PRE 14A: Preliminary proxy statement not related to a contested matter or merger/acquisition

Published on March 16, 2006

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant [ X ]

|

Filed by a Party other than the Registrant [ |

] |

Check the appropriate box:

|

x |

Preliminary Proxy Statement |

| |||

|

o |

Confidential, for Use of the Commission Only (as permitted by 14a-6(e)(2)) |

| |||

|

o |

Definitive Proxy Statement |

| |||

|

o |

Definitive Additional Materials |

| |||

|

o |

Soliciting Material Pursuant to Sections 240.14a-11(c) or Section 240.14a-12 | ||||

PATRICK INDUSTRIES, INC.

(Name of Registrant as Specified in its Charter)

(Name Of Person(S) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

x |

No fee required. |

|

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

|

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

(2) |

Aggregate number of securities to which transactions applies: |

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

|

(5) |

Total fee paid: |

|

o |

|

Fee paid previously with preliminary materials. |

|

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

Amount Previously Paid: |

|

|

(2) |

Form, Schedule or Registration Statement No.: |

|

|

(3) |

Filing Party: |

|

|

(4) |

Date Filed: |

PATRICK INDUSTRIES, INC.

107 West Franklin Street

P.O. Box 638

Elkhart, Indiana 46515-0638

574-294-7511

____________

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held May 11, 2006

TO OUR SHAREHOLDERS:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of Patrick Industries, Inc., an Indiana corporation, will be held at the Companys Corporate offices, 107 W. Franklin Street, Elkhart, Indiana, on Thursday, May 11, 2006 at 10:00 a.m., Indiana time, for the following purposes:

|

|

1. To elect three directors of the Company to serve until 2009; |

2. To approve the reinstatement of full voting rights of Tontine Capital Partners, L.P. common stock, which is currently subject to the control share restrictions of the Indiana Business Corporation Law;

|

|

3. To approve a proposed amendment to the Companys 1987 Stock Option Program; and |

4. To consider and transact such other business as may properly come before the meeting or any adjournments thereof.

The Board of Directors has fixed the close of business on March 17, 2006, as the record date for the determination of the holders of shares of the Companys outstanding Common Stock entitled to notice of and to vote at the Annual Meeting of Shareholders. Each shareholder is entitled to one vote per share on all matters to be voted on at the meeting.

Whether or not you expect to attend the meeting, you are urged to sign, date, and return the enclosed proxy in the enclosed envelope.

|

|

By Order of the Board of Directors, |

|

|

ANDY L. NEMETH | ||

|

|

SECRETARY |

| |

April 7, 2006

PLEASE DATE, SIGN AND MAIL THE ENCLOSED PROXY IN THE ENVELOPE PROVIDED WHICH REQUIRES NO POSTAGE FOR MAILING IN THE UNITED STATES. A PROMPT RESPONSE IS HELPFUL, AND YOUR COOPERATION WILL BE APPRECIATED.

PATRICK INDUSTRIES, INC.

107 West Franklin Street

P.O. Box 638

Elkhart, Indiana 46515-0638

574-294-7511

_____________________

PROXY STATEMENT

Annual Meeting of Shareholders

To Be Held May 11, 2006

_______________________________

This Proxy Statement is being mailed to shareholders of Patrick Industries, Inc. (the Company) on or about April 7, 2006, and is furnished in connection with the Board of Directors solicitation of proxies for the Annual Meeting of Shareholders to be held on May 11, 2006 for the purpose of considering and acting upon the matters specified in the Notice of Annual Meeting of Shareholders accompanying this Proxy Statement. If the form of proxy which accompanies this Proxy Statement is executed and returned, it may be revoked by the person giving it at any time prior to the voting thereof by written notice to the Secretary, by delivery of a later dated proxy, or by requesting to vote in person at the meeting. Additional solicitations, in person or by telephone or otherwise, may be made by certain directors, officers, and employees of the Company without additional compensation. Expenses incurred in the solicitation of proxies, including postage, printing and handling, and actual expenses incurred by brokerage houses, custodians, nominees, and fiduciaries in forwarding documents to beneficial owners, will be paid by the Company.

The Annual Report to shareholders for the year ended December 31, 2005, accompanies this Proxy Statement. Additional copies of the Annual Report may be obtained by writing the Secretary of the Company.

VOTING INFORMATION

Each shareholder is entitled to one vote for each share of the Companys Common Stock held as of the record date. For purposes of the meeting, a quorum means a majority of the outstanding shares. As of the close of business on March 17, 2006, the record date for shareholders entitled to vote at the Annual Meeting, there were outstanding 4,748,198 shares of Common Stock entitled to one vote each. In determining whether a quorum exists at the meeting, all shares represented in person or by proxy will be counted. A shareholder may, with respect to the election of directors, (i) vote for the election of all named director nominees, (ii) withhold authority to vote for all named director nominees, or (iii) vote for the election of all named director nominees other than any nominee with respect to whom the shareholder withholds authority to vote by so indicating in the appropriate space on the proxy. With respect to the other proposals, a shareholder may vote for, against, or abstain. Proxies properly executed and received by the Company prior to the meeting and not revoked will be voted as directed therein on all matters presented at the meeting. In the absence of a specific direction from the shareholder, proxies will be voted for the election of all named director nominees, for the proposal to reinstate the full voting rights of Tontine Capital Partners, L.P. common stock (the Reinstatement Proposal), and for the proposed amendment to the Companys 1987 Stock Option Program (the Stock Option Program Proposal).

The Directors are elected by a plurality of the votes cast by shares present in person or by proxy at the Annual Meeting and entitled to vote. Consequently, withholding authority to vote in the election of Directors will have no effect on the election of directors. The Reinstatement Proposal requires the approval of a majority of the outstanding shares and the Stock Option Program Proposal requires the approval of a majority of the votes cast at a meeting at which a quorum is present. A broker non-vote occurs when a broker holding shares registered in street name is permitted to vote, in the broker's discretion, on routine matters without receiving instructions from the client, but is not permitted to vote without instructions on non-routine matters, and the broker returns a proxy card with no vote on the non-routine matter. Under the rules and regulations of the primary trading markets applicable to most brokers, the election of directors is a routine matter on which a broker has the discretion to vote if instructions are not received from the client in a timely manner. Broker non-votes will have no effect the election of directors or the approval of the Stock Option Program Proposal. A broker non-vote will have the effect of a vote against the Reinstatement Proposal. An abstention will have the effect of a vote against both proposals.

The Board of Directors knows of no other matter which may come up for action at the Annual Meeting. However, if any other matter properly comes before the Annual Meeting, the persons named in the proxy form enclosed will vote in accordance with their judgment upon such matter.

Shareholder proposals for inclusion in proxy materials for the next Annual Meeting should be addressed to the Companys Secretary, P.O. Box 638, Elkhart, Indiana 46515-0638, and must be received no later than Friday, December 8, 2006. In addition, the Companys By-laws require notice of any other business to be brought before a meeting by a shareholder (but not included in the proxy statement) to be delivered, in writing, to the Companys Secretary, together with certain prescribed information, not less than 90 days nor more than 110 days prior to the first anniversary of the preceding years annual meeting. Likewise, the Articles of Incorporation and By-laws require that shareholder nominations to the Board of Directors be delivered to the Secretary, together with certain prescribed information in accordance with the procedures for bringing business before an Annual Meeting which directors are to be elected.

STOCK OWNERSHIP INFORMATION

The following table sets forth, as of the record date, information concerning the only parties known to the Company having beneficial ownership of more than 5 percent of its outstanding Common Stock and information with respect to the stock ownership of all directors and executive officers of the Company as a group.

|

|

Number of |

| ||||||

|

|

Shares |

| ||||||

|

|

Beneficially |

Percent | ||||||

|

|

Name and Address of Beneficial Owner |

Owned |

of Class | |||||

|

|

Tontine Capital Partners, L.P. . . . . . . . . . . . . . . . . . . . . . . . . . |

1,313,089 |

27.21% | |||||||||||||||||||

|

|

55 Railroad Avenue, 3rd Floor |

| ||||||||||||||||||||

|

|

Greenwich, Connecticut 06830 |

| ||||||||||||||||||||

|

|

CAM North America, LLC. . . . . . . . . . . . . . . . . . . . . . . . . . . . |

459,200 |

9.52% |

| ||||||||||||||||||

|

|

Smith Barney Fund Management, LLC |

| ||||||||||||||||||||

|

|

399 Park Avenue |

| ||||||||||||||||||||

|

|

New York, New York 10043 |

| ||||||||||||||||||||

|

|

Heartland Advisors, Inc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

398,625 |

8.26% |

| ||||||||||||||||||

|

|

789 North Water Street |

| ||||||||||||||||||||

|

|

Milwaukee, Wisconsin 53202 |

| ||||||||||||||||||||

|

|

Dimensional Fund Advisors, Inc . . . . . . . . . . . . . . . . . . . . . . . |

336,817 |

6.98% |

| ||||||||||||||||||

|

|

1299 Ocean Avenue, 11th Floor |

| ||||||||||||||||||||

|

|

Santa Monica, California 90401 |

| ||||||||||||||||||||

|

|

FMR Corp. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

273,280 |

5.66% |

| ||||||||||||||||||

|

|

25 Lovat Lane |

| ||||||||||||||||||||

|

|

Boston, Massachusetts 02109 |

| ||||||||||||||||||||

|

|

Wilen Capital Management . . . . . . . . . . . . . . . . . . . . . . . . . . . |

265,332 |

5.50% |

| ||||||||||||||||||

|

|

2360 West Joppa Road, Suite 226 |

| ||||||||||||||||||||

|

|

Lutherville, MD 21093 |

| ||||||||||||||||||||

|

|

Directors and Executive Officers as a group (10 persons) (1). . |

181,046 |

3.75%(1) |

_________

|

(1) |

The stock ownership of the executive officers named in the Summary Compensation Table is set forth under the heading Election of Directors, except for Paul E. Hassler (5,280 shares), Andy L. Nemeth (1,890 shares), and Gregory J. Scharnott (1,890 shares). Paul E. Hassler has 13,625 shares which are exercisable within 60 days of the record date and Andy L. Nemeth and Gregory J. Scharnott each have 3,625 shares which are exercisable within 60 days of the record date. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires that certain of the Companys officers, its directors and 10% shareholders file with the Securities and Exchange Commission and NASDAQ an initial statement of beneficial ownership and certain statements of changes in beneficial ownership of Common Stock of the Company. Based solely on its review of such forms received by the Company and written representation from the directors and officers that no other reports were required, the Company is unaware of any instances of noncompliance or late compliance with such filings during the fiscal year ended

December 31, 2005, except for Harold E. Wyland who was late in filing one Form 4 covering one transaction.

ELECTION OF DIRECTORS

The Board of Directors is divided into three classes, with the members of each class serving staggered three-year terms. Accordingly, at the 2006 Annual Meeting three directors will be elected to hold office until the 2009 Annual Meeting or until their successors are duly elected and qualified.

It is intended that the proxies will be voted for the nominees listed below, unless otherwise indicated on the proxy form. It is expected that these nominees will serve, but, if for any unforeseen cause any such nominee should decline or be unable to serve, the proxies will be voted to fill any vacancy so arising in accordance with the discretionary authority of the persons named in the proxies.

The following information concerning principal occupations and the number of shares of Common Stock of the Company owned beneficially as of March 17, 2006, has been furnished by the nominees and directors continuing in office:

|

|

Common |

Percent |

| ||||||||||||||

|

|

First |

Stock |

of |

| |||||||||||||

|

|

Year |

of the |

Common | ||||||||||||||

|

|

Principal Occupation |

Elected |

Company |

Stock |

| ||||||||||||

|

|

Name and Age |

and Other Directorships |

Director |

Owned(1) |

Owned |

| |||||||||||

Directors to Serve Until the 2009 Annual Meeting:

|

|

Walter E. Wells, 67 . . . . . . |

Retired President and CEO of Schult |

2001 |

15,000 |

less |

| ||

|

|

Homes Corporation |

than 1% | ||||||

|

|

John H. McDermott, 74 . . . |

Of counsel to the Chicago, Illinois |

1969 |

32,000 |

less |

| |||||||||||

|

|

law firm of McDermott Will & Emery LLP, |

than 1% | |||||||||||||||

|

|

which firm has been retained by the |

| |||||||||||||||

|

|

Company since 1968 for certain legal |

| |||||||||||||||

|

|

matters. |

| |||||||||||||||

|

|

Paul E. Hassler, 58 . . . . . . |

President and Chief Executive Officer |

2005 |

5,280 |

less |

| |||||||||||

|

|

since 2004. Vice President of Western |

than 1% | |||||||||||||||

|

|

Operations of Patrick Industries, Inc. |

| |||||||||||||||

|

|

from December, 2003 to April, 2004 and |

| |||||||||||||||

|

|

Executive Director, West 1994 to 2003. |

| |||||||||||||||

|

|

General Manager of CA operations from |

| |||||||||||||||

|

|

1986 to 1994. |

| |||||||||||||||

Directors to Serve Until the 2007 Annual Meeting:

|

|

Keith V. Kankel, 63 . . . . . . |

Retired Interim President and CEO |

1977 |

22,686 |

less |

| |||||||

|

|

from 2003 to 2004. Vice President of |

than 1% | |||||||||||

|

|

Finance of Patrick Industries, Inc. |

| |||||||||||

|

|

from 1987 through July, 2002 |

| |||||||||||

|

|

and retired Secretary-Treasurer |

| |||||||||||

|

|

from 1974 through July, 2002. |

| |||||||||||

|

|

Harold E. Wyland, 69 . . . . |

Chairman in 2001. |

1989 |

7,500 |

less |

| |||||||

|

|

Retired Vice President of Sales |

than 1% | |||||||||||

|

|

of Patrick Industries, Inc. from |

| |||||||||||

|

|

1990 through 1998. |

| |||||||||||

|

|

Andy L. Nemeth, 37 . . . . |

Executive Vice President |

2006 |

1,890 |

less |

| |||||||

|

|

Finance, Chief Financial Officer |

than 1% | |||||||||||

|

|

of the Company since May 2004. |

| |||||||||||

Vice President- Finance, Chief Financial Officer

and Secretary-Treasurer of the

|

|

Company from May 2003 to April 2004. | |||||

|

|

Secretary-Treasurer of the Company |

| ||||

|

|

from July 2002 to May 2003. Division |

| ||||

|

|

Controller of the Company from May |

| ||||

|

|

1996 to July 2002. |

| ||||

|

|

Common |

Percent |

| ||||||||||||||

|

|

First |

Stock |

of |

| |||||||||||||

|

|

Year |

of the |

Common | ||||||||||||||

|

|

Principal Occupation |

Elected |

Company |

Stock |

| ||||||||||||

|

|

Name and Age |

and Other Directorships |

Director |

Owned(1) |

Owned |

| |||||||||||

Nominees to Serve Until the 2008 Annual Meeting:

|

|

Robert C. Timmins, 84 . . . |

Retired Vice President and Director of |

1987 |

57,300 |

1.19% | |||||||||

|

|

a Musical Instrument Company and |

| ||||||||||||

|

|

CPA and Partner of McGladrey & |

| ||||||||||||

|

|

Pullen (certified public accountants) |

| ||||||||||||

|

|

until 1985. |

| ||||||||||||

|

|

Terrence D. Brennan, 67. . |

Retired President and CEO of NBD Bank, |

1999 |

15,000 |

less |

| ||||||||

|

|

Elkhart, IN, from 1973 to 1997. |

than 1% |

| |||||||||||

|

|

Larry D. Renbarger, |

67. . |

Retired as CEO of Shelter Components |

2002 |

22,500 |

less |

| |||||||

|

|

in 1998. |

than 1% |

| |||||||||||

- - - - - - -

(1) Each individual has sole voting and dispositive power over the shares indicated.

The Board of Directors unanimously recommends a vote FOR this Proposal, and your proxy will be so voted, unless you specify otherwise.

APPROVAL OF CONTROL SHARE ACQUISITION

On September 12, 2005, Tontine Capital Partners, L.P. (the Partnership) purchased 890,221 shares of common stock of the Company from Mervin and Dorothy Lung (the Control Shares). As a result of the purchase, Jeffrey L. Gendell, Tontine Capital Partners, L.P. and Tontine Capital Management L.L.C., along with their affiliates or associates (collectively, Tontine) own 1,313,089 shares or 27.2% of the outstanding common stock of the Company.

Since the acquisition of the Control Shares increased Tontines total share ownership to more than one-fifth but less than one-third of all voting power, under the Indiana Business Corporation Law, the Control Shares held by Tontine will have voting rights only to the extent granted by the resolution approved by the shareholders of the Company.

In order to restore full voting rights to the Control Shares, the Board of Directors of the Company recommends a vote FOR the following resolutions:

RESOLVED, that pursuant to Section 23-1-42-9 of the Indiana Business Corporation Law, the 890,221 shares of common stock of the Company acquired from Mervin and Dorothy Lung and held by Tontine Capital Partners, L.P. (Partnership) be and hereby are accorded the same voting rights as all other shares of common stock of the Company, and that any and all restrictions of such voting rights arising from the status of such shares as control shares under the Indiana Business Corporation Law shall not apply; and

RESOLVED, that pursuant to Section 23-1-42-9 of the Indiana Business Corporation Law, any additional shares of common stock of the Company beneficially owned or acquired by the Partnership and/or its affiliates and successors, to the extent that the Partnerships aggregate ownership of common stock represents less than thirty percent (30%) of the Companys outstanding common stock, be and hereby are accorded the same voting rights as all other shares of common stock of the Company, and that any and all restrictions of such voting rights arising from the status of such shares as control shares under the Indiana Business Corporation Law shall not apply.

The foregoing resolutions must be adopted by the affirmative vote of the holders of a majority of all the outstanding common stock of the Company entitled to vote excluding interested shares. Under the Indiana Business Corporation Law, all shares held by Tontine, as well as any shares held by officers of the Company or by anyone who is an employee as well as a director of the Company, are interested shares and will not be entitled to vote on this resolution. Abstentions and broker non-votes will count as a vote against the proposal.

The Partnership is a Delaware limited partnership which operates as a private investment partnership. The general partner of the Partnership is Tontine Capital Management, L.L.C., a Delaware limited liability company (the General Partner). Jeffrey L. Gendell is the managing member of the General Partner. According to the Schedule 13D filed by the Partnership, its investment objective is to achieve superior after-tax capital appreciation through investments that primarily focus on small capitalization companies. The General Partners investment approach emphasizes value investing and is based primarily on its industry research, analysis of company financial documents and discussions with company management. Tontine has delivered an acquiring person statement to the Company as permitted under Section 23-1-42-6 of the Indiana Business Corporation Law. A copy of the acquiring person statement is attached as Appendix A to this proxy statement.

Under the Companys Rights Agreement, Tontines ownership of shares of the Companys common stock will not constitute a Triggering Event to the extent that Tontines ownership of common stock represents less than 30% of the outstanding common stock of the Company. The Company is a party to a registration rights agreement with Tontine, which provides that, during the two year period following the September 12, 2005 acquisition date, Tontine may demand that the Company may register for resale the shares owned by Tontine or its affiliates of a Form S-3 Registration Statement, subject to certain exceptions as provided in the Agreement. In addition, as long as Tontine beneficially owns more than 8.86% of the outstanding common stock of the Company, Tontine is entitled to piggy-back registration rights in the event that the Company files a registration statement with the Securities and Exchange Commission subject to certain exceptions as provided in the Agreement.

The Board of Directors unanimously recommends a vote FOR this Proposal, and your proxy will be so voted, unless you specify otherwise.

PROPOSED AMENDMENTS TO 1987 STOCK OPTION PROGRAM

The Companys 1987 Stock Option Program (the Program) was adopted by the Board of Directors in 1987 and approved by the shareholders in the same year. The purpose of the Program is to attract and retain highly qualified persons as officers and key employees of the Company.

In 1994, the Program was amended to (i) extend the term of the Program to the year 2004, (ii) increase the number of shares available for grants under the Program to 600,000, (iii) change the class of eligible participants to include non-employee directors, and (iv) add a per person limitation of 50,000 shares to the number of shares which may be warded to any participant in any year during the term of the Program to comply with the requirements of Section 162(m) of the Internal Revenue Code. In 2001, the Program was amended to increase the number of shares available for grants under the Program by 200,000 shares. In 2004 the Program was emended to extend the expiration date of the Program from May 17, 2004 to May 17, 2014 and to change the non-employee director awards from bi-annual awards of 6,000 share vesting over a two-year period to annual awards of 3,000 shares to vest over a one-year period.

The Board of Directors has now amended the Program, subject to shareholder approval, to increase the number of shares available for grants under the program by 500,000 shares.

The proposed amendments will permit the Company to continue to keep pace with changing trends in management compensation and make the Company competitive with those companies that offer stock incentives to attract and keep management employees and non-employee directors.

A brief summary of the Program is provided below, but is qualified in its entirety by reference to the full text of the Program on file with the Securities and Exchange Commission. A copy of the Program is available from the Corporations Secretary at the address on the cover of this Proxy statement.

Eligibility for Participation

Under the Program, the Company may grant stock options that may either be incentive stock options or non-qualified stock options, related stock appreciation rights and stock awards. Officers and other key employees of the company are eligible to participate in the Program. In addition each non-employee director annually receives a restricted stock award for 3,000 shares of Common stock upon election to the Board which will vest after one year of continued service on the Board.

Federal Tax Treatment

The grant of a stock option is not a taxable event. Upon exercise of a stock option, the participant will have taxable income equal to the difference between the fair market value on the date of exercise and the exercise price.

The non-employee directors who receive restricted stock awards will not realize taxable income at the time of grant, and the Company will not be entitled to a tax deduction at the time of grant, unless any such person makes an election to be taxed at the time of grant. When the restrictions lapse, the non-employee director will recognize taxable income in an amount equal to the then fair market value of the shares. The Company will be entitled to a corresponding tax deduction.

Other Information

A new benefits table is not provided because no grants have been made in 2006 under the Program and all benefits are discretionary. The closing price of the Common Stock as reported on the NASDAQ/NMS for March 17, 2005 was $9.55 per share.

The affirmative vote of holders of a majority of the shares represented and entitled to vote at the meeting is required for approval of the amendments to the 1987 Stock Option Program. Abstentions will count as a vote against the proposal, and broker non-votes will have no effect on the proposal.

The Board of Directors unanimously recommends a vote FOR approval of the amendments to the 1987 Stock Option Program.

COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS

Summary Compensation Table

|

|

Long-Term Compensation |

| ||||||||||||||||||||||||

|

|

Securities |

| ||||||||||||||||||||||||

|

|

Annual Compensation |

Underlying |

All Other |

| ||||||||||||||||||||||

|

|

Name and Principal Position |

Year |

Salary ($) |

Bonus ($) |

Options(#) |

Compensation ($)(3) | ||||||||||||||||||||

|

|

Paul E. Hassler |

2005 |

293,460 |

28,000 |

24,500 |

664 |

| |||||||||||||||||||

|

|

President and CEO |

2004 |

282,601 |

28,000 |

24,500 |

624 |

| |||||||||||||||||||

|

|

2003 |

138,497 |

33,803 (1) |

- - - |

395 |

| ||||||||||||||||||||

|

|

Andy L. Nemeth |

2005 |

193,464 |

18,000 |

14,500 |

500 |

| |||||||||||||||||||

|

|

Executive Vice President of Finance, |

2004 |

192,887 |

18,000 |

14,500 |

386 |

| |||||||||||||||||||

|

|

CFO, and Secretary-Treasurer |

2003 |

163,460 |

13,000 (2) |

- - - |

353 |

| |||||||||||||||||||

|

|

Gregory J. Scharnott |

2005 |

193,464 |

18,000 |

14,500 |

560 |

| |||||||||||||||||||

|

|

Executive Vice President of Operations |

2004 |

192,727 |

18,000 |

14,500 |

520 |

| |||||||||||||||||||

|

|

and Distribution |

2003 |

155,040 |

13,000 (2) |

- - - |

470 |

| |||||||||||||||||||

|

|

(1) |

The bonus for Paul E. Hassler is related to compensation as an executive director of Western Operations. Mr. Hassler was elected Vice President of Operations and Distribution West in December 2003 and subsequently elected President and Chief Executive Officer of the Company effective April 5, 2004. |

|

|

(2) |

The bonus for the executive officers was a discretionary bonus awarded by the Board of Directors in February 2003. This award was based on managements efforts to contain costs as a result of the December 31, 2002 operating results. |

|

|

(3) |

Company contributions to 401(k) Savings Plan. |

Employment Contracts

The Company entered into Employment Agreements with Paul E. Hassler, Andy L. Nemeth, and Gregory J. Scharnott, pursuant to which they agreed to serve as executive officers of the Company. The agreements contain a non-compete clause and certain other stipulations and provide for a severance package that includes twelve (12) months base salary for Paul E. Hassler and six (6) months base salary for Andy L. Nemeth and Gregory J. Scharnott. The employment agreements renew automatically.

The executive officers of the Company have deferred compensation agreements which provide that the Company will pay each of these employees, or their beneficiaries, up to 40% of their base salary for 120 months upon retirement (if the employee continues in the employment of the Company until the age of 65) or upon the employees death or total disability.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year End Option Values

|

|

Number of |

Value of |

| |||||||||||||||||||||||||||||||||

|

|

Securities Underlying |

Unexercised |

| |||||||||||||||||||||||||||||||||

|

|

Unexercised |

In-the-Money |

| |||||||||||||||||||||||||||||||||

|

|

Options at FY- |

Options at FY- |

| |||||||||||||||||||||||||||||||||

|

|

Shares Acquired |

End (#) |

End ($)* |

| ||||||||||||||||||||||||||||||||

|

|

On Exercise |

Value Realized |

Exercisable / |

Exercisable / |

| |||||||||||||||||||||||||||||||

|

|

Name |

(#) |

($) (1) |

Nonexercisable |

Nonexercisable |

| ||||||||||||||||||||||||||||||

|

|

Paul E. Hassler . . . . . . . . . . . . |

6,000 |

$26,850 |

13,625/42,875 |

$35,728/26,338 |

| ||||||||||||||||||||||||||||||

|

|

Andy L. Nemeth . . . . . . . . . . . |

3,875 |

$18,562 |

3,625/25,375 |

$2,103/15,588 | |||||||||||||||||||||||||||||||

|

|

Gregory J. Scharnott . . . . . . . |

- - - |

- - - |

3,625/25,375 |

$2,103/15,588 |

| ||||||||||||||||||||||||||||||

- - - -

|

|

* |

Market value of the underlying stock at exercise date, or year-end as the case may be, minus the exercise price of the options. |

(1) Represents the difference between the closing price of the Corporations common stock on the date of exercise and the exercise price of the option.

Option Grants In Last Fiscal Year

The following table sets forth all grants of options to acquire shares of the Company's Common Stock granted to the Named Executive Officers for the fiscal year ended December 31, 2005.

|

|

|

|

|

|

Potential Realized Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(2) | ||

|

Name |

Number of Securities Underlying |

Percent of Total Options Granted to Employees in Fiscal Year (1) |

Exercise Price ($/Share) |

Expiration Date |

5% |

10% | |

|

Paul E. Hassler |

24,500 |

36% |

$ 9.95 |

10/30/2011 |

82,810 49,010 49,010 |

187,915 | |

|

Andy L. Nemeth |

14,500 |

21% |

9.95 |

10/30/2011 |

111,215 | ||

|

Gregory F. Scharnott |

14,500 |

21% |

9.95 |

10/30/2011 |

111,215 | ||

__________________

|

|

(1) |

All options were granted under the 1987 Stock Option Plan under which a total of 68,500 stock options were awarded in 2005. |

|

|

(2) |

Potential realizable values are net of exercise price before taxes, and are based on the assumption that the Companys Common Stock appreciates at the annual rate shown compounded annually from the date of grant until the expiration of the six-year term. These numbers are calculated based on SEC requirements and do not reflect the Companys projections or estimates of future stock price growth. The Companys management cautions shareholders and option holders that such increases in stock prices are based on speculative assumptions and should not inflate expectations of the future value of their holdings. |

The following table presents the number of shares and weighted average exercise price of equity compensation plans that have been approved by the security holders.

EQUITY COMPENSATION PLAN INFORMATION

|

Plan Category |

Number of securities to be issued upon exercise of outstanding options, warrants, and rights |

Weighted-average exercise price of outstanding options, warrants, and rights |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a) |

|

|

|

|

|

|

Equity compensation plans approved by security holders |

255,213 |

$8.99 |

247,655 |

|

|

|

|

|

|

Equity compensation plans not approved by security holders |

0 |

N/A |

500,000 |

|

|

|

|

|

|

Total |

255,213 |

$8.99 |

747,655 |

|

|

|

|

|

CORPORATE GOVERNANCE

General:

The Board believes that good corporate governance is important to ensure that the Company is managed for the long-term benefit of the shareholders. The Board annually reviews its corporate governance practices and policies as set forth in its Corporate Governance Guidelines, Code of Ethics, and various Committee Charters, all of which were updated in accordance with the listing standards of the NASDAQ national market and the new rules of the SEC.

The Companys Code of Ethics, Audit Committee Charter, Compensation Committee Charter, and Corporate Governance and Nominations Committee Charter are all available on our Website at www.patrickind.com, or by writing to:

|

|

Patrick Industries, Inc. |

| |||

|

|

Attn: Andy L. Nemeth |

| |||

|

|

Secretary |

| |||

|

|

P.O. Box 638 |

| |||

|

|

Elkhart, IN 46515-0638 | ||||

Shareholder Communications

Shareholders may send communications to members of the Board of Directors by either sending a communication to the Board of Directors and/or a particular member care of Andy L. Nemeth, Patrick Industries, Inc., P.O. Box 638, Elkhart, Indiana 46515-0638. Communications intended for independent directors should be directed to the chair of the Corporate Governance and Nominations Committee.

Board of Directors, Committees, and Committee Reports

Board of Directors:

The Board of Directors had four regular meetings and four special conference calls in 2005 and all directors attended all meetings except John H. McDermott and Paul E. Hassler, in which they participated in two of the special conference calls. Non-employee directors are paid an annual retainer of $5,000, $1,000 for each board meeting and conference call they attend, and $1,000 for each committee meeting they attend with a maximum of $2,000 per combined event. Committee members receive an additional annual retainer of $5,000, regardless of the number of committees on which they serve. The lead director receives an additional annual retainer of $5,000. Employee directors receive no compensation as such. On an annual basis in May, each non-employee director is automatically granted a restricted stock award for 3,000 shares of the Companys Common Stock which will vest upon such directors continued service as a member of the Board of Directors for one year or earlier upon certain events.

The Board and committees regularly meet in executive session without the presence of any management directors or representatives. Robert C. Timmins, Chair of the Audit Committee, was designated as the lead independent director for 2005 and will preside over the executive sessions of the Board.

The Corporation expects all Board members to attend the Annual Meeting of shareholders, but from time to time, other commitments may prevent all directors from attending each meeting. All directors attended the most recent Annual Meeting of shareholders, which was held on May 11, 2005.

Independent Directors:

The Board of Directors is comprised of eight (8) members, of which, six are classified as independent directors and thus comprise a majority of the Board. The Board of Directors has determined that the independent directors are Robert C. Timmins (Lead Director), Terrence D. Brennan, John H. McDermott, Larry D. Renbarger, Walter E. Wells, and Harold E. Wyland. The independent directors met four (4) times in 2005. All directors attended seventy-five percent or more of the combined total meetings of the Board and the committees on which they served during 2005.

Corporate Governance and Nominations Committee Processes

The Corporate Governance and Nominations Committee will consider board nominees recommended by shareholders. Those recommendations should be sent to the Chair of the Corporate Governance and Nominations Committee, care of the Corporate Secretary of Patrick Industries, Inc., P.O. Box 638, Elkhart, IN 46515-0638. In order for a shareholder to nominate a candidate for director, under the Companys By-Laws, timely notice of the nomination must be given in writing to the Secretary of the Company. To be timely, such notice must be received at the principal executive offices of the Company not less than 90 days, or more than 110 days prior to the next annual meeting of shareholders. Notice of nomination must include the name, address and number of shares owned by the person submitting the nomination; the name, age, business address, residence address, and principal occupation of the nominee; and the number of shares beneficially owned by the nominee. It must also include the information that

would be required to be disclosed in the solicitation of proxies for election of directors under the federal securities laws, as well as whether the individual can understand basic financial statements and the candidates other board memberships (if any). The nominees consent to be elected and serve must be submitted. The Corporate Governance and Nominations Committee may require any nominee to furnish any other information, within reason, that may be needed to determine the eligibility of the nominee. As provided in its Charter, the Corporate Governance and Nominations Committee will follow procedures which the committee deems reasonable and appropriate in the identification of candidates for election to the board and evaluating the background and qualification of those candidates. Those processes include consideration of nominees suggested by an outside search firm, by incumbent board members, and by shareholders. The committee will seek candidates having experience and abilities relevant to serving as a director of the Company, and who represent the best interests of shareholders as a whole and not any specific group or constituency.

The committee will consider a candidates qualifications and background, including, but not limited to, responsibility for operating a public company or a division of a public company, international business experience, a candidates technical background or professional qualification, and any other public company boards on which the candidate is a director. The committee will also consider whether the candidate would be independent for purposes of the NASDAQ National Market and rules and regulations of the Securities Exchange Commission. The committee may, from time to time, engage the service of a professional search firm to identify and evaluate potential nominees.

Audit Committee:

The Board of Directors has an Audit Committee comprised of Robert C. Timmins (Chairman), Terrence D. Brennan, John H. McDermott, Larry D. Renbarger, and Walter E. Wells who are not employees of the Company. The Audit Committees responsibilities include recommending to the Board of Directors the independent accountants to be employed for the purpose of conducting the annual examination of the Companys financial statements, discussing with the independent accountants the scope of their examination, reviewing the Companys financial statements and the independent accountants report thereon with Company personnel and the independent accountants, and inviting the recommendations of the independent accountants regarding internal controls and other matters. Additionally, the Audit Committee is responsible for approving all non-audit services provided by the independent accountants and reviews these engagements on a per occurrence basis.

The Board of Directors has determined that all of the members of the Audit Committee are independent as defined in the NASDAQ listing standards relevant SEC rules and Robert C. Timmins, Terrence D. Brennan, Larry D. Renbarger, and Walter E. Wells all meet the qualifications required to be an audit committee financial expert and meet the financial sophistication requirements of the NASDAQ listing standards. Robert Timmins and Larry Renbarger both have public accounting backgrounds. Terrence Brennan served as the President of NBD Bank in Elkhart, Indiana and Walter Wells was the President and Chief Executive Officer of Schult Homes. The Audit Committee met four (4) times in 2005.

Compensation Committee:

The Board of Directors has a Compensation Committee comprised of Terrence D. Brennan (Chairman), John H. McDermott, Larry D. Renbarger, Robert C. Timmins, and Walter E. Wells which met five (5) times in 2005. The primary responsibilities of this committee include:

|

|

|

Reviewing and recommending to the independent members of the Board the overall compensation programs for the Officers of the Company. |

|

|

|

Review and recommend to the Board of Directors, the compensation of directors. |

|

|

|

Oversight authority for the stock based compensation programs. |

For a more detailed list of the roles and responsibilities of the Compensation Committee, please see the Compensation Committee Charter located on the Companys website at www.patrickind.com.

Corporate Governance and Nominations Committee:

The Board of Directors has a Corporate Governance and Nominations Committee comprised of John H. McDermott (Chairman), Terrence D. Brennan, Larry D. Renbarger, Robert C. Timmins, and Walter E. Wells. This Committee met four (4) times in 2005 and their primary responsibilities are as follows:

|

|

|

To assist the Board in identifying, screening, and recommending qualified candidates to serve as directors. | |||

|

|

|

To recommend nominees to the Board to fill new positions or vacancies as they occur. |

| ||

|

|

|

To recommend to the Board candidates for re-election by shareholders at the annual meeting. |

| ||

|

|

|

To review and monitor corporate governance compliance as well as recommend appropriate changes. |

| ||

The Board of Directors has determined that each of John H. McDermott, Terrence D. Brennan, Larry D. Renbarger, Robert C. Timmins, and Walter E. Wells is independent as defined in the NASDAQ listing standards.

For a more detailed list of the roles and responsibilities of the Corporate Governance and Nominations Committee functions, please see the Corporate Governance and Nominations Committee Charter located on the Companys website at www.patrickind.com.

AUDIT COMMITTEE REPORT

The responsibilities of the Audit Committee, which are set forth in the Audit Committee Charter adopted by the Board of Directors, include providing oversight to the Companys financial reporting process through periodic meetings with the Companys independent auditors, principal accounting officer, and management to review accounting, auditing, internal controls, and financial reporting matters. The management of the Company is responsible for the preparation and integrity of the financial reporting information and related systems of internal controls. The Audit Committee, in carrying out its role, relies on the Companys senior management, including senior financial management, and its independent auditors.

We have reviewed and discussed with senior management the Companys audited financial statements included in the 2005 Annual Report to Shareholders. Management has confirmed to us that such financial statements (i) have been prepared with integrity and objectivity and are the responsibility of management and (ii) have been prepared in conformity with generally accepted accounting principles.

We have discussed with McGladrey & Pullen, LLP, our independent auditors, the matters required to be discussed by SAS 61 (Communications with Audit Committee). SAS 61 requires our independent auditors to provide us with additional information regarding the scope and results of their audit of the Companys financial statements, including with respect to (i) their responsibility under generally accepted auditing standards, (ii) significant accounting policies, (iii) management judgments and estimates, (iv) any significant audit adjustments, (v) any disagreements with management, and (vi) any difficulties encountered in performing the audit.

We have received from McGladrey & Pullen, LLP a letter providing the disclosures required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) with respect to any relationships between McGladrey & Pullen, LLP and the Company that in their professional judgment may reasonably be thought to bear on independence. McGladrey & Pullen, LLP has discussed its independence with us, and has confirmed in such letter that, in its professional judgment, it is independent of the Company within the meaning of the federal securities laws.

Based on the review and discussions described above, with respect to the Companys audited financial statements included in the Companys 2005 Annual Report to Shareholders, we have recommended to the Board of Directors that such financial statements be included in the Companys Annual Report on Form 10-K for filing with the Securities and Exchange Commission.

As specified in the Audit Committee Charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that the Companys financial statements are complete and accurate and in accordance with generally accepted accounting principles. That is the responsibility of management and the Companys independent auditors. In giving our recommendation to the Board of Directors, we have relied on (i) managements representation that such financial statements have been prepared with integrity and objectivity and in conformity with generally accepted accounting principles, and (ii) the report of the Companys independent auditors with respect to such financial statements.

|

|

Robert C. Timmins (Chairman) | ||||

|

|

Terrence D. Brennan |

| |||

|

|

John H. McDermott |

| |||

|

|

Larry D. Renbarger |

| |||

|

|

Walter E. Wells |

| |||

The foregoing report of the Audit Committee does not constitute soliciting material and shall not be deemed incorporated by

reference by any general statement incorporating by reference the proxy statement into any filing by the Company under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under such acts.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

This report of the Compensation Committee and the following Performance Graph shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

Overview

The Compensation Committee policy is to design compensation programs for salaries, incentive bonus programs, other benefits, and long-term incentive programs for all key executives, including the officers named in the Summary Compensation Table. The goals and objectives of the Committee are to attract and retain top quality management employees and ensure that an appropriate relationship exists between executive pay and the creation of shareholder value. The criteria used to determine the compensation of the Chief

Executive Officer will also be used in determining compensation for the other officers. The Committee will also receive the recommendation of the Chief Executive Officer regarding the compensation of the other officers.

Federal tax law imposes a $1 million limit on the tax deduction for certain executive compensation payments. Because the compensation paid to any executive office is significantly below the $1 million threshold, the Compensation Committee has not yet had to address the issues relative thereto.

Salaries

The executive salaries are reviewed annually. The Committee sets executive salaries based on competitive market levels, experience, individual and company performance, levels of responsibility, and pay practices of other companies relating to executives of similar responsibility. The Committee considered the compensation levels of executives at comparable companies and fixed the compensation for the CEO and other executive officers at levels approximating the midrange of such companies. The Committee includes in its consideration comparable companies listed in the CRSP Index for lumber and wood products and other in building products industries. See Performance Graph.

Annual Incentive

The Company provides an annual bonus plan for executive officers that gives them the opportunity to earn additional compensation based on the performance of the Company. The Chief Executive Officer and the other officers share in this program to achieve certain bonus amounts based on various levels of profitability of the Company.

|

|

Terrence D. Brennan (Chairman) | ||||

|

|

John H. McDermott |

| |||

|

|

Larry D. Renbarger |

| |||

|

|

Robert C. Timmins |

| |||

|

|

Walter E. Wells |

| |||

Compensation Committee Interlocks and Insider Participation

During 2005, no executive officer of the Company served on the Board of Directors or compensation committee of any other corporation with respect to which any member of the Compensation Committee was engaged as an executive officer. No member of the Compensation Committee was an officer or employee of the Company during 2005, and no member of the Compensation Committee was formerly an officer of the Company.

CERTAIN TRANSACTIONS

The Company leases one building from Mr. Mervin Lung, a former Director and former 5% shareholder of the Company, used as a manufacturing facility under an agreement that expires on August 31, 2007, the agreement provides for monthly rentals of $9,146, and the payment of property taxes and insurance premiums on the property, with an option to purchase on that date.

Mr. Mervin Lung owns a building supply firm which does not serve the Manufactured Housing and Recreational Vehicle industries. The Company purchases certain specialty items from and sells products to such firm. During the year ended

December 31, 2005, purchases from such firm totaled $67 and sales to such firm totaled $25,644.

The Company believes that the terms of each of the above transactions are at least as favorable as those which could have been obtained from unrelated parties.

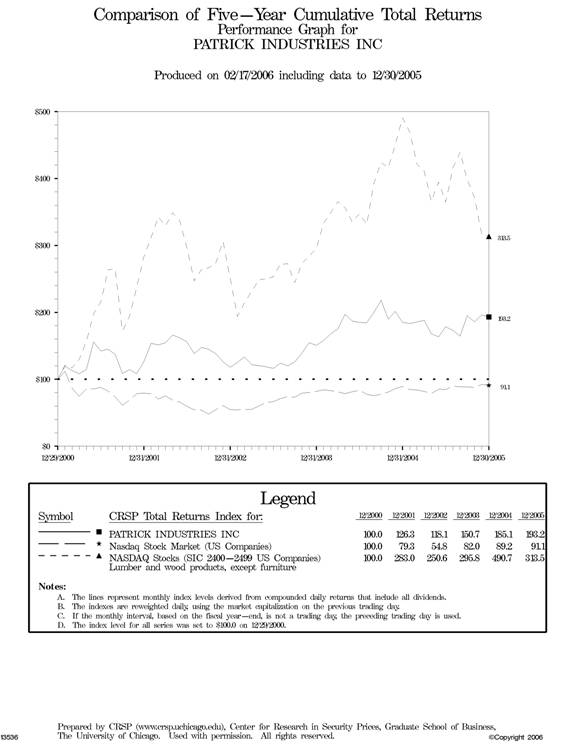

PERFORMANCE GRAPH*

Set forth below is a line graph comparing the yearly cumulative total shareholder return on the Company's Common Stock against the cumulative total return of the indices indicated for the period of five fiscal years commencing December 31, 2000 and ended December 31, 2005. This graph assumes that $100 was invested on December 31, 2000 and that all dividends were reinvested. The stock price performance shown on the graph below is not necessarily indicative of future price performance.

ACCOUNTING INFORMATION

The Audit Committee appointed McGladrey & Pullen, LLP as independent auditors to audit the financial statements of the Company for the year ending December 31, 2005. Representatives of McGladrey & Pullen, LLP are expected to be present at the annual meeting and will be given the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.

The Audit Committee expects to appoint McGladrey & Pullen, LLP as the independent auditors for the 2006 fiscal year subject to approval of the audit scope and fees.

Audit Fees

The following table presents fees for professional audit services rendered by McGladrey & Pullen, LLP for the audit of the Companys annual financial statements for the years ended December 31, 2005 and 2004, and fees billed for other services rendered by McGladrey & Pullen, LLP and RSM McGladrey, Inc. (an affiliate of McGladrey & Pullen, LLP).

|

|

2005 |

2004 |

| |||||

|

|

Audit Fees (1) |

$147,755 |

$139,325 | |||||

|

|

Audit-Related Fees (2) |

12,480 |

10,415 | |||||

|

|

Tax Services (3) |

39,095 |

34,055 | |||||

|

|

All Other Fees (4) |

73,925 |

9,125 | |||||

|

|

(1) |

Audit fees consist of fees for professional services rendered for the audit of the Companys financial statements and review of financial statements included in the Companys quarterly reports and services normally provided by the independent auditor in connection with statutory and regulatory filings or engagements. |

|

|

(2) |

Audit-related fees are fees principally for professional services rendered for the audit of the Companys employee benefit plans and due diligence and technical accounting consulting and research. |

|

|

(3) |

Tax services fees consist of compliance fees for the preparation of original and amended tax returns, claims for refunds and tax payment planning services for tax compliance, tax planning, and tax advice. Tax service fees also include fees relating to other tax advices, tax consulting and planning other than for tax compliance, and preparation. |

|

|

(4) |

Other services in 2005 consisted primarily of consulting services for strategic planning and executive compensation strategy and wage comparisons. Other services in 2004 consisted primarily of consulting services for compensation strategy and wage comparisons. |

The Audit Committee has advised the Company that it has determined that the non-audit services rendered by the Companys independent auditors during the Companys most recent fiscal year are compatible with maintaining the independence of such auditors.

The Audit Committee has adopted a Pre-Approval policy for Audit and Non-Audit Services pursuant to which it pre-approves all audit and non-audit services provided by the independent auditors prior to each particular engagement. The Committee has delegated authority to its Chairman to approve proposed services other than the annual audit, tax and quarterly review services and the Chairman must report any approvals to the balance of the Committee at the next scheduled meeting.

Householding of Annual Meeting Materials

Some banks, brokers, and other nominee record holders may be participating in the practice of "householding" proxy statements and annual reports. This means that only one copy of this Notice of Annual Meeting and Proxy Statement and the Annual Report for the year ended December 31, 2005 may have been sent to multiple shareholders in your household. If you would prefer to receive separate copies of a proxy statement or annual report either now or in the future, please contact your bank, broker or other nominee. Upon written or oral request to Andy L. Nemeth, we will provide a separate copy of the Annual Report for the year ended December 31, 2005 or Notice of Annual Meeting and Proxy Statement.

Other Matters

A copy of our Annual Report on Form 10-K for the year ended December 31, 2005, excluding certain of the exhibits thereto, may be obtained without charge by writing to: Andy L. Nemeth, Patrick Industries, Inc., P.O. Box 638, Elkhart, Indiana 46515-0638.

The Board of Directors knows of no other proposals which may be presented for action at the meeting. However, if any other proposal properly comes before the meeting, the persons named in the proxy form enclosed will vote in accordance with their judgment upon such matter.

|

|

Shareholders are urged to execute and return promptly the enclosed form of proxy in the envelope provided. |

|

|

By Order of the Board of Directors |

|

|

ANDY L. NEMETH | ||

|

|

Secretary |

| |

April 7, 2006

[Proxy card]

APPENDIX A

Acquiring Person Statement

Tontine hereby submits to Patrick Industries, Inc. (the Company) this Acquiring Person Statement (this Statement) pursuant to Section 23-1-42-6 of the Indiana Business Corporation Law (the Act). As required by the Act, this Statement provides the following information, which is for informational purposes only:

1. The identity of the acquiring person is Tontine Capital Partners, L.P., a Delaware limited partnership. Tontine Capital Management, L.L.C., a Delware limited liability company is the general partner of Tontine Capital Partners, L.P. Jeffrey L. Gendell is the managing member of Tontine Capital Management, L.L.C.

2. This Statement is given pursuant to Chapter 42-Control Share Acquisitions of the Act.

3. As of September 13, 2005, Tontine Capital Partners, L.P. beneficially owns 1,313,089 shares of common stock of the Company. Tontine Capital Management L.L.C. and Mr. Gendell each indirectly own 1,313,089 shares of common stock of the Company. Tontine Capital Management, L.L.C. and Mr. Gendell each disclaim beneficial ownership of such common stock except to the extent of their pecuniary interest.

4. As of September 13, 2005, the voting power attributable to Tontine Capital Partners, L.P. is 27.5% (as described in paragraph 3 above and based on 4,772,198 shares of common stock outstanding as of July 29, 2005 as reflected in the Companys Form 10-Q for the period ending June 30, 2005). Accordingly, the ownership of Tontine Capital Partners, L.P. falls within the first threshold triggering applicability under Section 1 of Chapter 42 of the Act (one-fifth (1/5) or more but less than one-third (1/3) of all voting power).