EX-99.2

Published on October 31, 2024

Q3 2024 Earnings Presentation October 31, 2024

Forward-looking statements 2 This presentation includes contains statements that are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward- looking statements are generally identified by words such as “estimates,” “guidance,” “expects,” ”anticipates,” “intends,” “plans,” “believes,” “seeks” and similar expressions. Forward-looking statements include information with respect to financial condition, results of operations, business strategies, operating efficiencies or synergies, competitive position, industry projections, growth opportunities, acquisitions, plans and objectives of management, markets for the common stock and other matters. These forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from either historical or anticipated results depending on a variety of factors. These risks and uncertainties include, in addition to other matters described in this presentation, the impacts of future pandemics, geopolitical tensions or natural disaster, on the overall economy, our sales, customers, operations, team members and suppliers. Further information concerning the Company and its business, including risk factors that potentially could materially affect the Company’s financial results are discussed under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the Securities and Exchange Commission on February 29, 2024. We caution readers not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date they are made, and we disclaim any obligation or undertaking to disseminate any updates or revisions to any forward- looking statements contained in this presentation or to reflect any change in our expectations after the date of this presentation or any change in events, conditions or circumstances on which any statement is based. USE OF NON-GAAP FINANCIAL MEASURES This presentation contains non-GAAP financial measures. These measures, the purposes for which management uses them, why management believes they are useful to investors, and a reconciliation to the most directly comparable GAAP financial measures can be found in the Appendix of this presentation. All references to profit measures and earnings per share on a comparable basis exclude items that affect comparability.

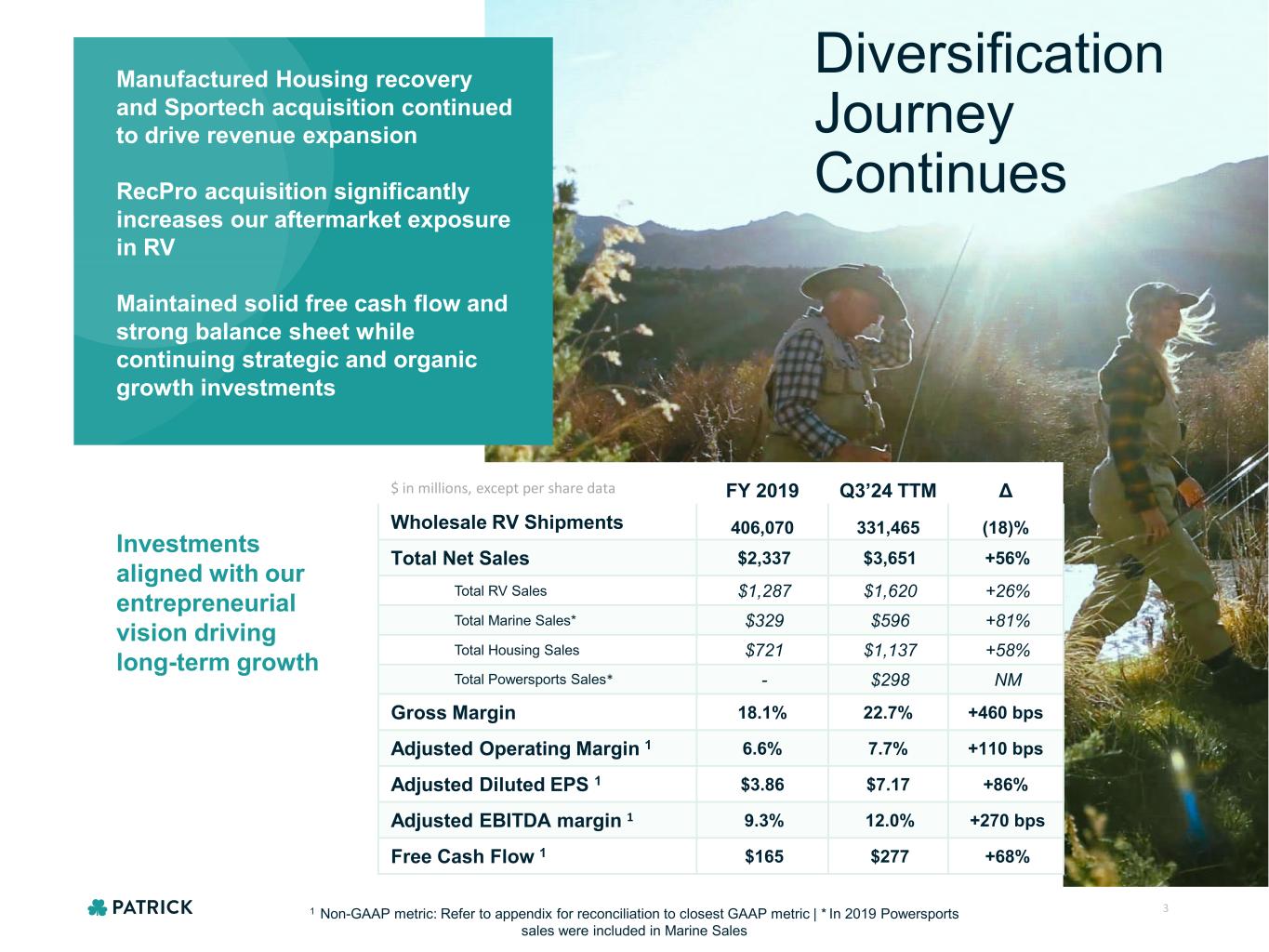

3 $ in millions, except per share data FY 2019 Q3’24 TTM Δ Wholesale RV Shipments 406,070 331,465 (18)% Total Net Sales $2,337 $3,651 +56% Total RV Sales $1,287 $1,620 +26% Total Marine Sales* $329 $596 +81% Total Housing Sales $721 $1,137 +58% Total Powersports Sales* - $298 NM Gross Margin 18.1% 22.7% +460 bps Adjusted Operating Margin 1 6.6% 7.7% +110 bps Adjusted Diluted EPS 1 $3.86 $7.17 +86% Adjusted EBITDA margin 1 9.3% 12.0% +270 bps Free Cash Flow 1 $165 $277 +68% Diversification Journey Continues Investments aligned with our entrepreneurial vision driving long-term growth Manufactured Housing recovery and Sportech acquisition continued to drive revenue expansion RecPro acquisition significantly increases our aftermarket exposure in RV Maintained solid free cash flow and strong balance sheet while continuing strategic and organic growth investments 1 Non-GAAP metric: Refer to appendix for reconciliation to closest GAAP metric | * In 2019 Powersports sales were included in Marine Sales

4 Highlights Q3 2024 Revenue up 6% y/y, driven by ongoing recovery in MH market and acquisitions completed in 2024 • RV revenue down 1%, reflecting the continued shift in demand toward lower-priced units • Marine revenue declined 21% y/y as OEMs worked aggressively to appropriately manage dealer inventory • Powersports revenue grew primarily due to the January 2024 acquisition of Sportech • Housing revenue improved 13% y/y as a result of an estimated 17% y/y increase in MH shipments amid continued solid demand for affordable housing Continued strategic diversification through acquisitions and balanced capital allocation • September acquisition of RecPro meaningfully expands Patrick’s aftermarket presence in RV and offers an established aftermarket platform for our other end markets • Subsequent to the quarter, opportunistically refinanced high-yield notes and amended credit facility, extending maturities and lowering average cost of debt Operating margin reflects our tactical decision to balance the current operating environment and maintain the ability to remain agile as we prepare for a future recovery in our end markets

Performance by End Market Q3 2024

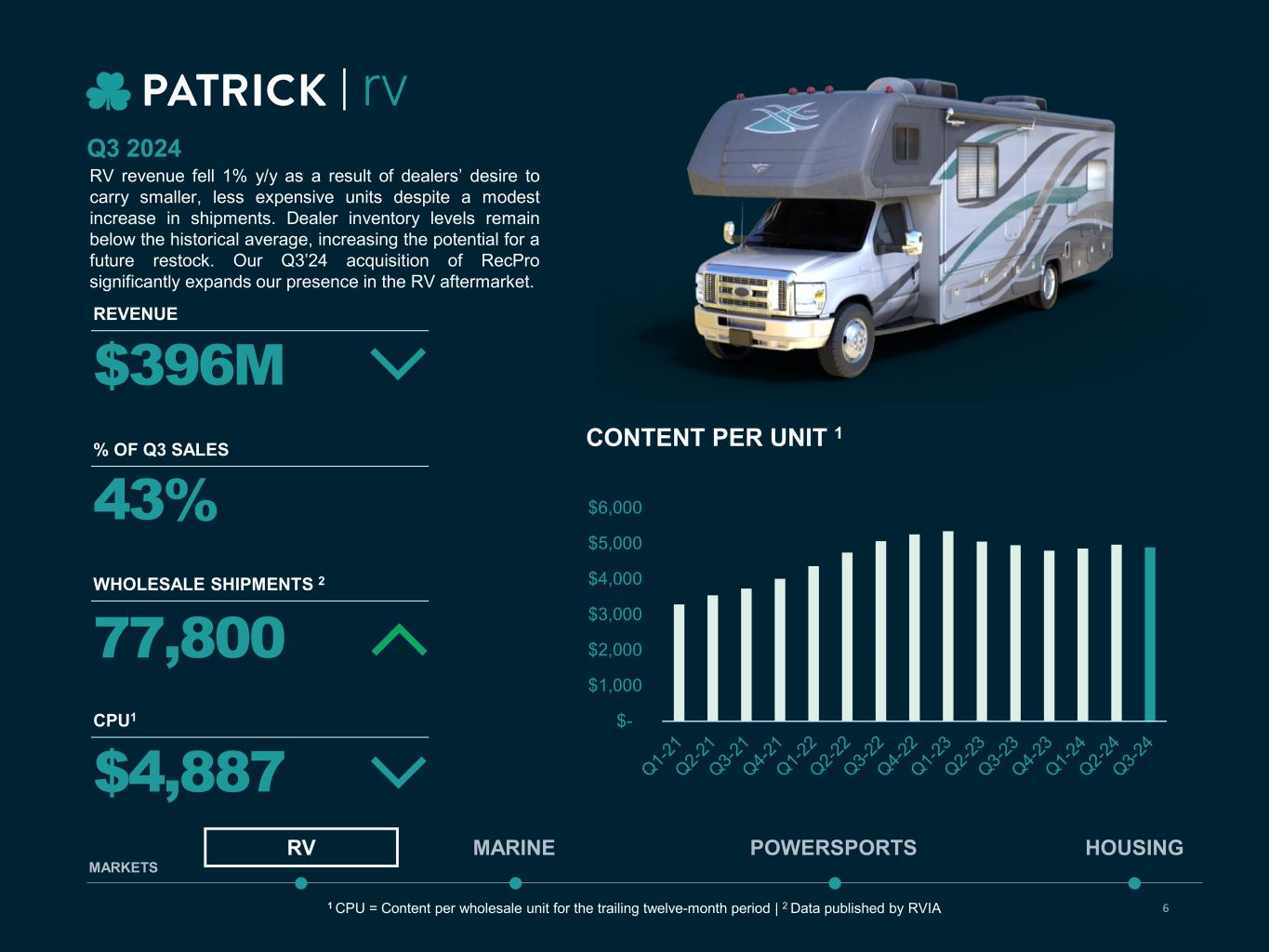

RV revenue fell 1% y/y as a result of dealers’ desire to carry smaller, less expensive units despite a modest increase in shipments. Dealer inventory levels remain below the historical average, increasing the potential for a future restock. Our Q3’24 acquisition of RecPro significantly expands our presence in the RV aftermarket. 6 $396M REVENUE % OF Q3 SALES 43% WHOLESALE SHIPMENTS 2 CPU1 $4,887 77,800 $- $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 CONTENT PER UNIT 1 1 CPU = Content per wholesale unit for the trailing twelve-month period | 2 Data published by RVIA Q3 2024 MARINE POWERSPORTS HOUSINGRV MARKETS

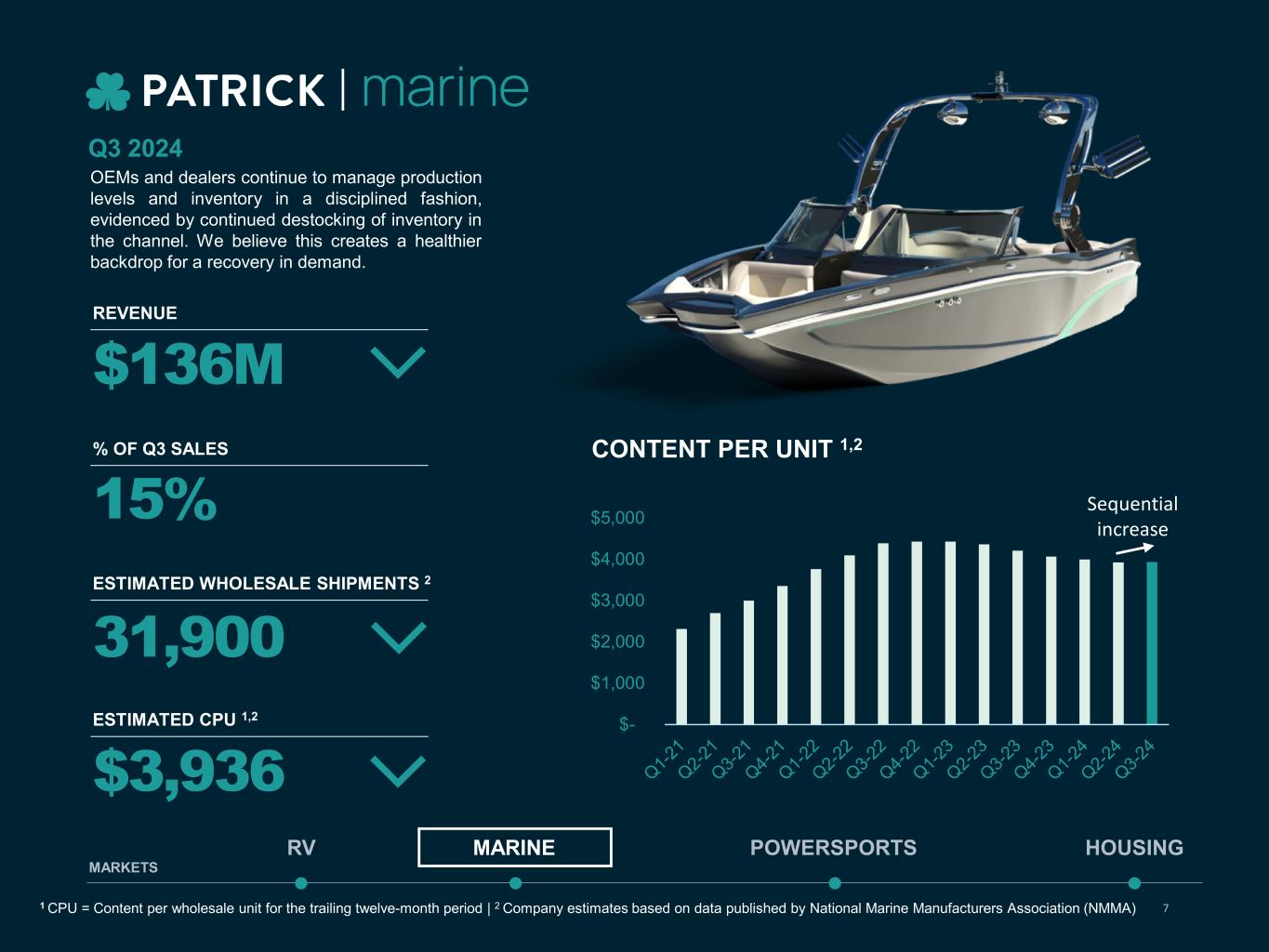

$- $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 CONTENT PER UNIT 1,2 7 $136M REVENUE % OF Q3 SALES 15% ESTIMATED WHOLESALE SHIPMENTS 2 ESTIMATED CPU 1,2 $3,936 31,900 1 CPU = Content per wholesale unit for the trailing twelve-month period | 2 Company estimates based on data published by National Marine Manufacturers Association (NMMA) MARINE POWERSPORTS HOUSINGRV MARKETS Q3 2024 OEMs and dealers continue to manage production levels and inventory in a disciplined fashion, evidenced by continued destocking of inventory in the channel. We believe this creates a healthier backdrop for a recovery in demand. Sequential increase

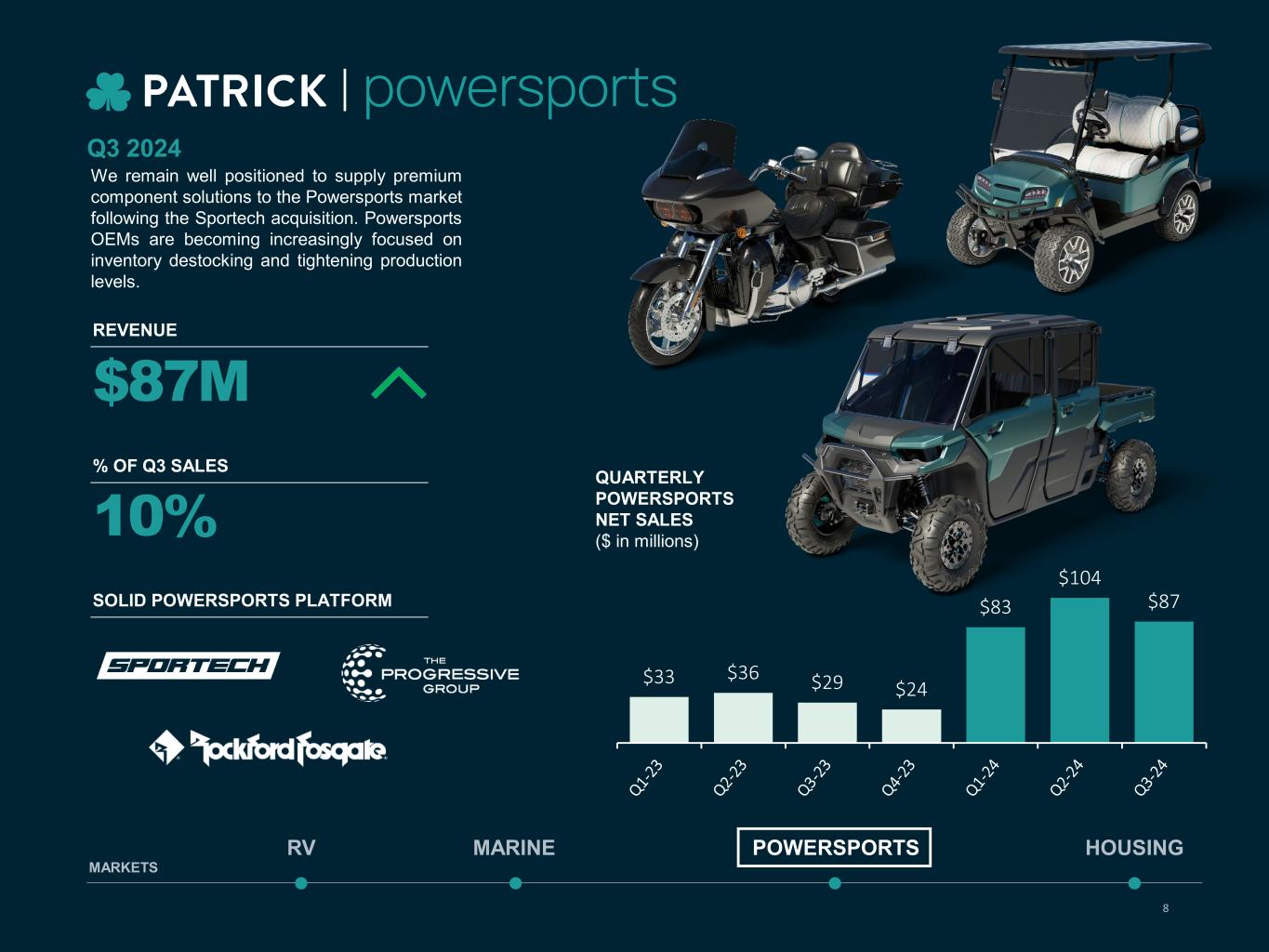

We remain well positioned to supply premium component solutions to the Powersports market following the Sportech acquisition. Powersports OEMs are becoming increasingly focused on inventory destocking and tightening production levels. 8 $87M REVENUE % OF Q3 SALES 10% SOLID POWERSPORTS PLATFORM Q3 2024 MARINE POWERSPORTS HOUSINGRV MARKETS $33 $36 $29 $24 $83 $104 $87 QUARTERLY POWERSPORTS NET SALES ($ in millions)

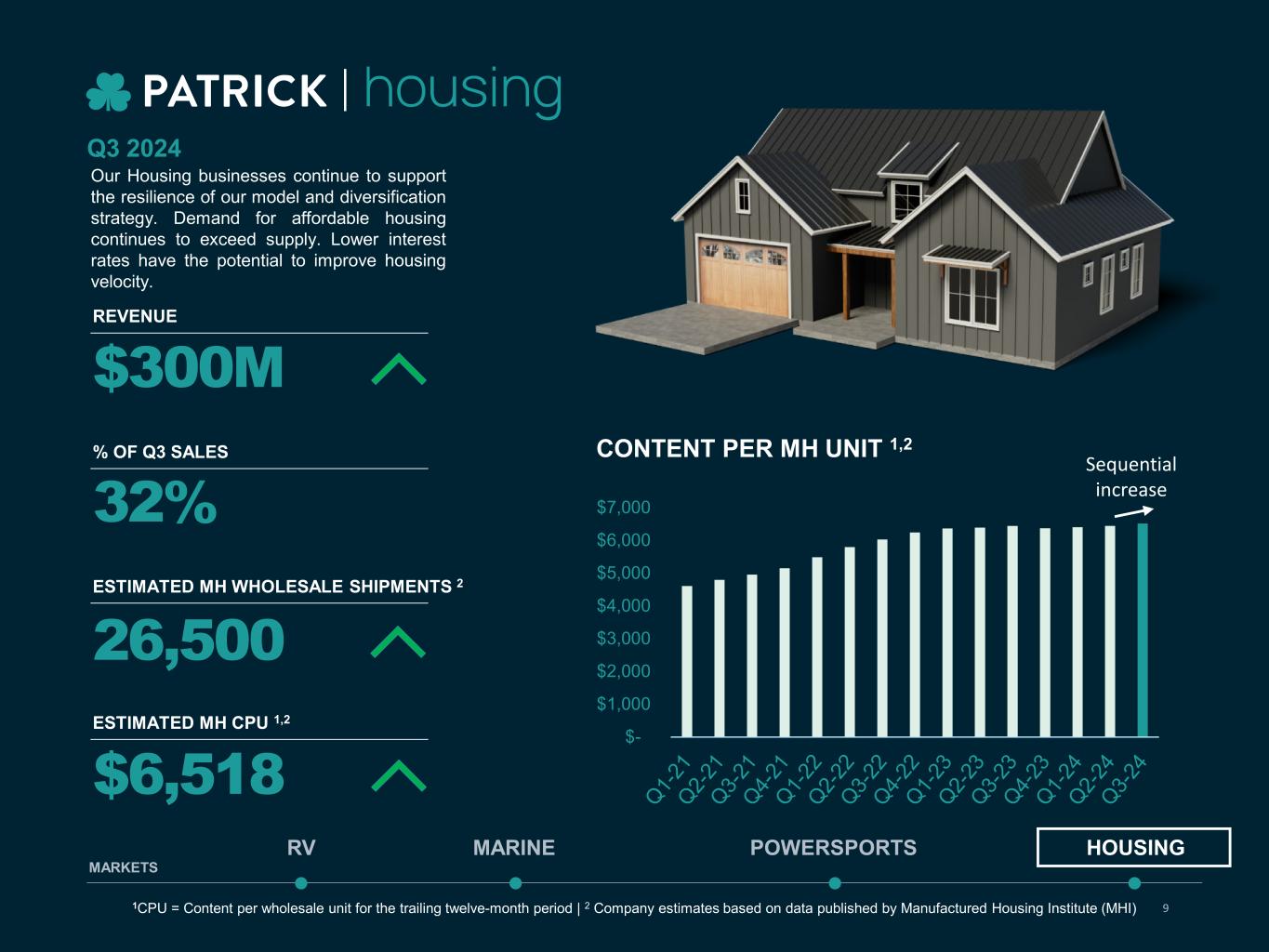

$- $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 CONTENT PER MH UNIT 1,2 Our Housing businesses continue to support the resilience of our model and diversification strategy. Demand for affordable housing continues to exceed supply. Lower interest rates have the potential to improve housing velocity. 9 $300M REVENUE % OF Q3 SALES 32% ESTIMATED MH WHOLESALE SHIPMENTS 2 ESTIMATED MH CPU 1,2 $6,518 26,500 1CPU = Content per wholesale unit for the trailing twelve-month period | 2 Company estimates based on data published by Manufactured Housing Institute (MHI) MARINE POWERSPORTS HOUSINGRV MARKETS Q3 2024 Sequential increase

Q3 2024 POWERSPORTS Utility-focused vehicles have been more resilient than the recreational segment Improved functionality and innovation drive more favorable demand for utility side-by-side vehicles Major OEMs have announced ongoing targeted dealer inventory reduction efforts MARINE Dealers and OEMs remain very disciplined in their efforts to lower inventory levels, with continued progress made in Q3; we now expect further production cuts in Q4’24 Consumer conversion is limited by high-interest rates and inflation RecPro platform provides meaningful opportunity to improve the efficiency of our aftermarket distribution channel in Marine RV RV recovery has been focused on entry-level units given consumers’ desire for smaller, more affordable units RecPro acquisition significantly expands presence in RV aftermarket We now expect OEMs to further limit production in Q4’24 amid dealers’ desire to delay restocking until 2025 HOUSING Interest rate relief has the potential to improve the availability of affordable housing Technological advancements and enhanced materials are improving the quality and efficiency of manufactured homes, increasing the attractiveness to consumers and long-term content growth potential for Patrick Market Sector Trends 10

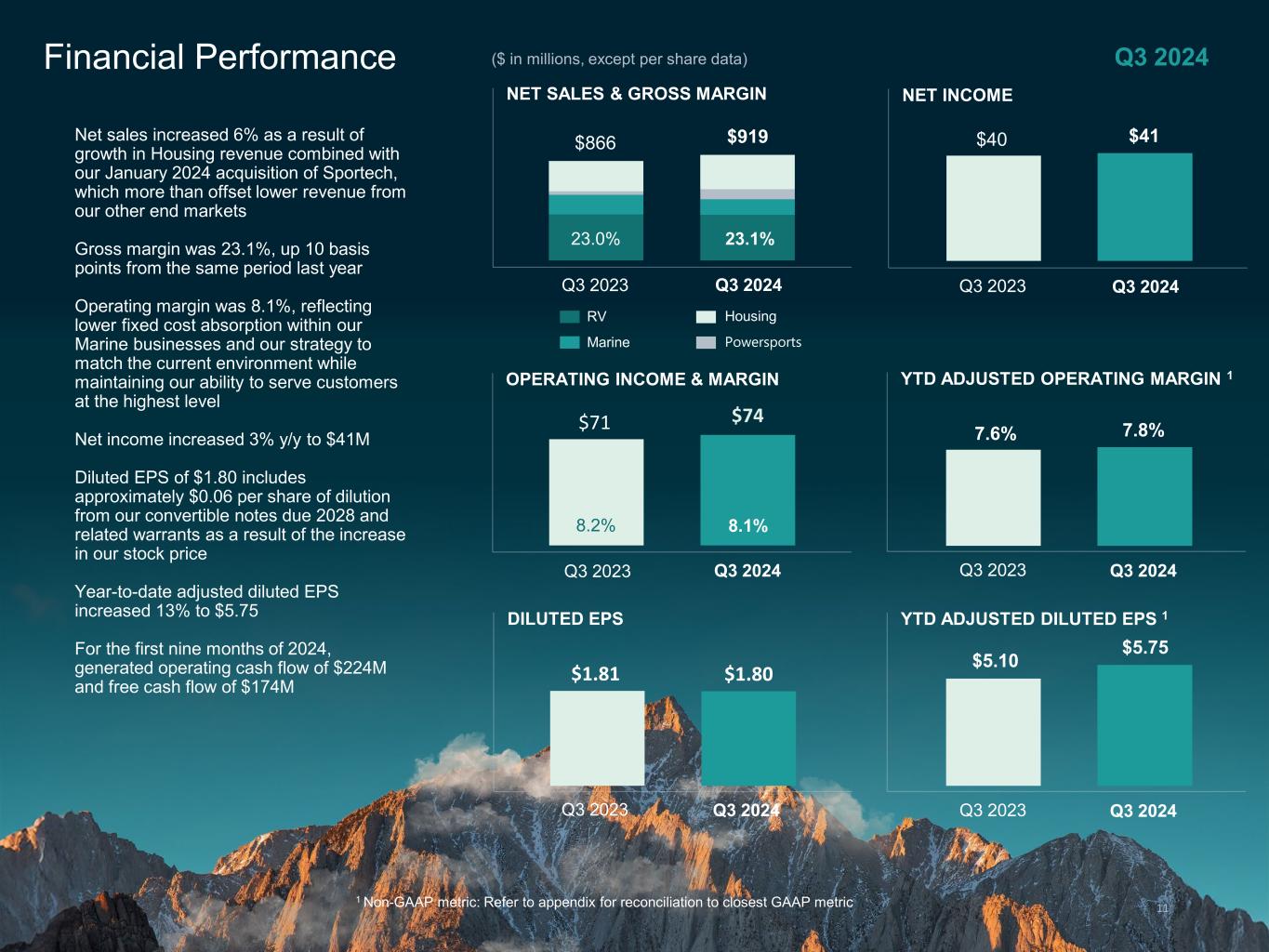

Financial Performance 11 Q3 2024 NET SALES & GROSS MARGIN $919$866 Q3 2023 Q3 2024 23.1%23.0% Powersports Housing Marine RV $71 $74 OPERATING INCOME & MARGIN 8.1%8.2% Q3 2023 Q3 2024 $1.81 $1.80 DILUTED EPS Q3 2023 Q3 2024 YTD ADJUSTED DILUTED EPS 1 Q3 2023 Q3 2024 ($ in millions, except per share data) $5.75 $5.10 YTD ADJUSTED OPERATING MARGIN 1 Q3 2023 Q3 2024 Net sales increased 6% as a result of growth in Housing revenue combined with our January 2024 acquisition of Sportech, which more than offset lower revenue from our other end markets Gross margin was 23.1%, up 10 basis points from the same period last year Operating margin was 8.1%, reflecting lower fixed cost absorption within our Marine businesses and our strategy to match the current environment while maintaining our ability to serve customers at the highest level Net income increased 3% y/y to $41M Diluted EPS of $1.80 includes approximately $0.06 per share of dilution from our convertible notes due 2028 and related warrants as a result of the increase in our stock price Year-to-date adjusted diluted EPS increased 13% to $5.75 For the first nine months of 2024, generated operating cash flow of $224M and free cash flow of $174M 7.8%7.6% NET INCOME Q3 2023 Q3 2024 $41$40 1 Non-GAAP metric: Refer to appendix for reconciliation to closest GAAP metric

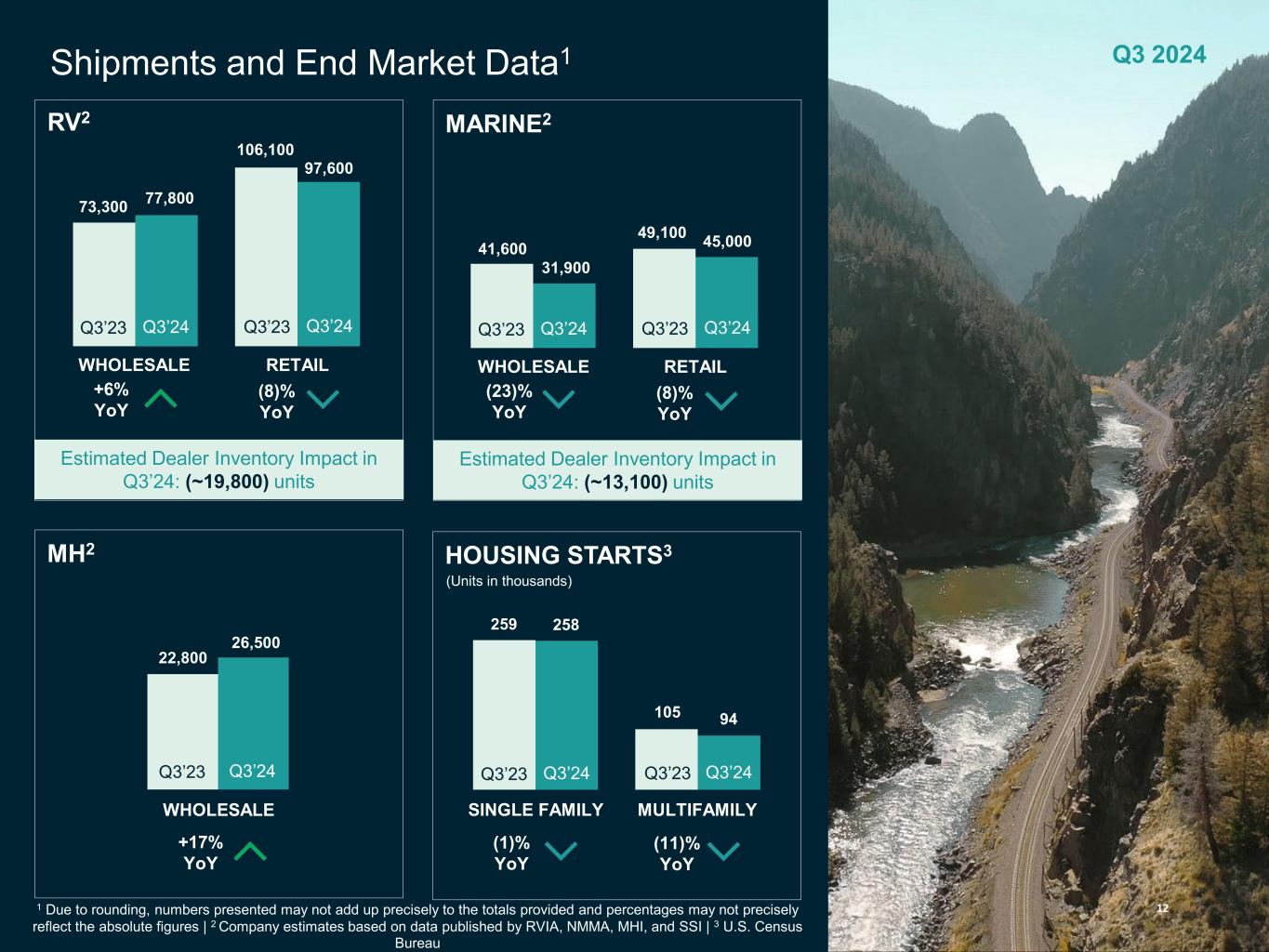

Shipments and End Market Data1 RETAILWHOLESALE 97,600 77,800 (8)% YoY +6% YoY RV2 RETAILWHOLESALE 45,000 31,900 (8)% YoY (23)% YoY MARINE2 WHOLESALE 26,500 +17% YoY MH2 MULTIFAMILYSINGLE FAMILY 105 259 (11)% YoY (1)% YoY HOUSING STARTS3 73,300 106,100 41,600 49,100 22,800 258 12 Q3 2024 Q3’23 Q3’24 Q3’23 Q3’24 Q3’23 Q3’24 Q3’23 Q3’24 Q3’23 Q3’24 Q3’23 Q3’24Q3’23 Q3’24 1 Due to rounding, numbers presented may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures | 2 Company estimates based on data published by RVIA, NMMA, MHI, and SSI | 3 U.S. Census Bureau Estimated Dealer Inventory Impact in Q3’24: (~19,800) units Estimated Dealer Inventory Impact in Q3’24: (~13,100) units (Units in thousands) 94

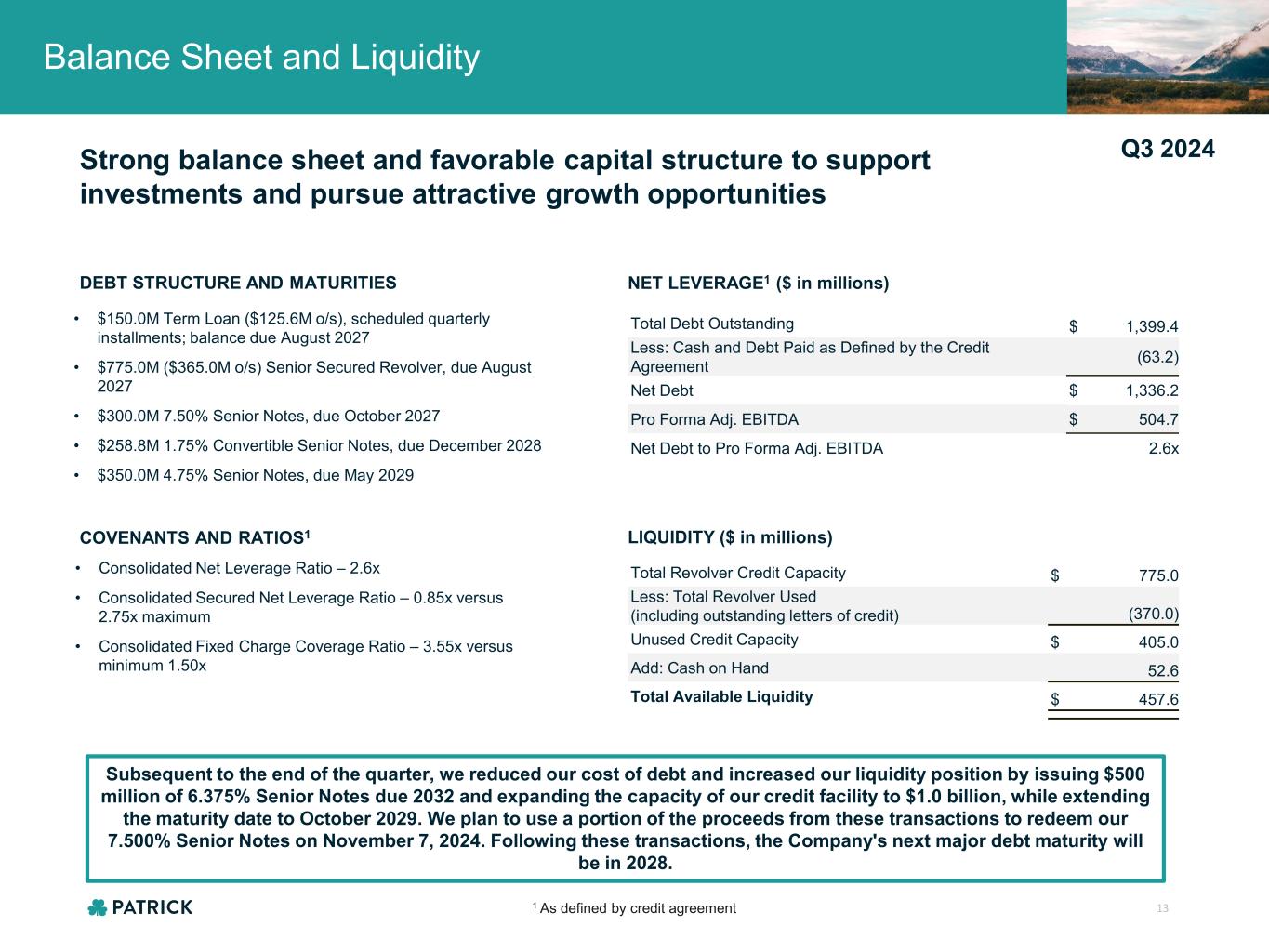

Balance Sheet and Liquidity 13 COVENANTS AND RATIOS1 DEBT STRUCTURE AND MATURITIES NET LEVERAGE1 ($ in millions) LIQUIDITY ($ in millions) • $150.0M Term Loan ($125.6M o/s), scheduled quarterly installments; balance due August 2027 • $775.0M ($365.0M o/s) Senior Secured Revolver, due August 2027 • $300.0M 7.50% Senior Notes, due October 2027 • $258.8M 1.75% Convertible Senior Notes, due December 2028 • $350.0M 4.75% Senior Notes, due May 2029 Total Debt Outstanding $ 1,399.4 Less: Cash and Debt Paid as Defined by the Credit Agreement (63.2) Net Debt $ 1,336.2 Pro Forma Adj. EBITDA $ 504.7 Net Debt to Pro Forma Adj. EBITDA 2.6x Total Revolver Credit Capacity $ 775.0 Less: Total Revolver Used (including outstanding letters of credit) (370.0) Unused Credit Capacity $ 405.0 Add: Cash on Hand 52.6 Total Available Liquidity $ 457.6 • Consolidated Net Leverage Ratio – 2.6x • Consolidated Secured Net Leverage Ratio – 0.85x versus 2.75x maximum • Consolidated Fixed Charge Coverage Ratio – 3.55x versus minimum 1.50x Strong balance sheet and favorable capital structure to support investments and pursue attractive growth opportunities 1 As defined by credit agreement Q3 2024 Subsequent to the end of the quarter, we reduced our cost of debt and increased our liquidity position by issuing $500 million of 6.375% Senior Notes due 2032 and expanding the capacity of our credit facility to $1.0 billion, while extending the maturity date to October 2029. We plan to use a portion of the proceeds from these transactions to redeem our 7.500% Senior Notes on November 7, 2024. Following these transactions, the Company's next major debt maturity will be in 2028.

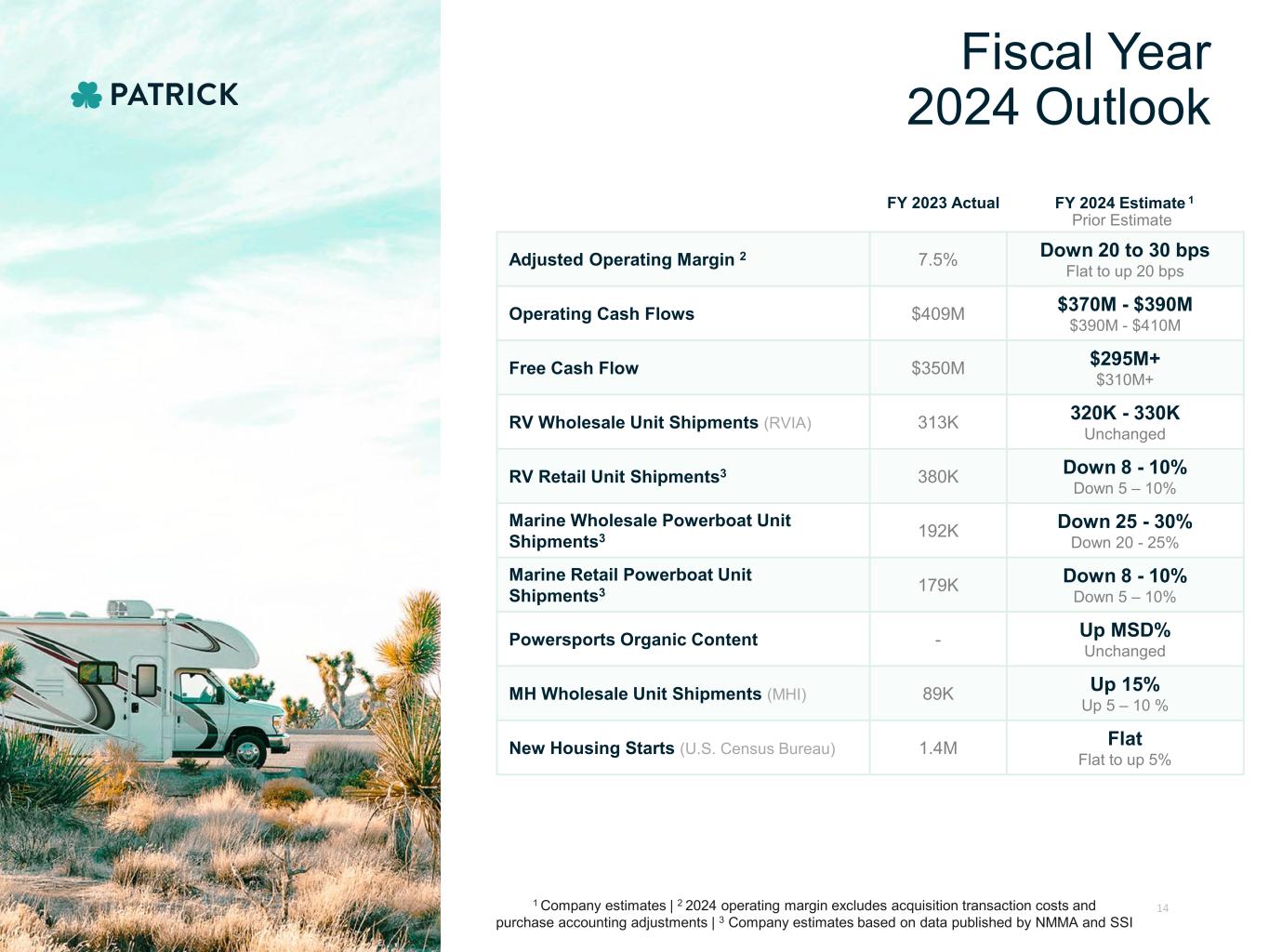

Adjusted Operating Margin 2 7.5% Down 20 to 30 bps Flat to up 20 bps Operating Cash Flows $409M $370M - $390M $390M - $410M Free Cash Flow $350M $295M+ $310M+ RV Wholesale Unit Shipments (RVIA) 313K 320K - 330K Unchanged RV Retail Unit Shipments3 380K Down 8 - 10% Down 5 – 10% Marine Wholesale Powerboat Unit Shipments3 192K Down 25 - 30% Down 20 - 25% Marine Retail Powerboat Unit Shipments3 179K Down 8 - 10% Down 5 – 10% Powersports Organic Content - Up MSD% Unchanged MH Wholesale Unit Shipments (MHI) 89K Up 15% Up 5 – 10 % New Housing Starts (U.S. Census Bureau) 1.4M Flat Flat to up 5% FY 2023 Actual FY 2024 Estimate 1 Fiscal Year 2024 Outlook 141 Company estimates | 2 2024 operating margin excludes acquisition transaction costs and purchase accounting adjustments | 3 Company estimates based on data published by NMMA and SSI Prior Estimate

Appendix

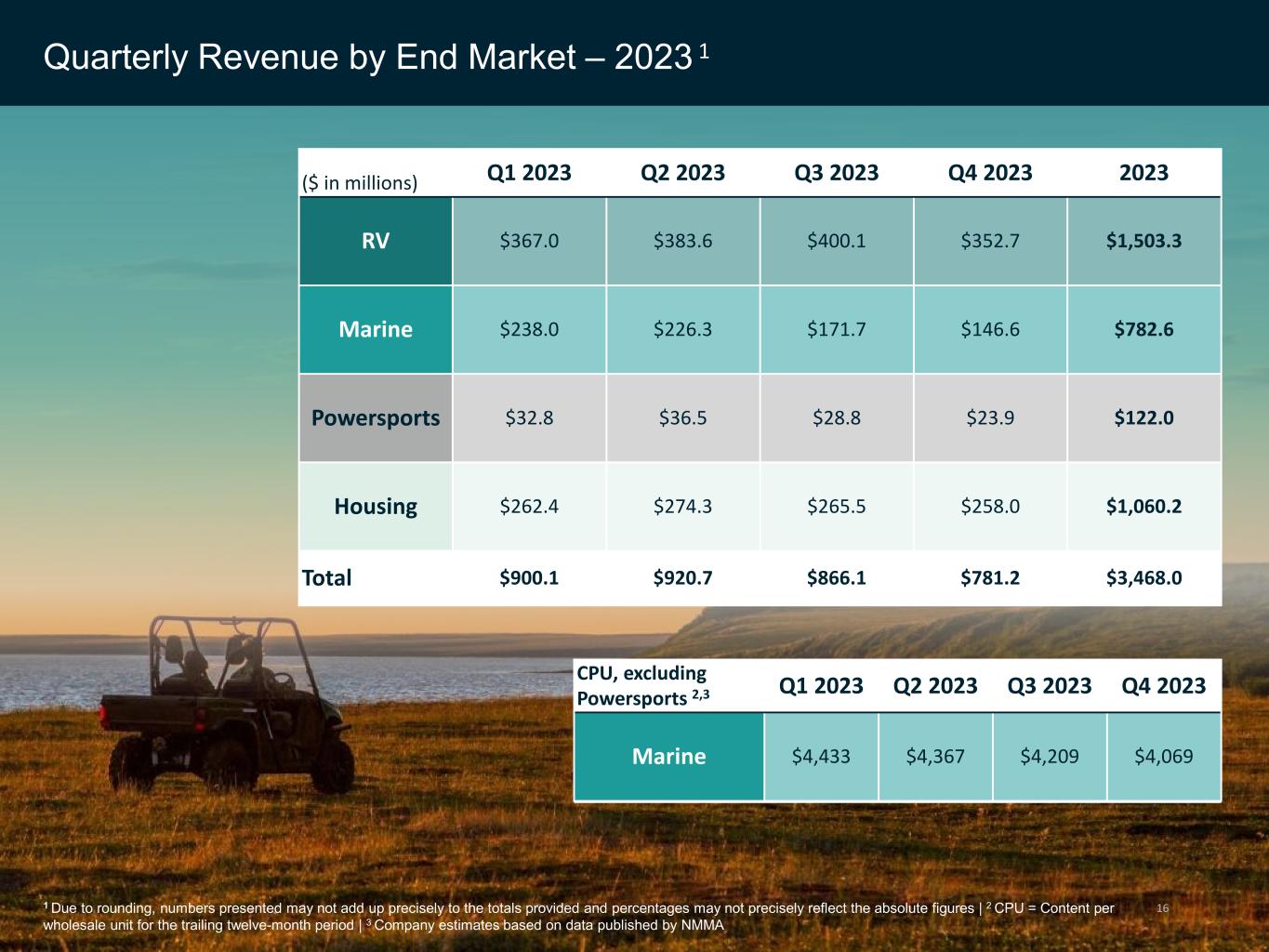

Quarterly Revenue by End Market – 2023 1 ($ in millions) Q1 2023 Q2 2023 Q3 2023 Q4 2023 2023 RV $367.0 $383.6 $400.1 $352.7 $1,503.3 Marine $238.0 $226.3 $171.7 $146.6 $782.6 Powersports $32.8 $36.5 $28.8 $23.9 $122.0 Housing $262.4 $274.3 $265.5 $258.0 $1,060.2 Total $900.1 $920.7 $866.1 $781.2 $3,468.0 16 CPU, excluding Powersports 2,3 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Marine $4,433 $4,367 $4,209 $4,069 1 Due to rounding, numbers presented may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures | 2 CPU = Content per wholesale unit for the trailing twelve-month period | 3 Company estimates based on data published by NMMA

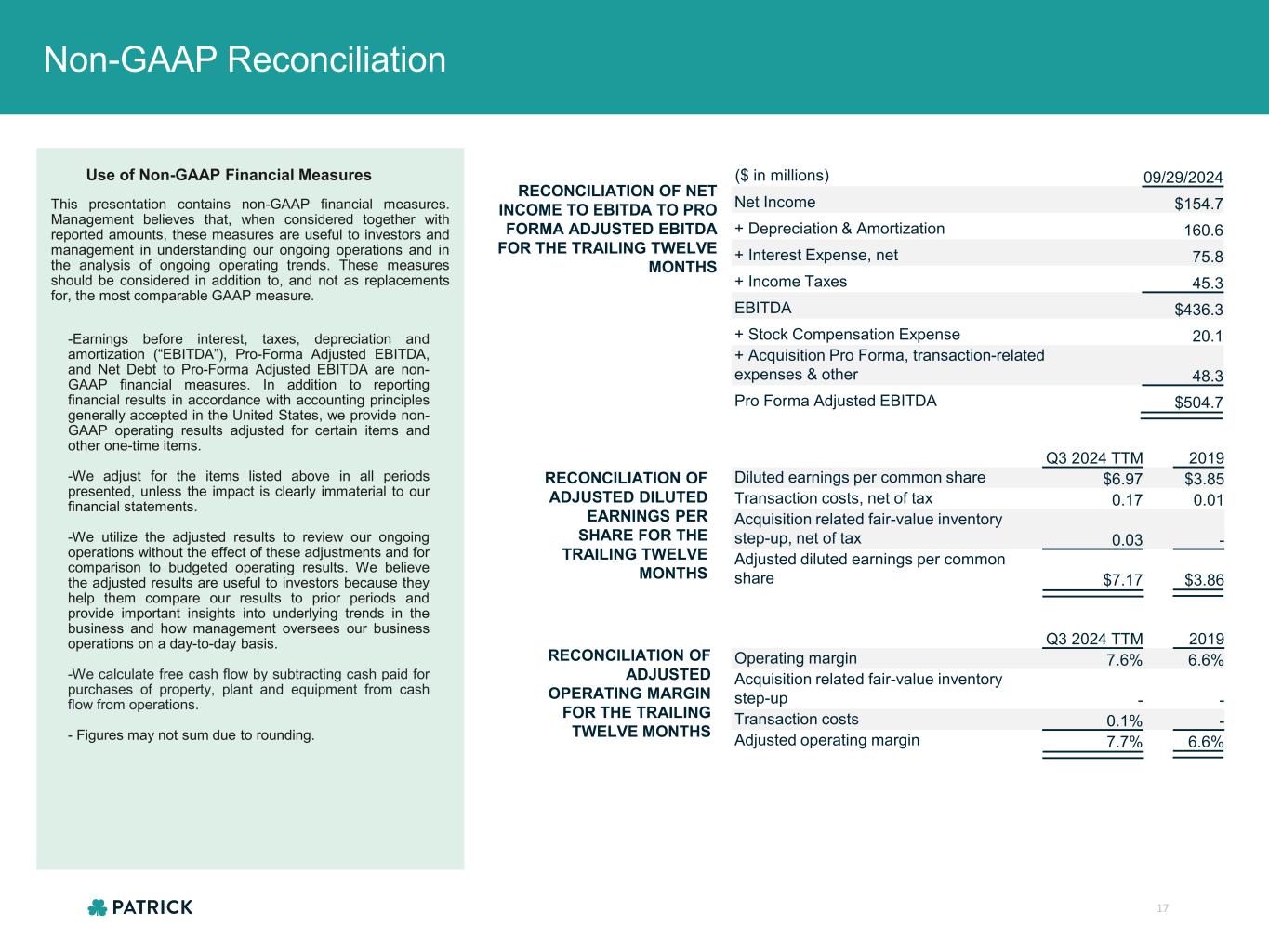

Non-GAAP Reconciliation 17 RECONCILIATION OF NET INCOME TO EBITDA TO PRO FORMA ADJUSTED EBITDA FOR THE TRAILING TWELVE MONTHS -Earnings before interest, taxes, depreciation and amortization (“EBITDA”), Pro-Forma Adjusted EBITDA, and Net Debt to Pro-Forma Adjusted EBITDA are non- GAAP financial measures. In addition to reporting financial results in accordance with accounting principles generally accepted in the United States, we provide non- GAAP operating results adjusted for certain items and other one-time items. -We adjust for the items listed above in all periods presented, unless the impact is clearly immaterial to our financial statements. -We utilize the adjusted results to review our ongoing operations without the effect of these adjustments and for comparison to budgeted operating results. We believe the adjusted results are useful to investors because they help them compare our results to prior periods and provide important insights into underlying trends in the business and how management oversees our business operations on a day-to-day basis. -We calculate free cash flow by subtracting cash paid for purchases of property, plant and equipment from cash flow from operations. - Figures may not sum due to rounding. Use of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. Management believes that, when considered together with reported amounts, these measures are useful to investors and management in understanding our ongoing operations and in the analysis of ongoing operating trends. These measures should be considered in addition to, and not as replacements for, the most comparable GAAP measure. ($ in millions) 09/29/2024 Net Income $154.7 + Depreciation & Amortization 160.6 + Interest Expense, net 75.8 + Income Taxes 45.3 EBITDA $436.3 + Stock Compensation Expense 20.1 + Acquisition Pro Forma, transaction-related expenses & other 48.3 Pro Forma Adjusted EBITDA $504.7 RECONCILIATION OF ADJUSTED DILUTED EARNINGS PER SHARE FOR THE TRAILING TWELVE MONTHS Q3 2024 TTM 2019 Operating margin 7.6% 6.6% Acquisition related fair-value inventory step-up - - Transaction costs 0.1% - Adjusted operating margin 7.7% 6.6% RECONCILIATION OF ADJUSTED OPERATING MARGIN FOR THE TRAILING TWELVE MONTHS Q3 2024 TTM 2019 Diluted earnings per common share $6.97 $3.85 Transaction costs, net of tax 0.17 0.01 Acquisition related fair-value inventory step-up, net of tax 0.03 - Adjusted diluted earnings per common share $7.17 $3.86

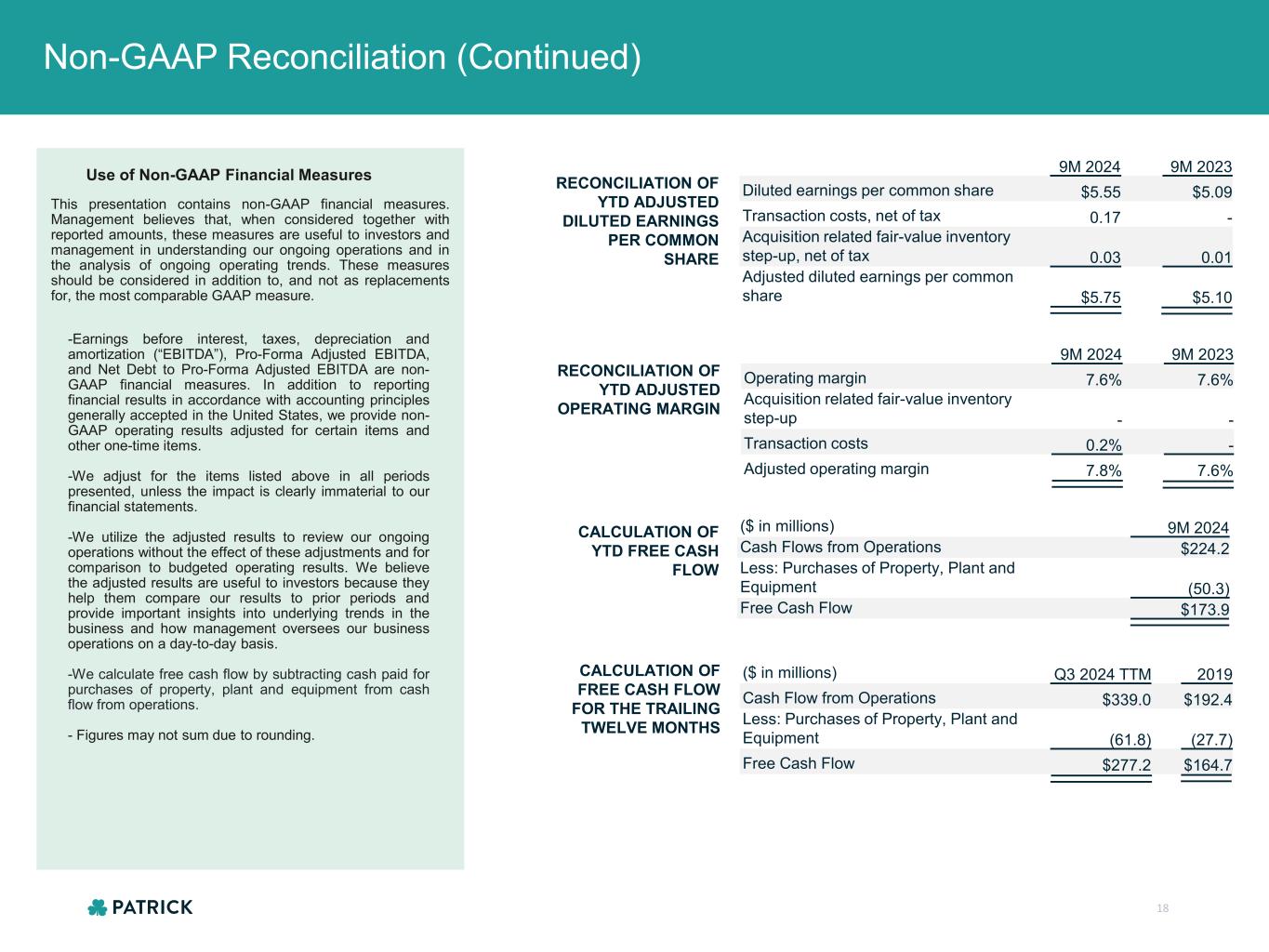

($ in millions) 9M 2024 Cash Flows from Operations $224.2 Less: Purchases of Property, Plant and Equipment (50.3) Free Cash Flow $173.9 Non-GAAP Reconciliation (Continued) -Earnings before interest, taxes, depreciation and amortization (“EBITDA”), Pro-Forma Adjusted EBITDA, and Net Debt to Pro-Forma Adjusted EBITDA are non- GAAP financial measures. In addition to reporting financial results in accordance with accounting principles generally accepted in the United States, we provide non- GAAP operating results adjusted for certain items and other one-time items. -We adjust for the items listed above in all periods presented, unless the impact is clearly immaterial to our financial statements. -We utilize the adjusted results to review our ongoing operations without the effect of these adjustments and for comparison to budgeted operating results. We believe the adjusted results are useful to investors because they help them compare our results to prior periods and provide important insights into underlying trends in the business and how management oversees our business operations on a day-to-day basis. -We calculate free cash flow by subtracting cash paid for purchases of property, plant and equipment from cash flow from operations. - Figures may not sum due to rounding. Use of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. Management believes that, when considered together with reported amounts, these measures are useful to investors and management in understanding our ongoing operations and in the analysis of ongoing operating trends. These measures should be considered in addition to, and not as replacements for, the most comparable GAAP measure. 9M 2024 9M 2023 Diluted earnings per common share $5.55 $5.09 Transaction costs, net of tax 0.17 - Acquisition related fair-value inventory step-up, net of tax 0.03 0.01 Adjusted diluted earnings per common share $5.75 $5.10 RECONCILIATION OF YTD ADJUSTED DILUTED EARNINGS PER COMMON SHARE 18 CALCULATION OF YTD FREE CASH FLOW CALCULATION OF FREE CASH FLOW FOR THE TRAILING TWELVE MONTHS ($ in millions) Q3 2024 TTM 2019 Cash Flow from Operations $339.0 $192.4 Less: Purchases of Property, Plant and Equipment (61.8) (27.7) Free Cash Flow $277.2 $164.7 9M 2024 9M 2023 Operating margin 7.6% 7.6% Acquisition related fair-value inventory step-up - - Transaction costs 0.2% - Adjusted operating margin 7.8% 7.6% RECONCILIATION OF YTD ADJUSTED OPERATING MARGIN

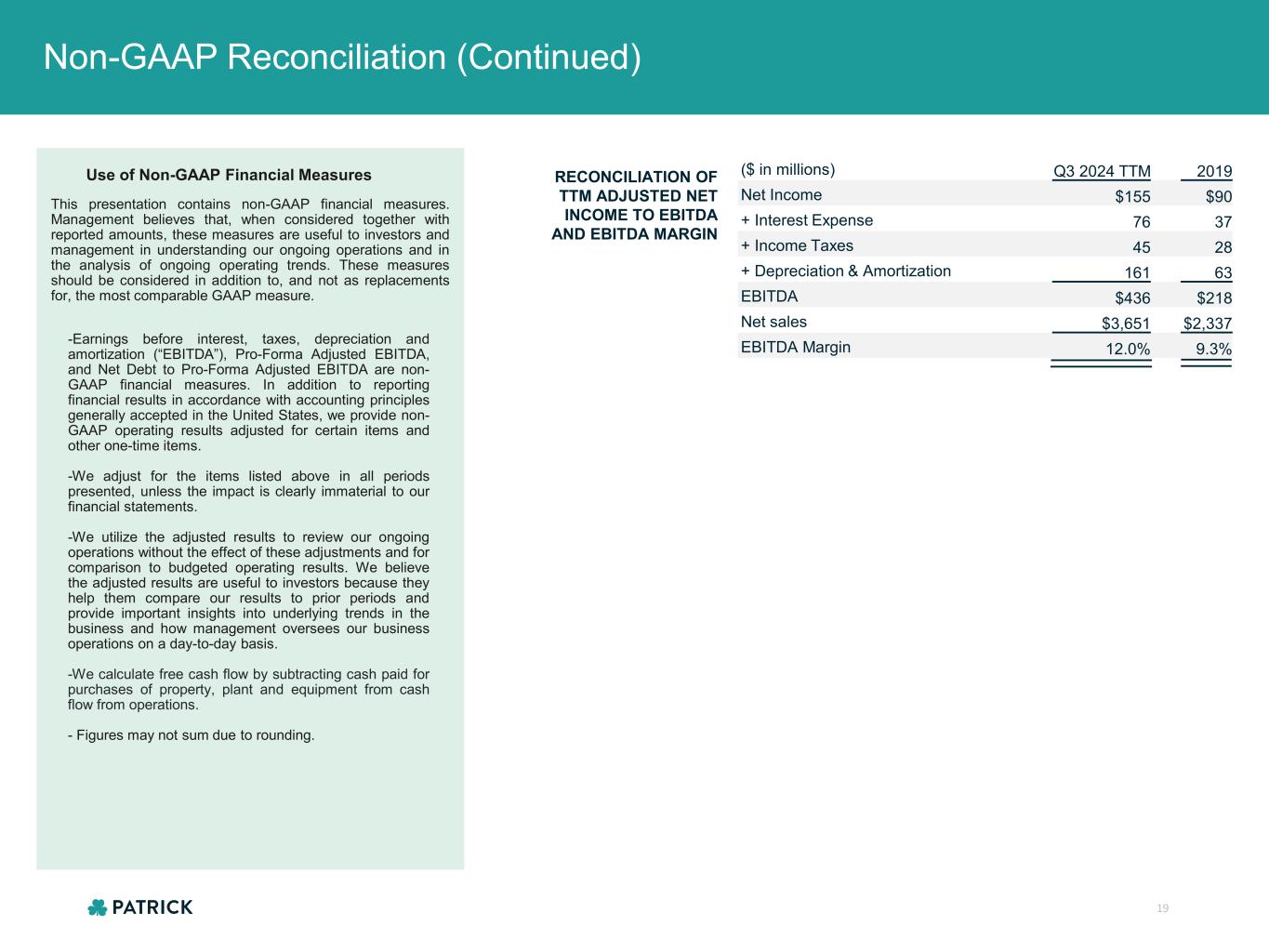

Non-GAAP Reconciliation (Continued) -Earnings before interest, taxes, depreciation and amortization (“EBITDA”), Pro-Forma Adjusted EBITDA, and Net Debt to Pro-Forma Adjusted EBITDA are non- GAAP financial measures. In addition to reporting financial results in accordance with accounting principles generally accepted in the United States, we provide non- GAAP operating results adjusted for certain items and other one-time items. -We adjust for the items listed above in all periods presented, unless the impact is clearly immaterial to our financial statements. -We utilize the adjusted results to review our ongoing operations without the effect of these adjustments and for comparison to budgeted operating results. We believe the adjusted results are useful to investors because they help them compare our results to prior periods and provide important insights into underlying trends in the business and how management oversees our business operations on a day-to-day basis. -We calculate free cash flow by subtracting cash paid for purchases of property, plant and equipment from cash flow from operations. - Figures may not sum due to rounding. Use of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. Management believes that, when considered together with reported amounts, these measures are useful to investors and management in understanding our ongoing operations and in the analysis of ongoing operating trends. These measures should be considered in addition to, and not as replacements for, the most comparable GAAP measure. RECONCILIATION OF TTM ADJUSTED NET INCOME TO EBITDA AND EBITDA MARGIN 19 ($ in millions) Q3 2024 TTM 2019 Net Income $155 $90 + Interest Expense 76 37 + Income Taxes 45 28 + Depreciation & Amortization 161 63 EBITDA $436 $218 Net sales $3,651 $2,337 EBITDA Margin 12.0% 9.3%