10-K: Annual report pursuant to Section 13 and 15(d)

Published on March 30, 2010

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K

(Mark

One)

[ X ] ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For

the Fiscal Year Ended December 31, 2009

or

[ ] TRANSITION REPORT PURSUANT TO SECTION

13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the

transition period from ……………… to ………………

Commission

file number 000-03922

PATRICK INDUSTRIES,

INC.

(Exact

name of registrant as specified in its charter)

|

INDIANA

|

35-1057796

|

|

(State

or other jurisdiction of

|

(I.R.S.

Employer

|

|

incorporation

or organization)

|

(Identification

No.)

|

|

107

W. FRANKLIN STREET, P.O. Box 638, ELKHART, IN

|

46515

|

||||

|

(Address

of principal executive offices)

|

(Zip

Code)

|

||||

(574) 294-7511

(Registrant’s

telephone number, including area code)

|

Securities

registered pursuant to Section 12(b) of the Act:

Common

stock, without par

value Nasdaq

Stock Market LLC

(Title

of each

class) (Name

of each exchange on which registered)

Securities registered pursuant

to Section 12(g) of the Act: None

|

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes

[ ] No [X]

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Exchange Act. Yes

[ ] No [X]

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes [X] No

[ ]

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding

12 months (or for such shorter period that the registrant was required to submit

and post such files). Yes [ ] No

[ ]

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. [X]

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act. Large accelerated filer

[ ] Accelerated filer

[ ] Non-accelerated filer [ ] (Do

not check if a smaller reporting company) Smaller

reporting company [X]

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act). Yes [ ] No

[X]

The

aggregate market value of the voting stock held by non-affiliates of the

registrant on June 26, 2009 (based upon the closing price on the Nasdaq Stock

Market LLC and an estimate that 37.7% of the shares are owned by non-affiliates)

was $5,348,424. The closing market price was $1.55 on that day and

9,146,939 shares of the Company’s common stock were outstanding. As

of March 12, 2010, there were 9,182,189 shares of the registrant’s common stock

outstanding.

DOCUMENTS

INCORPORATED BY REFERENCE

Portions

of the registrant’s Proxy Statement for its Annual Meeting of Shareholders

scheduled to be held on May 20, 2010 are incorporated by reference into Part III

of this Form 10-K.

PATRICK

INDUSTRIES, INC.

FORM

10-K

FISCAL

YEAR ENDED DECEMBER 31, 2009

TABLE

OF CONTENTS

|

PART I

|

3

|

|

|

ITEM 1. BUSINESS

|

3

|

|

|

ITEM 1A. RISK

FACTORS

|

14

|

|

|

ITEM 1B.

UNRESOLVED STAFF

COMMENTS

|

21

|

|

|

ITEM 2. PROPERTIES

|

21

|

|

|

ITEM 3. LEGAL

PROCEEDINGS

|

22

|

|

|

PART II

|

22

|

|

|

ITEM 5. MARKET FOR REGISTRANT’S COMMON

EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY

SECURITIES

|

22

|

|

|

ITEM 6. SELECTED FINANCIAL

DATA

|

23

|

|

|

ITEM 7. MANAGEMENT’S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

|

23

|

|

|

ITEM 7A. QUANTITATIVE AND QUALITATIVE

DISCLOSURES ABOUT MARKET RISK

|

48

|

|

|

ITEM 8. FINANCIAL STATEMENTS AND

SUPPLEMENTARY DATA

|

48

|

|

|

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH

ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

48

|

|

|

ITEM 9A. CONTROLS AND

PROCEDURES

|

49

|

|

|

ITEM 9B. OTHER

INFORMATION

|

49

|

|

|

PART III

|

50

|

|

|

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND

CORPORATE GOVERNANCE

|

50

|

|

|

ITEM 11.

EXECUTIVE

COMPENSATION

|

50

|

|

|

ITEM 12.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED

STOCKHOLDER MATTERS

|

50

|

|

|

ITEM 13.

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR

INDEPENDENCE

|

51

|

|

|

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND

SERVICES

|

51

|

|

|

PART IV

|

51

|

|

|

ITEM 15. EXHIBITS AND FINANCIAL STATEMENT

SCHEDULES

|

51

|

|

|

SIGNATURES

|

54

|

|

FINANCIAL

SECTION

|

Index

to Financial Statements and Financial Statement Schedules

|

F-1

|

|

Report

of Independent Registered Public Accounting Firm, Crowe Horwath

LLP

|

F-2

|

|

Report

of Independent Registered Public Accounting Firm, Ernst & Young

LLP

|

F-3

|

|

Consolidated

Statements of Financial Position

|

F-4

|

|

Consolidated

Statements of Operations

|

F-5

|

|

Consolidated

Statements of Shareholders’ Equity

|

F-6

|

|

Consolidated

Statements of Cash Flows

|

F-7

|

|

Notes

to Consolidated Financial Statements

|

F-8

|

|

Exhibits

|

|

|

|

2

INFORMATION CONCERNING

FORWARD-LOOKING STATEMENTS

This Form

10-K contains certain “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995 with respect to financial

condition, results of operations, business strategies, operating efficiencies or

synergies, competitive position, growth opportunities for existing products,

plans and objectives of management, markets for the common stock of

Patrick Industries, Inc. and other matters. Statements in this Form

10-K as well as other statements contained in the annual report and statements

contained in future filings with the Securities and Exchange Commission and

publicly disseminated press releases, and statements which may be made from time

to time in the future by management of the Company in presentations to

shareholders, prospective investors, and others interested in the business and

financial affairs of the Company, which are not historical facts, are

forward-looking statements that involve risks and uncertainties that could cause

actual results to differ materially from those set forth in the forward-looking

statements. Patrick Industries, Inc. does not undertake to

publicly update or revise any forward-looking statements to reflect

circumstances or events that occur after the date the forward-looking statements

are made, except as required by law. You should consider

forward-looking statements, therefore, in light of various important factors,

including those set forth in the reports and documents that Patrick Industries,

Inc. files with the Securities and Exchange Commission, including this Annual

Report on Form 10-K for the year ended December 31, 2009.

There are

a number of factors, many of which are beyond the control of Patrick Industries,

Inc., which could cause actual results and events to differ materially from

those described in the forward-looking statements. These factors

include pricing pressures due to competition, costs and availability of raw

materials, availability of commercial credit, availability of retail and

wholesale financing for residential and manufactured homes, availability and

costs of labor, inventory levels of retailers and manufacturers, levels of

repossessed residential and manufactured homes, the financial condition of our

customers, the ability to generate cash flow or obtain financing to fund growth,

future growth rates in the Company’s core businesses, interest rates, oil and

gasoline prices, the outcome of litigation, adverse weather conditions impacting

retail sales, and our ability to remain in compliance with our credit agreement

covenants. In addition, national and regional economic conditions and

consumer confidence may affect the retail sale of recreational vehicles and

residential and manufactured homes.

Any

projections of financial performance or statements concerning expectations as to

future developments should not be construed in any manner as a guarantee that

such results or developments will, in fact, occur. There can be no

assurance that any forward-looking statement will be realized or that actual

results will not be significantly different from that set forth in such

forward-looking statement. See Part I, Item 1A “Risk Factors” below

for further

discussion.

|

|

PART

I

|

ITEM

1. BUSINESS

Company

Overview

Patrick

Industries, Inc. (collectively, the “Company,” “we,” “our” or “Patrick”), which

was founded in 1959 and incorporated in Indiana in 1961, is a major manufacturer

and distributor of building products and materials to the recreational vehicle

(“RV”) and manufactured housing (“MH”) industries. In addition, we

are a supplier to certain other industrial markets, such as kitchen cabinet,

household furniture, fixtures and commercial furnishings, marine, and other

industrial markets. We manufacture a variety of products including

decorative vinyl and paper panels, wrapped moldings, interior passage doors,

cabinet doors and components, slotwall and slotwall components, and

countertops.

We are

also an independent wholesale distributor of pre-finished wall and ceiling

panels, drywall and drywall finishing products, electronics, adhesives, cement

siding, interior passage doors, roofing products, laminate flooring, and other

miscellaneous products. We have a nationwide network of manufacturing

and distribution centers for our products, thereby reducing in-transit delivery

time and cost to the regional manufacturing plants of our

customers. We believe that we are one of the few suppliers to the RV

and MH industries that has such a nationwide network. We maintain

three manufacturing plants and two distribution facilities near our principal

offices in Elkhart, Indiana, and operate nine other warehouse and distribution

centers and eight other manufacturing plants in eleven other

states.

3

Beginning

in 2007 in conjunction with the acquisition of Adorn Holdings, Inc. (“Adorn”)

and continuing throughout 2008 and 2009, we explored, initiated and completed a

number of cost reduction and efficiency improvements designed to address the

downturn in general worldwide economic conditions that adversely affected demand

for our products and services and to leverage our position to drive future

growth. These improvements included the restructuring and integration

of operations, consolidation of facilities, disposition of non-core operations,

streamlining of administrative and support activities, and the reduction of inventory

levels. The Company also continued to enhance its products and

services through the integration of new and expanded product lines designed to

create additional scale advantages and offer both increased breadth and depth of

products and services. In the Executive Summary section of Item

7. “Management’s Discussion and Analysis of Financial Condition and

Results of Operations,” we provide an overview of the impact that the

deterioration in macroeconomic conditions had on our operations and in the RV,

MH, and residential housing industries in 2009.

We

completed the divestitures of certain non-core businesses in 2009, including

American Hardwoods, Inc. (“American Hardwoods”) and our aluminum extrusion

operation. See “Strategic Divestitures” below and Note 4 to the

Consolidated Financial Statements in Item 8 of this report for further

details.

Patrick

had three reportable business segments in 2009 (based on continuing operations):

Primary Manufactured Products, Distribution, and Other Component Manufactured

Products. Financial information about Patrick’s three segments is

included in Note 19 to the Consolidated Financial Statements.

Competition

The RV

and MH industries are highly competitive with low barriers to

entry. This level of competition carries through to the suppliers to

these industries. Across the Company’s range of products and

services, competition exists primarily on price, product features, quality, and

service. We have several competitors that compete with us on a

regional and local basis. In order for a competitor to compete with

us on a national basis, we believe that a substantial capital commitment and

investment in personnel would be required. The other industrial

markets in which we continue to expand are also highly

competitive. In 2009, declining sales volumes and the depressed

economic conditions in the MH and industrial markets we serve caused extreme

pricing pressure on certain products as supply outweighed demand. We

believe that there may be further volatility in the markets we serve in 2010

before a sustained recovery takes hold. Given this environment, the

Company has identified several operating strategies to maintain or enhance

earnings through productivity and fixed cost reduction initiatives, expansion

into new product lines, and optimization of capacity utilization.

Strategy

Overview

We

believe that we have developed quality-working relationships with our customers

and suppliers, and have oriented our business to the needs of these

customers. These customers include all of the larger RV and MH

manufacturers and a number of large to medium-sized industrial

customers. Our industrial customers generally are directly linked to

the residential housing markets. Our RV and MH customers generally

demand the lowest competitive prices, high quality standards, short lead times,

and a high degree of flexibility from their suppliers. Our industrial

customers generally are less price sensitive than our RV and MH customers, and

more focused on quality customer service and quick response

time. Consequently, we have focused our efforts on maintaining and

improving the quality of our manufactured products, developing a nationwide

manufacturing and distribution presence in response to our customers’ needs for

flexibility and short lead times, and prioritizing the implementation of lean

manufacturing principles and continuous improvement in all of our facilities

including our corporate office. Additionally, because of the short

lead times, which range from 24 hours to same day order receipt and delivery, we

have intensified our focus on reducing our inventory levels with the help of

some of our key suppliers with vendor managed inventory

programs. These initiatives have been instrumental in improving our

operating cash flow and liquidity. As we explore new markets and

industries, we believe that these and other strategic initiatives provide us

with a strong foundation for future growth. In 2009, approximately

44% of our sales were to the RV industry, 37% to the MH industry, and 19% to the

industrial and other markets. In 2008, approximately 37% of our sales

were to the RV industry, 45% to the MH industry, and 18% to the industrial and

other markets.

4

Operating

Strategies

Key

operating strategies identified by management, include the

following:

Strategic

Acquisitions, Expansion and Restructuring

We supply

a broad variety of building material products and, with our nationwide

manufacturing and distribution capabilities, we believe that we are well

positioned for the introduction of new products. We, from time to

time, consider the acquisition of additional product lines, facilities,

companies with a strategic fit, or other assets to complement or expand our

existing businesses.

In May

2007, we purchased all of the outstanding stock of Adorn, an Elkhart,

Indiana-based major manufacturer and supplier to the RV, MH and industrial

markets, for $78.8 million. This acquisition represented the largest

acquisition in our history, virtually doubled our manufacturing revenues, and

immediately strengthened our market position and presence in the major

industries that we serve. The consolidation of Adorn into Patrick

afforded us many opportunities to realize synergies through facility

rationalization, headcount reduction, vendor consolidation, and the implementation

of best practices. In January 2010, we completed our first

acquisition since we acquired Adorn with the acquisition of a cabinet door

business.

In the

third quarter of 2008, the completion of our restructuring plan (the

“Restructuring Plan”) to integrate Adorn with our existing businesses, resulted

in cumulative pretax charges totaling approximately $3.3

million. Expenses associated with the Restructuring Plan included the

closure of duplicate facilities, severance related to the elimination of

redundant jobs, and various asset write-downs related to the consolidation of

product lines. We have realized, and expect to continue to realize,

synergy savings from this acquisition on a go-forward basis.

While

operating under depressed market and economic conditions throughout 2009, we

focused our attention on fixed cost and debt reduction initiatives in order to

reduce our leverage ratio, maintain operating cash flow, meet the covenants

under our credit agreement and maximize efficiencies from the consolidation of

Adorn into Patrick.

Strategic

Divestitures

In an

effort to strategically align our current operations with businesses within our

core competencies, reduce overall fixed costs, and reduce our leverage position,

we have explored and will continue to explore various alternatives for the

divestiture of certain unprofitable, non-core operations. In 2008, we

identified our American Hardwoods and aluminum extrusion operations as non-core

operations and reclassified the carrying values of the assets of American

Hardwoods and the aluminum extrusion operation to assets held for

sale. The decision to divest these two operations was largely based

on projected and potential operating losses under the current operating model

and working capital requirements of these operations that forced us to assess

the overall fit of these operations within the parameters of our strategic

plan. The financial results of these operations were classified as

discontinued operations in the consolidated financial statements and all prior

period operating results have been reclassified to conform to the current year

presentation. See Note 4 to the Consolidated Financial Statements for

further details.

Sale

of American Hardwoods, Inc. Operation/Building

In

January 2009, the Company sold certain assets and the business of the American

Hardwoods operation for cash consideration of $2 million and entered into a

separate real estate purchase agreement with the buyer to sell the building that

housed this operation for a purchase price of $2.5

million. Accordingly, the Company reclassified approximately $2.5

million of carrying value for this property to assets held for sale in the

Company’s consolidated financial statements at December 31, 2008. The building

and property were sold in June 2009 for a purchase price of $2.5

million. The pretax loss from operations was $19,000 and $0.5 million

in 2009 and 2008, respectively. The net pretax gain on the sale of

the American Hardwoods operation was $0.2 million in 2009. Estimated

pretax charges of approximately $1.0 million, which primarily reflected the

write down to fair market value of real estate and inventories, were included in

discontinued operations in 2008. Previously, the financial results of

American Hardwoods had been included in the Distribution segment.

5

Sale of Aluminum Extrusion

Operation

In July

2009, the Company sold certain assets of its aluminum extrusion

operation. The purchase price resulted in net cash proceeds of $7.4

million and the assumption by the buyer of approximately $2.2 million of certain

accounts payable and accrued liabilities. The net pretax gain on the

sale of the aluminum extrusion operation was $0.5 million in

2009. Estimated pretax charges of approximately $5.0 million

associated with the divesture were reflected in discontinued operations in 2008

and primarily reflected the write down to fair market value of inventories, real

estate and fixed assets. Pretax income from operations was $0.8

million in 2009 and the pretax loss from operations was $1.2 million in

2008. Previously, the financial results of this operation comprised

the entire Engineered Solutions business segment.

Diversification

into Other Markets

While we

continually seek to improve our position as a leading supplier to the RV and MH

industries and have substantially increased our presence in these markets

through the acquisition of Adorn in 2007, we are also seeking to expand our

product lines into other industrial, commercial and institutional

markets. Many of our products, such as countertops, cabinet doors,

laminated panels, slotwall, and shelving, have applications in the kitchen

cabinet, household furniture, and architectural markets. We have a

dedicated sales force focused on increasing our industrial market penetration

and on our diversification into additional commercial and institutional

markets.

We

believe that diversification into other industrial markets provides

opportunities for improved operating margins with products that are

complementary in nature to our current manufacturing processes. In

addition, we believe that our nationwide manufacturing and distribution

capabilities enable us to position ourselves for new product

expansion.

Utilization

of Manufacturing Capacity

Efficiency

Optimization

The

acquisition and consolidation of Adorn into Patrick allowed us to increase

capacity utilization at all of our consolidated manufacturing

facilities. While we increased capacity utilization as a result of

our facility consolidations, the decline in volume levels due to soft industry

conditions in all of the major end markets we serve has resulted in unused

capacity at almost all of our locations. We have the ability to

substantially increase volumes in almost all of our existing facilities without

adding comparable incremental fixed costs. With the expected

continued weak economic conditions in certain parts of the country, we are

continually exploring opportunities for further facility

consolidation. Additionally, we are focused on cross-training all of

our manufacturing work force in our manufacturing cells within each facility to

maximize our efficiencies and increase the flexibility of our labor

force.

Plant

Consolidations / Closures and Division Changes

In 2009,

we consolidated and closed certain manufacturing and distribution facilities in

an effort to align operating costs with our revenue base and keep our overhead

structure at a level consistent with operating needs, particularly given the

overall soft economic conditions experienced during the year.

In

December 2008, the Company decided to close its leased distribution facility in

Woodland, California and consolidate operations into the existing owned Fontana,

California manufacturing facility in order to offset a sizable reduction in

sales volumes that stemmed from the planned closure of one of our major

customers’ plants in the same area. The consolidation was completed

in January 2009.

During

the fourth quarter of 2008, the Company entered into a listing agreement to sell

its custom vinyls manufacturing facility in Ocala, Florida. We

originally anticipated that the sale of this facility would not be completed

until 2010 due to unfavorable real estate market conditions, and therefore the

property’s carrying value was not included in assets held for sale as of

December 31, 2008. However, this facility was sold in late December

2009 for $1.6 million resulting in a pretax gain on sale of $1.2

million. The Ocala operations were consolidated into the Company’s

Alabama and Georgia facilities.

6

In the

fourth quarter of 2009, the Company entered into a listing agreement to sell its

manufacturing and distribution facility in Woodburn,

Oregon. Approximately $3.2 million of carrying value for this

facility was reclassified to assets held for sale as of December 31,

2009. The Oregon facility was subsequently sold in February 2010 for

$4.2 million and the Company anticipates recording a pretax gain on sale of

approximately $0.8 million in its first quarter 2010 operating

results. The Company is currently operating in the same facility

under a license agreement with the purchaser while it explores options for a

more suitable long-term solution.

During

the fourth quarter of 2008, the Company entered into a listing agreement to sell

its remaining manufacturing and distribution facility in Fontana,

California. The Company reclassified approximately $1.6 million of

carrying value for this facility to assets held for sale in the consolidated

financial statements as of December 31, 2009 and 2008. In March 2010,

this facility was sold and the Company anticipates recording a pretax gain on

sale of approximately $2.0 million in its first quarter 2010 operating

results. The Company is currently operating in the same facility

under a lease agreement with the purchaser for the use of approximately one-half

of the square footage previously occupied.

Product Development and New Product

Introductions/Discontinuations

With our

versatile manufacturing and distribution capabilities, we are continually

striving to increase our market presence in all of the markets that we serve and

gain entrance into other potential markets. We remain committed to

new product development and introduction initiatives. New product

development is critical to growing our revenue base, keeping up with changing

market conditions, and proactively addressing customer demand. We

plan to continue to devote our time and attention to manufacturing and

distribution products that fit within the strategic parameters of our current

business model including appropriate margin and inventory turn

levels.

To

further enhance our product offerings to marine and RV customers, we established

new relationships with several vendors to distribute a complete line of

audio/video source units, televisions and microwaves to the marine, RV and

recreational product markets. This newly formed electronics division

within our Distribution segment was launched in the first quarter of

2009. In addition to line extensions of certain products in 2009, we

expanded our distribution line to include adhesives and a new laminate flooring

product line. We also began to manufacture interior passage doors to

complement our existing door product line.

In early

2009, we discontinued certain distribution product lines including our line of

resilient flooring products, a ceramic tile line, and the hardwood products

associated with the American Hardwoods operation.

Principal

Products

Through

our manufacturing divisions, we manufacture a variety of products including

decorative vinyl and paper panels, wrapped moldings, stiles and battens,

hardwood, foil and membrane pressed cabinet doors, drawer sides and bottoms,

interior passage doors, slotwall and slotwall components, components for

electronic desks, and countertops. In conjunction with our

manufacturing capabilities, we also provide value added processes, including

custom fabrication, edge-banding, drilling, boring, and cut-to-size

capabilities.

We

distribute pre-finished wall and ceiling panels, drywall and drywall finishing

products, electronics, adhesives, cement siding, interior passage doors, roofing

products, laminate flooring, and other miscellaneous products.

Manufactured

laminated panels contributed 49%, 45% and 39% of total sales for the years ended

December 31, 2009, 2008 and 2007, respectively. Pre-finished wall

panels and finishing products contributed 8%, 8%, and 10% of total sales for the

comparable periods in 2009, 2008 and 2007, respectively. The

electronics division within our Distribution segment (launched in the first

quarter of 2009), contributed 4% of total sales for the year ended December 31,

2009.

We have

no material patents, licenses, franchises, or concessions and do not conduct

significant research and development activities.

Manufacturing Processes and

Operations

Our

primary manufacturing facilities utilize various materials including gypsum,

particleboard, plywood and fiberboard, which are bonded by adhesives or a

heating process to a number of products, including vinyl, paper,

foil

7

and

high-pressure laminate. Additionally, we offer high-pressure laminate

laminated to substrates such as particleboard and lauan which has many uses,

including counter tops and ambulance cabinetry. We manufacture

laminate countertops and solid surface countertops, as well as slotwall and

slotwall components for the store and office fixture

markets. Laminated products are used in the production of wall,

cabinet, shelving, counter and fixture products with a wide variety of finishes

and textures.

We

manufacture three distinct cabinet door product lines in both raised and flat

panel designs, as well as square, shaker style, cathedral and arched

panels. One product line is manufactured from raw lumber using solid

oak, maple, cherry and other hardwood materials. Another line of

doors is made of laminated fiberboard, and a third line uses membrane press

technology to produce doors and components with vinyls ranging from 2 mil to 14

mil in thickness. Several outside profiles are available on square,

shaker style, cathedral, and arched raised panel doors and the components

include rosettes, hardwood moulding, arched window trim, blocks and windowsills,

among others. Our doors are sold mainly to the RV and MH

industries. We also market to the cabinet manufacturers and

“ready-to-assemble” furniture manufacturers.

Our vinyl

printing facility produces a wide variety of decorative vinyls which are 4 mil

in thickness and are shipped in rolls ranging from 300-750 yards in

length. This facility produces material for both internal and external

use.

Markets

We are

engaged in the manufacturing and distribution of building products and material

for use primarily by the RV and MH industries, and in other industrial

markets.

The

current downturn in the economy in general and the residential housing market

has had an adverse impact on our operations in 2009 in the three primary

industries in which we operate. On the RV side, the economic downturn

in the fourth quarter of 2008 and the first half of 2009 severely impacted

shipment levels, however, production levels were stronger than expected based on

a higher demand for RV’s by retail dealers in the latter half of

2009. The MH industry continues to be negatively impacted by

financing concerns and a lack of available financing sources, and the current

credit situation in the residential housing market puts additional pressure on

consumers, who are generally using financial institutions and conventional

financing as a source for these purchases. We expect the overall

declines experienced in the MH and industrial markets in 2009 to continue into

the first half of 2010. Recreational vehicle purchases are generally

consumer discretionary income purchases, and therefore any situation which

causes concerns related to discretionary income has a negative impact on these

markets. Approximately 70% of our industrial revenue base is

associated with the U.S. residential housing market, and therefore there is a

direct correlation between the demand for our products in this market and new

residential housing production.

Recreational

Vehicles

The

recreational vehicle industry has been characterized by cycles of growth and

contraction in consumer demand reflecting prevailing general economic conditions

which affect disposable income for leisure time activities. We

believe that fluctuations in interest rates, consumer confidence, and concerns

about the availability and price of gasoline have an impact on RV

sales.

Demographic

and ownership trends continue to point to favorable market growth in the

long-term as the number of “baby-boomers” reaching retirement is steadily

increasing, products such as sports-utility RV’s are becoming attractive to

younger buyers, and RV manufacturers are also providing an array of product

choices including producing lightweight towables and smaller, fuel

efficient motorhomes. Green technologies including lightweight

composite materials, solar panels, and energy-efficient components are appearing

on an increasing number of RVs. In addition, federal economic credit

and stimulus packages that contain provisions to stimulate RV lending and

provide favorable tax treatment for new RV purchases, may help promote sales and

aid in the RV industry’s economic recovery.

Recreational

vehicle classifications are based upon standards established by the

RVIA. The principal types of recreational vehicles include

conventional travel trailers, folding camping trailers, fifth wheel trailers,

motor homes, and conversion vehicles. These recreational vehicles are

distinct from mobile homes, which are manufactured houses designed for permanent

and semi-permanent residential dwelling.

8

Conventional

travel trailers and folding camping trailers are non-motorized vehicles designed

to be towed by passenger automobiles, pick-up trucks, or vans. They

provide comfortable, self-contained living facilities for short periods of

time. Conventional travel trailers and folding camping trailers are

towed by means of a frame hitch attached to the towing vehicle. Fifth

wheel trailers, designed to be towed by pick-up trucks, are constructed with a

raised forward section that is attached to the bed area of the pick-up

truck. This allows for a bi-level floor plan and more living space

than a conventional travel trailer.

A motor

home is a self-powered vehicle built on a motor vehicle chassis. The

interior typically includes a driver’s area, kitchen, bathroom, dining, and

sleeping areas. Motor homes are self-contained with their own

lighting, heating, cooking, refrigeration, sewage holding, and water storage

facilities. Although they are not designed for permanent or

semi-permanent living, motor homes do provide comfortable living facilities for

short periods of time.

Sales of

recreational vehicle products have been cyclical. Shortages of motor

vehicle fuels and significant increases in fuel prices have had a material

adverse effect on the market for recreational vehicles in the past, and could

adversely affect demand in the future. The RV industry is also

affected by the availability and terms of financing to dealers and retail

purchasers. Substantial increases in interest rates and decreases in

the general availability of credit have had a negative impact upon the industry

in the past and may do so in the future. Recession and lack of

consumer confidence generally result in a decrease in the sale of leisure time

products such as recreational vehicles.

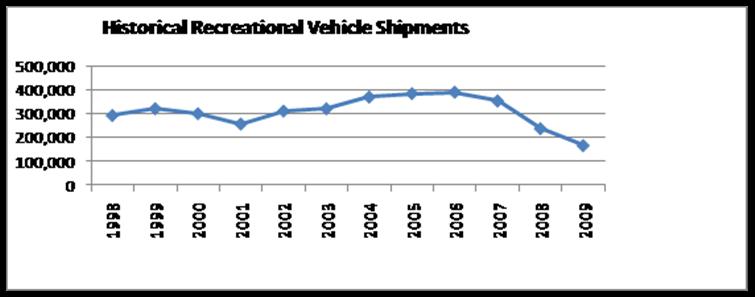

Since

1998, industry-wide wholesale unit shipments of RV’s have declined

43%. The period beginning in 1999 and continuing through 2007

resulted in eight out of the nine years with shipment levels over 300,000 units

primarily due to the favorable demographic trend of the aging “baby-boomer”

population, improved consumer confidence, depleted dealer inventories, lower

interest rates, and a fear of flying after the September 11, 2001 terrorist

attacks. Shipment levels started to soften in the third and fourth

quarters of 2006 and into 2007. In 2008, shipment levels declined

approximately 33% to 237,000 units reflecting the tightest credit conditions in

several decades, declining consumer confidence, reduced disposable income

levels, and the generally depressed economic environment. In 2009,

shipment levels declined approximately 30% versus 2008, reflecting low consumer

confidence and the continuance of unfavorable market conditions experienced by

the industry in 2008. However, production levels in the RV industry

were stronger than expected in the latter half of 2009 based on a higher demand

for RV’s by retail dealers.

In

anticipation of continued strengthening short-term demand, the Recreational

Vehicle Industry Association (the “RVIA”) is currently forecasting a 30%

increase in full year 2010 wholesale unit shipments to 215,900 units compared to

the full year 2009 level citing an improvement in dealer demand (as evidenced in

the second half of 2009) and an increase in capacity by certain new and existing

manufacturers that have also added to their workforce. According to

the RVIA, the recovery is expected to strengthen as credit availability, job

security and consumer confidence improve.

The

Company estimates that approximately 85% of its revenues related to the RV

industry are derived from the towables sector of the market. In 2009,

the towables sector of the RV market represented approximately 92% of total

units shipped into the market as a whole. The towable units are

lighter and less expensive than standard gas or diesel powered units

representing a more attractive solution for the cost-conscious

buyer. From 2008 to 2009, motorized unit shipments declined

approximately 53% and towable unit shipments declined approximately

27%. We believe that we are well positioned with respect to our

product mix within the RV industry to take advantage of any improved market

conditions.

The

following chart reflects the historical wholesale unit shipment levels in the RV

industry from 1998 through 2009 per RVIA statistics:

9

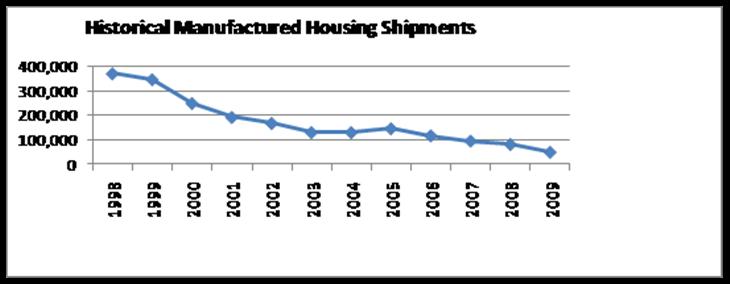

Manufactured

Housing

Manufactured

homes traditionally have been one of the principal means for first time

homebuyers to overcome the obstacles of large down payments and higher monthly

mortgage payments due to the relative lower cost of construction as compared to

site built homes. Manufactured housing also presents an affordable

alternative to site built homes for retirees and others desiring a lifestyle in

which home ownership is less burdensome than in the case of site built

homes. The increase in square footage of living space and updated

modern designs in manufactured homes created by multi-sectional models has made

them more attractive to a larger segment of homebuyers.

Manufactured

homes are built in accordance with national, state and local building

codes. Manufactured homes are factory built and transported to a site

where they are installed, often permanently. Some manufactured homes

have design limitations imposed by the constraints of efficient production and

over-the-road transit. Delivery expense limits the effective

competitive shipping range of the manufactured homes to approximately 400 to 600

miles.

Modular

homes, which are a component of the manufactured housing industry, are factory

built homes that are built in sections and transported to the site for

installation. These homes are generally set on a foundation and are

subject to land/home-financing terms and conditions. In recent years,

these units have been gaining in popularity due to their aesthetic similarity to

site-built homes and their relatively less expensive cost.

The

manufactured housing industry is cyclical and is affected by the availability of

alternative housing, such as apartments, town houses, condominiums and

site-built housing. In addition, interest rates, availability of

financing, regional population, employment trends, and general regional economic

conditions affect the sale of manufactured homes. Since 1998,

industry-wide wholesale unit shipments of manufactured homes have declined 87%.

The 2009 level of

49,800 wholesale units was at the lowest level in the last 50

years. MH unit shipments declined approximately 39% when compared to

2008. Factors that may favorably impact production levels in this

industry include quality credit standards in the residential housing market, job

growth, favorable changes in financing laws, new tax credits for new home buyers

and other government incentives, a lack of residential housing inventory, and

rising interest rates that make traditional site built homes more expensive to

finance. The Company currently estimates MH unit shipments for full

year 2010 to decline approximately 2% compared to full year 2009

levels.

We

believe that the factors responsible for the past decade-plus decline include

lack of available financing and access to the asset-backed securities markets,

high vacancy rates in apartments, high levels of repossessed housing

inventories, over-built housing markets in certain regions of the country that

resulted in fewer sales of new manufactured homes, as well as the generally

depressed economic environment. Additionally, low conventional

mortgage rates and less restrictive lending terms for residential site built

housing over much of this period contributed to the decline as manufactured home

loans generally carry a higher interest rate and less competitive

terms. Beginning in mid-1999 and continuing through 2009, the MH

industry has also had to contend with credit requirements that became more

stringent and a reduction in availability of lenders for manufactured homes for

both retail and dealers. While there is demand for permanent

rebuilding in the hurricane damaged areas, credit conditions remain adverse

especially in conjunction with the current credit crisis, and current overall

economic conditions are not

10

favorable

in relation to the factors which will promote positive growth. The

availability of financing and access to the asset-backed securities market is

still restricted, and we believe that employment growth and standard

quality-oriented lending practices in the conventional site-built housing

markets are needed to enable more balanced demand, thus resulting in the

potential for increased production and shipment levels in the MH

industry.

The

following chart reflects the historical wholesale unit shipment levels in the MH

industry from 1998 through 2009 per the Manufactured Housing

Institute:

Other

Markets

Many of

our core manufacturing products, including paper/vinyl laminated panels,

shelving, drawer-sides, and high-pressure laminated panels are routinely

utilized in the kitchen cabinet, store fixture and commercial furnishings, and

residential furniture markets. These markets are generally categorized by

a more performance than price driven customer base, and provide an opportunity

for us to diversify our clientele while providing increased contribution to our

core laminating and fabricating competencies. While the residential

furniture markets have been severely impacted by import pressures, other

segments have been less vulnerable, and therefore provide opportunities for

increased sales penetration and market share gains. While demand for

our products in the residential market has been adversely impacted by the severe

housing downturn, long-term growth in the residential market will be based on

improved job growth, low interest rates, and continuing government incentives to

stimulate housing demand and reduce surplus inventory due to foreclosures, which

we believe will ultimately increase the demand for our products.

Demand in

the industrial markets in which the Company competes also fluctuates with

economic cycles. Industrial demand tends to lag the housing cycle by six

to twelve months, and will vary based on differences in regional economic

prospects. As a result, we believe continued focus on the industrial

markets will help moderate the impact of the cyclical patterns in the RV/MH

markets on our operating results. We have the available capacity to

increase industrial revenue and benefit from the diversity of multiple market

segments, unique regional economies and varied customer

strategies.

Marketing and

Distribution

Our sales

are to recreational vehicle and manufactured housing manufacturers and other

industrial products manufacturers. We have approximately 1,000

customers. We have five customers, who together accounted for

approximately 53% and 44% of our total sales in 2009 and 2008,

respectively. We believe we have good relationships with our

customers.

Sales to

three different customers accounted for approximately 21%, 14% and 12%,

respectively, of consolidated net sales of the Company for the year ended

December 31, 2009. Sales to two different customers accounted for

approximately 13.1% and 11.5%, respectively, of consolidated net sales for the

year ended December 31, 2008. No one customer accounted for 10% or

more of consolidated net sales for the year ended December 31,

2007.

11

Most

products for distribution are generally purchased in carload or truckload

quantities, warehoused, and then sold and delivered by us. In

addition, approximately 45% and 33% of our distribution segment’s products were

shipped directly from the suppliers to our customers in 2009 and 2008,

respectively. We typically experience a one to two week delay between

issuing our purchase orders and the delivery of products to our warehouses or

customers. As lead times have declined over the years, in some

instances, certain customers have required same-day or next-day

service. We generally keep backup supplies of various commodity

products in our warehouses to ensure that we have product on hand at all times

for our distribution customers. Our customers do not maintain

long-term supply contracts, and therefore we must bear the risk of accurate

advanced estimation of customer orders. We have no significant

backlog of orders.

We

operate 11 warehouse and distribution centers and 11 manufacturing operations

located in Alabama, Arizona, California, Georgia, Illinois, Indiana, Kansas,

Minnesota, Oregon, Pennsylvania, Tennessee and Texas. By using these

facilities, we are able to minimize our in-transit delivery time and cost to the

regional manufacturing plants of our customers.

Patrick

does not engage in significant marketing efforts nor does it incur significant

marketing or advertising expenditures other than attendance at certain trade

shows and the activities of its sales personnel and the maintenance of customer

relationships through price, quality of its products, service and customer

satisfaction. In our design showroom located in Elkhart, Indiana,

many of our manufactured and distribution products are on display for current

and potential customers. We believe that the design showroom has

provided Patrick with the opportunity to grow its market share by educating our

customers regarding the style and content options that we have available and by

offering custom design services to further differentiate our product

lines.

Suppliers

During

the year ended December 31, 2009, we purchased approximately 74% of our raw

materials and distributed products from twenty different

suppliers. The five largest suppliers accounted for approximately 48%

of our purchases. Our current major material suppliers with contracts

through December 31, 2010 include United States Gypsum, MJB Wood Group and Tumac

Lumber Company. We have terms and

conditions with these and other suppliers that specify exclusivity in certain

areas, pricing structures, rebate agreements and other parameters.

Materials

are primarily commodity products, such as lauan, gypsum, particleboard, and other

lumber products, which are available from many suppliers. We maintain

a long-term supply agreement with one of our major suppliers

of materials to the MH industry. Our sales in the short-term could be

negatively impacted in the event any unforeseen negative circumstances were to

affect our major supplier. We believe that we have a good

relationship with this supplier and all of our other

suppliers. Alternate sources of supply are available for all of our

major material purchases.

Regulation and Environmental

Quality

The

Company’s operations are subject to certain Federal, state and local regulatory

requirements relating to the use, storage, discharge and disposal of hazardous

chemicals used during their manufacturing processes. Over the past

two and one-half years, Patrick has taken a proactive role in certifying that

the composite wood substrate materials that it uses to produce products for its

customers in the RV marketplace have complied with applicable emission standards

developed by the California Air Resources Board (“CARB”). All

suppliers and manufacturers of composite wood materials will be required to be

either CARB I or CARB II certified at some point in the near

future.

We

believe that we are currently operating in compliance with applicable laws and

regulations and have made reports and submitted information as

required. The Company believes that the expense of compliance with

these laws and regulations with respect to environmental quality, as currently

in effect, will not have a material adverse effect on its financial condition or

competitive position, and will not require any material capital expenditures for

plant or equipment modifications which would adversely affect

earnings.

12

Seasonality

Manufacturing

operations in the RV and MH industries historically have been seasonal and are

generally at the highest levels when the climate is

moderate. Accordingly, the Company’s sales and profits are generally

highest in the second and third quarters. However, depressed economic

conditions in both industries distorted the historical trends in

2009. RV unit shipments did not experience their normal seasonal

sales decline in the fourth quarter of 2009 as they generally have in prior

years.

Employees

As of

December 31, 2009, we had 580 employees, 486 of which were engaged directly in

production, warehousing, and delivery operations; 36 in sales; and 58 in office

and administrative activities. There were no manufacturing plants or

distribution centers covered by collective bargaining

agreements. Patrick continuously reviews benefits and other matters

of interest to its employees and considers its relations with its employees to

be good.

Executive Officers of the

Company

The

following table sets forth our executive officers as of February 1,

2010:

|

Name

|

Position

|

|

Todd

M. Cleveland

|

President

and Chief Executive Officer

|

|

Andy

L. Nemeth

|

Executive

Vice President of Finance, Chief Financial Officer, and

Secretary-Treasurer

|

|

Darin

R. Schaeffer

|

Vice

President, Corporate Controller, and Principal Accounting

Officer

|

Todd M. Cleveland

(age 41) was appointed Chief Executive Officer as of February 1,

2009. Mr. Cleveland assumed the position of President and Chief

Operating Officer of the Company in May 2008. Prior to that, Mr.

Cleveland served as Executive Vice President of Operations and Sales and Chief

Operating Officer from August 2007 to May 2008 following the acquisition of

Adorn by Patrick in May 2007. Mr. Cleveland spent 17 years with Adorn

serving as President and Chief Executive Officer since 2004; President and Chief

Operating Officer from 1998 to 2004; Vice President of Operations and Chief

Operating Officer from 1994 to 1998; Sales Manager from 1992 to 1994; and

Purchasing Manager from 1990 to 1992. Mr. Cleveland has over 19 years

of manufactured housing, recreational vehicle, and industrial experience in

various operating capacities.

Andy L. Nemeth (age

40) was elected Executive Vice President of Finance, Chief Financial Officer,

and Secretary-Treasurer as of May 2004. Prior to that,

Mr. Nemeth was Vice President-Finance, Chief Financial Officer, and

Secretary-Treasurer from 2003 to 2004, and Secretary-Treasurer from 2002 to

2003. Mr. Nemeth was a Division Controller from 1996 to 2002 and

prior to that, he spent five years in public accounting with Coopers &

Lybrand (now PricewaterhouseCoopers). Mr. Nemeth has over 17 years of

manufactured housing, recreational vehicle, and industrial experience in various

financial capacities.

Darin R. Schaeffer

(age 42) was elected Vice President, Corporate Controller, and Principal

Accounting Officer as of March 26, 2008. From September 2007 to March

26, 2008, Mr. Schaeffer served as the Company’s Corporate

Controller. From 2005 to 2007, Mr. Schaeffer was a Corporate

Controller for Utilimaster Corporation. Mr. Schaeffer also served in

a variety of roles, including plant controller, for Robert Bosch Corporation

from 1996 to 2005. Prior to that, Mr. Schaeffer spent seven

years in public accounting, including three years with Coopers & Lybrand

(now PricewaterhouseCoopers).

Website Access to Company

Reports

We make

available free of charge through our website, www.patrickind.com, our Annual

Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form

8-K, and all amendments to those reports as soon as reasonably practicable after

such material is electronically filed with or furnished to the Securities and

Exchange Commission (“SEC”). The charters of

our Audit, Compensation, and Corporate Governance/Nominations Committees, our

Corporate Governance Guidelines, our Code of Ethics and Business Conduct, and

our Code of Ethics Applicable to Senior Executives are also available on the

“About Us –Corporate Governance” portion of our website. Our

internet

13

website

and the information contained therein or incorporated therein are not intended

to be incorporated into this Annual Report on Form 10-K.

Additionally,

the public may read or copy any materials we file with the SEC at the SEC's

public reference room located at 100 F Street N.E., Washington D.C.

20549. The public may obtain information on the operation of the

public reference room by calling the SEC at 1-800-SEC-0330. The SEC

maintains an Internet site that contains reports, proxy and information

statements, and other information regarding issuers that file electronically

with the SEC at www.sec.gov.

ITEM

1A. RISK

FACTORS

The

Company’s consolidated results of operations, financial position and cash flows

can be adversely affected by various risks related to its

business. These risks include, but are not limited to, the principal

factors listed below and the other matters set forth in this Annual Report on

Form 10-K. All of these risks should be carefully

considered.

Our

results of operations have been, and may continue to be, adversely impacted by a

worldwide macroeconomic downturn.

In 2009,

general worldwide economic conditions continued to experience a downturn due to

the effects of the deterioration in the residential housing market, subprime

lending crisis, general credit market crisis, collateral effects on the finance

and banking industries, increased commodity costs, volatile energy costs,

concerns about inflation, slower economic activity, decreased consumer

confidence, reduced corporate profits and capital spending, adverse business

conditions and liquidity concerns (the “economic

crisis”). These conditions have adversely affected demand in the

three major end-markets we serve (the recreational vehicle, manufactured housing

and industrial markets), resulting in decreased sales of our component products

into these markets and could negatively affect our operations and result in

lower sales, income, and cash flows.

In

addition, it has become more difficult for our customers and us to accurately

forecast and plan future business activities, and ultimately our profitability

has been adversely affected. If our business conditions continue to

deteriorate, we may be forced to close and/or consolidate certain of our

operating facilities, sell assets, and/or reduce our workforce, which may result

in our incurring restructuring charges. We cannot predict the

duration of the economic downturn, the timing or strength of a subsequent

economic recovery or the extent to which the economic downturn will continue to

negatively impact our business, financial condition and results of

operations.

The

current economic downturn in the residential housing market has had an adverse

impact on our operations, and is expected to continue into 2010.

The

residential housing market has experienced overall declines and credit concerns

that are expected to continue into 2010. Approximately 70% of our

industrial revenue is directly or indirectly influenced by conditions in the

residential housing market. The decline in demand for residential

housing and the tightening of consumer credit have lowered demand for our

industrial products and have had an adverse impact on our operations as a

whole. In addition, the impact of the sub-prime mortgage crisis and

housing downturn on consumer confidence, discretionary spending, and general

economic conditions has decreased and may continue to decrease demand for our

products sold to the manufactured housing and recreational vehicle

industries.

We

may incur significant charges or be adversely impacted by the closure of all or

part of a manufacturing or distribution facility.

We

periodically assess the cost structure of our operating facilities to distribute

and/or manufacture and sell our products in the most efficient

manner. Based on our assessments, we may make capital investments to

move, discontinue manufacturing and/or distribution capabilities, sell or close

all or part of a manufacturing and/or distribution facility. In

January 2009, we closed our leased distribution facility in Woodland, California

and consolidated operations into the existing owned Fontana, California

manufacturing facility in order to offset a sizable reduction in sales volumes

that stemmed from the planned closure of one of our major customer’s plants in

the same area. The Fontana facility was subsequently sold in March

2010 and we are currently operating in the same facility

14

under a

lease agreement with the purchaser for the use of approximately one-half of the

square footage previously occupied. We have incurred charges in the

first quarter of 2010 related to downsizing our operations in this facility and

to accommodate the use of this facility by two different parties. In

addition, we closed and sold our manufacturing facility in Ocala, Florida in

late 2009 and consolidated its operations into our Alabama and Georgia

facilities. Our manufacturing and distribution facility in Oregon was

sold in February 2010 and we are currently operating in the same facility under

a license agreement with the purchaser while we explore options for a more

suitable long-term solution. These changes could result in

significant future charges or disruptions in our operations, and we may not

achieve the expected benefits from these changes which could result in an

adverse impact on our operating results, cash flows and financial

condition.

The

financial condition of our customers and suppliers may deteriorate as a result

of the current economic environment and competitive conditions in their

markets.

The

economic crisis may lead to increased levels of restructurings, bankruptcies,

liquidations and other unfavorable events for our customers, suppliers and other

service providers and financial institutions with whom we do

business. Such events could, in turn, negatively affect our business

either through loss of sales or inability to meet our commitments (or inability

to meet them without excess expense) because of loss of suppliers or other

providers. In addition, several of our major customers are undergoing

unprecedented financial distress which may result in such customers undergoing

major restructuring, reorganization or other significant changes. The

occurrence of any such event could have further adverse consequences to our

business including a decrease in demand for our products. If such

customers become insolvent or file for bankruptcy, our ability to recover

accounts receivables from those customers would be adversely affected and any

payments we received in the preference period prior to a bankruptcy filing may

be potentially recoverable by the bankruptcy trustee.

Many of

our customers participate in highly competitive markets, and their financial

condition may deteriorate as a result. A decline in the financial

condition of our customers could hinder our ability to collect amounts owed by

customers. In addition, such a decline could result in lower demand

for our products and services.

We

have a number of large customers, the loss of any of which could have a material

adverse impact on our operating results.

We have a

number of customers which account for a significant percentage of our net

sales. Specifically, two customers in the RV market accounted for a

combined 35%, and another customer in the MH market accounted for 12% of

consolidated net sales in 2009. The loss of any of these large

customers could have a material adverse impact on our operating

results. We do not have long-term agreements with customers and

cannot predict that we will maintain our current relationships with these

customers or that we will continue to supply them at current

levels.

The

manufactured housing and recreational vehicle industries are highly competitive,

and some of our competitors may have greater resources than we do.

We

operate in a highly competitive business environment and our sales could be

negatively impacted by our inability to maintain or increase prices, changes in

geographic or product mix, or the decision of our customers to purchase our

competitors’ products instead of our products. We compete not only

with other suppliers to the manufactured housing and recreational vehicle

producers, but also with suppliers to traditional site-built homebuilders and

suppliers of cabinetry and flooring. Sales could also be affected by

pricing, purchasing, financing, advertising, operational, promotional, or other

decisions made by purchasers of our products. Additionally, we cannot

control the decisions made by suppliers of our distributed and manufactured

products and therefore our ability to maintain our exclusive and non-exclusive

distributor contracts and agreements may be adversely impacted.

As a

result of highly competitive market conditions in the industries in which we

participate, some of our competitors have been forced to seek bankruptcy

protection. These competitors may emerge from bankruptcy protection

with stronger balance sheets and a desire to gain market share by offering below

market pricing, which would have an adverse impact on our financial condition

and results of operations and cash flows.

15

Seasonality

and cyclical economic conditions affect the RV and MH markets the Company

serves.

The RV

and MH markets are cyclical and dependent upon various factors, including the

general level of economic activity, consumer confidence, interest rates, access

to financing, inventory and production levels, and the cost of

fuel. Economic and demographic factors can cause substantial

fluctuations in production, which in turn impact sales and operating

results. Demand for recreational vehicles and manufactured housing

generally declines during the winter season. Our sales levels and

operating results could be negatively impacted by changes in any of these

items.

The

cyclical nature of the domestic housing market has caused our sales and

operating results to fluctuate. These fluctuations may continue in

the future, which could result in operating losses during

downturns.

The

U.S. housing industry is highly cyclical and is influenced by many national

and regional economic and demographic factors, including:

|

·

|

terms

and availability of financing for homebuyers and

retailers;

|

|

·

|

consumer

confidence;

|

|

·

|

interest

rates;

|

|

·

|

population

and employment trends;

|

|

·

|

income

levels;

|

|

·

|

housing

demand; and

|

|

·

|

general

economic conditions, including inflation, deflation and

recessions.

|

The

manufactured housing and recreational vehicle industries and the industrial

markets are affected by the fluctuations in the residential housing

market. As a result of the foregoing factors, our sales and operating

results fluctuate, and we expect that they will continue to fluctuate in the

future. Moreover, cyclical and seasonal downturns in the residential

housing market may cause us to experience operating losses.

Fuel

shortages, or higher prices for fuel, have had, and could continue to have, an

adverse impact on our operations.

The

products produced by the RV industry typically require gasoline or diesel fuel

for their operation, or the use of a vehicle requiring gasoline or diesel fuel

for their operation. There can be no assurance that the supply of

gasoline and diesel fuel will continue uninterrupted or that the price of or tax

on fuel will not significantly increase in the future. Shortages of

gasoline and diesel fuel have had a significant adverse effect on the demand for

recreational vehicles in the past and would be expected to have a material

adverse effect on demand in the future. Rapid significant increases

in fuel prices, as we experienced in recent years, appear to affect the demand

for recreational vehicles when gasoline prices reach unusually high

levels. Such a reduction in overall demand for recreational vehicles

could have a materially adverse impact on our revenues and

profitability. Approximately 44% and 37% of our sales were to the RV

industry for 2009 and for 2008, respectively. In 2010, we expect an

even higher percentage of our total sales to be concentrated in the RV industry

than in 2009 due to forecasted growth in the RV industry and continued softness

in the MH and industrial markets.

Dependence

on Third-Party Suppliers and Manufacturers.

Generally,

our raw materials, supplies and energy requirements are obtained from various

sources and in the quantities desired. While alternative sources are

available, our business is subject to the risk of price increases and periodic

delays in the delivery. Fluctuations in the prices of these

requirements may be driven by the supply/demand relationship for that commodity

or governmental regulation. In addition, if any of our suppliers seek

bankruptcy relief or otherwise cannot continue their business as anticipated,

the availability or price of these requirements could be adversely

affected.

Increased

cost and limited availability of raw materials may have a material adverse

effect on our business and results of operations.

Prices of

certain materials, including gypsum, lauan, particleboard, MDF, and other

commodity products, can be volatile and change dramatically with changes in

supply and demand. Certain products are purchased from overseas and

are dependent upon vessel shipping schedules and port

availability. Further, certain of our commodity product suppliers

sometimes operate at or near capacity, resulting in some products having the

potential of being put on

16

allocation. We

generally have been able to maintain adequate supplies of materials and to pass

higher material costs on to our customers in the form of surcharges and base

price increases where needed. However, it is not certain that future

price increases can be passed on to our customers without affecting demand or

that limited availability of materials will not impact our production

capabilities. The current credit crisis and its impact on the

financial and housing markets may also impact our suppliers and affect the

availability or pricing of materials. Our sales levels and operating

results could be negatively impacted by changes in any of these

items.

We

are subject to governmental and environmental regulations, and failure in our

compliance efforts could result in damages, expenses or liabilities that

individually or in the aggregate would have a material adverse affect on our

financial condition and results of operations.

Our

manufacturing businesses are subject to various governmental and environmental

regulations. Implementation of new regulations or amendments to

existing regulations could significantly increase the cost of the Company’s

products. Certain components of manufactured and modular homes are

subject to regulation by the U.S. Consumer Product Safety

Commission. We currently use materials that we believe comply with

government regulations. We cannot presently determine what, if any,

legislation may be adopted by Congress or state or local governing bodies, or

the effect any such legislation may have on us or the manufactured housing

industry. In addition, failure to comply with present or future

regulations could result in fines or potential civil or criminal

liability. Both scenarios could negatively our results of operations

or financial condition.

The

inability to attract and retain qualified executive officers and key personnel

may adversely affect our operations.

The loss

of any of our executive officers or other key personnel could reduce our ability

to manage our business and strategic plan in the short term and could cause our

sales and operating results to decline.

Our

ability to integrate acquired businesses may adversely affect

operations.

As part

of our business and strategic plan, we look for strategic acquisitions to

provide shareholder value. Any acquisition will require the effective

integration of an existing business and its administrative, financial, sales and

marketing, manufacturing and other functions to maximize

synergies. Acquired businesses involve a number of risks that may

affect our financial performance, including increased leverage, diversion of

management resources, assumption of liabilities of the acquired businesses, and

possible corporate culture conflicts. If we are unable to

successfully integrate these acquisitions, we may not realize the benefits

identified in our due diligence process, and our financial results may be

negatively impacted. Additionally, significant unexpected liabilities

could arise from these acquisitions.

Increased

levels of indebtedness may harm our financial condition and results of

operations.

As of

December 31, 2009, we had approximately $42.3 million of total debt of which

$41.8 million was under our senior secured credit facility (the “Credit

Facility”) and $0.5 million was related to our economic development revenue

bonds. Our indebtedness, which was primarily the result of the Adorn