DEF 14A: Definitive proxy statements

Published on April 11, 2022

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

PATRICK INDUSTRIES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

Table of Contents

Table of Contents

Table of Contents

Dear Shareholder,

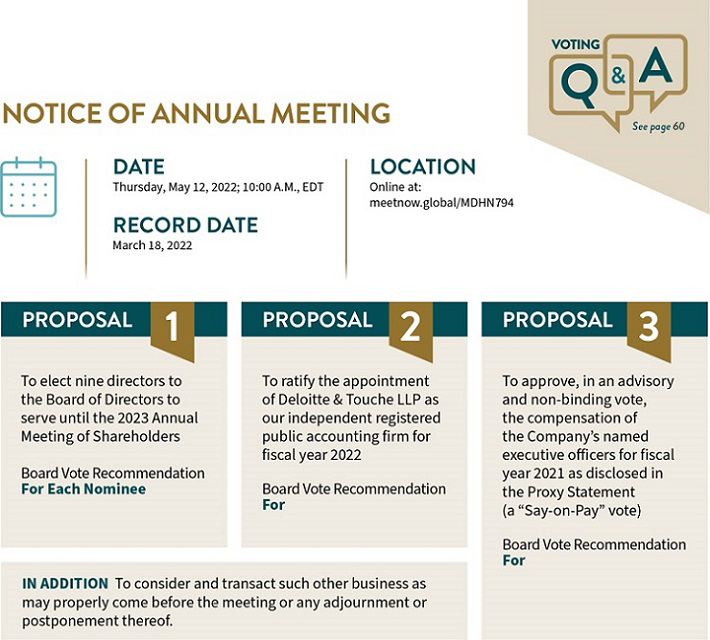

On behalf of the Board of Directors, we are pleased to invite you to join us for our Annual Meeting of Shareholders (Annual Meeting), which will be conducted via live audio webcast on May 12, 2022, at 10:00 A.M. EDT. The virtual Annual Meeting will be conducted online at meetnow.global/MDHN794. In the Notice of 2022 Annual Meeting and Proxy Statement, we describe the matters upon which you will be asked to vote at the meeting and provide instructions for attending the meeting.

This Proxy Statement describes our corporate governance policies and practices that foster the Boards effective oversight of the Companys business strategies and practices. We further welcome you to review this Proxy Statement as we describe our financial performance for fiscal year 2021 as well as our progress on our environmental, social and governance initiatives.

Please review the proxy/notice card for instructions on how to vote over the Internet, by telephone or by mail in order to be certain that your shares of stock are represented at the Annual Meeting. It is important that all Patrick Industries, Inc. shareholders vote and participate in the affairs and governance of our Company.

|

|

Sincerely, | |

|

|

||

|

Todd M. Cleveland |

||

| Executive Chairman of the Board | ||

| April 11, 2022 |

| Notice of 2022 Annual Meeting of Shareholders & Proxy Statement

|

||

Table of Contents

VOTING: Please vote your shares using the Internet, by telephone or by mail by signing, dating and returning the enclosed proxy in the enclosed envelope. If you hold shares through a broker, custodian, fiduciary, or nominee (a beneficial holder), please check the voting instructions used by that broker, custodian, fiduciary, or nominee. Holders with a control number from Computershare, our transfer agent, can vote at the virtual Annual Meeting. Please return your proxy card so your vote can be counted.

VIRTUAL MEETING FORMAT: You will be able to attend and participate in the Annual Meeting online, vote your shares electronically and submit your questions prior to and during the meeting by visiting: meetnow.global/MDHN794 on the meeting date and time described in the accompanying Proxy Statement.

If you plan to attend the meeting virtually on the Internet, you must register by following the instructions contained in the Voting Information section.

| By Order of the Board of Directors, | ||

|

|

Joel D. Duthie | |

| Executive Vice President, Chief Legal Officer and Secretary | ||

| April 11, 2022 |

NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS:

Our 2022 Proxy Statement and Annual Report to Shareholders for fiscal 2021 are available on Patrick Industries, Inc.s website at www.patrickind.com under For Investors - Company Information. You may also request hard copies of these documents free of charge by writing to us at the following address: 107 West Franklin Street, Elkhart, Indiana 46515-0638. Attention: Office of the Secretary.

| PATRICK INDUSTRIES, INC

|

||

Table of Contents

PROXY STATEMENT

Annual Meeting Of Shareholders

This Proxy Statement and the accompanying Proxy Card are being mailed to shareholders of Patrick Industries, Inc. (the Company or Patrick) on or about April 13, 2022, and are furnished in connection with the solicitation of proxies by the Board of Directors (the Board) for the Annual Meeting of Shareholders to be held online (virtual meeting) on May 12, 2022 (the Annual Meeting) for the purpose of considering and acting upon the matters specified in the Notice of Annual Meeting of Shareholders accompanying this Proxy Statement.

If the form of proxy which accompanies this Proxy Statement is executed and returned, or is voted by Internet or by telephone, it may be revoked by the person giving it at any time prior to the voting thereof by:

| (i) | changing your vote using the online voting method, in which case only your latest Internet proxy submitted prior to the Annual Meeting will be counted; |

| (ii) | filing with the Secretary of the Company, during or before the Annual Meeting, a written notice of revocation bearing a date later than the date of the proxy; |

| (iii) | duly executing and dating a subsequent proxy relating to the common stock and delivering it to the Secretary of the Company during or before the Annual Meeting; or |

| (iv) | Voting your shares electronically during the Annual Meeting. |

If the form of proxy is signed, dated and returned without specifying choices on one or more matters presented to the shareholders, the shares will be voted on the matter or matters listed on the proxy card as recommended by the Companys Board.

Additional solicitations, in person, or by telephone or otherwise, may be made by certain directors, officers and employees of the Company regarding the proposals without additional compensation. Expenses incurred in the solicitation of proxies, including postage, printing and handling, and actual expenses incurred by brokerage houses, custodians, nominees and fiduciaries in forwarding documents to beneficial owners, will be paid by the Company.

Patricks Annual Report to Shareholders, which contains Patricks Annual Report on Form 10-K for the year ended December 31, 2021, accompanies this Proxy Statement. Requests for additional copies of the Annual Report on Form 10-K should be submitted to the Office of the Secretary, Patrick Industries, Inc., 107 West Franklin Street, Elkhart, Indiana 46515-0638. Annual Meeting materials may also be viewed online through our website, www.patrickind.com under For Investors Company Information.

| Notice of 2022 Annual Meeting of Shareholders & Proxy Statement

|

||

Table of Contents

| 1 | ||||||

| 1 | ||||||

| 2 | ||||||

| 3 | ||||||

| 5 | ||||||

| 11 | ||||||

| 13 | ||||||

| 18 | ||||||

| 19 | ||||||

| PROPOSAL 2: |

||||||

| 23 | ||||||

| 24 | ||||||

| 26 | ||||||

| PROPOSAL 3: |

||||||

| 27 | ||||||

| PATRICK INDUSTRIES, INC

|

||

Table of Contents

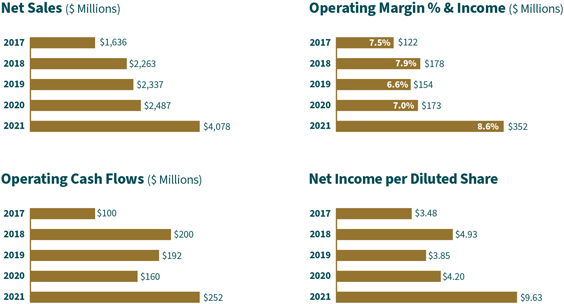

Fiscal Year 2021 Company Financial Performance Summary

|

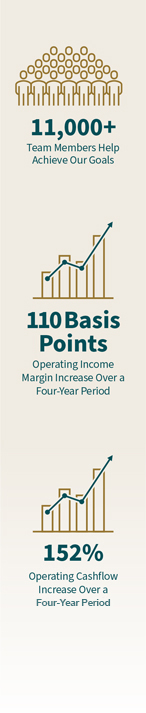

2021 was strong for us across a wide range of operational metrics, where we meaningfully exceeded historical milestones in revenue, gross margin, operating income, operating margin, and operating cash flows. We continued to strategically diversify our leisure lifestyle platform with the addition of key new businesses in marine and marine aftermarket, as well as fortifying our portfolio of RV, MH and Industrial offerings. We also amended our credit facility and broadened and strengthened our liquidity profile with a senior unsecured note offering and a senior unsecured convertible note offering which enhanced our strong capital structure. And while our family has grown to more than 11,000 team members, we have also leveraged the strengths of our culture and talent and grown profitably, while building a strong infrastructure to support further growth and improved performance.

While supply chain challenges impacted all major markets in 2021, our teams worked tirelessly in alignment with our customers demands based on market conditions, and delivered to our end markets in three key areas. First, our strong liquidity profile and cash generation, along with our multi-brand platform and strategic locations across the country, allowed us to leverage available production capacity, buying power, and procurement strength between brands to secure incremental inventory for customer production, supporting their strong operating pace and momentum. Second, our continued strategic investment in automation and our information systems, which began in the second half of fiscal 2020, allowed and further positioned our teams to adapt to the tight labor market conditions that we experienced in 2021. Third, we invested in human capital initiatives, discussed further in the ESG section of this Proxy.

The charts below illustrate our performance related to net sales, operating margin and operating income, operating cash flows, and diluted earnings per share since 2017.

The Companys performance is focused on meeting the needs of our large breadth of customers, generating returns for our shareholders, supporting our communities, and reinvesting in our team members. |

| Notice of 2022 Annual Meeting of Shareholders & Proxy Statement

|

1 | |

Table of Contents

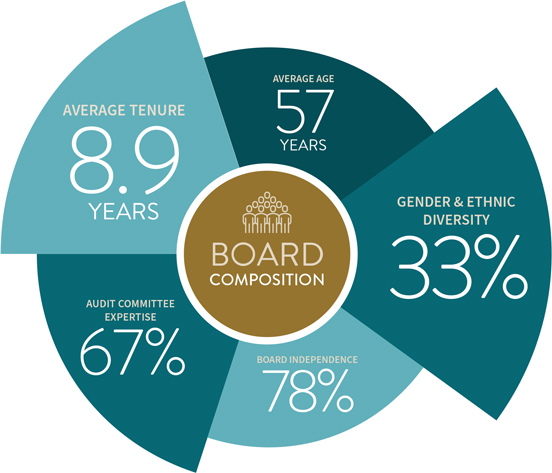

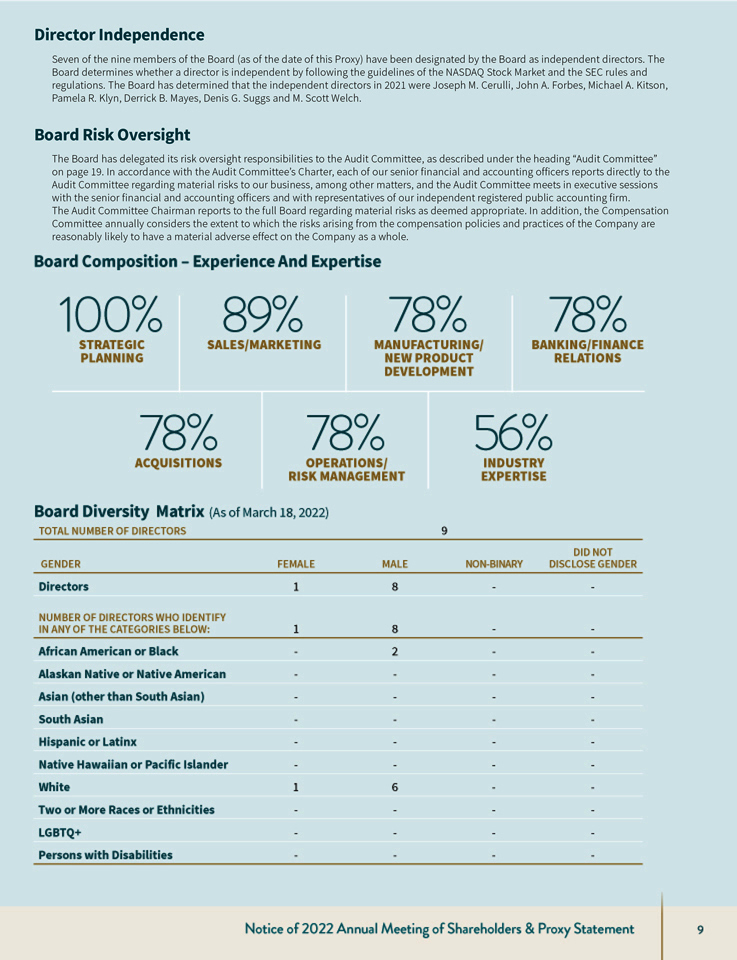

CORPORATE GOVERNANCE HIGHLIGHTS

2021 Highlights

The Board believes that fundamental corporate governance is critical to ensuring the Company is managed for the long-term benefit of our shareholders. Recent actions taken by the Board include the following:

|

· Amendment to Charters; Code of Ethics and Business Conduct; and Governance Guidelines. As part of an annual review process, the Boards Committees approved changes to their respective Committee Charters in 2021 to continue to facilitate alignment with best practices for management oversight. Similarly, the Board reviewed and approved proposed changes to the Companys Code of Ethics and Business Conduct and Corporate Governance Guidelines. |

|

|

· Board Diversity Policy. In alignment with the formal policy adopted in 2018, and as part of its self-evaluation under our Corporate Governance Guidelines, the Board annually considers whether the level of diversity of the Board is appropriate, and the Corporate Governance and Nominations Committee takes this consideration into account when identifying and evaluating director candidates. In addition, the Company has included a Board Diversity Matrix in alignment with the NASDAQ Listing Rule and has disclosed board-level diversity data. |

|

|

· Environmental, Health and Safety / Social Responsibility and Corporate Governance Disclosures. The Board aims to ensure that matters of environmental, health and safety, social and governance responsibility are considered and supported in the Companys operations and administrative matters and are consistent with Patrick shareholders best interests. |

|

| · The Board adopted a formal policy in 2018 for managing its commitment to social and environmental matters. This policy is available on the Companys website at www.patrickind.com under For InvestorsGovernance Governance Documents under the heading Social and Environmental Responsibility Policy. |

||

| · The Companys ESG disclosures are available on the Companys website at www.patrickind.com under For Investors Governance Governance Documents under the heading Environmental, Social and Governance Disclosures. |

||

|

· Information Security Risks/Matters. Executive leadership and the Board make determinations and decisions on strategy and direction of cyber security based on analysis and recommendations from Information Technology (IT) leadership. The Companys cyber security model, analysis of the effectiveness of the anti-phishing and other cyber security programs, and updates on cyber technology implementations are examples of cyber security content reviewed by the Board. The Company has retained a cyber security consulting firm to support cyber program priorities and harden system security. |

|

| In addition, the Companys IT department has implemented technology controls around user access, incident monitoring, event tracking, and security incident alert monitoring. Technology controls and governance documentation are reviewed regularly with executive leadership and the Board. The Company defines cyber security policies consistent with operations and employs continuous improvement measures to enhance reliability and flexibility in compliance with changing requirements. |

||

| 2 | PATRICK INDUSTRIES, INC

|

|

Table of Contents

EXECUTIVE COMPENSATION HIGHLIGHTS

Aligning Pay To Differentiated Performance

Our leaders understand and are motivated to impact key metrics that drive growth, profitability and ultimately shareholder value in both the short and long term. Our Compensation Committee recommends compensation decisions to the Board which support such philosophy. The plan design is brought to life through understanding each compensation element and the impact of the individuals and the teams performance as outlined below:

Each compensation component, relative to Peer Group and General Industry data, supports our philosophy of rewarding differentiated performance by emphasizing each executives variable pay elements.

| · | Base Salary, though lower than peer base compensation, is designed in alignment with the philosophy of focusing on performance-dependent variable pay. |

| · | The annual short-term cash compensation plan provides for enhanced payouts for performance above plan up to a maximum of 200% of target compensation at 115% of plan and incorporates a threshold payout of 50% of target compensation at 75% of plan. |

| COMPENSATION ELEMENT | PERCENTILE POSITIONING VS. PEER PROXY AND GENERAL INDUSTRY DATA |

|

| Base Salary |

25th - 50th | |

| Short-Term Incentive |

50th - 75th | |

| Total Target Cash |

50th - 75th | |

| Long-Term Incentive |

25th - 50th | |

|

Total Target Compensation |

50th - 75th | |

| · | The annual Long-term Incentive Compensation Plan is designed to drive the executives focus on long-term profitability through both organic and inorganic growth over the three-year award performance period. This equity plan is also designed to motivate leadership to perform above plan with a maximum payout of 200% of target compensation at 120% of plan and a threshold payout of 50% of target compensation at 80% of plan. |

Our focus on variable pay to motivate performance, a key component of our compensation plan over the past decade, has proven successful in aligning our teams compensation to shareholder returns.

Key Compensation Actions Taken In Fiscal 2021

| · | Adjusted compensation for our Named Executive Officers (NEOs) to align with changes in responsibility, the Companys performance in 2021, year-over-year revenue growth, and size-scoping of our Peer Group and General Industry data. |

| · | Continued to utilize external consultant, Willis Towers Watson, for data and consultation as requested by the Compensation Committee. |

For the compensation of our NEOs, please refer to the Compensation Discussion and Analysis (CD&A) beginning on page 31.

| Notice of 2022 Annual Meeting of Shareholders & Proxy Statement

|

3 | |

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

|

||

| There are nine nominees for election to the Board, all of which are current members of our Board. The individuals elected as directors at the 2022 Annual Meeting will be elected to hold office until the 2023 Annual Meeting or until their successors are duly elected and qualified.

It is intended that the proxies will be voted for the nominees listed below, unless otherwise indicated on the proxy form. It is expected that these nominees will serve, but, if for any unforeseen cause any such nominee should decline or be unable to serve, the proxies will be voted to fill any vacancy so arising in accordance with the discretionary authority of the persons named in the proxies. The Board does not anticipate that any nominee will be unable or unwilling to serve. |

The Board of Directors recommends that shareholders vote FOR the election of the following nominees to the Board of Directors.

|

|

|

|

||

| Notice of 2022 Annual Meeting of Shareholders & Proxy Statement

|

11 | |

Table of Contents

Table of Contents

|

|

|

|||

|

|

JOSEPH M. CERULLI | |||

|

Age 62 Director Since 2008 Committees Corporate Governance and Nominations (Chair)

Biography Joseph M. Cerulli, age 62, has been employed by Tontine Associates, LLC, an investment management firm (together with its affiliates, Tontine), since January 2007.

Qualifications Mr. Cerulli has particular knowledge of our Company and the industries in which we operate based on Tontines prior long-standing investment in the Company and possesses extensive knowledge with respect to business operations, strategic planning, financial and investment matters, including investment banking, capital markets, and mergers and acquisitions advisory. |

||||

|

|

TODD M. CLEVELAND

Age 54 Director Since 2008 Committees None

Biography Todd M. Cleveland, age 54, has been our Executive Chairman of the Board since January 1, 2020. Prior to that, Mr. Cleveland was Chairman of the Board from May 2018 to December 2019 and our Chief Executive Officer from February 2009 to December 31, 2019. Mr. Cleveland was President of the Company from May 2008 to December 2015 and Chief Operating Officer of the Company from May 2008 to March 2013. Mr. Cleveland has served as a director of IES Holdings, Inc. (IES) from 2017 to present, and he has been the chairman of IESs Human Resources and Compensation Committee since February 2019 and a member of IESs audit committee since February 2021.

Qualifications Mr. Cleveland has over 31 years of RV, MH, marine and industrial experience in various operating capacities. He also has extensive knowledge of our Company and the industries to which we sell our products and experience with management development and leadership, acquisitions, strategic planning, finance and capital allocation, and the manufacturing and sales of our products.

Other Public Board Directorships IES Holdings, Inc.

|

|||

| Notice of 2022 Annual Meeting of Shareholders & Proxy Statement

|

13 | |

Table of Contents

|

|

JOHN A. FORBES

Age 62 Director Since 2011 Committees Audit Compensation Corporate Governance and Nominations

Biography John A. Forbes, age 62, has been a partner with Outcomes LLC and Full Sails LLC, two firms engaged in new product development and strategic business consulting, since June 2017. In addition, Mr. Forbes served as the interim CFO of the Company from June 2020 to November 2020. Previously, Mr. Forbes was the President of Utilimaster, a business unit of Spartan Motors USA, Inc., from July 2010 to June 2017. Prior to that, he was the Chief Financial Officer of Utilimaster from May 2009 to July 2010, the Chief Financial Officer of Nautic Global Group LLC from 2007 to 2009 and the Chief Financial Officer of Adorn LLC from 2003 to 2007. Mr. Forbes has served as a director of Chase Packaging Corporation since March 2019

Qualifications Mr. Forbes has over 35 years of experience in serving various manufacturing industries, having held senior financial leadership roles. Mr. Forbes also has extensive experience with operations and talent management, acquisitions, strategic planning, risk management and banking relations. He has been determined to be an audit committee financial expert under the rules and regulations of the Securities and Exchange Commission (the SEC) by our Board.

Other Public Board Directorships Chase Packaging Corporation |

|

|

|

MICHAEL A. KITSON

Age 63 Director Since 2013 Committees Audit (Chair) Compensation Corporate Governance and Nominations

Biography Michael A. Kitson, age 63, served as the Chief Financial Officer of oVertone Haircare, Inc., a manufacturer of haircare products, from July 2018 through January 2022. Previously, Mr. Kitson was a principal with AVL Growth Partners, a firm that provides chief financial officer and other financial advisory services, from March 2017 to July 2018. Prior to that, Mr. Kitson was the Chief Financial Officer of MikaTek, Ltd. from January 2016 until July 2016, the Chief Executive Officer of SharpShooter Imaging from March 2015 to January 2016, the Chief Executive Officer of Nautic Global Group (Nautic) from March 2011 to October 2013 and the Chief Financial Officer of Nautic from August 2010 to March 2011.

Qualifications Mr. Kitson has over 35 years of experience in serving various manufacturing industries in senior financial leadership roles. Mr. Kitson also has extensive experience with corporate and operations management, finance and capital allocation, strategic planning and risk management. He has been determined to be an audit committee financial expert under the SECs rules and regulations by our Board. |

| 14 | PATRICK INDUSTRIES, INC

|

|

Table of Contents

|

|

PAMELA R. KLYN

Age 51 Director Since 2019 Committees Audit Compensation Corporate Governance and Nominations

Biography Pamela R. Klyn, age 51, has been the Senior Vice President of Communications, Public Affairs and Sustainability at Whirlpool Corporation, the worlds leading major home appliance company, since January 2022. Prior to that, Ms. Klyn was a Senior Vice President in the Global Product Organization at Whirlpool Corporation from 2018 to 2021, and has held various leadership positions in marketing and engineering since 1993.

Qualifications Ms. Klyn has over 29 years of experience in the home appliance industry and has extensive experience in marketing, engineering, strategic planning and new product development. |

|

|

|

||

|

|

DERRICK B. MAYES

Age 48 Director Since 2019 Committees Audit Compensation Corporate Governance and Nominations

Biography Derrick B. Mayes, age 48, has been a Managing Partner of Play Like a Champion Capital, LLC since 2020. Prior to that, Mr. Mayes was the Vice President of WME/IMG, a strategic advisor firm to the sports and entertainment industry, from 2015 2021. Previously, he was the Chief Executive Officer of Executive Action Sports & Entertainment, serving as a strategic adviser to high profile individuals, groups and organizations in the sports and entertainment industry, from 2007 to 2015.

Qualifications Mr. Mayes has over 21 years of experience in strategic planning, acquisitions, and executive leadership, with extensive experience in the digital communications space, and has been a leadership and diversity speaker to numerous public companies and private organizations, particularly in the sports and entertainment markets . |

| Notice of 2022 Annual Meeting of Shareholders & Proxy Statement

|

15 | |

Table of Contents

|

ANDY L. NEMETH

Age 53 Director Since 2006 Committees None

Biography Andy L. Nemeth, age 53, has been the Companys Chief Executive Officer since January 1, 2020. Prior to that, Mr. Nemeth was the President from January 2016 to July 2021, Executive Vice President of Finance and Chief Financial Officer from May 2004 to December 2015 and Secretary-Treasurer from 2002 to 2015. He was also the Vice President of Finance and Chief Financial Officer from 2003 to 2004.

Qualifications Mr. Nemeth has over 30 years of RV, MH, marine and industrial experience in various financial and management capacities. Mr. Nemeth also has particular knowledge of our Company and the industries to which we sell our products and has extensive experience with corporate management, development and leadership, acquisitions, strategic planning, risk management, capital allocation, and banking and finance relations. |

|

|

DENIS G. SUGGS

Age 56 Director Since 2019 Committees Audit Compensation Corporate Governance and Nominations

Biography Denis G. Suggs, age 56, has been the Chief Executive Officer of LCP Transportation, LLC, a non- emergency medical transportation company, since February 2020. Prior to that, Mr. Suggs was the President and Chief Executive Officer of Strategic Materials Corp. from March 2014 to January 2020 and also served as Chairman from 2017 to 2020. Prior to that, Mr. Suggs was the Global Executive Vice President of Belden, Inc. from 2009 to 2013 and the President of the Americas Division / Vice President of Belden, Inc. from 2007 to 2009. Mr. Suggs has served as a director of Smith & Wesson Brands, Inc. from May 2021 to present.

Qualifications Mr. Suggs has over 23 years of experience in leading complex global businesses, having also held senior financial executive leadership roles with Danaher Corporation and Public Storage Corporation. Mr. Suggs also has extensive experience with corporate and operations management, strategic planning, mergers and acquisitions and risk management. Mr. Suggs served as a director of the Education Corporation of America from 2015 to 2018 and of Strategic Materials, Inc. and the Glass Packaging Institute from 2014 to 2020. He has been determined to be an audit committee financial expert under the SECs rules and regulations by our Board. |

|

| Other Public Board Directorships Smith & Wesson Brands, Inc. |

||

| 16 | PATRICK INDUSTRIES, INC

|

|

Table of Contents

|

M. SCOTT WELCH

Age 62 Director Since 2015 Lead Independent Director Since 2018 Committees Compensation (Chair) Audit Corporate Governance and Nominations

Biography M. Scott Welch, age 62, has been the President and Chief Executive Officer of Welch Packaging Group, a large independently owned corrugated packaging company, since 1985. Prior to establishing Welch Packaging, he worked at Northern Box, Performance Packaging and Elkhart Container. Mr. Welch has served as a director of Lakeland Financial Corporation (Lakeland) from 1998 to present, and he has been the lead independent director from 2012 to 2019 and a member of Lakelands compensation committee since 2012. He has also served as a trustee of DePauw University since 2005. |

|

| Qualifications Mr. Welch has over 40 years of experience in the packaging industry and has extensive experience in sales, marketing, acquisitions, organizational development, strategic planning, and finance and capital allocation. He has been determined to be an audit committee financial expert under the SECs rules and regulations by our Board.

Other Public Board Directorships Lakeland Financial Corporation |

||

|

||

| Notice of 2022 Annual Meeting of Shareholders & Proxy Statement

|

17 | |

Table of Contents

2021 NON-EMPLOYEE DIRECTOR COMPENSATION

| 07/01/21-12/31/21 | 1/1/21-06/30/21 | |||||||||

| Annual Retainer |

$90,000 | $75,000 | ||||||||

| Committee Chairpersons Annual Retainer: |

||||||||||

|

Audit |

20,000 | 10,000 | ||||||||

|

Compensation |

10,000 | 6,000 | ||||||||

| Corporate Governance and Nominations |

10,000 | 6,000 | ||||||||

| Lead Independent Director Annual Retainer |

25,000 | 6,000 | ||||||||

| Annual Restricted Stock Grant (1) |

125,000 | 100,000 | ||||||||

| (1) | Non-employee directors receive an annual restricted stock grant in May of each year, which vests upon such directors continued service as a Board member for one year from the grant date or earlier upon certain events. In addition, non-employee directors receive cash dividends on their restricted common stock holdings. The Company does not have stock ownership guidelines for its directors. |

In addition to the compensation described above, the Company reimburses the non-employee directors expenses, including travel, accommodations and meals, for attending Board and Board Committee meetings, our Annual Meeting of Shareholders and any other activities related to our business. Employee directors receive no compensation as such.

| NAME |

FEES EARNED OR PAID IN CASH (1) |

STOCK AWARDS (2) |

OTHER COMPENSATION (3) |

TOTAL | ||||||||||||

| Joseph M. Cerulli |

$90,500 | $125,053 | $1,899 | $217,452 | ||||||||||||

| John A. Forbes (4) |

65,250 | 125,053 | 1,899 | 192,202 | ||||||||||||

| Michael A. Kitson |

97,500 | 125,053 | 1,899 | 224,452 | ||||||||||||

| Pamela R. Klyn |

82,500 | 125,053 | 1,899 | 209,452 | ||||||||||||

| Derrick B. Mayes |

82,500 | 125,053 | 1,899 | 209,452 | ||||||||||||

| Denis G. Suggs |

82,500 | 125,053 | 1,899 | 209,452 | ||||||||||||

| M. Scott Welch |

106,000 | 125,053 | 1,899 | 232,952 | ||||||||||||

| (1) | Fees consist of an annual cash retainer for the Board, lead independent director, and committee chairpersons service. |

| (2) | Amounts shown do not represent compensation actually received. Such amounts reflect the aggregate grant date fair value of 1,373 shares of restricted stock granted to each non-employee director, at a closing stock price of $91.08 on May 13, 2021. |

| (3) | Amounts shown represent cash dividends paid by the Company in 2021 on unvested shares held by the non-employee directors. |

| (4) | Mr. Forbes did not receive a cash retainer for his service to the Board in the first quarter of 2021 as he received $58,000 of cash compensation from the Company for his services during the transition from his role as Interim CFO, which concluded in November 2020 upon the appointment of Jacob Petkovich as permanent CFO. |

| 18 | PATRICK INDUSTRIES, INC

|

|

Table of Contents

|

Audit Committee

The Board has an Audit Committee for which Michael A. Kitson serves as the Chairman. The Audit Committee met 13 times in 2021. These meetings included conference calls with management to review quarterly earnings releases and SEC filings prior to their issuance.

The Audit Committee has a charter, which sets forth the primary responsibilities of the Audit Committee which includes:

Oversight responsibilities related to potential material risks to the business, including, but not limited to, credit, liquidity, IT security, and operational risks;

Recommending to the Board the independent auditors to be engaged by the company for the purpose of conducting the annual audit of our financial statements;

Discussing with the independent auditors the scope of their examination;

Reviewing our financial statements and the independent auditors report thereon with our personnel and the independent auditors;

Inviting the recommendations of the independent auditors regarding internal controls and other matters; and

Approving all non-audit services provided by the independent auditors and reviewing these engagements on a per occurrence basis.

The Board has determined that each of the current members of the Audit Committee is independent, as defined in the NASDAQ listing standards and relevant SEC rules. In addition, as of the date of this proxy, the Board has determined that four of these members also meet both the qualifications required to be an audit committee financial expert and the financial sophistication requirements contained in the NASDAQ listing standards (Messrs. Forbes, Kitson, Suggs and Welch).

|

|

|

For a more detailed list of the roles and responsibilities of the Audit Committee, please see the Audit Committee Charter located in the For Investors - Governance section of our website at www.patrickind.com.

|

||

|

Compensation Committee

The Board has a Compensation Committee for which M. Scott Welch serves as the Chairman. The Compensation Committee met five times in 2021.

The Compensation Committee has a charter, which sets forth the responsibilities of the Compensation Committee, which include:

Reviewing and recommending to the independent members of the Board the overall compensation programs for the officers of the Company;

Oversight authority to attract, develop, promote and retain qualified senior executive management; and

Oversight authority for the stock-based compensation programs.

In its oversight of executive officer compensation, the Compensation Committee seeks assistance from our management and our independent compensation consultant, Willis Towers Watson, as further described below under the heading Compensation Discussion and Analysis. Willis Towers Watsons |

|

| Notice of 2022 Annual Meeting of Shareholders & Proxy Statement

|

19 | |

Table of Contents

| fees are approved by the Compensation Committee. Willis Towers Watson provides the Compensation Committee with data about the compensation paid by our peer group and industry benchmark groups, updates the Compensation Committee on new developments in areas that fall within the Compensation Committees scope and is available to advise the Compensation Committee regarding all of its responsibilities, including best practices and market trends in executive compensation. Our Compensation Committee has assessed the independence of Willis Towers Watson pursuant to SEC and NASDAQ listing rules and determined that their work did not give rise to any conflicts of interest.

The Board has determined that each of the current members of the Compensation Committee is independent as defined in the NASDAQ listing standards and our Corporate Governance Guidelines.

Compensation Committee Interlocks and Director Participation

During 2021, no executive officer served on the board or compensation committee of any other corporation with respect to which any member of the Compensation Committee was engaged as an executive officer. No member of the Compensation Committee was an officer or employee of the Company during 2021.

|

|

For a more detailed list of the roles and responsibilities of the Compensation Committee, please see the Compensation Committee Charter located in the For Investors - Governance section of our website at www.patrickind.com.

|

||

Table of Contents

|

Corporate Governance and Nominations Committee

The Board has a Corporate Governance and Nominations Committee for which Joseph M. Cerulli serves as the Chairman. The Corporate Governance and Nominations Committee met four times in 2021.

The Corporate Governance and Nominations Committee has a charter, which sets forth the responsibilities of the Corporate Governance and Nominations Committee, which include:

Assisting the Board in identifying, screening and recommending qualified candidates to serve as directors;

Recommending nominees to the Board to fill new positions or vacancies as they occur;

Reviewing and recommending to the Board the compensation of directors;

Recommending to the Board nominees for election by shareholders at the Annual Meeting;

Reviewing and monitoring corporate governance compliance as well as recommending appropriate changes;

Reviewing the succession planning for our senior executive officers;

Providing overall oversight of our ESG policies and initiatives and working with management to identify and define relevant ESG topics and programs; and

Conducting an annual assessment of the Boards performance.

The Board has determined that each of the current members of the Corporate Governance and Nominations Committee (as of the date of this proxy) is independent as defined in the listing standards of the NASDAQ Stock Market and our Corporate Governance Guidelines.

Delinquent Section 16(a) Reports Section 16(a) of the Securities Exchange Act of 1934 requires that certain of our officers, directors and 10% shareholders file with the SEC an initial statement of beneficial ownership and certain statements of changes in beneficial ownership of our common stock. Based solely on our review of such forms and written representation from the directors and officers that no other reports were required, we are unaware of any instances of noncompliance or late compliance with such filings during the fiscal year ended December 31, 2021.

|

|

|

For a more detailed list of the roles and responsibilities of the Corporate Governance and Nominations Committee, please see the Corporate Governance and Nominations Committee Charter located in the For Investors - Governance section of our website at www.patrickind.com.

|

||

| Notice of 2022 Annual Meeting of Shareholders & Proxy Statement

|

21 | |

Table of Contents

Table of Contents

| Notice of 2022 Annual Meeting of Shareholders & Proxy Statement

|

23 | |

Table of Contents

INDEPENDENT PUBLIC ACCOUNTANTS

As noted above in Proposal 2, the Audit Committee has appointed Deloitte as our independent registered public accounting firm for the fiscal year ending December 31, 2022.

Audit Fees

The following table presents fees and out-of-pocket expenses for professional audit services rendered by Deloitte during the fiscal years ended December 31, 2021 and 2020:

| 2021 | 2020 | |||||||

| Audit Fees (1) |

$ | 1,867,000 | $ | 1,430,000 | ||||

| Audit Related Fees (2) |

290,200 | - | ||||||

| Tax Fees (3) |

320,100 | 236,700 | ||||||

| Other Fees (4) |

275,000 | - | ||||||

| Total Fees |

$ | 2,752,300 | $ | 1,666,700 | ||||

| (1) | Audit fees consist of fees for professional services rendered for the annual audit of the Companys financial statements, the reviews of the financial statements included in the Companys quarterly reports, and other services normally provided by the independent auditor in connection with statutory and regulatory filings or engagements. |

| (2) | Audit related fees consist of fees related to due diligence services. |

| (3) | Tax fees include fees related to tax compliance and consulting services. |

| (4) | Other fees consist of consulting service for advice on the Companys finance transformation strategy project. |

The Audit Committee has advised us that it has determined that the non-audit services rendered by our independent auditors during our most recent fiscal year are compatible with maintaining the independence of such auditors.

The Audit Committee has adopted a Preapproval Policy for Audit and Non-Audit Services pursuant to which it preapproves all audit and non-audit services provided by the independent auditors prior to each particular engagement. The Audit Committee has delegated authority to its Chairman to approve certain proposed services other than the annual audit, tax and quarterly review services, and the Chairman must report any approvals to the balance of the Committee at the next scheduled meeting.

| 24 | PATRICK INDUSTRIES, INC

|

|

Table of Contents

Table of Contents

| The following report of the Audit Committee does not constitute soliciting material and shall not be deemed incorporated by reference by any general statement incorporating by reference the proxy statement into any filing by us under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under such acts. |

The responsibilities of the Audit Committee, which are set forth in the Audit Committee Charter adopted by the Board, include providing oversight of our financial reporting process through periodic meetings with our independent auditors, principal accounting officer and management to review accounting, auditing, internal controls and financial reporting matters.

The Audit Committee has met and held discussions with management and Deloitte with respect to the 2021 audited financial statements. The Audit Committee reviewed and discussed with Deloitte the consolidated financial statements, and Deloittes evaluation of the Companys internal controls over financial reporting. The Audit Committee also discussed with Deloitte the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC, and other professional standards and regulatory requirements currently in effect.

We have received from Deloitte a letter providing the disclosures required by the applicable requirements of the Public Company Accounting Oversight Board regarding Deloittes communications with the Audit Committee concerning independence with respect to any relationships between us and Deloitte that in their professional judgment may reasonably be thought to bear on independence. Deloitte has discussed its independence with

us, and has confirmed in such letter that, in its professional judgment, it is independent from us within the meaning of the federal securities laws. The Audit Committee concluded that non-audit services provided by Deloitte during the year ended December 31, 2021 were compatible with Deloittes independence.

Based on the review and discussions described above, with respect to our audited financial statements included in our 2021 Annual Report to Shareholders, we have recommended to the Board of Directors that such financial statements be included in our Annual Report on Form 10-K for filing with the SEC.

As specified in the Audit Committee Charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that our financial statements are complete and accurate and in accordance with generally accepted accounting principles. That is the responsibility of management and our independent auditors. In giving our recommendation to the Board of Directors, we have relied on (i) managements representation that such financial statements have been prepared with integrity and objectivity and in conformity with generally accepted accounting principles and (ii) the report of our independent auditors with respect to such financial statements. This report was adopted by the Audit Committee on February 25, 2022.

The Audit Committee

Michael A. Kitson (Chairman)

John A. Forbes

Pamela R. Klyn

Derrick B. Mayes

Denis G. Suggs

M. Scott Welch

| 26 | PATRICK INDUSTRIES, INC

|

|

Table of Contents

|

Executive Compensation for Fiscal 2021

Our executive compensation policy is designed to enable the Company to attract, motivate and retain highly-qualified senior executives by providing a competitive compensation opportunity based on performance. Our intent is to provide fair and equitable compensation in a way that rewards executives for achieving specified financial and non-financial performance goals. Our performance-related awards are structured to link a substantial portion of our executives total potential compensation to the Companys performance on both a short-term and long-term basis, to recognize individual contributions and to align executive and shareholder interests.

We are requesting shareholder approval of the compensation of our named executive officers for fiscal 2021 as disclosed in this Proxy Statement, including the disclosures under Executive CompensationCompensation Discussion and Analysis, compensation tables and the related information and discussion.

Please note that the vote is advisory and therefore not binding on the Company or the Compensation Committee or the Board. However, we value the opinions of our shareholders, and we will carefully consider the outcome of the advisory vote on executive compensation when making future compensation decisions.

The affirmative vote of a majority of the votes cast is required for advisory approval of the foregoing non-binding resolution. See Voting Information on pages 60 to 62. |

For the reasons stated, the Board of Directors recommends a vote FOR the following non-binding resolution:

RESOLVED, that the compensation paid to the companys named executive officers for fiscal year 2021, as disclosed in this Proxy Statement pursuant to the compensation disclosure rules of the SEC, including the Compensation Discussion and Analysis, compensation tables and related information and discussion, is hereby APPROVED. |

| Notice of 2022 Annual Meeting of Shareholders & Proxy Statement

|

27 | |

Table of Contents

Table of Contents

The following Compensation Discussion and Analysis (CD&A) should be read in conjunction with the executive compensation tables and corresponding footnotes that follow. The discussion focuses on the compensation program approved by the Board for the 2021 fiscal year for the Named Executive Officers (NEOs).

Todd M. Cleveland, Andy L. Nemeth, Jeffrey M. Rodino, Kip B. Ellis and Jacob R. Petkovich, who are the NEOs for fiscal 2021, are shown below along with a brief biography. Effective July 2021, Mr. Rodino assumed the role of President of the Company.

Todd M. Cleveland

Todd M. Cleveland was appointed Executive Chairman of the Board of the Company in January 2020. Prior to that, Mr. Cleveland was Chairman of the Board from May 2018 to December 2019 and Chief Executive Officer from February 2009 until December 2019. Mr. Cleveland was President of the Company from May 2008 to December 2015, and Chief Operating Officer from May 2008 to March 2013. Prior to that, Mr. Cleveland served as Executive Vice President of Operations and Sales and Chief Operating Officer from August 2007 to May 2008 following the acquisition of Adorn Holdings, Inc. by Patrick in May 2007. Mr. Cleveland has over 31 years of recreational vehicle, manufactured housing, marine and industrial experience in various leadership capacities.

Andy L. Nemeth

Andy L. Nemeth was appointed Chief Executive Officer of the Company in January 2020. Prior to that, Mr. Nemeth served as President of the Company from January 2016 to July 2021. Mr. Nemeth was the Executive Vice President of Finance and Chief Financial Officer from May 2004 to December 2015, and Secretary-Treasurer from 2002 to 2015. Mr. Nemeth has over 30 years of recreational vehicle, manufactured housing, marine and industrial experience in various financial and managerial capacities.

| Notice of 2022 Annual Meeting of Shareholders & Proxy Statement

|

29 | |

Table of Contents

Jeffrey M. Rodino

Jeffrey M. Rodino was appointed President of the Company in July 2021. Prior to that, Mr. Rodino was Chief Sales Officer from September 2016 to July 2021 and Executive Vice President of Sales from December 2011 to July 2021. Mr. Rodino was Chief Operating Officer of the Company from March 2013 to September 2016, and Vice President of Sales for the Midwest from August 2009 to December 2011. Mr. Rodino has over 28 years of experience in serving the recreational vehicle, manufactured housing, marine and industrial markets.

Kip B. Ellis

Kip B. Ellis was appointed Executive Vice President of Operations and Chief Operating Officer of the Company in September 2016. He was elected an officer in September 2016. Mr. Ellis joined the Company as Vice President of Market Development in April 2016. Prior to his role at Patrick, Mr. Ellis served as Vice President of Aftermarket Sales for the Dometic Group from 2015 to 2016. Prior to his tenure at Dometic, Mr. Ellis served as Vice President of Global Sales and Marketing from 2007 to 2015 at Atwood Mobile Products. Mr. Ellis has over 25 years of experience serving the recreational vehicle, manufactured housing, marine and industrial and automotive markets.

Jacob R. Petkovich

Jacob R. Petkovich was appointed as Executive Vice President of Finance, Chief Financial Officer, and Treasurer of the Company in November 2020. Prior to joining Patrick, Mr. Petkovich served as Managing Director in the Leveraged Finance Group of Wells Fargo Securities and predecessor Wachovia Securities from 2004 to 2020, performing in various senior leadership roles responsible for leading, underwriting, structuring and arranging financing solutions to support issuers access to the capital markets for acquisition financings, recapitalizations, refinancings and restructurings.

2021 Executive Compensation Plan Highlights

| | The Company established base pay, short-term incentive (STI) and long-term incentive (LTI) target pay for each of the NEOs in alignment with its peer group and general industry scoping to assure a market-competitive compensation package for total target direct compensation. |

| | The Company increased the base pay of each NEO, with the exception of Mr. Cleveland. Base compensation was adjusted in alignment with the Companys and NEOs scope and to assure a competitive position with the market for total direct compensation. |

| | The Company made changes to the 2021 STI Plan performance targets and corresponding payout, eliminating the adjustment made to the STI Plan temporarily in 2020 due to the pandemic. |

| 30 | PATRICK INDUSTRIES, INC

|

|

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

We believe that our compensation plan as it relates to the NEOs and other executives should be aligned with the Companys short-term and long-term organizational strategic agendas and its operating performance and cash flows and ensure appropriate management ownership in the Company. Messrs. Cleveland, Nemeth, Rodino, Ellis and Petkovich comprise our NEOs for fiscal 2021, as such term is used under SEC rules. Our philosophy and objectives are to provide a comprehensive market competitive compensation program designed to attract, retain and motivate the best qualified talents from inside and outside the industry and to align the interests of our senior management team with the interests of our shareholders, both short-term and long- term. The Company utilizes a pay-for-differentiated performance compensation philosophy that establishes base salaries that are generally low relative to its peer group companies while offering the opportunity for greater upside potential by establishing performance-based short-term and long-term incentives that are generally high relative to its peer group companies. Our performance management system links compensation to achieving or exceeding certain objectives based on our short-term and long-term goals. In order to meet these objectives, the Compensation Committee has met numerous times over the past year and has conducted independent benchmark studies and analyses, in conjunction with the utilization of a third-party compensation consultant, to develop a comprehensive performance and rewards compensation strategy as it relates to our NEOs and other executives. See Plan Components discussion below.

2021 Executive Compensation Plan: Pay-at-Risk

The 2021 executive compensation plan for the NEOs was designed to compensate and reward the plan participants with pay-for-differentiated performance. The executive compensation is designed for each component to incrementally reward the NEO as performance against established key financial metrics is achieved. This plan design places a high degree of emphasis and reward based on variable compensation or pay-at-risk. Each element of compensation is outlined below to demonstrate the philosophy and architecture of the plan design.

Base Pay (Salary)

To implement our variable pay-at-risk philosophy in 2021, we intentionally set the NEOs base salaries lower than market-based salaries.

The CEO and each of the other NEOs base compensation for 2021 was aligned to the 25th to 50th percentile range of their respective established peer group and general industry data.

| EXECUTIVE | 2021 BASE PAY | FIXED

OR VARIABLE PAY |

||||||||||

| CEO |

$750,000 | Fixed Pay | ||||||||||

| All Other NEOs Combined (1) |

1,975,000 | Fixed Pay | ||||||||||

(1) All other NEOs comprised of Messrs. Cleveland, Rodino, Ellis and Petkovich.

| Notice of 2022 Annual Meeting of Shareholders & Proxy Statement

|

31 | |

Table of Contents

Non-Equity Incentive Plan Compensation (Short-Term Incentive Plan)

The 2021 Short-Term Incentive Plan (STIP) was designed to reward the CEO and each of the other NEOs for differentiated incremental performance against the net income of the plan year (net of 2021 acquisitions) and individual performance goals of each NEO. The STIP is designed to be 100% variable, performance dependent, pay-at-risk. Assuming target performance, the net income metric performance accounts for 70% of the performance payout and each NEOs personal strategic objectives account for 30% of the performance payout, allowing for differentiation of each individual NEOs contributions to the performance of the Company. STIP compensation may range from 0% to 200% of target.

If an individuals performance rating is below the threshold performance rating, such individual is not eligible for a STIP award regardless of Company performance. If the Companys net income (net of acquisitions) performance is below the threshold Company performance, no individual is eligible for that performance plan years annual STIP award regardless of individual performance.

The STIP threshold, target, stretch and maximum performance levels for both net income (net of 2021 acquisitions) and personal performance and related payouts, are noted below for reference.

| COMPANY PERFORMANCE (70% OF TARGET PERFORMANCE PAYOUT) | ||||||

|

|

|

|||||

| NET INCOME PERFORMANCE | PERFORMANCE TO PLAN (%) |

PAYOUT (%) | ||||

| Less Than Threshold |

<75 | 0 | ||||

|

Threshold |

75 | 50 | ||||

| Target (Plan) |

100 | 100 | ||||

|

Stretch |

110 | 175 | ||||

|

Maximum |

115 | 200 | ||||

| NEO INDIVIDUAL PERFORMANCE (30% OF TARGET PERFORMANCE PAYOUT) | ||||||

|

|

|

|||||

| PERSONAL PERFORMANCE |

PERFORMANCE RATING (0-5 SCALE) |

PAYOUT (%) | ||||

| Less Than Threshold |

<2.5 | 0 | ||||

|

Threshold |

2.5 | 50 | ||||

| Target (Plan) |

3.5 | 100 | ||||

|

Stretch |

4.4 | 175 | ||||

|

Maximum |

5.0 | 200 | ||||

The STIP target amount for the CEO and each of the other NEOs is designed to align to the 75th percentile range of established peer group and general industry pay percentiles.

| EXECUTIVE | 2021 TARGET STIP | FIXED OR VARIABLE PAY | ||||||||

| CEO |

$1,700,000 | Variable Pay | ||||||||

| All Other NEOs Combined (1) |

3,775,000 | Variable Pay | ||||||||

| (1) | All other NEOs comprised of Messrs. Cleveland, Rodino, Ellis and Petkovich. |

| 32 | PATRICK INDUSTRIES, INC

|

|

Table of Contents

Long-Term Incentive Plan Compensation (Long-Term Incentive Plan)

The 2021 Long-Term Incentive Plan (LTIP) was designed to reward the NEOs for sustained, long-range performance while ensuring incremental reward for differentiated performance against the Companys three-year cumulative earnings before interest, taxes, depreciation and amortization (EBITDA) plan. The design of the LTIP creates 80% of the target value of the award in the form of this performance-dependent variable pay and 20% in the form of retentive, time-based fixed compensation with three-year cliff vesting.

The LTIP threshold, target, stretch and maximum performance levels for three-year cumulative EBITDA and related payouts are noted below for reference.

| 3-YEAR CUMULATIVE EBITDA | PERFORMANCE TO PLAN (%) | PAYOUT (%) | ||||

| Less Than Threshold |

<80 | 0 | ||||

|

Threshold |

80 | 50 | ||||

| Target (Plan) |

100 | 100 | ||||

|

Stretch |

110 | 150 | ||||

|

Maximum |

120 | 200 | ||||

The LTIP target amount for the CEO and each of the other NEOs is designed to align to the 25th 50th percentile range of peer and general industry pay percentiles. The target value of the LTIP is awarded in Restricted Stock Units (RSUs). The table below outlines the target LTIP amount for the CEO and all the other NEOs combined.

| EXECUTIVE | 2021 TARGET LTIP | VARIABLE PAY (80%) | FIXED PAY (20%) | |||||

| CEO |

$2,800,000 | $2,240,000 | $560,000 | |||||

| All Other NEOs Combined (1) |

4,150,000 | 3,320,000 | 830,000 | |||||

(1) All other NEOs comprised of Messrs. Cleveland, Rodino, Ellis and Petkovich.

Total Target Compensation Fixed vs. Variable Pay Summary

Upon combining all pay elements of the 2021 Executive Compensation Plan, the percentages of total fixed versus variable pay at target are depicted in the table below.

| TOTAL TARGET FIXED PAY | TOTAL TARGET VARIABLE PAY | |||||||||||||||||||||||||||||

| EXECUTIVE | TOTAL TARGET COMPENSATION |

$ | % | $ | % | |||||||||||||||||||||||||

| CEO |

$5,250,000 | $1,310,000 | 25.0 | % | $3,940,000 | 75.0 | % | |||||||||||||||||||||||

| All Other NEOs Combined (1) |

9,900,000 | 2,805,000 | 28.3 | % | 7,095,000 | 71.7 | % | |||||||||||||||||||||||

| (1) | All other NEOs comprised of Messrs. Cleveland, Rodino, Ellis and Petkovich. |

| Notice of 2022 Annual Meeting of Shareholders & Proxy Statement

|

33 | |

Table of Contents

Participants and Roles

| PARTICIPANTS | RESPONSIBILITIES | |

| Compensation Committee |

Reviews and approves, with input from our management team and external advisors, the Companys executive compensation and benefits programs, including the NEOs. |

|

|

Provides annual and ongoing review, discussion, analysis and recommendations regarding the evaluation of the execution of the performance plan for the NEOs against defined business objectives. |

||

| Independent Committee Consultant |

Provides published survey data, peer group proxy data and analysis and consultation to the Compensation Committee on executive and non-employee director compensation. |

|

|

Establishes and maintains an independent perspective to avoid any conflicts of interests while working directly for the Compensation Committee unless the Committee has preapproved any work to be conducted with management for review by the Committee and approval by the Board. |

||

| Chief Executive Officer and Senior Human Resources Executive |

When requested by the Compensation Committee, provide executive compensation and benefit plan input related to the performance management structure and provides support on compensation and benefit program design and implementation, as well as compliance and disclosure requirements. |

|

|

The CEO evaluates the performance plans of the President, COO and CFO and other executives in accordance with the Board approved plan. |

||

Plan Factors

There are several key factors the Compensation Committee considers when recommending plan-year executive compensation decisions:

| | NEOs roles, position scope, experience, skill set and performance history; |

| | The external market for comparable roles; |

| | The current and expected business climate; and |

| | The Companys financial position and operating results. |

| 34 | PATRICK INDUSTRIES, INC

|

|

Table of Contents

Plan Components

The Compensation Committee utilizes its own judgment in approving the components of compensation, benefits, and plan targets for the NEOs. The Compensation Committee further reviews and approves compensation including base compensation, targets, thresholds, and maximums of short-term and long-term incentive compensation. In addition, the Compensation Committee utilizes a third-party compensation consulting firm, Willis Towers Watson, to provide relevant compensation benchmarks for the NEOs and other key leadership roles as well as plan design review and input. The CEO evaluates the performance plans of the President, CFO and other executive officers with the Compensation Committee. Final determinations regarding our CEOs performance and compensation are made during an executive session of the Compensation Committee and are reported to and reviewed by the Board in an independent directors session. The Compensation Committee overseas the performance and compensation of the Executive Chairman. Holders of approximately 70% of the shares voted in the most recent shareholder advisory vote at our Annual Meeting of Shareholders held on May 13, 2021 voted to approve the compensation of the NEOs for fiscal year 2020. The Compensation Committee takes the shareholder advisory voting results, along with any other shareholder input on executive compensation, into consideration as one of several decision points in its executive compensation decision making process for each plan year.

Benchmark Sources and Fiscal Year 2021 Peer Group

In an effort to provide a better aligned peer group for purposes of market comparison of our executive compensation packages based on our general guidelines and as described under Plan Components, an important factor in establishing executive compensation for 2021 is the external market for comparable roles. In addition, based on the data utilized from an index of General Industry companies provided by the Central Data Base Survey of Willis Towers Watson, our independent compensation committee consultant, there were no changes made by the Compensation Committee to the benchmark peer group for the period ended December 31, 2021 (as compared to the 2020 peer group). We believe the following companies listed below represent an effective comparator group of similar size and with similar scope of revenue and market capitalization.

| | American Woodmark Corporation |

| | Apogee Enterprises, Inc. |

| | Brunswick Corporation |

| | Cavco Industries, Inc. |

| | Cornerstone Building Brands, Inc. |

| | EnPro Industries , Inc. |

| | Hyster-Yale Materials Handling, Inc. |

| | LCI Industries, Inc. |

| | Masonite International Corporation |

| | Modine Manufacturing Company |

| | Mueller Industries, Inc. |

| | Polaris Inc. |

| | Thor Industries, Inc. |

| | UFP Industries, Inc. |

| | Wabash National Corporation |

| | Winnebago Industries, Inc. |

| Notice of 2022 Annual Meeting of Shareholders & Proxy Statement

|

35 | |

Table of Contents

FISCAL YEAR 2021 EXECUTIVE COMPENSATION

| COMPENSATION AND BENEFITS COMPONENTS |

DESCRIPTION AND PURPOSE | |

| Base Salary |

Cash payments reflecting a market competitive position for performance of functional role. | |

| Short-Term Incentives |

Lump sum cash payments reflective of approved pay-for-performance plan and the relative achievements of the business and individual performance objectives. In addition, the Board reserves the right at any time to award discretionary bonuses to senior management based on outstanding performance or other factors. | |

| Long-Term Incentives |

Stock vehicle grants reflecting approved pay-for-performance plan and the relative long-term achievement of the business performance plans as well as the Companys desire to retain high- performing talent and align the interests of senior management with shareholder interests. | |

| Executive Health and Welfare Benefits |

Health and welfare benefits mirror scope of standard plans for all employees. | |

| Voluntary Deferred Compensation Plan |

Highly compensated individuals can elect to voluntarily defer all or a portion of their wages in any given year subject to applicable laws and restrictions. Designed to supplement market competitive position and further drive retention of key executives. | |

| Other Compensation |

Other compensation includes: Automobile allowance, Company contributions pursuant to the Patrick Industries, Inc. 401(k) Plan and to individual Health Savings Accounts, and health club reimbursement pursuant to the Companys general health and welfare program. | |

| Severance Benefits |

Reasonable and customary transition support aligned to market benchmark data. | |

Base Salary

The Compensation Committee reviews and approves the base salaries of the NEOs each year, as well as at the time of promotion, change in job responsibilities or any other change deemed to be a material event. Base salaries are set during the first quarter of each year. The Compensation Committee sets the salary for the CEO and approves the base salaries for the other NEOs based on recommendations by the CEO.

When determining base salary adjustments for its NEOs, the Compensation Committee considers a combination of (i) peer group data, (ii) market data, including industry norms and benchmarking data from companies of similar size and scope and (iii) outstanding Company and individual performance. In general, the Compensation Committee targets the 25th to 50th percentile of the Companys peer group in determining base salaries.

The Board increased the CEO salary in 2021 in reflection of Mr. Nemeths individual performance and peer comparator group market data alignment. The other NEOs base salary increases were based on peer group data market alignment and individual performance contributions.

| 36 | PATRICK INDUSTRIES, INC

|

|

Table of Contents

| NAME | 2020 BASE SALARY ($) | 2021 BASE SALARY ($) | % INCREASE/DECREASE | |||||||||

| Todd M. Cleveland |

$600,000 | $600,000 | - | |||||||||

| Andy L. Nemeth |

675,000 | 750,000 | 11.1% | |||||||||

| Jeffrey M. Rodino (1) |

425,000 | 450,000 | 5.9% | |||||||||

| Kip B. Ellis |

450,000 | 475,000 | 5.6% | |||||||||

| Jacob R. Petkovich |

425,000 | 450,000 | 5.9% | |||||||||

| (1) | Mr. Rodinos base salary was further adjusted from $450,000 to $550,000 in July 2021 to reflect his promotion to President of the Company. |

Non-Equity Incentive Plan Awards

The short-term incentive portion of the 2021 compensation plan consists of annual non-equity incentive plan awards, which are reviewed and approved each year and are based on the Companys financial results and the individuals performance against defined objectives. Several key components were considered in the development of the 2021 STIP to align the STIP with shareholder interest by measuring the Companys financial performance and the individuals performance in support of the Companys short- and long-term strategies. The components are noted on page 32.

The STI metric components for 2021 are as follows:

| 2021 STIP AWARD COMPONENT ($ in millions) | THRESHOLD PERFORMANCE |

TARGET PERFORMANCE |

MAXIMUM PERFORMANCE |

|||

| Company Performance (Net Income) (1) |

$110.3 | $147.0 | $169.1 | |||

| Individual Rating |

2.5 | 3.5 | 5.0 | |||

| Payout as a Percentage of Target Award |

50% | 100% | 200% | |||

| (1) | All net income targets are net of the contributions of 2021 acquisitions and certain one-time and non-recurring charges and credits. |

The Company achieved adjusted fiscal 2021 net income of $221.5 million (net of 2021 acquisitions and non-recurring charges and credits) which equated to 151% of the target Company performance. When combined with the individual performance rating for each NEO, the actual STIP award payouts for 2021 were as follows:

| NAME / BENEFIT | 2021 BASE SALARY |

TARGET AWARD AS % OF BASE |

TARGET STI AWARD |

ACTUAL AWARD AMOUNT AS A % OF TARGET AWARD |

ACTUAL 2021 STI AWARD PAYOUT |

|||||||||||||||

| Todd M. Cleveland |

$600,000 | 233% | $1,400,000 | 183% | $2,555,140 | |||||||||||||||

| Andy L. Nemeth |

750,000 | 227% | 1,700,000 | 185% | 3,145,000 | |||||||||||||||

| Jeffrey M. Rodino |

450,000 | 200% | 900,000 | 183% | 1,642,590 | |||||||||||||||

| Kip B. Ellis |

475,000 | 163% | 775,000 | 185% | 1,433,750 | |||||||||||||||

| Jacob R. Petkovich |

450,000 | 156% | 700,000 | 185% | 1,295,000 | |||||||||||||||

| (1) | The target award as a percentage of base salary for the NEOs was determined by the Compensation Committee and applied to the base salary in effect as of January 2021. The target award as a percentage of base salary was established for each NEO in 2021 in alignment with the Companys pay-for-differentiated-performance philosophy, market competitive positions for earned payout and further enhancement of the pay-at-risk for each NEO. |

| Notice of 2022 Annual Meeting of Shareholders & Proxy Statement

|

37 | |

Table of Contents

While these targets were used in fiscal year 2021, the Compensation Committee reserves the right to modify, cancel, change or reallocate any components of this calculation or criteria at any time.

Each NEOs individual performance rating takes into account four strategic performance objectives in assessing the personal performance of the NEOs named in the Summary Compensation Table for 2021. The four strategic objectives are specific for each NEO and are linked to the Companys strategic plan and that years organizational strategic agenda and include, among others: (1) improving the revenue and profitability of business units under the leadership and control of the NEO; (2) the introduction of new product lines and product line extensions to achieve target revenue growth levels and market share; (3) the ongoing evaluation of strategic opportunities related to our capital allocation strategy and the execution of those opportunities, as appropriate; and (4) objectives linked to developing and managing talent consistent with the Companys values and enhancing and developing the leadership capabilities of the Companys future leaders.

Messrs. Rodino, Ellis and Petkovich initially develop their own individual objectives for the plan year which are then reviewed and approved by the CEO. Messrs. Cleveland and Nemeth develop their own objectives for the plan year which are reviewed and approved by the Board.

In assessing the NEOs individual performance, the Compensation Committee is provided with detailed quantitative and qualitative documentation substantiating individual performance against each individual objective. The Compensation Committee looks to the CEOs performance assessments of the other NEOs (with the exception of Mr. Cleveland) and his recommendations regarding a performance rating for each, as well as input from the non-management Board members. These recommendations may be adjusted by the Compensation Committee prior to finalization. The personal performance assessment of our Executive Chairman and CEO are determined by the Compensation Committee with input from members of the Board.

While the achievement of corporate objectives is quantified with an individual rating, each NEOs relative contribution to those objectives is only one qualitative component against which the individuals performance is assessed by the Compensation Committee. Based upon their individual achievements, as evaluated by the Compensation Committee, and by the CEO for Messrs. Rodino, Ellis and Petkovich, the individual performance rating achieved by each of these four NEOs exceeded the target performance rating of 3.5 set by the Compensation Committee.

Long-Term Equity Incentive Plan

We believe that long-term incentive compensation represents an important and appropriate motivational tool to achieve certain long-term Company goals and closely align the interests of our management team with those of our shareholders. Our executive officers participate in our long-term incentive plan (LTIP) as a result of their ability to make a significant contribution to the Companys financial performance, their level of responsibility, their ability to meet performance objectives and their leadership potential and execution.

In 2021, the Compensation Committee adopted a Board approved pay-for-differentiated-performance based Long-Term Incentive Plan (2021 LTIP) for the NEOs. The 2021 LTIP utilizes a long-term incentive target award, which is established as a percentage of base compensation for each of the NEOs. The target award is comprised of a restricted share award (80% of which is Company performance-contingent and 20% of which is time-based). In determining the number of shares comprising the restricted share award, the target value of the restricted share component is divided by the stock price per share as established by the Board for the particular plan year, reflecting the trading price range of the common stock preceding the grant date ($70.00 for the 2021 LTIP award). The awarded target shares vest over a three-year time/performance period. Time-based shares cliff vest at the conclusion of the three-year period from the grant date. The performance-contingent shares are earned based on the achievement of three-year cumulative Company EBITDA performance (2021 to 2023) against target from 0% up to a maximum payout of 200% of target. The 2021 LTIP further reflects the Companys pay-for-differentiated-performance philosophy through its upside potential for performance in excess of target levels. For 2021, the target as a percentage of base compensation was increased for all NEOs, with the exception of Messrs. Cleveland and Ellis, in alignment with the Companys pay-for-differentiated-performance philosophy, market competitive positions for earned payout and the increased component of the pay-at-risk compensation for each NEO.

| 38 | PATRICK INDUSTRIES, INC

|

|

Table of Contents

The table below shows a sample calculation of 2021 LTIP award components:

| BASE SALARY | TARGET AWARD AS A % OF BASE SALARY |

TARGET AWARD (1,200 RESTRICTED SHARES @$70.00 PER SHARE) |

RESTRICTED SHARES TARGET AWARD: PERFORMANCE- CONTINGENT (80%) (SHARES @ $70.00 PER SHARE) |

RESTRICTED SHARES TARGET AWARD: TIME- BASED (20%) (SHARES @ $70.00 PER SHARE) |

||||

| $280,000 |

30% | $84,000 | 960 | 240 | ||||

The restricted share award is divided into (i) restricted shares with time-based vesting (Time-Based Shares) and (ii) restricted shares with performance-based vesting (Performance-Contingent Shares). The Compensation Committee believes that the use of Time-Based Shares and Performance-Contingent Shares aligns the NEOs focus with the Companys long-term financial performance objectives and assures that significant retention value of the granted equity is maintained for each NEO.

The threshold, target, stretch and maximum performance metrics for the 2021 LTIP are outlined below:

| PLAN COMPONENT |

THRESHOLD EBITDA PERFORMANCE (1) PAYOUT AS % OF TARGET |

TARGET EBITDA PERFORMANCE (1) PAYOUT AS % OF TARGET |

STRETCH EBITDA PERFORMANCE (1) PAYOUT AS % OF TARGET |

MAXIMUM EBITDA PERFORMANCE (1) PAYOUT AS % OF TARGET |

||||||||||||

| Time-Based Shared |

100 | % | 100 | % | 100 | % | 100 | % | ||||||||

| Performance-Contingent Shares |

50 | % | 100 | % | 150 | % | 200 | % | ||||||||

| (1) | The Company EBITDA performance is measured as the cumulative EBITDA achieved in 2021, 2022 and 2023. |

| Notice of 2022 Annual Meeting of Shareholders & Proxy Statement

|

39 | |

Table of Contents

The target 2021 LTIP award components for the NEOs, as approved by the Board in January 2021, were as follows:

| NAME |

TOTAL TARGET AWARD AS % OF BASE SALARY |

TOTAL TARGET AWARD ($) |

TOTAL TARGET AWARD (SHARES) |

TARGET TIME-BASED SHARE AWARD (SHARES) |

TARGET PERFORMANCE- CONTINGENT SHARE AWARD (SHARES) |

|||||||||||||||

|

Todd M. Cleveland |

250 | % | $1,500,000 | 21,429 | 4,286 | 17,143 | ||||||||||||||

|

Andy L. Nemeth |

373 | % | 2,800,000 | 40,000 | 8,000 | 32,000 | ||||||||||||||

|

Jeffrey M. Rodino (1) |

178 | % | 800,000 | 11,429 | 2,286 | 9,143 | ||||||||||||||

| Kip B. Ellis |

211 | % | 1,000,000 | 14,286 | 2,857 | 11,429 | ||||||||||||||

|

Jacob R. Petkovich |

189 | % | 850,000 | 12,143 | 2,429 | 9,714 | ||||||||||||||

| (1) | The Board approved an increase to Mr. Rodinos total target award from $800,000 to $1,200,000 in July 2021 upon his promotion to President of the Company. |

Individual NEO threshold, target, stretch and maximum payouts in shares for each long-term incentive component of the 2021 LTIP are outlined below:

| NAME |

THRESHOLD EBITDA PERFORMANCE COMPONENT AWARD (SHARES) |

TARGET EBITDA PERFORMANCE COMPONENT AWARD (SHARES) |

STRETCH EBITDA PERFORMANCE COMPONENT AWARD (SHARES) |

MAXIMUM EBITDA PERFORMANCE COMPONENT AWARD (SHARES) |

||||||||||||

| Time-Based Shares (1) (2) |

|

|||||||||||||||

|

Todd M. Cleveland |

4,286 | 4,286 | 4,286 | 4,286 | ||||||||||||

|

Andy L. Nemeth |

8,000 | 8,000 | 8,000 | 8,000 | ||||||||||||

|

Jeffrey M. Rodino |

2,286 | 2,286 | 2,286 | 2,286 | ||||||||||||

| Kip B. Ellis |

2,857 | 2,857 | 2,857 | 2,857 | ||||||||||||

|

Jacob R. Petkovich |

2,429 | 2,429 | 2,429 | 2,429 | ||||||||||||

| Performance-Contingent Shares (1) |

|

|||||||||||||||

|

Todd M. Cleveland |

8,572 | 17,143 | 25,715 | 34,286 | ||||||||||||

|

Andy L. Nemeth |

16,000 | 32,000 | 48,000 | 64,000 | ||||||||||||

|

Jeffrey M. Rodino |

4,572 | 9,143 | 13,715 | 18,286 | ||||||||||||

| Kip B. Ellis |

5,715 | 11,429 | 17,144 | 22,858 | ||||||||||||

|

Jacob R. Petkovich |

4,857 | 9,714 | 14,571 | 19,428 | ||||||||||||