EX-99.1

Published on September 8, 2022

September 2022 Investor Presentation 1 Investor Presentation September 2022

September 2022 Investor Presentation 2 FORWARD LOOKING STATEMENTS This presentation contains certain statements related to future results, our intentions, beliefs and expectations or predictions for the future which are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from either historical or anticipated results depending on a variety of factors. These risks and uncertainties include, but are not limited to, the impact of the continuing financial and operational uncertainty due to the COVID-19 pandemic, including its impact on the overall economy, our sales, customers, operations, team members and suppliers. Further information concerning the Company and its business, including factors that potentially could materially affect the Company’s financial results, is contained in the Company’s filings with the Securities and Exchange Commission. This presentation includes market and industry data, forecasts and valuations that have been obtained from independent consultant reports, publicly available information, various industry publications and other published industry sources. Although we believe these sources are reliable, we have not independently verified the information and cannot make any representation as to the accuracy or completeness of such information. We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained in this presentation or to reflect any change in our expectations after the date of this presentation or any change in events, conditions or circumstances on which any statement is based. Use of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. These measures, the purposes for which management uses them, why management believes they are useful to investors, and a reconciliation to the most directly comparable GAAP financial measures can be found in the Appendix of this presentation. All references to profit measures and earnings per share on a comparable basis exclude items that affect comparability.

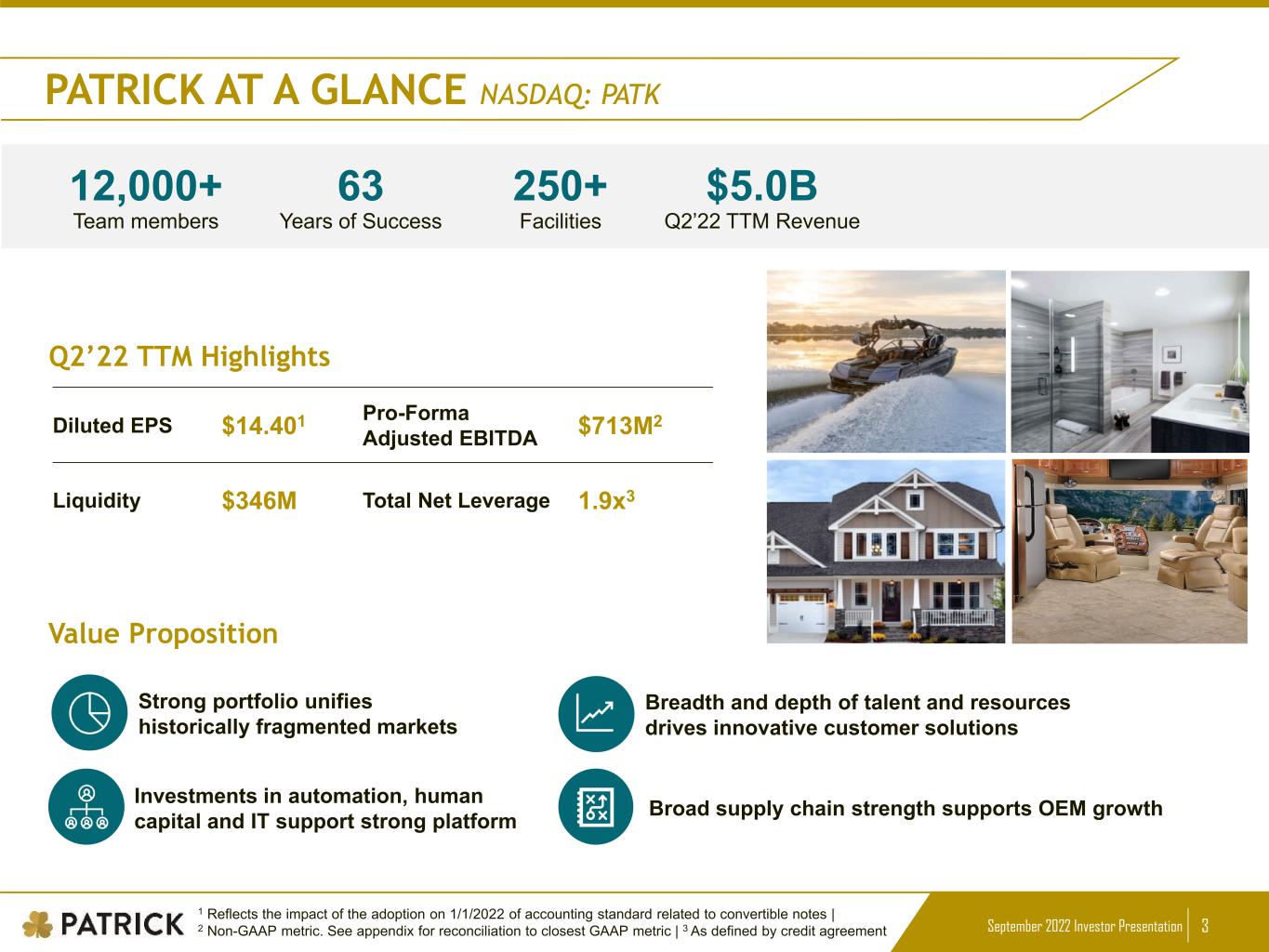

September 2022 Investor Presentation 3 Q2’22 TTM Highlights Team members 12,000+ Years of Success 63 Facilities 250+ Q2’22 TTM Revenue $5.0B Diluted EPS $14.401 Pro-Forma Adjusted EBITDA $713M2 Liquidity $346M Total Net Leverage 1.9x3 Strong portfolio unifies historically fragmented markets Investments in automation, human capital and IT support strong platform Breadth and depth of talent and resources drives innovative customer solutions Broad supply chain strength supports OEM growth Value Proposition PATRICK AT A GLANCE NASDAQ: PATK 1 Reflects the impact of the adoption on 1/1/2022 of accounting standard related to convertible notes | 2 Non-GAAP metric. See appendix for reconciliation to closest GAAP metric | 3 As defined by credit agreement

September 2022 Investor Presentation 4 Fulfilling customer visions of interior and exterior dream homes Nationwide manufacturing and distribution footprint allows Patrick to provide products to entire U.S. more efficiently than other competitors Aligned with long-term secular growth in housing starts Home improvement and DIY activity driven by work-from-anywhere environment Largest OEMs rely on Patrick for high degree of content Breadth of offering to provide packaged solutions not offered by competitors Our extensive supply chain helps us support the explosive growth in the leisure lifestyle markets Fully integrated into manufacturers’ design process Highly engineered and specialized products offer differentiated solutions to OEMs Growing aftermarket platform and powersports market 59% Q2’22 TTM revenue RV Marine 18% Q2’22 TTM revenue Manufactured Housing 13% Q2’22 TTM revenue Industrial 10% Q2’22 TTM revenue DIVERSIFIED MARKET PLATFORM

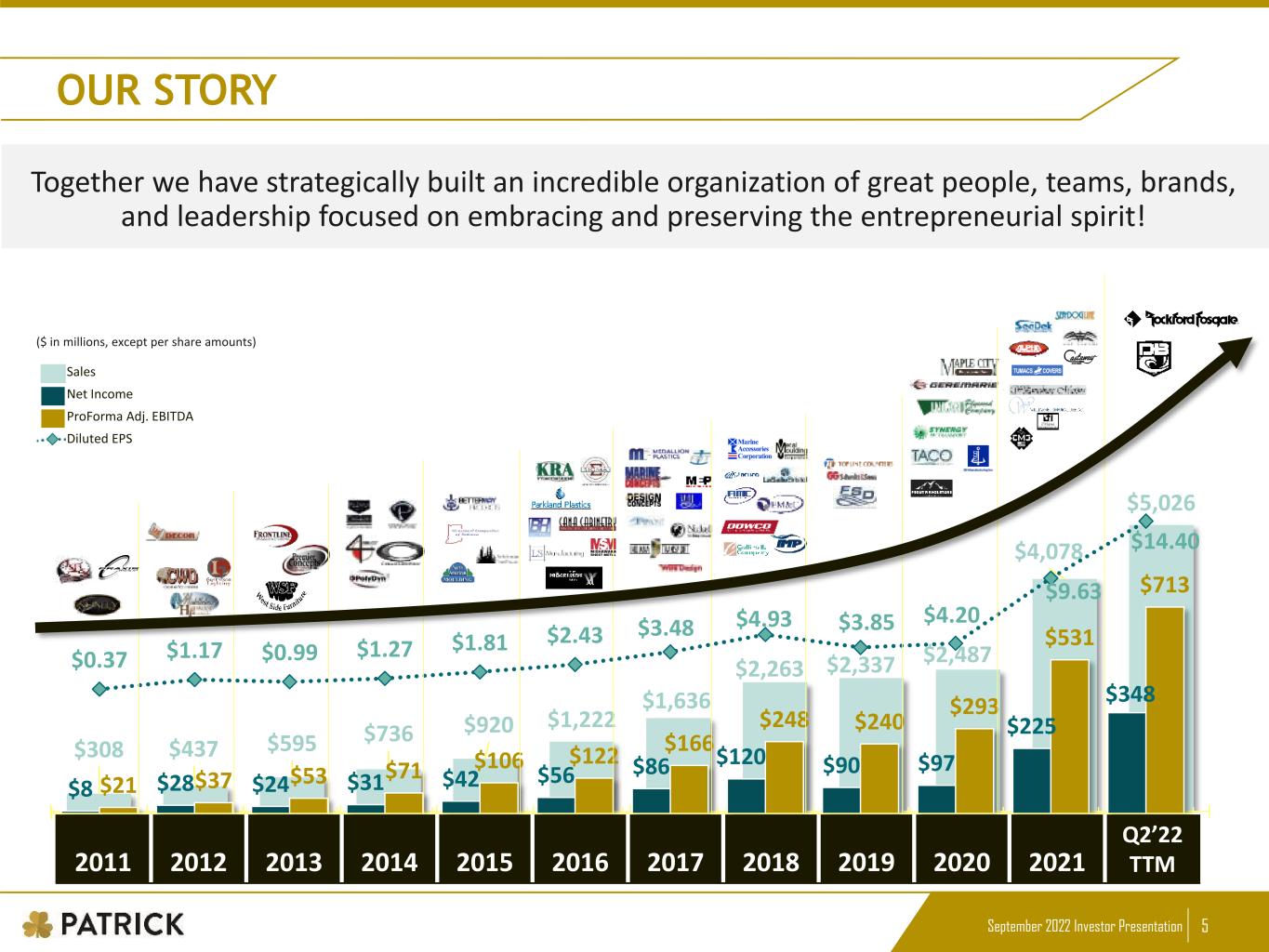

September 2022 Investor Presentation 5 $308 $437 $595 $736 $920 $1,222 $1,636 $2,263 $2,337 $2,487 $4,078 $5,026 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 LTM $8 $28 $24 $31 $42 $56 $86 $120 $90 $97 $225 $348 $21 $37 $53 $71 $106 $122 $166 $248 $240 $293 $531 $713 $0.37 $1.17 $0.99 $1.27 $1.81 $2.43 $3.48 $4.93 $3.85 $4.20 $9.63 $14.40 2014 2015 2016 2017 2018 2019 2020 2021 ltm OUR STORY Together we have strategically built an incredible organization of great people, teams, brands, and leadership focused on embracing and preserving the entrepreneurial spirit! Sales Net Income ProForma Adj. EBITDA Diluted EPS ($ in millions, except per share amounts) 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Q2’22 TTM

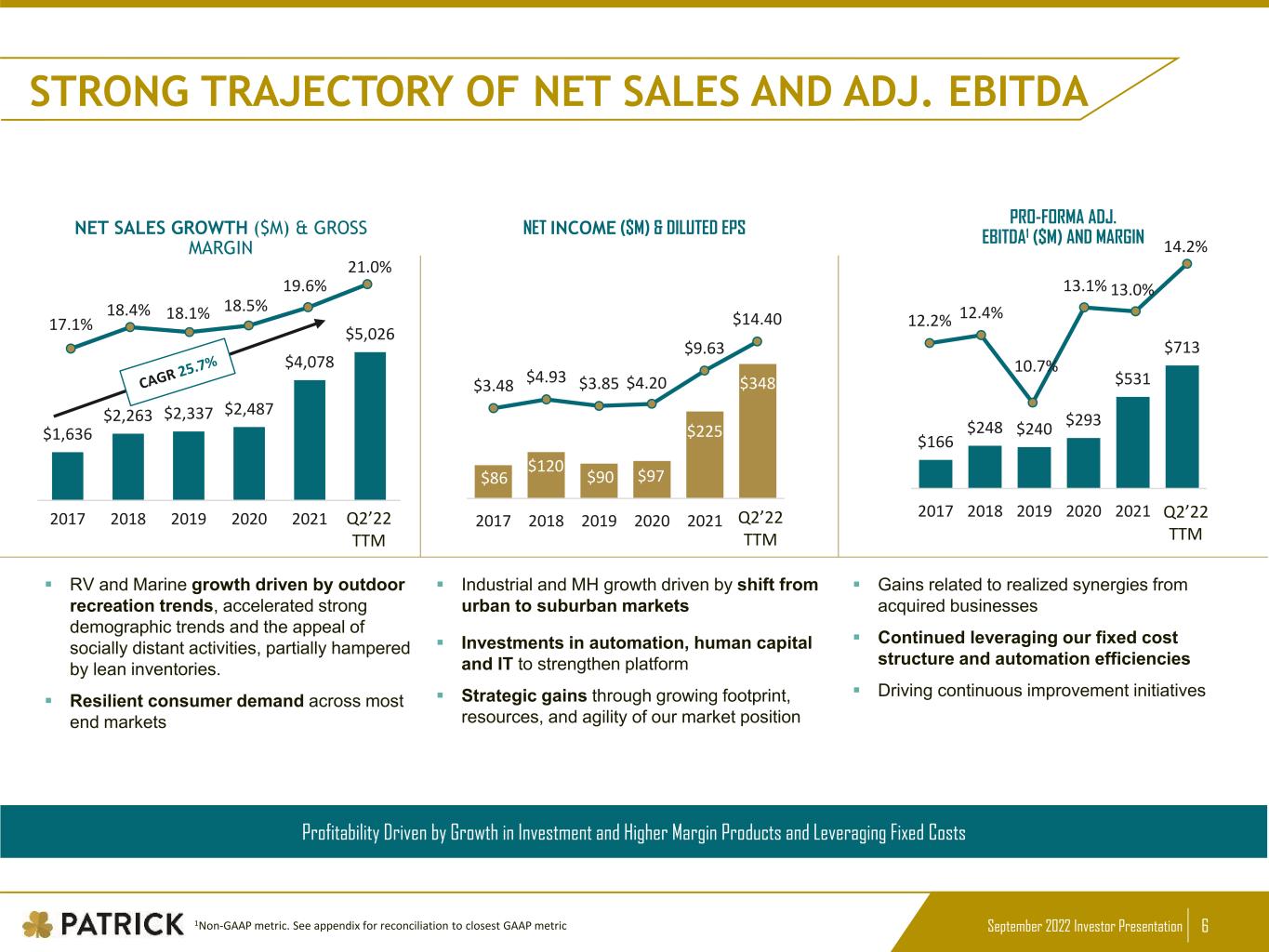

September 2022 Investor Presentation 6 17.1% 18.4% 18.1% 18.5% 19.6% 21.0% 12.2% 12.4% 10.7% 13.1% 13.0% 14.2% STRONG TRAJECTORY OF NET SALES AND ADJ. EBITDA NET SALES GROWTH ($M) & GROSS MARGIN NET INCOME ($M) & DILUTED EPS PRO-FORMA ADJ. EBITDA1 ($M) AND MARGIN $1,636 $2,263 $2,337 $2,487 $4,078 $5,026 2017 2018 2019 2020 2021 Q2'22… $86 $120 $90 $97 $225 $348 2017 2018 2019 2020 2021 Q1'22… $3.48 $4.93 $3.85 $4.20 $9.63 $14.40 $166 $248 $240 $293 $531 $713 $0 $100 $200 $300 $400 $500 $600 $700 $800 2017 2018 2019 2020 2021 Q1'22 TTM Profitability Driven by Growth in Investment and Higher Margin Products and Leveraging Fixed Costs ’ TTM 2’22 TTM 2’22 T 1Non-GAAP metric. See appendix for reconciliation to closest GAAP metric RV and Marine growth driven by outdoor recreation trends, accelerated strong demographic trends and the appeal of socially distant activities, partially hampered by lean inventories. Resilient consumer demand across most end markets Industrial and MH growth driven by shift from urban to suburban markets Investments in automation, human capital and IT to strengthen platform Strategic gains through growing footprint, resources, and agility of our market position Gains related to realized synergies from acquired businesses Continued leveraging our fixed cost structure and automation efficiencies Driving continuous improvement initiatives

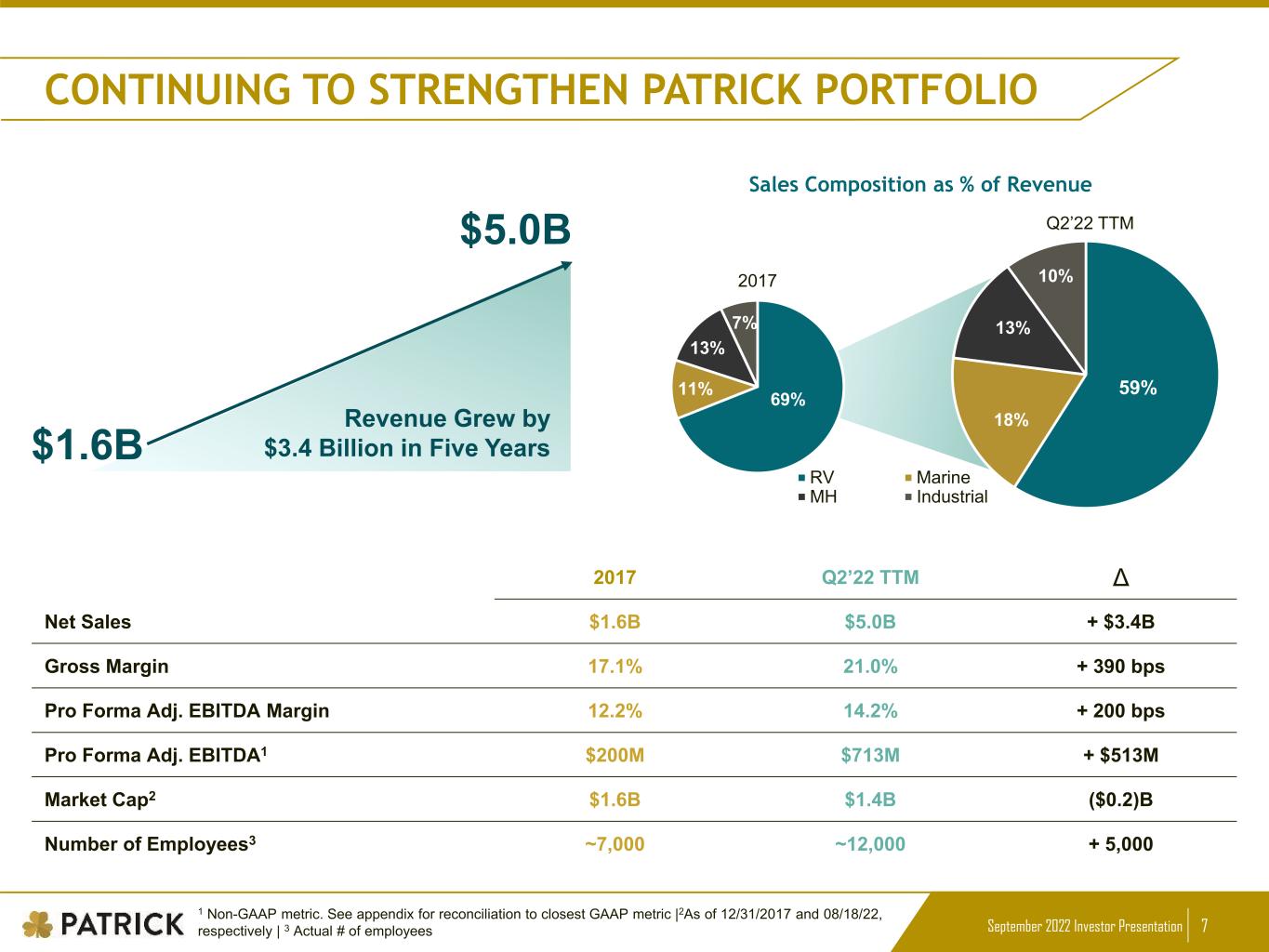

September 2022 Investor Presentation 7 Sales Composition as % of Revenue 69%11% 13% 7% 2017 RV Ind. $5.0B Revenue Grew by $3.4 Billion in Five Years 2017 Q2’22 TTM Δ Net Sales $1.6B $5.0B + $3.4B Gross Margin 17.1% 21.0% + 390 bps Pro Forma Adj. EBITDA Margin 12.2% 14.2% + 200 bps Pro Forma Adj. EBITDA1 $200M $713M + $513M Market Cap2 $1.6B $1.4B ($0.2)B Number of Employees3 ~7,000 ~12,000 + 5,000 CONTINUING TO STRENGTHEN PATRICK PORTFOLIO 1 Non-GAAP metric. See appendix for reconciliation to closest GAAP metric |2As of 12/31/2017 and 08/18/22, respectively | 3 Actual # of employees $1.6B 59% 18% 13% 10% RV Marine MH Industrial Q2’22 TTM

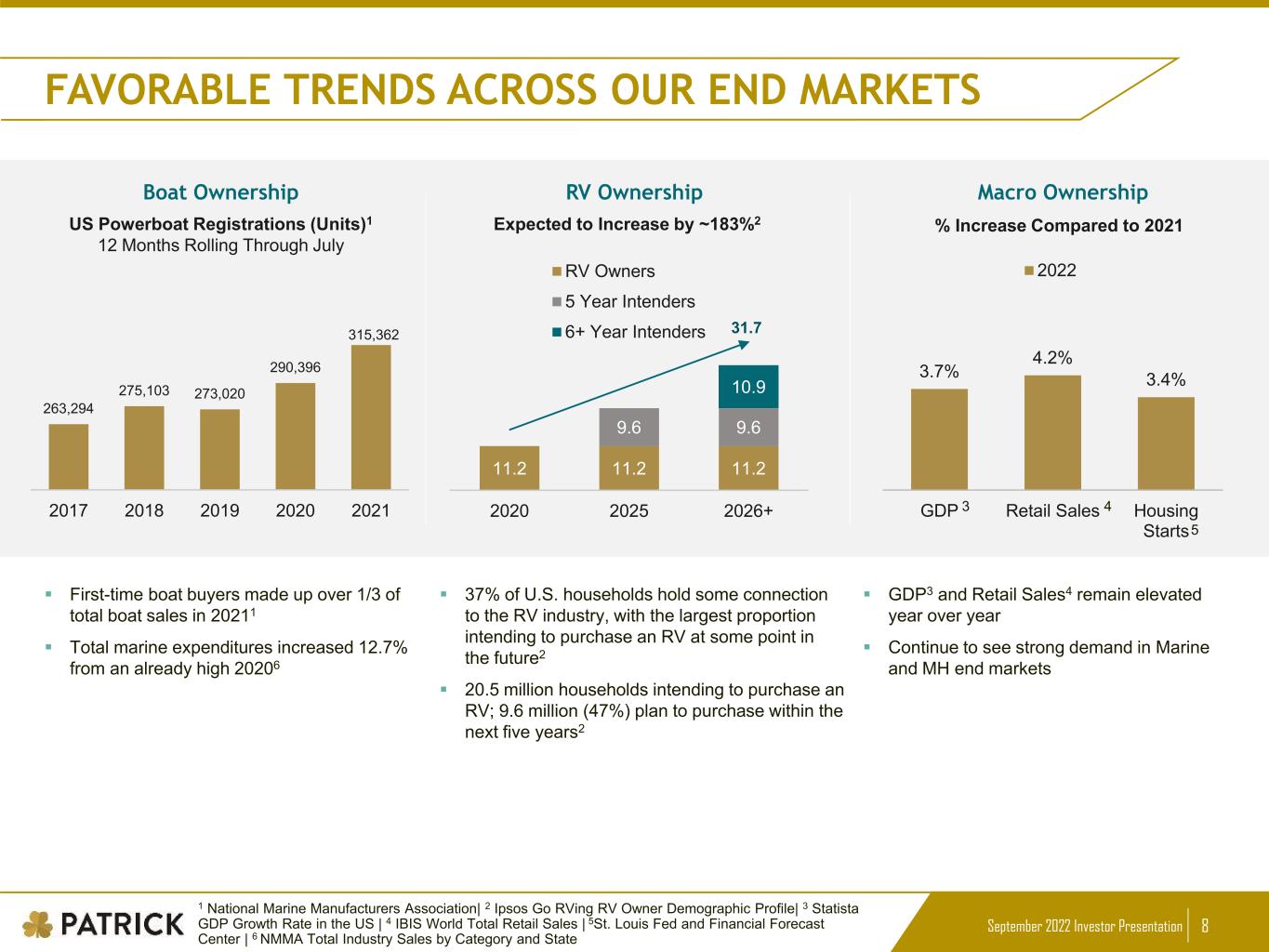

September 2022 Investor Presentation 8 Boat Ownership RV Ownership Macro Ownership 263,294 275,103 273,020 290,396 315,362 2017 2018 2019 2020 2021 11.2 11.2 11.2 9.6 9.6 10.9 0 5 10 15 20 25 30 35 2020 2025 2026+ RV Owners 5 Year Intenders 6+ Year Intenders 3.7% 4.2% 3.4% 0% 1% 2% 3% 4% 5% GDP Retail Sales Housing Starts 2022 Expected to Increase by ~183%2US Powerboat Registrations (Units)1 12 Months Rolling Through July 31.7 % Increase Compared to 2021 3 4 5 First-time boat buyers made up over 1/3 of total boat sales in 20211 Total marine expenditures increased 12.7% from an already high 20206 37% of U.S. households hold some connection to the RV industry, with the largest proportion intending to purchase an RV at some point in the future2 20.5 million households intending to purchase an RV; 9.6 million (47%) plan to purchase within the next five years2 GDP3 and Retail Sales4 remain elevated year over year Continue to see strong demand in Marine and MH end markets FAVORABLE TRENDS ACROSS OUR END MARKETS 1 National Marine Manufacturers Association| 2 Ipsos Go RVing RV Owner Demographic Profile| 3 Statista GDP Growth Rate in the US | 4 IBIS World Total Retail Sales | 5St. Louis Fed and Financial Forecast Center | 6 NMMA Total Industry Sales by Category and State

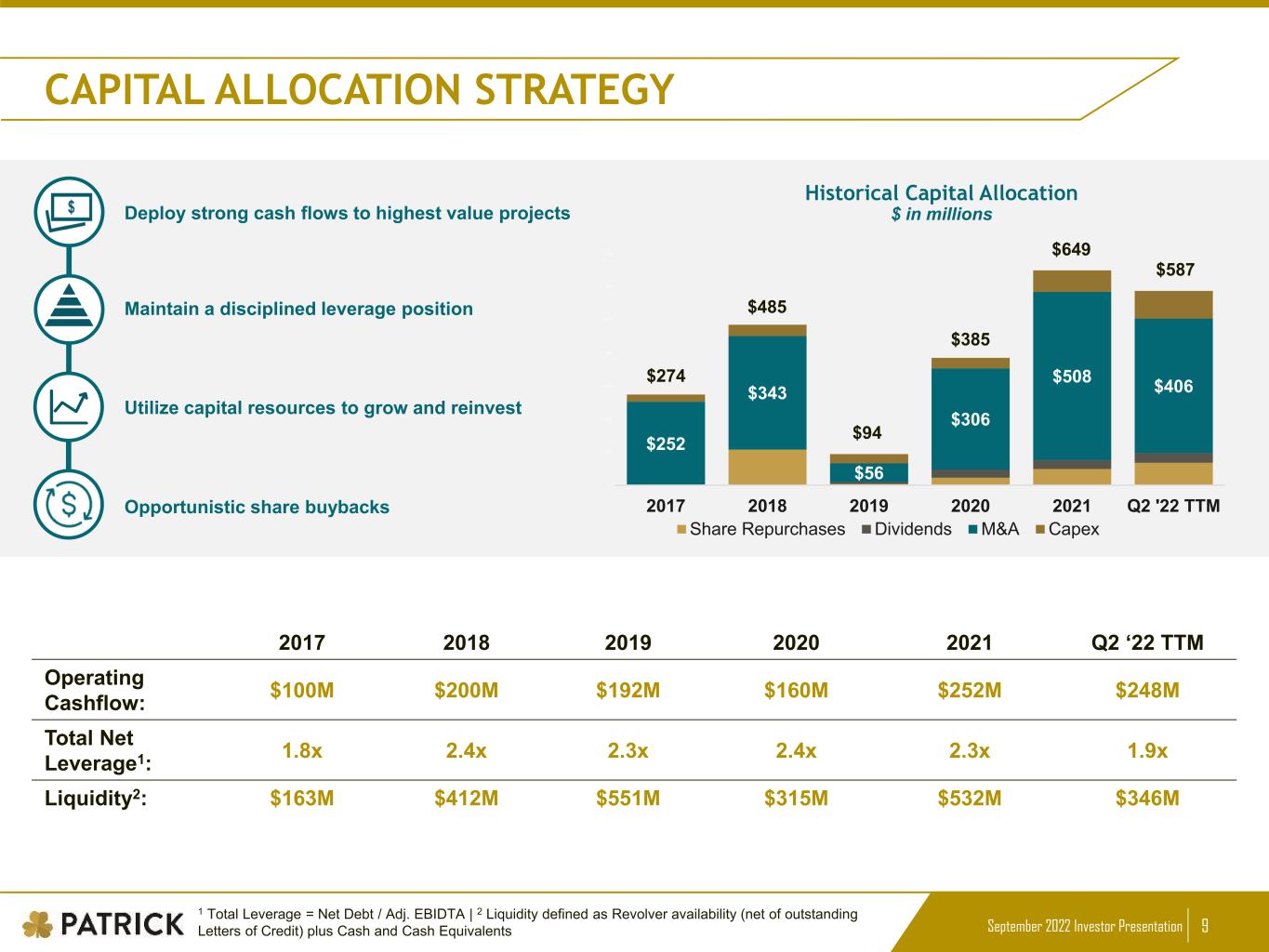

September 2022 Investor Presentation 9 Historical Capital Allocation $ in millions 2017 2018 2019 2020 2021 Q2 ‘22 TTM Operating Cashflow: $100M $200M $192M $160M $252M $248M Total Net Leverage1: 1.8x 2.4x 2.3x 2.4x 2.3x 1.9x Liquidity2: $163M $412M $551M $315M $532M $346M Deploy strong cash flows to highest value projects Maintain a disciplined leverage position Utilize capital resources to grow and reinvest Opportunistic share buybacks $252 $343 $56 $306 $508 $406 $0 $100 $200 $300 $400 $500 $600 $700 2017 2018 2019 2020 2021 Q2 '22 TTM Share Repurchases Dividends M&A Capex $274 $485 $94 $385 $649 Total $587 CAPITAL ALLOCATION STRATEGY 1 Total Leverage = Net Debt / Adj. EBIDTA | 2 Liquidity defined as Revolver availability (net of outstanding Letters of Credit) plus Cash and Cash Equivalents

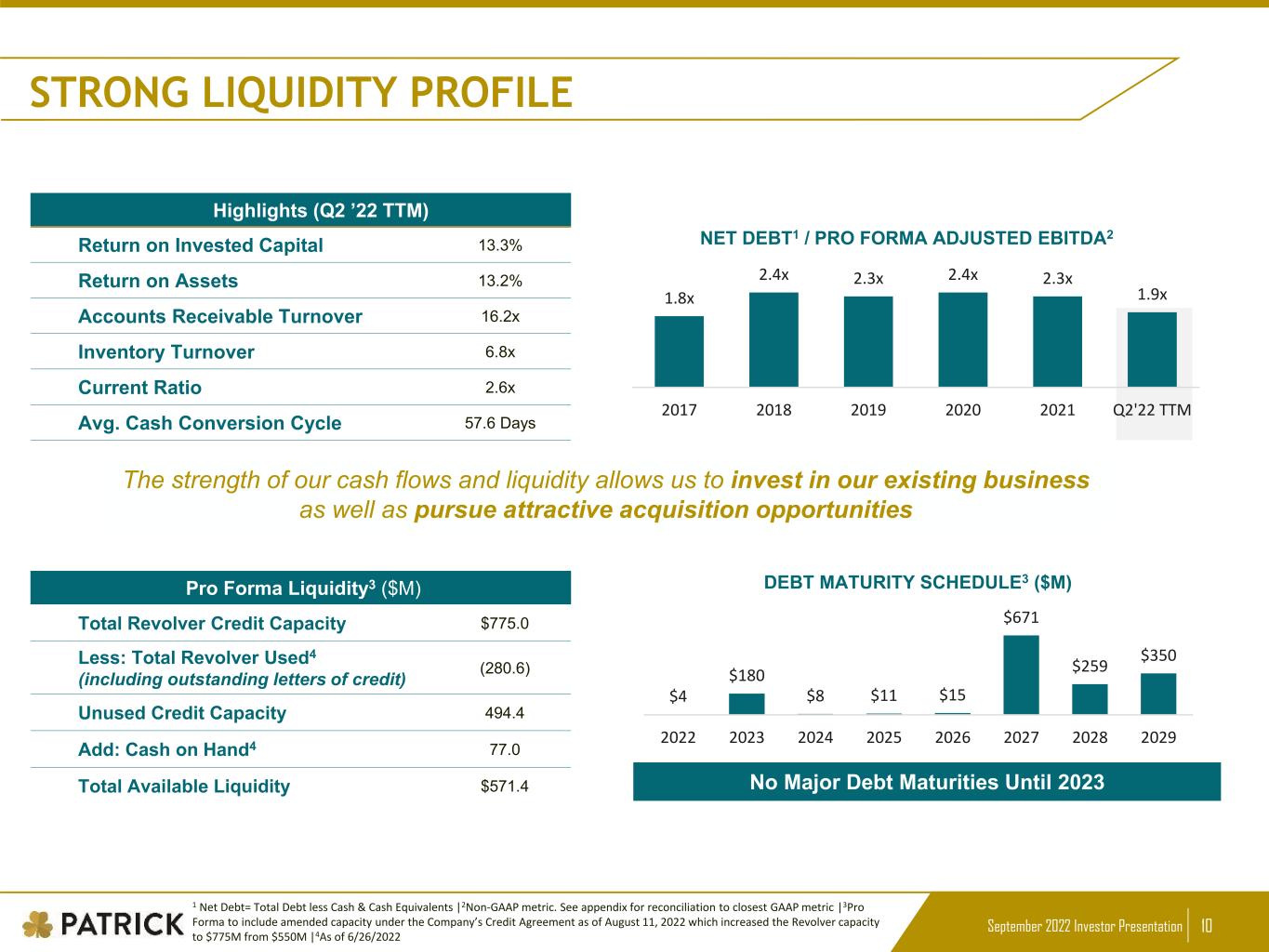

September 2022 Investor Presentation 10 STRONG LIQUIDITY PROFILE Pro Forma Liquidity3 ($M) Total Revolver Credit Capacity $775.0 Less: Total Revolver Used4 (including outstanding letters of credit) (280.6) Unused Credit Capacity 494.4 Add: Cash on Hand4 77.0 Total Available Liquidity $571.4 Highlights (Q2 ’22 TTM) Return on Invested Capital 13.3% Return on Assets 13.2% Accounts Receivable Turnover 16.2x Inventory Turnover 6.8x Current Ratio 2.6x Avg. Cash Conversion Cycle 57.6 Days The strength of our cash flows and liquidity allows us to invest in our existing business as well as pursue attractive acquisition opportunities NET DEBT1 / PRO FORMA ADJUSTED EBITDA2 1.8x 2.4x 2.3x 2.4x 2.3x 1.9x 2017 2018 2019 2020 2021 Q2'22 TTM No Major Debt Maturities Until 2023 $4 $180 $8 $11 $15 $671 $259 $350 2022 2023 2024 2025 2026 2027 2028 2029 DEBT MATURITY SCHEDULE3 ($M) 1 Net Debt= Total Debt less Cash & Cash Equivalents |2Non-GAAP metric. See appendix for reconciliation to closest GAAP metric |3Pro Forma to include amended capacity under the Company’s Credit Agreement as of August 11, 2022 which increased the Revolver capacity to $775M from $550M |4As of 6/26/2022

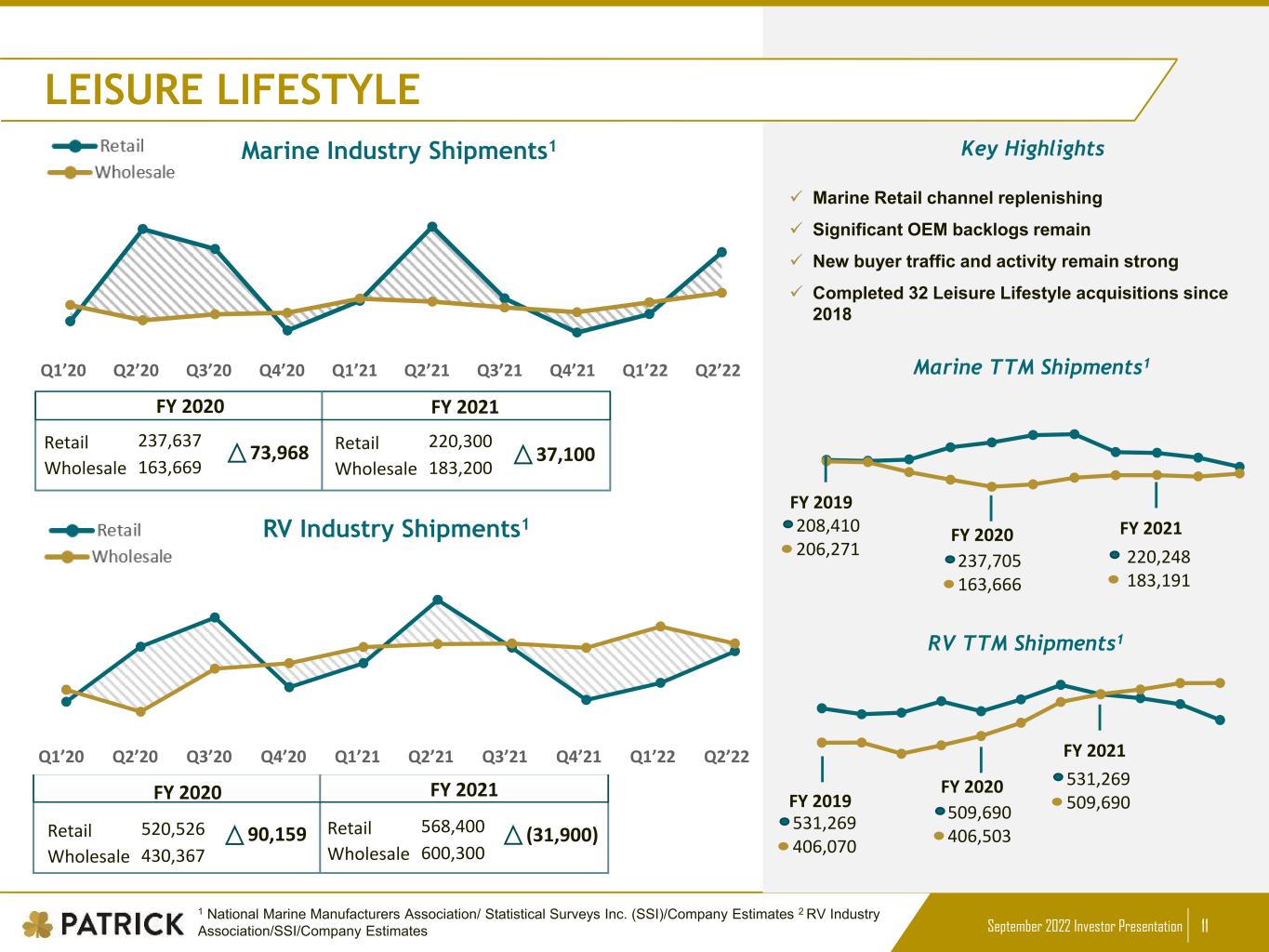

September 2022 Investor Presentation 11 Retail Wholesale 237,637 FY 2020 163,669 Marine Retail channel replenishing Significant OEM backlogs remain New buyer traffic and activity remain strong Completed 32 Leisure Lifestyle acquisitions since 2018 LEISURE LIFESTYLE 1 National Marine Manufacturers Association/ Statistical Surveys Inc. (SSI)/Company Estimates 2 RV Industry Association/SSI/Company Estimates Q1’20 Q2’20 Q3’20 Q4’20 Q1’21 Q2’21 Q3’21 Q4’21 Q1’22 Q2’22 FY 2021 Marine Industry Shipments1 FY 2020 Q1’20 Q2’20 Q3’20 Q4’20 Q1’21 Q2’21 Q3’21 Q4’21 Q1’22 Q2’22 FY 2021 RV Industry Shipments1 Marine TTM Shipments1 208,410 237,705 220,248 73,968 Retail Wholesale 220,300 183,200 37,100 Retail Wholesale 520,526 430,367 90,159 Retail Wholesale 568,400 600,300 (31,900) 206,271 163,666 183,191 RV TTM Shipments1 FY 2019 FY 2020 FY 2021 531,269 509,690 531,269 406,070 406,503 509,690FY 2019 FY 2020 FY 2021 Key Highlights

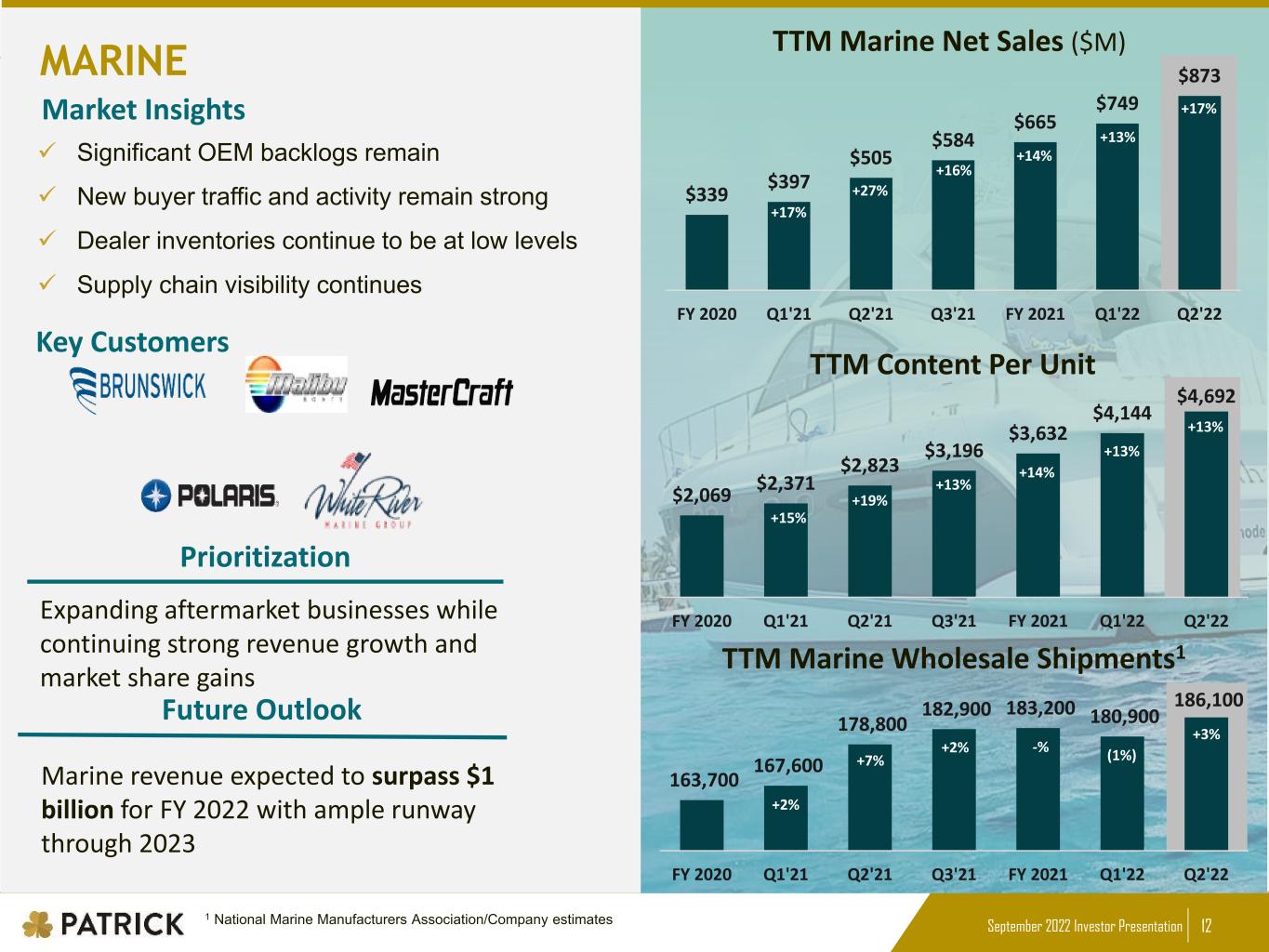

September 2022 Investor Presentation 12 MARINE TTM Marine Net Sales ($M) TTM Content Per Unit MARINE arket Insights Significant OEM backlogs remain New buyer traffic and activity remain strong Dealer inventories continue to be at low levels Supply chain visibility continues Key Customers Prioritization Future Outlook Marine revenue expected to surpass $1 billion for FY 2022 with ample runway through 2023 Expanding aftermarket businesses while continuing strong revenue growth and market share gains $2,069 $2,371 $2,823 $3,196 $3,632 $4,144 $4,692 FY 2020 Q1'21 Q2'21 Q3'21 FY 2021 Q1'22 Q2'22 $339 $397 $505 $584 $665 $749 $873 FY 2020 Q1'21 Q2'21 Q3'21 FY 2021 Q1'22 Q2'22 163,700 167,600 178,800 182,900 183,200 180,900 186,100 FY 2020 Q1'21 Q2'21 Q3'21 FY 2021 Q1'22 Q2'22 TTM Marine Wholesale Shipments1 +17% +27% +16% +14% +13% +17% +15% +19% +13% +14% +13% +13% +2% +7% +2% -% (1%) +3% 1 National Marine Manufacturers Association/Company estimates

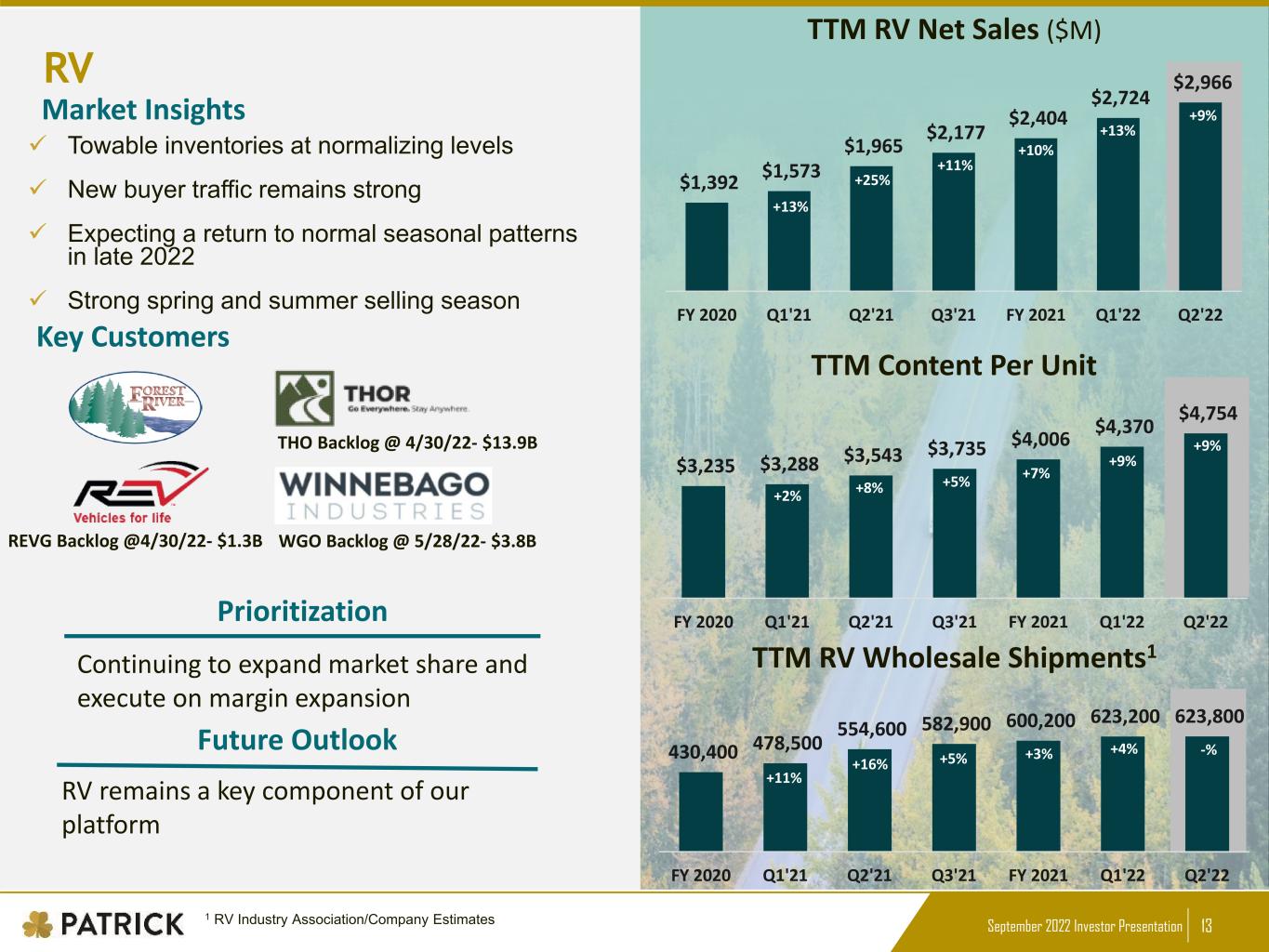

September 2022 Investor Presentation 13 MARINE RV arket Insights Key Customers Prioritization Future Outlook Towable inventories at normalizing levels New buyer traffic remains strong Expecting a return to normal seasonal patterns in late 2022 Strong spring and summer selling season RV remains a key component of our platform Continuing to expand market share and execute on margin expansion THO Backlog @ 4/30/22- $13.9B WGO Backlog @ 5/28/22- $3.8BREVG Backlog @4/30/22- $1.3B TTM RV Net Sales ($M) TTM Content Per Unit $3,235 $3,288 $3,543 $3,735 $4,006 $4,370 $4,754 FY 2020 Q1'21 Q2'21 Q3'21 FY 2021 Q1'22 Q2'22 $1,392 $1,573 $1,965 $2,177 $2,404 $2,724 $2,966 FY 2020 Q1'21 Q2'21 Q3'21 FY 2021 Q1'22 Q2'22 430,400 478,500 554,600 582,900 600,200 623,200 623,800 FY 2020 Q1'21 Q2'21 Q3'21 FY 2021 Q1'22 Q2'22 TTM RV Wholesale Shipments1 +13% +25% +11% +10% +13% +9% +2% +8% +5% +7% +9% +9% +11% +16% +5% +3% +4% -% 1 RV Industry Association/Company Estimates

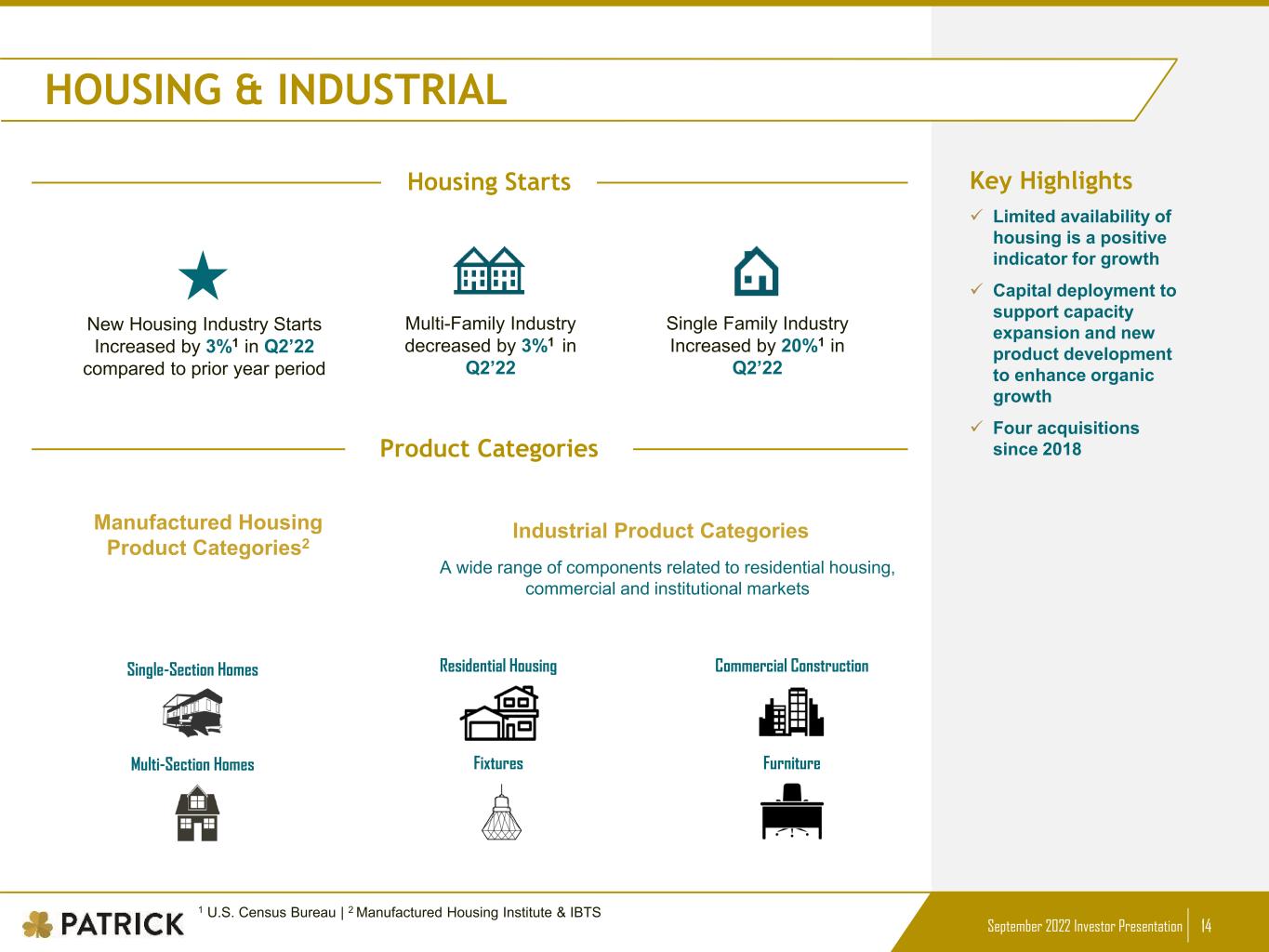

September 2022 Investor Presentation 14 Key Highlights Limited availability of housing is a positive indicator for growth Capital deployment to support capacity expansion and new product development to enhance organic growth Four acquisitions since 2018 Residential Housing Commercial Construction Fixtures Furniture Single-Section Homes Multi-Section Homes New Housing Industry Starts Increased by 3%1 in Q2’22 compared to prior year period Multi-Family Industry decreased by 3%1 in Q2’22 Single Family Industry Increased by 20%1 in Q2’22 Housing Starts Product Categories Manufactured Housing Product Categories2 Industrial Product Categories A wide range of components related to residential housing, commercial and institutional markets 1 U.S. Census Bureau | 2 Manufactured Housing Institute & IBTS HOUSING & INDUSTRIAL

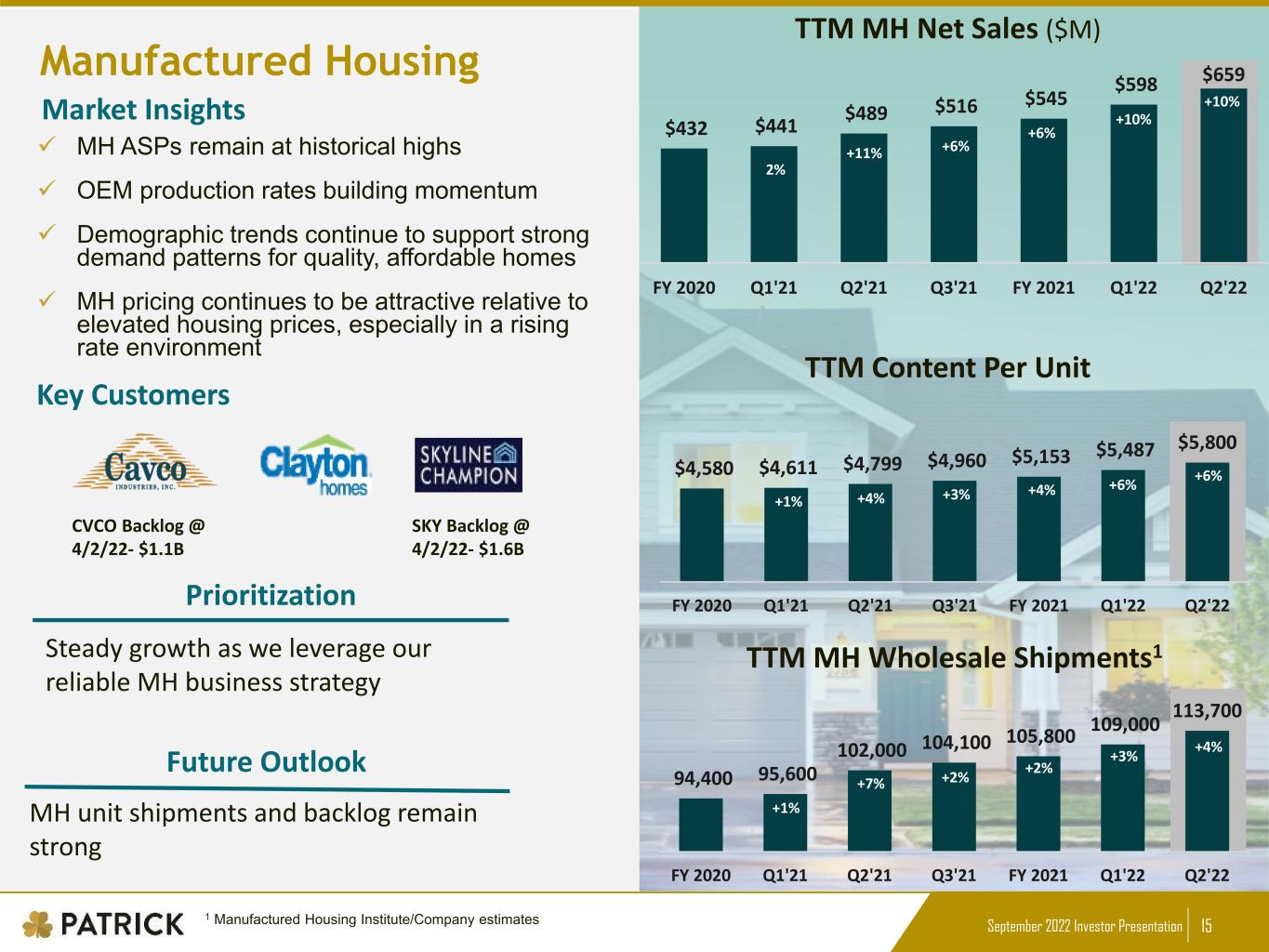

September 2022 Investor Presentation 15 MARINE Manufactured Housing arket Insights Key Customers Prioritization Future Outlook TTM MH Net Sales ($M) MH ASPs remain at historical highs OEM production rates building momentum Demographic trends continue to support strong demand patterns for quality, affordable homes MH pricing continues to be attractive relative to elevated housing prices, especially in a rising rate environment $432 $441 $489 $516 $545 $598 $659 FY 2020 Q1'21 Q2'21 Q3'21 FY 2021 Q1'22 Q2'22 $4,580 $4,611 $4,799 $4,960 $5,153 $5,487 $5,800 FY 2020 Q1'21 Q2'21 Q3'21 FY 2021 Q1'22 Q2'22 TTM Content Per Unit MH unit shipments and backlog remain strong Steady growth as we leverage our reliable MH business strategy CVCO Backlog @ 4/2/22- $1.1B SKY Backlog @ 4/2/22- $1.6B 2% +11% +6% +6% +10% +10% +1% +4% +3% +4% +6% +6% 94,400 95,600 102,000 104,100 105,800 109,000 113,700 FY 2020 Q1'21 Q2'21 Q3'21 FY 2021 Q1'22 Q2'22 TTM MH Wholesale Shipments1 +1% +7% +2% +2% +3% +4% 1 Manufactured Housing Institute/Company estimates

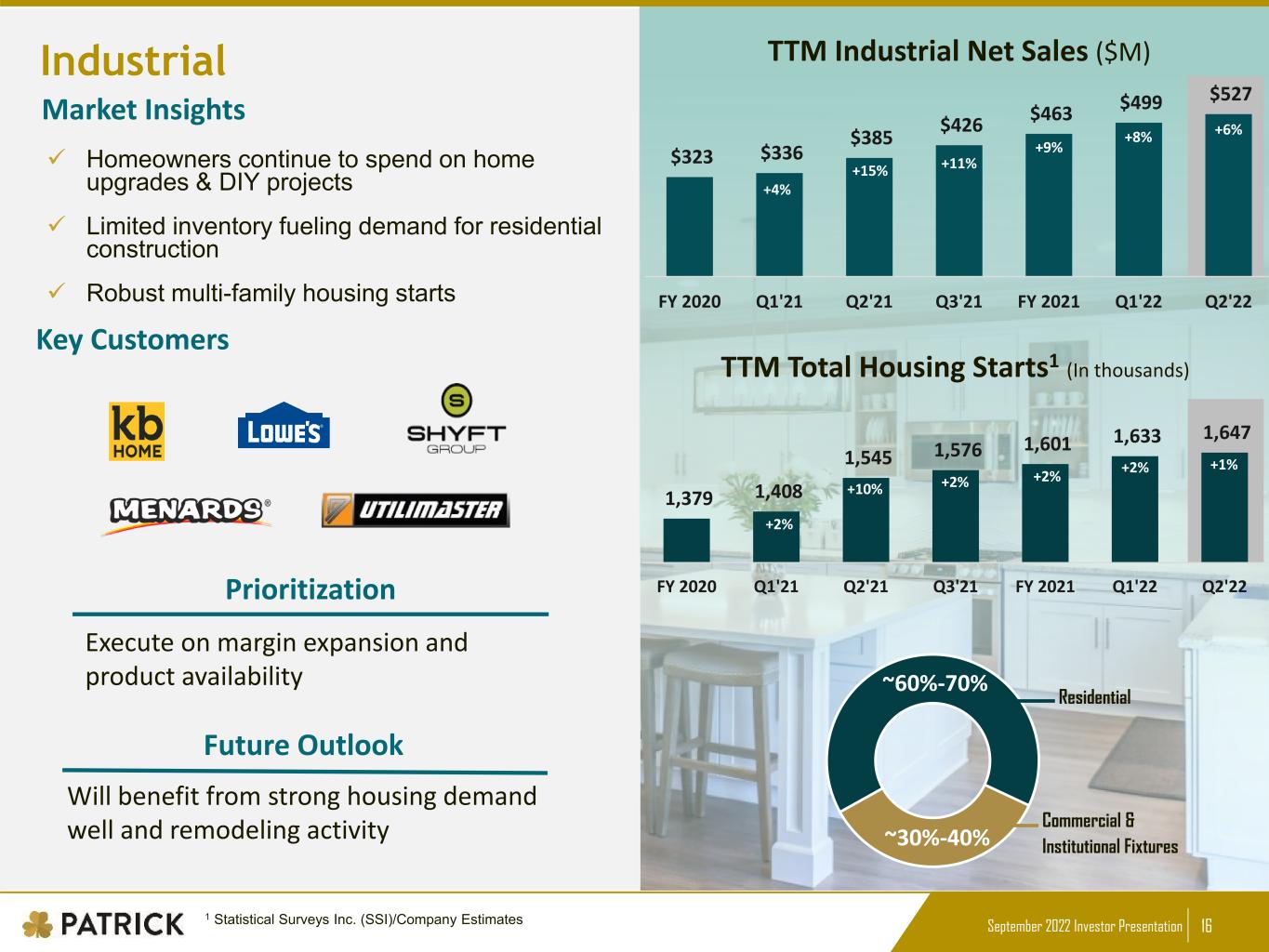

September 2022 Investor Presentation 16 MARINE Industrial arket Insights Key Customers Prioritization Future Outlook TTM Industrial Net Sales ($M) Homeowners continue to spend on home upgrades & DIY projects Limited inventory fueling demand for residential construction Robust multi-family housing starts ~60%-70% ~30%-40% Commercial & Institutional Fixtures Residential $323 $336 $385 $426 $463 $499 $527 FY 2020 Q1'21 Q2'21 Q3'21 FY 2021 Q1'22 Q2'22 Will benefit from strong housing demand well and remodeling activity Execute on margin expansion and product availability +4% +15% +11% +9% +8% +6% 1,379 1,408 1,545 1,576 1,601 1,633 1,647 FY 2020 Q1'21 Q2'21 Q3'21 FY 2021 Q1'22 Q2'22 TTM Total Housing Starts1 (In thousands) +2% +10% +2% +2% +2% +1% 1 Statistical Surveys Inc. (SSI)/Company Estimates

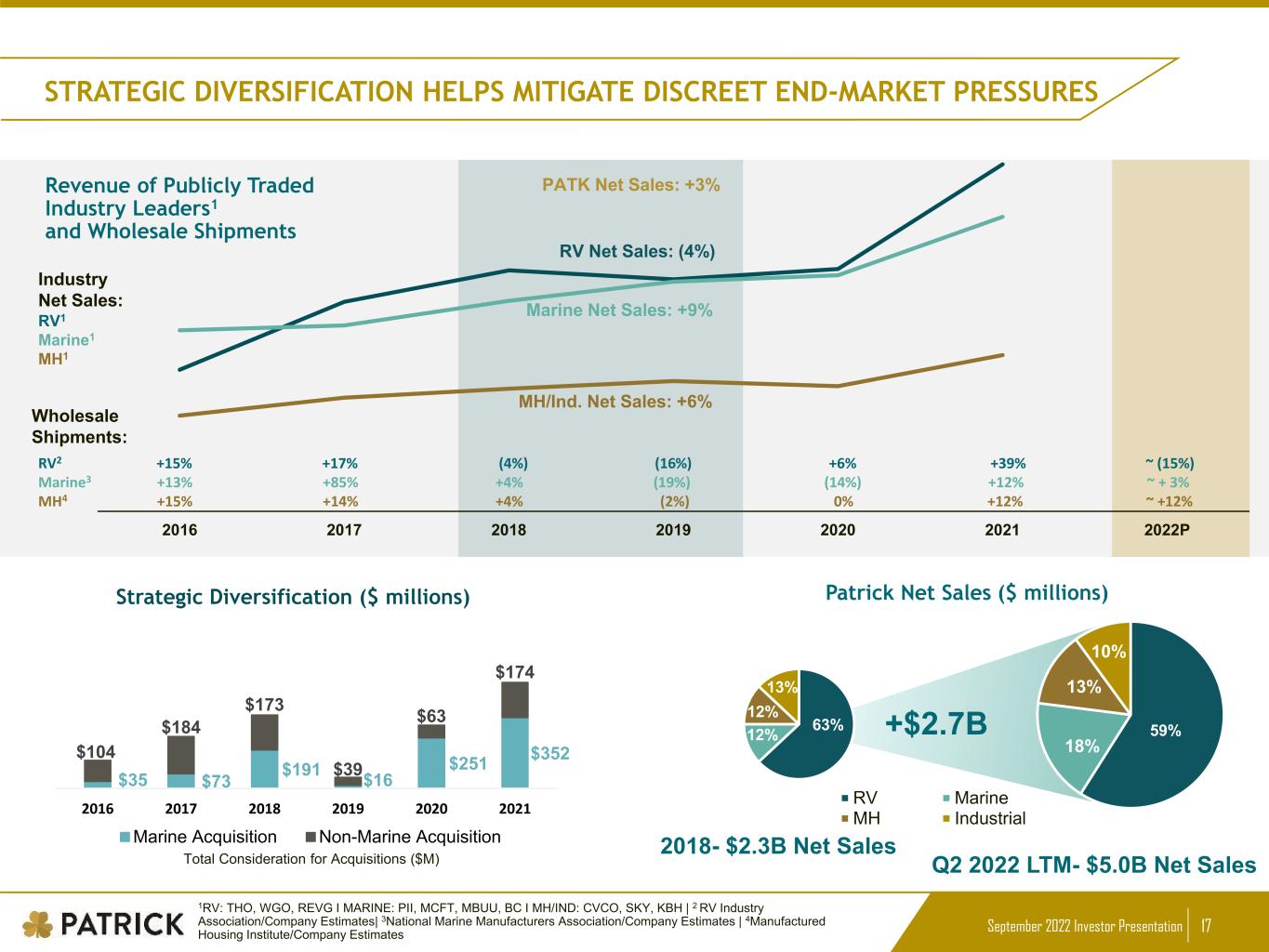

September 2022 Investor Presentation 17 2016 2017 2018 2019 2020 2021 2022P Patrick Net Sales ($ millions) RV Net Sales: (4%) Marine Net Sales: +9% MH/Ind. Net Sales: +6% PATK Net Sales: +3% Wholesale Shipments: Revenue of Publicly Traded Industry Leaders1 and Wholesale Shipments Industry Net Sales: RV1 Marine1 MH1 Strategic Diversification ($ millions) Total Consideration for Acquisitions ($M) STRATEGIC DIVERSIFICATION HELPS MITIGATE DISCREET END-MARKET PRESSURES $35 $73 $191 $16 $251 $352$104 $184 $173 $39 $63 $174 2016 2017 2018 2019 2020 2021 Marine Acquisition Non-Marine Acquisition 59% 18% 13% 10% RV Marine MH Industrial 63%12% 12% 13% +$2.7B 1RV: THO, WGO, REVG I MARINE: PII, MCFT, MBUU, BC I MH/IND: CVCO, SKY, KBH | 2 RV Industry Association/Company Estimates| 3National Marine Manufacturers Association/Company Estimates | 4Manufactured Housing Institute/Company Estimates 2018- $2.3B Net Sales Q2 2022 LTM- $5.0B Net Sales RV2 +15% +17% (4%) (16%) +6% +39% ~ (15%) Marine3 +13% +85% +4% (19%) (14%) +12% ~ + 3% MH4 +15% +14% +4% (2%) 0% +12% ~ +12%

September 2022 Investor Presentation 18 Publication of first sustainability report targeted for year-end 2022 Governance In 2021, Just in our RV facilities, we Recycled and Upcycled: Over 46,000 tons of wood product 8 million pounds of plastic 11 million pounds of aluminum 1 million pounds of steel A reduction of VOC emissions by 20% for every location that adopted a new technology initiative we are rolling out. Environmental Social Pioneer Partner for Care Camps Supporting numerous charitable organizations in local communities: Elkhart Community Foundation RV industry production associate skills training program Boys & Girls Clubs in Elkhart and neighboring towns Military Makeover house remodel for military veteran Recruiting recent college graduates for Leadership Development Program IMPACT Enhancing and expanding ESG Policies to best practice standards Development of Vendor Code of Conduct to assess social and environmental responsibility Committed to board diversity to enhance oversight ESG: CURRENT AND UPCOMING INITIATIVES

September 2022 Investor Presentation 19 LEADERSHIP WITH DEEP INDUSTRY EXPERIENCE Andy Nemeth CEO Jeff Rodino President Jake Petkovich CFO Kip Ellis COO 30 years Industry experience 28 years Industry experience 26 years Industry experience 25 years Industry experience 100+ years of industry experience spanning across multiple economic cycles Management team is adaptable and experienced during economic changes Proven ability to manage at scale with approximately 12,000 employees in over 250 facilities across 23 states

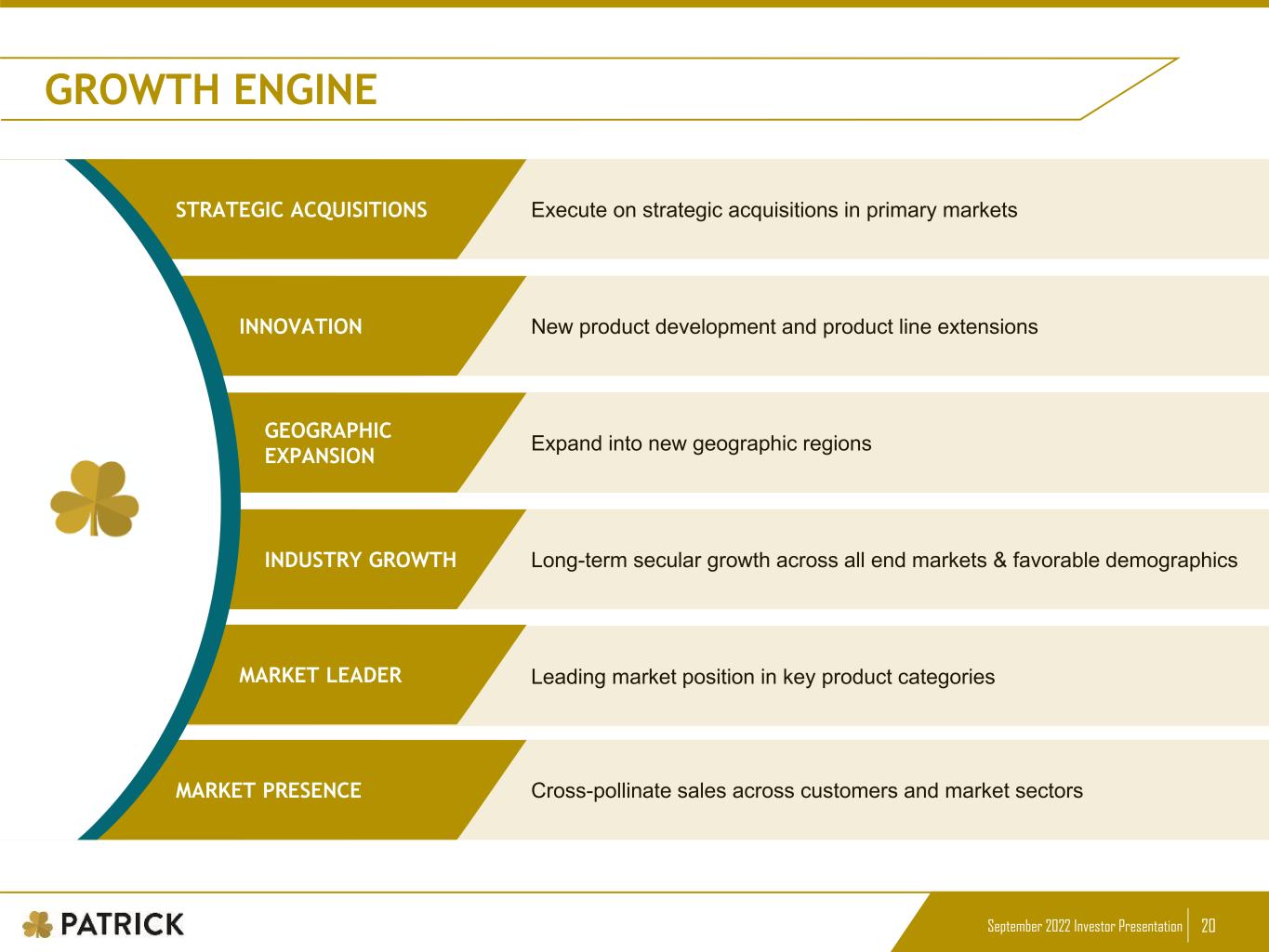

September 2022 Investor Presentation 20 Cross-pollinate sales across customers and market sectors Leading market position in key product categories Long-term secular growth across all end markets & favorable demographics Expand into new geographic regions New product development and product line extensions Execute on strategic acquisitions in primary marketsSTRATEGIC ACQUISITIONS INNOVATION GEOGRAPHIC EXPANSION INDUSTRY GROWTH MARKET LEADER MARKET PRESENCE GROWTH ENGINE

September 2022 Investor Presentation 21 Appendix

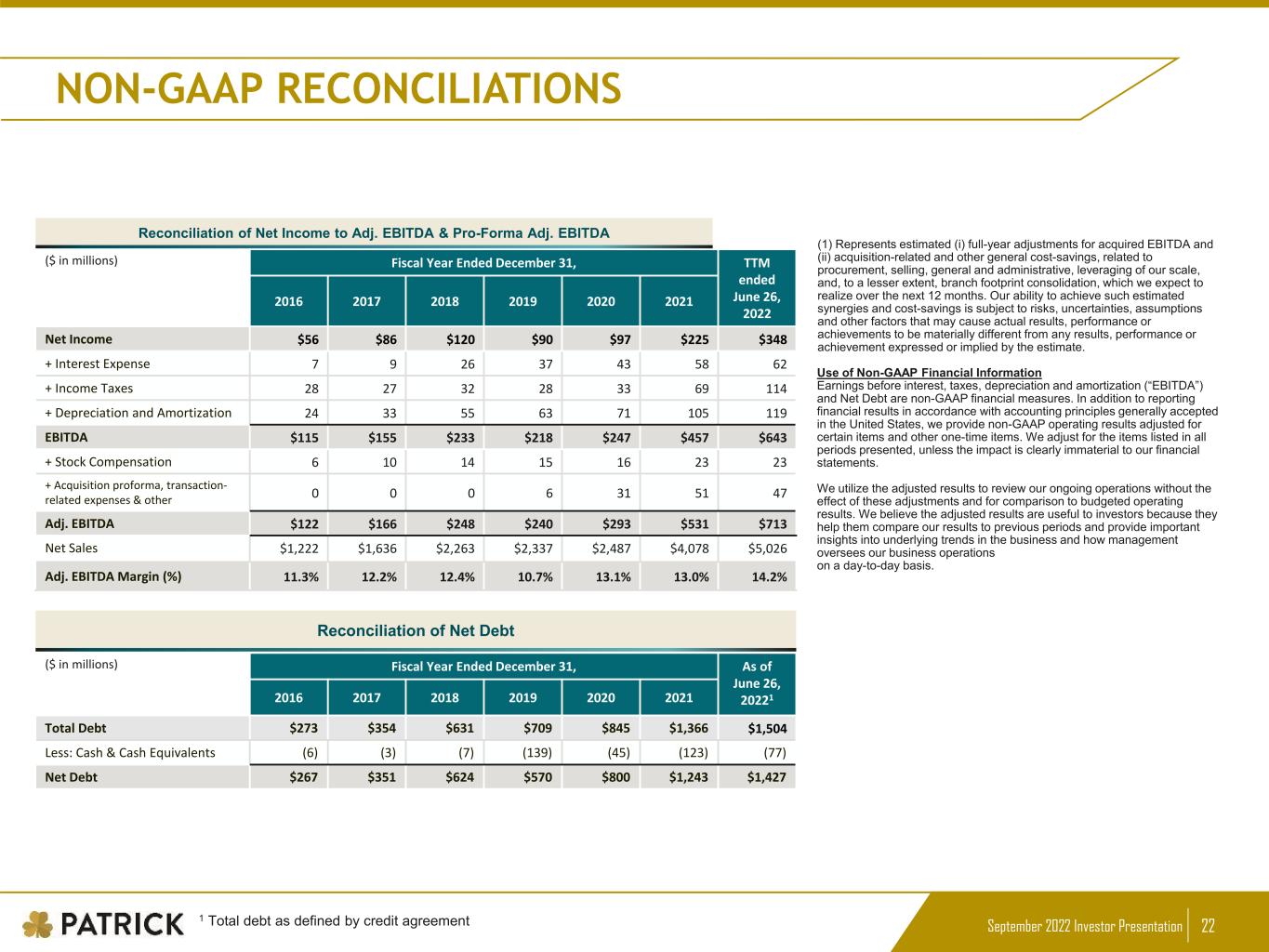

September 2022 Investor Presentation 22 NON-GAAP RECONCILIATIONS Reconciliation of Net Income to Adj. EBITDA & Pro-Forma Adj. EBITDA Net Sales $1,222 $1,636 $2,263 $2,337 $2,487 $4,078 $5,026 Adj. EBITDA Margin (%) 11.3% 12.2% 12.4% 10.7% 13.1% 13.0% 14.2% Fiscal Year Ended December 31, TTM ended June 26, 2022 2016 2017 2018 2019 2020 2021 Net Income $56 $86 $120 $90 $97 $225 $348 + Interest Expense 7 9 26 37 43 58 62 + Income Taxes 28 27 32 28 33 69 114 + Depreciation and Amortization 24 33 55 63 71 105 119 EBITDA $115 $155 $233 $218 $247 $457 $643 + Stock Compensation 6 10 14 15 16 23 23 + Acquisition proforma, transaction- related expenses & other 0 0 0 6 31 51 47 Adj. EBITDA $122 $166 $248 $240 $293 $531 $713 ($ in millions) (1) Represents estimated (i) full-year adjustments for acquired EBITDA and (ii) acquisition-related and other general cost-savings, related to procurement, selling, general and administrative, leveraging of our scale, and, to a lesser extent, branch footprint consolidation, which we expect to realize over the next 12 months. Our ability to achieve such estimated synergies and cost-savings is subject to risks, uncertainties, assumptions and other factors that may cause actual results, performance or achievements to be materially different from any results, performance or achievement expressed or implied by the estimate. Use of Non-GAAP Financial Information Earnings before interest, taxes, depreciation and amortization (“EBITDA”) and Net Debt are non-GAAP financial measures. In addition to reporting financial results in accordance with accounting principles generally accepted in the United States, we provide non-GAAP operating results adjusted for certain items and other one-time items. We adjust for the items listed in all periods presented, unless the impact is clearly immaterial to our financial statements. We utilize the adjusted results to review our ongoing operations without the effect of these adjustments and for comparison to budgeted operating results. We believe the adjusted results are useful to investors because they help them compare our results to previous periods and provide important insights into underlying trends in the business and how management oversees our business operations on a day-to-day basis. Fiscal Year Ended December 31, As of June 26, 202212016 2017 2018 2019 2020 2021 Total Debt $273 $354 $631 $709 $845 $1,366 $1,504 Less: Cash & Cash Equivalents (6) (3) (7) (139) (45) (123) (77) Net Debt $267 $351 $624 $570 $800 $1,243 $1,427 Reconciliation of Net Debt ($ in millions) 1 Total debt as defined by credit agreement

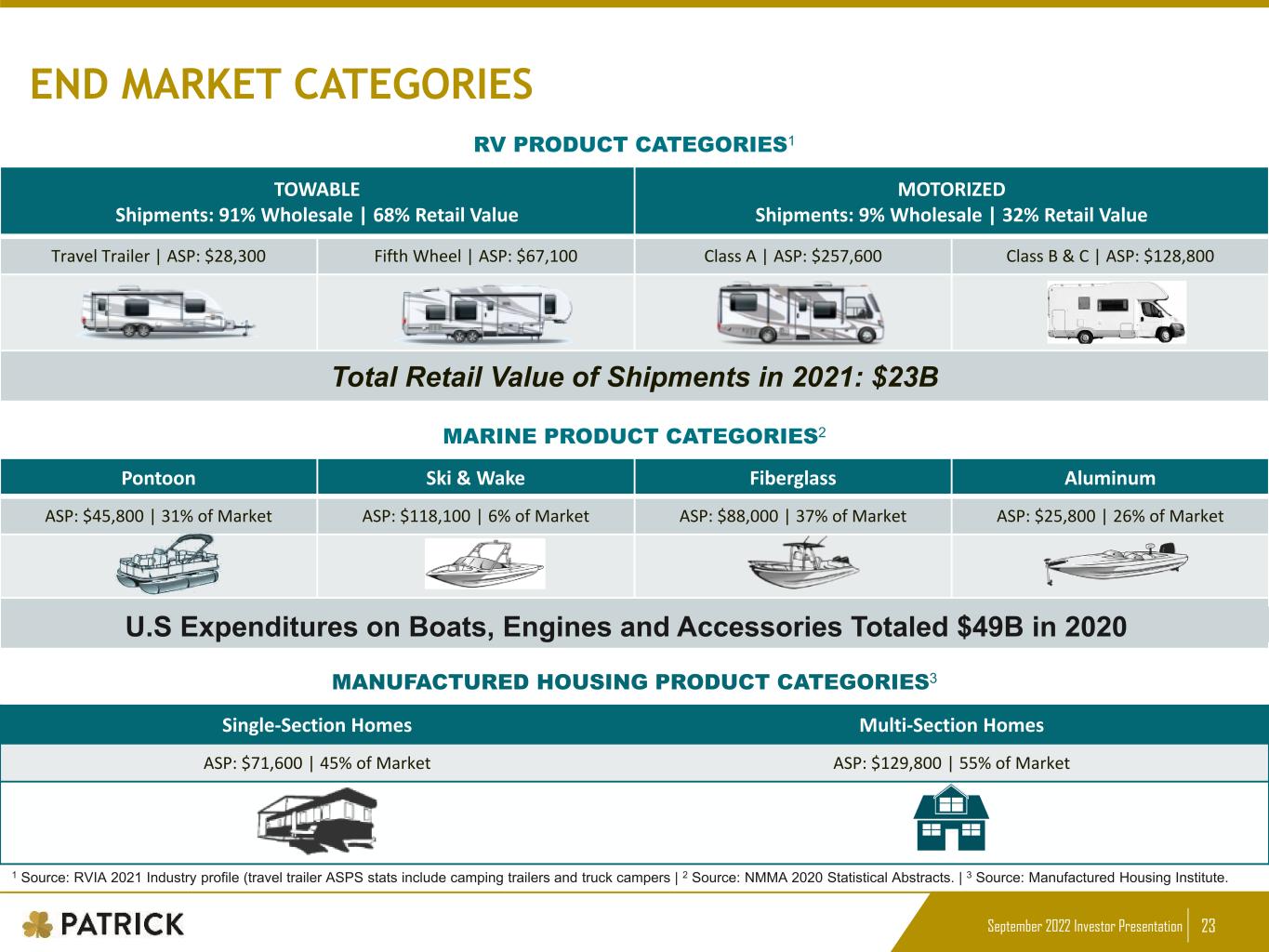

September 2022 Investor Presentation 23 END MARKET CATEGORIES Single-Section Homes Multi-Section Homes ASP: $71,600 | 45% of Market ASP: $129,800 | 55% of Market TOWABLE Shipments: 91% Wholesale | 68% Retail Value MOTORIZED Shipments: 9% Wholesale | 32% Retail Value Travel Trailer | ASP: $28,300 Fifth Wheel | ASP: $67,100 Class A | ASP: $257,600 Class B & C | ASP: $128,800 Total Retail Value of Shipments in 2021: $23B RV PRODUCT CATEGORIES1 Pontoon Ski & Wake Fiberglass Aluminum ASP: $45,800 | 31% of Market ASP: $118,100 | 6% of Market ASP: $88,000 | 37% of Market ASP: $25,800 | 26% of Market U.S Expenditures on Boats, Engines, and Accessories Totaled $xxB in 2019 MARINE PRODUCT CATEGORIES2 MANUFACTURED HOUSING PRODUCT CATEGORIES3 1 Source: RVIA 2021 Industry profile (travel trailer ASPS stats include camping trailers and truck campers | 2 Source: NMMA 2020 Statistical Abstracts. | 3 Source: Manufactured Housing Institute. . it t , i and Ac es ories Totaled $49B in 2020

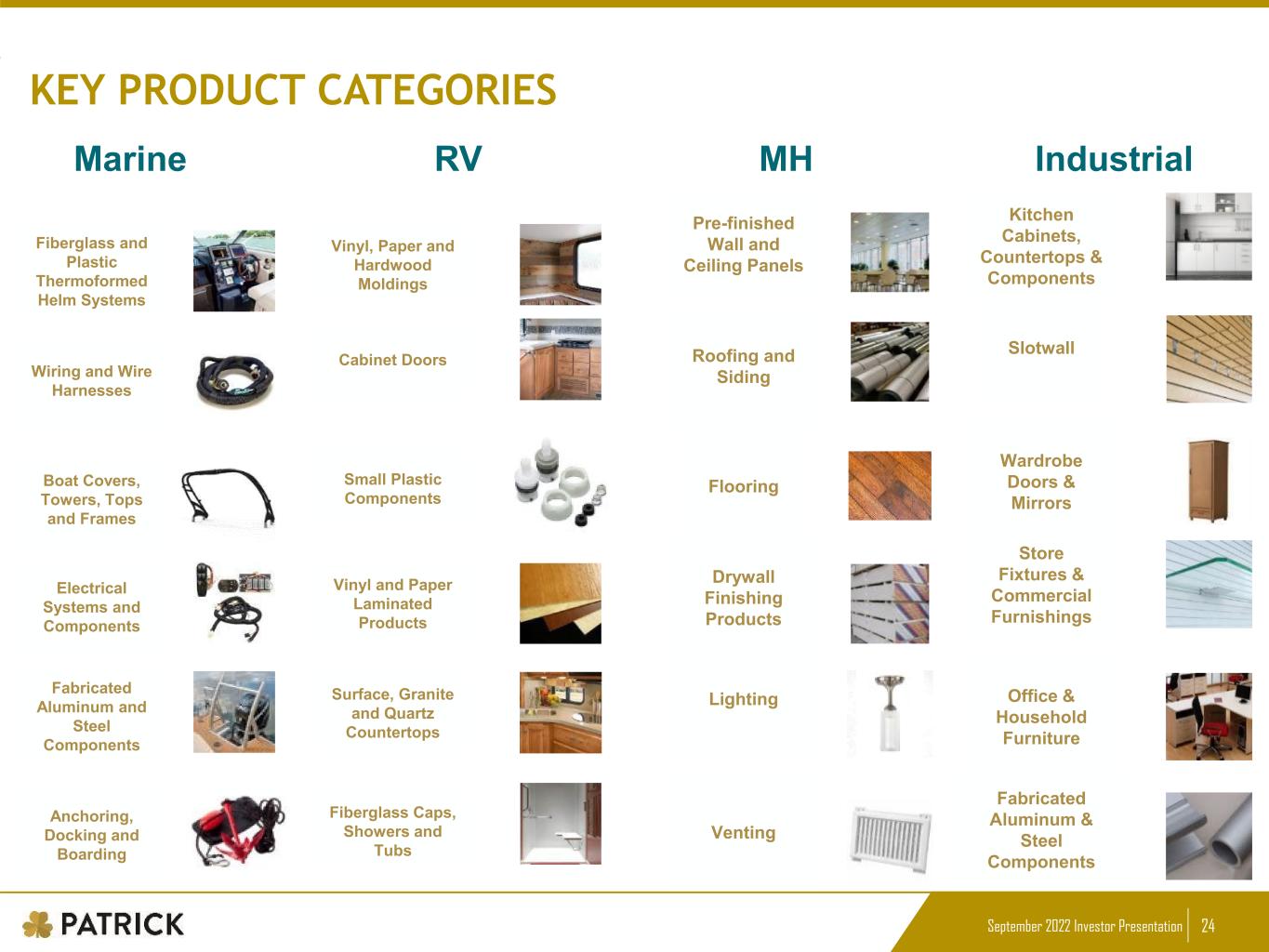

September 2022 Investor Presentation 24 KEY PRODUCT CATEGORIES Fiberglass and Plastic Thermoformed Helm Systems Wiring and Wire Harnesses Electrical Systems and Components Fabricated Aluminum and Steel Components Boat Covers, Towers, Tops and Frames Anchoring, Docking and Boarding Vinyl and Paper Laminated Products Surface, Granite and Quartz Countertops Vinyl, Paper and Hardwood Moldings Fiberglass Caps, Showers and Tubs Cabinet Doors Small Plastic Components Pre-finished Wall and Ceiling Panels Drywall Finishing Products Flooring Roofing and Siding Venting Lighting Kitchen Cabinets, Countertops & Components Office & Household Furniture Wardrobe Doors & Mirrors Store Fixtures & Commercial Furnishings Slotwall Fabricated Aluminum & Steel Components Marine RV MH Industrial

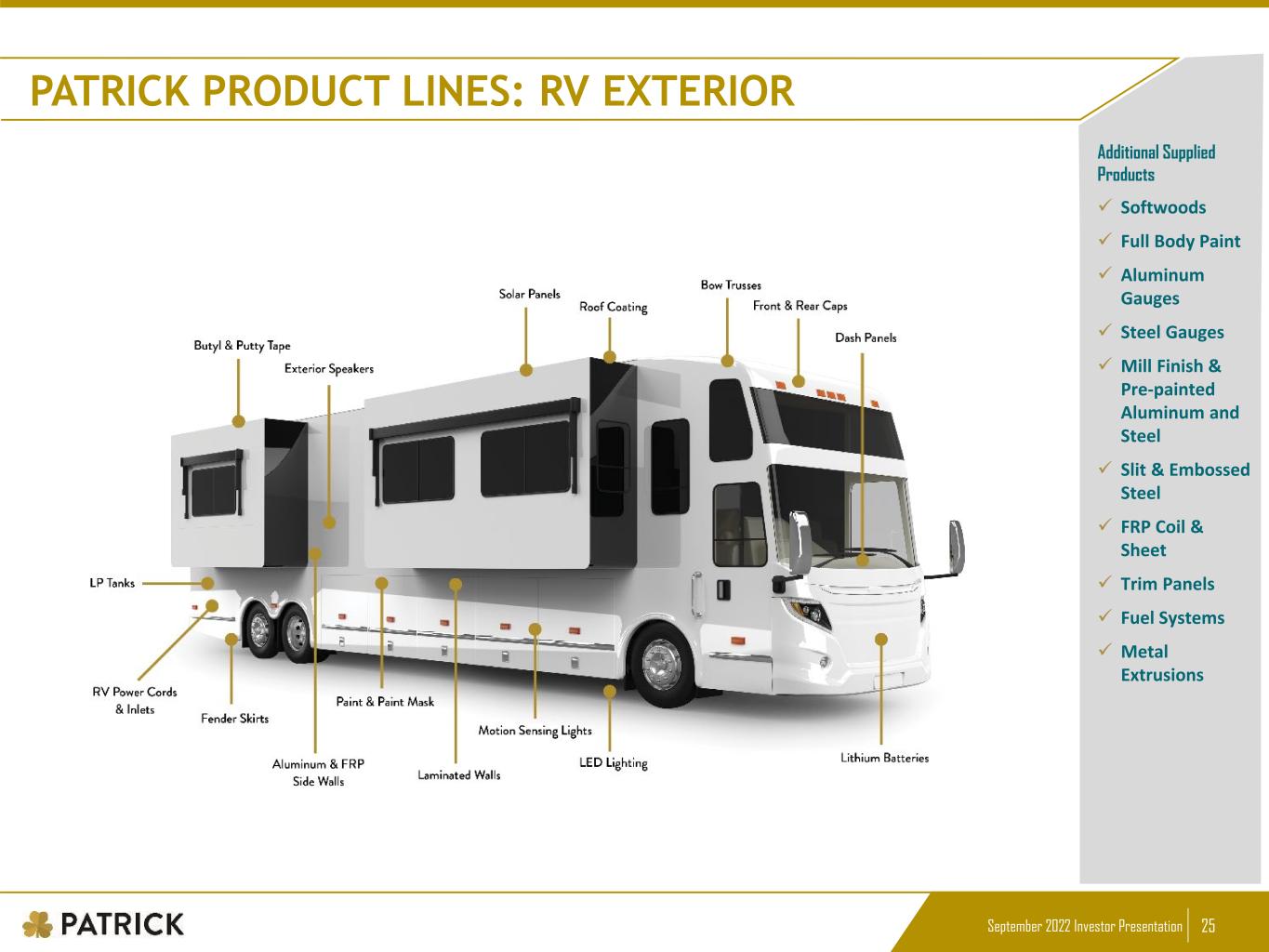

September 2022 Investor Presentation 25 PATRICK PRODUCT LINES: RV EXTERIOR Additional Supplied Products Softwoods Full Body Paint Aluminum Gauges Steel Gauges Mill Finish & Pre-painted Aluminum and Steel Slit & Embossed Steel FRP Coil & Sheet Trim Panels Fuel Systems Metal Extrusions

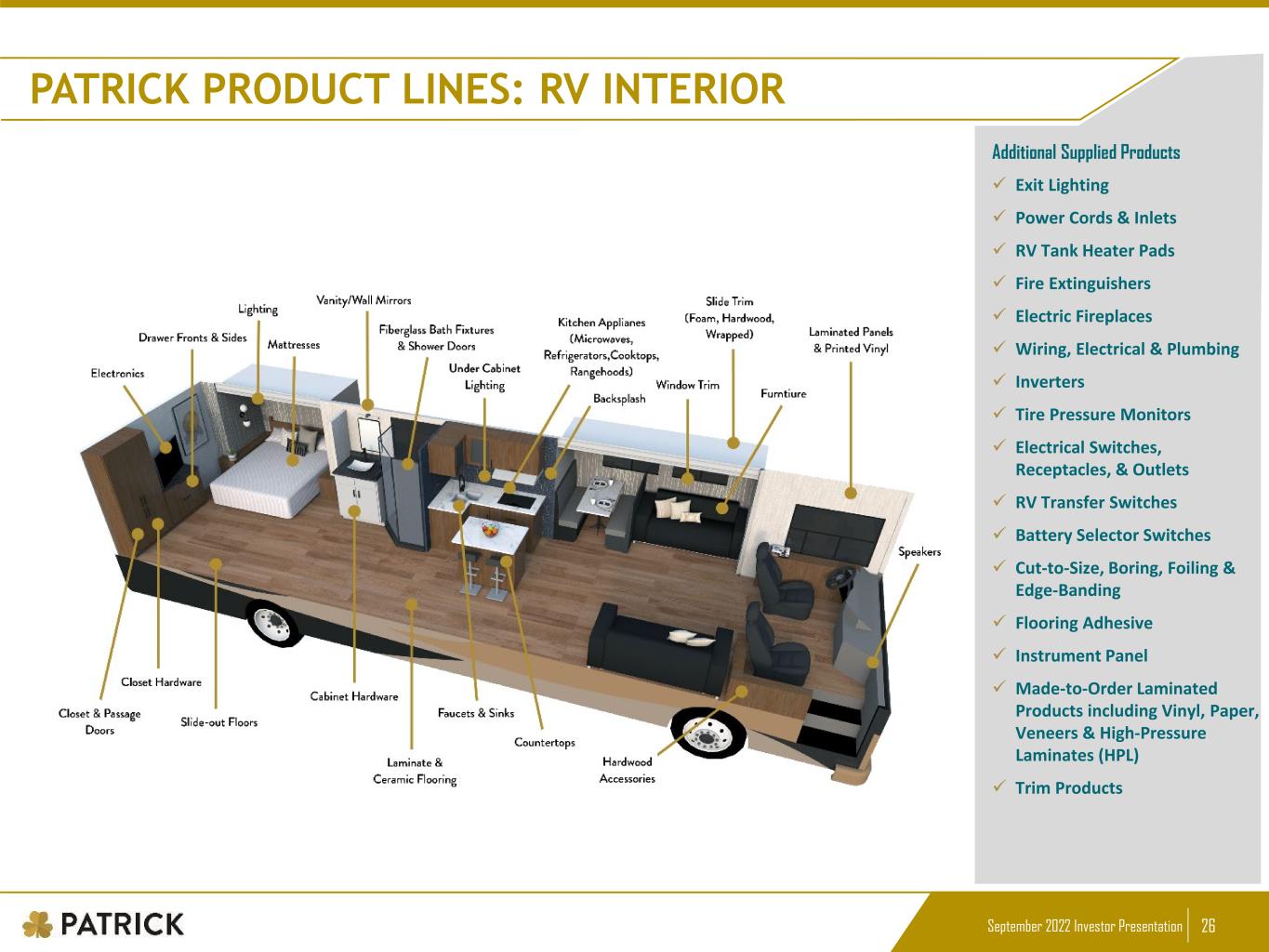

September 2022 Investor Presentation 26 PATRICK PRODUCT LINES: RV INTERIOR Additional Supplied Products Exit Lighting Power Cords & Inlets RV Tank Heater Pads Fire Extinguishers Electric Fireplaces Wiring, Electrical & Plumbing Inverters Tire Pressure Monitors Electrical Switches, Receptacles, & Outlets RV Transfer Switches Battery Selector Switches Cut-to-Size, Boring, Foiling & Edge-Banding Flooring Adhesive Instrument Panel Made-to-Order Laminated Products including Vinyl, Paper, Veneers & High-Pressure Laminates (HPL) Trim Products

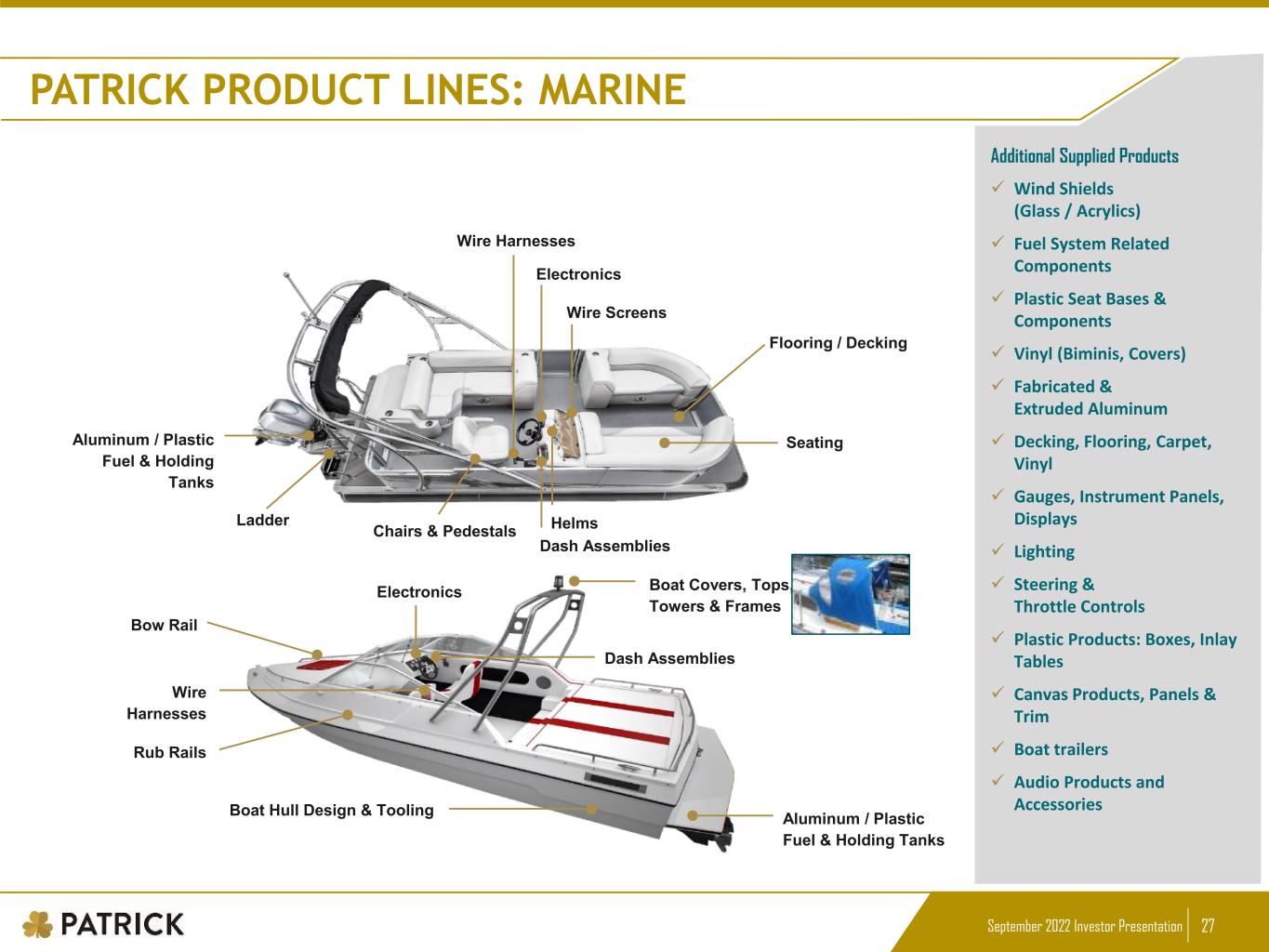

September 2022 Investor Presentation 27 PATRICK PRODUCT LINES: MARINE Additional Supplied Products Softwoods Full Body Paint Aluminum Gauges Steel Gauges Mill Finish & Pre-painted Aluminum and Steel Slit & Embossed Steel FRP Coil & Sheet Trim Panels Fuel Systems Metal Extrusions Aluminum / Plastic Fuel & Holding Tanks Wire Harnesses Electronics Dash Assemblies Wire Screens Helms Aluminum / Plastic Fuel & Holding Tanks Boat Hull Design & Tooling Wire Harnesses Dash Assemblies Electronics Boat Covers, Tops, Towers & Frames Ladder Chairs & Pedestals Rub Rails Bow Rail Flooring / Decking Seating Additional Supplied Products Wind Shields (Glass / Acrylics) Fuel System Related Components Plastic Seat Bases & Components Vinyl (Biminis, Covers) Fabricated & Extruded Aluminum Decking, Flooring, Carpet, Vinyl Gauges, Instrument Panels, Displays Lighting Steering & Throttle Controls Plastic Products: Boxes, Inlay Tables Canvas Products, Panels & Trim Boat trailers Audio Products and Accessories

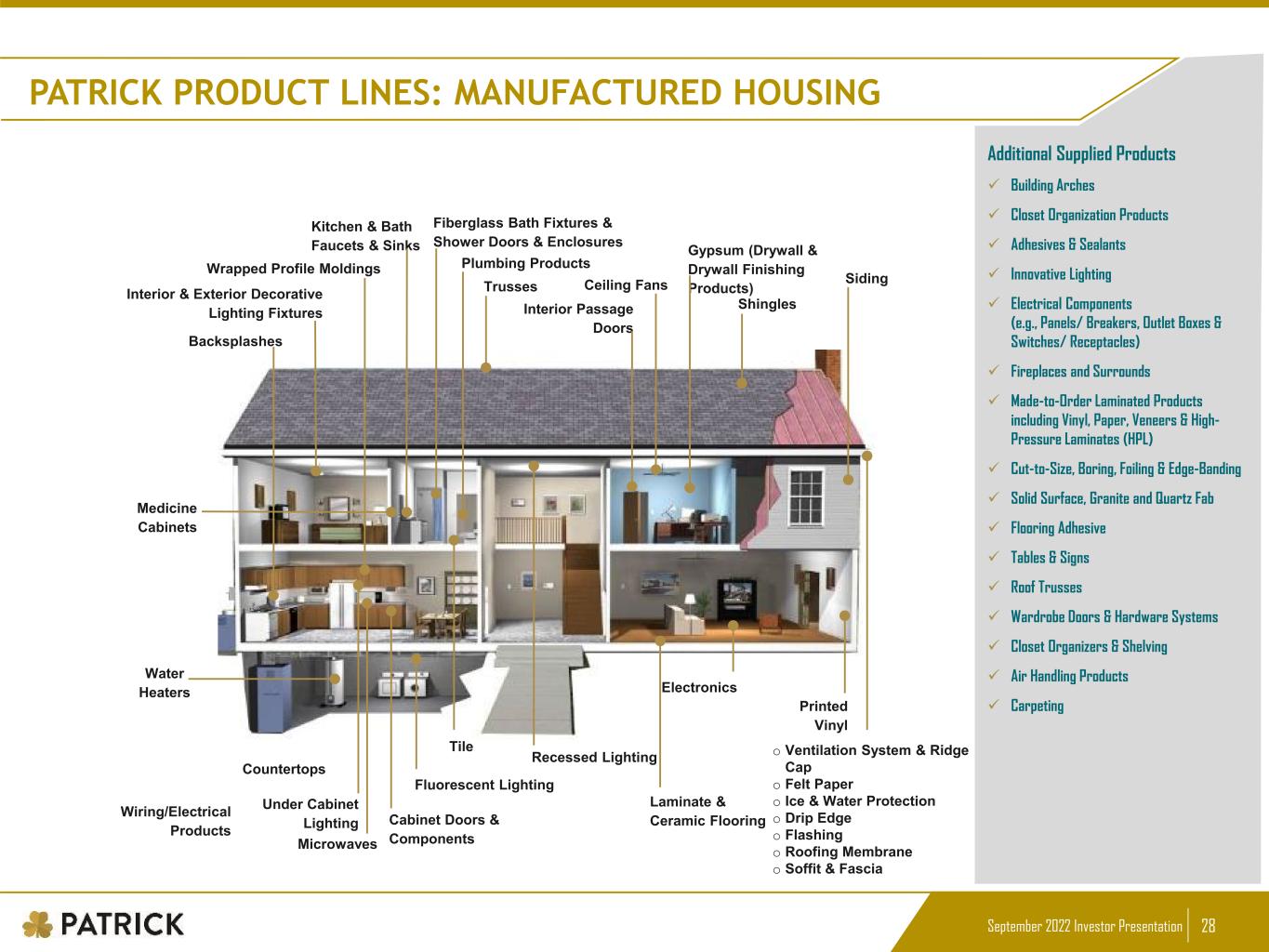

September 2022 Investor Presentation 28 PATRICK PRODUCT LINES: MANUFACTURED HOUSING Additional Supplied Products Softwoods Full Body Paint Aluminum Gauges Steel Gauges Mill Finish & Pre-painted Aluminum and Steel Slit & Embossed Steel FRP Coil & Sheet Trim Panels Fuel Systems Metal Extrusions Interior Passage Doors Kitchen & Bath Faucets & Sinks Gypsum (Drywall & Drywall Finishing Products) Laminate & Ceramic Flooring Fiberglass Bath Fixtures & Shower Doors & Enclosures Cabinet Doors & ComponentsMicrowaves Countertops Electronics Siding Shingles o Ventilation System & Ridge Cap o Felt Paper o Ice & Water Protection o Drip Edge o Flashing o Roofing Membrane o Soffit & Fascia Wrapped Profile Moldings Plumbing Products Backsplashes Recessed Lighting Fluorescent Lighting Wiring/Electrical Products Ceiling Fans Medicine Cabinets Under Cabinet Lighting Tile Printed Vinyl TrussesInterior & Exterior Decorative Lighting Fixtures Water Heaters Additional Supplied Products Building Arches Closet Organization Products Adhesives & Sealants Innovative Lighting Electrical Components (e.g., Panels/ Breakers, Outlet Boxes & Switches/ Receptacles) Fireplaces and Surrounds Made-to-Order Laminated Products including Vinyl, Paper, Veneers & High- Pressure Laminates (HPL) Cut-to-Size, Boring, Foiling & Edge-Banding Solid Surface, Granite and Quartz Fab Flooring Adhesive Tables & Signs Roof Trusses Wardrobe Doors & Hardware Systems Closet Organizers & Shelving Air Handling Products Carpeting

September 2022 Investor Presentation 29 www.patrickind.com