PRESENTATION

Published on November 14, 2006

Patrick Industries, Inc.

(Nasdaq: PATK)

This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with

respect to financial condition, results

of operations, business strategies, operating efficiencies or synergies, competitive position, growth

opportunities for existing products, plans and objectives of management, markets for the common stock of Patrick Industries, Inc. and other

matters. Statements in this presentation that are not historical facts are forward-looking statements for the purpose of the safe harbor provided

by Section 21E of the Exchange Act and Section 27A of the Securities Act. Forward-looking statements,

including, without limitation, those

relating to our future business prospects, revenues and income, wherever they occur in this presentation, are necessarily estimates reflecting the

best judgment of our senior management at the time such statements

were made, and involve a number of risks and uncertainties that could

cause actual results to differ materially from those suggested by forward-looking statements. Patrick Industries, Inc. does not undertake to

update forward-looking statements to reflect

circumstances or events that occur after the date the forward-looking statements are made. You

should consider forward-looking statements, therefore, in light of various important factors, including those set forth in the reports and documents

that

Patrick Industries, Inc. files with the Securities and Exchange Commission, including Patrick Industries Inc.s Annual Report on Form 10-K

for the year ended December 31, 2005. There are a number of factors, many of which are beyond control

of Patrick Industries, Inc., which could

cause actual results and events to differ materially from those described in the forward-looking statements. These factors include pricing

pressures due to competition, costs and availability of raw materials,

availability of retail and wholesale financing for manufactured homes,

availability and costs of labor, inventory levels of retailers and manufacturers, levels of repossessed manufactured homes, the financial condition

of our customers, interest rates,

oil and gasoline prices, the outcome of litigation, volume of orders related to hurricane damage and operating

margins on such business, and adverse weather conditions impacting retail sales. In addition,

national and regional economic conditions and

consumer confidence may affect the retail sale of recreational vehicles and manufactured homes..

Disclaimer

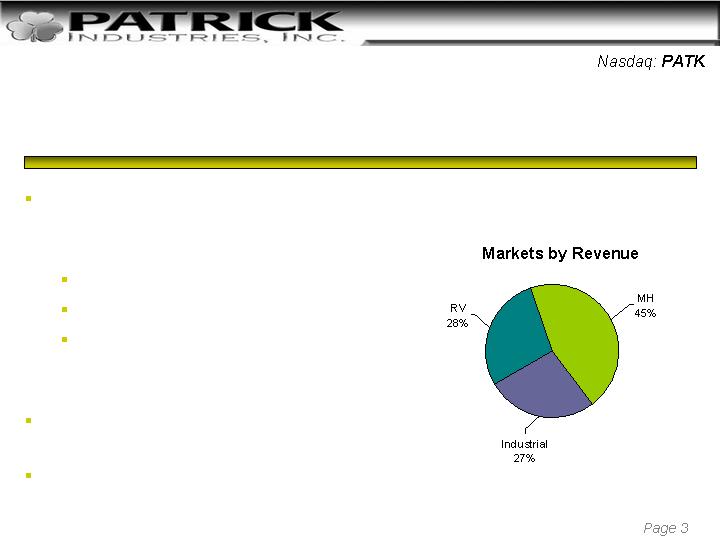

About Patrick Industries

A leading manufacturer and

distributor of building and component

products for the following markets:

Manufactured Housing (MH)

Recreational Vehicle (RV)

Industrial Markets: kitchen cabinet,

home and office furniture, marine,

fixture/commercial furnishings

Supply virtually all major RV and MH

OEMs

Increasing penetration into industrial

markets

History

1959 Company founded by Mervin Lung as a distributor to the MH

industry

1961 Date of Incorporation

1968 Company taken public

1968 Acquires Mobilcraft Door and Midwest lamination

1972 Starts first Panel lamination division

1980 Acquires ILC Products Aluminum extrusion division

1986 Paul Hassler leads Company into industrial market in CA

1989 David Lung named President

2003 David Lung retires

2004 Paul Hassler elected President & CEO

National Reach

Based in Elkhart, Ind., Patrick Industries

operates through 12 distribution centers

and 15 manufacturing facilities located in

13 states.

Patrick distribution centers.

Patrick manufacturing divisions.

Manufactured Products

Manufactured Products:

Make-to-order laminated products

using the latest in lamination

technology, including vinyl, paper,

veneers and high pressure

laminates (HPL)

Cut to Size, boring, foiling &

Edgebanding

Wrapped profile moldings

Custom-made extruded aluminum

products

Manufactured drawer sides and

bottoms

Pre-finished cabinet doors

Adhesives

Manufacturing Divisions:

Patrick Lamination

Patrick Metals

Nickell Enterprises

Patrick Door

Patrick Moulding

Sun Adhesives

Distributed Products

Pre-finished wall and ceiling

panels

Drywall and drywall finishing

products

Particleboard

Vinyl and cement siding

Interior passage doors

Resilient flooring

Decorative Tile

Hardwood flooring

Shelving and closet systems

Floor sealer

Sheet stock high pressure

laminates (HPL)

Decorative wood veneers and

wood products

Roofing products

Close-off material

Insulation

Decorative mirrors and glass

Bottom board

Wood glue and hot melt glue

Interior paint

Transition to New Management

& Ownership

Patrick founded by Mervin Lung in 1959; IPO in 1968

New management team formed in 2004

Mervin Lung, largest shareholder, retires and sells total

interest (27.5%) to Tontine Capital Partners in 2005

New management team implementing new strategic growth

plan 2005-2006

New Strategic Plan

Increased market penetration

Enhanced capacity utilization

Improving operating efficiencies

New marketing and product development

Strategic, accretive acquisition opportunities to further drive

growth and shareholder value.

New Products

Exclusive supplier of Lamitech high pressure laminates

Supplier of Beauflor resilient flooring product; introducing a

cutting edge European technology which provides superior

quality helping to reduce warranty costs for manufactured

homes

New powder paint facility for aluminum extrusions opening in

early 2007; Will be one of only three in North America with

these capabilities

Almost $2.0 million in top-line growth from new products year-

to-date in 2006

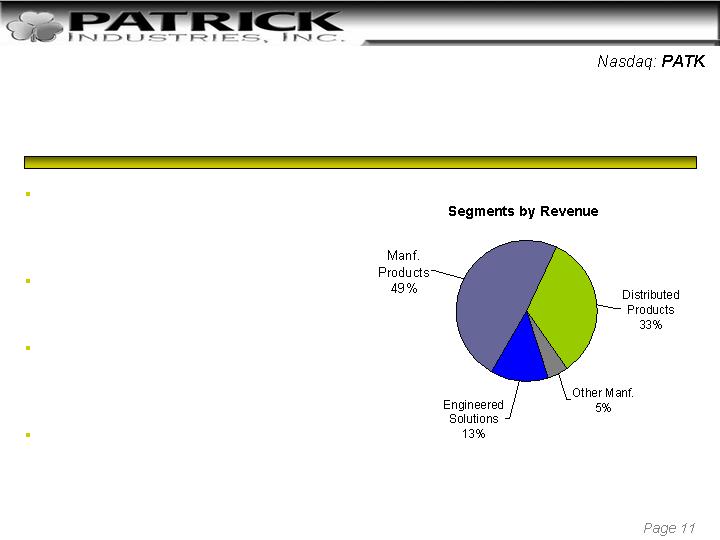

Business Segments

Manufactured Products produced

at 11 manufacturing facilities across

the U.S.

Distributed Products from 12

distribution centers across the U.S.

Engineered Solutions including

aluminum extrusion and fabrication

operations.

Other Manufactured products,

including adhesives, cabinet doors

and a machine manufacturing

division.

Major Customers

MH market:

Clayton/Oakwood (a

division of Berkshire

Hathaway)

Champion (NYSE: CHB)

Fleetwood (NYSE: FLE)

Palm Harbor Homes

(Nasdaq: PHHM)

Skyline (NYSE: SKY)

Industrial market:

Saco Industries (private)

Commercial Wood (private)

Hitachi (NYSE: HIT)

Kitchen Kompact (private)

Stack-a-Shelf (a division of

Emerson)

Zee Manufacturing (private)

RV market:

Fleetwood (NYSE: FLE)

Forest River (a division of

Berkshire Hathaway)

Monaco Coach (NYSE: MNC)

Skyline (NYSE: SKY)

Thor (NYSE: THO)

Patricks Content per MH*

*Based on Patrick industry sales divided by gross industry unit sales

** 2006 Forecast

Patricks Content per RV*

*Based on Patrick industry sales divided by gross industry unit sales

** 2006 Forecast

Third Quarter 2006 Results

Net sales of $90.8 million, 12% increase compared to last years 3Q

EPS of $0.08 per share compared with $0.03 per share in 3Q 2005

Increased sales led to increased profitability, as management continues

to keep fixed costs comparable from period to period

Operating income increased 66% compared to 3Q 2005

3Q 2006 included approximately $500,000 of incremental acquisition

costs related to the Companys investigation of strategic growth

opportunities

EPS of $0.50 for 9 months exceeded EPS of $0.30 for whole of 2005

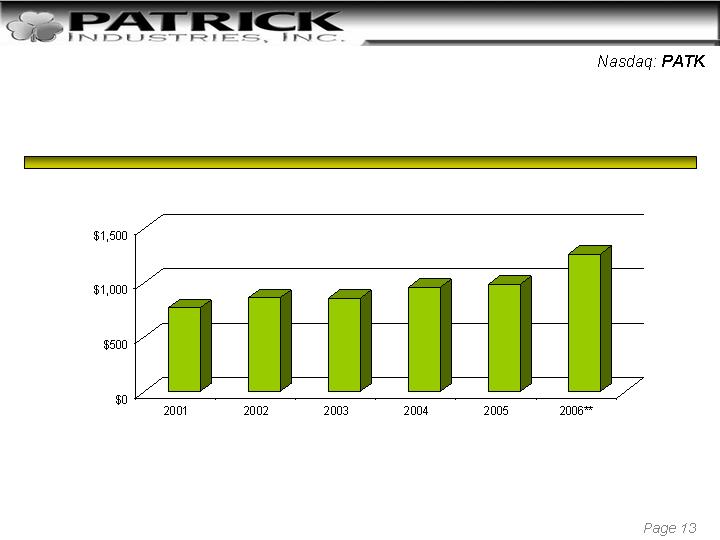

Financial Results

Revenue

(in millions of dollars)

EPS

Acquisition Strategy

Immediate accretion

High-quality/due-diligence emphasis

Maximum 5x - 6x multiple

Experienced, quality-driven management team

Strategic fit with existing businesses

Diversification

Strong market position

Quality customer relationships

Investment Highlights

Platform established for future growth

New experienced management team and strategic plan

Introducing new products

Solid balance sheet and low leverage position

Growing market share and increasing sales volume to leverage operating efficiencies

across fixed overhead

Aggressively exploring strategic, accretive acquisition opportunities

Improving financial results despite difficult MH market

Diversification into industrial markets beyond RV and MH

New investor relations strategy to expand awareness of story

For More Information

Company Contact:

Andy L. Nemeth, CFO

Patrick Industries, Inc.

574-294-7511 / nemetha@patrickind.com

Website: www.patrickind.com

Investor Relations Contact:

Ryan McGrath, Jeff Lambert

Lambert, Edwards & Associates, Inc.

616-233-0500 / mail@lambert-edwards.com