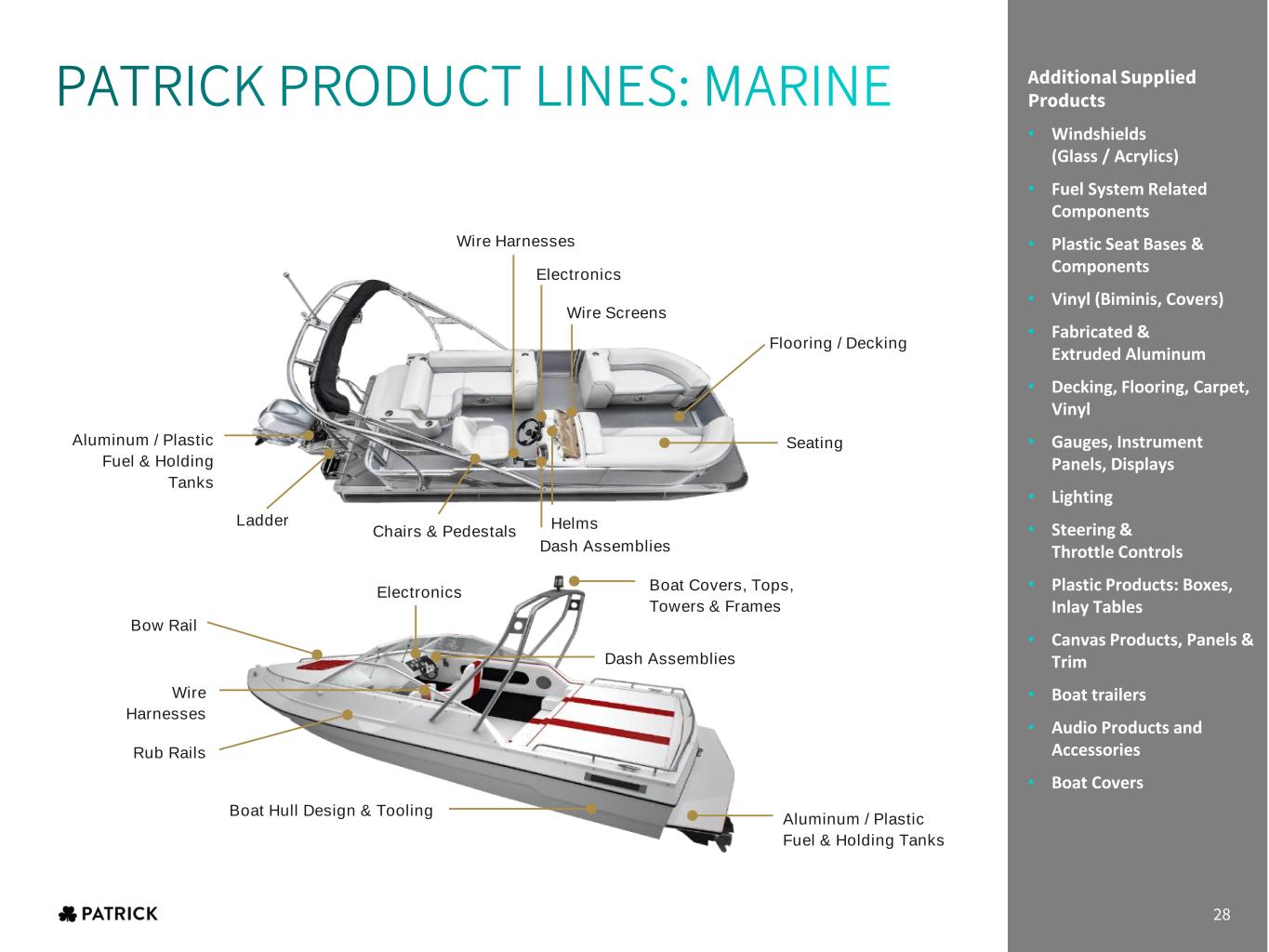

Additional Supplied Products ✓ Softwoods ✓ Full Body Paint ✓ Aluminum Gauges ✓ Steel Gauges ✓ Mill Finish & Pre-painted Aluminum and Steel ✓ Slit & Embossed Steel ✓ FRP Coil & Sheet ✓ Trim Panels ✓ Fuel Systems ✓ Metal Extrusions Aluminum / Plastic Fuel & Holding Tanks Wire Harnesses Electronics Dash Assemblies Wire Screens Helms Aluminum / Plastic Fuel & Holding Tanks Boat Hull Design & Tooling Wire Harnesses Dash Assemblies Electronics Boat Covers, Tops, Towers & Frames Ladder Chairs & Pedestals Rub Rails Bow Rail Flooring / Decking Seating PATRICK PRODUCT LINES: MARINE Additional Supplied Products • Windshields (Glass / Acrylics) • Fuel System Related Components • Plastic Seat Bases & Components • Vinyl (Biminis, Covers) • Fabricated & Extruded Aluminum • Decking, Flooring, Carpet, Vinyl • Gauges, Instrument Panels, Displays • Lighting • Steering & Throttle Controls • Plastic Products: Boxes, Inlay Tables • Canvas Products, Panels & Trim • Boat trailers • Audio Products and Accessories • Boat Covers 28

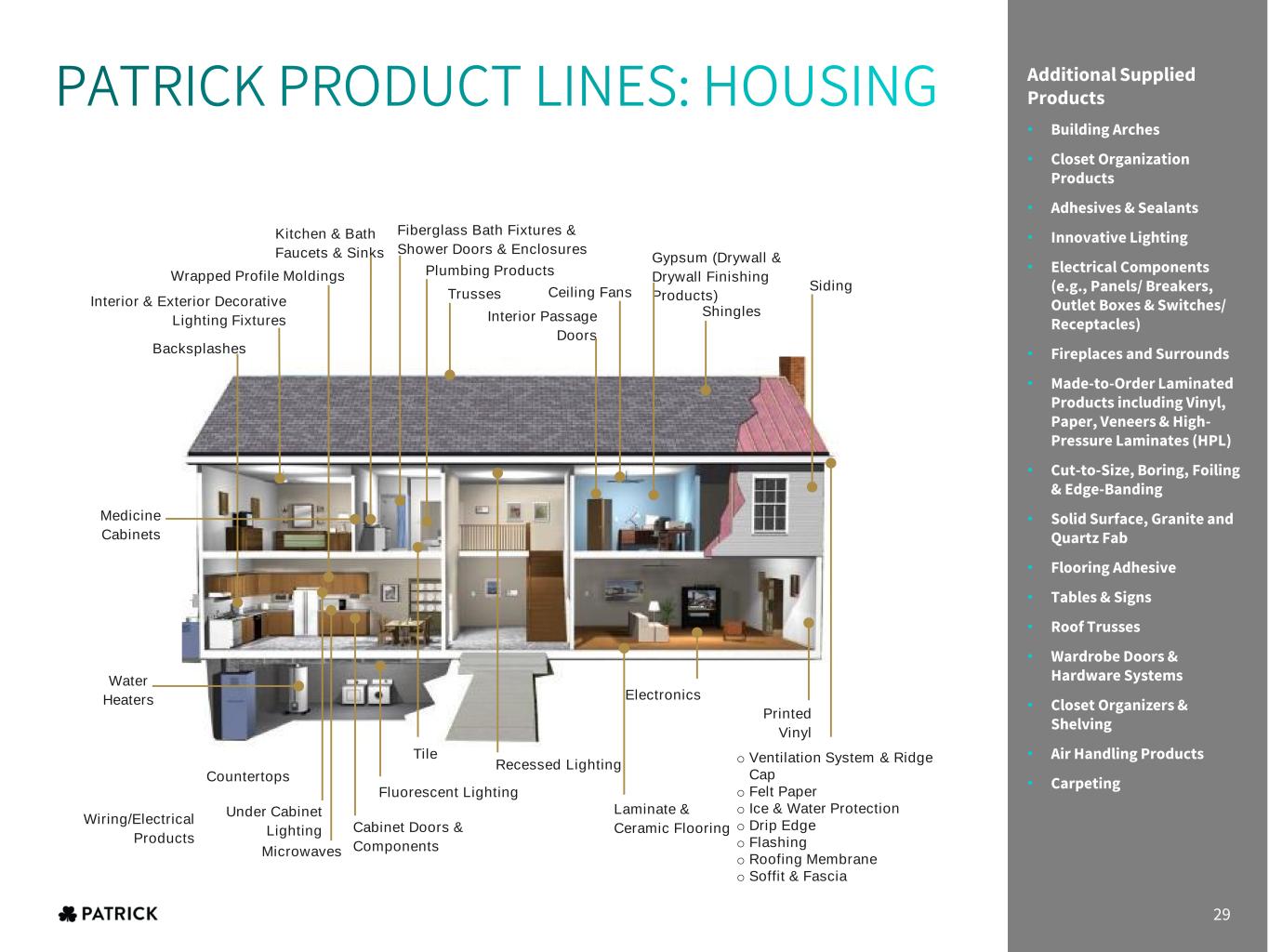

Additional Supplied Products ✓ Softwoods ✓ Full Body Paint ✓ Aluminum Gauges ✓ Steel Gauges ✓ Mill Finish & Pre-painted Aluminum and Steel ✓ Slit & Embossed Steel ✓ FRP Coil & Sheet ✓ Trim Panels ✓ Fuel Systems ✓ Metal Extrusions Interior Passage Doors Kitchen & Bath Faucets & Sinks Gypsum (Drywall & Drywall Finishing Products) Laminate & Ceramic Flooring Fiberglass Bath Fixtures & Shower Doors & Enclosures Cabinet Doors & ComponentsMicrowaves Countertops Electronics Siding Shingles o Ventilation System & Ridge Cap o Felt Paper o Ice & Water Protection o Drip Edge o Flashing o Roofing Membrane o Soffit & Fascia Wrapped Profile Moldings Plumbing Products Backsplashes Recessed Lighting Fluorescent Lighting Wiring/Electrical Products Ceiling Fans Medicine Cabinets Under Cabinet Lighting Tile Printed Vinyl Trusses Interior & Exterior Decorative Lighting Fixtures Water Heaters PATRICK PRODUCT LINES: HOUSING Additional Supplied Products • Building Arches • Closet Organization Products • Adhesives & Sealants • Innovative Lighting • Electrical Components (e.g., Panels/ Breakers, Outlet Boxes & Switches/ Receptacles) • Fireplaces and Surrounds • Made-to-Order Laminated Products including Vinyl, Paper, Veneers & High- Pressure Laminates (HPL) • Cut-to-Size, Boring, Foiling & Edge-Banding • Solid Surfac , Granite and Quartz Fab • Flooring Adhesive • Tables & Signs • Roof Trusses • Wardrobe Doors & Hardware Systems • Closet Organizers & Shelving • Air Handling Products • Carpeting 29

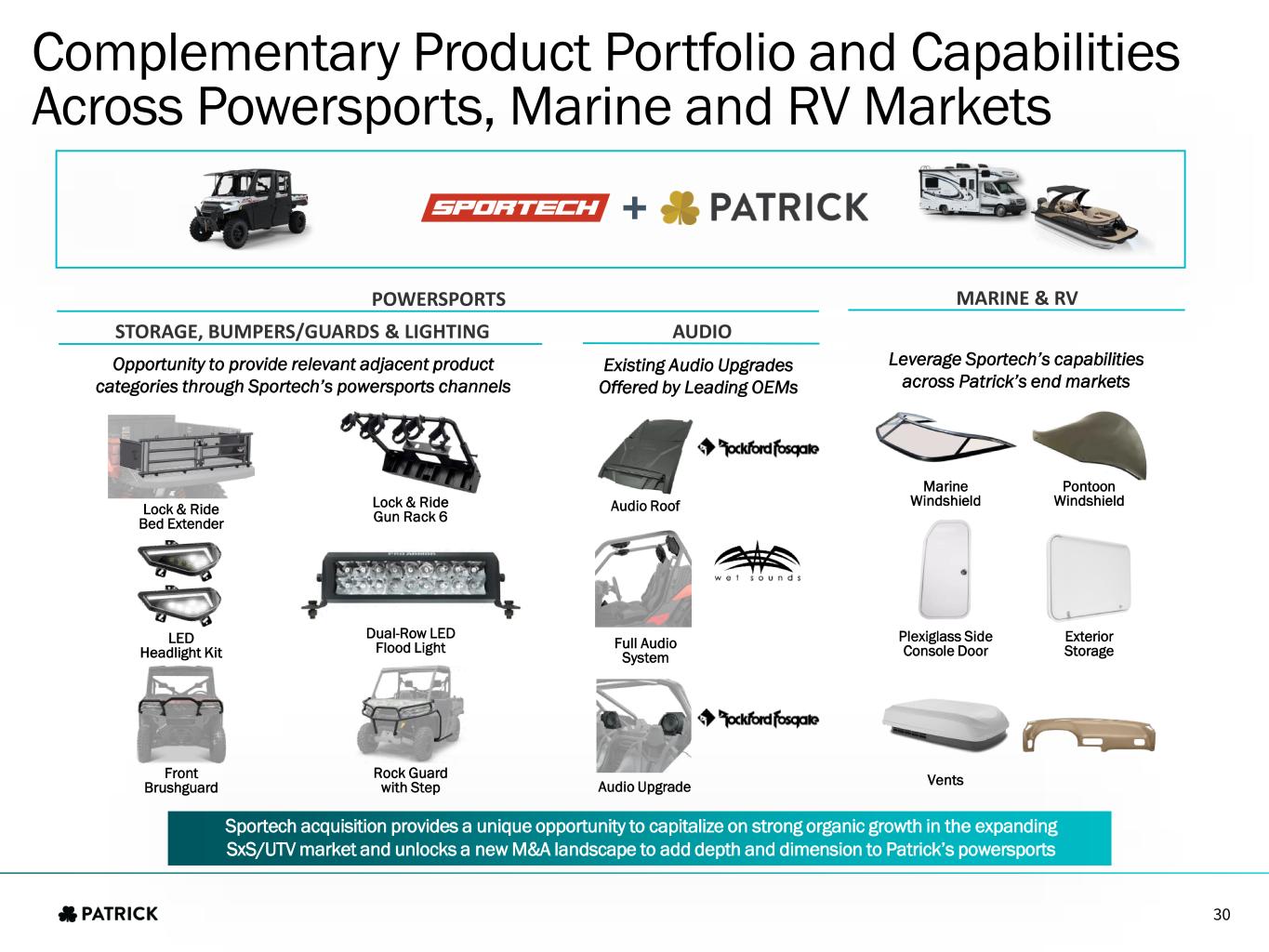

POWERSPORTS Sportech acquisition provides a unique opportunity to capitalize on strong organic growth in the expanding SxS/UTV market and unlocks a new M&A landscape to add depth and dimension to Patrick’s powersports Complementary Product Portfolio and Capabilities Across Powersports, Marine and RV Markets STORAGE, BUMPERS/GUARDS & LIGHTING AUDIO Opportunity to provide relevant adjacent product categories through Sportech’s powersports channels Existing Audio Upgrades Offered by Leading OEMs MARINE & RV Lock & Ride Bed Extender LED Headlight Kit Front Brushguard Lock & Ride Gun Rack 6 Dual-Row LED Flood Light Rock Guard with Step Leverage Sportech’s capabilities across Patrick’s end markets Audio Roof Full Audio System Audio Upgrade Marine Windshield Plexiglass Side Console Door Vents Exterior Storage Pontoon Windshield 30