DEF 14A: Definitive proxy statements

Published on April 9, 2021

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement | |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ |

Definitive Proxy Statement | |

| ☐ |

Definitive Additional Materials | |

| ☐ |

Soliciting Material Pursuant to Sections 240.14a-11(c) or Section 240.14a-12 | |

PATRICK INDUSTRIES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ |

No fee required | |||

| ☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 | |||

| 1) |

Title of each class of securities to which transaction applies:

|

|||

| 2) | Aggregate number of securities to which transaction applies:

|

|||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|||

| 4) | Proposed maximum aggregate value of transaction:

|

|||

| 5) | Total fee paid:

|

|||

| ☐ |

Fee paid previously with preliminary materials | |||

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing: | |||

| 1) | Amount Previously Paid:

|

|||

| 2) | Form, Schedule or Registration Statement No.:

|

|||

| 3) | Filing Party:

|

|||

| 4) | Date Filed:

|

|||

Table of Contents

Table of Contents

Table of Contents

| DEAR SHAREHOLDER,

|

|

|

PATRICK INDUSTRIES, INC.

|

|||

| We are pleased to invite you to join us for our Annual Meeting of Shareholders, which will be conducted via live audio webcast on May 13, 2021 at 10:00 a.m. Eastern time. Due to COVID-19-related public health restrictions and for the safety and well-being of our shareholders, the virtual Annual Meeting will be conducted online via the Internet. In the Notice of 2021 Annual Meeting and Proxy Statement, we describe the matters upon which you will be asked to vote at the meeting and provide instructions for attending the meeting.

The global COVID-19 pandemic defined fiscal 2020 as a year in which the values, strengths and flexibility of our organization shined in many different ways in the midst of both challenges and opportunities. Our team members health and safety were paramount in our efforts and priorities, and their inspiring dedication and outstanding performance during this past year energized and strengthened our commitment to strive for the highest level of internal and external customer service. At the same time, our nimble and resilient operating platform navigated both significant headwinds and tailwinds, and we emerged in the second half of 2020 in a strong position to serve our customers and execute our growth strategies.

Fiscal 2020 Highlights:

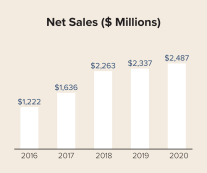

u Despite COVID-19-related operating disruptions in the first and second quarters of 2020, sales of $2.5 billion for the full year 2020 increased 6%, with strong organic growth

u Full year 2020 operating income of $173 million increased 12%, with operating margin improving 40 basis points

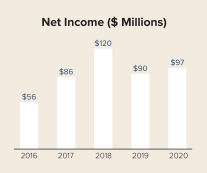

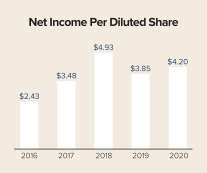

u Net income of $97 million increased 8% and diluted net income per share of $4.20 increased 9%

u Full year 2020 operating cash flow of $160 million

u RV, marine and industrial market acquisitions totaled $306 million

u We returned $24 million to shareholders in the form of dividends and $23 million in the form of opportunistic share repurchases

In the midst of the challenges we faced both as an organization and on a macroeconomic level, we reimagined our journey of corporate responsibilities in the Environmental, Social and Governance (ESG) arena. Our teams continued to emphasize sustainability in the way we use resources through innovative programs to reduce and reuse materials and reclaiming production byproducts where they have a valuable use in other industries. We also continue to make investments in human capital management initiatives, which are a product of our core values to provide a safe, inclusive and tolerant environment in which everyone is empowered to pursue their professional and personal development goals. Several of the initiatives that took place in 2020 are highlighted within this Proxy Statement. |

Please review the proxy / notice card for instructions on how to vote over the Internet, by telephone or by mail in order to be certain that your shares of stock are represented at the Annual Meeting. It is important that all Patrick Industries, Inc. shareholders vote and participate in the affairs and governance of our Company.

|

|||||

|

We are proud of our teams performance in 2020 and are very excited about the prospects for fiscal 2021 and beyond. Our culture, core values, and the dedication, passion, and commitment of our more than 8,800 team members who have worked tirelessly over this past year are both energizing and motivating as we drive the execution of our strategic plan and capital allocation strategy. Our financial flexibility, resources, liquidity, and balance sheet strength help enable us to opportunistically pursue strategic acquisitions to expand the portfolio of brands we offer our customers, and invest in strategic capital spending and automation to further drive capacity, efficiency, and continuous improvement initiatives. As we look ahead to 2021, we believe favorable demographic, macroeconomic and secular tailwinds will lead to continued strong demand in our end markets which provide tremendous quality of life benefits in both a COVID and post-COVID environment.

Finally, the ongoing support we receive from our customers, suppliers, Board of Directors and shareholders will help us increase long-term shareholder value by serving our customers at the highest level, investing in and protecting our talented and dedicated team members, dealing ethically and responsibly with our business partners, and supporting our local communities.

In closing, please review the proxy / notice card for instructions on how to vote over the Internet, by telephone or by mail in order to be certain that your shares of stock are represented at the Annual Meeting. It is important that all Patrick Industries, Inc. shareholders vote and participate in the affairs and governance of our Company.

Sincerely,

Todd M. Cleveland

Executive Chairman of the Board April 16, 2021

|

Table of Contents

NOTICE OF ANNUAL MEETING

| DATE & TIME: | LOCATION: | RECORD DATE: | ||||||

| Thursday May 13, 2021 10:00 A.M., EDT |

Online at www.meetingcenter.io/241836370 Meeting Password: PATK2021 |

March 19, 2021 | ||||||

| VOTING MATTERS | ||||||||

| Board Vote | Page Reference | |||||||

| Proposal |

Recommendation | (for more detail) | ||||||

| PROPOSAL 1 |

To elect nine directors to the Board of Directors to serve until the 2022 Annual Meeting of Shareholders |

FOR EACH NOMINEE |

12 | |||||

| PROPOSAL 2 |

To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 2021 |

FOR | 20 | |||||

| PROPOSAL 3 |

To approve, in an advisory and non-binding vote, the compensation of the Companys named executive officers for fiscal year 2020 as disclosed in the Proxy Statement (a Say-on-Pay vote) |

FOR | 23 | |||||

| To consider and transact such other business as may properly come before the meeting or any adjournment or postponement thereof |

||||||||

VOTING: Whether or not you expect to attend the virtual meeting, please vote your shares using the Internet, by telephone or by mail by signing, dating and returning the enclosed proxy in the enclosed envelope, so that even if you are unable to attend, your shares will still be represented at the meeting. If you hold shares through a broker, custodian, fiduciary, or nominee (beneficial holders), please check the voting instructions used by that broker, custodian, fiduciary, or nominee. Holders with a control number from Computershare, our transfer agent, can vote at the virtual Annual Meeting. Please return your proxy card so your vote can be counted.

VIRTUAL MEETING FORMAT: Due to COVID-19 related public health restrictions and for the safety and well-being of our shareholders, you will be able to attend and participate in the Annual Meeting online, vote your shares electronically and submit your questions prior to and during the meeting by visiting: www.meetingcenter.io/241836370 on the meeting date and time described in the accompanying Proxy Statement. The password for the meeting is PATK2021. There is no physical location for the Annual Meeting.

If you plan to attend the meeting virtually on the Internet, you must register by following the instructions contained in the Voting Information section of this proxy statement.

| By Order of the Board of Directors, |

|

Joel D. Duthie Vice President, General Counsel and Secretary

|

|||||

AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS:

Our 2021 Proxy Statement and Annual Report to Shareholders for fiscal 2020 are available on Patrick Industries, Inc.s website at www.patrickind.com under Investor Relations-Investor Information. You may also request hard copies of these documents free of charge by writing to us at the following address: 107 West Franklin Street, Elkhart, Indiana 46515-0638. Attention: Office of the Secretary.

Table of Contents

|

|

||||

| PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

This Proxy Statement and the accompanying Proxy Card are being mailed to shareholders of Patrick Industries, Inc. (the Company or Patrick) on or about April 16, 2021, and are furnished in connection with the solicitation of proxies by the Board of Directors (the Board) for the Annual Meeting of Shareholders to be held online (virtual meeting) on May 13, 2021 (the Annual Meeting) for the purpose of considering and acting upon the matters specified in the Notice of Annual Meeting of Shareholders accompanying this Proxy Statement.

If the form of proxy which accompanies this Proxy Statement is executed and returned, or is voted by Internet or by telephone, it may be revoked by the person giving it at any time prior to the voting thereof by:

(i) changing your vote using the online voting method described under Voting Information on pages 9 and 10, in which case only your latest Internet proxy submitted prior to the Annual Meeting will be counted;

(ii) filing with the Secretary of the Company, during or before the Annual Meeting, a written notice of revocation bearing a date later than the date of the proxy;

(iii) duly executing and dating a subsequent proxy relating to the common stock and delivering it to the Secretary of the Company during or before the Annual Meeting; or

(iv) voting your shares electronically during the Annual Meeting.

If the form of proxy is signed, dated and returned without specifying choices on one or more matters presented to the shareholders, the shares will be voted on the matter or matters listed on the proxy card as recommended by the Companys Board.

Additional solicitations, in person or by telephone or otherwise, may be made by certain directors, officers and employees of the Company regarding the proposals without additional compensation. Expenses incurred in the solicitation of proxies, including postage, printing and handling, and actual expenses incurred by brokerage houses, custodians, nominees and fiduciaries in forwarding documents to beneficial owners, will be paid by the Company. |

|

107 West Franklin Street Elkhart, Indiana 46515-0638 (574) 294-7511

VOTING METHODS

By Internet Vote online at: www.investorvote.com/PATK

By Mail Sign, date and return the enclosed proxy in the enclosed envelope

By Phone For shareholders of record: 800-652-8683

|

Patricks Annual Report to Shareholders, which contains Patricks Annual Report on Form 10-K for the year ended December 31, 2020, accompanies this Proxy Statement. Requests for additional copies of the Annual Report on Form 10-K should be submitted to the Office of the Secretary, Patrick Industries, Inc., 107 West Franklin Street, Elkhart, Indiana 46515-0638. Annual Meeting materials may also be viewed online through our website, www.patrickind.com under Investor Relations Investor Information.

Table of Contents

Table of Contents

This summary highlights certain information contained in our 2021 Proxy Statement. Although it does not contain all of the information in this Proxy Statement, it provides an overview of the information discussed herein. You should carefully review the entire Proxy Statement before voting.

VOTING MATTERS

PROPOSAL 1: ELECTION OF DIRECTORS

As of the date of this Proxy Statement, our Board of Directors (the Board) is comprised of nine members, each of whom has been nominated for election to the Board at the May 13, 2021 Annual Meeting: Joseph M. Cerulli, Todd M. Cleveland, John A. Forbes, Michael A. Kitson, Pamela R. Klyn, Derrick B. Mayes, Andy L. Nemeth, Denis G. Suggs and M. Scott Welch.

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED ACCOUNTING FIRM FOR FISCAL YEAR 2021

PROPOSAL 3: ADVISORY VOTE TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

The Board recommends you vote FOR each of the nine nominees listed under Proposal 1 and FOR Proposals 2 and 3.

BOARD COMPOSITION EXPERIENCE AND EXPERTISE

CORPORATE GOVERNANCE DEVELOPMENTS

The Board believes that fundamental corporate governance is important to ensure that we are managed for the long-term benefit of our shareholders. See page 24 of the Proxy for a summary of recent actions taken by the Board.

In 2021, the Board provided additional disclosures, as summarized on pages 5 to 8, regarding the Companys journey of corporate responsibility in the area of environmental, social and governance (ESG) practices. The Board aims to ensure that ESG matters are considered and supported in the Companys operations and administrative matters and are consistent with Patrick shareholders best interests. In support of this objective, the Company established an ESG committee in 2020 under the oversight of the Corporate Governance and Nominations Committee in order to identify and define ESG initiatives and priorities and enhance its communications to its stakeholders.

1

Table of Contents

FISCAL YEAR 2020 COMPANY FINANCIAL PERFORMANCE SUMMARY

| 8,800+

Team Members Helped Achieve Our Goals

|

138%

Cumulative Company TSR % Over a Five Year Period

|

84%

Cumulative S&P 500 Index TSR % Over Same Five Years

|

||||||

|

|

|

|

||||||

Despite the challenges presented by a global pandemic, our disciplined focus to effect our strategic execution and service to our customers, while implementing safety protocols to maintain the well-being of our team members during fiscal 2020, became of paramount importance. We remained focused on our balanced and disciplined capital allocation strategy, strengthening our balance sheet position to provide flexibility for our business and to mitigate any disruption in our operations and supply chains, and positioning for execution of strategic growth initiatives in the four core markets we serverecreational vehicle (RV), marine, manufactured housing (MH), and Industrial. Our strategic vision remains focused on rewarding our shareholders in balance with the interests all of our stakeholders and the communities in which we operate and live.

The Company continued to execute on a company-wide market and performance-based compensation platform designed to reward for differentiated performance that supported operating excellence and growth organically and through acquisitions in 2020.

Through execution of our 2020 Organizational Strategic Agenda and the efforts of our 8,800 team members, the Company produced sales in 2020 that were above our targeted operating results (net of acquisitions and after adjustment for an approximate five-week operations shutdown in the late first quarter and early second quarter of 2020 in many of our RV and marine facilities caused by the global pandemic). Despite the impact of the global pandemic on our industry and markets, the Company adapted and flexed its operating structure to appropriately align costs with the revenue stream, deliver organic market share gains, and position itself to respond to the swift increase in customer demand, especially for recreational vehicles and powerboats, during the second half of 2020.

The Companys cumulative total shareholder return (TSR) over the five-year period from December 31, 2015 to December 31, 2020 was 138% compared to 84% for the S&P 500 Index over the same time period.

The charts below illustrate the Companys performance related to net sales, net income and net income per diluted share since 2016. We believe these achievements result from the execution by our autonomous business units of the Companys strategic initiatives.

|

|

|

|

||||

The Companys performance is ultimately focused on meeting the needs of our large breadth of customers, generating returns for our shareholders, supporting our communities, and reinvesting in our team members. While we focus on achieving annual objectives and outcomes, the Company continues to emphasize our long-range strategic plan and the execution of that plan.

2

Table of Contents

EXECUTIVE COMPENSATION HIGHLIGHTS

ALIGNING PAY TO DIFFERENTIATED PERFORMANCE

The Company continues to embrace a long-time philosophy of rewarding its leadership team for differentiated performance in a given performance year and over the long term. The architecture of the Executive Compensation Plan is specifically designed to support this philosophy by focusing on variable pay for the leadership team and cascading this philosophy throughout the levels of the organization. Our Compensation Committee recommends compensation decisions to the Board which support such philosophy. Our leaders understand and are motivated to impact the key metrics that will drive growth, profitability and ultimately shareholder value in both the short and long term. The plan design is brought to life through understanding each compensation element and the impact of the individuals and the teams performance as outlined below:

| Compensation Element |

Percentile Positioning vs. Peer Proxy and General Industry Data |

|

| BASE SALARY |

25th 50th | |

| SHORT-TERM INCENTIVE |

50th 75th | |

| TOTAL TARGET CASH |

50th 75th | |

| LONG-TERM INCENTIVE |

25th 50th | |

| TOTAL TARGET DIRECT COMPENSATION |

50th 75th | |

Each compensation component, relative to Peer Group and General Industry data, supports our philosophy of rewarding differentiated performance by emphasizing each executives variable pay elements.

|

u |

Base Salary, though lower than peer base compensation, is designed in alignment with the philosophy to reduce the importance of fixed pay with the intention of driving focus on performance-dependent variable pay. |

|

u |

The annual Short-term cash compensation plan is highlighted through enhanced payouts for performance above plan up to a maximum of 200% of target compensation and incorporates a threshold payout of 50% of target compensation at 75% of plan. (The STI plan was modified in 2020 due to the global pandemic and included a threshold payout of 50% at 50% of plan). |

|

u |

Long-term incentive compensation is designed to drive the executives focus on long-term profitability through both organic and inorganic growth over the three-year award performance period. This equity plan is also designed to motivate leadership to perform above plan with a maximum payout of 200% of target compensation and a threshold payout of 50% of target compensation at 80% of plan. |

Our focus on variable pay to motivate performance, a key component of our compensation plan over the past decade, continues to prove successful in aligning our teams compensation to shareholder returns.

3

Table of Contents

KEY COMPENSATION ACTIONS TAKEN IN FISCAL 2020

|

u |

Adjusted compensation for our Named Executive Officers (NEOs) to align with changes in responsibility, the Companys performance in 2020, year-over-year revenue growth, and size scoping of our Peer Group and General Industry data; |

|

u |

Continued to utilize external consultant, Willis Towers Watson, for data and consultation as requested by the Compensation Committee; |

|

u |

Proactively and voluntarily initiated temporary salary compensation reductions for all NEOs and other executives and implemented salary adjustments for salaried team members in late March and early April, in addition to furloughing certain team members with benefits for those affected by the shutdown of operations at certain facilities due to the pandemic; |

|

u |

Initiated temporary reductions in cash fees for the Board; |

|

u |

Implemented COVID-19 pandemic related changes to the performance payout metrics for the 2020 STI plan, with adjustments to threshold performance targets and corresponding payouts when below plan to align with exceptional performance and maximize flexibility of the organizations opportunity to deliver differentiated results; |

|

u |

Granted long-term incentive grants in May 2020 comprised of stock options to each of our then NEOs in recognition of the NEOs performance and proven leadership, particularly during the pandemic; and |

|

u |

Approved a year-end 2020 discretionary cash bonus for certain of the NEOs based on the overall performance of the Company in 2020 and each NEOs individual contribution to those results. |

For additional information regarding the pandemic-related compensation actions taken in 2020, see Summary of COVID-19 Compensation Actions on page 32. For the compensation of our NEOs, please refer to the Compensation Discussion and Analysis (CD&A) beginning on page 33.

4

Table of Contents

It has often been said that a journey of a thousand miles begins with a single step, but the decision to embark on such a journey often begins with thousands of footsteps to the starting line. In 2020, Patrick Industries stepped up to the starting line by reimagining our journey of corporate responsibility in the areas of Environmental, Social and Governance (ESG). To embark on this journey, we established a formal ESG Committee comprised of passionate team members leading our internal environmental, social and financial governance functions, championed by senior management in partnership with Board sponsorship and oversight. We recognize that the path will not always be straight but the curves on the path and the challenges encountered will lead to the betterment of all of our stakeholders, internal and external, and the communities in which we live and work.

As we reflect on 2020, our journey, as that of others, was met with strong headwinds in the forms of a global pandemic, cultural unrest, and economic uncertainty. Those challenges were addressed by a dedicated work force, determined to consider and implement measures to continue the advancement of our objectives to provide a healthy and safe environment for our team members, to find opportunities for efficiency and the elimination of wastes in our processes, and to seek input from a wide array of thought leaders from varied backgrounds, all under the guidance of balanced management. We remain proud of our accomplishments, and humbled by the work to be accomplished. We take this opportunity to highlight some of the efforts of our team members and our Company in the midst of these challenges.

|

|

|

||

| Environmental Impact | Social Responsibility | Governance and Ethics | ||

| u Environmental Management

u Innovation and Environmentally Responsible Products

u Sustainable Initiatives |

u Safety and Human Capital

u Product Safety and Quality

u Community and Employee Engagement

u Diversity and Inclusion |

u Corporate Governance

u Ethics and Integrity

u Board Composition |

||

A JOURNEY TO RECLAIM ENVIRONMENTAL

The continuous, thoughtful evaluation and improvement of the Patrick footprint are vital to how we lead efforts to protect our team members, the communities in which we serve and our world. Our journey through environmentally-responsible initiatives is shaping who we are as an organization and community partner. We are proud to share stories of our journey, reflective of our team members commitment to our call to action.

At Patrick, our team members are challenged to continually white-board when considering operational efficiencies and opportunities for positive environmental impacts from our business. Perhaps there is no greater illustration of team member commitment to our call to action on sustainability than our efforts to reclaim and recapture excess materials and waste generated from the varied manufacturing processes of our business units. The following practices are representative of the sustainability initiatives through reclamation programs being conducted by engaged team members across Patrick.

Medallion Plastics Regrind

Using a practice called thermoformed molding, our Medallion Plastics business unit manufactures custom thermoformed products and components for use in recreational vehicles and automobiles, among other products. A result of the thermoforming process, excess plastic, trimmed from the finished product, is rendered unusable waste. Recognizing the opportunity for the recycling of excess trimmings, Medallion Plastics began collecting such waste in color-coordinated bins. The trimmings are then reground into pellets by Medallion Plastics team members and sold back to the business units suppliers. The suppliers are then able to re-extrude the reground trimmings into raw materials for sale to Medallion Plastics and other manufacturers. On average, Medallion Plastics regrinds approximately 75 tons of plastic annually. This regrind process and waste removal lessen the effect of Medallion Plastics operations on the environment.

5

Table of Contents

Middlebury Hardwoods Wood Recapture

A manufacturer of high quality hardwood cabinetry for the recreational vehicle and manufactured housing industries, Middlebury Hardwoods carefully inspects the wood harvested to manufacture its products. Team members identify defective wood during the inspection process and an optimizer chop saw removes only the defective sections of wood, preserving as much of the good wood as possible for use in the balance of the manufacturing process. Defective wood sections are segregated and are either (i) used as fuel for the business units boilers to heat the state-of-the-art drying oven on the door finishing line; or (ii) sold, along with sawdust, to be reused as pellets for wood burning stoves. Defective wood is also sold to be utilized in bedding materials for farm animals. Over 50% of defective wood and wood waste is reclaimed and reused, affording Middlebury Hardwoods the opportunity to responsibly maximize its use of each harvested tree.

Sigma Wire Copper Wire Recycling Program

Sigma Wire manufactures a range of PVC-insulated wire and cable products primarily serving our leisure lifestyle markets. As part of its efforts toward corporate sustainability practices, Sigma implemented a recycling initiative, reclaiming copper wire, PVC compound and packing materials. A large majority of Sigma-produced wire is packed onto recycled reels or inside re-used drums, resulting in the reuse of 5,000 6,000 packaging units monthly. In addition to reuse of packing materials, Sigma recycles its excess or scrapped copper wire and PVC coatings. Segregated scrap wire is sold to a metal recycler, and Sigma estimates it produces and recycles approximately 120 tons of scrapped copper wire annually. Much like the scrapped copper wire, excess PVC is produced through Sigmas extrusion process, which is in turn segregated and resold to PVC recyclers. Sigma produces for recycling approximately one truckload of scrapped PVC every six months.

During 2020, our ongoing initiatives to reduce our carbon footprint and manage waste in our operations included the following efforts:

| Replacement of fluorescent & high pressure sodium light bulbs with LED bulbs |

Exploration of conversion to electric-powered fork trucks |

Replication of wood recycling program across hardwood and lamination business units |

Paper and cardboard recycling initiatives produced 22 tons of recycled product |

|||

|

|

|

|

|||

A JOURNEY TO CARE SOCIAL

At Patrick, nothing is of greater value to us than the health, well-being, and personal and professional development of our people. Creating and maintaining a strong and positive workplace culture are critical to our goal of being an inclusive, rewarding place to work. We remain committed to investing in our team members to afford them opportunities and resources to learn, grow and achieve their potential. We are equally committed to providing our team members with opportunities to positively impact not only our Patrick community, but the communities in which our team members live and work.

COVID-19 Response

The global COVID-19 pandemic defined 2020 and disrupted all segments of our society. In reaction to the crisis that enveloped our nation, our team members met the challenges presented with steadfast resolve to prepare and protect our talented workforce and support the overall efforts in reducing the spread of the virus throughout our communities. This journey began with the immediate creation of Patricks COVID-19 Task Force, led by management and charged with the mission of creating a company-wide playbook to (i) establish return to work protocols and procedures for the protection of team members via thoughtful and proactive measures; (ii) empower champions at our business units, armed with the knowledge to directly guide the implementation of the playbook on the ground and across the organization; and (iii) educate our workforce relative to the ever-changing landscape of COVID-19 and the efforts to eradicate the virus through the rollout of vaccinations across the many states in which we operate. The COVID-19 Task Force endeavored to provide team members with personal protective equipment through mask-up challenges and enhanced facility disinfecting efforts to afford those team members with safe environments within which to work.

Despite the uncertainties of COVID-19, our dedicated team members remained committed to supporting our communities in 2020. Our teams contributions to charities and charitable causes exceeded $600,000 in 2020, reflecting a 62% increase in philanthropy across the

6

Table of Contents

organization. The future focus of our ESG initiatives will be a call to action for ways in which we can do more to support our communities with team member time, talent and treasure.

Impact Leadership Program

In 2020, the Company continued to invest in the training and development of future leaders though the Patrick Industries Impact Leadership Program (the Impact Program). Through a 3-year management-training career development curriculum, the Impact Program provides recent college graduates with leadership and development opportunities via a cross-functional project rotation and operational immersion, culminating with the Impact Program participants career launch with the Company upon program completion. The Company welcomed its third class of Impact Program participants this past year.

Care Camps

Our team members embrace philanthropic efforts to impact the communities in which we live and serve. The giving spirit of the organization is highlighted by our partnership with Care Camps, announced in early 2021. Care Camps affords children who are battling cancer the opportunity to experience the healing power of the outdoors through unique camping opportunities. Care Camps works with 135 special oncology camps that serve communities across the U.S. and Canada. Through this partnership our Company supports Care Camps financially while our team members have the ability to impact campers through direct engagement in 2021 and beyond.

A JOURNEY TO GUIDE GOVERNANCE

Our corporate governance policies and practices promote the long-term interests of our shareholders, strengthen the accountability of our Board of Directors and management, and help build public trust in the Company. We remain committed to maintaining a strong corporate governance program, compliant with all legal and regulatory requirements and reflective of best practices to ensure that we are well-managed for the benefit of all of our stakeholders. Below is a summary of some of the highlights on our corporate governance framework.

7

Table of Contents

BOARD COMPOSITION

8

Table of Contents

Table of Contents

10

Table of Contents

11

Table of Contents

|

|

||||

|

ELECTION OF DIRECTORS

There are nine nominees for election to the Board, all of which are current members of our Board. The individuals elected as directors at the 2021 Annual Meeting will be elected to hold office until the 2022 Annual Meeting or until their successors are duly elected and qualified.

It is intended that the proxies will be voted for the nominees listed below, unless otherwise indicated on the proxy form. It is expected that these nominees will serve, but, if for any unforeseen cause any such nominee should decline or be unable to serve, the proxies will be voted to fill any vacancy so arising in accordance with the discretionary authority of the persons named in the proxies. The Board does not anticipate that any nominee will be unable or unwilling to serve. |

The Board of Directors

|

The information provided below has been furnished by the director nominee, and sets forth (as of March 31, 2021) the names, ages, principal occupations, recent professional experience, certain specific qualifications identified as part of the Boards determination that each such individual should serve on the Board and other directorships at other public companies for at least the past five years, if any. Each of the following nominees was elected to his or her present term of office at the Annual Meeting of Shareholders held on May 14, 2020.

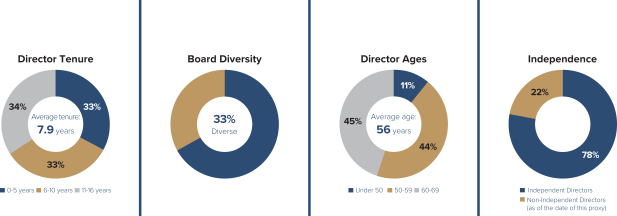

BOARD COMPOSITION

|

Average |

Gender & Ethnic Diversity |

Audit Committee Expertise |

Board Independence |

Average Age |

||||

| 7.9 years | 33% | 67% | 78% | 56 years | ||||

12

Table of Contents

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE

FOR THE NOMINATED DIRECTORS.

|

|

JOSEPH M. CERULLI

AGE: 61

DIRECTOR SINCE: 2008

COMMITTEES: u

Corporate Governance |

|

TODD M. CLEVELAND

AGE: 53

DIRECTOR SINCE: 2008

COMMITTEES: u None |

|||||||

| BIOGRAPHY:

Joseph M. Cerulli, age 61, has been employed by Tontine Associates, LLC, an investment management firm (together with its affiliates, Tontine), since January 2007. During fiscal 2020, Mr. Cerulli served as a member of the Corporate Governance and Nominations committee and as its chairman effective June 12, 2020, replacing Mr. Forbes who resigned from his position as chairman of the committee following his appointment as the Companys Interim CFO.

QUALIFICATIONS:

Mr. Cerulli has particular knowledge of our Company and the industries in which we operate based on Tontines long-standing investment in the Company and possesses extensive knowledge with respect to business operations, strategic planning, financial and investment matters, including investment banking, capital markets, and mergers and acquisitions advisory. |

BIOGRAPHY:

Todd M. Cleveland, age 53, has been our Executive Chairman of the Board since January 1, 2020. Prior to that, Mr. Cleveland was Chairman of Board from May 2018 to December 2019 and our Chief Executive Officer from February 2009 to December 31, 2019. Mr. Cleveland was President of the Company from May 2008 to December 2015 and Chief Operating Officer of the Company from May 2008 to March 2013. Mr. Cleveland has served as a director of IES Holdings, Inc. (IES) from 2017 to present, and he has been the chairman of IESs Human Resources and Compensation Committee since February 2019 and a member of IESs audit committee since February 2021.

QUALIFICATIONS:

Mr. Cleveland has over 30 years of RV, MH, marine and industrial experience in various operating capacities. He also has extensive knowledge of our Company and the industries to which we sell our products and experience with management development and leadership, acquisitions, strategic planning, finance and capital allocation, and the manufacturing and sales of our products.

OTHER PUBLIC BOARD DIRECTORSHIPS:

u IES Holdings, Inc. |

|||||||||

13

Table of Contents

|

|

JOHN A. FORBES

AGE: 61

DIRECTOR SINCE: 2011

COMMITTEES: u Corporate Governance and Nominations u Audit u Compensation |

|

MICHAEL A. KITSON

AGE: 62

DIRECTOR SINCE: 2013

COMMITTEES: u Audit (Chair) u Compensation u

Corporate Governance |

|||||||

| BIOGRAPHY:

John A. Forbes, age 61, has been a partner with Outcomes LLC and Full Sails LLC, two firms engaged in new product development and strategic business consulting, since June 2017. Previously, Mr. Forbes was the President of Utilimaster, a business unit of Spartan Motors USA, Inc., from July 2010 to June 2017. Prior to that, he was the Chief Financial Officer of Utilimaster from May 2009 to July 2010, the Chief Financial Officer of Nautic Global Group LLC from 2007 to 2009 and the Chief Financial Officer of Adorn LLC from 2003 to 2007. Mr. Forbes has served as a director of Chase Packaging Corporation since March 2019.

During fiscal 2020, Mr. Forbes served as chairman of the Corporate Governance and Nominations committee and a member of the Audit and Compensation committees through June 11, 2020. Effective June 12, 2020, Mr. Forbes resigned from his positions on the Audit, Compensation, and Corporate Governance and Nominations Committees upon his appointment as the Companys Interim CFO, a position which he held until November 23, 2020. On November 24, 2020, Mr. Forbes resumed his membership positions on all three Board committees.

QUALIFICATIONS:

Mr. Forbes has over 34 years of experience in serving various manufacturing industries, having held senior financial leadership roles. Mr. Forbes also has extensive experience with operations and talent management, acquisitions, strategic planning, risk management and banking relations. He has been determined to be an audit committee financial expert under the rules and regulations of the Securities and Exchange Commission (the SEC) by our Board prior to his appointment as Interim CFO.

OTHER PUBLIC BOARD DIRECTORSHIPS:

u Chase Packaging Corporation |

BIOGRAPHY:

Michael A. Kitson, age 62, has been the Chief Financial Officer of oVertone Haircare, Inc., a manufacturer of haircare products, since July 2018. Previously, Mr. Kitson was a principal with AVL Growth Partners, a firm that provides chief financial officer and other financial advisory services, from March 2017 to July 2018. Prior to that, Mr. Kitson was the Chief Financial Officer of MikaTek, Ltd. from January 2016 until July 2016, the Chief Executive Officer of SharpShooter Imaging from March 2015 to January 2016, the Chief Executive Officer of Nautic Global Group (Nautic) from March 2011 to October 2013 and the Chief Financial Officer of Nautic from August 2010 to March 2011.

QUALIFICATIONS:

Mr. Kitson has over 34 years of experience in serving various manufacturing industries, having also held senior financial leadership roles with Lilly Industries, Inc. Mr. Kitson also has extensive experience with corporate and operations management, finance and capital allocation, strategic planning and risk management. He has been determined to be an audit committee financial expert under the SECs rules and regulations by our Board. |

|||||||||

14

Table of Contents

|

|

PAMELA R. KLYN

AGE: 50

DIRECTOR SINCE: 2019

COMMITTEES: u Audit u Compensation u Corporate Governance |

|

DERRICK B. MAYES

AGE: 47

DIRECTOR SINCE: 2019

COMMITTEES: u Audit u Compensation u Corporate Governance |

|||||||

| BIOGRAPHY:

Pamela R. Klyn, age 50, has been a Senior Vice President in the Global Product Organization at Whirlpool Corporation, the worlds leading major home appliance company, since 2018 and has held various leadership positions in marketing and engineering since 1993.

QUALIFICATIONS:

Ms. Klyn has over 28 years of experience in the home appliance industry and has extensive experience in marketing, engineering, strategic planning and new product development. |

BIOGRAPHY:

Derrick B. Mayes, age 47, has been the Vice President of WME/IMG, a strategic advisory firm to the sports and entertainment industry, since 2015. Prior to that, Mr. Mayes was the Chief Executive Officer of ExecutiveAction Sports & Entertainment, serving as a strategic adviser to high profile individuals, groups and organizations in the sports and entertainment industry, from 2007 to 2015.

QUALIFICATIONS:

Mr. Mayes has over 20 years of experience in strategic planning, with extensive experience in the digital communications space, and has been a leadership and diversity speaker to numerous public companies and private organizations, particularly in the sports and entertainment markets. |

|||||||||

15

Table of Contents

|

|

ANDY L. NEMETH

AGE: 52

DIRECTOR SINCE: 2006

COMMITTEES: u None |

|

DENIS G. SUGGS

AGE: 55

DIRECTOR SINCE: 2019

COMMITTEES u Audit u Compensation u Corporate Governance |

|||||||

| BIOGRAPHY:

Andy L. Nemeth, age 52, has been the Companys Chief Executive Officer since January 1, 2020 and President since January 2016. Prior to that, Mr. Nemeth was the Executive Vice President of Finance and Chief Financial Officer from May 2004 to December 2015 and Secretary-Treasurer from 2002 to 2015. He was also the Vice President of Finance and Chief Financial Officer from 2003 to 2004.

QUALIFICATIONS:

Mr. Nemeth has over 29 years of RV, MH, marine and industrial experience in various financial and management capacities. Mr. Nemeth also has particular knowledge of our Company and the industries to which we sell our products and has extensive experience with corporate management, development and leadership, acquisitions, strategic planning, risk management, capital allocation, and banking and finance relations. |

BIOGRAPHY:

Denis G. Suggs, age 55, has been the Chief Executive Officer of LCP Transportation, LLC, a non-emergency medical transportation company, since February 2020. Prior to that, Mr. Suggs was the President and Chief Executive Officer of Strategic Materials Corp. from March 2014 to January 2020 and also served as Chairman from 2017 to 2020. Prior to that, Mr. Suggs was the Global Executive Vice President of Belden, Inc. from 2009 to 2013 and the President of the Americas Division / Vice President of Belden, Inc. from 2007 to 2009.

QUALIFICATIONS:

Mr. Suggs has over 22 years of experience in leading complex global businesses, having also held senior financial executive leadership roles with Danaher Corporation and Public Storage Corporation. Mr. Suggs also has extensive experience with corporate and operations management, strategic planning, mergers and acquisitions and risk management. Mr. Suggs served as a director of the Education Corporation of America from 2015 to 2018 and of Strategic Materials, Inc. and the Glass Packaging Institute from 2014 to 2020. He has been determined to be an audit committee financial expert under the SECs rules and regulations by our Board. |

|||||||||

16

Table of Contents

|

|

M. SCOTT WELCH

AGE: 61

DIRECTOR SINCE: 2015

LEAD INDEPENDENT

COMMITTEES: u Compensation (Chair) u Audit u

Corporate Governance |

|||||||

| BIOGRAPHY:

M. Scott Welch, age 61, has been the President and Chief Executive Officer of Welch Packaging Group, a large independently owned corrugated packaging company, since 1985. Prior to establishing Welch Packaging, he worked at Northern Box, Performance Packaging and Elkhart Container. Mr. Welch has served as a director of Lakeland Financial Corporation (Lakeland) from 1998 to present, and he has been the lead independent director from 2012 to 2019 and a member of Lakelands compensation committee since 2012. He has also served as a trustee of DePauw University since 2005.

QUALIFICATIONS:

Mr. Welch has over 39 years of experience in the packaging industry and has extensive experience in sales, marketing, acquisitions, organizational development, strategy planning, and finance and capital allocation. He has been determined to be an audit committee financial expert under the SECs rules and regulations by our Board.

OTHER PUBLIC BOARD DIRECTORSHIPS:

u Lakeland Financial Corporation

|

||||||||

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE

FOR EACH OF THE NOMINATED DIRECTORS.

17

Table of Contents

DIRECTOR COMPENSATION

The overall structure of the 2020 Non-Employee Director Compensation Plan was unchanged from the 2019 plan. However, in alignment with compensation reductions by our senior management team, the Board temporarily reduced its annual cash retainer payments during the shutdown of the Companys operations caused by the Covid-19 pandemic. The plan structure and compensation composition, as approved by the Board, are detailed below:

| 1/1/20-12/31/20 | ||||||||||

| ANNUAL RETAINER |

$ | 75,000 | ||||||||

| COMMITTEE CHAIRPERSONS ANNUAL RETAINER |

||||||||||

| Audit |

10,000 | |||||||||

| Compensation |

6,000 | |||||||||

| Corporate Governance and Nominations |

6,000 | |||||||||

| LEAD INDEPENDENT DIRECTOR ANNUAL RETAINER |

6,000 | |||||||||

| ANNUAL RESTRICTED STOCK GRANT (1) |

100,000 | |||||||||

| (1) | Non-employee directors receive an annual restricted stock grant in May of each year, which vests upon such directors continued service as a Board member for one year from the grant date or earlier upon certain events. In addition, non-employee directors receive cash dividends on their restricted common stock holdings. The Company does not have stock ownership guidelines for its directors. |

Employee directors receive no compensation as such. In addition to the compensation described above, the Company reimburses the non-employee directors expenses, including travel, accommodations and meals, for attending Board and Board Committee meetings, our Annual Meeting of Shareholders and any other activities related to our business.

The following table sets forth a summary of the compensation paid to non-employee directors in the year ended December 31, 2020:

| Name |

Fees Earned or Paid in Cash (1) |

Stock Awards (2) | Other |

Total | ||||||||||||||||||||||||||

| JOSEPH M. CERULLI (4) |

$ | 71,291 | $ | 100,019 | $ | 2,448 | $ | 173,758 | ||||||||||||||||||||||

| JOHN A. FORBES (5) |

30,375 | 100,019 | 2,448 | 132,842 | ||||||||||||||||||||||||||

| MICHAEL A. KITSON |

77,060 | 100,019 | 2,448 | 179,527 | ||||||||||||||||||||||||||

| PAMELA R. KLYN |

67,995 | 100,019 | 2,535 | 170,549 | ||||||||||||||||||||||||||

| DERRICK B. MAYES |

67,995 | 100,019 | 2,535 | 170,549 | ||||||||||||||||||||||||||

| DENIS G. SUGGS |

67,995 | 100,019 | 2,535 | 170,549 | ||||||||||||||||||||||||||

| M. SCOTT WELCH |

78,874 | 100,019 | 2,448 | 181,341 | ||||||||||||||||||||||||||

| (1) | Fees consist of an annual cash retainer for the Board, lead independent director, and committee chairpersons service and reflect a temporary 50% reduction in the normal annual cash retainer paid during the shutdown of the Companys operations related to the pandemic. |

| (2) | Amounts shown do not represent compensation actually received. Such amounts reflect the aggregate grant date fair value of 2,420 shares of restricted stock granted to each non-employee director, at a closing stock price of $41.33 on May 14, 2020. |

| (3) | Amounts shown represent cash dividends paid by the Company in 2020 on unvested shares held by the non-employee directors. |

| (4) | Mr. Cerulli was appointed to serve as the Chairman of the Corporate Governance and Nominations Committee of the Board effective June 12, 2020. Mr. Cerulli replaced Mr. Forbes following the suspension of his membership from all committees of the Board due to his appointment as Interim CFO of the Company. |

18

Table of Contents

| (5) | Mr. Forbes served as the Chairman of the Corporate Governance and Nominations Committee of the Board from January 1, 2020 through June 11, 2020. He suspended his membership positions on all three committees of the Board while he served as Interim CFO of the Company from June 12, 2020 through November 23, 2020. Effective November 24, 2020, he resumed his membership positions on all three Board committees. See Summary Compensation table on pages 46 and 47 for compensation paid to Mr. Forbes in 2020 in his role as Interim CFO. |

19

Table of Contents

|

|

||||

|

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu Limited, and their respective affiliates (collectively, Deloitte) as our independent registered public accounting firm for the fiscal year ending December 31, 2021. Deloitte has been the Companys independent registered public accounting firm since June 2019. The Board and the Audit Committee recommend that shareholders ratify the appointment of Deloitte as our independent registered public accounting firm for our fiscal year 2021. Although we are not required to do so, we believe that it is appropriate to request that shareholders ratify this appointment. If shareholders do not ratify the appointment, the Audit Committee will investigate the reasons for the shareholders rejection and reconsider the appointment. Representatives of Deloitte will be present at the Annual Meeting, will have the opportunity to make a statement if they desire to do so, and will be available to respond to any shareholder questions that may arise. |

The Board of Directors

|

Unless otherwise instructed, the proxy holders will vote the proxies received by them FOR approval of the ratification of the appointment of Deloitte. The ratification of the appointment will be approved by our shareholders if, at the Annual Meeting, a quorum is present and the vote of a majority of the votes cast are voted in favor of the proposal.

20

Table of Contents

INDEPENDENT PUBLIC ACCOUNTANTS

As noted above in Proposal 2, the Audit Committee has appointed Deloitte as our independent registered public accounting firm for the fiscal year ending December 31, 2021.

AUDIT FEES

The following table presents fees and out-of-pocket expenses for professional audit services rendered by Deloitte during the fiscal years ended December 31, 2020 and 2019:

| 2020 | 2019 | |||||||||||||||||||

| AUDIT FEES (1) |

$1,430,000 | $1,314,500 | ||||||||||||||||||

| TAX FEES (2) |

236,700 | 328,800 | ||||||||||||||||||

| TOTAL FEES |

$1,666,700 | $1,643,300 | ||||||||||||||||||

| (1) | Audit fees consist of fees for professional services rendered for the annual audit of the Companys financial statements, the reviews of the financial statements included in the Companys quarterly reports, and other services normally provided by the independent auditor in connection with statutory and regulatory filings or engagements. |

| (2) | Tax fees include fees related to tax compliance and consulting services. |

The Audit Committee has advised us that it has determined that the non-audit services rendered by our independent auditors during our most recent fiscal year are compatible with maintaining the independence of such auditors.

The Audit Committee has adopted a Pre-Approval Policy for Audit and Non-Audit Services pursuant to which it pre-approves all audit and non-audit services provided by the independent auditors prior to each particular engagement. The Audit Committee has delegated authority to its Chairman to approve certain proposed services other than the annual audit, tax and quarterly review services, and the Chairman must report any approvals to the balance of the Committee at the next scheduled meeting.

21

Table of Contents

|

|

|

|||

|

The responsibilities of the Audit Committee, which are set forth in the Audit Committee Charter adopted by the Board, include providing oversight of our financial reporting process through periodic meetings with our independent auditors, principal accounting officer and management to review accounting, auditing, internal controls and financial reporting matters. Our management is responsible for the preparation and integrity of the financial reporting information and related systems of internal controls. The Audit Committee, in carrying out its role, relies on senior management, including senior financial management, and the independent auditors.

The Audit Committee has met and held discussions with management and Deloitte with respect to the 2020 audited financial statements. Management represented to the Audit Committee that the Companys consolidated financial statements, included in its 2020 Annual Report to Shareholders, were prepared in accordance with accounting principles generally accepted in the United States of America, and the Audit Committee has reviewed and discussed with management their assessment of the effectiveness of the Companys internal controls over financial reporting. The Audit Committee reviewed and discussed with Deloitte the consolidated financial statements, and Deloittes evaluation of the Companys internal controls over financial reporting. The Audit Committee also discussed with Deloitte the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC, and other professional standards and regulatory requirements currently in effect. |

The foregoing report of the Audit Committee does not constitute soliciting material and shall not be deemed incorporated by reference by any general statement incorporating by reference the proxy statement into any filing by us under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under such acts.

|

We have received from Deloitte a letter providing the disclosures required by the applicable requirements of the Public Company Accounting Oversight Board regarding Deloittes communications with the Audit Committee concerning independence with respect to any relationships between us and Deloitte that in their professional judgment may reasonably be thought to bear on independence. Deloitte has discussed its independence with us, and has confirmed in such letter that, in its professional judgment, it is independent from us within the meaning of the federal securities laws. The Audit Committee concluded that non-audit services provided by Deloitte during the year ended December 31, 2020 were compatible with Deloittes independence.

Based on the review and discussions described above, with respect to our audited financial statements included in our 2020 Annual Report to Shareholders, we have recommended to the Board of Directors that such financial statements be included in our Annual Report on Form 10-K for filing with the SEC.

As specified in the Audit Committee Charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that our financial statements are complete and accurate and in accordance with generally accepted accounting principles. That is the responsibility of management and our independent auditors. In giving our recommendation to the Board of Directors, we have relied on (i) managements representation that such financial statements have been prepared with integrity and objectivity and in conformity with generally accepted accounting principles and (ii) the report of our independent auditors with respect to such financial statements. This report was adopted by the Audit Committee on February 26, 2021.

THE AUDIT COMMITTEE

Michael A. Kitson (Chairman)

John A. Forbes

Pamela R. Klyn

Derrick B. Mayes

Denis G. Suggs

M. Scott Welch

22

Table of Contents

|

|

||||

|

ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Act requires that the Company seek a non-binding advisory vote from its shareholders to approve the compensation of its named executive officers as disclosed under the Executive Compensation section in this Proxy Statement in accordance with SEC rules.

Our executive compensation policy is designed to enable the Company to attract, motivate and retain highly-qualified senior executives by providing a competitive compensation opportunity based on performance. Our intent is to provide fair and equitable compensation in a way that rewards executives for achieving specified financial and non-financial performance goals. Our performance-related awards are structured to link a substantial portion of our executives total potential compensation to the Companys performance on both a long-term and short-term basis, to recognize individual contribution, as well as overall business results, and to align executive and shareholder interests.

We are requesting shareholder approval of the compensation of our named executive officers as disclosed in this Proxy Statement, including the disclosures under Executive CompensationCompensation Discussion and Analysis, compensation tables and the related information and discussion.

The vote is advisory and therefore not binding on the Company or the Compensation Committee or the Board. However, we value the opinions of our shareholders, and we will carefully consider the outcome of the advisory vote on executive compensation when making future compensation decisions. |

For the reasons stated, the

|

The affirmative vote of a majority of the votes cast is required for advisory approval of the foregoing non-binding resolution. See Voting Information on page 9.

23

Table of Contents

CORPORATE GOVERNANCE AND RELATED MATTERS

The Board believes that fundamental corporate governance is critical to ensuring the Company is managed for the long-term benefit of our shareholders. Recent actions taken by the Board include the following:

|

u |

Amendment to Charters; Code of Ethics and Business Conduct; and Governance Guidelines. As part of an annual review process, the Boards Committees approved changes to their respective Committee Charters in 2020 to continue to facilitate alignment and continued review of best practices for management oversight. Similarly, the Board reviewed and approved proposed changes to the Companys Code of Ethics and Business Conduct and Corporate Governance Guidelines. |

|

u |

Board Diversity Policy. In alignment with the formal policy adopted in 2018 and as part of its annual self-evaluation under our Corporate Governance Guidelines, the Board considers whether the level of diversity of the Board is appropriate, and the Corporate Governance and Nominations Committee will take this consideration into account when identifying and evaluating director candidates. See Director Qualifications and Board Diversity Policy below for a more detailed description of the diversity policy. |

|

u |

Environmental, Health and Safety / Social Responsibility and Corporate Governance Disclosures. The Board aims to ensure that matters of environmental, health and safety, social and governance responsibility are considered and supported in the Companys operations and administrative matters and are consistent with Patrick shareholders best interests. |

|

u |

The Board adopted a formal policy in 2018 for managing its commitment to social and environmental matters. This policy is available on the Companys website at www.patrickind.com under Investor RelationsCorporate Governance under the heading Social and Environmental Responsibility Policy. |

|

u |

In 2020, the Board provided disclosures regarding the Companys ESG practices as noted below. The ESG disclosures are also available on the Companys website at www.patrickind.com under Investor RelationsCorporate Governance under the heading Environmental, Social and Governance Disclosures. |

|

u |

In 2020, the Corporate Governance and Nominations Committee, charged with providing appropriate oversight on ESG matters, directed the Company to establish, and the Company established, a formal ESG committee comprised of team members leading our internal environmental, social and financial governance functions, championed by senior management in partnership with Board sponsorship and oversight. The ESG committee works to identify and define relevant ESG priorities and initiatives, and enhance our communications with our employees, customers, communities and shareholders. |

|

u |

Information Security Risks/Matters: The Company has enhanced its oversight of cybersecurity to help ensure that cyber risk is effectively monitored with the Board. Executive leadership and the Board make determinations and decisions on strategy and direction of cybersecurity based on analysis and recommendations from Information Technology (IT) leadership. The Companys cyber security model, analysis of the effectiveness of the anti-phishing and other cyber security programs, and updates on cyber technology implementations are examples of cybersecurity content reviewed by the Board. The Company has retained a cybersecurity consulting firm to support cyber program priorities and harden system security. |

In addition, the Companys IT department has implemented technology controls around user access, incident monitoring, event tracking, and security incident alert monitoring. Technology controls and governance documentation are reviewed regularly with executive leadership and the Board. The Company defines cybersecurity policies consistent with operations and employs continuous improvement measures to enhance reliability and flexibility in compliance with changing requirements.

ENVIRONMENTAL, HEALTH AND SAFETY / SOCIAL RESPONSIBILITY

We are conscious of our environmental impact and the health and safety (EHS) of all of our team members, contractors, and communities in which we operate. We actively seek to implement sound practices and safe behaviors to protect the environment and the health and safety of our employees insofar as they are affected by our facilities, products and services. In particular, we strive to:

|

u |

Meet or exceed applicable environmental, health, safety and legal requirements; |

|

u |

Continuously improve our processes to reduce our impact on the environment and eliminate workplace injuries; |

|

u |

Require individual accountability and provide regular training and development of all team members; |

24

Table of Contents

|

u |

Identify, consider and minimize potential EHS impacts of new and modified products and production processes, acquisitions, and capital project review and approval activities; and |

|

u |

Promote health and wellness of our employees |

With Board oversight, the Executive Management team, Business Unit directors, the ESG committee, and Human Resources teams work to develop, implement, and manage safety and health programs in the interest of a safe work environment that also promotes a work/life balance. In addition, we seek to contribute positively to the communities in which we operate.

In conjunction with Board oversight related to climate related risks and opportunities, our goal is to comply with all applicable environmental and local, state, and federal safety and health regulations, and conduct our operations in a manner that safeguards the environment and minimizes waste, emissions, and energy consumption. We look forward to developing new processes and technologies to recycle more material, manage energy consumption, and engineer products for each of the markets we serve.

We require everyone in the Patrick organization to assume the responsibility of individual and organizational safety. It is each team members responsibility that all work tasks be conducted in a safe and efficient manner. An extensive array of metrics has been established and communicated to team members to ensure an understanding of our current level of performance and to continually identify opportunities for improvement.

The Board believes that fundamental corporate governance is important to help ensure that we are managed for the long-term benefit of our shareholders. Commensurate with the size and nature of each of Patricks businesses, the Company utilizes management systems, tools and processes to help (1) ensure compliance with applicable laws, regulations and the requirements set forth in its Code of Ethics and Business Conduct (the Code); (2) promote an awareness and commitment to ethical business practices, including, without limitation, the expectations set forth in the Code; (3) facilitate the timely discovery, investigation, disclosure and implementation of corrective actions for violations of law, regulations or the expectations set forth in the Code; and (4) provide training to all employees on compliance requirements, including IT security, as necessary and as required by law.

The Board intends to continue to review its corporate governance practices and policies as set forth in its Corporate Governance Guidelines, Code of Ethics and Business Conduct, Diversity Policy, Social and Environmental Responsibility Policy, and various Committee Charters, all of which were updated in accordance with the listing standards of the NASDAQ Stock Market and the SEC rules.

Board Membership and Leadership

As of the date of this Proxy Statement, our Board has nine members. Mr. Cleveland serves as Executive Chairman of the Board and Mr. Welch serves as lead independent director. Except for Mr. Cleveland and Mr. Nemeth, our President and Chief Executive Officer, no director is an employee. As described on page 14 of the Proxy Statement under Nominees for Election, Mr. Forbes served as the Companys Interim CFO from June 12, 2020 through November 23, 2020.

Election of Directors and Length of Board Term

Directors are currently elected for a one-year term at the Annual Meeting of Shareholders.

Board Meetings and Attendance

The Board and Board Committees hold regular meetings on a set schedule and may hold special meetings and act by written consent from time to time as necessary or appropriate. The Board had five regular meetings in 2020. Additionally, the Board had 13 special meetings in 2020 which included periodic update calls with the President and Chief Executive Officer and the Chief Financial Officer. Each director attended at least 75% of the meetings of the Board and the Board Committees on which he/she served in 2020 and all directors attended the most recent Annual Meeting of Shareholders which was held on May 14, 2020. We expect all Board members to attend the 2021 Annual Meeting, but from time to time, other commitments may prevent all directors from attending each meeting.

25

Table of Contents

Access to Corporate Governance Documents

The charters of our Audit, Compensation, and Corporate Governance and Nominations Committees, our Corporate Governance Guidelines and our Code of Ethics and Business Conduct are all available on our website at www.patrickind.com, under Investor RelationsCorporate Governance or by writing to:

Patrick Industries, Inc.

Attn: Joel D. Duthie, Secretary

107 West Franklin Street

Elkhart, Indiana 46515-0638

Shareholder Communications

Shareholders may send communications to the full Board and/or a particular Board member c/o Joel D. Duthie-Secretary, Patrick Industries, Inc., 107 West Franklin Street, Elkhart, Indiana 46515-0638. Communications intended for independent directors should be directed to the Chairman of the Corporate Governance and Nominations Committee.

Executive Sessions of Independent Directors

The Board and Board Committees regularly meet in executive session without the presence of any employee directors or representatives. The executive sessions of the Board are presided over by Mr. Welch, the lead independent director. Any independent director can request additional executive sessions. The independent directors met in executive sessions five times in 2020.

Seven of the nine members of the Board (as of the date of this Proxy) have been designated by the Board as independent directors. The Board determines whether a director is independent by following the guidelines of the NASDAQ Stock Market and the SEC rules and regulations. The Board has determined that the independent directors in 2020 were Joseph M. Cerulli, John A. Forbes (from January 1, 2020 to June 11, 2020 and effective November 24, 2020), Michael A. Kitson, Pamela R. Klyn, Derrick B. Mayes, Denis G. Suggs and M. Scott Welch.

Board Risk Oversight

The Board has delegated its risk oversight responsibilities to the Audit Committee, as described below under the heading Audit Committee. In accordance with the Audit Committees Charter, each of our senior financial and accounting officers reports directly to the Audit Committee regarding material risks to our business, among other matters, and the Audit Committee meets in executive sessions with the senior financial and accounting officers and with representatives of our independent registered public accounting firm. The Audit Committee Chairman reports to the full Board regarding material risks as deemed appropriate.

Director Qualifications and Board Diversity Policy

The Board seeks a diverse group of candidates who possess the background, skills and expertise and the highest level of personal and professional ethics, integrity, judgment and values to represent the long-term interests of our Company and its shareholders. Our Corporate Governance and Nominations Committee follows a diversity practice which it formally adopted as a Board Diversity Policy in 2018. The Diversity Policy requires that the Corporate Governance and Nominations Committee consider diversity criteria, including race, ethnicity and gender, when identifying candidates for Board membership. In addition, to be considered for membership on the Board, a candidate should possess some or all of the following major attributes:

|

u |

Breadth of knowledge about issues affecting the Company and the industries/markets in which it operates; |

|

u |

Significant experience in leadership positions or at senior policy-making levels and an established reputation in the business community; |

|

u |

Expertise in key areas of corporate management and in strategic planning; |

|

u |

Financial literacy and financial and accounting expertise; and |

|

u |

Independence and a willingness to devote sufficient time to carry out his or her duties and responsibilities effectively and assume broad fiduciary responsibility. |

The Board Diversity Policy is available on the Companys website at www.patrickind.com under Investor RelationsCorporate Governance.

26

Table of Contents

The Board believes that a board made up of highly qualified directors with diverse backgrounds, skills and experiences and who reflect the changing population demographics of the markets in which the Company operates, the talent available with the required expertise and the Companys evolving customer and employee base, promotes better corporate governance.

The Committee will consider a candidates qualifications and background, including responsibility for operating a public company or a division of a public company, international business experience, a candidates technical and financial background or professional qualification, diversity of background and personal experience, and any other public company boards on which the candidate is a director. The Committee will also consider whether the candidate would be independent for purposes of the NASDAQ Stock Market and the SEC rules and regulations by our Board. The Committee may, from time to time, engage the services of a professional search firm to identify and evaluate potential nominees.

Process for Consideration of Director Candidates

The Corporate Governance and Nominations Committee will consider board nominees recommended by shareholders. Those recommendations should be sent to the Chairman of the Corporate Governance and Nominations Committee, c/o of the Secretary of Patrick Industries, Inc., 107 West Franklin Street, Elkhart, Indiana 46515-0638. In order for a shareholder to nominate a candidate for director, under our By-laws, timely notice of the nomination must be given in writing to the Secretary of the Company. To be timely, such notice must be received at our principal executive office not less than 20 days or more than 50 days prior to the next Annual Meeting of Shareholders. Notice of nomination must include the name, address and number of shares owned by the person submitting the nomination; the name, age, business address, residence address and principal occupation of the nominee; and the number of shares beneficially owned by the nominee. It must also include the information that would be required to be disclosed in the solicitation of proxies for election of directors under the federal securities laws, as well as whether the individual can understand basic financial statements and the candidates other board memberships (if any). The nominees consent to be elected and serve must be submitted. The Corporate Governance and Nominations Committee may require any nominee to furnish any other information, within reason, that may be needed to determine the eligibility of the nominee.

As provided in its Charter, the Corporate Governance and Nominations Committee will follow procedures which the committee deems reasonable and appropriate in the identification of candidates for election to the Board and evaluating the background and qualification of those candidates. Those processes include consideration of nominees suggested by an outside search firm, by incumbent board members, and by shareholders. The Committee will seek candidates having experience and abilities relevant to serving as a director of the Company, and who represent the best interests of shareholders as a whole and not any specific group or constituency.

Board Committee Responsibilities and Related Matters

The Company has three standing committees of the Board: the Audit Committee, the Compensation Committee, and the Corporate Governance and Nominations Committee. All members of each Committee are independent directors who meet the independence and experience standards of NASDAQ. The Board annually selects the directors who serve on each of the Board Committees. Each Board Committee functions pursuant to a written charter. The Board has delegated certain responsibilities and authority to each Board Committee as described below. At each regularly scheduled Board meeting, each Board Committee Chairman (or other designated Board Committee member) reports to the full Board on his/her Board Committees activities.

The following table reflects the current membership of each Board Committee (as of the date of this proxy):

| Name |

Audit Committee |

Compensation Committee |

Corporate Governance and Nominations Committee |

|||||||||||||||||||||||||||

| JOSEPH M. CERULLI |

Chair | |||||||||||||||||||||||||||||

| JOHN A. FORBES (1) |

X | X | X | |||||||||||||||||||||||||||

| MICHAEL A. KITSON |

Chair | X | X | |||||||||||||||||||||||||||

| PAMELA R. KLYN |

X | X | X | |||||||||||||||||||||||||||

| DERRICK B. MAYES |

X | X | X | |||||||||||||||||||||||||||

| DENIS G. SUGGS |

X | X | X | |||||||||||||||||||||||||||

| M. SCOTT WELCH |

X | Chair | X | |||||||||||||||||||||||||||

| (1) | Mr. Forbes served as chairman of the Corporate Governance and Nominations Committee from January 1, 2020 through June 11, 2020. |

27

Table of Contents

|

AUDIT COMMITTEE

The Audit Committees report is provided on page 22 of this Proxy Statement.